Are you tired of feeling overwhelmed by your finances?

Keeping track of bills and saving for the future can feel like a never-ending juggling act.

That’s where Refresh Me comes in.

This personal financial management tool promises to simplify your money matters.

But does it really deliver?

In this review, we’ll take a closer look at Refresh Me’s features, user experience, and overall effectiveness.

Ready to take control of your money? Thousands of people use Refresh Me to get their finances in order. See the difference!

What is Refresh Me?

Refresh Me is like a personal financial advisor in your pocket.

It connects to your bank accounts and uses your spending données to help you understand your financial habits.

Think of it as a personalized treatment plan for your finances.

It analyzes your spending, spots areas where you might be overspending, and suggests ways to save.

It can even help you find better deals on services like assurance or your phone bill.

To do all this, Refresh Me collects some information about your spending.

But it’s all done securely and with your privacy in mind.

Who Created Refresh Me?

Refresh Me was started by a group of financial experts led by the visionary entrepreneur Emily Chen.

They wanted to faire managing money less stressful for everyone.

They had seen many clients struggle with their finances, and they knew there had to be a better way.

These experts weren’t just good with numbers; they also understood the art of communication.

They realized that most money tools failed because they were too complicated.

So, they set out to build a platform that anyone could understand and use.

Their vision was to create a tool that could analyze your spending, give you personalized insights, and help you make smarter financial decisions.

And that’s exactly what Refresh Me does.

Top Benefits of Refresh Me

- Personalized Financial Insights: Refresh Me analyzes your spending habits and provides tailored advice to help you make better financial decisions. It’s like having a personal finance coach in your pocket.

- Budgeting Made Easy: Create and track budgets effortlessly. Refresh Me helps you stay on top of your spending and avoid overspending.

- Bill Tracking and Reminders: Never miss a payment again. Refresh Me enables you to keep track of your bills and sends you timely reminders.

- Goal Setting and Tracking: Set financial goals, big or small, and track your progress towards achieving them. Refresh Me keeps you motivated and on track.

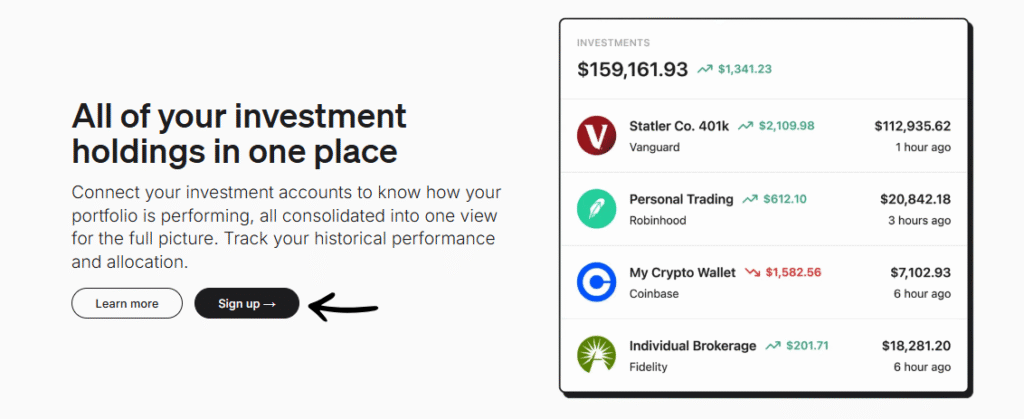

- Investment Tracking: Monitor your investments and get insights into their performance. Make informed decisions about your investment portfolio.

- Secure and Private: Your financial information is safe and secure with Refresh Me. They use the new encryption technology to protect your data.

- Interface conviviale : Refresh Me is easy to use, even if you need to be tech-savvy. The interface is clean & intuitive, making it easy to navigate.

- Excellent Customer Support: If you have any questions or need help, Refresh Me’s customer support team is always there to assist you.

- Regular Updates and Improvements: Refresh Me is constantly being updated with new features & improvements based on user feedback and the latest financial trends. You can expect the content and information within the app to change and be updated regularly, ensuring you always have access to the most relevant and helpful tools.

Best Features of Refresh Me

Refresh me is a great tool for managing your money.

It brings all your financial information together in one simple place.

It helps you understand where your money is going and gives you helpful tips on how to handle it better.

Here are some of the key features that make it special and help you take charge of your finances.

1. AI Assistant

Think of this as your personal finance buddy.

