Are you tired of piles of receipts and messy expense reports?

It can be a real headache trying to keep track of where your money is going, right?

Well, there is!

Two popular tools, Synder vs Expensify, aim to simplify expense management.

But which one is the better fit for you?

Let’s take a closer look and help you decide.

Descripción general

We looked closely at both Synder and Expensify.

Probamos sus características.

Vimos lo fácil que era utilizarlos.

Esto nos ayudó a compararlos lado a lado.

Ahora podemos mostrarte lo que cada uno hace mejor.

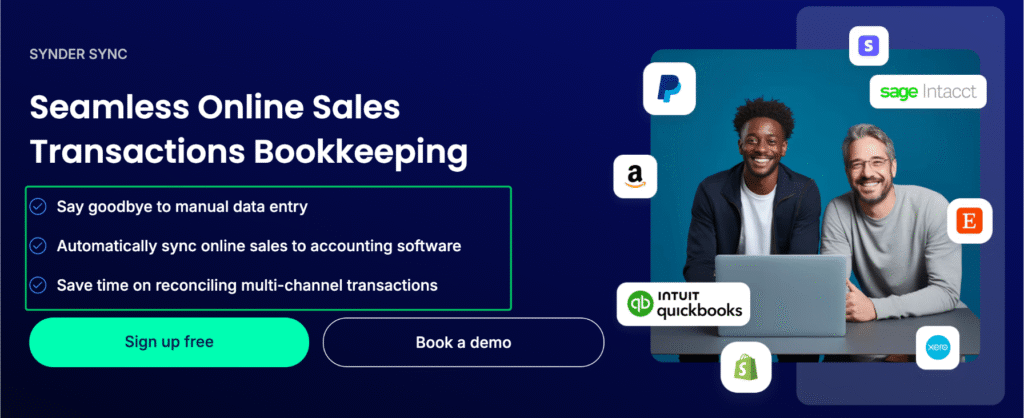

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Check it out today!

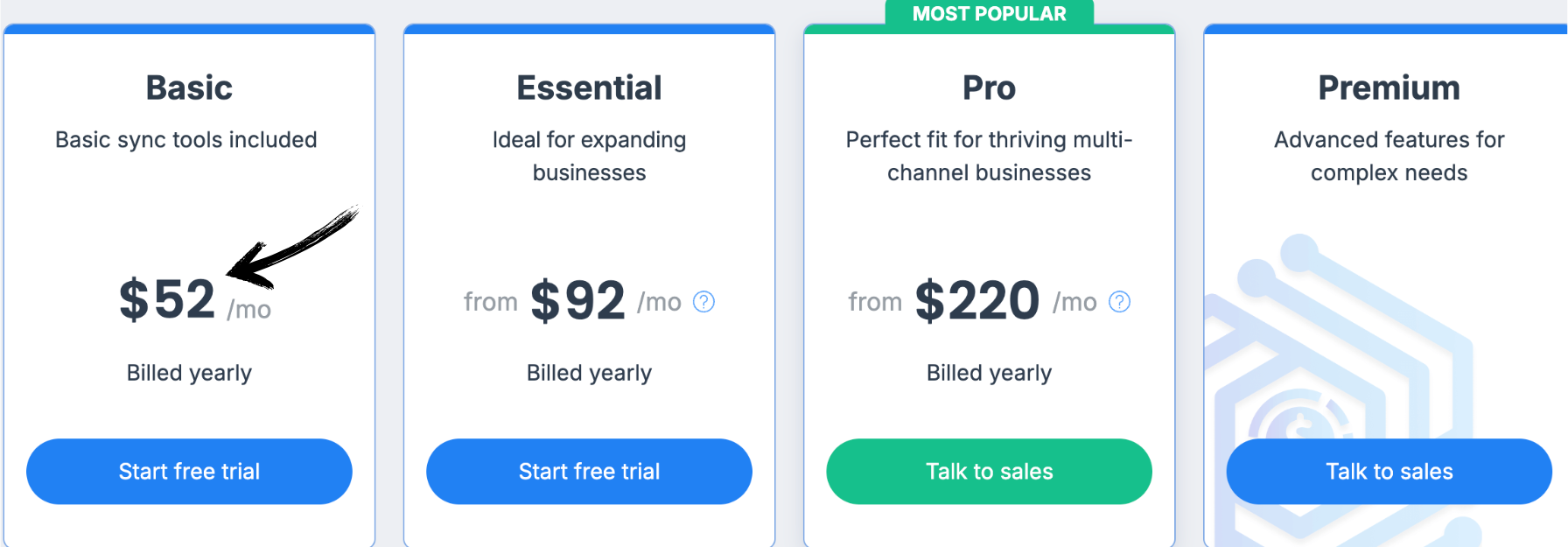

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $52 al mes.

