Are you tired of month-end closing taking forever?

It can feel like a huge headache, right?

All those papers and numbers can get confusing.

Two of these are Dext vs Easy Month End.

Let’s take a look at how these tools can help you say goodbye to month-end stress!

Обзор

We looked closely at both Dext and Easy Month End.

Мы протестировали их, чтобы посмотреть, как они работают.

This helped us understand what each one is good at.

Now we can compare them and show you what we found.

Готовы сэкономить более 10 часов в месяц? Узнайте, как Dext автоматизирует ввод данных, отслеживание расходов и оптимизирует ваши финансы.

Цены: Доступен бесплатный пробный период. Премиум-план стоит от 24 долларов в месяц.

Основные характеристики:

- Сканирование чеков

- Отчеты о расходах

- Сверка банковских счетов

В конце этого месяца, воспользовавшись услугой Easy, присоединитесь к 1257 пользователям, которые сэкономили в среднем 3,5 часа и сократили количество ошибок на 15%. Начните бесплатную пробную версию!

Цены: Доступен бесплатный пробный период. Премиум-план стоит от 45 долларов в месяц.

Основные характеристики:

- Автоматическая сверка

- Оптимизированные рабочие процессы

- Удобный интерфейс

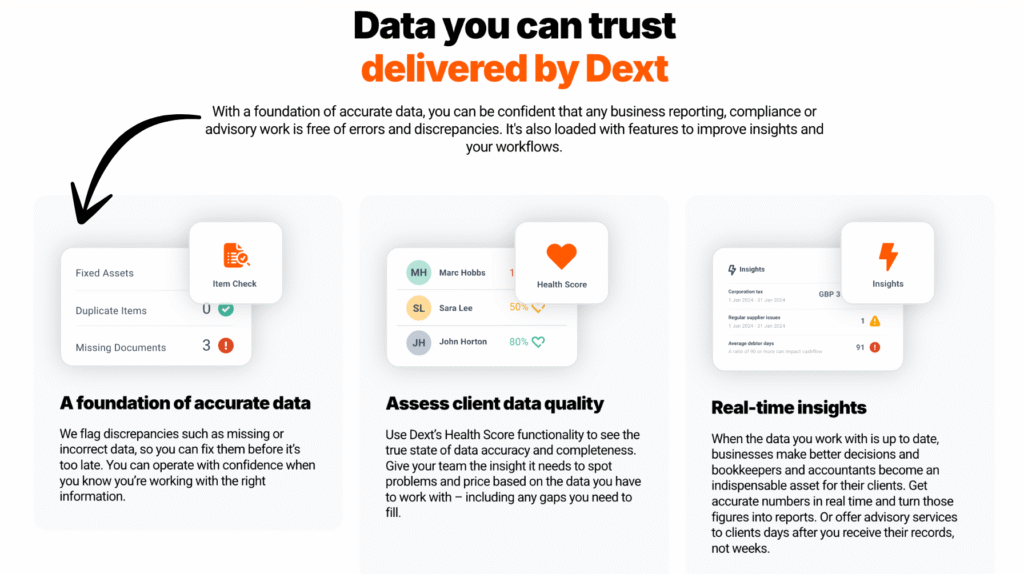

Что такое Dext?

Итак, что же такое Dext?

Воспринимайте это как суперумного помощника для ваших работ.

В основном, это касается таких вещей, как счета и квитанции.

Вы просто делаете снимок, и Декст получает всю важную информацию.

Раскройте его потенциал с помощью нашего Альтернативы Дексту…

Наше мнение

Готовы сэкономить более 10 часов в месяц? Узнайте, как автоматизированный ввод данных, отслеживание расходов и отчетность Dext могут оптимизировать ваши финансы.

Основные преимущества

Dext действительно превосходно справляется с задачей упрощения управления расходами.

- 90% пользователей отмечают значительное уменьшение количества бумажных документов.

- Его точность превышает 98%. при извлечении данных из документов.

- Создание отчетов о расходах становится невероятно быстрым и простым.

- Беспроблемно интегрируется с популярными бухгалтерскими платформами, такими как QuickBooks и Xero.

- Помогает гарантировать, что вы никогда не потеряете важные финансовые документы.

Цены

- Годовая подписка: $24

Плюсы

Минусы

Что такое «Легкое завершение месяца»?

Таким образом, Easy Month End — это своего рода помощник, который пригодится в конце месяца.

Оно пытается делать Вам будет проще закрывать бухгалтерские книги.

Воспринимайте это как способ хранить все свои финансовые дела в одном месте в конце месяца.

