Paying bills and sending invoices can be a real headache for small businesses.

Juggling stacks of paper and trying to keep track of due dates can lead to mistakes.

Have you ever wished there was an easier way?

This is a common problem that can seriously hurt your 仕事.

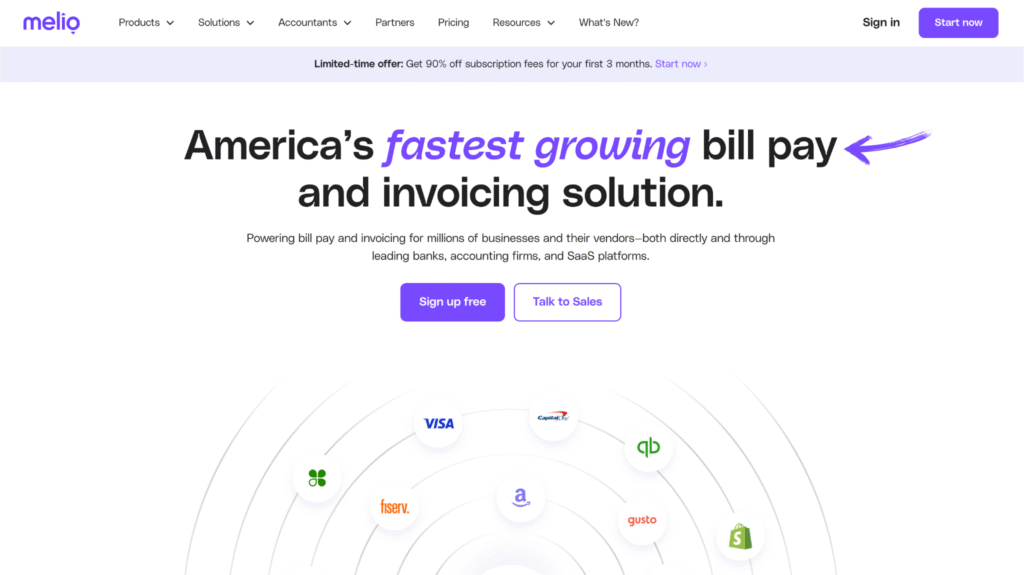

That’s where Melio comes in.

It’s a payment platform designed to 作る things simple.

In this review, we’ll look at how Melio helps you streamline bill payments and invoicing.

We’ll see if it’s the right tool to help you manage your money better in 2025.

Join the 100,000+ businesses that trust Melio to streamline their payments and save an average of 15+ hours per month on bill pay.

What is Melio?

Melio is a payment platform made for 中小企業.

Think of it as your all-in-one digital hub for managing myour finances

It simplifies your bill pay process, helping you manage your cash flow with ease.

You can use it to pay vendors and handle your accounts receivable quickly.

It’s designed to help you send multiple payments at once, which saves a ton of time.

Whether you need to make a single payment or multiple payments, Melio makes it simple.

It also helps you collect invoice payments from your customers without any hassle.

Who Created Melio?

Melio was co-founded by Matan Bar, Ilan Atias, そして Ziv Paz 2018年に。

The company’s vision was to make B2B payments as easy as sending money to a friend.

They aimed to assist everyday business owners by enhancing their cash flow through a straightforward system.

The platform allows you to use many different payment methods.

It even handles international transactions.

There is no processing fee for bank transfers.

You can also send payments to the same vendor in different ways and easily create professional invoices.

Top Benefits of Melio

- Amplify Cash Flow: Melio helps you improve your cash flow by giving you more control over when and how you pay vendors and get paid by customers. It allows you to schedule payments tailored to your business needs.

- アカウントを接続する: It’s simple to link your bank accounts to Melio. The platform syncs with popular 会計ソフトウェア like QuickBooks Online, making it simple to manage your accounts payable and other transactions.

- 時間とお金の節約: Melio’s core benefit is to save you both time and money. It’s a free service for bank transfers, so you don’t incur any extra cost or fees. This helps you streamline your financial operations on one platform.

- Simple for Recipients: You can pay any recipients, even if they don’t have a Melio account. They can receive a check or a bank transfer, eliminating the need to worry about whether your vendors are signed up.

- 使いやすい: Melio is known for being very user-friendly. Most users can get started in just minutes. If you need support, the Melio team is there to help with any subject.

- 安全: Melio handles sensitive financial データ with high-level security. This ensures that your transactions and personal information are safe.

