Got that tricky month-end close giving you a headache?

Or maybe you’re swamped with receipts and invoices, dreaming of a magic wand to handle data entry?

You’re not alone.

Many businesses, big and small, struggle with these akuntansi tugas.

Let’s dive in and see Easy Month End vs AutoEntry, which can make your akuntansi easier.

Tinjau

We’ve put both Easy Month End and AutoEntry through their paces.

Testing their features and how they handle real-world akuntansi tantangan.

This hands-on experience has given us a clear picture for this direct comparison.

This Easy month-end, join 1,257 users who saved an average of 3.5 hours and reduced errors by 15%. Start your free trial!

Harga: It has a free trial. The premium plan starts at $45/month.

Fitur Kunci:

- Automated Reconciliation

- Streamlined Workflows

- Antarmuka Ramah Pengguna

Hentikan pemborosan 10+ jam/minggu untuk entri data manual. Lihat bagaimana Autoentry memangkas waktu pemrosesan faktur hingga 40% untuk Sage pengguna.

Harga: Tersedia uji coba gratis. Paket berbayar mulai dari $12/bulan.

Fitur Kunci:

- Ekstraksi Data

- Pemindaian Struk

- Otomatisasi Pemasok

What is Easy Month End?

Let’s talk about Easy Month End. What is it, exactly?

It’s a tool designed to make your month-end akuntansi much smoother.

Think of it as your assistant for closing the books.

Juga, mengeksplorasi favorit kita Alternatif Mudah di Akhir Bulan…

Our Take

Tingkatkan akurasi keuangan dengan Easy Month End. Manfaatkan rekonsiliasi otomatis dan pelaporan siap audit. Jadwalkan demo yang dipersonalisasi untuk menyederhanakan proses akhir bulan Anda.

Manfaat Kunci

- Alur kerja rekonsiliasi otomatis

- Manajemen dan pelacakan tugas

- Analisis varians

- Manajemen dokumen

- Alat kolaborasi

Harga

- Starter: $24/bulan.

- Kecil: $45/bulan.

- Perusahaan: $89/bulan.

- Perusahaan: Penetapan Harga Khusus.

Pro

Kons

Apa itu AutoEntry?

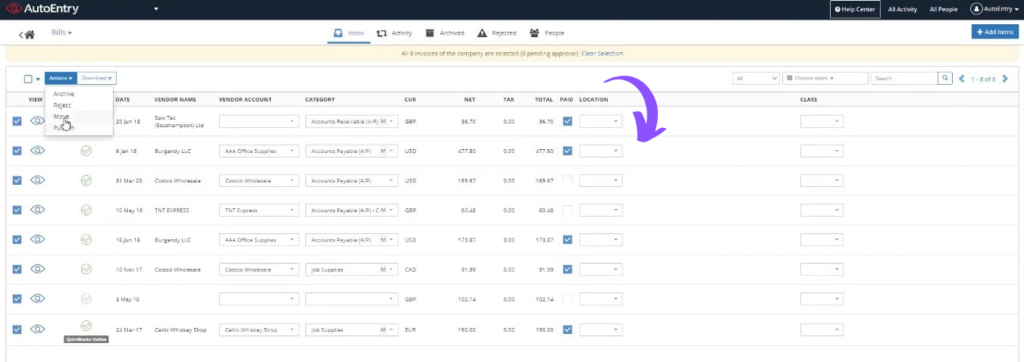

Now, let’s look at AutoEntry. What is it all about?

Simply put, it’s a smart tool that helps you with data entry.

Imagine taking a picture of a receipt, and all the numbers automatically appear in your perangkat lunak akuntansi.

Juga, mengeksplorasi favorit kita Alternatif AutoEntry…

Our Take

Siap mengurangi waktu pembukuan Anda? AutoEntry memproses lebih dari 28 juta dokumen setiap tahun dan menawarkan akurasi hingga 99%. Mulai hari ini dan bergabunglah dengan lebih dari 210.000 bisnis di seluruh dunia yang telah mengurangi jam kerja entri data mereka hingga 80%!

