Are you tired of the month-end closing feeling like a huge headache?

It can take forever to sort through all those numbers.

¿Pero qué pasaría si hubiera una manera mejor?

¿Qué pasa si tu software de contabilidad could make month-end simpler and faster?

Two names often come up: Xero vs Easy Month End.

Descripción general

We’ve put both Xero and Easy Month End through their paces.

Exploring how they handle real-world negocio escenarios.

Our hands-on testing focused on ease of use, features for month-end closing, and overall efficiency to bring you this clear comparison.

Únase a más de 2 millones de empresas que utilizan el software de contabilidad en la nube de Xero. ¡Explore sus potentes funciones de facturación ahora!

Precios: Tiene una prueba gratuita. El plan pago comienza en $29/mes.

Características principales:

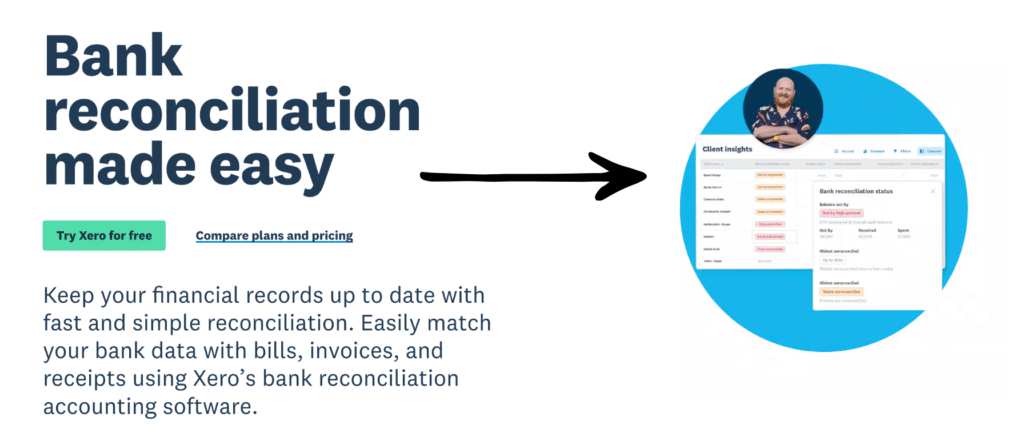

- Conciliación bancaria

- Facturación

- Informes

Este fin de mes fácil, únete a 1257 usuarios que ahorraron un promedio de 3,5 horas y redujeron los errores en un 15 %. ¡Comienza tu prueba gratuita!

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $45 al mes.

Características principales:

- Conciliación automatizada

- Flujos de trabajo optimizados

- Interfaz fácil de usar

¿Qué es Xero?

So, Xero, huh? It’s popular.

Lots of businesses use it. It’s contabilidad software in the cloud.

You can access it anywhere. It helps manage your money stuff.

Además, explora nuestros favoritos Alternativas a Xero…

Nuestra opinión

Únase a más de 2 millones de empresas usando Xero Software de contabilidad. ¡Explora sus potentes funciones de facturación ahora!

Beneficios clave

- Conciliación bancaria automatizada

- Facturación y pagos en línea

- Gestión de facturas

- Integración de nóminas

- Informes y análisis

Precios

- Motor de arranque: $29/mes.

- Estándar: $46/mes.

- De primera calidad: $69/mes.

Ventajas

Contras

¿Qué es Easy Month End?

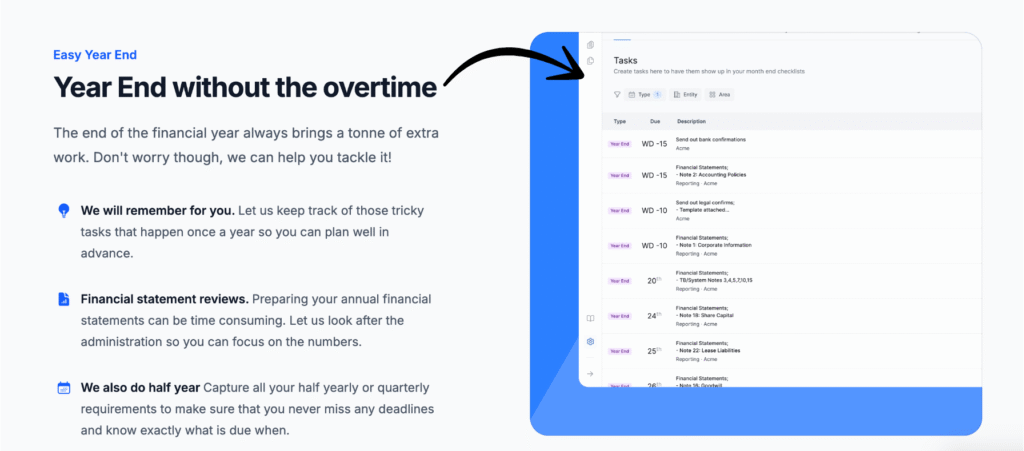

Easy Month End, right? The name tells you a lot.