Это помогает увидеть, какие деньги поступили, а какие ушли.

Раскройте его потенциал с помощью нашего Простые альтернативы закрытию месяца…

Наше мнение

Повысьте точность финансовых данных с помощью Easy Month End. Воспользуйтесь автоматической сверкой и отчетностью, готовой к аудиту. Закажите индивидуальную демонстрацию, чтобы оптимизировать процесс закрытия месяца.

Основные преимущества

- Автоматизированные процессы сверки

- Управление задачами и отслеживание

- Дисперсионный анализ

- Управление документами

- Инструменты для совместной работы

Цены

- Стартер: 24 доллара в месяц.

- Маленький: 45 долларов в месяц.

- Компания: 89 долларов в месяц.

- Предприятие: Индивидуальное ценообразование.

Плюсы

Минусы

Сравнение характеристик

We looked at both Dext and Easy Month End closely.

This comparison shows what each tool is best at doing for your finance team.

1. Захват чеков и извлечение данных.

- Декст is an expert at automating данные entry. It gives you multiple ways to capture receipts and other financial documents. You can use the Dext mobile app, send an email, or have it get receipts and invoices straight from suppliers.

- It uses OCR technology to quickly extract data and removes the need for manual entry.

- Простой конец месяца does not focus on the first step of data collection from documents.

2. Data Extraction Accuracy

- Декст (formerly Receipt Bank) is known for its high accuracy when using its optical character recognition to extract data. This helps you avoid errors.

- Простой конец месяца is a workflow tool, so data extraction is not its main job.

3. Прямая интеграция с бухгалтерским программным обеспечением

- Декст has deep integration with all major бухгалтерский учет software, like QuickBooks Online and Xero. This helps with a secure data flow of all your cost and sales data.

- Простой конец месяца also connects with QuickBooks Online and Xero. Its main goal is to pull balance sheets for reconciliation.

4. Supplier Rules and Categorisation

- Декст lets you set up supplier rules. You can tell the system how to handle documents from a certain word or supplier automatically. This makes бухгалтерский учет workflows more efficient.

- Простой конец месяца does not have a feature for setting up these specific supplier rules.

5. Balance Sheet Reconciliation

- Простой конец месяца is made to handle the month-end process. It is excellent at balance sheet reconciliation. It connects to your бухгалтерский учет data, shows balances, and helps you get sign offs on all your reconciliations in one spot.

- Декст Prepare focuses on pre-accounting, but it supports bank reconciliation with its accurate data extraction and bank feeds.

6. Team Collaboration and Workflow Management

- Простой конец месяца is a strong workflow management tool for the finance team. It lets you make task checklists for the month-end process, assign work, leave comments, and track sign offs. This helps with team collaboration.

- Декст focuses more on the collaboration needed between small бизнес owners and their accountants for submitting and processing documents quickly.

7. Audit Evidence and Compliance

- Простой конец месяца helps you collect аудит evidence. It keeps a log of tasks, documents, preparer and reviewer sign-offs, and all in a single platform. This ensures compliance for auditors.

- Декст helps by keeping all your original documents and extracted data stored securely in the cloud.

8. Expense Claims and Management

- Декст gives employees an easy way to submit receipts and expense claims using the Dext mobile app. This makes it easy to track expenses and manage expenses.

- Простой конец месяца can track the task of reviewing expense claims, but it does not handle the initial receipt capture receipts and submission part.