Características principales:

- Sincronización de ventas multicanal

- Conciliación automatizada

- Informes detallados

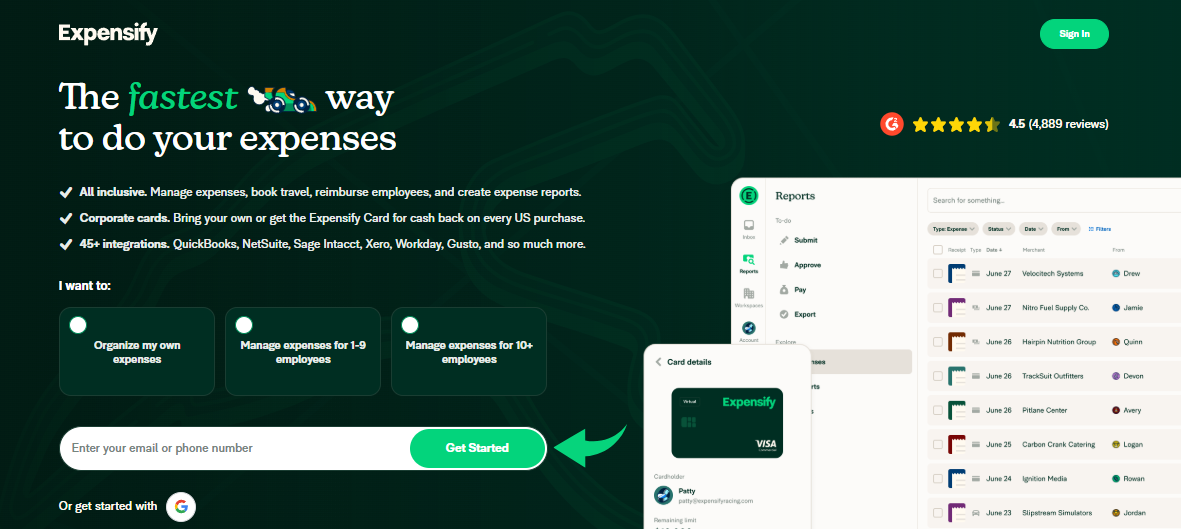

Únase a más de 15 millones de usuarios que confían en Expensify para simplificar sus finanzas. Ahorre hasta un 83 % en tiempo dedicado a informes de gastos.

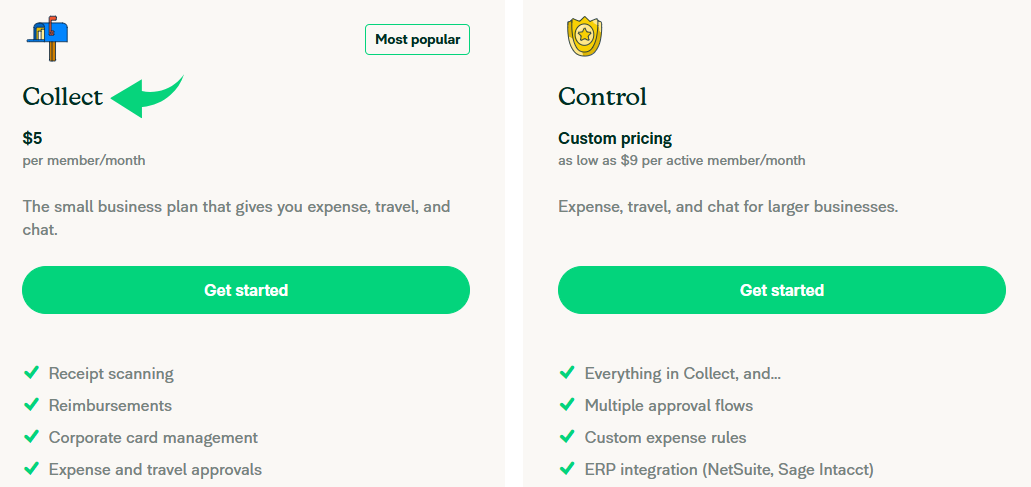

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $5 al mes.

