Exécution d'un petites entreprises is tough, right?

You’re juggling a million things.

Often, managing your money can feel like the biggest headache.

Keeping track of income, expenses, and taxes can take up tons of your precious time.

Et s'il existait un moyen plus simple ?

Good accounting software can change everything.

It helps you simply stay organized, save time, and make smart choices about your money.

Let’s find the 9 Best Accounting Software for Small Business in 2025 that’s perfect for you.

What is the Best Accounting Software for Small Business?

Choosing the perfect accounting software can feel overwhelming.

There are so many options out there. We’ve done the hard work for you.

Our list cuts through the clutter.

We’ll help you find the perfect tool to manage your money.

Here are our top picks.

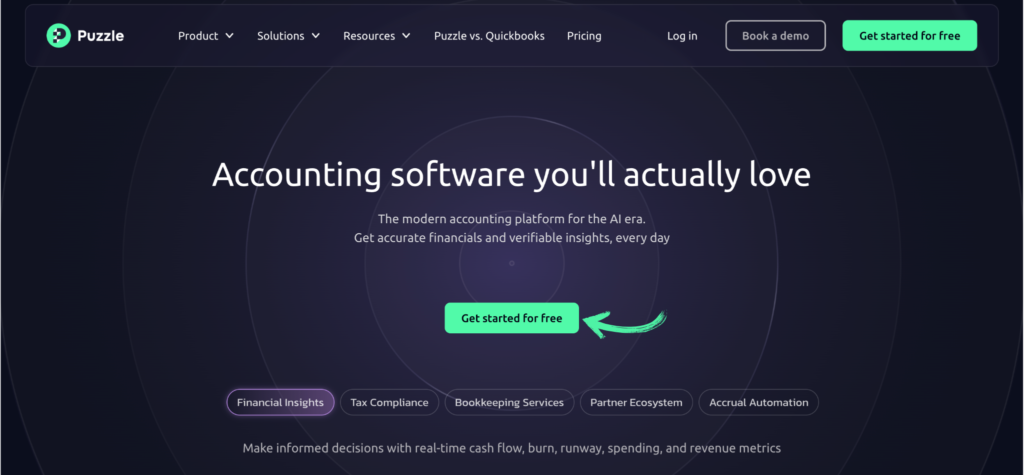

1. Puzzle IO

Puzzle IO is a smart accounting tool. It helps you automate many tasks.

It makes managing your books easier.

This saves you a lot of time.

Libérez son potentiel grâce à notre Puzzle IO tutorial.

Notre point de vue

Puzzle IO’s predictive power and automation are really strong. However, the price point might not be for everyone, and there’s a slight learning curve.

