Вы тонете в бумажной работе и устали тратить часы на... бухгалтерский учет?

Вы не одиноки!

Вот где бухгалтерский учет В дело вступают инструменты автоматизации.

Dext и Docyt — два популярных варианта, которые обещают кардинально изменить подход к управлению финансами.

Но какой из них является лучший для ты?

Давайте углубимся в изучение их функций, которые помогут вам. делать Решение принято!

Обзор

Мы внимательно изучили как Dext, так и Docyt.

Мы протестировали их функции.

Это помогло нам понять, как они работают при выполнении различных задач.

Теперь мы можем сравнить их и рассказать вам о результатах нашего исследования.

Готовы сэкономить более 10 часов в месяц? Узнайте, как Dext автоматизирует ввод данных, отслеживание расходов и оптимизирует ваши финансы.

Цены: Доступен бесплатный пробный период. Премиум-план стоит от 24 долларов в месяц.

Основные характеристики:

- Сканирование чеков

- Отчеты о расходах

- Сверка банковских счетов

Устали от ручного управления? бухгалтерский учетDocyt AI автоматизирует ввод и сверку данных, экономя пользователям в среднем 40 часов.

Цены: Доступен бесплатный пробный период. Премиум-план начинается от 299 долларов в месяц.

Основные характеристики:

- Автоматическая сверка

- Оптимизированные рабочие процессы

- Удобный интерфейс

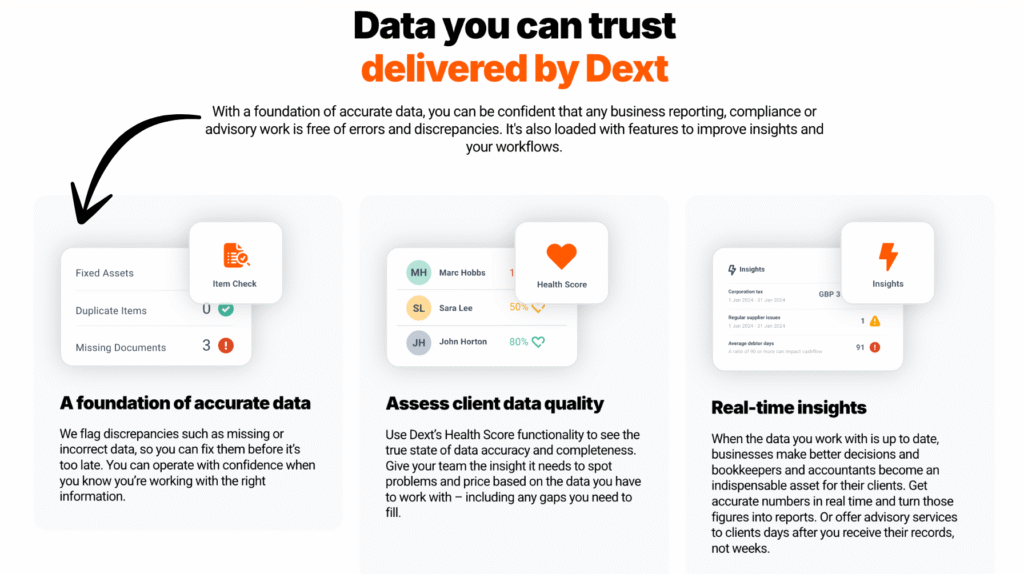

Что такое Dext?

Давайте посмотрим на Dext. Раньше он назывался Receipt Bank.

Это действительно отличное средство для организации квитанций и счетов-фактур.

Вы просто делаете снимок или пересылаете электронное письмо. Затем Dext получает важную информацию.

Это помогает убедиться в том, что ваш данные готов к взаимодействию с вашим бухгалтером.

Главная цель – сделать отслеживание ваших расходов максимально простым.

Раскройте его потенциал с помощью нашего Альтернативы Дексту…

Наше мнение

Готовы сэкономить более 10 часов в месяц? Узнайте, как автоматизированный ввод данных, отслеживание расходов и отчетность Dext могут оптимизировать ваши финансы.

Основные преимущества

Dext действительно превосходно справляется с задачей упрощения управления расходами.

- 90% пользователей отмечают значительное уменьшение количества бумажных документов.

- Его точность превышает 98%. при извлечении данных из документов.

- Создание отчетов о расходах становится невероятно быстрым и простым.

- Беспроблемно интегрируется с популярными бухгалтерскими платформами, такими как QuickBooks и Xero.

- Помогает гарантировать, что вы никогда не потеряете важные финансовые документы.

