Вам надоели горы чеков и чрезмерные траты? отслеживание времени Ваши бизнес-расходы?

Это может казаться бесконечной рутиной, не правда ли?

Два известных бренда, о которых вы, возможно, слышали, — это Dext и Expensify.

Давайте рассмотрим, что предлагает каждый из них, и посмотрим, какой из них может стать вашим новым любимым инструментом.

Обзор

Мы внимательно изучили как Dext, так и Expensify.

Мы протестировали их функции и убедились, насколько легко ими пользоваться.

Это помогло нам увидеть как хорошие, так и плохие стороны каждого из них.

Теперь мы можем сравнить их для вас!

Готовы сэкономить более 10 часов в месяц? Узнайте, как Dext автоматизирует ввод данных, отслеживание расходов и оптимизирует ваши финансы.

Цены: Доступен бесплатный пробный период. Премиум-план стоит от 24 долларов в месяц.

Основные характеристики:

- Сканирование чеков

- Отчеты о расходах

- Сверка банковских счетов

Присоединяйтесь к более чем 15 миллионам пользователей, которые доверяют Expensify упрощение управления своими финансами. Экономьте до 83% времени, затрачиваемого на составление отчетов о расходах.

Цены: Доступен бесплатный пробный период. Премиум-план начинается от 5 долларов в месяц.

Основные характеристики:

- SmartScan — захват чеков

- Сверка корпоративных карт

- Расширенные рабочие процессы утверждения.

Что такое Dext?

Итак, что же такое Dext?

Воспринимайте это как суперумного помощника для ваших работ.

В основном, это касается таких вещей, как счета и квитанции.

Вы просто делаете снимок, и Декст получает всю важную информацию.

Довольно круто, правда?

Также ознакомьтесь с нашими любимыми Альтернативы Дексту…

Наше мнение

Готовы сэкономить более 10 часов в месяц? Узнайте, как автоматизированный ввод данных, отслеживание расходов и отчетность Dext могут оптимизировать ваши финансы.

Основные преимущества

Dext действительно превосходно справляется с задачей упрощения управления расходами.

- 90% пользователей отмечают значительное уменьшение количества бумажных документов.

- Его точность превышает 98%. при извлечении данных из документов.

- Создание отчетов о расходах становится невероятно быстрым и простым.

- Беспроблемно интегрируется с популярными бухгалтерскими платформами, такими как QuickBooks и Xero.

- Помогает гарантировать, что вы никогда не потеряете важные финансовые документы.

Цены

- Годовая подписка: $24

Плюсы

Минусы

Что такое Expensify?

Итак, давайте поговорим об Expensify.

Это инструмент, который помогает вам отслеживать все ваши данные. бизнес расходы.

Представьте это как помощника, который помнит, куда уходят ваши деньги.

Она может получать информацию из ваших чеков и банковских выписок. Довольно удобно!

Также ознакомьтесь с нашими любимыми Альтернативы Expensify…

Основные преимущества

- Технология SmartScan сканирует данные чека и извлекает их с точностью более 95%.

- Сотрудники получают возмещение быстро, зачастую всего за один рабочий день, через систему ACH.

- Карта Expensify позволяет сэкономить до 50% на подписке благодаря программе возврата части потраченных средств.

- Гарантии не предоставляются; в их условиях указано, что ответственность ограничена.

Цены

- Собирать: 5 долларов в месяц.

- Контроль: Индивидуальное ценообразование.

Плюсы

Минусы

Сравнение характеристик

И Dext, и Expensify стремятся упростить процесс управления расходами.

Давайте углубимся в детали и посмотрим, что предлагает каждая система и как она справляется с различными задачами.

1. Извлечение данных

- Декс:

- Преуспевает в данные Извлечение данных с использованием технологии OCR.

- Может извлекать данные из квитанций, счетов-фактур, заказов на покупку и других финансовых документов.

- Фиксируйте чеки с помощью мобильного приложения Dext или отправляя их по электронной почте.

- Expensify:

- Использует функцию SmartScan для быстрого сканирования чеков.

- Создано для того, чтобы сотрудники могли быстро и легко сделать снимок на свой телефон.

- Помогает сэкономить время, сводя к минимуму ручной ввод данных.

2. Мобильное приложение и пользовательский опыт

- Декс:

- Мобильное приложение Dext — это мощное приложение, предоставляющее клиентам и бухгалтерам доступ к финансовым данным.

- Позволяет регистрировать пробег и отслеживать расходы в пути.

- Expensify:

- Expensify упрощает управление расходами для небольшого числа сотрудников, позволяя им делать это из собственных средств.

