Vous en avez assez de ressentir la frustration de la clôture de fin de mois ?

Trier tous ces chiffres peut prendre une éternité.

Et s'il existait une meilleure solution ?

Et si votre logiciel de comptabilité Cela pourrait simplifier et accélérer la clôture des comptes mensuels ?

Deux noms reviennent souvent : Xero et Easy Month End.

Aperçu

Nous avons testé Xero et Easy Month End en profondeur.

Explorer comment ils gèrent le monde réel entreprise scénarios.

Nos tests pratiques se sont concentrés sur la facilité d'utilisation, les fonctionnalités de clôture de fin de mois et l'efficacité globale afin de vous proposer cette comparaison claire.

Rejoignez plus de 2 millions d'entreprises qui utilisent le logiciel de comptabilité en ligne Xero. Découvrez dès maintenant ses puissantes fonctionnalités de facturation !

Tarification : Il propose un essai gratuit. L'abonnement payant commence à 29 $/mois.

Caractéristiques principales :

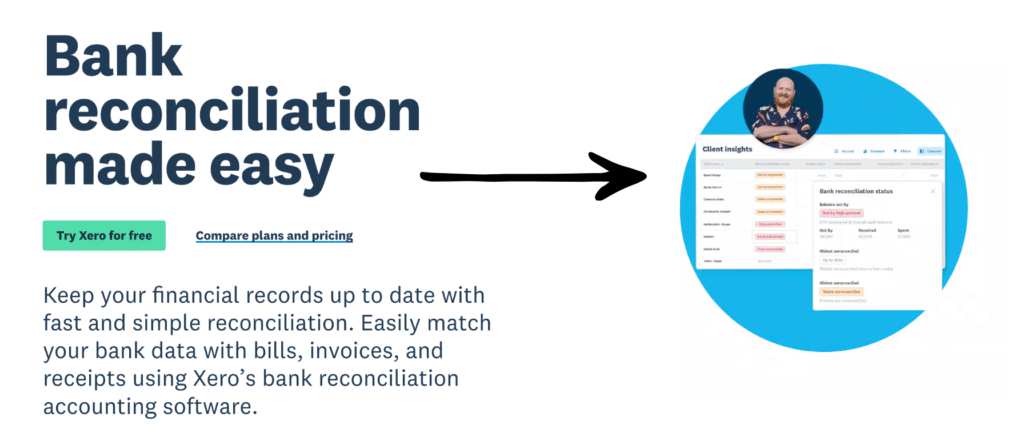

- Rapprochement bancaire

- Facturation

- Signalement

En cette fin de mois, rejoignez les 1 257 utilisateurs d'Easy qui ont économisé en moyenne 3,5 heures et réduit leurs erreurs de 15 %. Commencez votre essai gratuit !

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 45 $/mois.

Caractéristiques principales :

- Rapprochement automatisé

- Flux de travail rationalisés

- Interface conviviale

Qu'est-ce que Xero ?

Alors, Xero, hein ? C'est populaire.

De nombreuses entreprises l'utilisent. comptabilité Logiciel dans le cloud.

Vous pouvez y accéder partout. Cela vous aide à gérer vos finances.

Découvrez également nos favoris Alternatives à Xero…

Notre avis

Rejoignez plus de 2 millions d'entreprises utilisation de Xero Logiciel de comptabilité. Découvrez dès maintenant ses puissantes fonctionnalités de facturation !

Principaux avantages

- Rapprochement bancaire automatisé

- Facturation et paiements en ligne

- Gestion des factures

- Intégration de la paie

- Rapports et analyses

Tarification

- Démarreur: 29 $/mois.

- Standard: 46 $/mois.

- Prime: 69 $/mois.

Avantages

Cons

Qu'est-ce qu'une fin de mois facile ?

Fin de mois facile, n'est-ce pas ? Le nom en dit long.

Il vise vraiment à simplifier la fin du mois.

Il est conçu pour rationaliser l'ensemble du processus.

Considérez-le comme votre allié de fin de mois. Il vous aide à tout organiser.

Découvrez également nos favoris Alternatives faciles pour la fin du mois…

Notre avis

Améliorez la précision de vos finances avec Easy Month End. Bénéficiez du rapprochement automatisé et de rapports conformes aux exigences d'audit. Planifiez une démonstration personnalisée pour simplifier votre processus de clôture mensuelle.