Manfaat Kunci

Keunggulan terbesar AutoEntry adalah menghemat waktu berjam-jam pekerjaan yang membosankan.

Pengguna sering kali melihat pengurangan waktu hingga 80% yang dihabiskan untuk memasukkan data secara manual.

Sistem ini menjanjikan akurasi hingga 99% dalam ekstraksi datanya.

AutoEntry tidak menawarkan garansi pengembalian uang secara spesifik, tetapi paket bulanannya memungkinkan Anda untuk membatalkan kapan saja.

- Akurasi data hingga 99%.

- Pengguna tak terbatas pada semua paket berbayar.

- Mengambil semua item baris dari faktur.

- Aplikasi seluler mudah untuk mengambil foto struk belanja.

- Saldo kredit yang tidak terpakai akan diakumulasikan dalam waktu 90 hari.

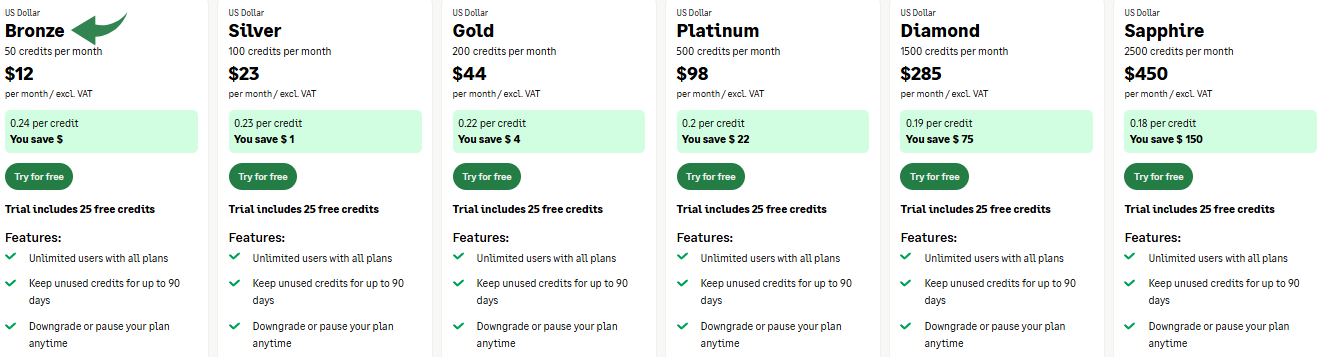

Harga

- Perunggu: $12/bulan.

- Perak: $23/bulan.

- Emas: $44/bulan.

- Platinum: $98/bulan.

- Berlian: $285/bulan.

- Safir: $450/bulan.

Pro

Kons

Perbandingan Fitur

Now that we’ve examined each product individually, let’s compare them side-by-side.

This feature comparison will help you see where each tool truly stands out.