Características principales:

- Captura de recibos SmartScan

- Conciliación de tarjetas corporativas

- Flujos de trabajo de aprobación avanzados.

¿Qué es Synder?

Hablemos de Synder.

Es una herramienta que te ayuda a diferentes negocio Las aplicaciones se comunican entre sí.

Piense en ello como un ayudante que mueve la información de su dinero a donde debe ir.

Esto puede ahorrarle mucho tiempo.

Además, explora nuestros favoritos Alternativas a Synder…

Nuestra opinión

Synder automatiza su contabilidad, sincronizando los datos de ventas sin problemas con QuickBooks, XeroY más. Las empresas que utilizan Synder informan que ahorran un promedio de más de 10 horas por semana.

Beneficios clave

- Sincronización automática de datos de ventas

- Seguimiento de ventas multicanal

- Conciliación de pagos

- Integración de la gestión de inventario

- Informes de ventas detallados

Precios

Todos los planes se cumplirán Facturado anualmente.

- Básico: $52/mes.

- Básico: $92/mes.

- Pro: $220/mes.

- De primera calidad: Precios personalizados.

Ventajas

Contras

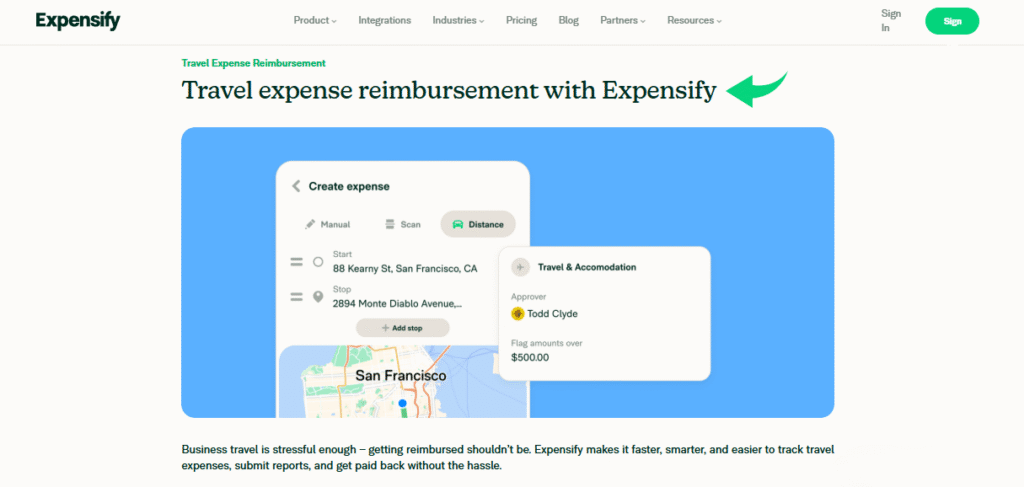

¿Qué es Expensify?

Bien, hablemos de Expensify.

Es una herramienta que le ayuda a realizar un seguimiento de todos los gastos de su negocio.

Piense en ello como un ayudante que recuerda dónde va su dinero.

Puede obtener información de tus recibos y datos bancarios. ¡Muy práctico!

Además, explora nuestros favoritos Alternativas a Expensify…

Beneficios clave

- La tecnología SmartScan escanea los detalles del recibo y los extrae con una precisión superior al 95%.

- Los empleados reciben el reembolso rápidamente, a menudo en tan solo un día hábil a través de ACH.

- La tarjeta Expensify puede ahorrarle hasta un 50% en su suscripción con su programa de devolución de efectivo.

- No se ofrece garantía; sus términos establecen que las responsabilidades son limitadas.

Precios

- Recolectar: $5/mes.

- Control: Precios personalizados.

Ventajas

Contras

Comparación de características

Let’s dive into the details of what each tool offers.

We will look at nine key features to help you see how they are different and which one might work best for you.

1. Sales Channels & Transaction Syncing

Synder is built for ecommerce businesses.

It can connect to all your sales channels like Shopify, Etsy, eBay, Stripe, Square, and PayPal.

This allows it to bring in a high volume of sales datos, including historical transactions.

