Sei stanco di passare troppo tempo a digitare ricevute e fatture?

Può sembrare un compito infinito, vero?

Dext e AutoEntry sono due strumenti popolari che possono aiutarti a sbarazzarti di questo problema.

Ma quale dovresti scegliere?

Immergiamoci in ciò che rende ciascuno di questi software di contabilità opzioni speciali e scopri quale potrebbe essere la più adatta a te.

Panoramica

Abbiamo esaminato attentamente sia Dext che AutoEntry.

Li abbiamo provati per vedere quanto funzionassero bene.

Questo ci ha aiutato a confrontarli equamente.

Ora possiamo mostrarvi cosa abbiamo scoperto.

Pronto a recuperare più di 10 ore al mese? Scopri come Dext automatizza l'inserimento dati, il monitoraggio delle spese e la semplificazione delle tue finanze.

Prezzi: La prova è gratuita. Il piano premium parte da 24 dollari al mese.

Caratteristiche principali:

- Scansione delle ricevute

- Note spese

- Riconciliazione bancaria

Smetti di sprecare più di 10 ore alla settimana nell'inserimento manuale dei dati. Scopri come l'inserimento automatico ha ridotto del 40% i tempi di elaborazione delle fatture per Saggio utenti.

Prezzi: La prova è gratuita. Il piano a pagamento parte da 12 $ al mese.

Caratteristiche principali:

- Estrazione dei dati

- Scansione delle ricevute

- Automazione dei fornitori

Che cos'è Dext?

Ok, quindi cos'è Dext?

Consideralo un aiutante super intelligente per i tuoi documenti.

Si occupa principalmente di cose come fatture e ricevute.

Basta scattare una foto e Dext ottiene tutte le informazioni importanti.

Davvero carino, eh?

Esplora anche i nostri preferiti Alternative a Dext…

La nostra opinione

Pronto a recuperare più di 10 ore al mese? Scopri come l'inserimento automatico dei dati, il monitoraggio delle spese e la rendicontazione di Dext possono semplificare le tue finanze.

Vantaggi principali

Dext è davvero eccezionale quando si tratta di semplificare la gestione delle spese.

- Il 90% degli utenti segnala una significativa riduzione dell'ingombro della carta.

- Vanta un tasso di precisione superiore al 98% nell'estrazione di dati dai documenti.

- Creare rendiconti spese diventa incredibilmente rapido e semplice.

- Si integra perfettamente con le piattaforme di contabilità più diffuse, come QuickBooks e Xero.

- Aiuta a non perdere mai di vista i documenti finanziari importanti.

Prezzi

- Abbonamento annuale: $24

Professionisti

Contro

Che cos'è AutoEntry?

Ok, parliamo di AutoEntry.

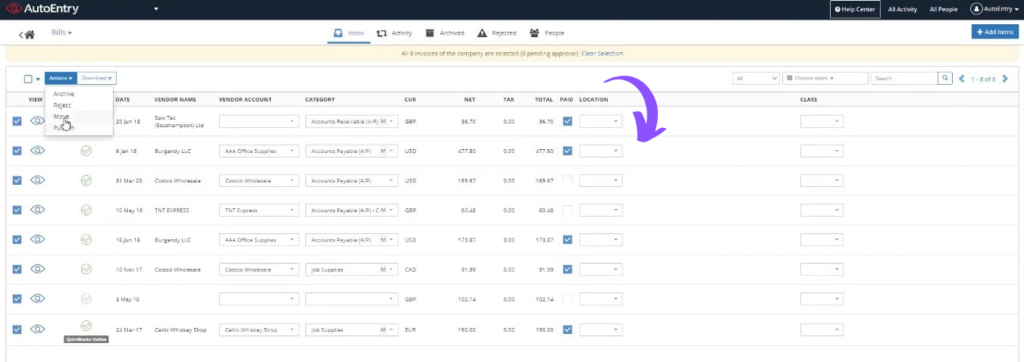

È uno strumento che ti aiuta a trasferire i tuoi documenti sul computer senza dover digitare tutto tu stesso.