1. Workflow Management

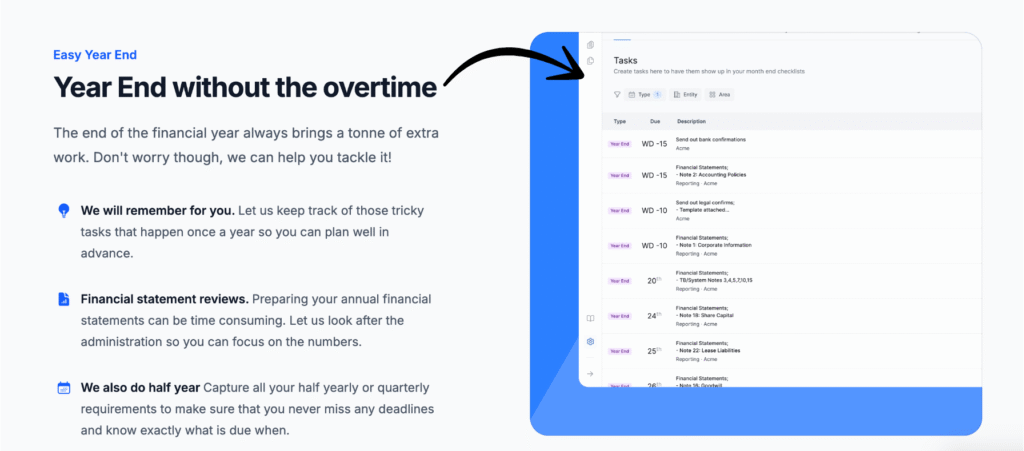

- Akhir Bulan yang Mudah: This tool is a complete workflow management system. It helps you handle month-end, quarter-end, and year-end tasks. It brings clarity to the entire month-end process for your finance team. You can easily leave comments and assign tasks.

- Entri Otomatis: This is not a workflow management tool. Its primary function is to simplify collecting financial documents. It gets data in, but it doesn’t manage the overall month-end process.

2. Balance Sheet Reconciliation

- Akhir Bulan yang Mudah: This tool makes balance sheet reconciliation easy. It helps you match transactions and provides a full audit trail. You get a clear view of all your reconciliations in one place.

- Entri Otomatis: Its main purpose is data extraction. It gets the information from documents so you can do your reconciliations, but it doesn’t provide the reconciliation tools itself.

3. Audit Evidence and Compliance

- Akhir Bulan yang Mudah: This platform is built to help you collect audit evidence. It tracks every action and provides a clear audit trail. You can even invite auditors to the platform to help you prove compliance.

- Entri Otomatis: This tool helps you have digital copies of your financial documents for an audit. However, it doesn’t provide the tracking and sign-offs that a dedicated audit tool offers.

4. Team Collaboration

- Akhir Bulan yang Mudah: This tool is designed for team collaboration. You can assign tasks, leave comments, and track progress in real-time. This makes sure the entire finance team is on the same page and works more efficiently.

- Entri Otomatis: This tool is mainly for individual use, though multiple users can have access. Its collaboration features are limited to sharing documents and data, not managing shared workflow tasks.

5. Document Data Extraction

- Akhir Bulan yang Mudah: This tool does not have a direct data extraction feature. You need to manually upload or enter your documents.

- Entri Otomatis: Its key strength is data extraction. Its optical character recognition (OCR) technology automatically extracts data from receipts, purchase invoices, bank statements, and other financial documents. This saves an incredible amount of time spent on manual data entry.

6. Expense Reports

- Akhir Bulan yang Mudah: This tool is not an expense pelaporan tool. It helps you manage the month-end close process, but it doesn’t compile expense data.

- Entri Otomatis: This tool simplifies expense reporting. It can capture and categorize expenses from documents and organize them.

7. Bank Reconciliations

- Akhir Bulan yang Mudah: This tool can directly perform balance sheet reconciliations and connect with your bank accounts to ensure your books are balanced.

- Entri Otomatis: This tool captures bank account data and helps get it ready for reconciliation. It provides the transaction details you need.

8. Handling Ad-Hoc Tasks

- Akhir Bulan yang Mudah: This tool has expanded its features to handle ad hoc tasks beyond the month-end close process. This makes it a single platform for a variety of finance team tasks.

- Entri Otomatis: This tool’s focus is too narrow to help with ad hoc tasks. It is built for one thing: getting data from financial documents into your akuntansi perangkat lunak.

9. Pricing Model

- Akhir Bulan yang Mudah: This tool uses a traditional subscription model based on users and entities. You have a set monthly fee that gives you access to all features.

- Entri Otomatis: This tool offers a flexible subscription. It uses a credit-based model where you pay for what you use. There are no long-term contracts, and you can cancel anytime.

What to Look for When Choosing Accounting Software?

When you’re trying to find a tool that can give your finance team an easier life, here’s a checklist to buat sure you get the right fit.