Principaux avantages

- Smart cash flow forecasting

- Automated budget creation

- Real-time performance tracking

- Scenario planning tools

- Integration with popular platforms

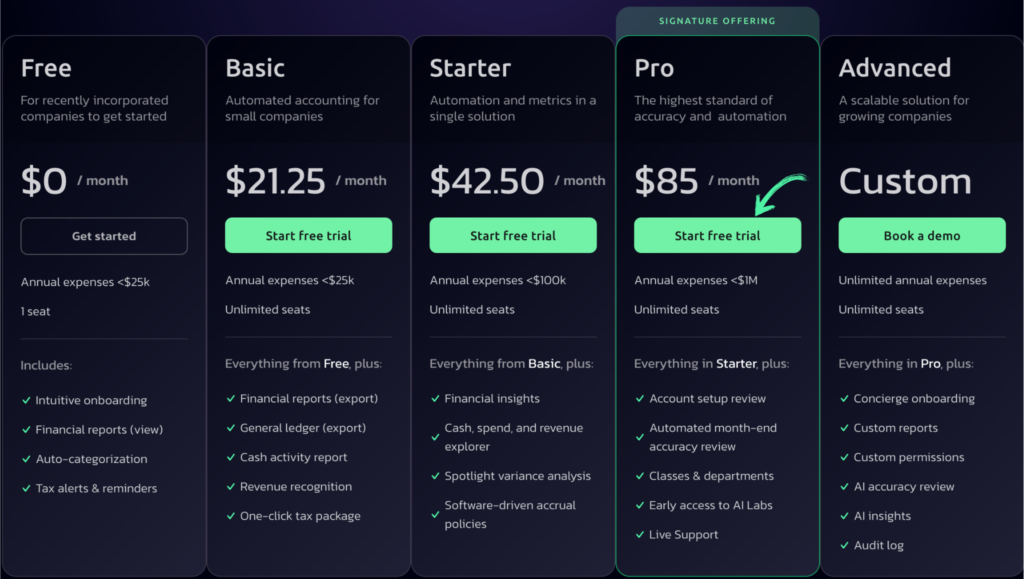

Tarification

- Gratuit : $0/mois.

- De base : $21.25/month.

- Démarrage : $42.50/month.

- Pro : $85/month.

- Avancée : Tarification personnalisée.

Pour

Cons

2. Dext

Dext helps you get rid of paper receipts. Just snap a photo.

It pulls out all the info. This makes expense tracking super simple.

Libérez son potentiel grâce à notre Dext tutorial.

Notre point de vue

Dext is fantastic for cutting down on tedious data entry, and the mobile app is a game-changer. Just be mindful of the cost if you process a large volume of documents. The focus is more on input automation than deep financial insights.

Principaux avantages

- Automatic data extraction from documents

- Receipt and invoice scanning on the go

- Integration with many accounting software

- Expense report automation

- Bank statement integration

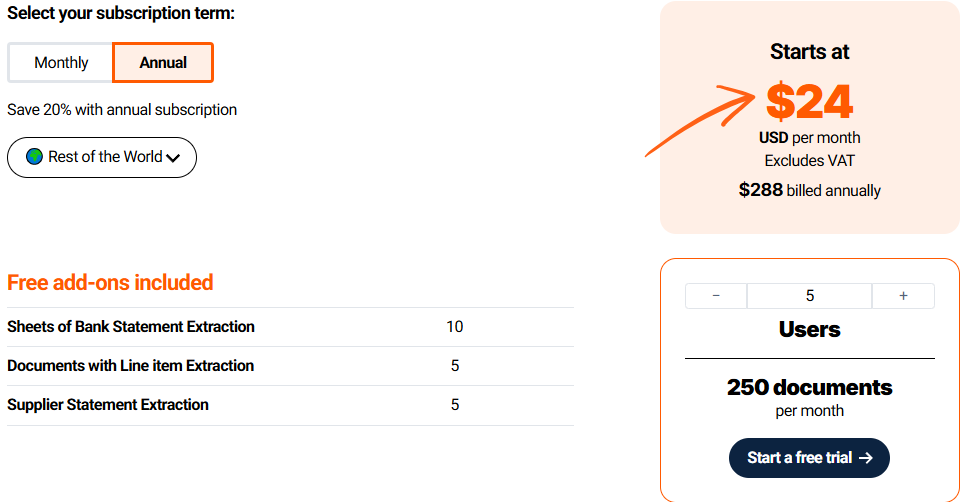

Tarification

- Pricing starts at $24/month for 5 users and 250 documents/month.

Pour

Cons

3. Xero

Xero is cloud-based accounting software.

It helps small businesses with invoicing and banking.

It’s easy to use and helps you see your money clearly.

Libérez son potentiel grâce à notre Xero tutorial.

Notre point de vue

Xero is a reliable and widely used platform with helpful automation. However, its AI capabilities aren’t as cutting-edge as some of the other dedicated AI accounting software on this list.

