Struggling with messy expense reports?

Do you feel like you’re drowning in receipts, trying to figure out where your money went?

¿Pero qué pasaría si hubiera una manera mejor?

Expense management software like Sage and Expensify promise to fix these headaches.

But choosing the right one can be tricky.

Let’s break down Sage vs Expensify to help you decide which tool is best for your negocio.

Descripción general

We thoroughly tested both Sage and Expensify.

We used them to track spending, upload receipts, and create reports.

This hands-on experience helped us see how they stack up against each other.

Más de 6 millones de clientes confían en Sage. Con una calificación de satisfacción del cliente de 56 sobre 100, sus robustas funciones son una solución de eficacia comprobada.

Precios: Prueba gratuita disponible. El plan premium cuesta $66.08 al mes.

Características principales:

- Facturación

- Integración de nóminas

- Gestión de inventario

Únase a más de 15 millones de usuarios que confían en Expensify para simplificar sus finanzas. Ahorre hasta un 83 % en tiempo dedicado a informes de gastos.

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $5 al mes.

Características principales:

- Captura de recibos SmartScan

- Conciliación de tarjetas corporativas

- Flujos de trabajo de aprobación avanzados.

¿Qué es Sage?

Hablemos de Sage.

Ya existe desde hace tiempo.

Muchas empresas lo utilizan. Ayuda a controlar el dinero.

Piense en ello como un cuaderno digital para sus asuntos de negocios.

Además, explora nuestros favoritos Alternativas a la salvia…

Nuestra opinión

¿Listo para optimizar tus finanzas? Los usuarios de Sage han reportado un aumento promedio del 73 % en la productividad y una reducción del 75 % en el tiempo de procesamiento.

Beneficios clave

- Facturación y pagos automatizados

- Informes financieros en tiempo real

- Fuerte seguridad para proteger los datos

- Integración con otras herramientas empresariales

- Soluciones de nómina y RRHH

Precios

- Contabilidad profesional: $66.08/mes.

- Contabilidad Premium: $114.33/mes.

- Contabilidad cuántica: $198.42/mes.

- Paquetes de RRHH y nómina: Precios personalizados según sus necesidades.

Ventajas

Contras

¿Qué es Expensify?

Bien, hablemos de Expensify.

Es una herramienta que le ayuda a realizar un seguimiento de todos los gastos de su negocio.

Piense en ello como un ayudante que recuerda dónde va su dinero.

Puede obtener información de tus recibos y datos bancarios. ¡Muy práctico!

Además, explora nuestros favoritos Alternativas a Expensify…

Beneficios clave

- La tecnología SmartScan escanea los detalles del recibo y los extrae con una precisión superior al 95%.

- Los empleados reciben el reembolso rápidamente, a menudo en tan solo un día hábil a través de ACH.

- La tarjeta Expensify puede ahorrarle hasta un 50% en su suscripción con su programa de devolución de efectivo.

- No se ofrece garantía; sus términos establecen que las responsabilidades son limitadas.

Precios

- Recolectar: $5/mes.

- Control: Precios personalizados.

Ventajas

Contras

Comparación de características

This comparison provides a brief overview of Sage and Expensify, two distinct contabilidad soluciones.

We analyze how a comprehensive accounting platform compares with a specialized expense management tool, helping pequeña empresa owners choose the right fit.