- との統合 クイックブックス: Melio is a great alternative to manual QuickBooks payments. It syncs with your QuickBooks data, so you can easily import and manage your bills without double entry.

- カスタマーサポート: The Melio team is dedicated to providing excellent customer support and further information. You can reach out to them for any questions or issues you may have.

- クライアント管理: のために 会計 firms, Melio provides tools to manage many clients from a single dashboard. This makes it easier to handle bill payments for different businesses.

- No Investment: You don’t need a large upfront investment to get started with Melio. It is free for bank transfers, making it accessible to any business.

- 簡略化 Payments: Sign up quickly and access all features easily. Melio simplifies payments, so you can forget about paper checks and focus on your business. It truly brings your business payments into the modern world.

- Local Focus: Melio can help local business owners sell more and worry less about getting paid. The platform simplifies B2B payments for everyone, from individuals to large businesses.

- 自動給与計算: You can even use Melio to handle some payroll tasks, although that is not its main purpose. This shows how flexible the platform is.

Best Features of Melio

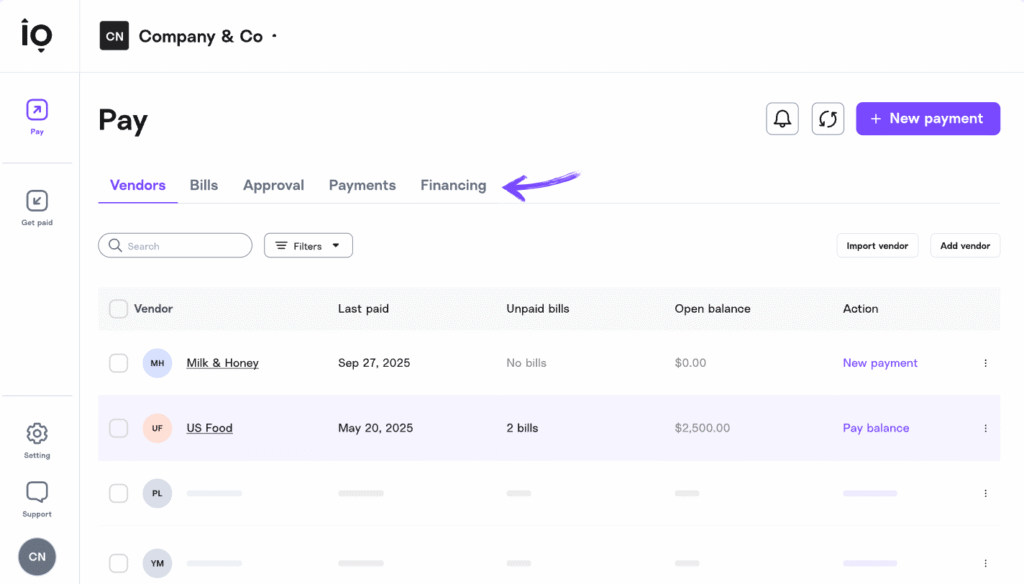

Melio offers a lot of great features that make managing your money simpler.

These tools help you handle everything from paying bills to getting paid.

Here are some of the best and most unique features that set Melio apart.

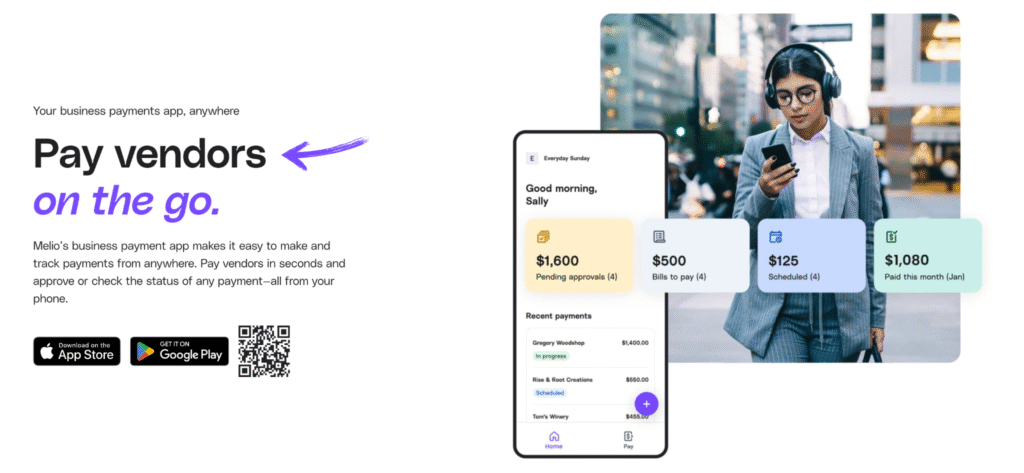

1. Mobile App

You can manage your payments from anywhere with the Melio mobile app.