Principaux avantages

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

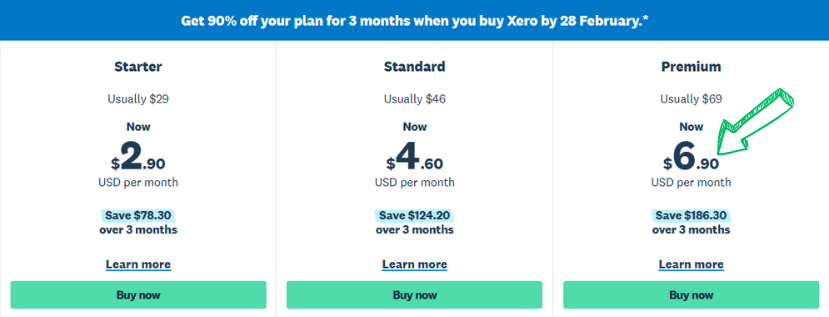

Tarification

- Démarrage : $2.90/month for the first 3 months, then $29/month.

- Standard : $4.60/month for the first 3 months, then $46/month.

- Prime : $6.90/month for the first 3 months, then $69/month.

Pour

Cons

4. Synder

Synder helps online sellers. It pulls sales data from places like Shopify.

This sends your online store info straight to your accounting books.

No manual entry for each sale.

Unlock its potential with our Synder tutorial.

Notre point de vue

Synder is awesome for e-commerce businesses. It’s incredibly helpful for managing online sales data. However, its focus is quite specific, so it might not be the best fit for everyone.

Principaux avantages

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

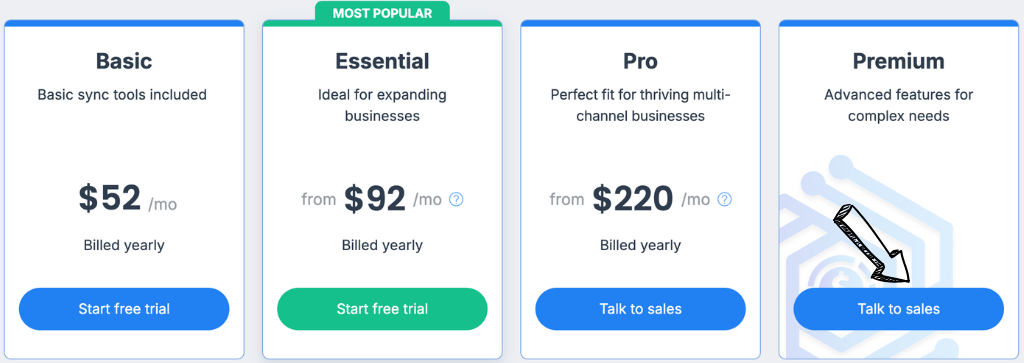

Tarification

- De base : $52/month.

- Essentiel : $92/month.

- Pro : $220/month.

- Prime : Tarification personnalisée.