Consideralo un aiutante intelligente per le tue bollette e ricevute.

Li legge e inserisce le informazioni dove devono andare.

Esplora anche i nostri preferiti Alternative ad AutoEntry…

La nostra opinione

Pronti a ridurre i tempi di contabilità? AutoEntry elabora oltre 28 milioni di documenti ogni anno e offre una precisione fino al 99%. Inizia oggi stesso e unisciti alle oltre 210.000 aziende in tutto il mondo che hanno ridotto i tempi di inserimento dati fino all'80%!

Vantaggi principali

Il vantaggio più grande di AutoEntry è il risparmio di ore di lavoro noioso.

Gli utenti spesso notano un risparmio fino all'80% del tempo dedicato all'inserimento manuale dei dati.

Promette una precisione fino al 99% nell'estrazione dei dati.

AutoEntry non offre una garanzia specifica di rimborso, ma i suoi piani mensili consentono di annullare in qualsiasi momento.

- Fino al 99% di accuratezza sui dati.

- Utenti illimitati su tutti i piani a pagamento.

- Estrae voci complete dalle fatture.

- Semplice applicazione mobile per scattare foto delle ricevute.

- 90 giorni per il rinnovo dei crediti non utilizzati.

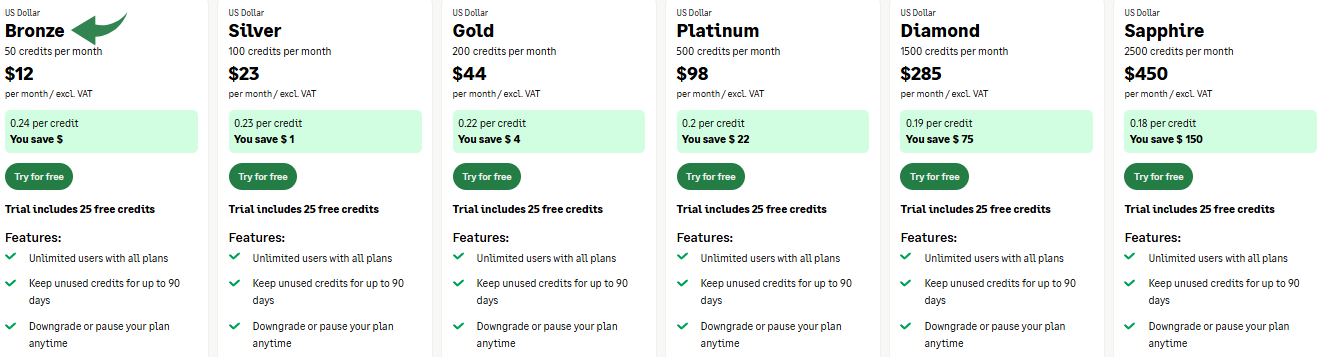

Prezzi

- Bronzo: $ 12/mese.

- Argento: $23/mese.

- Oro: $44/mese.

- Platino: $98/mese.

- Diamante: $285/mese.

- Zaffiro: $450/mese.

Professionisti

Contro

Confronto delle funzionalità

Ora vediamo cosa possono fare realmente Dext e AutoEntry.

Vedremo in che cosa sono uguali e in che cosa sono diversi.

Questo confronto ti aiuterà a decidere quale si adatta meglio alle tue esigenze.

1. Tecnologia di estrazione dei dati

- Sia Dext che AutoEntry utilizzano potenti tecnologie di riconoscimento ottico dei caratteri (OCR) e intelligenza artificiale.

- Lavorano per estrarre dati da documenti finanziari con elevata accuratezza.

- Questo processo di automazione dell'inserimento dei dati aiuta a eliminare l'inserimento manuale e trasforma rapidamente le ricevute in informazioni digitali.

2. Opzioni di invio dei documenti

- Dext offre diversi modi per acquisire le ricevute, ad esempio utilizzando l'app mobile Dext per le foto.

- Con Dext puoi anche utilizzare l'invio tramite e-mail, i feed bancari e Invoice Fetch.

- AutoEntry dispone anche di un'app mobile e di un'e-mail per inviare ricevute e fatture, concentrandosi sulla semplicità d'uso per i clienti.