Цены

- Годовая подписка: $24

Плюсы

Минусы

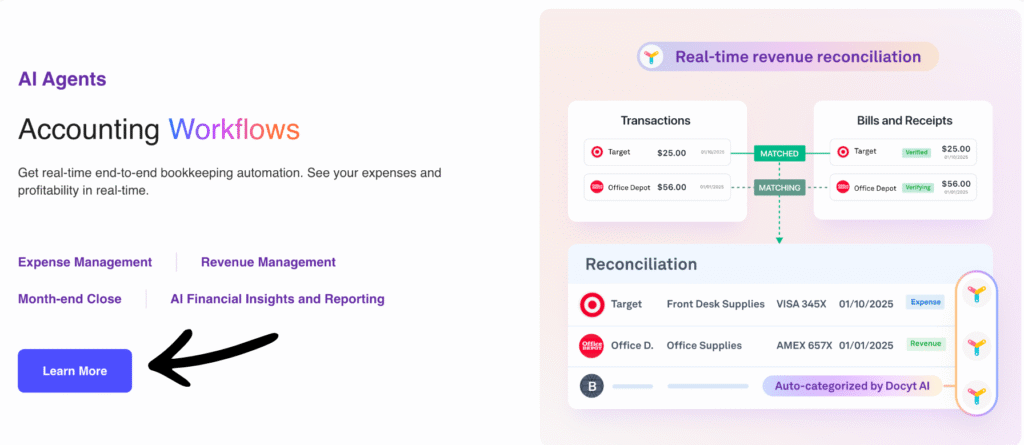

Что такое Docyt?

Docyt — это инструмент, который помогает предприятиям управлять своими финансами.

В нем используются интеллектуальные технологии для считывания счетов и квитанций.

Это значит, что печатать придётся гораздо меньше.

Это также позволяет получить четкое и актуальное представление о финансовом положении вашего бизнеса.

Раскройте его потенциал с помощью нашего Альтернативы Доциту…

Основные преимущества

- Автоматизация на основе искусственного интеллекта: Docyt использует искусственный интеллект. Он автоматически извлекает данные из финансовых документов. Это включает в себя информацию о более чем 100 000 поставщиках.

- Ведение бухгалтерского учета в режиме реального времени: Обеспечивает своевременное обновление бухгалтерской отчетности. Это позволяет получать точную финансовую картину в любой момент времени.

- Управление документами: Централизованная система для всех финансовых документов. Вы можете легко осуществлять поиск и получать к ним доступ.

- Автоматизация оплаты счетов: Автоматизирует процесс оплаты счетов. Позволяет легко планировать и оплачивать счета.

- Возмещение расходов: Упрощает процесс подачи заявок на возмещение расходов сотрудников. Быстрая отправка и утверждение расходов.

- Бесшовная интеграция: Интегрируется с популярным бухгалтерским программным обеспечением. В том числе: QuickBooks и Xero.

- Выявление мошенничества: Его искусственный интеллект может помочь выявлять необычные транзакции. Это добавляет дополнительный уровень защиты. безопасностьКонкретной гарантии на программное обеспечение нет, но предоставляются постоянные обновления.

Цены

- Влияние: 299 долларов в месяц.

- Передовой: 499 долларов в месяц.

- Передовой Кроме того: 799 долларов в месяц.

- Предприятие: 999 долларов в месяц.

Плюсы

Минусы

Сравнение характеристик

Давайте сравним Dext и Docyt.

Мы сравним десять важных функций, которые они предлагают.

Это поможет вам определить, какой инструмент лучше всего подходит для ваших целей. бухгалтерский учет и рабочих процессов ведения бухгалтерского учета.

1. Сбор и извлечение данных

- Декс: Программа использует технологию оптического распознавания символов (OCR) для извлечения данных из чеков, счетов-фактур и других документов. Цель Dext Prepare — обеспечить высокоточную обработку чеков, исключая ручной ввод данных в исходные документы.

- Докит: Доцит на основе ИИ Эта платформа сочетает в себе оптическое распознавание символов (OCR) и передовые методы машинного обучения для извлечения данных. Она разработана для чтения и понимания финансовых документов подобно человеку, минимизируя ошибки ручного ввода и справляясь с более сложными задачами извлечения данных.

2. Полная автоматизация рабочих процессов

- Декс: Основное внимание уделяется этапу сбора и подготовки данных. Это помогает автоматизировать начальные этапы. бухгалтерский учет рабочие процессы и управление документами.

- Докит: Это полностью искусственный интеллект. автоматизация Программное обеспечение, автоматизирующее такие задачи, как автоматическая сверка банковских счетов, оплата счетов и даже сложная сверка доходов. Оно призвано избавить от множества рутинных задач, исключая ручной ввод данных на протяжении всего процесса.

