毎月帳簿を締めるのに時間がかかりすぎることにうんざりしていませんか?

終わりのないパズルのように感じませんか?

そこで、ここでは 2 つの人気ツール、Synder と Easy Month End について詳しく見ていきます。

どちらも財務決算を簡素化することを約束していますが、どちらが本当に実現するのでしょうか?

詳しく見て、どれがあなたに最も適しているかを考えてみましょう。

概要

私たちはSynderとEasy Month Endの両方を詳しく調べました。

どれくらい効果があるか試してみました。

これにより、公平に比較することができます。それでは、それぞれの概要を見てみましょう。

Synderは会計業務を自動化し、売上データをQuickBooks、Xeroなどとシームレスに同期します。ぜひ今すぐお試しください!

価格: 無料トライアルがあります。プレミアムプランは月額52ドルからです。

主な特徴:

- マルチチャネル販売同期

- 自動調整

- 詳細なレポート

Easyの月末、1,257人のユーザーが平均3.5時間を節約し、エラーを15%削減しました。ぜひ無料トライアルをお試しください!

価格: 無料トライアルがあります。プレミアムプランは月額45ドルからです。

主な特徴:

- 自動調整

- 合理化されたワークフロー

- ユーザーフレンドリーなインターフェース

Synderとは何ですか?

Synderについて話しましょう。

これは、さまざまな 仕事 アプリは互いに通信します。

あなたのお金の情報を必要な場所に移動するヘルパーのようなものだと考えてください。

これにより、多くの時間を節約できます。

また、私たちのお気に入りを探索してください シンダーの代替品…

私たちの見解

Synderは会計を自動化し、売上データをQuickBooksにシームレスに同期します。 ゼロなど。Synder を使用している企業は、平均して週 10 時間以上を節約していると報告しています。

主なメリット

- 自動販売データ同期

- マルチチャネル販売追跡

- 支払い調整

- 在庫管理統合

- 詳細な売上レポート

価格

すべての計画は 年払い.

