Choisir le bon logiciel de comptabilité Cela peut sembler être une décision importante pour votre entreprise, n'est-ce pas ?

Vous avez probablement entendu parler de Wave et QuickBooks, deux choix populaires.

Mais lequel convient le mieux à ton besoins?

Cet article comparera Wave et QuickBooks.

Aperçu

Nous avons mis Wave et QuickBooks à l'épreuve.

Nous avons utilisé chaque logiciel pour gérer des données réelles. entreprise finances.

Ces tests pratiques nous ont permis de voir comment ils fonctionnent.

Maintenant, nous pouvons les comparer équitablement pour vous.

Plus de 4 millions petites entreprises Confiez la gestion de vos finances à Wave. Découvrez les offres de Wave et trouvez celle qui vous convient.

Tarification : Formule gratuite disponible. Formule payante à partir de 19 $/mois.

Caractéristiques principales :

- Facturation

- Bancaire

- Module complémentaire de paie.

Utilisé par plus de 7 millions d'entreprises, QuickBooks peut vous faire gagner en moyenne 42 heures par mois sur comptabilité.

Tarification : Il propose un essai gratuit. L'abonnement commence à 1,90 $/mois.

Caractéristiques principales :

- Gestion des factures

- Suivi des dépenses

- Signalement

Qu'est-ce qu'une vague ?

Bon, parlons de Wave.

Considérez-le comme un ami précieux pour les finances de votre entreprise.

Il vous permet notamment d'envoyer des factures et de suivre les entrées et sorties d'argent.

Cela peut vous aider à avoir une vision d'ensemble des finances de votre entreprise.

Découvrez également nos favoris Alternatives aux vagues…

Notre avis

N’acceptez pas moins ! Rejoignez les plus de 2 millions de petites entreprises qui font confiance dès aujourd’hui aux puissantes fonctionnalités comptables gratuites de Wave pour optimiser leurs finances.

Principaux avantages

Les points forts de Wave incluent :

- Un plan de comptabilité de base 100% gratuit.

- Au service de plus de 2 millions de petites entreprises.

- Création de factures et traitement des paiements simplifiés.

- Aucun contrat ni garantie à long terme.

Tarification

- Plan de démarrage : 0 $ par mois.

- Formule Pro : 19 $ par mois.

Avantages

Cons

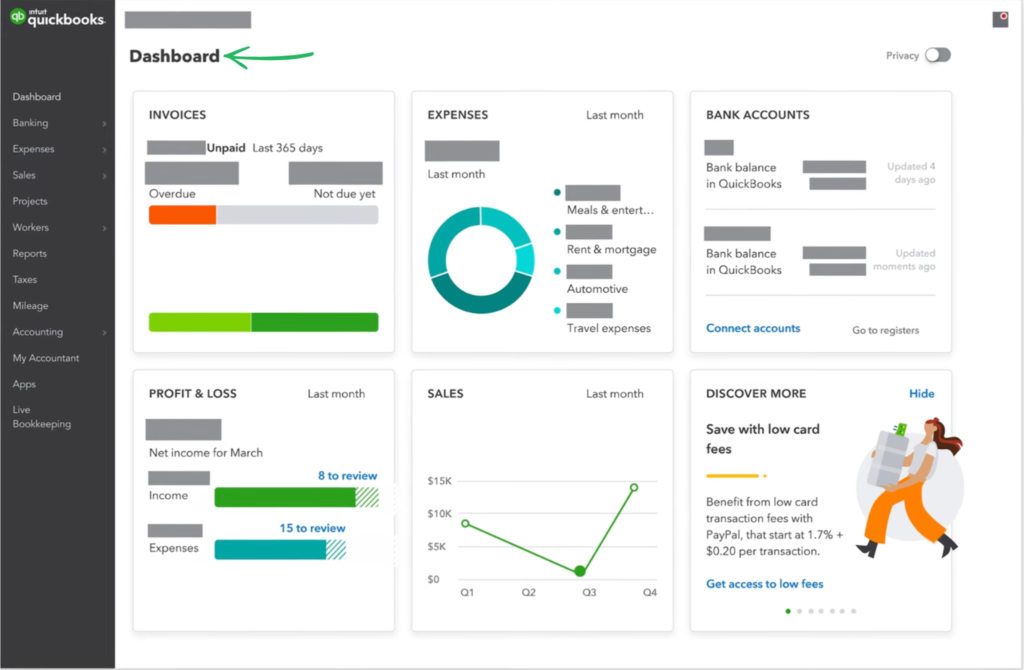

Qu'est-ce que QuickBooks ?