Principaux avantages

- Flux de travail de rapprochement automatisés

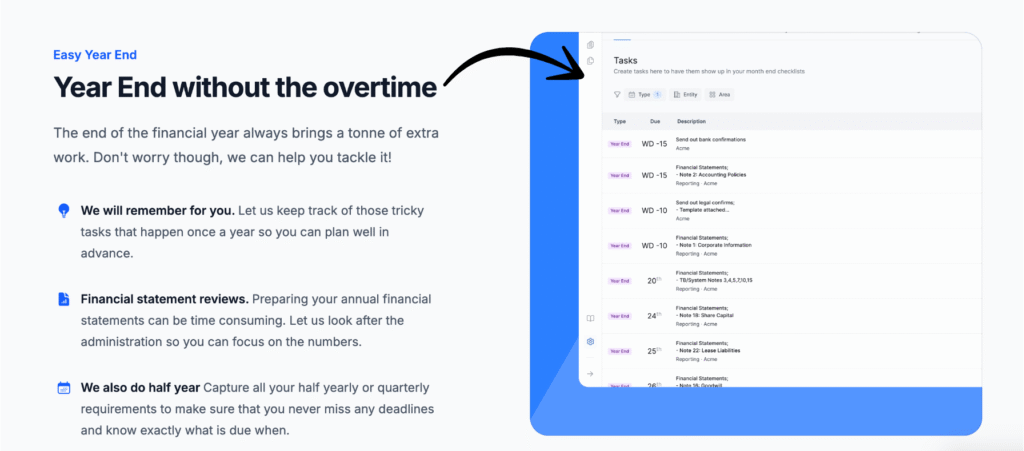

- Gestion et suivi des tâches

- Analyse de la variance

- Gestion documentaire

- Outils de collaboration

Tarification

- Démarreur: 24 $/mois.

- Petit: 45 $/mois.

- Entreprise: 89 $/mois.

- Entreprise: Tarification personnalisée.

Avantages

Cons

Comparaison des fonctionnalités

Comparer deux types d'outils différents peut s'avérer délicat.

Xero est une solution entièrement basée sur le cloud. comptabilité Easy Month End est un logiciel qui permet de rationaliser le processus de clôture, tandis qu'Easy Month End est une solution ciblée.

Examinons neuf fonctionnalités clés pour déterminer laquelle convient le mieux à votre équipe financière.

1. Fonctionnalités de base de la comptabilité et du progiciel de gestion intégré (PGI)

- Xero : Une véritable solution basée sur le cloud comptabilité Ce logiciel offre une vaste gamme de services, notamment la gestion de la comptabilité générale, des comptes clients et des comptes fournisseurs. Pour les entreprises établies ou en phase de développement, il constitue une base solide pour un système de planification des ressources de l'entreprise (ERP).

- Clôture de mois simplifiée : Ce n’est pas une tâche essentielle comptabilité système. Il est conçu pour fonctionner avec votre xero existant comptabilité Il ne gère pas les transactions courantes telles que le paiement des factures ou l'envoi de factures en ligne.

2. Focus sur la clôture de fin de mois

- Xero : Bien qu’il facilite le rapprochement et reportageLes outils de fin de mois de Xero font partie d'un système plus vaste. Ils permettent d'enregistrer et de stocker certaines données financières, mais ne proposent pas d'outils dédiés à la gestion des flux de travail.

- Clôture de mois simplifiée : C’est sa principale fonction. Elle offre un flux de travail structuré pour les tâches de l’équipe financière. Elle facilite la clôture de fin de mois en assurant le suivi de tous vos rapprochements et en fournissant audit preuve.

3. Rapprochement bancaire et du bilan

- Xero utilise des flux bancaires automatiques pour rapprocher les transactions et comptes bancaires quotidiens. C'est essentiel pour une meilleure visibilité des flux de trésorerie et pour réduire les tâches manuelles.

- Easy Month End : Spécialisée dans les rapprochements de bilan rapides, cette solution est conçue pour collecter les justificatifs d'audit et centraliser tous vos rapprochements sur une plateforme unique, simplifiant ainsi les clôtures annuelles et trimestrielles.

4. Gestion des flux de travail et des équipes

- Xero: Xero logiciel de comptabilité allows collaboration and multiple user access. However, it lacks a dedicated workflow management tool for the closing checklist itself.

- Easy Month End : Cette solution propose des outils dédiés à la gestion et à la collaboration d'équipe. Vous pouvez attribuer des tâches, suivre leur avancement et automatiser les validations, ce qui optimise le travail d'équipe. Il est également possible de laisser des commentaires et de suivre chaque action, contribuant ainsi à une meilleure efficacité de votre équipe financière.