3. App mobile per la gestione delle spese

- Entrambi hanno un'app mobile che aiuta piccola impresa proprietari e i loro team.

- L'app mobile Dext è un ottimo strumento per la gestione delle spese. Permette di monitorare le spese e gestire facilmente le richieste di rimborso.

- L'app di AutoEntry consente anche di acquisire rapidamente le ricevute tramite il tuo telefono cellulare.

4. Automazione e categorizzazione del flusso di lavoro

- Dext, in particolare Dext Prepare, offre funzionalità avanzate per la contabilità e contabilità flussi di lavoro.

- È possibile impostare regole per i fornitori e pubblicare automaticamente i dati utilizzando Dext.

- AutoEntry apprende anche le tue categorie per automatizzare il processo per i fornitori ripetuti, semplificando il tuo contabilità flussi di lavoro.

5. Acquisizione dati di vendita e di voci di riga

- AutoEntry si concentra sull'acquisizione di voci di spesa da fatture e bollette. Questo aiuta a tenere traccia di dati specifici su prodotti o vendite.

- Dext offre anche l'estrazione delle voci di riga, ma potrebbe avere un costo aggiuntivo a seconda dei piani tariffari.

- Entrambi ti aiutano a ottenere dati dettagliati sui costi e sulle vendite.

6. Integrazione con il software di contabilità

- Entrambi gli strumenti offrono un'integrazione perfetta con i principali software come QuickBooks Online, Xero e Sage.

- Queste integrazioni dirette garantiscono un flusso di dati sicuro e fanno risparmiare tempo nell'inserimento manuale.

7. Modelli di prezzo e prova

- AutoEntry utilizza un modello flessibile di pagamento a documento con un sistema di crediti. Offre una prova gratuita con crediti gratuiti.

- Dext (in precedenza Receipt Bank) utilizza un modello per cliente o di abbonamento con diversi piani tariffari.

- Dext offre anche una prova gratuita per consentirti di testare Dext.

8. Funzionalità di gestione delle spese

- Dext è progettato per gestire esigenze di gestione delle spese più complesse, tra cui il chilometraggio e le richieste di rimborso spese complesse.

- AutoEntry si concentra maggiormente sulla precisione dell'estrazione dei dati per una varietà di documenti finanziari.

9. Sicurezza e affidabilità del sistema

- Entrambi i servizi attribuiscono grande importanza alla sicurezza.

- Utilizzano un servizio di sicurezza e crittografia per proteggere i tuoi documenti finanziari e garantire un flusso di dati sicuro.

- Si concentrano sull'elevata affidabilità del sistema per proteggere i tuoi dati dagli attacchi online.

Cosa cercare quando si sceglie un software di contabilità?

- Struttura dei prezzi: Dai un'occhiata ai prezzi di AutoEntry e ai piani di Dext per trovare quello più adatto al tuo budget. AutoEntry offre prezzi flessibili e spesso consente un numero illimitato di utenti, mentre i piani di Dext sono solitamente per cliente.

- Facilità d'uso: Verifica quanto tempo ci vuole per caricare i documenti ed elaborarli. Vuoi uno strumento che faccia il lavoro in pochi minuti.

- Sicurezza e accesso: Fare Assicurati che la soluzione di sicurezza sia efficace. A volte, errori come "Cloudflare Ray ID trovato" indicano che il servizio sta cercando di proteggersi dagli attacchi online. Se non riesci ad accedere a una pagina a causa dell'errore "Cloudflare Ray ID", spesso è dovuto al servizio di sicurezza che protegge il sito.

- Errori di gestione: Tieni presente che alcune azioni possono attivare un blocco di sicurezza. Se vedi un messaggio che dice "l'azione appena eseguita ha attivato la soluzione di sicurezza", potrebbe essere causato da un comando SQL o da dati non validi. Ciò significa che potresti aver eseguito una delle diverse azioni che potrebbero attivare questo blocco, come l'invio di una determinata parola o frase a un comando SQL. Se vieni bloccato, potresti dover inviare un'e-mail al proprietario del sito per risolvere il problema.

