Is Quicken giving you grief with bugs or fees?

Feeling stuck with software that just doesn’t fit? You’re not alone!

Managing money shouldn’t be a pain.

The good news? There are great options!

This article reveals the 9 best Quicken alternatives for 2025.

Discover powerful, user-friendly tools to simplify your finances, budget better, and track your money easily.

Find your perfect financial match!

What is the Best Quicken Alternative?

Finding the right financial tool can feel like searching for a needle in a haystack.

But don’t worry! We’ve done the digging for you.

Below is a list of the top 9 Quicken alternatives, ranked to help you choose the best fit for your money management.

1. Xero (⭐️4.8)

Xero is popular for small businesses. It’s easy to use and has a clean design.

It’s a modern, cloud-based tool for organizing finances, connecting with your bank, tracking sales, and paying bills.

Great for straightforward, user-friendly accounting.

Unlock its potential with our Xero tutorial.

Also, explore our Quicken vs Xero comparison!

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

2. Dext (⭐️4.5)

Dext is a bookkeeping automation tool.

It’s not a full accounting system on its own.

Think of it as a super-efficient digital shoebox for all your receipts and invoices.

You just snap a picture with your phone or email a document, and Dext uses smart technology to pull out all the important details.

This saves you from a lot of manual data entry and helps you go paperless.

Unlock its potential with our Dext tutorial.

Also, explore our Quicken vs Dext comparison!

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

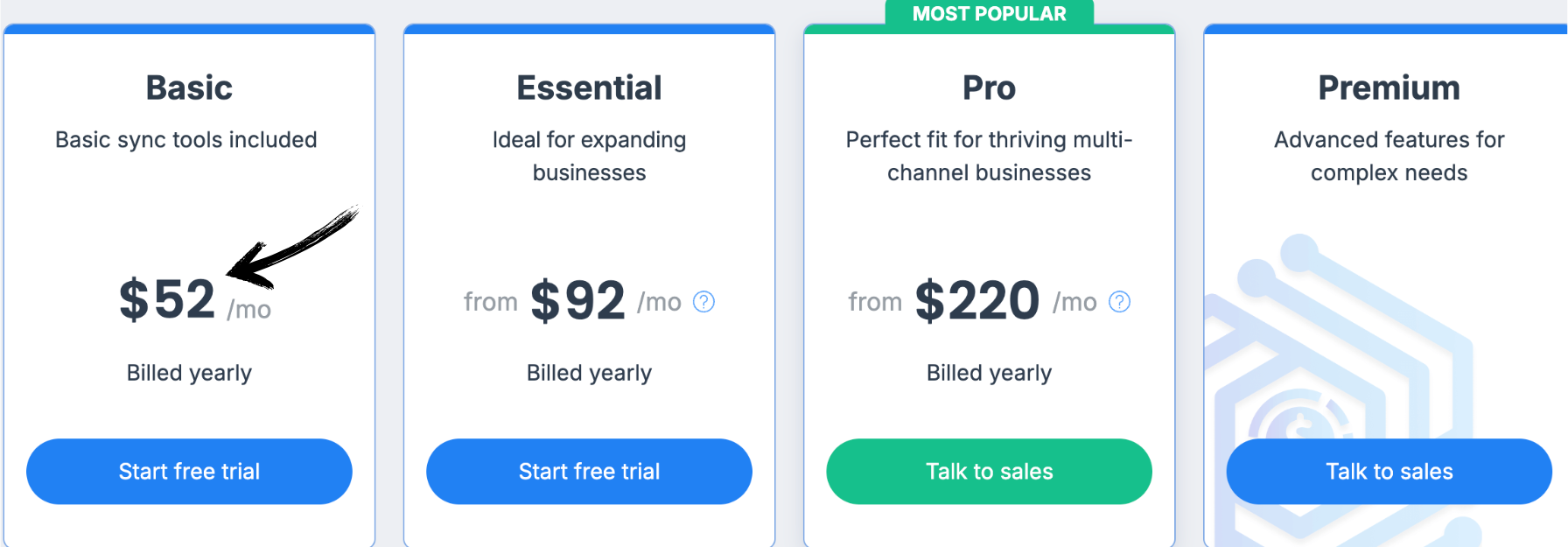

3. Synder (⭐️4.0)

Synder connects your online sales to your accounting software.