1. Alcance y propósito de la plataforma

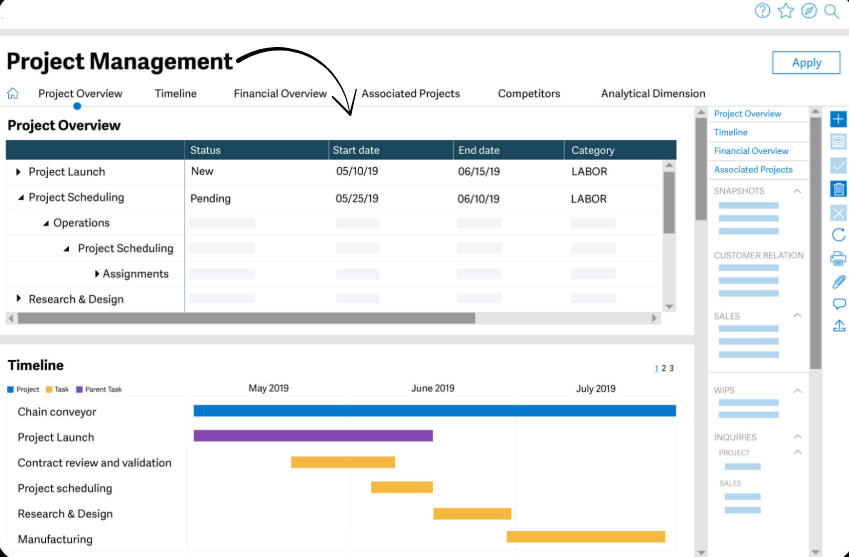

- Sabio Business Cloud Accounting is a full accounting platform built for pequeña empresa owners and medium-sized businesses. The software includes a wide range of services, such as inventory and payroll, making it a robust desktop solution with cloud connectivity.

- Expensificar is a specialized expense management process tool. Its main purpose is to simplify and automate the every expense management process from start to finish, which is its main difference from a full accounting platform.

2. Automatización y tareas manuales

- Sabio automates many manual tasks with features like bank reconciliation and bill tracking. Its workflow management features can be customized to streamline the entire accounting process. It is a powerful system that helps accounting teams to save time.

- Expensificar makes expense management easy. It uses new and advanced optical character recognition (OCR) to extract data from a receipt or invoice and then auto publish that information to your software de contabilidad. The Expensify reviews and other articles highlight how much time spent is reduced, saving you from manual data entry.

3. Precios y costos

- Sabio Tiene precios más altos que muchas otras plataformas. Su precio es escalonado, ya sea mensual o por usuario, e incluye varios complementos para nómina e inventario con costos adicionales.

- Expensificar pricing is flexible and based on a credit system per month, where each purchase invoice, receipt, or bank statement uses a certain amount of credits. You only pay for the data extraction you need, and you can get unlimited users and cloud storage for free. The Expensify card is also free.

4. Integración y conectividad

- Sabio offers a dedicated mobile app and cloud connectivity, though it can have mobile access limitations. It integrates with other business apps via its sage marketplace. Its desktop solution with cloud connectivity and online backups offers a comprehensive solution for companies that want a single platform.

- Expensificar está diseñado para una integración perfecta con software de contabilidad como Sage, QuickBooks Online y Xero. It works by uploading a purchase invoice or other documents from a mobile phone or desktop, which then triggers the data extraction. Expensify reviews often mention the ease of a QuickBooks online integration.

5. Informes y análisis

- Sabio Es conocido por sus estados financieros detallados. reportando e informes en tiempo real. Le permite generar informes sobre diversos aspectos de su negocio, desde el cálculo de costos de trabajo hasta los productos que generan más ingresos. El software le brinda las herramientas para analizar y evaluar su rendimiento.

- Expensify’s reporting is limited to the documents it processes, as its main focus is data extraction, not financial reporting. The software helps accountants by getting the data ready for them, so they can then generate reports in their accounting platform.

6. Inventario y ventas

- Sabio Proporciona un sistema robusto de gestión de inventario. Puede crear variaciones de productos, sincronizar el inventario automáticamente y emitir alertas de stock bajo para no perder ninguna venta.

- Expensificar Es una herramienta de extracción de datos, no una plataforma de contabilidad completa, por lo que no ofrece gestión de inventario ni herramientas de ventas. Sin embargo, puede extraer información de una factura de compra, que luego puede ser utilizada por la plataforma de contabilidad Sage Business Cloud para gestionar el inventario.

7. Apoyo y recursos

- Sabio Ofrece una gran cantidad de material educativo a través de Sage University, un centro comunitario y soporte directo para resolver dudas. Si una función o proceso falla, el usuario puede encontrar recursos y artículos para resolverlo. El mercado de Sage ofrece acceso a más ayuda.