5. Gestion des stocks

- Xero : Xero propose une fonctionnalité de gestion des stocks dans son abonnement le plus complet. Celle-ci aide les entreprises à gérer leurs niveaux de stock et leurs inventaires. données pour soutenir la performance de l'entreprise.

- Easy Month End : Ce module ne permet pas de gérer les stocks ni de suivre les données d'inventaire. Il se concentre exclusivement sur le processus de clôture financière.

6. Suivi des flux de trésorerie et des dépenses

- Xero : Le tableau de bord Xero offre une vue d’ensemble en temps réel de la gestion des flux de trésorerie. Xero excelle dans le suivi des dépenses, la gestion des factures à payer et des comptes clients (factures dues), ce qui en fait un outil essentiel pour… petite entreprise propriétaires.

- Easy Month End : Ce module se concentre sur le processus post-transactionnel (rapprochement et clôture). Il ne propose pas d'outils frontaux pour le suivi quotidien des flux de trésorerie ou des dépenses.

7. Évolutivité et public cible

- Xero : Avec ses différentes formules tarifaires, de l’offre de base à la prise en charge multidevises, Xero est idéal pour petites entreprises et les entreprises en pleine croissance. Nous recommandons Xero à toute entité ayant besoin d'une plateforme complète de planification des ressources d'entreprise.

- Clôture de mois simplifiée : Cette solution est idéale pour les entreprises établies disposant d’une équipe financière en pleine croissance qui a besoin de formaliser et de rationaliser son processus de clôture, souvent en s’intégrant au logiciel comptable Xero existant.

8. Fonctionnalités mobiles et accès

- Xero : Xero propose une application mobile performante pour iOS et les appareils Android. Cette fonctionnalité vous permet d'envoyer des factures en ligne, de saisir des factures et d'effectuer des rapprochements bancaires en déplacement, ce qui en fait une véritable solution de comptabilité basée sur le cloud.

- Clôture de mois simplifiée : Bien qu’il s’agisse également d’une comptabilité basée sur le cloud, son application mobile se concentre sur le suivi de l’avancement de la clôture et l’approbation des tâches, plutôt que sur la gestion des transactions quotidiennes.

9. Documentation d'audit et de conformité

- Xero : Fournit une piste d'audit des transactions. Les fonctionnalités de reporting de Xero facilitent le contrôle de la situation financière.

- Clôture de mois simplifiée : Conçu spécifiquement pour aider les préparateurs et les réviseurs à centraliser les éléments probants d’audit, cet outil facilite la transmission des informations aux auditeurs pour la validation de la fin d’exercice.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

Voici les points clés à prendre en compte :

- Interface conviviale : Vous souhaitez une interface claire et conviviale qui simplifie la gestion de vos tâches financières avec Xero.

- Évolutivité : Xero peut-il soutenir la croissance de votre entreprise ? Vérifiez si ses tarifs et ses formules conviennent aux petites entreprises et aux entreprises en expansion.

- Données en temps réel : Le logiciel devrait fournir des données en temps réel sur vos informations financières et la santé financière de votre entreprise.

- Assistance et ressources : Recherchez des ressources en ligne complètes et une procédure de demande d'assistance rapide pour obtenir une réponse. La communauté Xero Central est très active à cet égard.

- Accessibilité: Propose-t-elle une application mobile pour iOS et Android ? appareils Vous pouvez donc travailler depuis plusieurs endroits ?

- Profondeur des fonctionnalités : Avez-vous besoin d'une gestion financière simple ou de fonctionnalités avancées comme le suivi de projet et la gestion de plusieurs devises ?

- Gestion de la clientèle : La possibilité de gérer les données clients et d'envoyer un nombre illimité de factures est essentielle pour les travailleurs indépendants et les prestataires de services professionnels.

- Efficacité de fin de mois : Pour votre équipe financière, vérifiez les fonctionnalités de collaboration d'équipe pour le processus de fin de mois afin d'éviter les confirmations manuelles et les retards.

- Personnalisation : Est-il possible d'obtenir des rapports personnalisables et de programmer facilement les paiements ?

- Migration des données : Le processus de migration des données est-il simple lorsque vous importez vos enregistrements existants ? Vous devriez pouvoir tester facilement Xero ou tout autre logiciel.

- Contrats : Comprenez les conditions avant d'annuler ou de prolonger votre abonnement afin de connaître le coût réel de Xero.

- Piste d'audit : Le système doit garantir un journal clair des modifications afin de se prémunir contre les erreurs.

- Intégration : À quelle vitesse votre équipe peut-elle gérer les processus de fin de mois lors de la première clôture mensuelle ?