3. Финансовая аналитика в режиме реального времени

- Декс: Предоставляет наглядную историю расходов и покупок, обеспечивая актуальные данные для принятия более обоснованных решений.

- Докит: Отлично справляется с предоставлением информации в режиме реального времени и мгновенным отображением финансового состояния. Отчеты и панели мониторинга показывают движение денежных средств и ключевые показатели эффективности. немедленно, обеспечивая постоянный финансовый контроль.

4. Поддержка нескольких сущностей

- Декс: Позволяет управлять несколькими клиентскими аккаунтами Dext или филиалами компании, что очень удобно. бухгалтерский учет фирмы.

- Докит: Разработан специально для различных предприятий. Он позволяет легко создавать сводные отчеты и без труда управлять отдельными финансовыми отчетами для разных подразделений компании.

5. Возможности мобильного приложения

- Декс: Мобильное приложение Dext известно своими удобными функциями сканирования на мобильных устройствах. Оно позволяет пользователям быстро отправлять чеки и заявки на возмещение расходов на ходу, упрощая процесс захвата чеков.

- Докит: Мобильное приложение ориентировано на предоставление отчетов в режиме реального времени, а также на возможность просмотра и утверждения транзакций, обеспечивая прозрачность управления финансами прямо у вас в кармане.

6. Интеграция и взаимосвязь

- Декс: Предлагает прямую интеграцию с такими платформами, как QuickBooks Online и Ксерообеспечивая глубокую интеграцию для упрощения публикации финансовых данных.

- Докит: Также интегрируется с QuickBooks Online и другими программами. бухгалтерское программное обеспечениеОднако его возможности подключения зачастую шире, он использует данные из банковских счетов и различных бизнес-систем для получения всеобъемлющей картины.

7. Данные о расходах и продажах

- Декс: Отлично подходит для управления заявками на возмещение расходов и отслеживания затрат. Позволяет собирать документы, содержащие как данные о затратах, так и данные о продажах.

- Докит: Обрабатывает заявки на возмещение расходов, а также предоставляет инструменты для сверки доходов и управления данными о продажах на уровне отдела или нескольких предприятий.

8. Обеспечение безопасности и надежности.

- Декс: Обеспечивает высокий уровень безопасности и надежность системы для хранения чеков и других финансовых документов.

- Докит: Этот сервис ориентирован на безопасный поток данных и является надежным решением для обеспечения безопасности. Если вы столкнетесь с незначительной проблемой, например, с обнаруженным идентификатором Cloudflare Ray, это, как правило, стандартное сообщение от базовой службы безопасности, а не нарушение безопасности.

9. Бесплатная пробная версия и цены

- Декс: Часто можно попробовать Dext с бесплатной пробной версией. Он предлагает конкурентоспособные тарифные планы как для пробного периода, так и для платного. малый бизнес владельцы и крупные бухгалтерские фирмы.

- Докит: Также сегодня предлагается бесплатная пробная версия, хотя ее начальная цена часто выше, поскольку она включает в себя более мощный искусственный интеллект. бухгалтерский учет и полные функции автоматизации.

10. Сосредоточьтесь на ИИ, а не на подготовке данных.

- Декс: Основное внимание уделяется использованию ИИ для точного извлечения и подготовки данных, что эффективно упрощает работу на стороне клиента. бухгалтерский учет процессы.

- Докит: Использует свою платформу Docyt AI в качестве ИИ-бухгалтера для выполнения ряда действий, таких как категоризация и сверка, обработка трудоемких задач и автоматизация работы бэк-офиса.

На что следует обратить внимание при выборе бухгалтерской программы?

- В режиме реального времени Отчетность: Ищите программное обеспечение, которое предоставляет финансовые отчеты в режиме реального времени и позволяет получить представление о прибыльности. Это ключевой фактор для принятия стратегических решений.

- Глубина автоматизации: Проверьте, еслиЭтот инструмент выходит за рамки простого сбора квитанций и выполняет сложные бухгалтерские задачи, такие как оплата счетов и закрытие месяца.

- Обучение с помощью ИИ: Адаптируется ли система, подобная той, которую изучает Docyt, к уникальным особенностям вашего бизнеса? Это значительно упрощает жизнь и действительно меняет правила игры.

- Снижение количества ошибок: Этот инструмент должен помочь избежать ошибок в учете доходов и выявлять такие проблемы, как некорректные данные.

- Простота интеграции: Убедитесь, что программное обеспечение совместимо с вашими текущими системами, используя защищенные банковские выписки и возможности отправки электронных писем.