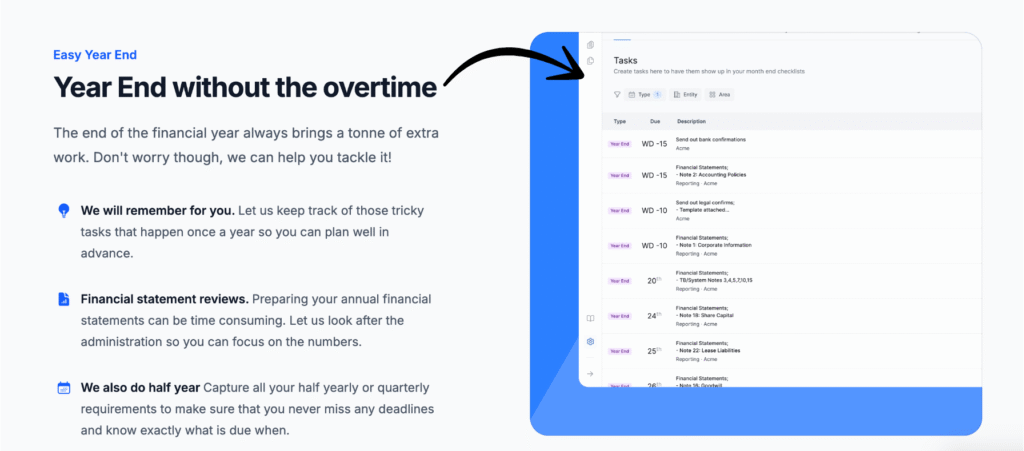

9. Year End and Quarter-End Support

- Простой конец месяца works as a checklist for the month-end process, quarter-end, and year-end. You can manage all your recurring accounting and бухгалтерский учет workflows from one spot.

- Декст provides consistent, accurate, and timely data, which is key for all those отчетность periods.

10. System Dependability and Security

- Both tools offer a безопасность solution for secure data flow.

- Декст has a strong reputation for system dependability in its data collection and extraction.

- Простой конец месяца offers a high level of security service and compliance features in its top pricing plans to protect financial data.

На что обращать внимание при выборе бухгалтерского программного обеспечения?

Here are the key things to look at when choosing the right tool to handle month-end for your finance team:

- Team Management and Efficiency: Look for features that support team management and make your finance team more efficient finance team. The goal is a smoother month-end close and an easier life for everyone.

- Reconciliation Speed: Does the tool help you achieve faster balance sheet reconciliations? This ability is a must-have to reconcile accounts quickly and stay on top of your balances.

- Гибкость рабочего процесса: Make sure the system can handle more than just monthly tasks. Can it manage ad hoc tasks and recurring items? This expanded scope improves efficiency.

- Payment and Contract Terms: Check how you pay. Can you cancel easily? Is the price clear, or are there hidden fees? Avoid being locked into long contracts.

- Ease of Use for Your Team: The platform should be easy for your team to access and use. If your team is stuck using Excel and Outlook for tracking, you need a modern solution to reduce delays.

- Готовность к аудиту: The tool must reduce hassle with manual confirmations. It should keep track of every completed task and all supporting documents you upload or import.

- Support for Multiple Entities: If you manage several companies, you need the ability to handle multiple entities easily from one place.

- Support and Communication: Can you quickly answer questions or submit a support ticket? Good support makes your first month-end a breeze.

Окончательный вердикт

After looking closely at both tools, we choose Dext as the better platform for your team. Why?

Dext works best at removing hassle from the start of your бухгалтерский учет.

Его автоматизация of manual data entry is top-notch.

You can collect receipts and invoices using mobile scanning or email submission in just a few minutes.

This helps your whole finance team save time. Dext saves hours every week!

Additionally, the accurate data it extracts makes expense management much easier.

Easy Month End is great for tracking finance team tasks, but Dext is better at getting the data in right away.

Your finance team deserves the efficiency Dext provides. Try Dext with their free trial today.

Больше от Dext

Мы также сравнили Dext с другими инструментами для управления расходами и бухгалтерского учета:

- Dext против Xero: Xero предлагает комплексные решения для бухгалтерского учета с интегрированными функциями управления расходами.

- Декст против Головоломка IO: Компания Puzzle IO преуспевает в предоставлении финансовых аналитических данных и прогнозировании на основе искусственного интеллекта..

- Декст против Снайдера: Компания Synder специализируется на синхронизации данных о продажах в электронной коммерции и обработке платежей.

- Dext против Easy в конце месяца: Easy Month End упрощает процедуру закрытия финансового месяца.

- Декст против Доцита: Docyt использует искусственный интеллект для автоматизации задач бухгалтерского учета и управления документами.

- Dext против RefreshMe: RefreshMe предоставляет информацию о финансовых показателях бизнеса в режиме реального времени.

- Лекст против Сейджа: Компания Sage предлагает широкий спектр бухгалтерских решений с возможностями отслеживания расходов.

- Dext против Zoho Books: Zoho Books предоставляет интегрированную систему бухгалтерского учета с функциями управления расходами.

- Dext против Wave: Wave предлагает бесплатное бухгалтерское программное обеспечение с базовыми функциями отслеживания расходов.

- Dext против Quicken: Quicken популярен для управления личными финансами и отслеживания основных деловых расходов.

- Dext против Hubdoc: Hubdoc специализируется на автоматизированном сборе документов и извлечении данных.

- Dext против Expensify: Expensify предлагает надежные решения для составления отчетов о расходах и управления ими.

- Dext против QuickBooks: QuickBooks — это широко используемая бухгалтерская программа с инструментами для управления расходами.