QuickBooks, c'est comme un ami serviable pour gérer les finances de votre entreprise.

Cela vous permet de suivre les entrées et les sorties d'argent.

De nombreuses petites entreprises aiment l'utiliser.

Découvrez également nos favoris Alternatives à QuickBooks…

Principaux avantages

- Catégorisation automatisée des transactions

- Création et suivi des factures

- Gestion des dépenses

- Services de paie

- Rapports et tableaux de bord

Tarification

- Démarrage simple : 1,90 $/mois.

- Essentiel: 2,80 $/mois.

- Plus: 4 $/mois.

- Avancé: 7,60 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Pour les propriétaires de petites entreprises, choisir le bon comptabilité La solution se résume souvent à un compromis entre le coût et l'ensemble des fonctionnalités.

Ce comparatif entre Wave et QuickBooks détaillera les différences entre une plateforme gratuite et essentielle et un service d'abonnement riche en fonctionnalités et évolutif pour vous aider à suivre vos finances et à rester organisé.

1. Gestion de la paie et des employés

- Vague La gestion de la paie est un module complémentaire intégré, facturé en supplément. Elle assure le traitement de la paie et les déclarations fiscales des employés et des travailleurs indépendants rémunérés par virement bancaire.

- QuickBooks La paie est un service robuste qui prend en charge l'ensemble des services. comptabilitéLa gestion du temps des employés (QuickBooks Time), les paiements aux prestataires et toutes les taxes associées sont assurés par les produits Intuit QuickBooks, qui offrent des avantages complets et une assistance à la préparation des déclarations fiscales.

2. Fondements de la comptabilité

- Wave gratuit comptabilité Le système offre des fonctionnalités robustes pour les tâches essentielles. Il inclut la comptabilité en partie double et des rapports financiers tels que les bilans et les comptes de résultat. Il permet le suivi de plusieurs sociétés à partir d'un seul compte Wave.

- QuickBooks QuickBooks est un système standard du secteur offrant des fonctionnalités comptables complètes. Il comprend un plan comptable détaillé et des outils de rapprochement complets qui permettent de tenir une comptabilité précise. données et les rapports financiers.

3. Facturation et paiements

- Wave Les fonctionnalités de facturation sont performantes et incluses gratuitement. Vous pouvez planifier et créer des factures professionnelles, configurer des factures récurrentes et accepter les paiements en ligne par carte bancaire et virement bancaire (des frais de transaction s'appliquent).

- QuickBooks Elle propose des fonctionnalités avancées pour les clients, comme la conversion des devis en factures, et offre des options de paiement en ligne, notamment Apple Pay. Elle fournit des rappels de paiement efficaces et des outils pour une gestion optimale de la facturation récurrente.

4. Gestion des dépenses et saisie des données

- Vague Vous pouvez ainsi suivre vos dépenses en connectant l'application à vos comptes bancaires et à votre carte de crédit. La version Pro payante inclut l'importation automatique des transactions bancaires et la numérisation des reçus pour une lecture simplifiée.

- QuickBooks Ces produits simplifient le suivi des dépenses en permettant aux utilisateurs d'importer automatiquement les transactions bancaires et de cartes de crédit. QuickBooks contribue à un gain de temps grâce à l'appariement et au suivi automatiques des factures fournisseurs.

5. Tarification et accès

- Vague Financial propose une formule de base gratuite performante qui constitue un système comptable complet. La version gratuite inclut un grand livre et un nombre illimité de factures. Wave rend la gestion financière accessible à un nombre illimité d'utilisateurs.