It can sync mode to keep everything up to date, which helps keep your books balanced in real time.

2. Expense Management

Expensify is a powerful tool for the expense management process.

You can take a photo of a receipt with the app. It will then capture the details in a few seconds.

This makes it easy for employees to submit their costs and manage expenses.

It also has the Expensify card to hacer things even faster.

3. Financial Automation & Bookkeeping

Synder’s main goal is automated contabilidad.

It helps finance teams with teneduría de libros. It can automatically record sales and expenses from your sales channels.

Expensify is more about automating the expense management process.

It uses AI to simplify submitting and getting approval for reports.

4. Multi-Currency & Payouts

For businesses that sell in different countries, multi-currency support is important.

Synder handles this well. It also helps you track payouts from your different platforms and match them with your bank account.

Expensify also has multi-currency features to handle international spending.

5. Integraciones

Both platforms are compatible with many other programs.

Expensify can integrate with popular accounting systems like QuickBooks Online, NetSuite, and Xero.

Synder is also compatible with these and more, including Sabio Intacto.

6. Experiencia del usuario

Synder is designed to run in the background.

You just do a quick setup, and then it handles things on its own.

Expensify is very easy to use for the user on a phone, web, or desktop.

You can capture a receipt with a quick photo and it is immediately ready.

7. Team Management & Approval

Expensify is perfect for finance teams who need to streamline their approval process.

A manager can review a report in a few seconds and approve it.

You can log mileage and track different projects.

You can also give access to contractors.

8. Real-Time Data & Insights

With Synder, you get real time data. It gives you insights into your sales.

You can see all the details from your sales channels.

Expensify also gives you real-time data for your expenses.

This lets a manager respond to requests right away.

9. Issue Resolution

Sometimes things can go wrong.

Synder can help you resolve issues with fees, taxes, refunds, and discounts.

This helps keep your balance sheets accurate.

Expensify can also help you resolve issues when an expense is blocked or has details that need to be fixed.

¿Qué tener en cuenta al elegir un software de contabilidad?

When you’re ready to switch from a manual system, it can be a lot of stress to pick the right tool.

The truth is, the best choice depends on what your organization needs.

Here are some key things to focus on to avoid mistakes and find the best connection.

- Look at the Expensify reviews and other product feedback to see what real employers and contadores think.

- Check if it can handle multi-channel sales. You want a tool that can reimburse employees and manage all your sales channels, from your website to Clover.

- A good tool helps keep your books balanced and supports reconciliation to prevent financial mistakes.

- For your team, the tool should be easy to use and not a stress. It should allow employees to capture a photo and file it in a flexible way.

- Make sure it handles subscriptions, shipping, taxes, and refunds automatically. This will help you achieve proper revenue recognition and gaap compliance.

- The tool should make it simple for a small number of users to submit expenses and get them approved with one click.

- Check if the tool allows you to add tags and categories to transactions. This helps with organization and getting expected insights.

- The best tools are compatible with what you already use. It should export data easily to your contabilidad sistema.

- See how it handles different types of expenses, like inventory or mileage. It should be flexible enough for your unique business needs.

- A connection to all your sales channels like Clover is key for an ecommerce business. It helps keep your inventory and sales records straight.

- Look for a tool that makes it easy for employees to get reimbursed for completing their expense reports. They should be able to file reports and have them stored on a single page.

- A tool should also let you set up triggers or rules. This means a report can be highlighted or approved based on certain details.

Veredicto final

So, which one should you pick: Synder or Expensify?

It’s easy to use for snapping receipts and managing reimbursements.

However, if you run a pequeña empresa and need help with things like invoices, getting paid.

And keeping your books in order with your contabilidad software, Synder might be the better fit.

Its ability to integrate and automate many financial tasks can save you a lot of time.

We think Synder offers a bit more for businesses that want to automate more of their money management.

We’ve looked closely at both, so we hope this helps you choose what works best for you!

Más de Synder

- Synder contra Puzzle io: Puzzle.io es una herramienta de contabilidad basada en IA diseñada para startups, centrada en métricas como la tasa de consumo y el recorrido de la inversión. Synder se centra más en la sincronización de datos de ventas multicanal para una gama más amplia de negocios.

- Synder contra Dext: Dext es una herramienta de automatización que destaca por capturar y gestionar datos de facturas y recibos. Synder, por otro lado, se especializa en automatizar el flujo de transacciones de ventas.