Pour

Cons

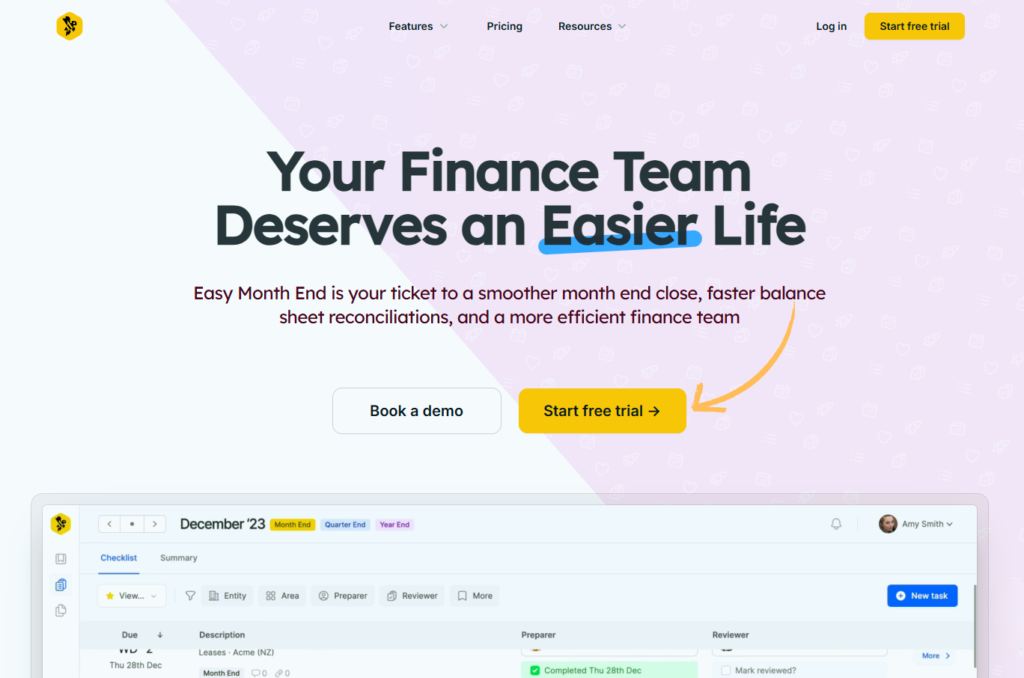

5. Easy Month End

Easy Month End focuses on closing your books quickly each month.

It streamlines reconciliations and reporting.

This helps you get financial insights faster.

Libérez son potentiel grâce à notre Easy Month End tutorial.

Notre point de vue

Easy Month End is a valuable tool for businesses looking to optimize their month-end close. However, its specialized focus might not appeal to everyone needing broader AI accounting help.

Principaux avantages

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Outils de collaboration

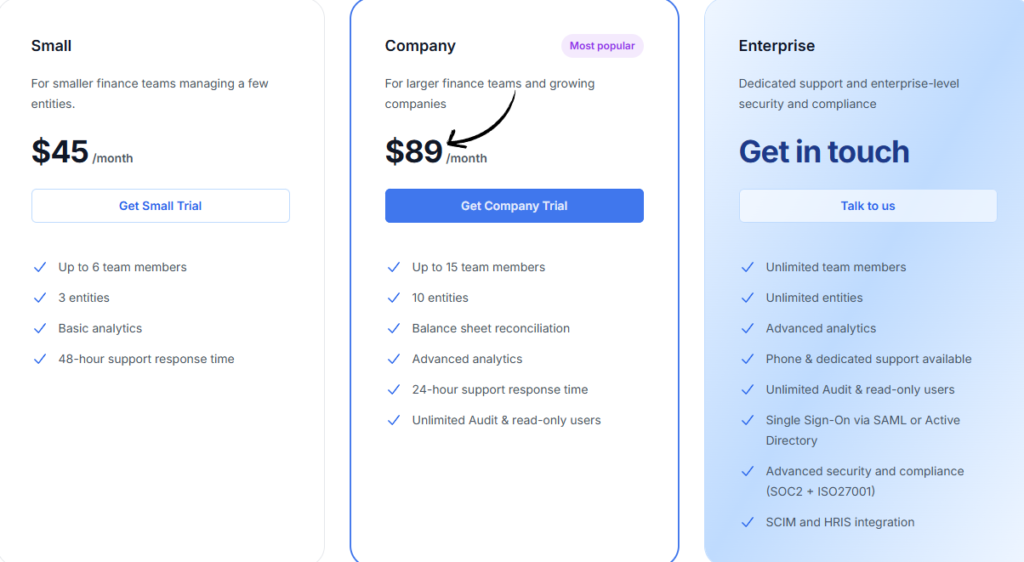

Tarification

- Petit : $45/month.

- Company: $89/month.

- Entreprise : Tarification personnalisée.

Pour

Cons

6. QuickBooks

QuickBooks is a popular accounting solution.

It offers many features for small businesses.

You can manage invoices, expenses, and payroll all in one place.

Libérez son potentiel grâce à notre QuickBooks tutorial.

Notre point de vue

QuickBooks is a solid and well-established accounting solution with some helpful AI features. However, if you’re looking for deep AI-powered automation, other options might be stronger.

