Êtes-vous un petite entreprise Êtes-vous propriétaire ou membre d'une équipe financière qui a des difficultés avec les clôtures de fin de mois ?

Les tableurs et les tâches interminables vous donnent-ils l'impression d'être submergé(e) et d'être à la traîne ?

Vous n'êtes pas seul.

Il est essentiel de savoir comment se porte votre entreprise, mais cela peut aussi être un véritable casse-tête.

Nous allons détailler les différences entre l'outil Easy Month End et l'outil QuickBooks et vous aider à choisir.

Aperçu

Pour vous aider faire La meilleure décision pour votre entreprise.

Nous avons examiné en détail Easy Month End et QuickBooks.

Cette expérience pratique nous a permis de nous faire une idée claire de leurs forces et de leurs faiblesses, ce qui nous a conduits à cette comparaison directe.

En cette fin de mois, rejoignez les 1 257 utilisateurs d'Easy qui ont économisé en moyenne 3,5 heures et réduit leurs erreurs de 15 %. Commencez votre essai gratuit !

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 45 $/mois.

Caractéristiques principales :

- Rapprochement automatisé

- Flux de travail rationalisés

- Interface conviviale

Utilisé par plus de 7 millions d'entreprises, QuickBooks peut vous faire gagner en moyenne 42 heures par mois sur comptabilité.

Tarification : Il propose un essai gratuit. L'abonnement commence à 1,90 $/mois.

Caractéristiques principales :

- Gestion des factures

- Suivi des dépenses

- Signalement

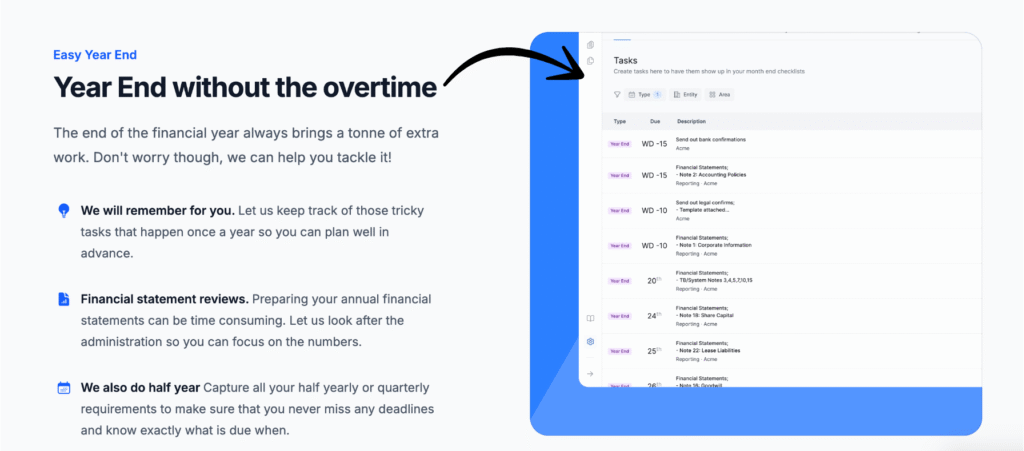

Qu'est-ce qu'une fin de mois facile ?

Alors, qu'est-ce que la fin de mois facile exactement ?

Considérez-le comme votre assistant numérique pour la clôture de vos comptes.

Il est conçu pour rendre ce processus souvent redouté beaucoup plus facile.

Découvrez également nos favoris Alternatives faciles pour la fin du mois…

Notre avis

Améliorez la précision de vos finances avec Easy Month End. Bénéficiez du rapprochement automatisé et de rapports conformes aux exigences d'audit. Planifiez une démonstration personnalisée pour simplifier votre processus de clôture mensuelle.

Principaux avantages

- Flux de travail de rapprochement automatisés

- Gestion et suivi des tâches

- Analyse de la variance

- Gestion documentaire

- Outils de collaboration

Tarification

- Démarreur: 24 $/mois.

- Petit: 45 $/mois.

- Entreprise: 89 $/mois.

- Entreprise: Tarification personnalisée.

Avantages

Cons

Qu'est-ce que QuickBooks ?

Parlons maintenant de QuickBooks.