Verdict final

Après cette analyse approfondie, le bon choix dépend de votre besoin fondamental.

Si votre objectif est d'établir des rapports financiers complets et de gérer toutes les transactions quotidiennes, alors utilisez le logiciel de comptabilité Xero.

Xero, en tant que logiciel de comptabilité en nuage de premier plan, est un choix plus judicieux pour les propriétaires de petites entreprises.

Xero vous permet de gérer tout, de la taxe de vente aux bons de commande, et de payer jusqu'à cinq factures avec le plan anticipé.

Cependant, si votre équipe financière mérite une vie plus facile en résolvant les difficultés de la clôture de fin de mois.

Easy Month End est un outil fantastique. Il simplifie la vie en optimisant les rapprochements bancaires ponctuels et en éliminant les feuilles de calcul d'Outlook.

Vous pouvez également l'intégrer pour consulter votre logiciel de comptabilité ERP principal Xero.

Les deux sont excellents ; choisissez Xero pour son support client global et son étendue, ou l'autre pour une meilleure organisation et une réduction plus rapide des confirmations manuelles.

Plus d'informations sur Xero

Choisir le bon logiciel de comptabilité implique d'examiner plusieurs options.

Voici un aperçu rapide de Xero par rapport à d'autres produits populaires.

- Xero contre QuickBooks: QuickBooks est un concurrent majeur. Bien que les deux logiciels offrent des fonctionnalités de base similaires, Xero est souvent apprécié pour son interface épurée et son nombre illimité d'utilisateurs. QuickBooks peut s'avérer plus complexe, mais il propose des outils de reporting très performants.

- Xero contre FreshBooks: FreshBooks est une option populaire, notamment pour les travailleurs indépendants et les entreprises de services. Il excelle dans la facturation et le suivi du temps. Xero offre une solution comptable plus complète.

- Xero contre Sage: Sage et Xero proposent tous deux des solutions pour les petites entreprises. Cependant, Sage fournit également des outils de planification des ressources d'entreprise (ERP) plus complets pour les grandes entreprises.

- Xero contre Zoho Books: Zoho Books fait partie d'une vaste suite d'applications professionnelles. Elle offre souvent des fonctionnalités avancées pour la gestion des stocks et se révèle très économique. Xero, quant à elle, est une solution de choix pour sa simplicité et sa facilité d'utilisation.

- Xero contre Wave: Wave est réputé pour sa version gratuite. C'est une excellente option pour les très petites entreprises ou les indépendants disposant d'un budget limité. Xero offre une gamme de fonctionnalités plus étendue et est mieux adapté à la croissance des entreprises.

- Xero contre Quicken: Quicken est principalement destiné aux finances personnelles. Bien qu'il propose certaines fonctionnalités professionnelles, il ne s'agit pas d'une véritable solution de comptabilité d'entreprise. Xero, quant à lui, est conçu spécifiquement pour gérer la complexité de la comptabilité d'entreprise.

- Xero contre HubdocCes deux outils ne sont pas des concurrents directs. Dext et Hubdoc automatisent la capture de documents et la saisie de données. Ils s'intègrent directement à Xero pour une comptabilité plus rapide et plus précise.

- Xero contre Synder: Synder est une plateforme qui connecte les canaux de vente et les passerelles de paiement aux logiciels de comptabilité. Elle automatise la saisie de données provenant de plateformes comme Shopify et Stripe directement dans Xero.

- Xero contre ExpensifyExpensify se concentre spécifiquement sur la gestion des dépenses. Bien que Xero propose des fonctionnalités de gestion des dépenses, Expensify offre des outils plus avancés pour la gestion des frais et des remboursements des employés.

- Xero contre Netsuite: NetSuite est un système ERP complet destiné aux grandes entreprises. Il offre une suite complète d'outils de gestion. Xero n'est pas un ERP, mais constitue une excellente solution comptable pour les petites entreprises.

- Xero contre Puzzle IO: Puzzle IO est une plateforme financière conçue pour les startups, axée sur les états financiers en temps réel et la saisie automatisée de données.

- Xero vs Easy Month End: Ce logiciel est un outil spécialisé permettant d'automatiser le processus de clôture mensuelle, facilitant le rapprochement bancaire et la traçabilité des opérations. Il est conçu pour fonctionner avec Xero, et non pour le remplacer.

- Xero contre Docyt: Docyt utilise l'IA pour automatiser les tâches administratives et comptables. Elle permet de consulter tous vos documents et données financières au même endroit.

- Xero contre RefreshMe: RefreshMe est un logiciel de comptabilité plus simple, doté de fonctionnalités de base, souvent utilisé pour les finances personnelles ou les très petites entreprises.