- Захват документов: Сервис должен предлагать несколько способов отправки документов, как это делает Dext или какие функции Dext предоставляет различными способами.

- Надежность системы: Обратите внимание на удобство использования и надежность системы, чтобы обеспечить безопасность ваших финансовых операций от потенциальных проблем, таких как онлайн-атаки.

- Управление расходами: Это поможет вам сэкономить время, автоматически получая счета-фактуры и применяя правила к поставщикам с учетом корректных налоговых данных.

- Специфические потребности: Подумайте, нужна ли вам подробная departmental-учетная система или отслеживание для конкретных отраслей или заказов на закупку у клиентов.

- Безопасность данных: Отдавайте предпочтение поставщику услуг, который защищает ваши данные, в том числе от потенциальных угроз, обозначенных такими терминами, как «команда SQL» (хотя это больше относится к команде разработчиков владельца сайта).

Окончательный вердикт

Мы рассмотрели функции и изучили, что делает эти инструменты такими замечательными.

Оба варианта помогают сэкономить время и сократить ручной ввод данных.

Dext — это отличный выбор, если ваша главная задача — быстрое получение чеков и подготовка документов всего за несколько минут.

Однако, на наш взгляд, Docyt — лучший выбор для современного бизнеса.

Это решение предлагает полностью автоматизированный бухгалтерский учет с использованием искусственного интеллекта, позволяющий автоматизировать все процессы учета и ведения бухгалтерии.

Для многих это кардинально изменит ситуацию.

Docyt берет на себя гораздо больше работы, от сложной сверки данных до предоставления вам информации о вашей прибыльности в режиме реального времени.

Мы приложили усилия, сопоставимые с усилиями экспертов, чтобы действительно сравнить эти системы, поэтому вы можете быть уверены, что ваш выбор облегчит вашу финансовую жизнь.

Больше от Dext

Мы также сравнили Dext с другими инструментами для управления расходами и бухгалтерского учета:

- Dext против Xero: Xero предлагает комплексные решения для бухгалтерского учета с интегрированными функциями управления расходами.

- Декст против Головоломка IO: Компания Puzzle IO преуспевает в предоставлении финансовых аналитических данных и прогнозировании на основе искусственного интеллекта..

- Декст против Снайдера: Компания Synder специализируется на синхронизации данных о продажах в электронной коммерции и обработке платежей.

- Dext против Easy в конце месяца: Easy Month End упрощает процедуру закрытия финансового месяца.

- Декст против Доцита: Docyt использует искусственный интеллект для автоматизации задач бухгалтерского учета и управления документами.

- Dext против RefreshMe: RefreshMe предоставляет информацию о финансовых показателях бизнеса в режиме реального времени.

- Лекст против Сейджа: Компания Sage предлагает широкий спектр бухгалтерских решений с возможностями отслеживания расходов.

- Dext против Zoho Books: Zoho Books предоставляет интегрированную систему бухгалтерского учета с функциями управления расходами.

- Dext против Wave: Wave предлагает бесплатное бухгалтерское программное обеспечение с базовыми функциями отслеживания расходов.

- Dext против Quicken: Quicken популярен для управления личными финансами и отслеживания основных деловых расходов.

- Dext против Hubdoc: Hubdoc специализируется на автоматизированном сборе документов и извлечении данных.

- Dext против Expensify: Expensify предлагает надежные решения для составления отчетов о расходах и управления ими.

- Dext против QuickBooks: QuickBooks — это широко используемая бухгалтерская программа с инструментами для управления расходами.

- Dext против AutoEntry: AutoEntry автоматизирует ввод данных из счетов-фактур, квитанций и банковских выписок.

- Dext против FreshBooks: FreshBooks предназначен для предприятий сферы услуг и включает в себя функции выставления счетов и отслеживания расходов.

- Dext против NetSuite: NetSuite предлагает комплексную ERP-систему с функциями управления расходами.

Больше информации о Docyt

При выборе подходящего бухгалтерского программного обеспечения полезно сравнить различные платформы.

Ниже приведено краткое сравнение Docyt со многими его альтернативами.

- Docyt против Puzzle IO: Хотя обе компании помогают с финансами, Docyt специализируется на ведении бухгалтерского учета для бизнеса с использованием искусственного интеллекта, а Puzzle IO упрощает выставление счетов и учет расходов для фрилансеров.

- Доцит против Декста: Docyt предлагает полноценную платформу для ведения бухгалтерского учета на основе искусственного интеллекта, в то время как Dext специализируется на автоматизированном сборе данных из документов.