It’s not a full accounting system, but a bridge for your e-commerce data.

It takes transactions from Shopify or Stripe and sends them to QuickBooks or Xero, cutting down manual work.

Unlock its potential with our Synder tutorial.

Also, explore our Quicken vs Synder comparison!

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

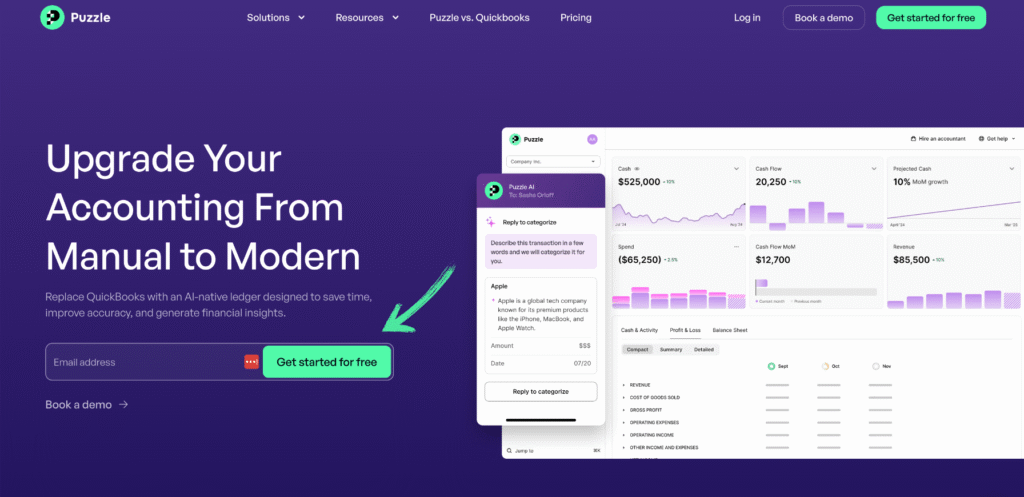

4. Puzzle IO (⭐️3.8)

Puzzle IO is a modern accounting tool for startups.

It automates bookkeeping and gives clear financial insights.

It’s like a smart assistant for your numbers, so you can focus on your business, making finances simpler.

Unlock its potential with our Puzzle IO tutorial.

Also, explore our Quicken vs Puzzle IO comparison!

