Êtes-vous un petite entreprise owner feeling overwhelmed by managing your finances?

Do you struggle with invoicing, expense tracking, and keeping your books in order?

Vous n'êtes pas seul !

In 2025, two popular options stand out: Sage and FreshBooks.

Both promise to simplify your financial life, but which one is truly the best fit for ton entreprise?

This article will break down Sage vs FreshBooks.

Plongeons-nous dans le vif du sujet !

Aperçu

We tried both Sage and FreshBooks ourselves.

We used them to handle invoices, track money, and see what they were really like.

This hands-on test helped us compare them fairly.

Plus de 6 millions de clients font confiance à Sage. Avec un taux de satisfaction client de 56 sur 100, ses fonctionnalités robustes constituent une solution éprouvée.

Tarification : Essai gratuit disponible. Abonnement premium à 66,08 $/mois.

Caractéristiques principales :

- Facturation

- Intégration de la paie

- Gestion des stocks

Envie de simplifier votre facturation et d'être payé plus rapidement ? Plus de 30 millions de personnes utilisent FreshBooks. Découvrez-en plus !

Tarification : Il propose un essai gratuit. L'abonnement payant commence à 2,10 $/mois.

Caractéristiques principales :

- Suivi du temps

- Facturation

- Comptabilité

Qu'est-ce que Sage ?

Parlons de Sage. Ça fait un moment que ça existe.

De nombreuses entreprises l'utilisent. Cela permet de suivre les flux financiers.

Considérez-le comme un carnet numérique pour vos documents professionnels.

Découvrez également nos favoris Alternatives à la sauge…

Notre avis

Prêt à booster vos finances ? Les utilisateurs de Sage ont constaté une augmentation moyenne de 73 % de leur productivité et une réduction de 75 % du temps de cycle de traitement.

Principaux avantages

- Facturation et paiements automatisés

- Rapports financiers en temps réel

- Un système de sécurité renforcé pour protéger les données

- Intégration avec d'autres outils d'entreprise

- Solutions de paie et de RH

Tarification

- Comptabilité professionnelle : 66,08 $/mois.

- Comptabilité premium : 114,33 $/mois.

- Comptabilité quantique : 198,42 $/mois.

- Solutions RH et paie groupées : Tarification personnalisée en fonction de vos besoins.

Avantages

Cons

Qu'est-ce que FreshBooks ?

Bon, parlons donc de FreshBooks.

Considérez cela comme une aide pour vos affaires financières.

Il est conçu pour les personnes qui courent petites entreprises et faire du travail indépendant.

Cela vous permet d'envoyer des factures, de suivre vos entrées d'argent et de voir où va votre argent.

C'est comme avoir un moyen simple de gérer les finances de son entreprise.

Découvrez également nos favoris Alternatives à Freshbooks…

Notre avis

Fatigué(e) de la comptabilité complexe ? Plus de 30 millions d’entreprises font confiance à FreshBooks pour créer des factures professionnelles. Simplifiez-vous la vie ! logiciel de comptabilité aujourd'hui!