- Приложение очень простое в использовании для заполнения отчетов и получения возмещения.

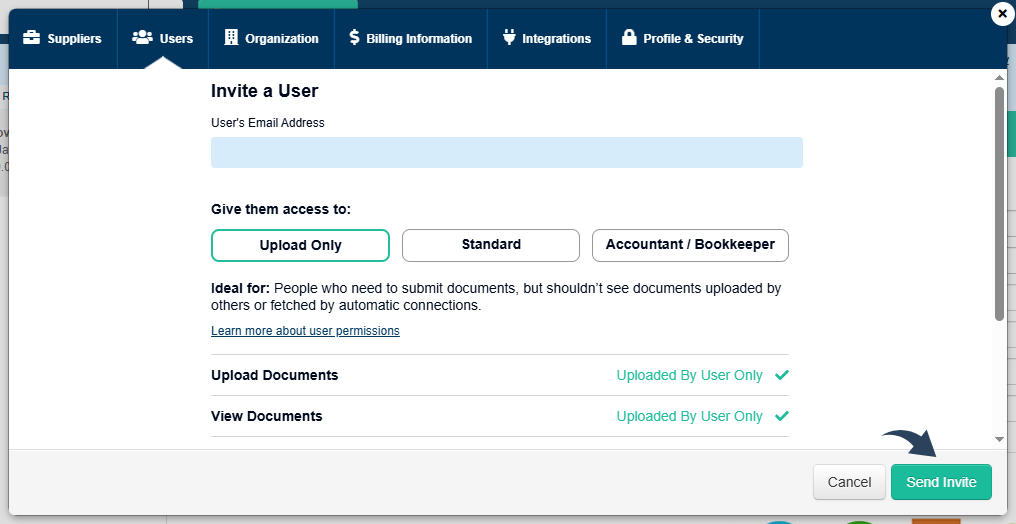

3. Согласования и рабочие процессы

- Декс:

- Предлагает систему утверждения, позволяющую бухгалтерам или работодателям утверждать документы и заявки на возмещение расходов.

- Предоставляет гибкий способ обработки согласований.

- Expensify:

- Известны своими простыми процедурами утверждения.

- Менеджер может просмотреть и утвердить заявки на возмещение расходов всего за несколько минут.

- Вы можете настроить правила для автоматического реагирования на определенные заявки на возмещение расходов.

4. Интеграция

- Декс:

- Предлагает глубокую интеграцию с популярными инструментами, такими как QuickBooks В сети.

- Имеет прямые интеграции, обеспечивающие безопасный поток данных.

- Dext хорошо работает в рамках бухгалтерский учет и рабочих процессов ведения бухгалтерского учета.

- Expensify:

- Имеет множество интеграций для подключения к вашему банку и бухгалтерское программное обеспечение.

- Надежная связь помогает оптимизировать процесс управления расходами.

5. Управление счетами и платежами

- Декс:

- Безусловный лидер в управлении счетами-фактурами.

- Вы можете использовать функцию автоматического получения счетов-фактур от онлайн-поставщиков.

- Имеет правила для поставщиков, позволяющие кодировать и обрабатывать входящие счета. бухгалтерский учет.

- Expensify:

- Можно обрабатывать некоторые счета-фактуры, но это не основная задача.

- Dext предоставляет вам больше возможностей, если вы имеете дело с большим количеством счетов.

6. Корпоративные карты

- Декс:

- Работает с корпоративными картами, но не предлагает собственную карту.

- Expensify:

- Компания предлагает собственную карту Expensify Card, которая помогает работодателям управлять расходами.

- Операции с карты отображаются на вашей странице мгновенно в режиме реального времени.

7. Аудит и безопасность

- Декс:

- Обеспечивает безопасный поток данных и надежно хранит финансовые документы.

- Использует надежную службу безопасности.

- Expensify:

- Также обладает мощным решением для защиты от онлайн-атак.

- Помогает защитить ваши финансовые данные. (например, сообщения типа «Обнаружен идентификатор Cloudflare Ray» являются частью этой защиты).

8. Автоматизация данных

- Декс:

- Отлично справляется с автоматизацией ввода данных и помогает экономить время.

- Dext сохраняет ваши малый бизнес из огромного количества данных, введенных вручную.

- Основное внимание уделяется автоматизации ввода данных на начальном этапе. бухгалтерский учет рабочие процессы.

- Expensify:

- Помогает упростить процесс за счет автоматизации создания отчетов и возмещения расходов.

9. Поддержка клиентов

- Декс:

- Оказывает поддержку клиентам и бухгалтерам.

- Помогает в настройке для обеспечения надежности системы.