It really focuses on making the month-end easier.

It’s designed to streamline that whole process.

Think of it as your month-end buddy. It helps keep everything on track.

Además, explora nuestros favoritos Alternativas fáciles para el fin de mes…

Nuestra opinión

Aumente la precisión financiera con Easy Month End. Aproveche la conciliación automatizada y los informes listos para auditoría. Programe una demostración personalizada para optimizar su proceso de cierre de mes.

Beneficios clave

- Flujos de trabajo de conciliación automatizados

- Gestión y seguimiento de tareas

- Análisis de varianza

- Gestión de documentos

- Herramientas de colaboración

Precios

- Motor de arranque:$24/mes.

- Pequeño: $45/mes.

- Compañía: $89/mes.

- Empresa: Precios personalizados.

Ventajas

Contras

Comparación de características

Comparing two different types of tools can be tricky.

Xero is a full cloud based contabilidad software, while Easy Month End is a focused solution for streamlining the close process.

Let’s look at nine key features to see which one fits your finance team better.

1. Core Accounting & ERP Functionality

- Xero: As a true cloud based contabilidad software, it provides a wide range of services. This includes general ledger, accounts receivable, and accounts payable functionality. For established businesses or those on the established plan, it has a foundation for an enterprise resource planning system.

- Easy Month End: It is not a core contabilidad system. It is designed to work con your existing xero contabilidad software or other ledgers. It does not handle day-to-day transactions like paying bills or sending online invoicing.

2. Month-End Close Focus

- Xero: While it helps with reconciliation and reportando, Xero’s month-end tools are part of a larger system. It allows you to log and store some financial records, but lacks dedicated workflow management tools.

- Easy Month End: This is its main purpose. It provides a structured workflow for the finance team tasks. It helps with a smoother month end close by tracking all your reconciliations and providing auditoría evidence.

3. Bank and Balance Sheet Reconciliation

- Xero: It uses automatic bank feeds to reconcile day-to-day bank transactions and bank accounts. This is key for cash flow visibility and reducing manual work.

- Easy Month End: It specializes in faster balance sheet reconciliations. It’s designed to collect audit evidence and bring all your reconciliations together in a single platform, taking the stress out of year end and quarter end.

4. Workflow and Team Management

- Xero: Xero software de contabilidad allows collaboration and multiple user access. However, it lacks a dedicated workflow management tool for the closing checklist itself.

- Easy Month End: It offers specific team management and collaboration tools. You can assign tasks, track progress, and have automated sign offs, making the team works more efficiently. You can also leave comments and track every action, leading to a more efficient finance team.

5. Gestión de inventario

- Xero: Xero offers an inventory management feature on its more established plan. This helps businesses manage their stock levels and inventory datos to support business performance.

- Easy Month End: It does not have the ability to manage inventory or track inventory data. Its focus is purely on the financial close process.

6. Cash Flow and Expense Tracking

- Xero: The xero dashboard gives a real-time overview of cash flow management. Xero excels at expense tracking, bill payable functionality, and accounts receivable (invoices owed), making it essential for pequeña empresa propietarios.

- Easy Month End: It focuses on the post-transaction process (reconciliation and close). It does not provide the front-end tools for daily cash flow tracking or expense tracking.

7. Scalability and Target Audience

- Xero: With various pricing plans from the early plan up to multi-currency support, Xero is great for pequeñas empresas and growing businesses. We recommend xero for any entity needing a complete enterprise resource planning foundation.

- Easy Month End: It is best for established businesses with a growing finance team that needs to formalize and streamline its close process, often integrating with the existing xero accounting software.

8. Funcionalidad y acceso móvil

- Xero: Xero offers a powerful mobile app for iOS and android devices. This ability allows you to send online invoicing, capture bills, and reconcile on the go, making it a truly cloud based accounting solution.

- Easy Month End: While cloud based accounting as well, its mobile app functionality focuses on checking in on the close progress and approving tasks, rather than handling day-to-day transactions.

9. Audit and Compliance Documentation

- Xero: Provides an audit evidence trail of transactions. The xero’s reporting features help in checking the financial position.

- Easy Month End: It is specifically built to help the preparer and reviewers collect audit evidence in one place. It makes providing information to auditors for signing off on the year end less of a hassle.

¿Qué tener en cuenta al elegir un software de contabilidad?