It learns from your spending habits and offers personalized advice. It can even help you find ways to save money on bills and subscriptions.

The more you use it, the smarter it gets, tailoring its suggestions to your specific needs.

It’s like having a finance expert of any age by your side, ready to offer advice whenever you need it.

2. Budget Manager

Creating & sticking to a budget could be tough.

Refresh Me makes it simple. You could set spending limits for different categories, & it will track your progress, giving you a heads-up if you’re getting close to your limit.

No more surprises at the end of the month!

You can even review your spending habits and make adjustments as needed to improve your financial health.

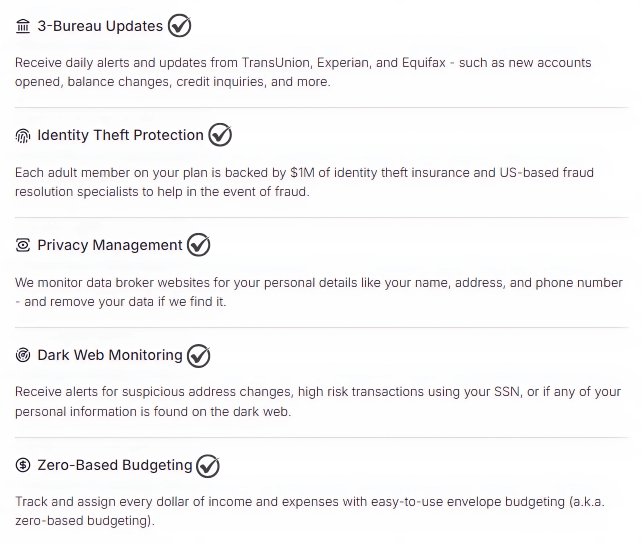

3. Dark Web Monitoring

Identity theft is a real threat, and your personal information could be lurking on the dark web without you knowing.

Refresh Me scans the dark web for your data and alerts you if it finds anything suspicious.

C'est comme avoir un sécurité guard for your identity, always on the lookout for any threats you might face.

4. Privacy Management

Are companies collecting too much of your personal information?

Refresh Me helps you take control. It shows you which companies have your data and lets you request they delete it.

It’s a great way to reclaim your privacy and limit the amount of information companies can collect about you.

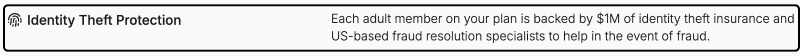

5. Identity Theft Protection

If the worst happens & your identity is stolen, Refresh Me has your back.

They offer comprehensive identity theft protection, including fraud resolution support and even insurance to cover any losses.

It’s peace of mind knowing you have help if you need it, no matter what challenges you face.