This lets you handle bills on the go.

You can check your cash flow, approve payments, and keep track of everything right from your phone.

2. ACH Bank Transfers

Sending money from one bank account to another is free with Melio.

This is known as an ACH transfer.

It’s a simple, secure, and cost-effective way to pay your vendors and other recipients.

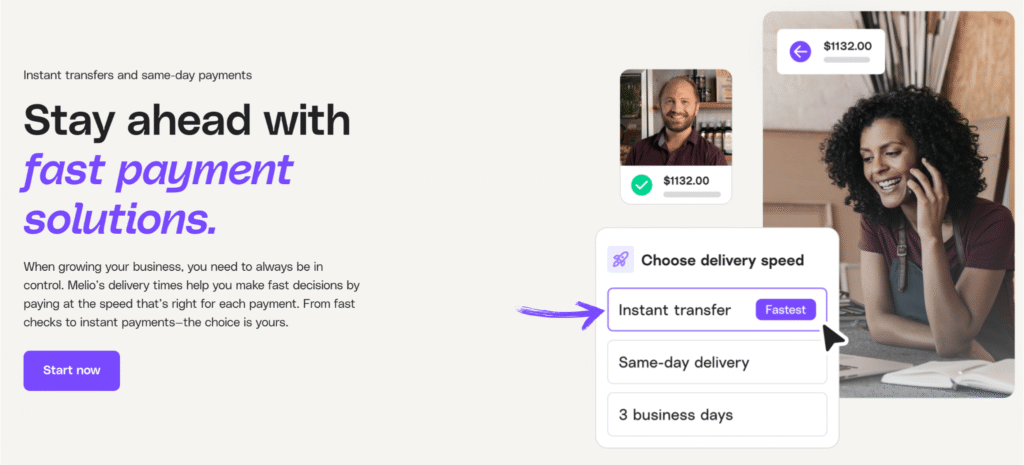

3. Fast Payments

Need to pay someone quickly? Melio offers fast payment options.

While standard transfers are free, you can pay a small fee for expedited payments.

This is helpful if you need to get money to someone in a hurry.

4. 統合

Melio works well with other tools you already use.

It simply connects with popular 会計 software like QuickBooks Online, helping you to manage accounts payable and other financial data.

This connection keeps your information synced and up-to-date.