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

Pricing

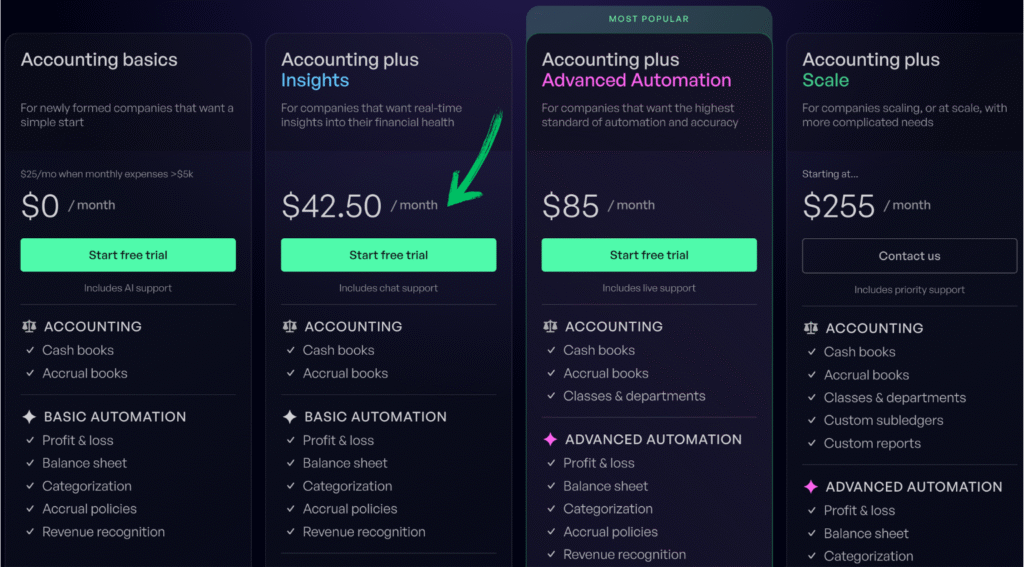

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

5. Easy Month End (⭐️3.7)

Easy Month End helps businesses close their books faster.

It’s not a full accounting system, but a tool for the “month-end close.”

It finds errors, reconciles accounts, and preps financial statements.

This ensures accurate books without hassle.

Unlock its potential with our Easy Month End tutorial.

Also, explore our Quicken vs Easy Month End comparison!

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

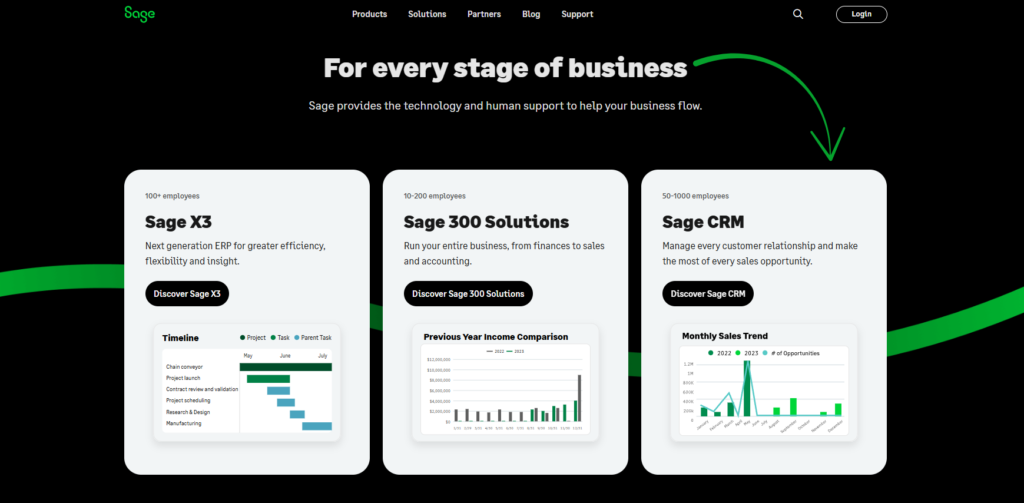

6. Sage (⭐️3.6)

Sage is a long-standing name in the accounting world.

It offers a wide range of solutions for businesses of all sizes, from startups to large companies.

Think of it as a reliable partner for all your accounting needs.

It can handle everything from simple bookkeeping to advanced financial management.

Sage is a solid choice because you can often find a product that fits your specific industry or business type perfectly.

Unlock its potential with our Sage tutorial.

Also, explore our Quicken vs Sage comparison!