- 基本: 月額52ドル。

- 不可欠: 月額92ドル。

- プロ: 月額220ドル。

- プレミアム: カスタム価格設定。

長所

短所

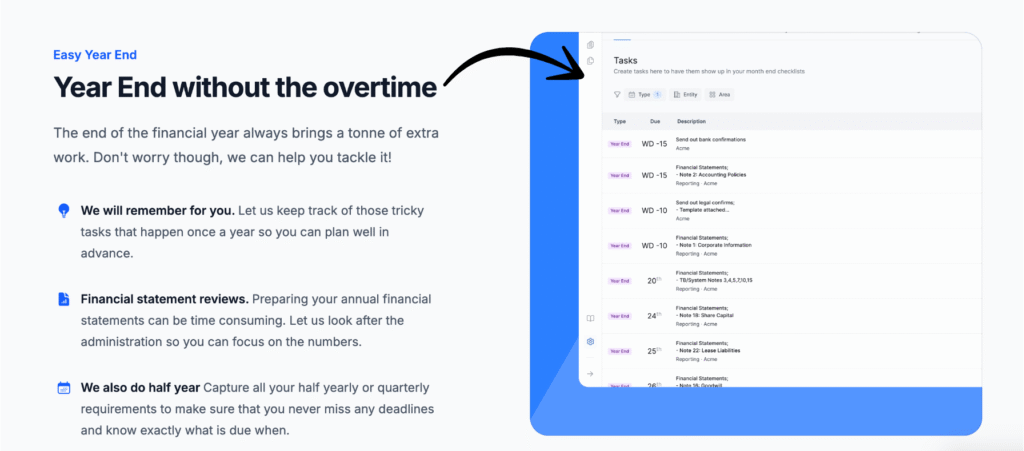

イージー・マンス・エンドとは

つまり、「Easy Month End」は月末のヘルパーのようなものです。

それは 作る 帳簿を簡単に閉じることができます。

月末にすべてのお金を一箇所にまとめて保管する方法として考えてください。

これによって、いくらお金が入ってきて、いくら出て行ったかを把握できるようになります。

また、私たちのお気に入りを探索してください 月末の簡単な代替案…

私たちの見解

Easy Month Endで財務精度を向上。自動照合と監査対応レポートを活用できます。月末処理プロセスを効率化するための個別デモをご予約ください。

主なメリット

- 自動調整ワークフロー

- タスク管理と追跡

- 差異分析

- 文書管理

- コラボレーションツール

価格

- スターター: 月額 24 ドル。

- 小さい: 月額45ドル。

- 会社: 月額89ドル。

- 企業: カスタム価格設定。

長所

短所

機能比較

それぞれのプログラムが何をするのか見てみましょう。9つの主要な機能を比較します。

これにより、それぞれの真実がわかるようになります。

1. 販売チャネルの連携

- Synder はすべての販売チャネルを接続するのに最適です。

- Shopify、Stripe、PayPal、Square などのプラットフォームと同期できます。

- これにより、過去の取引と新しい売上を データ 1つのプラットフォームに統合します。

- Easy Month End はワークフロー管理に重点を置いています。

- 接続する販売プラットフォームが少なくなります。

2. 調整と自動化

- Synderは自動化を提供 会計.

- 複数の場所からのデータを調整するのに役立ちます。

- 調整が簡単になり、手動での確認が減ります。

- 多くの場合、これはワンクリックのプロセスです。

- Easy Month End は月末のタスクの処理に役立ちます。

- すべての調整を管理および確認するのに役立ちます。

3. チームコラボレーション

- Easy Month End は財務チーム向けに構築されています。

- 「コメントを残す」、「サインオフ」、チーム管理などの機能があります。

- これにより、チームはスムーズに連携できるようになります。

- 月末処理の効率が向上します。

- Synder はチームワークもサポートします。

- Easy Month End の主な焦点は、チームのコラボレーションとワークフロー管理にあります。

4. データとレポート

- Synder は、手数料、配送、返金、割引などの詳細を提供します。

- 帳簿のバランスを保つのに役立ちます。

- Easy Month End は、貸借対照表を作成するのに最適です。

- 収集に役立ちます 監査 監査人のための証拠。

- これにより、四半期末や年度末のストレスが軽減されます。

- 貸借対照表の調整を高速化するために設計されています。

5. マルチチャンネルと高音量

- Synder は、マルチチャネル販売に最適な選択肢です。

- 多くの場所からの大量のトランザクションを処理できるように構築されています。

- 複数通貨での販売にも対応しています。

- Easy Month End は、財務チームのワークフローに重点を置いています。

- タスクを合理化することで、財務チームの業務が楽になります。

6. 会計システムの互換性

- シンダーは主要な 会計 プログラム。

- これらには、QuickBooks、QuickBooks Online、Xero、 セージ 一致しました。

- これにより、セットアップが簡単になります。

- Easy Month End はこれらのシステムの多くとも互換性があります。

7. 料金と価格

- お支払いいただく合計料金は、お客様のニーズに応じて異なります。

- Synder の場合、取引件数に応じて料金が請求される場合があります。

- Easy Month End には、サブスクリプションのさまざまなレベルがあります。

8. エラーとセキュリティの処理

- Synder はエラーや間違いを自動的に解決するのに役立ちます。

- 問題を検出できる同期モード機能があります。

- どちらのプログラムも、 安全.

- これにより、財務データが安全であるという確信を維持できます。

- 彼らはGAAP準拠を目指しています。

9. セットアップと使いやすさ

- Synder の初期設定は簡単です。

- Etsy や Clover などのプラットフォームを接続できます。

- Easy Month End は、素早いセットアップでより簡単な生活を約束します。

- 最初の月末を問題なく開始するのに役立ちます。

- 月末処理がスムーズになります。

会計ソフトウェアを選択する際に注意すべきことは何ですか?

適切なツールを確実に入手するには、次の点を確認してください。

- 財務チームの効率性が向上し、業務が楽になりますか? 財務チームの効率を高めるには、手作業を自動化し、削減するツールが必要です。

- eコマースでの販売に対応できる能力を確認してください。これには、eBayなどのプラットフォームへの対応や、適切な支払い処理が含まれます。

- すべての販売チャネルと支払いシステムからのデータを同期できるかどうかを確認します。

- サブスクリプションがある場合は、強力な収益認識機能を備えているか確認してください。これはGAAPコンプライアンスにとって重要です。

- システムは在庫と顧客を適切に管理し、明確な洞察を提供していますか?

- システムが月末処理プロセスに重点を置いているか確認してください。よりスムーズな月末処理を約束していますか?

- チームのコラボレーションやタスクの簡単な割り当てなど、財務チームのタスクを簡素化する機能を探してください。

- タスクにすばやくアクセスするための Outlook アドインまたは同様の方法を提供していますか?

- 契約書やその他のファイルなどのデータをプラットフォームに簡単にアップロードしてインポートできますか?