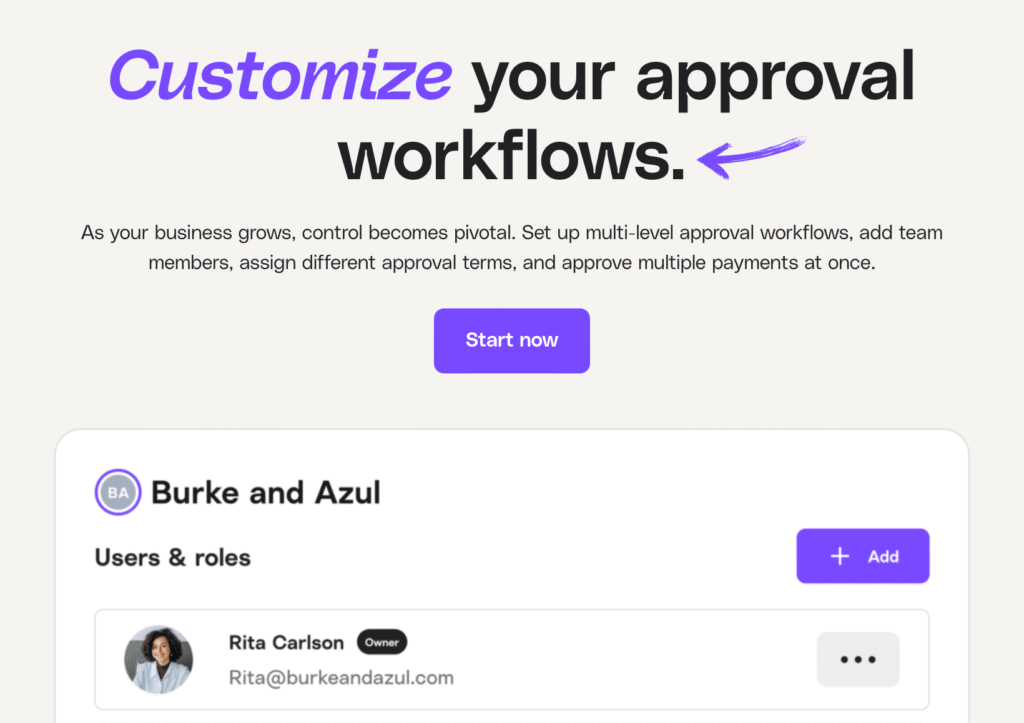

5. Approval Workflows

This feature is great for teams.

You can set up an approval process for payments.

This means that a payment needs to be approved by a specific person before it goes out.

It adds a layer of control and 安全 to your business needs.

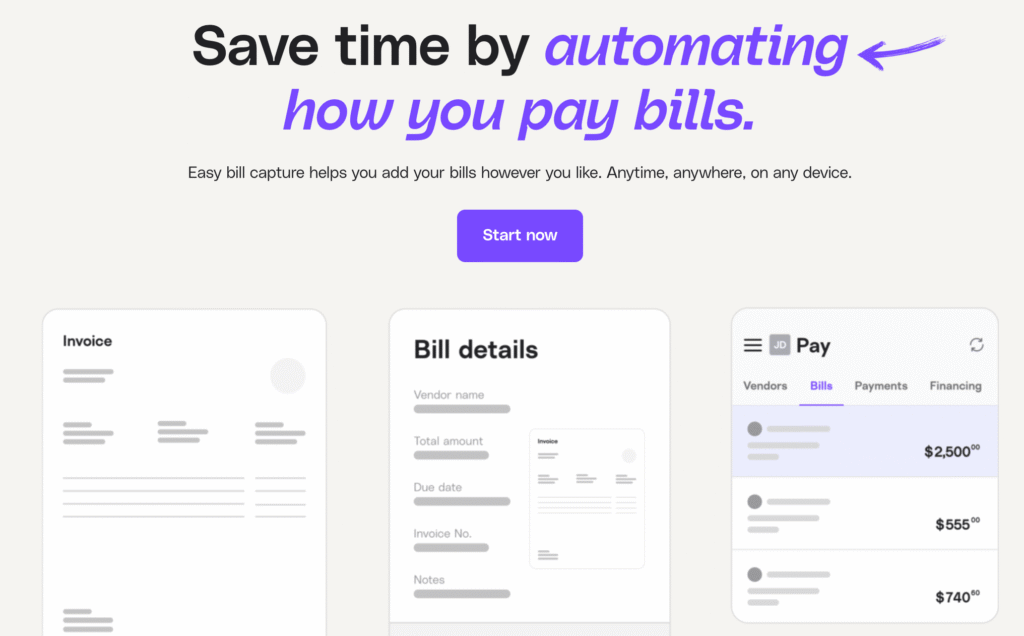

6. Easy Bill Capture

Forget typing in all your bill details.

You can simply upload a picture of an invoice or a PDF.

Melio’s system will read the information and fill in the details for you.

It saves time and reduces mistakes.

