Passez-vous trop de temps à déplacer votre entreprise Des infos à ce sujet ?

Ça peut être vraiment pénible, n'est-ce pas ?

Préservez vos ventes, vos paiements et comptabilité Rester synchronisés donne l'impression d'être une tâche sans fin.

Et s'il existait une meilleure solution ?

Dans cet article, nous allons examiner deux outils populaires : Synder et Quicken.

Plongeons-nous dans le sujet et trouvons la solution qui vous convient le mieux !

Aperçu

Nous avons examiné de près Synder et Quicken.

Nous les avons testés pour voir comment ils fonctionnent.

Cela nous a permis de les comparer équitablement.

Nous pouvons maintenant vous montrer ce que chacun fait de mieux.

Synder automatise votre comptabilité en synchronisant automatiquement vos données de vente avec QuickBooks, Xero et bien d'autres logiciels. Découvrez-le dès aujourd'hui !

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 52 $/mois.

Caractéristiques principales :

- Synchronisation des ventes multicanaux

- Rapprochement automatisé

- Rapport détaillé

Envie de maîtriser vos finances ? Avec Quicken, connectez-vous à des milliers d’établissements financiers. Découvrez-en plus !

Tarification : Il propose un essai gratuit. L'abonnement premium est à 5,59 $/mois.

Caractéristiques principales :

- Outils budgétaires

- Gestion des factures

- Suivi des investissements

Qu'est-ce que Synder ?

Parlons de Snyder.

C'est un outil qui permet à vos différentes applications métier de communiquer entre elles.

Considérez cela comme un assistant qui déplace vos informations financières là où elles doivent aller.

Cela peut vous faire gagner beaucoup de temps.

Découvrez également nos favoris Alternatives à Synder…

Notre avis

Synder automatise votre comptabilité en synchronisant de manière transparente les données de vente avec QuickBooks. Xeroet bien plus encore. Les entreprises utilisant Synder déclarent économiser en moyenne plus de 10 heures par semaine.

Principaux avantages

- Synchronisation automatique des données de vente

- Suivi des ventes multicanaux

- Rapprochement des paiements

- Intégration de la gestion des stocks

- Rapports de vente détaillés

Tarification

Tous les plans seront Facturé annuellement.

- Basique: 52 $/mois.

- Essentiel: 92 $/mois.

- Pro: 220 $/mois.

- Prime: Tarification personnalisée.

Avantages

Cons

Qu'est-ce que Quicken ?

Alors, vous vous interrogez sur Quicken ?

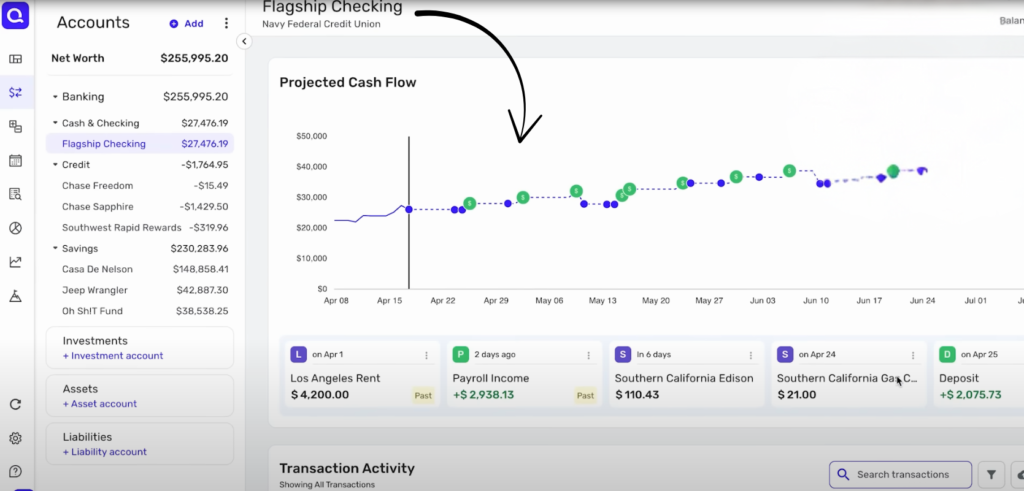

C'est comme un outil qui vous permet de voir toutes vos informations financières au même endroit.

Considérez-le comme votre gestionnaire d'argent numérique.

Il peut vous aider à suivre vos comptes bancaires, vos factures et même vos investissements.

Plutôt pratique, non ?

Découvrez également nos favoris Alternatives à Quicken…

Principaux avantages

Quicken est un outil puissant pour mettre de l'ordre dans vos finances.

Ils se targuent de plus de 40 ans d'expérience et leur produit est numéro 1 des ventes.