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

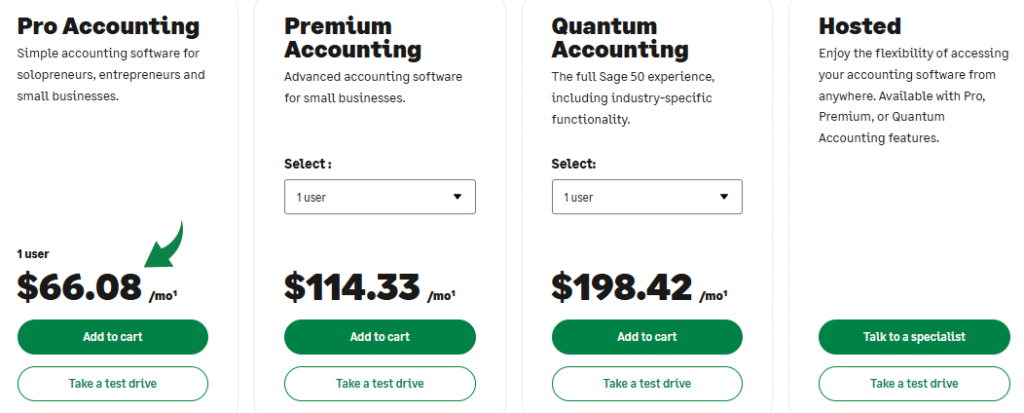

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

7. RefreshMe (⭐️3.5)

RefreshMe is an all-in-one personal finance platform.

It’s designed to help you organize all your money matters in one place.

Think of it as a personal financial advisor in your pocket.

It connects to your bank accounts, tracks spending, and even monitors your investments and credit score to give you a complete picture of your financial health.

Unlock its potential with our RefreshMe tutorial.

Also, explore our Quicken vs RefreshMe comparison!

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

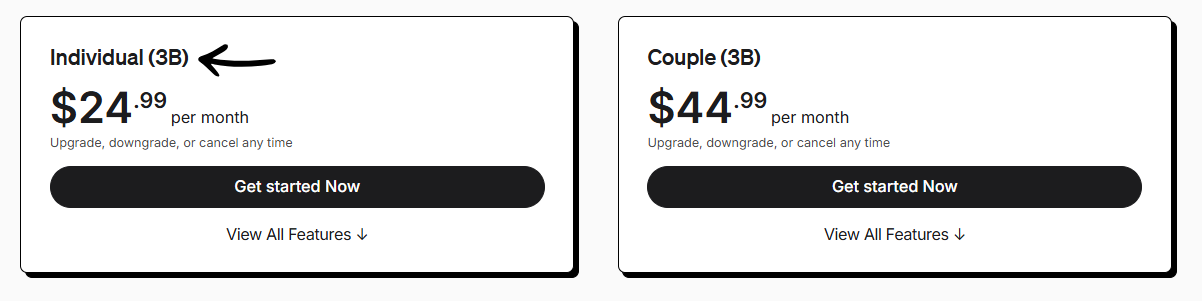

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

8. QuickBooks (⭐️3.4)

QuickBooks is a top name for managing business money.

It’s like a powerful assistant for your finances, tracking everything from invoices to bills.

Many businesses rely on it to keep their books straight.

Unlock its potential with our QuickBooks tutorial.

Also, explore our Quicken vs QuickBooks comparison!

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

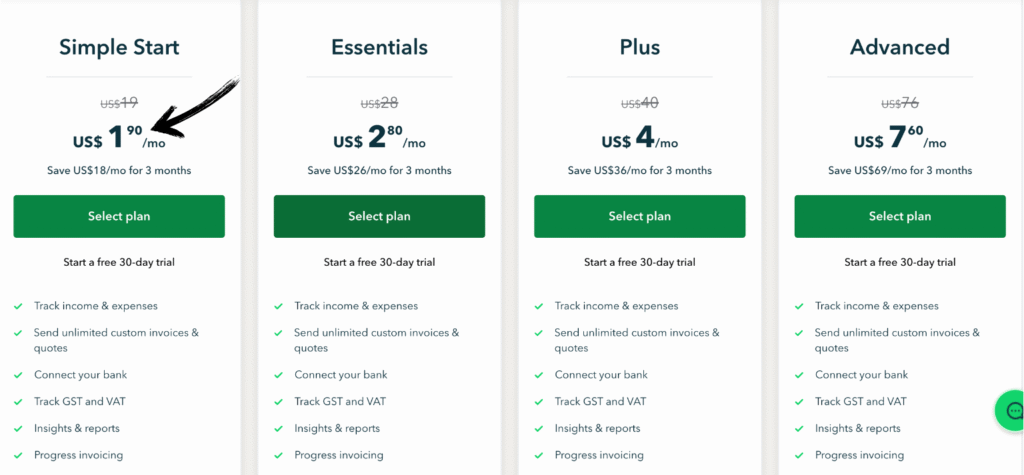

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

9. FreshBooks (⭐️3.2)

FreshBooks makes invoicing and expense tracking easy, especially for freelancers & service businesses.