- Synder frente a Xero: Xero es una plataforma de contabilidad en la nube con todas las funciones. Synder trabaja con Xero para automatizar la entrada de datos de los canales de ventas, mientras que Xero maneja tareas contables todo en uno, como facturación e informes.

- Synder vs Easy Month End: Easy Month End es una herramienta diseñada para ayudar a las empresas a organizar y optimizar su proceso de cierre de mes. Synder se centra más en automatizar el flujo de datos de las transacciones diarias.

- Synder frente a Docyt: Docyt utiliza IA para una amplia gama de tareas contables, como el pago de facturas y la gestión de gastos. Synder se centra más en la sincronización automática de datos de ventas y pagos de múltiples canales.

- Synder frente a RefreshMe: RefreshMe es una aplicación de finanzas personales y gestión de tareas. No es un competidor directo, ya que Synder es una herramienta de automatización de la contabilidad empresarial.

- Synder contra Sage: Sage es un sistema de contabilidad integral y de larga trayectoria con funciones avanzadas como la gestión de inventario. Synder es una herramienta especializada que automatiza la entrada de datos en sistemas contables como Sage.

- Synder frente a Zoho Books: Zoho Books es una solución de contabilidad completa. Synder complementa Zoho Books al automatizar el proceso de importación de datos de ventas desde varias plataformas de comercio electrónico.

- Synder contra Wave: Wave es un software de contabilidad gratuito e intuitivo, utilizado frecuentemente por autónomos y pequeñas empresas. Synder es una herramienta de automatización de pago diseñada para empresas con un gran volumen de ventas multicanal.

- Synder frente a Quicken: Quicken es principalmente un software de gestión de finanzas personales, aunque incluye algunas funciones para pequeñas empresas. Synder está diseñado específicamente para la automatización de la contabilidad empresarial.

- Synder contra Hubdoc: Hubdoc es una herramienta de gestión de documentos y captura de datos, similar a Dext. Se centra en la digitalización de facturas y recibos. Synder se centra en la sincronización de datos de ventas y pagos en línea.

- Synder frente a Expensify: Expensify es una herramienta para gestionar informes de gastos y recibos. Synder permite automatizar los datos de las transacciones de venta.

- Synder frente a QuickBooks: QuickBooks es un software de contabilidad integral. Synder Se integra con QuickBooks para automatizar el proceso de introducción de datos de ventas detallados, lo que lo convierte en un complemento valioso en lugar de una alternativa directa.

- Synder frente a AutoEntry: AutoEntry es una herramienta de automatización de entrada de datos que captura información de facturas, recibos y recibos. Synder se centra en la automatización de datos de ventas y pagos desde plataformas de comercio electrónico.

- Synder frente a FreshBooks: FreshBooks es un software de contabilidad diseñado para autónomos y pequeñas empresas de servicios, con especial atención a la facturación. Synder es ideal para empresas con un alto volumen de ventas en múltiples canales online.

- Synder frente a NetSuite: NetSuite es un sistema integral de Planificación de Recursos Empresariales (ERP). Synder es una herramienta especializada que sincroniza datos de comercio electrónico con plataformas más amplias como NetSuite.

Más de Expensify

- Expensify vs PuzzleEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Expensify frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Expensify frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Expensify vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Expensify frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Expensify frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Expensify frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Expensify frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Expensify frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Expensify vs. AutoEntryEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Expensify frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Expensify frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

What is the main difference between Synder and Expensify?

Expensify is mostly for tracking expenses and receipts. Synder does that too, but it also helps with invoices, payments, and connects to your software de contabilidad to automate things.

Is Synder better for small businesses?

Synder can be very helpful for a pequeña empresa. It helps with getting paid and keeping your financial records organized by integrateing with tools like Zoho and FreshBooks.

Can Expensify integrate with my accounting software?

Yes, Expensify can integrate with many accounting software options. This helps you keep your expense information in one place.

Does Synder help with getting paid faster?

Yes, Synder helps you create and send invoices. It can also remind customers to pay, which can help you get paid faster.

Which tool is easier to use for a startup?

Both tools try to be easy to use. Expensify is simple for tracking expenses. Synder might take a little more time to set up all its automation features, but it can save time más tarde for a startup.