Leurs différents forfaits permettent de se connecter à plus de 14 500 institutions financières.

Vous pouvez également bénéficier d'une garantie de remboursement de 30 jours pour l'essayer sans risque.

- Compatible avec des milliers de banques et de cartes de crédit.

- Élabore des budgets détaillés.

- Suivi des investissements et du patrimoine net.

- Offre des outils de planification de la retraite.

Tarification

- Quicken Simplifi : 2,99 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Voici d'autres fonctionnalités de Synder et Quicken.

Nous avons examiné certaines fonctionnalités clés qui comptent.

Cela vous aide à choisir l'outil adapté à votre budget.

1. À qui s'adresse ce contenu ?

- Quicken est un logiciel de gestion de finances personnelles.

- Il est conçu pour aider les particuliers et les familles à gérer leur argent, à suivre leurs dépenses et à planifier leur avenir et leur retraite.

- Synder se concentre sur petites entreprises, notamment celles qui pratiquent le commerce électronique et les ventes multicanaux.

- Cela aide les entreprises à connecter tous leurs canaux de vente à leur comptabilité système, comme QuickBooks Online ou Xero.

2. Mode de comptabilité et de synchronisation automatisé

- Synder propose une comptabilité automatisée grâce à un mode de synchronisation.

- Cette fonctionnalité récupère automatiquement vos données Le système intègre les transactions effectuées via des plateformes de vente comme Stripe ou PayPal à votre système comptable. Cela vous fait gagner du temps et contribue à la bonne tenue de votre comptabilité.

- Quicken n'offre pas le même niveau de comptabilité automatisée.

- Il est davantage axé sur le téléchargement et l'enregistrement des transactions et des soldes bancaires pour vos finances personnelles.

3. Gestion multidevises

- Si votre entreprise vend à des clients dans différents pays, vous gérez plusieurs devises.

- Synder peut gérer et enregistrer correctement ces transactions. C'est particulièrement utile pour les entreprises qui réalisent un volume important de ventes en ligne.

- Quicken ne propose pas de fonctionnalités multidevises performantes. Étant donné qu'il s'agit d'un logiciel de gestion des finances personnelles, ce n'est pas sa fonction principale.

4. Intégration des transactions historiques

- Synder vous permet d'importer l'historique des transactions de vos canaux de vente dès la première configuration du logiciel.

- C'est un bon moyen d'avoir une comptabilité équilibrée et précise dès le début de votre activité.

- Quicken peut enregistrer et suivre l'historique des transactions de vos comptes bancaires une fois connectés.

5. Comptabilisation des produits

- Synder vous aide à comptabiliser les revenus de votre entreprise.

- Il garantit que les revenus provenant de plateformes comme Stripe ou Square sont correctement enregistrés dans votre système comptable, même avec les frais, les remboursements et les remises.

- Quicken ne gère pas les règles commerciales complexes telles que la comptabilisation des revenus.

- Il enregistre simplement les revenus lorsqu'ils arrivent sur votre compte bancaire afin de vous aider à avoir une vision claire de votre situation financière.

6. Conformité aux PCGR et rapports

- Synder est conçu pour vous aider à tenir des registres précis conformes aux normes telles que les PCGR (Principes Comptables Généralement Acceptés).

- Il est conçu pour travailler en étroite collaboration avec vos comptables afin de garantir l'exactitude de vos bilans et rapports.

- Les rapports de Quicken sont destinés à la planification et aux finances personnelles.

- Ils vous aident à établir des budgets et à suivre vos dépenses, mais ils ne sont pas conçus pour garantir la conformité aux normes comptables généralement admises (PCGR).

7. Connexion à votre système comptable

- Synder est conçu pour se connecter aux principaux systèmes comptables tels que QuickBooks Online, Xero, et même à des systèmes plus importants comme NetSuite ou Sage Intacct.

- Sa fonction principale est d'automatiser le traitement des données.

- Quicken est un outil autonome. Il ne se connecte à aucun système comptable.

- Il est conçu pour être l'endroit principal où vous suivez les finances de votre équipe.

8. Différentes versions pour les utilisateurs

- Quicken propose de nombreuses versions, telles que Quicken Deluxe, Quicken Premier et Quicken Home & Business, pour répondre à différents besoins en matière de finances personnelles, de comptes d'investissement et même de biens locatifs.

- Synder propose différents niveaux d'abonnement en fonction de la taille de votre entreprise et du volume de vos transactions.

- Ses fonctionnalités sont axées sur la comptabilité automatisée pour les vendeurs de commerce électronique.

9. Réconciliation

- Synder vous aide à rapprocher vos paiements et transactions quotidiens.

- Cela vous aide à résoudre rapidement tout problème et garantit que l'argent enregistré dans vos livres comptables correspond à l'argent déposé sur votre compte bancaire.