- Доцит против Ксеро: Docyt известна своей глубокой автоматизацией с помощью искусственного интеллекта. Xero предоставляет комплексную и удобную систему бухгалтерского учета для общих бизнес-задач.

- Доцит против Снайдера: Docyt — это инструмент для ведения бухгалтерского учета на основе искусственного интеллекта, предназначенный для автоматизации внутренних процессов. Synder же фокусируется на синхронизации данных о продажах в электронной коммерции с вашим бухгалтерским программным обеспечением.

- Docyt против Easy Month End: Docyt — это полноценное решение для бухгалтерского учета на основе искусственного интеллекта. Easy Month End — это специализированный инструмент, разработанный специально для оптимизации и упрощения процесса закрытия месяца.

- Docyt против RefreshMe: Docyt — это инструмент для ведения бухгалтерского учета в бизнесе, а RefreshMe — это приложение для управления личными финансами и составления бюджета.

- Доцит против Сейджа: Docyt использует современный подход, в первую очередь основанный на искусственном интеллекте. Sage — это компания с многолетней историей, предлагающая широкий спектр традиционных и облачных решений для бухгалтерского учета.

- Docyt против Zoho Books: Docyt специализируется на автоматизации бухгалтерского учета с помощью ИИ. Zoho Books — это комплексное решение, предлагающее полный набор функций по конкурентоспособной цене.

- Docyt против Wave: Docyt предоставляет мощные инструменты автоматизации на основе ИИ для растущих предприятий. Wave — это бесплатная бухгалтерская платформа, лучше всего подходящая для фрилансеров и микропредприятий.

- Docyt против Quicken: Docyt создан для ведения бухгалтерского учета в бизнесе. Quicken — это, прежде всего, инструмент для управления личными финансами и составления бюджета.

- Docyt против Hubdoc: Docyt — это полноценная система бухгалтерского учета на основе искусственного интеллекта. Hubdoc — это инструмент для сбора данных, который автоматически собирает и обрабатывает финансовые документы.

- Docyt против Expensify: Docyt выполняет полный спектр бухгалтерских задач. Expensify специализируется на управлении и отчетности по расходам сотрудников.

- Docyt против QuickBooks: Docyt — это платформа автоматизации на основе искусственного интеллекта, которая расширяет возможности QuickBooks. QuickBooks — это комплексное бухгалтерское программное обеспечение для предприятий любого размера.

- Docyt против AutoEntry: Docyt — это комплексное решение для ведения бухгалтерского учета на основе искусственного интеллекта. AutoEntry специализируется на извлечении данных из документов и автоматизации этого процесса.

- Docyt против FreshBooks: Docyt использует передовые технологии искусственного интеллекта для автоматизации. FreshBooks — это удобное решение, популярное среди фрилансеров благодаря функциям выставления счетов и учета рабочего времени.

- Docyt против NetSuite: Docyt — это инструмент автоматизации бухгалтерского учета. NetSuite — это полноценная система планирования ресурсов предприятия (ERP) для крупных корпораций.

Часто задаваемые вопросы

В чём основное различие между Dext и Docyt?

Dext отлично подходит для отслеживания расходов и управления квитанциями. Docyt предлагает более широкую автоматизацию бухгалтерского учета, обрабатывая счета-фактуры и предоставляя финансовые обзоры в режиме реального времени. Цель Docyt — упростить общий рабочий процесс.

С какими бухгалтерскими программами интегрируются Dext и Docyt?

И Dext, и Docyt обычно интегрируются с популярными бухгалтерскими программами, такими как QuickBooks и Xero. Docyt часто имеет более широкий спектр интеграций с другими инструментами управления бизнесом.

Что лучше подходит для малого бизнеса: Dext или Docyt?

Dext может стать хорошей отправной точкой для очень малых предприятий, ориентированных на управление расходами. Однако, если малый бизнес Если вам нужна более комплексная автоматизация бухгалтерского учета для оптимизации процессов, Docyt может стать лучшей долгосрочной инвестицией.

Может ли мой бухгалтер использовать Dext или Docyt?

Да, оба инструмента могут быть использованы. бухгалтеры и бухгалтерских фирм. Docyt обладает специальными функциями, разработанными для того, чтобы помочь бухгалтерам эффективно управлять несколькими клиентами.

Какой инструмент лучше подходит для автоматизации ввода данных?

Оба инструмента автоматизируют ввод данных, но Docyt, как правило, обрабатывает более широкий спектр документов, помимо квитанций, используя ИИ для извлечения информации, что может еще больше упростить процесс по сравнению с Dext, который в основном ориентирован на документы, касающиеся расходов.