It helps you send invoices fast, track project time, and scan receipts.

It focuses on simple billing and getting paid.

Unlock its potential with our FreshBooks tutorial.

Also, explore our Quicken vs FreshBooks comparison!

Our Take

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

Key Benefits

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

Pricing

- Lite: $2.10/month.

- Plus: $3.80/month.

- Premium: $6.50/month.

- Select: Custom Pricing.

Pros

Cons

Buyers Guide

We know choosing the right tool for your finances is a big deal.

To help you, we dug deep to bring you the best information. Here’s how we did our research:

- Audience Focus: We focused on what Quicken users and those seeking a free Quicken alternative are looking for. We read through forums and articles to understand common frustrations and desired features, whether for personal finance apps or managing a checking and savings account.

- Core Evaluation Factors: We meticulously evaluated each product against a set of crucial criteria, ensuring we provided a balanced view:

- Pricing: We looked at the subscription model, noting which products offered a free version or a day free trial. We also considered the value of different paid plans.

- Features: We identified the key functionalities, such as cash flow tracking, account tracking, net worth tracking, and the ability to download transactions from financial institutions. We also looked for specialized features like calendar budgeting, tax reports, and tools for retirement accounts.

- Limitations: We pinpointed any drawbacks, such as a steeper learning curve, or missing features like direct connect to banks or a dedicated Mac version for Mac users.

- Usability: We considered how easy each web app or iOS app was to use. We looked at whether it felt intuitive and didn’t require a finance degree to understand.

- Data Handling: We paid close attention to how each platform handles your data. This included the ease of importing Quicken data, managing bank transactions, and securely connecting to your online bank or multiple accounts.

- Security & Privacy: We looked at the security measures in place to protect your sensitive financial information, a critical factor when dealing with financial lives.

- Target User: We identified who each product was best for. For example, some are ideal as a budgeting app with a zero based budgeting approach, while others are better for investment accounts or handling loan accounts. We also considered if there was a good free plan for those on a tight budget.

Wrapping Up

We’ve covered the best Quicken alternatives, from powerful personal finance software with great financial tracking to simpler budgeting software.

Whether you’re a Quicken Classic fan or a new user, a new tool can make a big difference.

Many options offer a free pricing plan or a free trial, letting you easily import data and categorize transactions.

You can track a simple checking account or more complex investment accounts.

Tools like Personal Capital are great for tracking investments.

While others, like Tiller Money, are perfect for Google Sheets users.

Find a tool with the key features you need to manage your recurring expenses and financial goals.

Frequently Asked Questions

What is the best free alternative to Quicken?

Wave is an excellent best free quicken alternative. It offers key features like invoicing and basic financial tracking at no cost, making it a great option for freelancers and small businesses. It’s a solid best free alternative to get started with.

Do these alternatives work on Mac and mobile?

Many modern budgeting tools are cross-platform. Apps like Personal Capital and YNAB have dedicated mobile apps for both iOS and Android. You can find versions for Quicken Mac users and those who prefer a web app.

Can I track investments and prepare for taxes?

Yes, many alternatives go beyond simple budgeting. They offer investment tracking, allowing you to monitor portfolios. Some, like the business version of QuickBooks, also include features to simplify tax preparation and reporting.

How do I switch from Quicken?

Most alternatives make it easy to import data from your Quicken files or download Quicken transactions. The process often involves exporting your data file from Quicken and then importing it into the new software, which can connect to most major banks.

Are there alternatives for specific budgeting methods?

Yes. You can find an excellent budgeting app for almost any method. Some offer zero-based budgeting, while others use calendar-based budgeting. You can also find software for bill paying and managing recurring expenses.