- Quicken facilite le rapprochement bancaire en vous permettant de comparer votre solde bancaire avec les soldes qu'il suit.

- Ce processus concerne les finances personnelles et est plus simple que le processus complet. comptabilité Synder propose une réconciliation.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

Choisir le bon logiciel exige de ne pas se laisser berner par le discours commercial.

Voici les points clés à évaluer avant de faire un changement ou un achat :

- Est-ce pour un usage professionnel ou personnel, ou uniquement pour les finances de l'entreprise ? C'est là l'essentiel. question Pour résoudre ce problème. Quicken est une marque de Quicken présente depuis des décennies dans le domaine des finances personnelles, tandis que Synder se concentre sur les finances d'entreprise et tous vos canaux de vente.

- Vérifiez le prix et le coût. Assurez-vous que le prix de l'abonnement correspond à votre budget. N'abandonnez pas un outil sans avoir évalué la valeur à long terme des alternatives.

- Examinez l'interface utilisateur et la facilité de configuration. La gestion de vos données est-elle aisée ? Une interface utilisateur complexe peut engendrer des erreurs et du stress lors de la soumission de vos rapports.

- Est-ce que cela offre automationLes meilleurs outils simplifient les processus. Privilégiez des fonctionnalités comme le suivi des factures et le rapprochement bancaire en un clic pour gagner du temps en arrière-plan.

- Quelles sont les exigences de la plateforme ? Fonctionne-t-il sur Mac Et sous Windows ? Peut-on utiliser l’application mobile pour obtenir des détails ou faire une vérification rapide en déplacement ?

- Comment protège-t-il vos données ? Renseignez-vous sur sécurité et obtenir une identité sécurisée pour accéder à vos données. Puisqu'il s'agit de votre argent, vous devez avoir la certitude que vos informations sont en sécurité.

- Vérifiez la compatibilité avec vos plateformes, comme eBay ou Clover. Si vous gérez un stock ou avez des besoins d'expédition, assurez-vous que l'outil est compatible avec votre site web existant.

- Pouvez-vous obtenir des analyses et des informations approfondies ? Un bon logiciel ne doit pas se contenter d’enregistrer des données ; il doit vous fournir des informations claires sur votre marché et vos clients.

- Analysez l'historique de l'entreprise. Par exemple, Aquiline Capital Partners a investi dans la marque Quicken. Examinez le passé de l'entreprise pour vous assurer de son avenir.

- Parlez-en à vos comptables. Ils pourront vous dire la vérité sur le système le plus adapté à la gestion des finances de votre entreprise.

Verdict final

Après avoir examiné attentivement les deux outils, le choix est évident.

Si vous avez simplement besoin de suivre les dépenses de votre famille, Quicken est l'outil idéal pour rester organisé et contrôler vos flux de trésorerie personnels.

Vous pouvez facilement payer vos factures et consulter le solde de vos cartes de crédit.

Cependant, pour les chefs d'entreprise sérieux, Synder est clairement le grand gagnant.

It directly solves the problem of getting your complex business data from your sales platforms into your chart of accounts on your main logiciel de comptabilité.

Cette configuration est essentielle pour obtenir des rapports financiers précis et gérer la taxe de vente.

Intuit QuickBooks propose de nombreux produits et services, tels que QuickBooks Payroll et un service complet. comptabilité.

Synder vous aide à optimiser l'utilisation de ces outils en assurant un accès en ligne sécurisé.

Écoutez-nous, car nous avons mis en lumière la vérité sur les deux pour aider votre entreprise à prospérer.

Plus de Snyder

- Synder contre Puzzle io: Puzzle.io est un outil de comptabilité basé sur l'IA, conçu pour les startups et axé sur des indicateurs tels que le taux de consommation de trésorerie et l'autonomie financière. Synder, quant à lui, se concentre davantage sur la synchronisation des données de vente multicanaux pour un plus large éventail d'entreprises.

- Synder contre Dext: Dext est un outil d'automatisation qui excelle dans la capture et la gestion des données issues des factures et des reçus. Synder, quant à lui, est spécialisé dans l'automatisation du flux des transactions de vente.

- Synder contre Xero: Xero est une plateforme de comptabilité en nuage complète. Synder Il fonctionne avec Xero pour automatiser la saisie des données provenant des canaux de vente, tandis que Xero gère les tâches comptables globales telles que la facturation et les rapports.

- Synder vs Easy Fin de mois: Easy Month End est un outil conçu pour aider les entreprises à organiser et à simplifier leur processus de clôture de fin de mois. Synder, quant à lui, se concentre davantage sur l'automatisation du flux de données transactionnelles quotidiennes.