- Intuit QuickBooks Les produits sont proposés sous forme d'abonnements payants à plusieurs niveaux. QuickBooks offre plusieurs formules, chacune avec des coûts supplémentaires variables, à partir d'une licence monoposte. QuickBooks accompagne la croissance des entreprises en prenant en charge jusqu'à 25 utilisateurs dans sa formule avancée.

6. Outils commerciaux spécialisés

- Vague Il propose des fonctionnalités essentielles de gestion financière, mais manque d'outils pour la gestion des stocks ou le suivi de la rentabilité des projets. Ses principales caractéristiques sont axées sur les besoins des travailleurs indépendants et des micro-entreprises qui recherchent la simplicité et le suivi des flux de trésorerie.

- QuickBooks Il offre des fonctionnalités plus spécialisées, telles que la gestion des stocks, le suivi de la TVA et la gestion des bons de commande. Son écosystème intégré fournit des analyses de données et des rapports adaptés aux entreprises de taille moyenne.

7. Accessibilité et plateforme

- Vague est une plateforme native du cloud qui vous permet d'accéder en ligne à vos rapports financiers et à vos données depuis l'application mobile. C'est une plateforme gratuite idéale pour les tâches comptables simples.

- QuickBooks Nous proposons une version en ligne hébergée dans le cloud et une version de bureau (où les données sont stockées localement). La version en ligne offre une flexibilité accrue et un accès direct à votre comptable et à vos utilisateurs.

8. Assistance clientèle et sécurité

- A vague Les analyses comptables soulignent souvent que l'assistance en direct est généralement réservée aux abonnés payants (ou utilisant Wave Payroll ou les services de paiement Wave). La sécurité inclut une authentification multifacteurs pour protéger les comptes bancaires des utilisateurs.

- QuickBooks Les produits protègent les données de l'entreprise grâce à une sécurité renforcée et offrent une assistance plus accessible et complète, incluant souvent le téléphone et le chat. Cette tranquillité d'esprit est un argument de vente majeur dans les avis sur QuickBooks.

9. Automatisation et flux de travail

- Vague Wave propose des outils comme la fusion automatique pour simplifier le rapprochement bancaire et gérer automatiquement les transactions de votre banque. Les produits Wave privilégient les rappels automatisés et la réduction de la saisie manuelle de données.

- QuickBooks Ce système offre des fonctionnalités d'automatisation avancées qui simplifient les flux de travail complexes. Il permet de payer les factures à temps, de gérer les rapports par période et de suivre les flux financiers grâce à des règles de rapprochement automatisées sophistiquées.

Quels sont les critères à prendre en compte pour choisir un logiciel de comptabilité ?

Choisir le bon petite entreprise Le choix d'un logiciel comptable nécessite l'évaluation de quelques domaines clés afin de s'assurer qu'il corresponde à vos opérations actuelles et à votre croissance future.

- Modèle de tarification et fonctionnalités principalesNe vous fiez pas uniquement au prix initial. De nombreux fournisseurs proposent une offre gratuite ou une période d'essai généreuse, mais les fonctionnalités essentielles sont souvent réservées aux abonnements payants. Par exemple, certains fournisseurs proposent deux formules adaptées aux utilisateurs occasionnels et aux entreprises en pleine croissance, avec parfois un tarif préférentiel pour un engagement annuel. Vérifiez si les fonctionnalités de base, comme le logiciel de facturation et les outils de comptabilité générale, répondent à vos besoins.

- Évolutivité et accès utilisateur: Consider how the software manages growth. If your team expands, you’ll need a platform that supports multiple users without excessive extra fees. While most small business logiciel de comptabilité can handle basic personal finance tracking, look for systems that allow you to manage multiple entities or fully integrate external data as your business grows.

- Spécialisation et automatisationLes meilleurs logiciels excellent dans l'automatisation des flux de travail complexes. Si vous facturez vos clients pour des services, le suivi des heures facturables est essentiel. De plus, une automatisation fiable, comme les rappels de paiement automatiques, améliorera considérablement votre trésorerie. Vérifiez si le logiciel propose des solutions intégrées telles que la comptabilité et la paie, ou si le fournisseur (Wave) s'intègre facilement avec d'autres services tiers nécessaires.