- Expensify:

- В отзывах об Expensify часто отмечается качественная служба поддержки клиентов.

- Они стараются оперативно реагировать на запросы, чтобы помочь вам решить проблемы.

На что следует обратить внимание при выборе бухгалтерской программы?

- Ознакомьтесь с тарифными планами, чтобы делать Конечно, они подойдут под ваш бюджет и предлагают бесплатную пробную версию уже сегодня, так что вы можете попробовать Dext или Expensify.

- Система должна поддерживать мобильное сканирование, чтобы упростить сбор и отправку чеков с телефона и сэкономить время.

- Используйте надежные системы оптического распознавания символов (OCR), чтобы свести к минимуму ручной ввод данных и предотвратить попадание некорректных данных в ваши записи.

- Система должна предлагать несколько способов загрузки документов, а не только один. Это включает в себя электронную почту, сканирование с мобильного устройства и подключение к банковским счетам.

- Программному обеспечению необходимы надежные банковские выписки для автоматического импорта и сверки транзакций, а также для их сопоставления с банковскими квитанциями.

- Убедитесь, что система поддерживает категории отслеживания, чтобы вы могли правильно кодировать расходы и получать точные налоговые данные для подачи налоговой декларации.

- Малый бизнес Владельцам необходимы данные в режиме реального времени для отслеживания затрат и продаж, а также для эффективного управления денежными потоками.

- Узнайте о возможностях использования и надежности системы — вам нужен инструмент, который будет бесперебойно работать после первоначальной настройки и защищен надежной службой безопасности.

- Оно должно иметь возможность безопасно хранить квитанции, а также предоставлять возможность легко экспортировать или архивировать выписки и записи.

- Найдите простой способ управления расходами и автоматизации задач, чтобы избавить вашего бухгалтера от лишних хлопот.

- Система должна помочь вам лучше управлять своим бизнесом, предоставляя точную и полную картину ваших доходов и прибыли.

- Проверьте, подключается ли учетная запись Dext или Expensify к бизнес-приложениям и другим сторонним приложениям, которые вы используете для расчета заработной платы или отправки счетов.

- Система должна позволять выполнять несколько действий, запускаемых определенным словом или правилом, что поможет автоматизировать весь процесс управления расходами.

Окончательный вердикт

После тщательного изучения обоих инструментов мы выбрали Expensify для большинства малых предприятий. бухгалтерский учет. Почему?

Она отлично справляется с быстрым отслеживанием расходов и обработкой платежей в кратчайшие сроки.

Его мобильное приложение отлично подходит для отслеживания пробега и отправки отчетов о расходах, что избавляет ваших сотрудников от лишних хлопот.

В то время как Dext Prepare предлагает неограниченные возможности бухгалтерский учет Записи о некоторых планах и dext предлагают несколько способов сбора данных.

Expensify просто упрощает отслеживание расходов для среднестатистического владельца малого бизнеса, находящегося в постоянном движении.

Если вы являетесь фирмой и имеете Ксеро Для пользователей Dext — отличный вариант. Но для простых бизнес-операций...

Удобный онлайн-сервис Expensify бухгалтерский учет помогает быстро оплачивать счета.

Мы проверили все ключевые функции и знаем, что работает в реальном мире бухгалтерского учета для бизнеса.

Ознакомьтесь с их стартовым планом уже сегодня!

Больше от Dext

Мы также сравнили Dext с другими инструментами для управления расходами и бухгалтерского учета:

- Dext против Xero: Xero предлагает комплексные решения для бухгалтерского учета с интегрированными функциями управления расходами.

- Декст против Головоломка IO: Компания Puzzle IO преуспевает в предоставлении финансовых аналитических данных и прогнозировании на основе искусственного интеллекта..

- Декст против Снайдера: Компания Synder специализируется на синхронизации данных о продажах в электронной коммерции и обработке платежей.

- Dext против Easy в конце месяца: Easy Month End упрощает процедуру закрытия финансового месяца.

- Декст против Доцита: Docyt использует искусственный интеллект для автоматизации задач бухгалтерского учета и управления документами.

- Dext против RefreshMe: RefreshMe предоставляет информацию о финансовых показателях бизнеса в режиме реального времени.

- Лекст против Сейджа: Компания Sage предлагает широкий спектр бухгалтерских решений с возможностями отслеживания расходов.

- Dext против Zoho Books: Zoho Books предоставляет интегрированную систему бухгалтерского учета с функциями управления расходами.

- Dext против Wave: Wave предлагает бесплатное бухгалтерское программное обеспечение с базовыми функциями отслеживания расходов.

- Dext против Quicken: Quicken популярен для управления личными финансами и отслеживания основных деловых расходов.