- Look for a tool that can make your month-end process a breeze, resulting in a smoother month-end close with fewer errors and delays. This way, you can stay calm, and your finance team deserves that.

- The software should help your team be more efficient and offer features for team management and team collaboration. The whole team works better with the ability to see tasks and leave comments in one place.

- Make sure the platform can handle faster balance sheet reconciliations and has a clear audit trail for your preparer to use. You should be able to review and reconcile everything easily.

- Check the pricing model, such as autoentry pricing, which is often a flexible pricing per month rather than a fixed subscription. Some also offer unlimited users, which saves a lot of money.

- The solution should handle all your paperwork effortlessly. Look for the ability to import data from bank transfers and other sources, and to auto-publish documents.

- Consider a tool that helps with ad hoc needs, so you can answer any questions that come up and feel less stress.

- Security is key. The software should protect itself from online attacks and use a security service and a strong security solution to prevent being blocked. If you’re unable to access a page, you might see a cloudflare ray id found or a Cloudflare Ray ID.

- The software should be able to handle actions that could trigger this block, including submitting a certain word or phrase or a sql command, or malformed data. If your action you just performed triggered the security solution, you should be able to email the site owner to resolve it.

- Check if it has a good mobile phone app. Your clients will also appreciate the effort of a good system.

Keputusan Akhir

So, which one do we pick? It depends on your biggest need.

If month-end closing gives you headaches, and you need clear workflows.

Easy Month End is your champion. It truly streamlines that process.

But if you’re buried in receipts, AutoEntry is the clear winner.

Its otomasi for document capture is a game-changer, making data entry much simpler.

We’ve tested these tools ourselves to give you honest advice.

The best tool solves your specific problems.

More of Easy Month End

Here is a brief comparison of Easy Month End with some of the leading alternatives.

- Easy Month End vs Puzzle io: While Puzzle.io is for startup accounting, Easy Month End focuses specifically on streamlining the close process.

- Easy Month End vs Dext: Dext is primarily for document and receipt capture, whereas Easy Month End is a comprehensive month-end close management tool.

- Easy Month End vs Xero: Xero is a full accounting platform for small businesses, while Easy Month End provides a dedicated solution for the close process.

- Easy Month End vs Synder: Synder specializes in integrating e-commerce data, unlike Easy Month End which is a workflow tool for the entire financial close.

- Easy Month End vs Docyt: Docyt uses AI for bookkeeping and data entry, while Easy Month End automates the steps and tasks of the financial close.

- Easy Month End vs RefreshMe: RefreshMe is a financial coaching platform, which is different from Easy Month End’s focus on close management.

- Easy Month End vs Sage: Sage is a large-scale business management suite, while Easy Month End offers a more specialized solution for a critical accounting function.

- Easy Month End vs Zoho Books: Zoho Books is an all-in-one accounting software, whereas Easy Month End is a purpose-built tool for the month-end process.

- Easy Month End vs Wave: Wave provides free accounting services for small businesses, while Easy Month End offers a more advanced solution for close management.

- Easy Month End vs Quicken: Quicken is a personal finance tool, making Easy Month End a better choice for businesses needing to manage a month-end close.

- Easy Month End vs Hubdoc: Hubdoc automates document collection, but Easy Month End is designed to manage the full close workflow and team tasks.

- Easy Month End vs Expensify: Expensify is an expense management software, which is a different function than Easy Month End’s core focus on the financial close.

- Easy Month End vs QuickBooks: QuickBooks is a comprehensive accounting solution, while Easy Month End is a more specific tool for managing the month-end close itself.

- Easy Month End vs AutoEntry: AutoEntry is a data capture tool, whereas Easy Month End is a complete platform for task and workflow management during the close.

- Easy Month End vs FreshBooks: FreshBooks is for freelancers and small businesses, while Easy Month End offers a dedicated solution for the month-end close.

- Easy Month End vs NetSuite: NetSuite is a full-featured ERP system, which is broader in scope than Easy Month End’s specialized focus on the financial close.