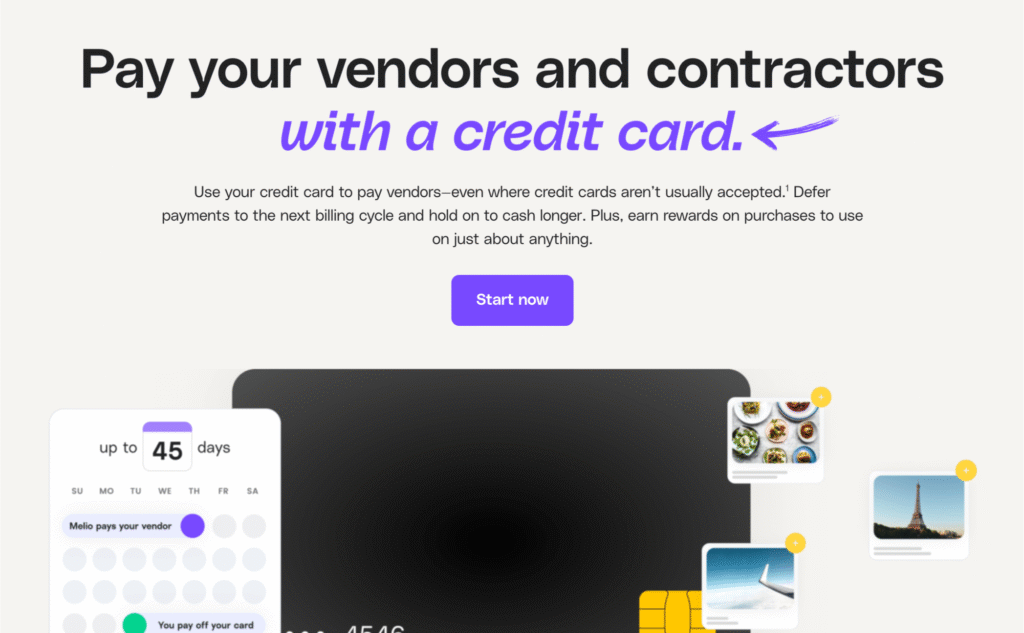

7. Pay By Card

You can easily pay bills with a credit card, even if your vendor doesn’t accept them.

Melio will charge your card and then send a check or bank transfer to the vendor.

This is a great way to earn credit card rewards.

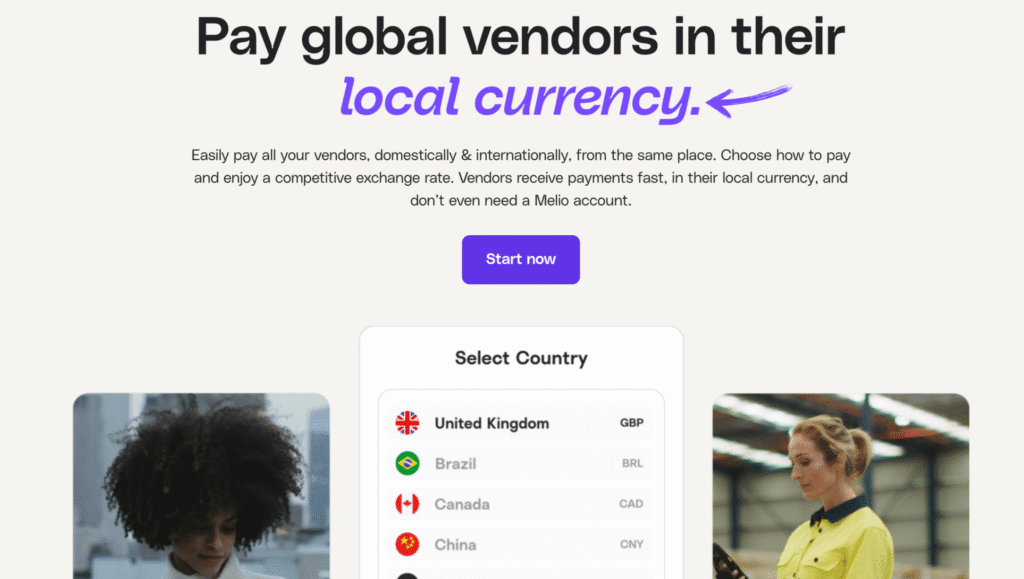

8. International Payments

Melio lets you make international payments to vendors in other countries.

It handles all the currency conversion and details.

This makes it easy to pay people around the world without any hassle.

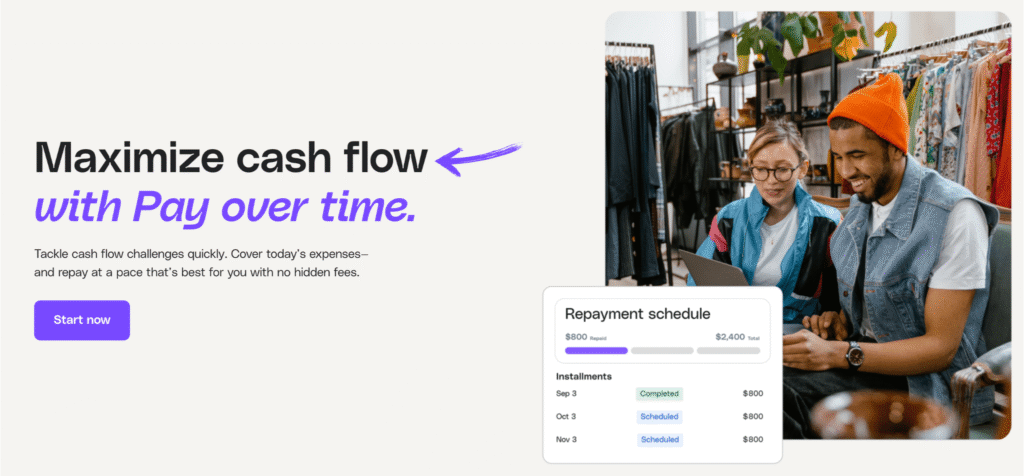

9. Pay Over Time

With this feature, you can pay a bill in installments.