Principaux avantages

- Création de factures professionnelles

- Rappels de paiement automatisés

- Suivi du temps

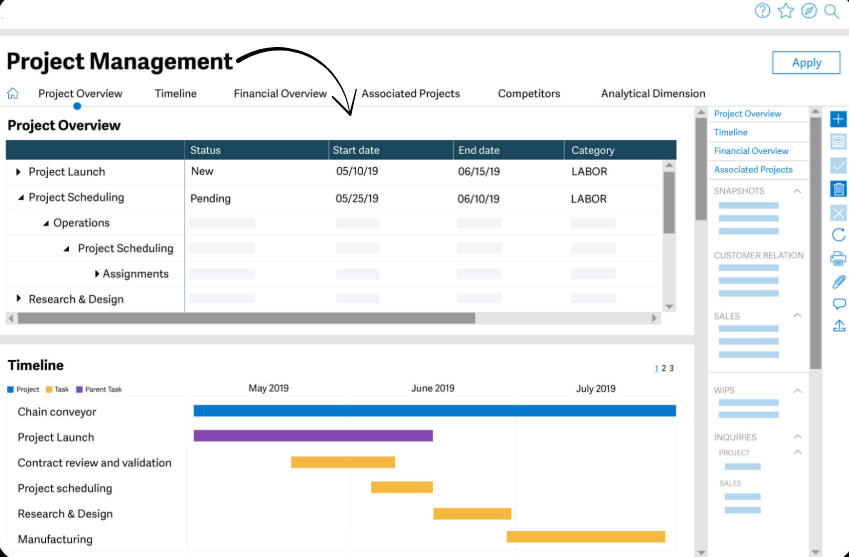

- outils de gestion de projet

- Suivi des dépenses

Tarification

- Lite : 2,10 $/mois.

- Plus: 3,80 $/mois.

- Prime: 6,50 $/mois.

- Sélectionner: Tarification personnalisée.

Avantages

Cons

Comparaison des fonctionnalités

This comparison provides a brief overview of Sage and FreshBooks, two distinct comptabilité solutions logicielles.

We analyze how a feature-rich, scalable platform stacks up against an intuitive, invoice-focused solution to help petite entreprise Les propriétaires trouvent le logiciel comptable adapté à leurs activités.

1. Accessibility and Security

- Sage is a powerful desktop solution that has been updated with cloud connectivity. However, some of its older desktop software versions may have mobile access limitations and some potential drawbacks. It offers robust online backups and sécurité caractéristiques.

- FreshBooks is a true cloud-based solution that is accessible from anywhere with an stable internet connection via its freshbooks mobile app. The platform provides a strong level of security for bank transfers, ach payments and all other transactions. The platform also helps manage your money with its recurring billing feature and offers a free version for a certain number of clients.

2. Portée de la plateforme et public cible

- Sage est complet comptabilité platform designed for small business owners and medium sized businesses. The software includes a wide range of services, such as inventory and payroll, making it a robust desktop solution with cloud connectivity. It is a great QuickBooks online alternative.

- FreshBooks est un logiciel de comptabilité solutions for managing business partners and self employed professionals. Its features are heavily geared toward project management, tracking time and invoicing, making it a top choice for a service-based business.

3. Facturation et paiements

- Sage allows you to create professional sales invoices and manage purchase orders. It is built to improve cash flow and helps you manage all aspects of your sales.

- FreshBooks has robust invoicing features, including the ability to create professional invoices and set up recurring invoices. The freshbooks platform allows you to accept payments online via freshbooks payments and ach transfers, with its virtual terminal also allowing for in-person payments.

4. Automatisation et efficacité

- Sage automates many manual tasks, such as bank reconciliation and bill tracking, to help save time. Its workflow management features can be customized to streamline the entire accounting process, and it provides online backups for all existing accounting données.

- FreshBooks est un outil puissant pour automation, especially for invoicing. The software sends automated payment reminders and can convert estimates into invoices, reducing the need for manual tasks. The freshbooks dashboard provides a clear visual of these automations. It also offers the ability to track your billable time with a mobile device.

5. Rapports et analyses

- Sage est connu pour ses informations financières détaillées reportage and real time reporting. It allows you to plan and generate detailed reports on various aspects of your personal business, from job costing to what products generate the most revenue. The software gives you the tools to analyze and evaluate your performance.

- FreshBooks offers a variety of accounting reports, such as profit and loss statements. It also has project profitability tracking to help you understand the cost and profit of only the projects you bill for. You can export any types of csv file of your reports for further analysis.

6. Inventaire et paie

- Sage provides a robust inventory management system. You can create product variations, sync inventory automatically, and issue low stock alerts so you never miss a sale. Sage payroll is an optional add-on that offers comprehensive payroll software for your business.

- FreshBooks does not have a native inventory management system, which is a major difference. It also does not have built-in payroll software, but it does offer an integration with Gusto payroll for an additional user fee.

7. Soutien et ressources

- Sage provides a wealth of educational material through sage university, its community hub, and direct support to answer questions. If a feature or process failed, a user can find resources and tutorials in its articles and other resources to resolve it. The sage marketplace can provide access to further assistance.

- FreshBooks provides great customer support and a comprehensive freshbooks faqs section. The positive freshbooks reviews often recommend freshbooks as a reliable option. The platform is designed to faire it easy for customers to get help.