Here are the key points to consider:

- Interfaz fácil de usar: You want a clean and user-friendly interface that xero makes navigating financial tasks a breeze.

- Escalabilidad: Can it support business growth? Check if xero pricing and pricing plans suit small businesses and expanding businesses.

- Real Time Data: The software should provide real-time data into your financial details and business’s financial health.

- Soporte y recursos: Look for robust online resources and a responsive way to submit a support ticket to get an answer. Xero central offers a great community for this.

- Accesibilidad: Does it offer a mobile app for ios and android dispositivos so you can work from multiple locations?

- Feature Depth: Do you need simple financial management or advanced features like project tracking and multiple currencies?

- Gestión de clientes: The ability to manage client data and send unlimited invoices is essential for independent contractors and professional services.

- Month End Efficiency: For your finance team, check features for team collaboration on the month end process to avoid manual confirmations and delays.

- Personalización: Can you get customizable reporting and easily schedule payments?

- Migración de datos: Is the data migration process simple when you upload your existing records? You should be able to test xero or any software easily.

- Contracts: Understand the terms before you cancel or expand your subscription to know the true xero cost.

- Audit Trail: The system should ensure a clear log of changes to protect against errors.

- Incorporación: How quickly can your team handle month-end processes during the first month-end?

Veredicto final

After this deep dive, the right choice depends on your core need.

If your goal is comprehensive financial reporting and managing all daily transactions, then use Xero accounting.

Xero, as a leading cloud-based accounting software, is a stronger choice for small business owners.

Xero lets you handle everything from sales tax to purchase orders and paying up to five bills on the early plan.

However, if your finance team deserves an easier life by solving the pain of the month-end close.

Easy Month End is a fantastic tool. It frees up lives by simplifying ad hoc reconciliations and eliminating spreadsheets from outlook.

You can additionally integrate it to review your main Xero accounting software ERP.

Both are great; pick Xero for overall customer support and scope, or the other to stay organized and get out of manual confirmations faster.

Más de Xero

Elegir el software de contabilidad adecuado implica considerar varias opciones.

He aquí una rápida comparación entre Xero y otros productos populares.

- Xero frente a QuickBooks: QuickBooks es un competidor importante. Si bien ambos ofrecen funciones básicas similares, Xero suele ser elogiado por su interfaz clara y su número ilimitado de usuarios. QuickBooks puede ser más complejo, pero ofrece informes muy eficaces.

- Xero frente a FreshBooks: FreshBooks es una opción popular, especialmente para autónomos y empresas de servicios. Destaca por su facturación y control de horas trabajadas. Xero ofrece una solución de contabilidad más completa.

- Xero frente a Sage: Tanto Sage como Xero ofrecen soluciones para pequeñas empresas. Sin embargo, Sage también proporciona herramientas de planificación de recursos empresariales (ERP) más completas para empresas más grandes.

- Xero vs. Zoho Books: Zoho Books forma parte de una amplia gama de aplicaciones empresariales. Suele ofrecer funciones de inventario más avanzadas y es muy rentable. Xero, por su parte, es una opción líder por su simplicidad y facilidad de uso.

- Xero frente a Wave: Wave es conocido por su plan gratuito. Es una excelente opción para pequeñas empresas o autónomos con un presupuesto ajustado. Xero ofrece una gama más amplia de funciones y es ideal para el crecimiento empresarial.

- Xero frente a Quicken: Quicken se centra principalmente en finanzas personales. Si bien ofrece algunas funciones empresariales, no es una auténtica solución de contabilidad empresarial. Xero está diseñado específicamente para gestionar las complejidades de la contabilidad empresarial.

- Xero frente a HubdocEstos no son competidores directos. Tanto Dext como Hubdoc son herramientas que automatizan la captura de documentos y la entrada de datos. Se integran directamente con Xero para agilizar y hacer más precisa la contabilidad.

- Xero frente a Synder: Synder es una plataforma que conecta canales de venta y pasarelas de pago con software de contabilidad. Ayuda a automatizar la entrada de datos desde plataformas como Shopify y Stripe directamente a Xero.

- Xero frente a ExpensifyExpensify se centra específicamente en la gestión de gastos. Si bien Xero cuenta con funciones de gastos, Expensify ofrece herramientas más avanzadas para gestionar los gastos y reembolsos de los empleados.

- Xero frente a Netsuite: Netsuite es un sistema ERP integral para grandes corporaciones. Ofrece un conjunto completo de herramientas de gestión empresarial. Xero no es un ERP, pero es una excelente solución de contabilidad para pequeñas empresas.

- Xero frente a Puzzle IO: Puzzle IO es una plataforma financiera diseñada para empresas emergentes, centrada en estados financieros en tiempo real y entrada de datos automatizada.