This gives you more flexibility with your cash flow.

It’s a useful tool if you have a large bill and need a little extra time to pay it off.

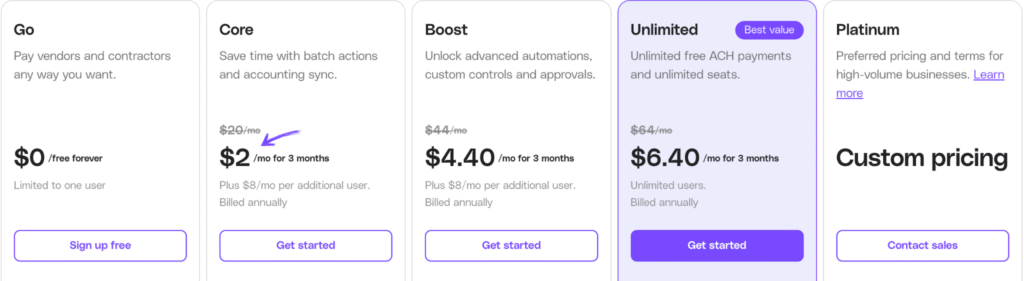

価格

| プラン | 月額料金 |

| Go | $0 |

| コア | $2 |

| ブースト | $4.40 |

| 無制限 | $6.40 |

| 白金 | カスタム |

長所と短所

長所

短所

Melio Alternatives

If you’re looking for different options, here are five alternatives to Melio.

They offer similar services, but each has its own unique focus.

- BILL: A more robust platform for accounts payable.

- クイックブックス: Popular 会計 software with payment features.

- PayPal: A well-known option for sending and receiving payments.

- アテラ: 強力な IT管理 solution with AI features.

- 忍者ワン: A unified IT management platform for endpoints.

Personal Experience with Melio

When our team started using Melio, we were drowning in paper invoices and checks.

Our goal was to simplify our bill-paying process and free up time.

By using Melio, we were able to digitize our accounts payable and streamline our workflow quickly

We no longer had to manually write checks or worry about mailing them on time.

The whole process became faster and much more efficient.

- Easy Bill Capture: We took photos of invoices with the mobile app. The information was automatically entered into the system.

- Approval Workflows: This feature enables managers to approve payments from their phones quickly. It made sure no bill was paid without proper approval.

- 会計 Software Integration: Melio synced with our QuickBooks Online, so all our payment data was automatically updated. This meant we didn’t have to do double data entry.

We encourage you to visit Melio’s website to see how it can help you. To learn more about our experience, feel free to read the rest of this article.

最後に

After reviewing Melio, it’s clear this platform is a strong solution for small businesses.

It simplifies your bill payments, improves cash flow, and integrates with your existing 会計 ソフトウェア。

While it has some limitations, like fees for credit card payments.

Its core features are powerful and easy to use.

Melio helps you save time and removes the stress of managing bills.

If you’re looking for a simple and free way to manage your accounts payable, this option is definitely worth considering.

Ready to simplify your payments?

Sign up for free and get started with Melio today.

よくある質問

Is Melio free to use?

Melio is free for ACH bank transfers and has no monthly subscription fee. There are small fees for using a credit card or for expedited payments.

How does Melio make money?

Melio makes money by charging fees on certain transactions. These include costs for credit card payments, expedited bank transfers, and international transfers.

Is my financial data secure with Melio?

Yes, Melio prioritizes security. It uses multi-factor authentication, encryption, and adheres to strict security standards to keep your financial data safe.

Does Melio integrate with QuickBooks?

Yes, Melio has a two-way sync with both QuickBooks Online and QuickBooks Desktop. This helps to update your bill pay information automatically.

Can I use Melio for international payments?

Yes, Melio allows you to pay international vendors in over 70 countries. A small fee is typically charged for these transactions, with payments arriving in a few days.