Principaux avantages

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

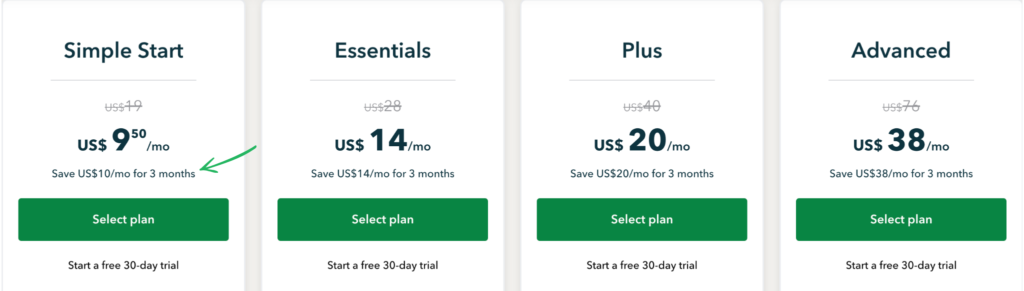

Tarification

- Simple Start : $9.50/month.

- Essentiel : $14/month.

- Plus : $20/month.

- Avancée : $38/month.

Pour

Cons

7. FreshBooks

FreshBooks is designed for service-based businesses.

It’s great for invoicing and tracking time.

It helps freelancers and small teams get paid faster.

Libérez son potentiel grâce à notre FreshBooks tutorial.

Notre point de vue

FreshBooks is well-known for freelancers and service-based businesses. It excels in invoicing and project management. However, its AI accounting features are not as broad as some dedicated AI solutions.

Principaux avantages

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

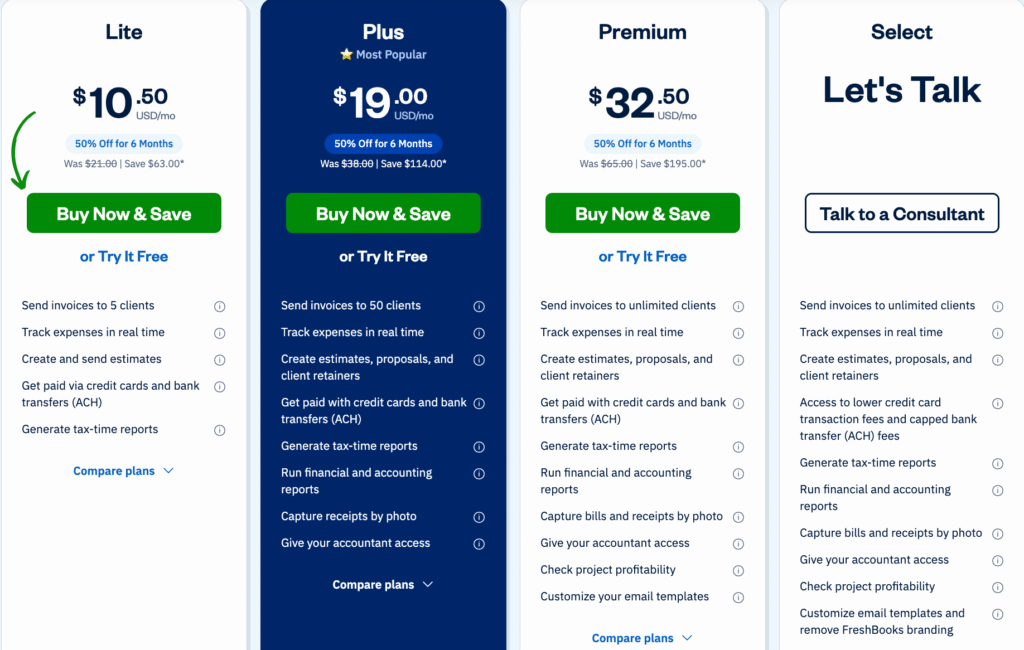

Tarification

- Lite : $10.50/month.

- Plus : $19/month.

- Prime : $32.50/month.

- Select: Tarification personnalisée.

Pour

Cons

8. Docyt

Docyt uses AI to automate your bookkeeping.

It gathers documents and categorizes expenses.

This takes the manual work out of managing your finances.

Libérez son potentiel grâce à notre Docyt tutorial.