- Assistance et facilité d'utilisationUne conception intuitive est essentielle. Les analyses de Wave Accounting mettent souvent en avant la simplicité d'utilisation des plateformes, ce qui explique pourquoi beaucoup recommandent Wave aux nouveaux entrepreneurs. Assurez-vous que le fournisseur propose un centre d'aide complet avec des ressources facilement accessibles et des délais de réponse clairs, idéalement sous quelques jours ouvrables, afin de résoudre rapidement vos questions.

Verdict final

Nous avons examiné attentivement les deux. Nous avons choisi QuickBooks.

C'est mieux pour la plupart des entreprises en croissance.

Wave est gratuit et simple d'utilisation. Mais QuickBooks offre davantage de fonctionnalités.

Il offre également un meilleur support. Il gère les tâches complexes. C'est un atout précieux pour accompagner la croissance de votre entreprise.

Nous avons testé les deux systèmes en profondeur. Nos tests montrent que QuickBooks est plus performant.

Il offre également plus de flexibilité. Pour une gestion financière sérieuse, il est plus performant.

Cela contribuera à la réussite de votre entreprise.

Plus de Wave

- Wave vs Puzzle IOCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Wave contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Wave contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Vague contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Wave vs Easy Fin de moisIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Wave vs DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Vague contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Wave vs Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Wave vs QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- Wave vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Wave contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- Wave contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Wave vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Wave contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Wave contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Plus d'informations sur QuickBooks

- QuickBooks contre Puzzle IOCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- QuickBooks contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- QuickBooks contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- QuickBooks contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- QuickBooks vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- QuickBooks contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- QuickBooks contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- QuickBooks contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- QuickBooks contre WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- QuickBooks contre QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- QuickBooks contre HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- QuickBooks contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- QuickBooks contre AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- QuickBooks contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- QuickBooks contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

QuickBooks Online est-il meilleur que Wave Accounting ?

QuickBooks Online offre souvent plus de fonctionnalités et une meilleure évolutivité pour les entreprises en pleine croissance. Wave Accounting est idéal pour les très petites entreprises ou les travailleurs indépendants qui ont besoin d'une comptabilité simple et gratuite. Le choix le plus adapté dépendra des besoins spécifiques de votre entreprise et de votre budget.

Puis-je gérer mes stocks avec Wave ?

Wave Accounting n'intègre pas de gestion des stocks. Pour le suivi de vos stocks, vous devrez probablement utiliser une application externe et l'intégrer. QuickBooks Desktop et certaines formules QuickBooks Online proposent des outils de gestion des stocks plus performants.

Quelles sont les principales différences entre QuickBooks Desktop et QuickBooks Online ?

QuickBooks Desktop s'installe sur votre ordinateur, tandis que QuickBooks Online est une solution cloud accessible via un navigateur web. Online offre plus de flexibilité et d'accessibilité. Desktop offre un contrôle accru et représente souvent un achat unique, mais ne propose pas les avantages du cloud.

Existe-t-il un logiciel de comptabilité véritablement gratuit comme Wave pour les propriétaires de petites entreprises ?

Oui, Wave Accounting est une solution entièrement gratuite pour les besoins comptables de base. Bien que les fonctionnalités essentielles soient gratuites, certains services comme la paie ou le traitement des paiements peuvent être payants. C'est un excellent choix de logiciel pour les petites entreprises disposant d'un budget limité.

Comment le plan tarifaire de QuickBooks se compare-t-il à celui de Wave ?

Les fonctionnalités comptables de base de Wave sont gratuites. QuickBooks fonctionne sur un modèle d'abonnement avec différents niveaux offrant diverses fonctionnalités. Si Wave propose des fonctionnalités de base gratuites, QuickBooks offre des fonctionnalités plus complètes moyennant un coût, ce qui le rend adapté aux entreprises prêtes à investir.