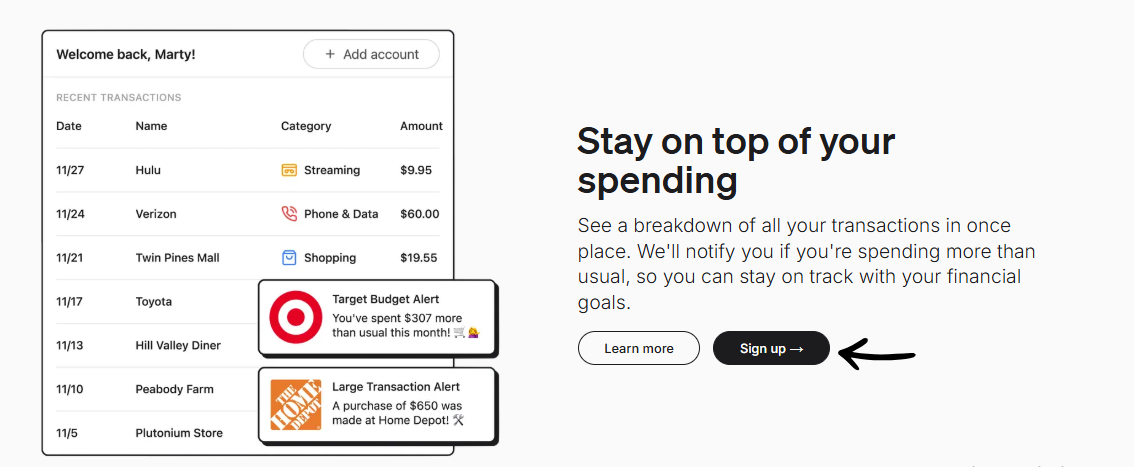

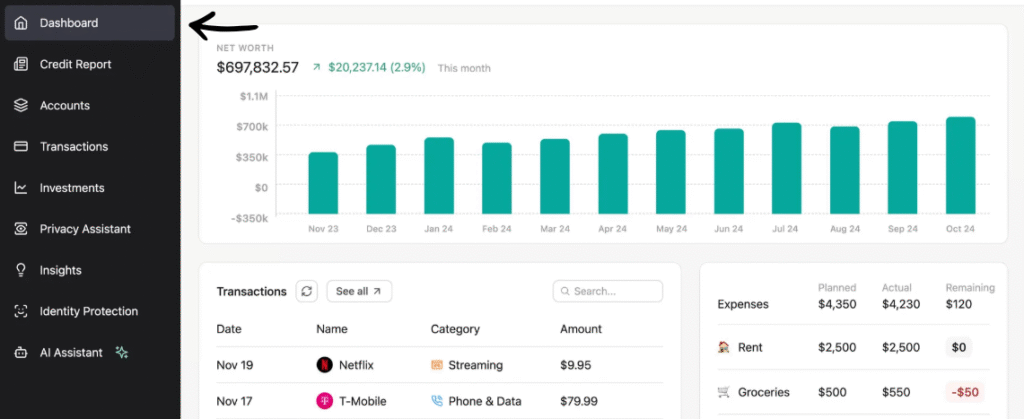

6. Financial Dashboard

This is like your control center for all your money.

You can see all your different bank accounts, credit cards, and investments in one spot.

It gives you a clear and simple picture of your total money and financial health.

This helps you get a complete view of everything at a single glance.

7. Spending Tracker

Refresh me keeps track of everything you spend money on.

It automatically sorts your spending into different groups, so you can easily see where your money is going each month.

This feature makes it easier to find areas where you can cut back and save more money for your goals.

8. Bill Data Gestion

You won’t miss a payment again with this helpful feature.

It helps you keep track of all your upcoming bills and due dates.

It also sends you timely reminders so you can pay your current bills on time & avoid late fees, which helps you stay organized and stress-free.

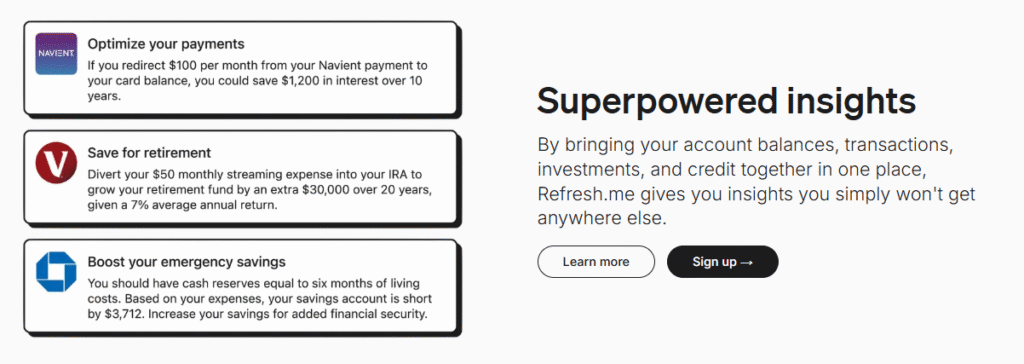

9. Superpowered Insights

This feature gives you clear and easy-to-read reports on your money habits.

These reports can show you what you are doing well.

And what you can improve on to meet your goals.

This tool helps you make smart choices with your money by giving you a detailed look at your financial life.

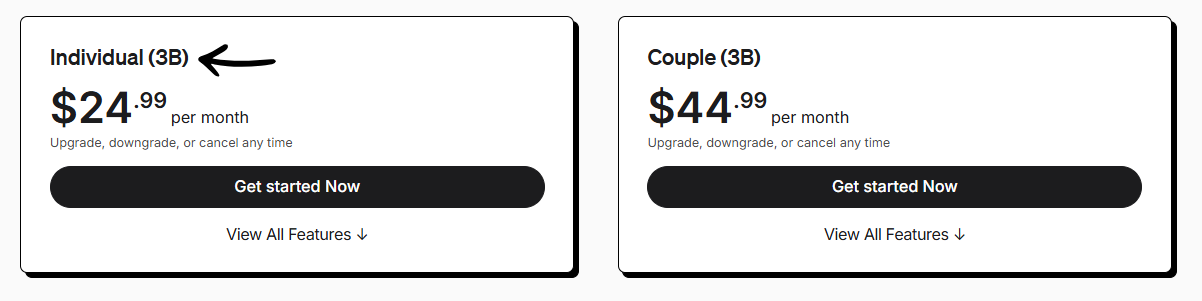

Tarification

| Nom du régime | Tarification | Caractéristiques principales |

|---|---|---|

| Individual (3B) | $24.99/month | Monthly credit report & score, AI assistant |

| Couple (3B) | $44.99/month | Monthly credit report & score, AI assistant |

Avantages et inconvénients

Understanding the strengths & weaknesses of any product helps you make an informed decision.

