Você está se afogando em recibos e planilhas?

Acompanhar o seu negócios Dinheiro pode parecer uma grande dor de cabeça, não é?

Duas opções populares são Synder e Docyt.

Mas qual deles é realmente o melhor para você?

Vamos examinar estes software de contabilidade escolha suas opções e determine qual delas facilitaria sua vida.

Visão geral

Analisamos atentamente tanto Synder quanto Docyt.

Nós os testamos para ver o que eles podem fazer.

Isso nos ajudou a compará-los de forma justa.

Agora podemos mostrar a vocês as semelhanças e as diferenças entre eles.

O Synder automatiza sua contabilidade, sincronizando dados de vendas perfeitamente com o QuickBooks, Xero e muito mais. Confira hoje mesmo!

Preços: Oferece um período de teste gratuito. O plano premium custa a partir de US$ 52 por mês.

Principais características:

- Sincronização de vendas multicanal

- Reconciliação automatizada

- Relatórios detalhados

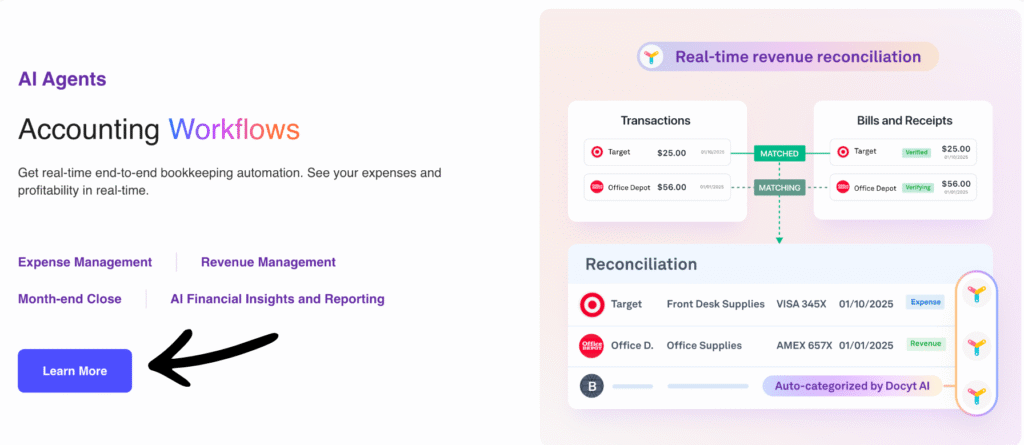

Cansado do manual? contabilidadeA Docyt AI automatiza a entrada e a conciliação de dados, economizando em média 40 horas para os usuários.

Preços: Oferece um período de teste gratuito. O plano premium custa a partir de US$ 299 por mês.

Principais características:

- Reconciliação automatizada

- Fluxos de trabalho simplificados

- Interface amigável

O que é Snyder?

Vamos falar sobre Snyder.

É uma ferramenta que ajuda os diferentes aplicativos da sua empresa a se comunicarem entre si.

Pense nisso como um assistente que transfere suas informações financeiras para onde elas precisam ir.

Isso pode te poupar muito tempo.

Explore também os nossos favoritos. Alternativas Snyder…

Nossa opinião

O Synder automatiza sua contabilidade, sincronizando dados de vendas perfeitamente com o QuickBooks. XeroE muito mais. Empresas que utilizam o Synder relatam economizar, em média, mais de 10 horas por semana.

Principais benefícios

- Sincronização automática de dados de vendas

- Rastreamento de vendas multicanal

- Conciliação de pagamentos

- Integração de gerenciamento de estoque

- Relatórios de vendas detalhados

Preços

Todos os planos serão Cobrado anualmente.

- Básico: $ 52 por mês.

- Essencial: US$ 92 por mês.

- Pró: $ 220 por mês.

- Premium: Preços personalizados.

Prós

Contras

O que é Docyt?

Vamos falar sobre o Docyt.

É uma ferramenta que ajuda as empresas a controlar suas finanças.

Ele pode obter informações do seu banco e das suas contas.

Isso significa menos digitação para você!

Explore também os nossos favoritos. Alternativas ao Docyt…

Principais benefícios

- Automação com Inteligência Artificial: A Docyt utiliza inteligência artificial para extrair automaticamente dados de documentos financeiros, incluindo informações de mais de 100.000 fornecedores.

- Contabilidade em tempo real: Mantém seus registros contábeis atualizados em tempo real. Isso proporciona uma visão financeira precisa a qualquer momento.

- Gestão de Documentos: Centraliza todos os documentos financeiros. Você pode pesquisá-los e acessá-los facilmente.

- Automatização do pagamento de contas: Automatiza o processo de pagamento de contas. Agende e pague contas com facilidade.