- Expensificar provides support, including articles and videos to help users. The Expensify reviews mention that the support is quick and responsive, which is helpful for clients who need to resolve an issue with a purchase invoice or other documents.

8. Funcionalidad única

- Sabio Ofrece funciones únicas para empresas, como contabilidad profesional, cálculo de costes de trabajo con códigos de coste y seguimiento del estado de los trabajos. La plataforma también ofrece Sage Payroll como complemento.

- Expensify unique functionality is its OCR technology and ability to read financial documents. The Expensify review notes that it is a security service to protect against potential online attacks. It is designed to protect itself from online attacks that could trigger a security solution, such as a cloudflare ray i or a cloudflare ray id found error. This can happen with a certain word or phrase, a dedicated sql command, or malformed data that could trigger this block.

9. Comparison and Recommendations

- SabioComo plataforma de contabilidad completa, ofrece funciones avanzadas para gestionar las finanzas eficazmente, especialmente para empresas con inventario y ventas complejas. Su solución de escritorio con conectividad en la nube y copias de seguridad en línea ofrece una solución integral para empresas que buscan una plataforma única.

- Expensificar is an excellent tool for data extraction and is a perfect complement to other accounting software. Its seamless integration with products like QuickBooks Online makes it a great choice for businesses that want to automate tasks and reduce the time spent on manual data entry.

¿Qué tener en cuenta al elegir un software de contabilidad?

Choosing accounting software is a big deal, like picking the right gear for a big project. Here’s a simple guide on what to look for!

- How easy is it to use? You want software that makes it easy to get started. The setup should be simple, and you should be able to connect your bank accounts in a few seconds. Some programs let you work on a web page, while others have a desktop software you install. A good app for your pocket is super helpful so you can do things like capture receipts right away.

- Does it have the right features? The software should help you keep track of your money. It needs to manage your cash flow and let you create sales invoices for your customers or clients. Being able to create purchase orders is also important. Some software can even handle things like payroll software for your employees, or keep track of payments to contractors. It should have all the tools you need to manage your money and payments.

- How does it help you stay organized? Good software helps with organization. You can use tags and categories to sort your bank transactions and expenses. This makes it easy to log and find things más tarde. It should also help you with reconciliation, which is like making sure your bank statement and your books match up. The software should identify any unreconciled differences for you.

- What about using it on the go? A strong internet connection is key for working from anywhere. Be aware of potential drawbacks like limited acceso remoto on some programs. A good app should let you capture pictures of receipts and keep a log of your mileage from your phone, which is always in your pocket.

- How does it handle your team? If you’re not a one user operation, you need a system that supports a team. The software should have features for approval. For example, a manager can approve requests for expenses. It’s important for everyone on the team, from employers to employees, to be able to respond to these requests and keep things moving.

- What about security and reporting? The best accounting software will protect your data. All your information should be stored safely, and it should have strong security features. The program should be able to handle your existing accounting data when you start, and help you generate reports on things like your sales and expenses. You should be able to export these reports to share with others.

- Is it good for my business? The software should handle your specific needs, like keeping unique records or filling out contact fields. It should also be able to reimburse employees and contractors for expenses immediately. The software should hacer completing projects easier. You should feel confident that the program you choose is the expected quality and will be a great help for your business.

Veredicto final

So, which one wins: Sage or Expensify?

For most modern businesses, looking for ease of use and automated features.

Sage is our top pick.

Its SmartScan technology and direct reimbursements truly save time and effort.

While Expensify is solid, Expensify often feels more intuitive and speeds up the entire expense process.

We dug deep into both tools, testing every feature to give you the clearest picture.

Our goal is to help su business run smoother.

Choosing the right software can save you headaches and money, based on our hands-on review.

Sage stands out for its streamlined approach.

Más de Sage

Es útil ver cómo se compara Sage con otro software popular.

A continuación se muestra una breve comparación con algunos de sus competidores.