8. Tarification et forfaits

- Sage offers a range of pricing, with its desktop solution having higher prices and its sage business cloud accounting being more affordable. It has various add ons for payroll and inventory that come with additional costs.

- FreshBooks has four plans and is known for its per month pricing that scales with the number of billable clients. It does not offer a free version, but its lite plan and plus plan are considered to have a great cost to value ratio for travailleurs indépendants. The select plan is a custom enterprise-level plan for large companies.

9. Comparison and Unique Functionality

- Sage, as a full accounting platform, offers advanced features for managing finances effectively, especially for businesses with inventory and complex sales. Its job statuses and cost codes are an example of its in-depth business tools.

- FreshBooks, by contrast, is designed for simplicity and efficiency. Its key features for freelancers and self employed professionals include unlimited estimates, tracking time, and the ability to accept online payments easily, making it a great alternative to quickbooks online and other accounting software. It also provides a flat fee for the Lite and Plus plans, so you always know your cost. Its client retainers and exclusive pos systems features are also great.

Quels sont les critères de choix d'un logiciel de comptabilité ?

Lors du choix d'un logiciel de gestion des dépenses, tenez compte des points suivants :

- Taille de votre entreprise: Are you a one user or a larger team? Some tools fit better for different sizes. For a larger organization, you may need a system that supports an unlimited number of team members and allows for multiple accounting teams. Some versions of freshbooks accounting software offer three plans that scale from freelancers to larger companies, and some even include pro accounting features.

- Qualité des applications mobiles: How good is the phone app? You’ll use a dedicated mobile app a lot for snapping receipts. The best software is available on both iOS & android devices, giving you the flexibility to work from any phone. Make sure the app works on your specific android appareils.

- Flux d'approbation: Can you set up who needs to approve what? The system should be able to handle unreconciled transactions and identify any unreconciled differences from bank transactions. This is key for managing accounts payable and for setting up late fees for overdue invoices.

- Service client: Is help easy to get if you have problems? Check their support options. Some platforms provide exclusive access to support teams, which can be invaluable when you have unlimited number of questions. You should always be able to get help.

- Besoins en matière de rapportsDe quels types de rapports avez-vous besoin ? Assurez-vous que le logiciel puisse les générer. Un bon système devrait vous permettre de produire des rapports sur tous les aspects de votre activité, de la gestion de vos dépenses à votre situation financière globale. Les meilleurs logiciels utilisent la comptabilité en partie double pour garantir l’exactitude des données et permettent la création de rapports personnalisés avec des champs de contact et des enregistrements uniques.

- Croissance futureLe logiciel peut-il évoluer avec votre entreprise ? Vous ne souhaitez pas avoir à changer de solution de sitôt. Recherchez une plateforme dotée de fonctionnalités qui vous seront utiles à l’avenir, comme la gestion de projets. suivi du temps, and custom invoicing. These advanced payments features are crucial for a growing business. Be aware of any limited accès à distance or other drawbacks of a desktop solution.

Verdict final

After looking at both, we pick FreshBooks for most small businesses.

Especially those that sell services.

It’s super easy to use, great for sending invoices, and tracks your time well.

If you want less stress with your money and quick ways to get paid.

FreshBooks is likely your best friend.

Sage is good too, especially if your business is getting bigger and needs very detailed reports.

But for many, FreshBooks just makes things simpler.

We tested both, and FreshBooks truly shines for its ease and focus on what small businesses need most.

Trust us, your books will thank you!

Plus de Sage

Il est utile de voir comment Sage se compare aux autres logiciels populaires.

Voici une brève comparaison avec certains de ses concurrents.

- Sage contre Puzzle IO: Bien que les deux logiciels gèrent la comptabilité, Puzzle IO est conçu spécifiquement pour les startups, en se concentrant sur les flux de trésorerie en temps réel et des indicateurs comme le taux d'épuisement des ressources.

- Sage contre Dext: Dext est avant tout un outil d'automatisation de la saisie des données issues des reçus et des factures. Il est souvent utilisé conjointement avec Sage pour accélérer la comptabilité.