- Varietà di documenti: Considera il tipo di documenti che devi gestire. Entrambi gestiscono ricevute e fatture, ma cerca funzionalità per fatture di acquisto e altri documenti finanziari.

- Caratteristiche delle spese: Se hai bisogno di gestire le spese oltre alla semplice acquisizione dei dati, valuta funzionalità come il monitoraggio del chilometraggio e flussi di lavoro avanzati per le spese. Dext è perfetto per eliminare la seccatura del monitoraggio.

- Metodi di acquisizione dati: Scopri come puoi raccogliere le ricevute. Entrambe le soluzioni offrono la scansione e il recupero delle fatture da dispositivi mobili, ma scopri quale semplifica la raccolta dati per il tuo team.

- Approfondimenti: Dext può offrire funzionalità aggiuntive per i dettagli fiscali e utilizzare categorie di monitoraggio per ottenere informazioni più approfondite.

- Affidabilità del sistema: Controllare sempre l'utilizzo complessivo e l'affidabilità del sistema per garantire un flusso di dati sicuro ed evitare problemi dovuti a dati non validi.

Verdetto finale

Dopo aver esaminato attentamente entrambi gli strumenti, abbiamo scelto Dext.

Offre un modo leggermente più semplice per gestire i tuoi dati finanziari.

Dext ti fa risparmiare tempo eliminando la seccatura di dover gestire ricevute, fatture e ordini di acquisto.

Sebbene AutoEntry sia ottimo per il suo piano per documento, Dext offre più funzionalità, soprattutto se si sceglie un piano avanzato.

Puoi iniziare una prova gratuita oggi stesso per testare la piattaforma. La sua profonda integrazione con contabilità il software rende il tuo flusso di lavoro fluido.

Se hai dubbi sulla sicurezza, sappi che entrambi utilizzano un servizio di sicurezza per proteggere i tuoi dati.

Ora puoi archiviare facilmente le ricevute nel tuo account Dext e dedicare il tuo tempo a cose più importanti dell'inserimento dei dati.

Altro di Dext

Abbiamo anche esaminato il confronto tra Dext e altri strumenti di gestione delle spese e di contabilità:

- Dext contro Xero: Xero offre una contabilità completa con funzionalità integrate di gestione delle spese.

- Destro contro Puzzle IO: Puzzle IO eccelle nelle previsioni e nelle analisi finanziarie basate sull'intelligenza artificiale.

- Dext contro Synder: Synder si concentra sulla sincronizzazione dei dati di vendita e sull'elaborazione dei pagamenti dell'e-commerce.

- Dext vs Easy Month End: Easy Month End semplifica le procedure di chiusura finanziaria di fine mese.

- Dext contro Docyt: Docyt utilizza l'intelligenza artificiale per automatizzare le attività di contabilità e gestione dei documenti.

- Dext contro RefreshMe: RefreshMe fornisce informazioni in tempo reale sulle performance finanziarie aziendali.

- Dext contro Sage: Sage offre una gamma di soluzioni contabili con funzionalità di monitoraggio delle spese.

- Dext contro Zoho Books: Zoho Books offre una contabilità integrata con funzionalità di gestione delle spese.

- Destra contro Onda: Wave offre un software di contabilità gratuito con funzionalità di base per il monitoraggio delle spese.

- Dext contro Quicken: Quicken è uno strumento molto diffuso per la gestione delle finanze personali e per il monitoraggio delle spese aziendali di base.

- Dext contro Hubdoc: Hubdoc è specializzata nella raccolta automatizzata di documenti e nell'estrazione di dati.

- Dext contro Expensify: Expensify offre soluzioni affidabili per la gestione e la rendicontazione delle spese.

- Dext contro QuickBooks: QuickBooks è un software di contabilità ampiamente utilizzato, dotato di strumenti di gestione delle spese.

- Dext contro AutoEntry: AutoEntry automatizza l'inserimento dei dati da fatture, ricevute ed estratti conto bancari.

- Dext contro FreshBooks: FreshBooks è progettato per le aziende che forniscono servizi, con fatturazione e monitoraggio delle spese.