- システム内で質問に答えたりコメントを残したりできるかどうか確認してください。これは監査証拠に役立ちます。

- ツールは銀行振込の詳細を正しく処理しますか?

- アドホックタスクとアカウントのレビューの柔軟性を確認します。

- 複数のビジネスエンティティを処理し、必要に応じてサブスクリプションを簡単にキャンセルできますか?

- QuickBooks、Xero、 ネットスイート、または Sage Intacct。

- 作成者は遅滞なく作業を完了し、レビューのために送信できますか?

- Excel での作業のように、古い方法を切り替えたり削除したりする簡単な方法を提供する必要があります。

- 特徴を探して 簿記 背景がわかりやすい。

- ソフトウェアは、よりよい意思決定のためにデータの拡張ビューを提供しますか?

- 取引に固有の ID または追跡番号が提供されているかどうかを確認します。

- その会社(サンフランシスコに拠点を置く会社など)はよく知られており、信頼できるでしょうか?

- システムが完了として強調表示するはずの情報をユーザーが迅速に送信していることを喜ぶべきです。

最終評決

そこで、Synder と Easy Month End の両方を検討しました。

多数のオンライン販売を扱っており、すべての取引を追跡して帳簿を簡単に整理したい場合。

Synderは本当に良い選択です。

さまざまなプログラムを接続するのに役立ち、税金情報にも役立ちます。

Easy Month End は月末のタスクを整理するのに役立ちます。

私たちはこれらを試したことがあるので、何について話しているのか分かっています。

経済生活をもっとシンプルにしたいなら、Synder を試してみてください。

シンダーの詳細

- シンダー vs パズル io: Puzzle.ioは、スタートアップ向けに開発されたAI搭載の会計ツールで、バーンレートやランウェイといった指標に重点を置いています。Synderは、より幅広いビジネス向けに、マルチチャネルの販売データを同期することに重点を置いています。

- シンダー vs デクスト: Dextは、請求書や領収書からデータを取得・管理することに優れた自動化ツールです。一方、Synderは販売取引フローの自動化に特化しています。

- シンダー vs ゼロ: Xero はフル機能を備えたクラウド会計プラットフォームです。 シンダー Xero と連携して販売チャネルからのデータ入力を自動化し、Xero が請求書発行やレポート作成などのオールインワンの会計タスクを処理します。

- シンダー vs イージー・マンスエンド: Easy Month Endは、企業の月末処理プロセスを整理・効率化するために設計されたツールです。Synderは、日々の取引データフローの自動化に重点を置いています。

- シンダー vs ドサイト: Docytは、請求書の支払いや経費管理など、幅広い簿記業務にAIを活用しています。Synderは、複数のチャネルからの売上データと支払いデータの自動同期に重点を置いています。

- Synder vs RefreshMe: RefreshMeは個人の財務管理とタスク管理アプリケーションです。Synderはビジネス会計自動化ツールであるため、直接的な競合ではありません。

- シンダー vs セージ: Sageは、在庫管理などの高度な機能を備えた、長年実績のある総合的な会計システムです。Synderは、Sageなどの会計システムへのデータ入力を自動化する専用ツールです。

- Synder vs Zoho Books: Zoho Books は完全な会計ソリューションです。 シンダー さまざまな電子商取引プラットフォームから販売データをインポートするプロセスを自動化することで、Zoho Books を補完します。

- シンダー vs ウェーブ: Waveは、フリーランサーや小規模企業に多く利用されている、無料で使いやすい会計ソフトウェアです。Synderは、多チャネルで大量販売を行う企業向けに設計された有料の自動化ツールです。

- シンダー vs クイッケン: Quickenは主に個人向けの財務管理ソフトウェアですが、中小企業向けの機能もいくつか備えています。Synderは、特にビジネス会計の自動化を目的として開発されています。

- シンダー vs ハブドック: HubdocはDextに似たドキュメント管理およびデータキャプチャツールです。請求書や領収書のデジタル化に重点を置いています。Synderはオンライン販売と支払いデータの同期に重点を置いています。

- Synder vs Expensify: Expensifyは経費報告書と領収書を管理するためのツールです。Synderは販売取引データを自動化するためのツールです。

- Synder vs QuickBooks: QuickBooks は総合的な会計ソフトウェアです。 シンダー QuickBooks と統合して詳細な販売データを取り込むプロセスを自動化し、直接的な代替手段ではなく貴重なアドオンになります。

- Synder vs AutoEntry: AutoEntryは、請求書、領収書、領収書から情報を取得するデータ入力自動化ツールです。Synderは、eコマースプラットフォームからの売上データと支払いデータの自動化に重点を置いています。