- Dext против Hubdoc: Hubdoc специализируется на автоматизированном сборе документов и извлечении данных.

- Dext против Expensify: Expensify предлагает надежные решения для составления отчетов о расходах и управления ими.

- Dext против QuickBooks: QuickBooks — это широко используемая бухгалтерская программа с инструментами для управления расходами.

- Dext против AutoEntry: AutoEntry автоматизирует ввод данных из счетов-фактур, квитанций и банковских выписок.

- Dext против FreshBooks: FreshBooks предназначен для предприятий сферы услуг и включает в себя функции выставления счетов и отслеживания расходов.

- Dext против NetSuite: NetSuite предлагает комплексную ERP-систему с функциями управления расходами.

Больше информации об Expensify

- Expensify против PuzzleЭто программное обеспечение ориентировано на финансовое планирование для стартапов с использованием искусственного интеллекта. Аналогичное программное обеспечение предназначено для управления личными финансами.

- Expensify против DextЭто бизнес-инструмент для учета квитанций и счетов-фактур. Другой инструмент отслеживает личные расходы.

- Expensify против XeroЭто популярное онлайн-программное обеспечение для бухгалтерского учета, предназначенное для малого бизнеса. Его конкурент предназначен для личного использования.

- Expensify против SynderЭтот инструмент синхронизирует данные электронной коммерции с бухгалтерским программным обеспечением. Его альтернатива ориентирована на личные финансы.

- Expensify против Easy Month EndЭто бизнес-инструмент для оптимизации задач по закрытию месяца. Его конкурент предназначен для управления личными финансами.

- Expensify против Docyt: Одна из них использует ИИ для ведения бухгалтерского учета и автоматизации бизнеса. Другая использует ИИ в качестве личного финансового помощника.

- Expensify против SageЭто комплексный пакет бухгалтерских программ для бизнеса. Его конкурент — более удобный инструмент для управления личными финансами.

- Expensify против Zoho BooksЭто онлайн-инструмент для ведения бухгалтерского учета для малых предприятий. Его конкурент предназначен для личного использования.

- Expensify против WaveЭто бесплатное бухгалтерское программное обеспечение для малых предприятий. Его аналог предназначен для частных лиц.

- Expensify против HubdocЭтот продукт специализируется на оцифровке документов для ведения бухгалтерского учета. Его конкурентом является инструмент для управления личными финансами.

- Expensify против QuickBooksЭто хорошо известная бухгалтерская программа для бизнеса. Её альтернатива разработана для управления личными финансами.

- Expensify против AutoEntryЭто приложение предназначено для автоматизации ввода данных в бухгалтерский учет предприятий. Его альтернативой является инструмент для управления личными финансами.

- Expensify против FreshBooksЭто бухгалтерское программное обеспечение для фрилансеров и малых предприятий. Его альтернатива предназначена для управления личными финансами.

- Expensify против NetSuiteЭто мощный пакет программного обеспечения для управления бизнесом, предназначенный для крупных компаний. Его конкурентом является простое приложение для управления личными финансами.

Часто задаваемые вопросы

Dext лучше, чем Expensify?

Все зависит от ваших потребностей! Expensify отлично подходит для удобного составления отчетов о расходах и возмещения затрат, особенно благодаря мобильному приложению. Dext же хорошо справляется с обработкой большого количества квитанций и счетов-фактур и больше помогает в ведении детального бухгалтерского учета.

Что проще в использовании, Dext или Expensify?

Большинство пользователей считают Expensify немного проще в освоении, особенно для отправки отчетов о расходах. Его мобильное приложение и сканирование чеков очень удобны в использовании. Dext может делать больше, поэтому на изучение всех его функций может потребоваться немного больше времени.

Предлагает ли Expensify бесплатную версию?

Да, у Expensify есть бесплатная версия, но она имеет ограниченный функционал и предназначена только для одного пользователя. Dext обычно не предлагает полностью бесплатную версию, но у них может быть бесплатная пробная версия для тестирования.

Можно ли интегрировать Dext и Expensify с моим бухгалтерским программным обеспечением?

Да, и Dext, и Expensify могут интегрироваться с популярными бухгалтерскими программами, такими как QuickBooks и Xero. Это помогает синхронизировать ваши финансовые данные и оптимизировать ведение бухгалтерского учета.

Какой из них лучше подходит для работы с корпоративными картами?

Expensify обычно считается лучшим инструментом для управления корпоративными картами. Он обладает специфическими функциями, которые упрощают отслеживание расходов компании и сверку транзакций по картам. Dext тоже справляется с этим, но Expensify предлагает больше инструментов для этой задачи.