- Synder contre Docyt: Docyt utilise l'IA pour de nombreuses tâches comptables, notamment le paiement des factures et la gestion des dépenses. Synder, quant à lui, se concentre davantage sur la synchronisation automatique des données de vente et de paiement provenant de multiples canaux.

- Synder contre RefreshMe: RefreshMe est une application de gestion des finances personnelles et des tâches. Ce n'est pas un concurrent direct, car Synder est un outil d'automatisation de la comptabilité d'entreprise.

- Synder contre Sage: Sage est un système comptable complet et éprouvé, doté de fonctionnalités avancées telles que la gestion des stocks. Synder est un outil spécialisé qui automatise la saisie de données dans les systèmes comptables comme Sage.

- Synder contre Zoho Books: Zoho Books est une solution comptable complète. Synder Il complète Zoho Books en automatisant le processus d'importation des données de vente provenant de diverses plateformes de commerce électronique.

- Synder contre Wave: Wave est un logiciel de comptabilité gratuit et intuitif, souvent utilisé par les indépendants et les très petites entreprises. Synder est un outil d'automatisation payant conçu pour les entreprises réalisant un volume important de ventes multicanales.

- Synder contre Quicken: Quicken est principalement un logiciel de gestion des finances personnelles, bien qu'il propose également quelques fonctionnalités pour les petites entreprises. Synder, quant à lui, est conçu spécifiquement pour l'automatisation de la comptabilité des entreprises.

- Synder vs Hubdoc: Hubdoc est un outil de gestion de documents et de saisie de données, similaire à Dext. Il est principalement destiné à la numérisation des factures et des reçus. Synder, quant à lui, se concentre sur la synchronisation des données de vente et de paiement en ligne.

- Synder contre Expensify: Expensify est un outil de gestion des notes de frais et des reçus. Synder permet d'automatiser le traitement des données de transactions de vente.

- Synder contre QuickBooks: QuickBooks est un logiciel de comptabilité complet. Synder Il s'intègre à QuickBooks pour automatiser le processus d'importation de données de vente détaillées, ce qui en fait un complément précieux plutôt qu'une alternative directe.

- Synder vs AutoEntry: AutoEntry est un outil d'automatisation de la saisie de données qui capture les informations des factures et des reçus. Synder se concentre sur l'automatisation des données de vente et de paiement issues des plateformes de commerce électronique.

- Synder contre FreshBooks: FreshBooks est un logiciel de comptabilité conçu pour les travailleurs indépendants et les petites entreprises de services, axé sur la facturation. Synder, quant à lui, s'adresse aux entreprises réalisant un volume important de ventes via plusieurs canaux en ligne.

- Synder contre NetSuite: NetSuite est un système de planification des ressources d'entreprise (ERP) complet. Synder est un outil spécialisé qui synchronise les données de commerce électronique avec des plateformes plus larges comme NetSuite.

Plus de Quicken

- Quicken contre PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Quicken contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Quicken contre XeroC'est populaire en ligne. logiciel de comptabilité pour les petites entreprises. Son concurrent est destiné à un usage personnel.

- Quicken contre SnyderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Quicken vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Quicken contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Quicken contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Quicken contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Quicken contre WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- Quicken contre HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Quicken contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- Quicken contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Quicken vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Quicken contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Quicken contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Quelle est la principale différence entre Synder et Quicken ?

Synder est principalement destiné aux entreprises pour connecter différentes plateformes de vente et de paiement à un logiciel de comptabilité. Quicken, quant à lui, s'adresse surtout aux particuliers pour gérer leurs finances personnelles, suivre leurs dépenses et établir leur budget.

Synder est-il adapté à un usage personnel ?

Synder est conçu pour un usage professionnel, notamment pour les vendeurs en ligne. Bien qu'il permette de gérer de l'argent, ses fonctionnalités sont orientées vers les transactions commerciales plutôt que vers la gestion budgétaire personnelle.

Quicken peut-il se connecter à ma boutique en ligne ?

Quicken se connecte principalement aux banques et aux institutions financières pour le suivi des finances personnelles. Il ne s'intègre généralement pas aux plateformes de vente en ligne comme Shopify ou Etsy.

Quel logiciel est le plus facile à apprendre ?

Quicken est généralement considéré comme plus facile à prendre en main pour la gestion des finances personnelles grâce à son interface intuitive. Synder, bien que convivial, peut nécessiter un apprentissage légèrement plus complexe en raison de ses intégrations avec des logiciels d'entreprise.

Synder propose-t-il une aide pour les impôts ?

Synder facilite l'organisation et la synchronisation des données financières de votre entreprise, ce qui peut simplifier la déclaration de revenus. Cependant, il ne s'agit pas d'un logiciel de préparation fiscale à proprement parler.