- Synder vs FreshBooks: FreshBooksは、請求書作成に特化した、フリーランサーや小規模サービス企業向けに設計された会計ソフトウェアです。Synderは、複数のオンラインチャネルから大量の売上を上げている企業に最適です。

- Synder vs. NetSuite: NetSuiteは包括的なエンタープライズ・リソース・プランニング(ERP)システムです。Synderは、eコマースデータをNetSuiteのようなより広範なプラットフォームに同期するための専用ツールです。

月末の楽な過ごし方

以下は、Easy Month End といくつかの主要な代替製品との簡単な比較です。

- 簡単な月末 vs パズル io: Puzzle.io はスタートアップの会計向けですが、Easy Month End は決算プロセスの合理化に特に重点を置いています。

- イージー・マンスエンド vs Dext: Dext は主に文書と領収書のキャプチャを目的としていますが、Easy Month End は包括的な月末処理管理ツールです。

- 月末の簡単操作 vs Xero: Xero は中小企業向けの完全な会計プラットフォームであり、Easy Month End は決算プロセス専用のソリューションを提供します。

- イージー・マンスエンド vs シンダー: Synder は、財務決算全体のワークフロー ツールである Easy Month End とは異なり、電子商取引データの統合に特化しています。

- イージー・マンスエンド vs Docyt: Docyt は簿記とデータ入力に AI を使用し、Easy Month End は財務決算の手順とタスクを自動化します。

- Easy Month End vs RefreshMe: RefreshMe は財務コーチング プラットフォームであり、綿密な管理に重点を置く Easy Month End とは異なります。

- イージー・マンスエンド vs Sage: Sage は大規模なビジネス管理スイートであり、Easy Month End は重要な会計機能向けのより専門的なソリューションを提供します。

- Easy Month End vs Zoho Books: Zoho Books はオールインワンの会計ソフトウェアですが、Easy Month End は月末処理専用のツールです。

- イージー・マンスエンド vs ウェーブ: Wave は中小企業向けに無料の会計サービスを提供しており、Easy Month End は綿密な管理のためのより高度なソリューションを提供しています。

- Easy Month End vs Quicken: Quicken は個人向け財務ツールであるため、月末処理を管理する必要のある企業にとって Easy Month End はより適した選択肢となります。

- イージー・マンスエンド vs Hubdoc: Hubdoc はドキュメントの収集を自動化しますが、Easy Month End は完全な決算ワークフローとチームタスクを管理するように設計されています。

- Easy Month End vs Expensify: Expensify は経費管理ソフトウェアであり、財務決算に重点を置いた Easy Month End とは異なる機能を備えています。

- Easy Month End と QuickBooks: QuickBooks は包括的な会計ソリューションですが、Easy Month End は月末処理そのものを管理するためのより具体的なツールです。

- 簡単な月末処理と自動入力: AutoEntry はデータキャプチャツールですが、Easy Month End は決算時のタスクとワークフロー管理のための完全なプラットフォームです。

- Easy Month End vs FreshBooks: FreshBooks はフリーランサーや中小企業向けであり、Easy Month End は月末処理専用のソリューションを提供します。

- 月末処理の簡単化 vs NetSuite: NetSuite はフル機能を備えた ERP システムであり、Easy Month End が財務決算に特化している範囲よりも広範囲にわたります。

よくある質問

Synder は何をしますか?

Synderは、販売アプリや決済アプリと連携し、すべてのお金の情報を会計システムに一元管理します。これにより、収入と支出を簡単に追跡できます。

Easy Month End は使いにくいですか?

いいえ、Easy Month Endはシンプルに作られています。チェックリストを使って、毎月の月末に必要な作業を表示します。これにより、ステップを逃すことなく帳簿を締めることができます。

Synder は税金の問題を解決できますか?

はい、Synderがお手伝いします。売上データの正確性を確保します。記録がより正確になるため、確定申告の時期がスムーズになります。

Synder は誰が使用すべきでしょうか?

オンラインで商品を販売し、決済に複数のアプリを使用している場合、Synderを使えば多くの時間を節約できます。また、 会計士 多くのクライアントと仕事をする人。

中小企業の経営者にとって最適なプログラムはどれでしょうか?

どちらのプログラムも役立ちます。Synderは日々の売上と資金管理に最適です。Easy Month Endは月末の決算整理に最適です。現在、ビジネスのどの部分に最もサポートが必要なのかによって、最適なプログラムが異なります。