- Xero contre AutoEntry: À l'instar de Dext et Hubdoc, AutoEntry est un outil qui automatise l'extraction de données à partir de reçus et de factures, conçu pour s'intégrer et améliorer les logiciels comptables tels que Xero.

Plus de fins de mois faciles

Voici une brève comparaison d'Easy Month End avec quelques-unes des principales alternatives.

- Fin de mois facile vs Puzzle io: Alors que Puzzle.io est destiné à la comptabilité des startups, Easy Month End se concentre spécifiquement sur la simplification du processus de clôture.

- Fin de mois facile vs Dext: Dext est principalement destiné à la capture de documents et de reçus, tandis qu'Easy Month End est un outil complet de gestion de la clôture de fin de mois.

- Easy Month End vs Xero: Xero est une plateforme comptable complète pour les petites entreprises, tandis qu'Easy Month End propose une solution dédiée au processus de clôture.

- Fin de mois facile vs Synder: Synder est spécialisé dans l'intégration des données de commerce électronique, contrairement à Easy Month End qui est un outil de flux de travail pour l'ensemble de la clôture financière.

- Fin de mois facile vs Docyt: Docyt utilise l'IA pour la comptabilité et la saisie de données, tandis qu'Easy Month End automatise les étapes et les tâches de la clôture financière.

- Easy Month End vs RefreshMe: RefreshMe est une plateforme de coaching financier, différente de Easy Month End qui se concentre sur la gestion des clôtures.

- Easy Month End vs Sage: Sage est une suite logicielle de gestion d'entreprise à grande échelle, tandis qu'Easy Month End offre une solution plus spécialisée pour une fonction comptable essentielle.

- Easy Month End vs Zoho Books: Zoho Books est un logiciel de comptabilité tout-en-un, tandis qu'Easy Month End est un outil spécialement conçu pour le processus de clôture mensuelle.

- Fin de mois facile vs vague: Wave propose des services de comptabilité gratuits pour les petites entreprises, tandis qu'Easy Month End offre une solution plus avancée pour la gestion des clôtures.

- Easy Month End vs Quicken: Quicken est un outil de gestion de finances personnelles, ce qui fait d'Easy Month End un meilleur choix pour les entreprises qui doivent gérer leur clôture de fin de mois.

- Easy Month End vs Hubdoc: Hubdoc automatise la collecte de documents, mais Easy Month End est conçu pour gérer l'intégralité du flux de travail de clôture et les tâches d'équipe.

- Easy Month End vs Expensify: Expensify est un logiciel de gestion des dépenses, ce qui est une fonction différente de l'objectif principal d'Easy Month End, qui est la clôture financière.

- Easy Month End vs QuickBooks: QuickBooks est une solution comptable complète, tandis qu'Easy Month End est un outil plus spécifique pour la gestion de la clôture de fin de mois.

- Fin de mois simplifiée vs saisie automatique: AutoEntry est un outil de saisie de données, tandis qu'Easy Month End est une plateforme complète pour la gestion des tâches et des flux de travail lors de la clôture.

- Easy Month End vs FreshBooks: FreshBooks est destiné aux travailleurs indépendants et aux petites entreprises, tandis qu'Easy Month End offre une solution dédiée à la clôture de fin de mois.

- Easy Month End vs NetSuite: NetSuite est un système ERP complet, dont la portée est plus large que celle d'Easy Month End, spécialisé dans la clôture financière.

Foire aux questions

Xero peut-il m'aider à stocker tous mes documents financiers ?

Oui, Xero vous permet de joindre des documents sources aux transactions, ce qui permet de tout garder organisé numériquement.

Easy Month End nécessite-t-il beaucoup de saisie manuelle de données ?

Easy Month End vise à réduire le travail manuel grâce à des fonctionnalités axées sur la simplification du processus de clôture de fin de mois.

Pourrais-je importer des données de mon système comptable actuel dans l'une ou l'autre plateforme ?

Oui, Xero et Easy Month End proposent généralement tous deux des options pour importer des données provenant d'autres systèmes.

À quelle fréquence les données financières sont-elles mises à jour dans Xero et Easy Month End ?

Xero propose souvent des flux bancaires en direct pour des mises à jour quasi instantanées. Easy Month End se concentre sur les mises à jour lors de la clôture mensuelle.

Easy Month End convient-il à toutes les entreprises ?

Easy Month End peut être utile à diverses entités rencontrant des difficultés lors de la clôture mensuelle, mais sa valeur dépend de leurs besoins spécifiques.