Il s'agit probablement d'un nom que vous avez déjà entendu.

Contrairement à Easy Month End, QuickBooks est une solution complète. comptabilité solution.

Découvrez également nos favoris Alternatives à QuickBooks…

Principaux avantages

- Catégorisation automatisée des transactions

- Création et suivi des factures

- Gestion des dépenses

- Services de paie

- Rapports et tableaux de bord

Tarification

- Démarrage simple : 1,90 $/mois.

- Essentiel: 2,80 $/mois.

- Plus: 4 $/mois.

- Avancé: 7,60 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Entrons dans le détail. Nous avons testé les deux plateformes pour voir comment elles gèrent les tâches principales.

Ce comparatif vous permettra de voir quel logiciel est réellement conçu pour vos besoins financiers spécifiques.

1. Objectif principal et gestion des flux de travail

- Fin de mois facile : Cet outil est spécialisé. Il s'agit d'une plateforme unique pour gérer les tâches de fin de mois et les missions ponctuelles de votre équipe financière. Son objectif est de créer un système de gestion des flux de travail qui vous simplifie la vie.

- QuickBooks : Intuit QuickBooks est une suite comptable complète. QuickBooks vous aide à suivre vos flux financiers, à créer des factures et à régler vos factures. C'est un outil global pour la gestion de toutes les finances de votre entreprise, et non pas seulement une étape du processus.

2. Réconciliation et intégrité des données

- Fin de mois facile : C'est un atout majeur. Il permet des rapprochements de bilan plus rapides grâce à sa connexion à votre système comptable. donnéesCela permet de rapprocher vos comptes bancaires avec moins de confirmations manuelles, réduisant ainsi le stress lié aux erreurs.

- QuickBooks : QuickBooks vous permet de rapprocher facilement vos comptes bancaires. Il importe les transactions de votre compte bancaire pour garantir l'exactitude de vos enregistrements. Vous pouvez également rapprocher les relevés de carte de crédit.

3. Collaboration d'équipe et gestion des tâches

- Fin de mois facile : La plateforme est conçue pour la collaboration en équipe. Vous pouvez attribuer des tâches à différents employés de l'équipe financière et suivre leur progression. Cette fonctionnalité facilite la gestion de votre équipe et améliore son efficacité.

- QuickBooks : La version en ligne de QuickBooks permet à plusieurs utilisateurs d'y accéder. Vous pouvez inviter votre comptable ou vos employés à consulter les données de l'entreprise, ce qui facilite la collaboration au sein de l'équipe.

4. Paiements et paie

- Fin de mois facile : Cet outil se concentre sur les tâches de révision et de clôture, il n'offre donc pas de services de paiement ou de paie.

- QuickBooks : QuickBooks est une solution performante pour la gestion des paiements et de la paie. Avec QuickBooks Payroll, vous pouvez payer vos employés et vos fournisseurs. Il gère également les paiements des sous-traitants et les virements bancaires.

5. Gestion et audit des documents

- Fin de mois facile : Il s'agit d'une plateforme unique pour la collecte des pièces justificatives d'audit. Vous pouvez y télécharger des documents et obtenir les signatures nécessaires. Cela vous permet de garantir que vos dossiers sont prêts pour les auditeurs, réduisant ainsi les complications et les retards.

- QuickBooks : Vous pouvez joindre des documents aux transactions. Cela facilite la collecte de preuves lors d'un audit et vous permet de tenir des registres précis à des fins de déclaration et de conformité fiscale.

6. Type de plateforme et accessibilité

- Fin de mois facile : Il s'agit d'une version en ligne accessible de partout. Elle est conçue pour simplifier le processus de clôture pour votre équipe financière.

- QuickBooks : Intuit propose QuickBooks en version bureau et en ligne. La version bureau s'installe sur votre ordinateur, tandis que la version en ligne vous donne accès à Internet et permet de bénéficier de tous les services. comptabilité.

7. Commerce électronique et gestion fiscale

- Fin de mois facile : Cet outil n'est pas conçu pour la gestion de la taxe de vente. Il est destiné au rapprochement des comptes et aux tâches des équipes financières.