- Dext против AutoEntry: AutoEntry автоматизирует ввод данных из счетов-фактур, квитанций и банковских выписок.

- Dext против FreshBooks: FreshBooks предназначен для предприятий сферы услуг и включает в себя функции выставления счетов и отслеживания расходов.

- Dext против NetSuite: NetSuite предлагает комплексную ERP-систему с функциями управления расходами.

Ещё немного о лёгком завершении месяца

Ниже приведено краткое сравнение Easy Month End с некоторыми из ведущих альтернатив.

- Easy Month End vs Puzzle io: В то время как Puzzle.io предназначен для бухгалтерского учета стартапов, Easy Month End специализируется на оптимизации процесса закрытия отчетного периода.

- Easy Month End vs Dext: Dext предназначен в первую очередь для захвата документов и квитанций, тогда как Easy Month End — это комплексный инструмент для управления закрытием месяца.

- Easy Month End против Xero: Xero — это полноценная бухгалтерская платформа для малого бизнеса, а Easy Month End предоставляет специализированное решение для процесса закрытия отчетного периода.

- Easy Month End vs Synder: В отличие от Easy Month End, который представляет собой инструмент для организации рабочего процесса на протяжении всего периода закрытия финансового года, Synder специализируется на интеграции данных электронной коммерции.

- Easy Month End vs Docyt: Docyt использует искусственный интеллект для ведения бухгалтерского учета и ввода данных, а Easy Month End автоматизирует этапы и задачи закрытия финансовой отчетности.

- Easy Month End vs RefreshMe: RefreshMe — это платформа для финансового консультирования, которая отличается от Easy Month End, ориентированной на управление процессом закрытия финансового года.

- Easy Month End vs Sage: Sage — это комплексное решение для управления крупным бизнесом, а Easy Month End предлагает более специализированное решение для выполнения критически важных бухгалтерских функций.

- Easy Month End против Zoho Books: Zoho Books — это универсальное бухгалтерское программное обеспечение, а Easy Month End — это специализированный инструмент для закрытия месяца.

- Easy Month End vs Wave: Wave предоставляет бесплатные бухгалтерские услуги для малых предприятий, а Easy Month End предлагает более продвинутое решение для управления процессом закрытия отчетного периода.

- Easy Month End против Quicken: Quicken — это инструмент для управления личными финансами, поэтому Easy Month End — лучший выбор для компаний, которым необходимо управлять закрытием месяца.

- Easy Month End vs Hubdoc: Hubdoc автоматизирует сбор документов, но Easy Month End разработан для управления полным процессом закрытия отчетного периода и задачами команды.

- Easy Month End против Expensify: Expensify — это программное обеспечение для управления расходами, и его функциональность отличается от основной функции Easy Month End, ориентированной на закрытие финансового периода.

- Easy Month End против QuickBooks: QuickBooks — это комплексное бухгалтерское решение, а Easy Month End — более специализированный инструмент для управления самим закрытием месяца.

- Простое закрытие месяца против автоматического ввода: AutoEntry — это инструмент для сбора данных, а Easy Month End — это полноценная платформа для управления задачами и рабочими процессами во время закрытия месяца.

- Easy Month End против FreshBooks: FreshBooks предназначен для фрилансеров и малых предприятий, а Easy Month End предлагает специализированное решение для закрытия месяца.

- Easy Month End против NetSuite: NetSuite — это полнофункциональная ERP-система, которая имеет более широкий функционал, чем Easy Month End, специализирующаяся на закрытии финансового периода.

Часто задаваемые вопросы

What is the main difference between Dext and Easy Month End?

Dext focuses more on automation like receipt and invoice processing and integrates with many бухгалтерское программное обеспечение options. Easy Month End is simpler and mainly helps organize the month-end closing process.

Какой вариант лучше подходит для малого бизнеса?

Dext is often better for a малый бизнес wanting to automate tasks like expense reports and data entry, saving valuable time and improving accuracy.

Does Dext or Easy Month End offer a free trial?

Yes, Dext offers a free trial so you can test its features before committing. Easy Month End may also have a trial, but it’s good to check their website for details.

Can my accountant use Dext or Easy Month End?

Yes, accountants often find Dext very useful due to its advanced features and integration capabilities. Easy Month End can also be helpful for basic bookkeeping tasks.

Is Dext or Easy Month End easy to use?

Dext is generally considered very user-friendly with a well-designed mobile app. Easy Month End aims for simplicity, but some users find Dext’s interface more intuitive.