- Reembolso de despesas: Simplifica o processo de reembolso de despesas dos funcionários. Envie e aprove despesas rapidamente.

- Integrações perfeitas: Integra-se com softwares de contabilidade populares. Isso inclui: QuickBooks e Xero.

- Detecção de Fraudes: Sua IA pode ajudar a sinalizar transações incomuns. Isso adiciona uma camada de segurança. segurançaNão há garantia específica para o software, mas são fornecidas atualizações contínuas.

Preços

- Impacto: US$ 299 por mês.

- Avançado: $499 por mês.

- Avançado Mais: $799 por mês.

- Empresa: US$ 999 por mês.

Prós

Contras

Comparação de recursos

Vamos analisar o que cada um faz de melhor.

Isso ajudará você a decidir qual opção é a mais adequada para o seu negócio.

1. Canais de Vendas

- O Synder é ótimo para empresas que vendem muito online. Ele se conecta facilmente a todos os seus canais de venda, como Shopify, Stripe e Etsy.

- A Docyt também se conecta a diversas plataformas de vendas para gerenciar seu negócio de vendas multicanal.

2. Contabilidade Automatizada

- Synder oferece soluções automatizadas. contabilidadeEle importa suas transações em segundo plano para ajudar a manter suas contas em dia com um único clique.

- O Docyt também é um divisor de águas na automação de processos administrativos e operacionais. contabilidade tarefas usando sua plataforma inteligente.

3. Contabilidade com IA

- A Docyt se destaca com sua IA. contabilidadeEle usa IA. automação Software para lidar com tarefas demoradas. O Docyt aprende as complexidades do seu negócio para fazer As coisas ficam mais fáceis.

- Synder se concentra mais em vincular suas vendas e pagamentos. dados ao seu sistema de contabilidade principal.

4. Informações em tempo real

- O Synder oferece informações em tempo real para que você tenha visibilidade instantânea da sua situação financeira.

- A Docyt também fornece relatórios financeiros em tempo real. Isso ajuda você a tomar decisões estratégicas inteligentes.

5. Gestão de Despesas

- Ambas as ferramentas podem ajudar com as despesas. O Synder monitora suas taxas e impostos.

- O Docyt é excelente para gestão de despesas. Seu recurso de captura de recibos facilita o controle de gastos, além de auxiliar na conciliação bancária automatizada.

6. Fechamento do mês

- Fechar os livros no final do mês é uma tarefa complexa. O Docyt auxilia suas equipes financeiras nesse processo. Ele pode até mesmo gerar demonstrações financeiras consolidadas e individuais.

- Isso ajuda a garantir um controle financeiro constante e a reduzir tarefas tediosas.

7. Transações Históricas

- Ao configurar o Synder, você pode importar transações históricas. Isso é útil para migrar seus dados antigos para o novo software.

8. Integrações principais

- O Synder é compatível com diversas ferramentas. Ele funciona com o QuickBooks Online, QuickBooks e Sábio Conta intacta.

- O Docyt também funciona bem com o QuickBooks Online e auxilia no pagamento de contas e na conciliação de receitas.

9. Multimoeda

- Se você vende em diferentes lugares, precisa lidar com várias moedas. O Synder foi desenvolvido para facilitar o gerenciamento de diferentes moedas. Ele cuida dos detalhes para que você não precise se preocupar.

O que levar em consideração ao escolher um software de contabilidade?

Aqui estão os principais pontos a serem considerados ao escolher uma ferramenta como o Snyder ou o Docyt:

- Procure por uma forte automação contábil. O software deve automatizar tarefas como gerenciamento de faturas e pagamentos para economizar seu tempo.

- Verifique se isso ajuda a eliminar a entrada manual de dados. Isso reduz a probabilidade de erros e falhas na contabilização de receitas.

- O software deve atender às suas necessidades, quer você tenha várias empresas ou gerencie diversas filiais.

- A ferramenta deve oferecer relatórios e insights em tempo real. Isso é importante para a tomada de decisões estratégicas e para o acompanhamento de indicadores-chave de desempenho.

- Certifique-se de que seja compatível com todas as suas plataformas, como PayPal, Stripe, Square, Shopify, eBay e seus processos contábeis atuais.

- Caso seja necessário, o software deve suportar múltiplas moedas e auxiliar no reconhecimento de receita e na conformidade com os princípios contábeis geralmente aceitos (GAAP).

- Procure por funcionalidades que auxiliem na gestão financeira e no gerenciamento de suas contas bancárias.

- A plataforma da Docyt, com inteligência artificial, e seus recursos de contabilidade com IA são excelentes se você deseja usar a IA mais recente para otimizar suas operações financeiras.

