Are you tired of month-end closing taking forever?

It can feel like a huge headache, right?

All those papers and numbers can get confusing.

Two of these are Dext vs Easy Month End.

Let’s take a look at how these tools can help you say goodbye to month-end stress!

Tinjau

We looked closely at both Dext and Easy Month End.

We tried them out to see how they work.

This helped us understand what each one is good at.

Now we can compare them and show you what we found.

Siap menghemat lebih dari 10 jam per bulan? Lihat bagaimana Dext mengotomatiskan entri data, pelacakan pengeluaran, dan menyederhanakan keuangan Anda.

Harga: Tersedia masa uji coba gratis. Paket premium dimulai dari $24/bulan.

Fitur Kunci:

- Pemindaian Struk

- Laporan Pengeluaran

- Rekonsiliasi Bank

This Easy month-end, join 1,257 users who saved an average of 3.5 hours and reduced errors by 15%. Start your free trial!

Harga: It has a free trial. The premium plan starts at $45/month.

Fitur Kunci:

- Automated Reconciliation

- Streamlined Workflows

- Antarmuka Ramah Pengguna

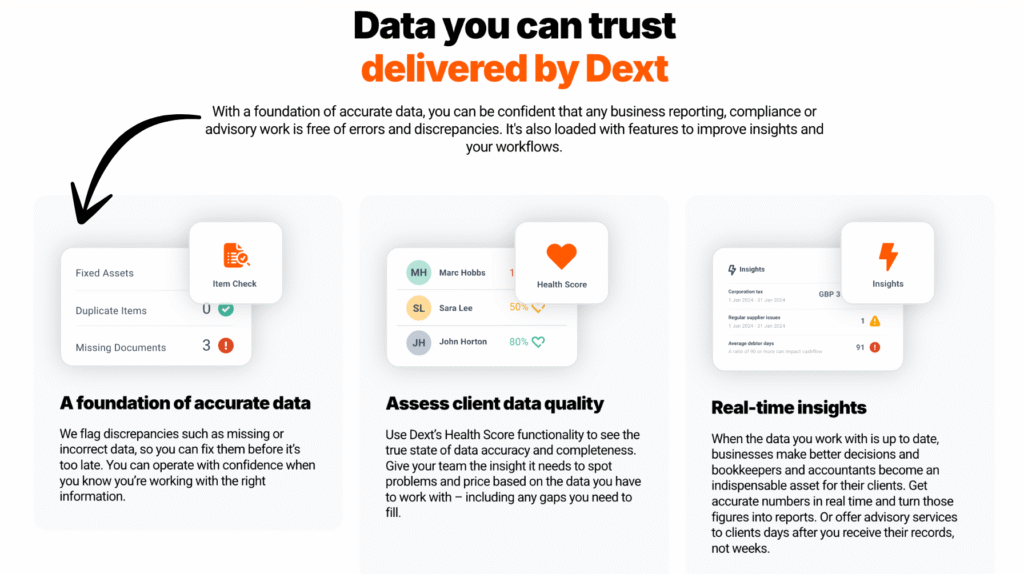

Apa itu Dext?

Oke, jadi apa itu Dext?

Anggap saja ini seperti asisten super pintar untuk makalah Anda.

Fungsinya sebagian besar menangani hal-hal seperti tagihan dan kwitansi.

Anda hanya perlu mengambil gambar, dan Dext akan mendapatkan semua informasi penting.

Maksimalkan potensinya dengan kami. Alternatif Dext…

Our Take

Siap menghemat lebih dari 10 jam per bulan? Lihat bagaimana entri data otomatis, pelacakan pengeluaran, dan pelaporan Dext dapat merampingkan keuangan Anda.

Manfaat Kunci

Dext benar-benar unggul dalam hal membuat pengelolaan pengeluaran menjadi mudah.

- 90% pengguna melaporkan penurunan signifikan dalam tumpukan kertas.

- Sistem ini menawarkan tingkat akurasi lebih dari 98%. dalam mengekstrak data dari dokumen.

- Membuat laporan pengeluaran menjadi sangat cepat dan mudah.

- Terintegrasi dengan lancar dengan platform akuntansi populer, seperti QuickBooks dan Xero.

- Membantu memastikan Anda tidak pernah kehilangan jejak dokumen keuangan penting.

Harga

- Langganan Tahunan: $24

Pro

Kons

What is Easy Month End

So, Easy Month End is like a helper for when the month finishes.