- Xero vs. Easy Month End: Este software es una herramienta especializada para automatizar el proceso de cierre de mes, facilitando la conciliación y los registros de auditoría. Está diseñado para funcionar con Xero, no para reemplazarlo.

- Xero frente a Docyt: Docyt utiliza IA para automatizar las tareas administrativas y de contabilidad. Permite consultar todos sus documentos y datos financieros en un solo lugar.

- Xero frente a RefreshMe: RefreshMe es un software de contabilidad más simple con funciones básicas, a menudo utilizado para finanzas personales o empresas muy pequeñas.

- Xero frente a AutoEntry: Similar a Dext y Hubdoc, AutoEntry es una herramienta que automatiza la extracción de datos de recibos y facturas, diseñada para integrarse y mejorar el software de contabilidad como Xero.

Más de Fin de Mes Fácil

A continuación se muestra una breve comparación de Easy Month End con algunas de las principales alternativas.

- Fin de mes fácil vs Puzzle io: Mientras que Puzzle.io está destinado a la contabilidad de empresas emergentes, Easy Month End se centra específicamente en agilizar el proceso de cierre.

- Fin de mes fácil vs. Dext: Dext está destinado principalmente a la captura de documentos y recibos, mientras que Easy Month End es una herramienta integral de gestión de cierre de mes.

- Fin de mes fácil vs. Xero: Xero es una plataforma de contabilidad completa para pequeñas empresas, mientras que Easy Month End proporciona una solución dedicada al proceso de cierre.

- Fin de mes fácil vs. Synder: Synder se especializa en la integración de datos de comercio electrónico, a diferencia de Easy Month End, que es una herramienta de flujo de trabajo para todo el cierre financiero.

- Fin de mes fácil vs. Docyt: Docyt utiliza IA para la contabilidad y la entrada de datos, mientras que Easy Month End automatiza los pasos y tareas del cierre financiero.

- Fin de mes fácil vs. RefreshMe: RefreshMe es una plataforma de asesoramiento financiero, que se diferencia del enfoque de Easy Month End en la gestión cercana.

- Fin de mes fácil vs. Sage: Sage es una suite de gestión empresarial a gran escala, mientras que Easy Month End ofrece una solución más especializada para una función contable crítica.

- Fin de mes fácil vs. Zoho Books: Zoho Books es un software de contabilidad todo en uno, mientras que Easy Month End es una herramienta diseñada específicamente para el proceso de fin de mes.

- Fin de mes fácil vs. ola: Wave ofrece servicios de contabilidad gratuitos para pequeñas empresas, mientras que Easy Month End ofrece una solución más avanzada para la gestión cercana.

- Fin de mes fácil vs. Quicken: Quicken es una herramienta de finanzas personales, lo que hace que Easy Month End sea una mejor opción para las empresas que necesitan administrar el cierre de mes.

- Fin de mes fácil vs. Hubdoc: Hubdoc automatiza la recopilación de documentos, pero Easy Month End está diseñado para administrar todo el flujo de trabajo de cierre y las tareas del equipo.

- Fin de mes fácil vs. Expensify: Expensify es un software de gestión de gastos, que es una función diferente del enfoque principal de Easy Month End en el cierre financiero.

- Fin de mes fácil vs. QuickBooks: QuickBooks es una solución de contabilidad integral, mientras que Easy Month End es una herramienta más específica para gestionar el cierre de mes en sí.

- Fin de mes fácil vs. entrada automática: AutoEntry es una herramienta de captura de datos, mientras que Easy Month End es una plataforma completa para la gestión de tareas y flujo de trabajo durante el cierre.

- Fin de mes fácil vs. FreshBooks: FreshBooks está dirigido a autónomos y pequeñas empresas, mientras que Easy Month End ofrece una solución específica para el cierre de mes.

- Fin de mes fácil vs NetSuite: NetSuite es un sistema ERP completo, con un alcance más amplio que el enfoque especializado de Easy Month End en el cierre financiero.

Preguntas frecuentes

Can Xero help me store all my financial documents?

Yes, Xero allows you to attach source documents to transactions, keeping everything organized digitally.

Does Easy Month End require a lot of manual data entry?

Easy Month End aims to reduce manual work with features focused on streamlining the month-end close process.

Could I import data from my existing accounting system into either platform?

Yes, both Xero and Easy Month End typically offer options to import data from other systems.

How often does the financial data update in both Xero and Easy Month End?

Xero often has live bank feeds for near real-time updates. Easy Month End focuses on updating during the monthly close.

Is Easy Month End suitable for any business entity?

Easy Month End can benefit various entities struggling with month-end, but its value depends on their specific needs.