- Dext contro NetSuite: NetSuite offre un sistema ERP completo con funzionalità di gestione delle spese.

Altro su AutoEntry

- AutoEntry vs Puzzle: Questo software si concentra sulla pianificazione finanziaria basata sull'intelligenza artificiale per le startup. La sua controparte è per la finanza personale.

- AutoEntry vs Dext: Questo è uno strumento aziendale per l'acquisizione di ricevute e fatture. L'altro strumento tiene traccia delle spese personali.

- AutoEntry vs Xero: Questo è un popolare software di contabilità online per le piccole imprese. Il suo concorrente è per uso personale.

- AutoEntry vs Synder: Questo strumento sincronizza i dati dell'e-commerce con il software di contabilità. La sua alternativa si concentra sulla finanza personale.

- AutoEntry vs Easy Month End: Questo è uno strumento aziendale per semplificare le attività di fine mese. Il suo concorrente è per la gestione delle finanze personali.

- AutoEntry vs Docyt: Questo utilizza l'intelligenza artificiale per la contabilità aziendale e l'automazione. L'altro utilizza l'intelligenza artificiale come assistente finanziario personale.

- AutoEntry contro Sage: Si tratta di una suite completa per la contabilità aziendale. Il suo concorrente è uno strumento più semplice da usare per la gestione delle finanze personali.

- AutoEntry vs Zoho Books: Questo è uno strumento di contabilità online per piccole imprese. Il suo concorrente è per uso personale.

- AutoEntry vs Wave: Questo software di contabilità gratuito è pensato per le piccole imprese. La sua controparte è pensata per i privati.

- AutoEntry vs Quicken: Entrambi sono strumenti di finanza personale, ma questo offre un monitoraggio degli investimenti più approfondito. L'altro è più semplice.

- AutoEntry vs Hubdoc: Questo è specializzato nell'acquisizione di documenti per la contabilità. Il suo concorrente è uno strumento di finanza personale.

- AutoEntry vs Expensify: Questo è uno strumento per la gestione delle spese aziendali. L'altro è per il monitoraggio delle spese personali e la creazione di budget.

- Inserimento automatico vs QuickBooks: Questo è un noto software di contabilità per le aziende. La sua alternativa è pensata per la gestione delle finanze personali.

- AutoEntry vs FreshBooks: Questo è un software di contabilità per liberi professionisti e piccole imprese. La sua alternativa è per la finanza personale.

- AutoEntry vs NetSuite: Si tratta di una potente suite di gestione aziendale per grandi aziende. Il suo concorrente è una semplice app di finanza personale.

Domande frequenti

Qual è la differenza principale tra Dext e AutoEntry?

Dext è spesso considerato un po' più intuitivo, con funzionalità aggiuntive come il monitoraggio del chilometraggio. AutoEntry eccelle nella gestione di una più ampia gamma di tipologie di documenti, comprese le fatture di vendita, e vanta un ampio riconoscimento da parte dei fornitori.

Quale software si integra meglio con QuickBooks Online?

Sia Dext che AutoEntry offrono forti integrazioni con QuickBooks Online, consentendo il trasferimento senza interruzioni dei dati elaborati direttamente nel tuo contabilità software per una contabilità efficiente.

Dext o AutoEntry sono più adatti per una piccola impresa con poche fatture?

Per un piccolo Attività commerciale con un volume ridotto di fatture, i piani base di Dext potrebbero essere più convenienti, pur continuando a fornire solide capacità di acquisizione e integrazione dei dati.

Posso automatizzare l'elaborazione dell'estratto conto bancario con Dext o AutoEntry?

Sì, sia Dext che AutoEntry consentono di automatizzare l'elaborazione degli estratti conto bancari, estraendo i dati chiave delle transazioni e riducendo l'inserimento manuale dei dati da parte del contabile.

Quale piattaforma offre un migliore supporto clienti?

In base alla nostra esperienza, sia Dext che AutoEntry forniscono un utile supporto clienti attraverso vari canali, come basi di conoscenza e assistenza diretta in caso di problemi.