- QuickBooks : QuickBooks facilite la gestion de la TVA en la calculant automatiquement sur les paiements. Il génère également des rapports pour simplifier la préparation des déclarations fiscales, ce qui simplifie la gestion des finances de votre entreprise.

8. Personnalisation et efficacité

- Fin de mois facile : Cet outil a étendu ses fonctionnalités pour la gestion des tâches de fin de mois. Vous pouvez personnaliser les listes de contrôle et les flux de travail, ce qui contribue à améliorer l'efficacité de votre équipe.

- QuickBooks : QuickBooks Online Advanced offre de puissantes fonctionnalités de personnalisation. Vous pouvez adapter vos rapports aux besoins spécifiques de votre entreprise, ce qui améliore l'efficacité et contribue à garantir l'exactitude des données. reportage.

9. Tarification et abonnements

- Fin de mois facile : Vous pouvez payer les services mensuellement. Vous pouvez résilier à tout moment, sans engagement. Essayez-le pendant un mois pour voir s'il vous convient.

- QuickBooks : La licence des produits QuickBooks est un abonnement mensuel. Vous pouvez l'annuler à tout moment. Il est important de consulter les avis sur QuickBooks afin de choisir la formule la mieux adaptée à votre entreprise.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

- Taille de votre entreprise : petites entreprises Les systèmes plus importants nécessitent moins de fonctionnalités complexes. Ils bénéficient d'options robustes.

- Besoins spécifiques : Avez-vous besoin d'une formule complète ? comptabilité Ou simplement une aide de fin de mois ? Identifiez vos principaux points faibles.

- Intégration: Sera-t-il compatible avec vos outils existants ? Vérifiez la fluidité des connexions.

- Expérience utilisateur : Est-il facile à apprendre et à utiliser au quotidien ? Une interface conviviale permet de gagner du temps.

- Signalement : Vous fournit-il les informations financières dont vous avez besoin ? Recherchez des rapports personnalisables.

- Évolutivité : Le logiciel pourrait-il évoluer avec votre entreprise ? Vous ne souhaitez pas changer de plateforme fréquemment.

- Soutien: Quel type d'aide est disponible ? Un bon support est essentiel pour le dépannage.

- Coût par rapport à la valeur : Le prix est-il justifié par les fonctionnalités offertes ? Comparez les coûts mensuels aux avantages.

- Accès comptable : Votre comptable peut-il facilement utiliser ce système ? Cela simplifie la clôture de l’exercice.

- Adéquation au secteur : Répond-il aux exigences spécifiques d'un secteur d'activité ? Certains logiciels sont plus adaptés à certains créneaux.

- Données Sécurité: Dans quelle mesure vos données financières sont-elles protégées ? C’est non négociable.

Verdict final

Alors, lequel choisir ?

Après avoir examiné attentivement les deux solutions, QuickBooks est notre choix pour la plupart des entreprises.

Elle offre une solution comptable complète.

Vous pouvez tout gérer, des ventes quotidiennes aux rapports détaillés.

Easy Month End est idéal pour la simple clôture des comptes.

QuickBooks offre plus de fonctionnalités et de flexibilité pour l'entreprise moyenne.

Cela vous permet de centraliser toutes vos informations financières.

Plus de fins de mois faciles

Voici une brève comparaison d'Easy Month End avec quelques-unes des principales alternatives.

- Fin de mois facile vs Puzzle io: Alors que Puzzle.io est destiné à la comptabilité des startups, Easy Month End se concentre spécifiquement sur la simplification du processus de clôture.

- Fin de mois facile vs Dext: Dext est principalement destiné à la capture de documents et de reçus, tandis qu'Easy Month End est un outil complet de gestion de la clôture de fin de mois.

- Easy Month End vs Xero: Xero est une plateforme comptable complète pour les petites entreprises, tandis qu'Easy Month End propose une solution dédiée au processus de clôture.

- Fin de mois facile vs Synder: Synder est spécialisé dans l'intégration des données de commerce électronique, contrairement à Easy Month End qui est un outil de flux de travail pour l'ensemble de la clôture financière.

- Fin de mois facile vs Docyt: Docyt utilise l'IA pour la comptabilité et la saisie de données, tandis qu'Easy Month End automatise les étapes et les tâches de la clôture financière.