So, let’s take a balanced look at what Refresh Me offers.

Pour

Cons

Alternatives of Refresh me

Here is a brief look at some of the top RefreshMe alternatives to Refresh me.

- Puzzle IO: This software focuses on AI-powered financial planning.

- Dext: This tool is great for capturing documents and extracting data.

- Xero: This is a popular online accounting software for small businesses.

- Synder: It specializes in syncing e-commerce and payment data with accounting software.

- Fin de mois facile: This software is designed to streamline your month-end financial tasks.

- Docyt: It uses artificial intelligence for bookkeeping and automates financial workflows.

- Sage: This is a comprehensive business and accounting software suite.

- Zoho Books: An online accounting tool, it is known for being affordable and great for small businesses.

- Vague: This option provides free accounting software for small businesses.

- Quicken: A popular personal finance management tool that helps organize budgets.

- Hubdoc: It specializes in capturing and organizing financial documents for bookkeeping.

- Expensify: This app is focused on expense management, making it easy to track and submit receipts.

- QuickBooks: A very well-known accounting software that helps businesses with everything from invoicing to payroll.

- Entrée automatique: This tool automates data entry by scanning and analyzing documents like invoices and receipts.

- FreshBooks: This software is built specifically for freelancers & small businesses, with a focus on invoicing & time tracking.

- NetSuite: A powerful and complete cloud-based business management suite for larger companies.

Refresh me Compared

- Refresh me vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Refresh me vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Refresh me vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Refresh me vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Refresh me vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Refresh me vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Refresh me vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Refresh me vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Refresh me vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Refresh me vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- Refresh me vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Refresh me vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Refresh me vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Refresh me vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Refresh me vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Refresh me vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Personal Experience with Refresh Me

Our team was eager to test Refresh me.

We wanted to see if it lived up to the hype. So, we signed up and connected our accounts.

Right away, we noticed how easy it was to use. The interface was clean and simple, and we had no trouble finding what we needed.

Here’s a quick list of how Refresh Me helped our team:

- Personalized Insights: The AI assistant gave us specific tips based on our spending habits. We were able to see where we could cut back and save.

- Budgeting Made Easy: We created budgets for different categories, and Refresh Me kept us on track. No more overspending on dining out!

- Bill Reminders: We never missed a payment again, thanks to the timely reminders.

- Goal Setting: We set a goal to save for a team retreat, and Refresh Me helped us track our progress. It felt great to see our savings grow!

Overall, we were really impressed with Refresh Me. It made managing our team’s finance reviews a breeze. We felt more organized and in control than ever before.

Réflexions finales

Refresh Me is a powerful tool that can help you take control of your finances.

It prefers a wide range of features, from budgeting and bill tracking to identity theft protection.

If you’re looking for an easy-to-use, all-in-one solution to simplify your financial life, Refresh Me is definitely worth considering.

Give it a try and see how it can help you achieve your financial goals.

You might be surprised at how much of a difference it makes!

Questions fréquemment posées

Is Refresh Me safe to use?

Absolutely. Refresh Me takes security very seriously. They use bank-level encryption to protect your data, and they never sell your information to third parties.

Can I cancel my Refresh Me subscription anytime?

Yes, you could cancel your subscription anytime, directly from within the app or by contacting customer support. There are no hidden fees or cancellation penalties.

Does it Refresh my work with all banks?

Refresh Me works with most major banks and financial institutions. However, it’s always a good idea to check their website to see if your bank is supported before signing up.

Can I use Refresh Me on my phone?

Yes, Refresh Me has a mobile app available for both iOS and Android devices. You can manage your finances on the go, wherever you are.

Is there a free trial for Refresh Me?

Yes, Refresh Me offers a free trial, so you could try out all the features before committing to a subscription. It’s a great way to see if it’s the right fit for you.