- Sage vs Puzzle IO: Si bien ambos se encargan de la contabilidad, Puzzle IO está diseñado específicamente para empresas emergentes y se centra en el flujo de caja en tiempo real y en métricas como la tasa de consumo.

- Sage contra Dext: Dext es principalmente una herramienta para automatizar la captura de datos de recibos y facturas. Suele funcionar junto con Sage para agilizar la contabilidad.

- Sage frente a Xero: Xero es una opción basada en la nube conocida por su facilidad de uso, especialmente para pequeñas empresas. Sage puede ofrecer funciones más robustas a medida que la empresa crece.

- Sage contra Synder: Synder se centra en sincronizar plataformas de comercio electrónico y sistemas de pago con software de contabilidad como Sage.

- Fin de mes sabio vs. fácil: Este software es un administrador de tareas que le ayuda a realizar un seguimiento de todos los pasos necesarios para cerrar sus libros al final del mes.

- Sage contra Docyt: Docyt utiliza IA para automatizar la contabilidad y eliminar la entrada manual de datos, proporcionando una alternativa altamente automatizada a los sistemas tradicionales.

- Sage vs. RefreshMe: RefreshMe no es un competidor directo de contabilidad. Se centra más en el reconocimiento y el compromiso de los empleados.

- Sage vs. Zoho Books: Zoho Books forma parte de una amplia gama de aplicaciones empresariales. Recibe elogios por su diseño limpio y sus sólidas conexiones con otros productos de Zoho.

- Sage vs Wave: Wave es conocido por su plan gratuito, que ofrece contabilidad y facturación básicas, lo que lo convierte en una opción popular para trabajadores independientes y empresas muy pequeñas.

- Sage frente a Quicken: Quicken está más orientado a las finanzas personales o de empresas muy pequeñas. Sabio ofrece funciones más sólidas para un negocio en crecimiento, como nómina e inventario avanzado.

- Sage contra Hubdoc: Hubdoc es una herramienta de gestión documental que recopila y organiza automáticamente documentos financieros, similar a Dext, y puede integrarse con plataformas de contabilidad.

- Sage frente a Expensify: Expensify es experto en la gestión de gastos. Es ideal para escanear recibos y automatizar los informes de gastos de los empleados.

- Sage frente a QuickBooks: QuickBooks es una plataforma líder en el sector contable para pequeñas empresas. Es conocido por su interfaz intuitiva y su amplia gama de funciones.

- Sage vs. AutoEntry: Esta es otra herramienta que automatiza la entrada de datos de recibos y facturas. Funciona bien como complemento de software de contabilidad como Sabio.

- Sage frente a FreshBooks: FreshBooks es especialmente bueno para trabajadores independientes y empresas de servicios, con un enfoque en la facturación simple y el seguimiento del tiempo.

- Sage frente a NetSuite: NetSuite es un sistema ERP a gran escala para empresas grandes. Sabio tiene una gama de productos, algunos de los cuales compiten en este nivel, pero NetSuite es una solución más grande y más compleja.

Más de Expensify

- Expensify vs PuzzleEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Expensify frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Expensify frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Expensify vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Expensify frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Expensify frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Expensify frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Expensify frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Expensify frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Expensify vs. AutoEntryEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Expensify frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Expensify frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Es Expensify bueno para las pequeñas empresas?

Yes, Expensify is often great for small businesses. Its simple interface and strong mobile app make managing expenses easy. They also offer plans that fit smaller team sizes.

Can Sage handle international expenses?

Sage can handle multi-currency transactions, which helps with international expenses. You’ll need to check if its specific features meet all your global needs, especially for tax compliance in different regions.

How secure are these expense tracking tools?

Both Sage and Expensify use strong security measures to protect your data. They use encryption and other safeguards to keep your financial information safe.

Do I still need to keep paper receipts with these apps?

Generally, no. Both apps allow you to snap photos of receipts. These digital copies are often enough for records, but always check your local tax rules to be sure.

Can employees easily learn to use Expensify or Sage?

Expensify is known for being very easy to learn and use. Sage might take a little more time to get used to, but both are designed to be user-friendly with some training.