- Easy Month End vs RefreshMe: RefreshMe est une plateforme de coaching financier, différente de Easy Month End qui se concentre sur la gestion des clôtures.

- Easy Month End vs Sage: Sage est une suite logicielle de gestion d'entreprise à grande échelle, tandis qu'Easy Month End offre une solution plus spécialisée pour une fonction comptable essentielle.

- Easy Month End vs Zoho Books: Zoho Books est un logiciel de comptabilité tout-en-un, tandis qu'Easy Month End est un outil spécialement conçu pour le processus de clôture mensuelle.

- Fin de mois facile vs vague: Wave propose des services de comptabilité gratuits pour les petites entreprises, tandis qu'Easy Month End offre une solution plus avancée pour la gestion des clôtures.

- Easy Month End vs Quicken: Quicken est un outil de gestion de finances personnelles, ce qui fait d'Easy Month End un meilleur choix pour les entreprises qui doivent gérer leur clôture de fin de mois.

- Easy Month End vs Hubdoc: Hubdoc automatise la collecte de documents, mais Easy Month End est conçu pour gérer l'intégralité du flux de travail de clôture et les tâches d'équipe.

- Easy Month End vs Expensify: Expensify est un logiciel de gestion des dépenses, ce qui est une fonction différente de l'objectif principal d'Easy Month End, qui est la clôture financière.

- Easy Month End vs QuickBooks: QuickBooks est une solution comptable complète, tandis qu'Easy Month End est un outil plus spécifique pour la gestion de la clôture de fin de mois.

- Fin de mois simplifiée vs saisie automatique: AutoEntry est un outil de saisie de données, tandis qu'Easy Month End est une plateforme complète pour la gestion des tâches et des flux de travail lors de la clôture.

- Easy Month End vs FreshBooks: FreshBooks est destiné aux travailleurs indépendants et aux petites entreprises, tandis qu'Easy Month End offre une solution dédiée à la clôture de fin de mois.

- Easy Month End vs NetSuite: NetSuite est un système ERP complet, dont la portée est plus large que celle d'Easy Month End, spécialisé dans la clôture financière.

Plus d'informations sur QuickBooks

- QuickBooks contre Puzzle IOCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- QuickBooks contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- QuickBooks contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- QuickBooks contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- QuickBooks vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- QuickBooks contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- QuickBooks contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- QuickBooks contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- QuickBooks contre WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- QuickBooks contre QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- QuickBooks contre HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- QuickBooks contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- QuickBooks contre AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- QuickBooks contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- QuickBooks contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Easy Month End peut-il remplacer QuickBooks ?

Non, Easy Month End ne remplace pas un logiciel de comptabilité complet. Il est spécialisé dans la gestion des opérations de clôture. QuickBooks gère toutes vos tâches comptables quotidiennes, comme la facturation et le suivi des dépenses.

Puis-je utiliser Easy Month End avec QuickBooks ?

Oui, Easy Month End est conçu pour s'intégrer à QuickBooks. Vous pouvez lier vos données financières, ce qui simplifie le processus de rapprochement et de clôture de fin de mois sur les deux plateformes.

Quel logiciel est le mieux adapté aux petites entreprises ?

Grâce à ses fonctionnalités complètes, QuickBooks est généralement mieux adapté aux petites entreprises pour la comptabilité générale. Si votre principale difficulté réside dans la clôture de fin de mois, l'extension Easy Month End pourrait s'avérer un complément utile à votre système actuel.

QuickBooks simplifie-t-il la clôture de fin de mois ?

QuickBooks propose des outils facilitant les opérations de fin de mois, notamment le rapprochement et la production de rapports. Cependant, il s'agit d'un logiciel comptable généraliste, non spécifiquement axé sur la clôture étape par étape comme Easy Month End.

Quelle est la principale différence entre leurs objectifs ?

La principale différence réside dans la spécialisation. Easy Month End est un outil spécialisé dans les tâches de clôture de fin de période, tandis que QuickBooks est un logiciel tout-en-un plus complet. logiciel de comptabilité qui couvre tous les aspects de la gestion financière.