Selengkapnya tentang AutoEntry

- Entri Otomatis vs Teka-tekiPerangkat lunak ini berfokus pada perencanaan keuangan berbasis AI untuk perusahaan rintisan. Versi pasangannya ditujukan untuk keuangan pribadi.

- Entri Otomatis vs DextIni adalah alat bisnis untuk mencatat tanda terima dan faktur. Alat lainnya melacak pengeluaran pribadi.

- AutoEntry vs XeroIni adalah perangkat lunak akuntansi online populer untuk usaha kecil. Pesaingnya ditujukan untuk penggunaan pribadi.

- AutoEntry vs SynderAlat ini menyinkronkan data e-commerce dengan perangkat lunak akuntansi. Alternatifnya berfokus pada keuangan pribadi.

- Entri Otomatis vs Akhir Bulan yang MudahIni adalah alat bisnis untuk menyederhanakan tugas akhir bulan. Pesaingnya adalah untuk mengelola keuangan pribadi.

- AutoEntry vs DocytYang satu menggunakan AI untuk pembukuan dan otomatisasi bisnis. Yang lainnya menggunakan AI sebagai asisten keuangan pribadi.

- AutoEntry vs SageIni adalah paket perangkat lunak akuntansi bisnis yang komprehensif. Pesaingnya adalah alat yang lebih mudah digunakan untuk keuangan pribadi.

- AutoEntry vs Zoho BooksIni adalah alat akuntansi online untuk usaha kecil. Pesaingnya ditujukan untuk penggunaan pribadi.

- Entri Otomatis vs GelombangIni menyediakan perangkat lunak akuntansi gratis untuk usaha kecil. Versi lainnya dirancang untuk individu.

- AutoEntry vs QuickenKeduanya adalah alat keuangan pribadi, tetapi yang satu ini menawarkan pelacakan investasi yang lebih mendalam. Yang lainnya lebih sederhana.

- AutoEntry vs HubdocIni khusus untuk pengambilan data dokumen untuk pembukuan. Pesaingnya adalah alat keuangan pribadi.

- AutoEntry vs ExpensifyIni adalah alat manajemen pengeluaran bisnis. Yang lainnya untuk pelacakan pengeluaran pribadi dan penganggaran.

- AutoEntry vs QuickBooksIni adalah perangkat lunak akuntansi yang terkenal untuk bisnis. Alternatifnya dirancang untuk keuangan pribadi.

- AutoEntry vs FreshBooksIni adalah perangkat lunak akuntansi untuk pekerja lepas dan usaha kecil. Alternatifnya adalah untuk keuangan pribadi.

- AutoEntry vs NetSuiteIni adalah rangkaian perangkat lunak manajemen bisnis yang andal untuk perusahaan besar. Pesaingnya adalah aplikasi keuangan pribadi yang sederhana.

Pertanyaan Yang Sering Muncul

Does AutoEntry help with personal budgeting?

No, using AutoEntry mainly focuses on business expense automation, not personal budgeting or personal finance software for individuals to track spending or personal financial data.

Is Easy Month End a comprehensive cloud accounting for businesses?

Easy Month End is a tool that streamlines the closing process but isn’t a full accounting system. It complements existing software, rather than offering comprehensive cloud accounting for businesses.

Can these tools help with financial planning for investment?

Neither Easy Month End nor AutoEntry directly offers features for financial planning or investment management. They focus on data entry and month-end tasks for operational accounting.

Do these solutions work for e-commerce businesses?

Yes, both can be useful for e-commerce. AutoEntry helps with high volumes of transaction data, while Easy Month End aids in organizing the financial close for online sales.

How do these compare to solutions like Docyt uses AI, or Puzzle IO offers unique features?

Tools like Docyt use AI, and Teka-teki IO offers unique features, often leveraging AI for broader automated bookkeeping or specific industry needs. Easy Month End and AutoEntry specialize in their respective areas: month-end close and data entry.