- Isso deve ajudá-lo a visualizar facilmente sua lucratividade e gerenciar estoque, frete e descontos.

- Deve gerar balanços patrimoniais precisos e funcionar bem com escritórios de contabilidade que auxiliam nesse processo. pequenas empresas.

Veredicto final

Analisamos ambas as ferramentas com muita atenção.

Embora o Synder seja uma escolha sólida para vendedores de comércio eletrônico com alto volume de vendas.

Temos que escolher o Docyt como o vencedor geral para a maioria das pequenas empresas. Por quê?

O Docyt oferece funcionalidades que realmente ajudam a eliminar a entrada manual de dados.

Sua plataforma inteligente lida com tarefas complexas, como contabilidade departamental e gerenciamento de várias filiais, sem esforço.

Isso reduz seu estresse. Se você realmente deseja trocar o trabalho repetitivo e tedioso pela automação contábil, o Docyt é a melhor escolha.

Analisamos detalhadamente essas ferramentas, para que você possa confiar na nossa escolha para suas necessidades específicas.

Mais de Snyder

- Synder vs Puzzle io: Puzzle.io é uma ferramenta de contabilidade com inteligência artificial criada para startups, com foco em métricas como taxa de consumo de caixa e reserva financeira. Já o Synder se concentra mais na sincronização de dados de vendas multicanal para uma gama mais ampla de empresas.

- Synder vs Dext: Dext é uma ferramenta de automação que se destaca na captura e gestão de dados de faturas e recibos. Já o Synder é especializado na automatização do fluxo de transações de vendas.

- Synder vs Xero: O Xero é uma plataforma de contabilidade em nuvem completa. Snyder Funciona com o Xero para automatizar a entrada de dados dos canais de vendas, enquanto o Xero lida com todas as tarefas contábeis, como faturamento e relatórios.

- Synder vs Easy Month End: Easy Month End é uma ferramenta criada para ajudar empresas a organizar e otimizar o processo de fechamento mensal. Já o Synder foca mais na automatização do fluxo diário de dados de transações.

- Synder vs Docyt: A Docyt utiliza IA para uma ampla gama de tarefas de contabilidade, incluindo pagamento de contas e gestão de despesas. A Synder concentra-se mais na sincronização automática de dados de vendas e pagamentos provenientes de múltiplos canais.

- Synder vs RefreshMe: O RefreshMe é um aplicativo de finanças pessoais e gerenciamento de tarefas. Não é um concorrente direto, já que o Synder é uma ferramenta de automação contábil para empresas.

- Snyder vs Sage: O Sage é um sistema de contabilidade completo e consolidado, com recursos avançados como gestão de estoque. O Synder é uma ferramenta especializada que automatiza a entrada de dados em sistemas de contabilidade como o Sage.

- Synder vs Zoho Books: O Zoho Books é uma solução completa de contabilidade. Snyder Complementa o Zoho Books ao automatizar o processo de importação de dados de vendas de diversas plataformas de comércio eletrônico.

- Snyder vs Onda: Wave é um software de contabilidade gratuito e fácil de usar, frequentemente utilizado por freelancers e microempresas. Synder é uma ferramenta de automação paga, projetada para empresas com alto volume de vendas em múltiplos canais.

- Synder vs Quicken: O Quicken é principalmente um software de gestão de finanças pessoais, embora também ofereça alguns recursos para pequenas empresas. O Synder foi desenvolvido especificamente para a automação da contabilidade empresarial.

- Synder vs Hubdoc: O Hubdoc é uma ferramenta de gerenciamento de documentos e captura de dados, semelhante ao Dext. Ele se concentra na digitalização de contas e recibos. O Synder, por sua vez, concentra-se na sincronização de dados de vendas e pagamentos online.

- Synder vs Expensify: Expensify é uma ferramenta para gerenciar relatórios de despesas e recibos. Synder serve para automatizar dados de transações de vendas.

- Synder vs QuickBooks: O QuickBooks é um software de contabilidade completo. Snyder Integra-se com o QuickBooks para automatizar o processo de importação de dados de vendas detalhados, tornando-se um valioso complemento em vez de uma alternativa direta.

- Synder vs Entrada Automática: O AutoEntry é uma ferramenta de automação de entrada de dados que captura informações de faturas, contas e recibos. O Synder se concentra na automação de dados de vendas e pagamentos de plataformas de comércio eletrônico.

- Snyder vs FreshBooks: O FreshBooks é um software de contabilidade desenvolvido para freelancers e pequenas empresas prestadoras de serviços, com foco na emissão de faturas. O Synder é voltado para empresas com alto volume de vendas em diversos canais online.