Notre point de vue

Docyt’s focus on automating document handling is impressive. However, the lack of clear pricing might be a drawback for some, and it seems best suited for businesses with a larger volume of transactions.

Principaux avantages

- AI-powered document processing

- Automated data extraction and categorization

- Bank and credit card reconciliation

- Real-time financial insights

- Integration with accounting software

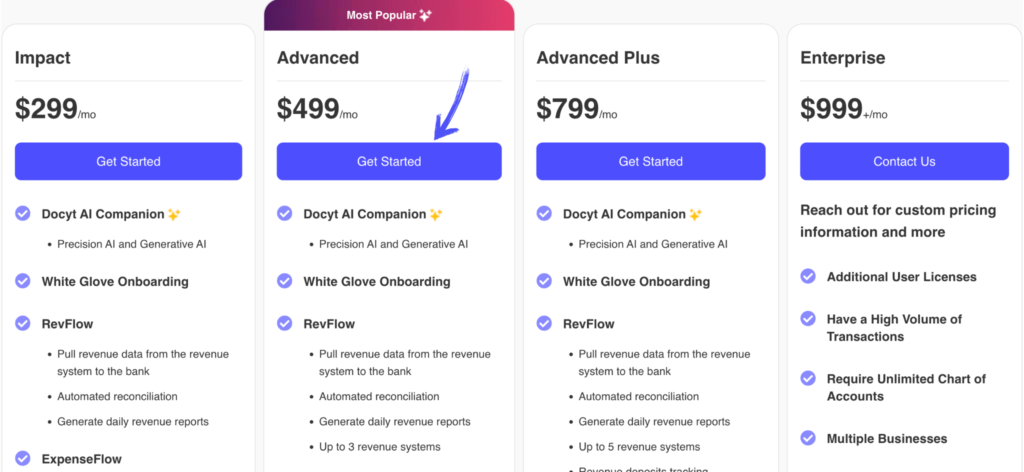

Tarification

- Impact: $299/month.

- Avancée : $499/month.

- Avancé Plus : $799/month.

- Entreprise : $999/month.

Pour

Cons

9. RefreshMe

RefreshMe helps you keep your books clean and accurate.

It can help find and fix errors.

This ensures your financial data is always reliable. Sources

Libérez son potentiel grâce à notre RefreshMe tutorial.

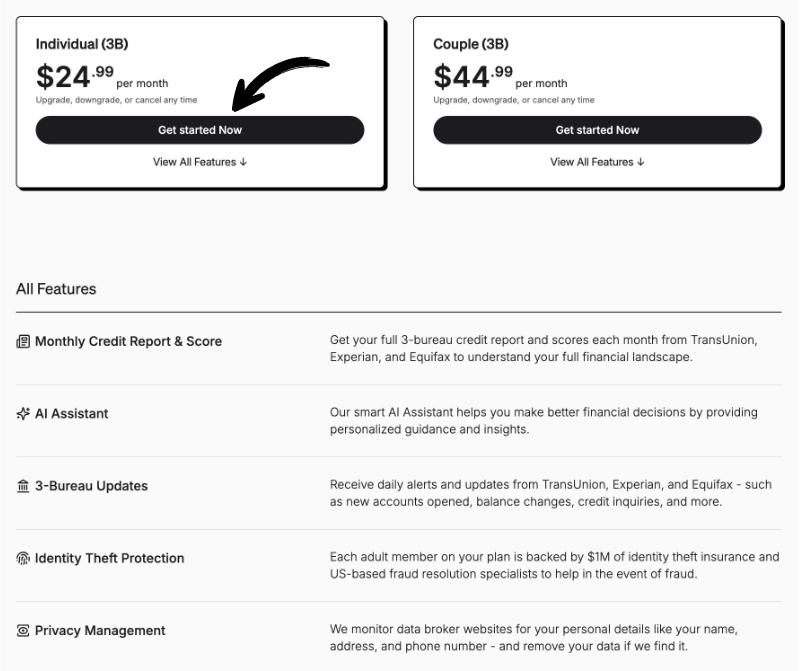

Notre point de vue

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Principaux avantages

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

Tarification

- Individuel (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pour

Cons

What to Look for When Choosing Accounting Software for Small Business?