It tries to buat closing your books easier.

Think of it as a way to keep all your money stuff in one place at the end of the month.

It helps you see what money came in and what went out.

Maksimalkan potensinya dengan kami. Alternatif Mudah di Akhir Bulan…

Our Take

Tingkatkan akurasi keuangan dengan Easy Month End. Manfaatkan rekonsiliasi otomatis dan pelaporan siap audit. Jadwalkan demo yang dipersonalisasi untuk menyederhanakan proses akhir bulan Anda.

Manfaat Kunci

- Alur kerja rekonsiliasi otomatis

- Manajemen dan pelacakan tugas

- Analisis varians

- Manajemen dokumen

- Alat kolaborasi

Harga

- Starter: $24/bulan.

- Kecil: $45/bulan.

- Perusahaan: $89/bulan.

- Perusahaan: Penetapan Harga Khusus.

Pro

Kons

Perbandingan Fitur

We looked at both Dext and Easy Month End closely.

This comparison shows what each tool is best at doing for your finance team.

1. Receipt Capture and Data Extraction

- Dext is an expert at automating data entry. It gives you multiple ways to capture receipts and other financial documents. You can use the Dext mobile app, send an email, or have it get receipts and invoices straight from suppliers.

- It uses OCR technology to quickly extract data and removes the need for manual entry.

- Akhir Bulan yang Mudah does not focus on the first step of data collection from documents.

2. Data Extraction Accuracy

- Dext (formerly Receipt Bank) is known for its high accuracy when using its optical character recognition to extract data. This helps you avoid errors.

- Akhir Bulan yang Mudah is a workflow tool, so data extraction is not its main job.

3. Accounting Software Direct Integrations

- Dext has deep integration with all major akuntansi software, like QuickBooks Online and Xero. This helps with a secure data flow of all your cost and sales data.

- Akhir Bulan yang Mudah also connects with QuickBooks Online and Xero. Its main goal is to pull balance sheets for reconciliation.

4. Supplier Rules and Categorisation

- Dext lets you set up supplier rules. You can tell the system how to handle documents from a certain word or supplier automatically. This makes pembukuan workflows more efficient.

- Akhir Bulan yang Mudah does not have a feature for setting up these specific supplier rules.

5. Balance Sheet Reconciliation

- Akhir Bulan yang Mudah is made to handle the month-end process. It is excellent at balance sheet reconciliation. It connects to your akuntansi data, shows balances, and helps you get sign offs on all your reconciliations in one spot.

- Dext Prepare focuses on pre-accounting, but it supports bank reconciliation with its accurate data extraction and bank feeds.

6. Team Collaboration and Workflow Management

- Akhir Bulan yang Mudah is a strong workflow management tool for the finance team. It lets you make task checklists for the month-end process, assign work, leave comments, and track sign offs. This helps with team collaboration.

- Dext focuses more on the collaboration needed between small bisnis owners and their accountants for submitting and processing documents quickly.

7. Audit Evidence and Compliance

- Akhir Bulan yang Mudah helps you collect audit evidence. It keeps a log of tasks, documents, preparer and reviewer sign-offs, and all in a single platform. This ensures compliance for auditors.

- Dext helps by keeping all your original documents and extracted data stored securely in the cloud.

8. Expense Claims and Management

- Dext gives employees an easy way to submit receipts and expense claims using the Dext mobile app. This makes it easy to track expenses and manage expenses.

- Akhir Bulan yang Mudah can track the task of reviewing expense claims, but it does not handle the initial receipt capture receipts and submission part.