- Sage contre Xero: Xero est une solution cloud réputée pour sa simplicité d'utilisation, notamment auprès des petites entreprises. Sage, quant à elle, offre des fonctionnalités plus avancées pour accompagner la croissance de l'entreprise.

- Sage contre Snyder: Synder se concentre sur la synchronisation des plateformes de commerce électronique et des systèmes de paiement avec des logiciels comptables comme Sage.

- Sage vs Easy Fin de mois: Ce logiciel est un gestionnaire de tâches qui vous aide à suivre toutes les étapes nécessaires à la clôture de vos comptes à la fin du mois.

- Sage contre Docyt: Docyt utilise l'IA pour automatiser la comptabilité et éliminer la saisie manuelle des données, offrant ainsi une alternative hautement automatisée aux systèmes traditionnels.

- Sage contre RefreshMe: RefreshMe n'est pas un concurrent direct des services comptables. L'entreprise se concentre davantage sur la reconnaissance et l'engagement des employés.

- Sage contre Zoho Books: Zoho Books fait partie d'une vaste suite d'applications professionnelles. Elle est souvent saluée pour son design épuré et ses fortes connexions avec les autres produits Zoho.

- Sage contre vague: Wave est connu pour son forfait gratuit, qui offre des fonctionnalités de comptabilité et de facturation de base, ce qui en fait un choix populaire auprès des indépendants et des très petites entreprises.

- Sage contre Quicken: Quicken est plutôt destiné aux finances personnelles ou aux très petites entreprises. Sage offre des fonctionnalités plus robustes pour une entreprise en pleine croissance, comme la gestion de la paie et des stocks avancés.

- Sage vs Hubdoc: Hubdoc est un outil de gestion documentaire qui collecte et organise automatiquement les documents financiers, similaire à Dext, et peut s'intégrer aux plateformes comptables.

- Sage contre Expensify: Expensify est un expert en gestion des dépenses. C'est idéal pour numériser les reçus et automatiser les notes de frais des employés.

- Sage contre QuickBooks: QuickBooks est un acteur majeur du secteur de la comptabilité pour les petites entreprises. Il est réputé pour son interface conviviale et sa large gamme de fonctionnalités.

- Sage vs AutoEntry: Voici un autre outil qui automatise la saisie des données à partir des reçus et des factures. Il fonctionne parfaitement comme module complémentaire aux logiciels de comptabilité tels que… Sage.

- Sage contre FreshBooks: FreshBooks est particulièrement adapté aux travailleurs indépendants et aux entreprises de services, car il met l'accent sur la facturation simple et le suivi du temps.

- Sage contre NetSuite: NetSuite est un système ERP complet destiné aux grandes entreprises. Sage propose une gamme de produits, dont certains sont concurrents à ce niveau, mais NetSuite est une solution plus vaste et plus complexe.

Plus de FreshBooks

- FreshBooks contre Puzzle IOCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- FreshBooks contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- FreshBooks contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- FreshBooks contre SnyderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- FreshBooks vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- FreshBooks contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- FreshBooks contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- FreshBooks contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- FreshBooks contre WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- FreshBooks contre QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- FreshBooks vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- FreshBooks contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- FreshBooks contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- FreshBooks vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- FreshBooks contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Is FreshBooks good for product-based businesses?

While FreshBooks is great for service businesses, it can work for product-based ones too. It handles invoicing and expense tracking well, but its inventory management features are more basic compared to other software.

Can I switch from Sage to FreshBooks easily?

Switching is possible, but it takes some effort. You’ll need to export your data from Sage and import it into FreshBooks. It’s often best to do this at the start of a new financial year.

Do both Sage and FreshBooks have mobile apps?

Yes, both Sage and FreshBooks offer mobile apps. This lets you manage your finances on the go, whether you’re sending invoices or tracking expenses from your phone or tablet.

Which software is better for tax time?

Both can help with taxes by keeping your financial records organized. FreshBooks provides clear reports like profit and loss. Sage can offer more detailed reports that might be useful for complex tax situations.

How much do Sage and FreshBooks cost?

Both offer different pricing plans depending on the features you need and the size of your business. FreshBooks often has simpler, more predictable pricing, while Sage’s pricing can vary more based on specific modules.