When picking accounting software, consider these key factors:

- Facilité d'utilisation : Is it very simple to navigate and understand, even if you’re not an accountant?

- Caractéristiques : Does it offer what you need, like invoicing, expense tracking, payroll, or reporting?

- Évolutivité : Can it grow with your business as your needs change?

- Intégrations : Does it connect with other tools you use (e.g., banks, payment processors, CRM)?

- Coût : Does it fit your budget, both now and as your business expands?

- Soutien : Is reliable customer support available if you run into problems?

- Sécurité: Comment protège-t-il vos données financières ?

- Cloud-based vs. Desktop: Do you prefer accessing it online or having it installed on your computer?

- Accès mobile : Can you manage finances on the go with a mobile app?

- Capacités d'établissement de rapports : Does it provide clear, customizable financial reports to help you make decisions?

How Can Accounting Software Improve Your Small Business?

Accounting software can really boost your small business.

It makes managing money much simpler. You can track all your income & spending easily.

This helps you know exactly where your money is going.

It also saves you tons of time.

No more manual entry or digging through piles of receipts.

The software handles routine tasks. This frees you up to focus on growing your business.

Plus, it helps you prepare for taxes.

Good software gives you a clear picture of your business’s health.

You can see what’s working and what’s not.

This helps you make smarter decisions.

It’s like having a financial assistant always working for you.

Guide de l'acheteur

We took a careful approach to find the best accounting software for small business.

Here’s how we did our research:

- Keyword Analysis: We started by looking at important keywords like app, QuickBooks, Xero, invoice, payroll, cash flow, and online accounting. We also considered phrases like QuickBooks online, business accounting, and small business accounting software. This helped us understand what people are searching for.

- Factor-Based Evaluation: We then judged each product based on key factors:

- Prix : How much did each product cost? We looked at different plans.

- Caractéristiques : What were the best features of each platform? Did it handle payment and transaction tracking well? Could it automate tasks?

- Négatifs : What was missing from each product? Were there any downsides for business owners?

- Soutien ou remboursement : Did they offer a community, good support, or a refund policy? Could an accountant easily use it? Did it have a strong mobile app? Was bookkeeping simple?

Conclusion

We’ve explored the best accounting software for small businesses in 2025.

Choosing the right tool can really change how you run things.

It helps you save time, avoid mistakes, & make smart money decisions.

We looked at top options like Puzzle IO, Dext, and QuickBooks, seeing what each offers.

Finding the perfect fit means looking at ease of use, features, and cost.

Our goal is to give you clear, honest advice.

We want to help you pick software that truly works for votre business.

Ready to take control of your finances and grow your business with confidence?

Questions fréquemment posées

What is the easiest accounting software for a small business?

Many find FreshBooks and Xero very user-friendly. They focus on simple interfaces and clear navigation. Puzzle IO also aims for automation to make things easier. The easiest one often depends on your specific needs and how comfortable you are with technology.

Do I really need accounting software for a small business?

Yes, it’s highly recommended. Accounting software helps you simply track income and expenses, manage invoices, and prepare for taxes. It saves time, reduces errors, & gives you a clear financial picture. This allows you to make better decisions for your business.

How much does accounting software cost for a small business?

Costs vary widely, from free basic versions to hundreds of dollars/month for advanced features. Most popular options offer tiered pricing plans. The price often depends on the number of users, features included, and transaction volume.

Can accounting software do my taxes?

While accounting software helps organize your financial data, it usually doesn’t file your taxes directly. It provides the necessary reports (like profit and loss statements) that you or your accountant will use to prepare and file your tax returns.

Is QuickBooks the only option for small business accounting?

No, absolutely not. While QuickBooks is popular, many excellent alternatives exist. Xero, FreshBooks, Puzzle IO, and Dext are strong competitors, each with unique strengths. The “best” choice depends on your specific business type and needs.