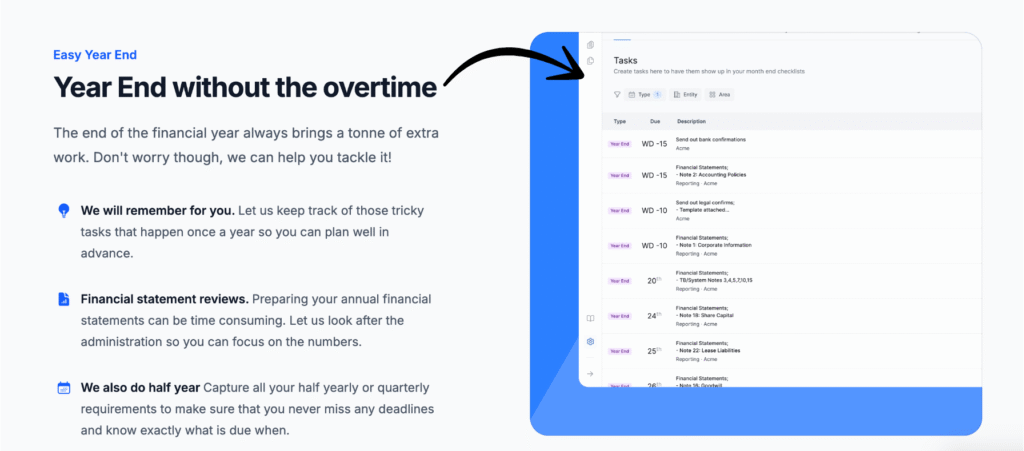

9. Year End and Quarter-End Support

- Akhir Bulan yang Mudah works as a checklist for the month-end process, quarter-end, and year-end. You can manage all your recurring accounting and pembukuan workflows from one spot.

- Dext provides consistent, accurate, and timely data, which is key for all those pelaporan periods.

10. System Dependability and Security

- Both tools offer a keamanan solution for secure data flow.

- Dext has a strong reputation for system dependability in its data collection and extraction.

- Akhir Bulan yang Mudah offers a high level of security service and compliance features in its top pricing plans to protect financial data.

Apa yang Harus Diperhatikan Saat Memilih Perangkat Lunak Akuntansi?

Here are the key things to look at when choosing the right tool to handle month-end for your finance team:

- Team Management and Efficiency: Look for features that support team management and make your finance team more efficient finance team. The goal is a smoother month-end close and an easier life for everyone.

- Reconciliation Speed: Does the tool help you achieve faster balance sheet reconciliations? This ability is a must-have to reconcile accounts quickly and stay on top of your balances.

- Workflow Flexibility: Make sure the system can handle more than just monthly tasks. Can it manage ad hoc tasks and recurring items? This expanded scope improves efficiency.

- Payment and Contract Terms: Check how you pay. Can you cancel easily? Is the price clear, or are there hidden fees? Avoid being locked into long contracts.

- Ease of Use for Your Team: The platform should be easy for your team to access and use. If your team is stuck using Excel and Outlook for tracking, you need a modern solution to reduce delays.

- Audit Readiness: The tool must reduce hassle with manual confirmations. It should keep track of every completed task and all supporting documents you upload or import.

- Support for Multiple Entities: If you manage several companies, you need the ability to handle multiple entities easily from one place.

- Support and Communication: Can you quickly answer questions or submit a support ticket? Good support makes your first month-end a breeze.

Keputusan Akhir

After looking closely at both tools, we choose Dext as the better platform for your team. Why?

Dext works best at removing hassle from the start of your pembukuan.

Its otomasi of manual data entry is top-notch.

You can collect receipts and invoices using mobile scanning or email submission in just a few minutes.

This helps your whole finance team save time. Dext saves hours every week!

Additionally, the accurate data it extracts makes expense management much easier.

Easy Month End is great for tracking finance team tasks, but Dext is better at getting the data in right away.

Your finance team deserves the efficiency Dext provides. Try Dext with their free trial today.

Lebih banyak tentang Dext

Kami juga telah melihat bagaimana Dext dibandingkan dengan alat manajemen pengeluaran dan akuntansi lainnya:

- Dext vs Xero: Xero menawarkan akuntansi komprehensif dengan fitur manajemen pengeluaran terintegrasi.

- Dext vs Teka-teki IO: Puzzle IO unggul dalam wawasan dan perkiraan keuangan berbasis AI..

- Dext vs Synder: Synder berfokus pada sinkronisasi data penjualan e-commerce dan pemrosesan pembayaran.

- Dext vs Easy Akhir Bulan: Easy Month End menyederhanakan prosedur penutupan keuangan akhir bulan.

- Dext vs Docyt: Docyt menggunakan AI untuk mengotomatiskan tugas pembukuan dan manajemen dokumen.

- Dext vs RefreshMe: RefreshMe menyediakan wawasan waktu nyata tentang kinerja keuangan bisnis.

- Dext vs Sage: Sage menawarkan berbagai solusi akuntansi dengan kemampuan pelacakan pengeluaran.

- Dext vs Zoho Books: Zoho Books menyediakan akuntansi terintegrasi dengan fitur manajemen pengeluaran.