- Snyder vs NetSuite: O NetSuite é um sistema abrangente de Planejamento de Recursos Empresariais (ERP). O Synder é uma ferramenta especializada que sincroniza dados de comércio eletrônico com plataformas mais amplas, como o NetSuite.

Mais de Docyt

Ao procurar o software de contabilidade certo, é útil ver como as diferentes plataformas se comparam.

Segue uma breve comparação entre o Docyt e muitas de suas alternativas.

- Docyt vs Puzzle IO: Embora ambas auxiliem nas finanças, a Docyt se concentra na contabilidade com inteligência artificial para empresas, enquanto a Puzzle IO simplifica a emissão de faturas e o controle de despesas para freelancers.

- Docyt vs Dext: A Docyt oferece uma plataforma completa de contabilidade com IA, enquanto a Dext se especializa na captura automatizada de dados a partir de documentos.

- Docyt vs Xero: A Docyt é conhecida por sua avançada automação com inteligência artificial. A Xero oferece um sistema de contabilidade completo e fácil de usar para as necessidades gerais de uma empresa.

- Docyt vs Snyder: Docyt é uma ferramenta de contabilidade com IA para automação administrativa. Synder se concentra na sincronização de dados de vendas de e-commerce com seu software de contabilidade.

- Docyt vs Easy Month End: Docyt é uma solução completa de contabilidade com IA. Easy Month End é uma ferramenta especializada, projetada especificamente para agilizar e simplificar o processo de fechamento mensal.

- Docyt vs RefreshMe: Docyt é uma ferramenta de contabilidade empresarial, enquanto RefreshMe é um aplicativo de finanças pessoais e orçamento.

- Docyt vs Sage: A Docyt utiliza uma abordagem moderna, com foco em inteligência artificial. A Sage é uma empresa consolidada que oferece uma ampla gama de soluções contábeis tradicionais e baseadas em nuvem.

- Docyt vs Zoho Books: A Docyt se concentra na automação contábil com IA. O Zoho Books é uma solução completa que oferece um conjunto abrangente de recursos a um preço competitivo.

- Docyt vs Onda: A Docyt oferece automação poderosa com IA para empresas em crescimento. A Wave é uma plataforma de contabilidade gratuita ideal para freelancers e microempresas.

- Docyt vs Quicken: O Docyt foi desenvolvido para contabilidade empresarial. O Quicken, por sua vez, é uma ferramenta voltada principalmente para gestão de finanças pessoais e orçamento.

- Docyt vs Hubdoc: Docyt é um sistema completo de contabilidade com inteligência artificial. Hubdoc é uma ferramenta de captura de dados que coleta e processa documentos financeiros automaticamente.

- Docyt vs Expensify: A Docyt realiza uma gama completa de tarefas de contabilidade. A Expensify é especializada em gerenciar e gerar relatórios de despesas de funcionários.

- Docyt vs QuickBooks: Docyt é uma plataforma de automação com IA que aprimora o QuickBooks. O QuickBooks é um software de contabilidade completo para empresas de todos os portes.

- Docyt vs AutoEntry: Docyt é uma solução completa de contabilidade com IA. O AutoEntry concentra-se especificamente na extração e automação de dados de documentos.

- Docyt vs FreshBooks: A Docyt utiliza inteligência artificial avançada para automação. O FreshBooks é uma solução intuitiva e popular entre freelancers por seus recursos de faturamento e controle de tempo.

- Docyt vs NetSuite: Docyt é uma ferramenta de automação contábil. NetSuite é um sistema completo de planejamento de recursos empresariais (ERP) para grandes corporações.

Perguntas frequentes

O Snyder é melhor para empresas de vendas?

O Synder é ótimo para quem vende muito online. Ele se conecta facilmente a diversas plataformas de vendas e sistemas de pagamento, permitindo acompanhar seus ganhos.

O Docyt ajuda a organizar as contas?

Sim, o Docyt possui funcionalidades especiais que ajudam você a gerenciar e organizar suas contas e recibos. Ele pode até usar inteligência artificial para entender o que são seus documentos.

Meu contador pode usar o Synder ou o Docyt?

Sim, tanto Synder quanto Docyt permitem. contadores Para acessar seus dados financeiros. Isso facilita o auxílio deles com as finanças da sua empresa.

Qual software é mais fácil para iniciantes?

Ambas as plataformas foram projetadas para serem fáceis de usar. No entanto, os recursos de IA do Docyt para organizar documentos podem ser um pouco diferentes para alguns novos usuários no início.

Synder e Docyt me ajudam a visualizar meu fluxo de caixa?

Sim, ambos fornecem relatórios que mostram as entradas e saídas de dinheiro da sua empresa. Isso ajuda você a entender sua saúde financeira.