- Dext vs Wave: Wave menawarkan perangkat lunak akuntansi gratis dengan fitur pelacakan pengeluaran dasar.

- Dext vs Quicken: Quicken populer untuk pengelolaan keuangan pribadi dan pelacakan pengeluaran bisnis dasar.

- Dext vs Hubdoc: Hubdoc berspesialisasi dalam pengumpulan dokumen dan ekstraksi data secara otomatis.

- Dext vs Expensify: Expensify menawarkan solusi pelaporan dan manajemen pengeluaran yang andal.

- Dext vs QuickBooks: QuickBooks adalah perangkat lunak akuntansi yang banyak digunakan dengan fitur manajemen pengeluaran.

- Dext vs AutoEntry: AutoEntry mengotomatiskan entri data dari faktur, kwitansi, dan laporan bank.

- Dext vs FreshBooks: FreshBooks dirancang untuk bisnis berbasis jasa dengan fitur pembuatan faktur dan pelacakan pengeluaran.

- Dext vs NetSuite: NetSuite menawarkan sistem ERP komprehensif dengan fungsionalitas manajemen pengeluaran.

More of Easy Month End

Here is a brief comparison of Easy Month End with some of the leading alternatives.

- Easy Month End vs Puzzle io: While Puzzle.io is for startup accounting, Easy Month End focuses specifically on streamlining the close process.

- Easy Month End vs Dext: Dext is primarily for document and receipt capture, whereas Easy Month End is a comprehensive month-end close management tool.

- Easy Month End vs Xero: Xero is a full accounting platform for small businesses, while Easy Month End provides a dedicated solution for the close process.

- Easy Month End vs Synder: Synder specializes in integrating e-commerce data, unlike Easy Month End which is a workflow tool for the entire financial close.

- Easy Month End vs Docyt: Docyt uses AI for bookkeeping and data entry, while Easy Month End automates the steps and tasks of the financial close.

- Easy Month End vs RefreshMe: RefreshMe is a financial coaching platform, which is different from Easy Month End’s focus on close management.

- Easy Month End vs Sage: Sage is a large-scale business management suite, while Easy Month End offers a more specialized solution for a critical accounting function.

- Easy Month End vs Zoho Books: Zoho Books is an all-in-one accounting software, whereas Easy Month End is a purpose-built tool for the month-end process.

- Easy Month End vs Wave: Wave provides free accounting services for small businesses, while Easy Month End offers a more advanced solution for close management.

- Easy Month End vs Quicken: Quicken is a personal finance tool, making Easy Month End a better choice for businesses needing to manage a month-end close.

- Easy Month End vs Hubdoc: Hubdoc automates document collection, but Easy Month End is designed to manage the full close workflow and team tasks.

- Easy Month End vs Expensify: Expensify is an expense management software, which is a different function than Easy Month End’s core focus on the financial close.

- Easy Month End vs QuickBooks: QuickBooks is a comprehensive accounting solution, while Easy Month End is a more specific tool for managing the month-end close itself.

- Easy Month End vs AutoEntry: AutoEntry is a data capture tool, whereas Easy Month End is a complete platform for task and workflow management during the close.

- Easy Month End vs FreshBooks: FreshBooks is for freelancers and small businesses, while Easy Month End offers a dedicated solution for the month-end close.

- Easy Month End vs NetSuite: NetSuite is a full-featured ERP system, which is broader in scope than Easy Month End’s specialized focus on the financial close.

Pertanyaan Yang Sering Muncul

What is the main difference between Dext and Easy Month End?

Dext focuses more on automation like receipt and invoice processing and integrates with many perangkat lunak akuntansi options. Easy Month End is simpler and mainly helps organize the month-end closing process.

Which one is better for a small business?

Dext is often better for a usaha kecil wanting to automate tasks like expense reports and data entry, saving valuable time and improving accuracy.

Does Dext or Easy Month End offer a free trial?

Yes, Dext offers a free trial so you can test its features before committing. Easy Month End may also have a trial, but it’s good to check their website for details.

Can my accountant use Dext or Easy Month End?

Yes, accountants often find Dext very useful due to its advanced features and integration capabilities. Easy Month End can also be helpful for basic bookkeeping tasks.

Is Dext or Easy Month End easy to use?

Dext is generally considered very user-friendly with a well-designed mobile app. Easy Month End aims for simplicity, but some users find Dext’s interface more intuitive.