¿Está cansado de revisar pilas de recibos o luchar con hojas de cálculo complejas?

Muchos de nosotros nos enfrentamos al dolor de cabeza de tener que hacer un seguimiento de los gastos, ya sea de trabajo o de presupuestos personales.

Puede resultar confuso y llevar mucho tiempo.

Aquí es donde entra en juego el software de gastos, que promete: hacer La vida más fácil.

Hoy vamos a comparar dos opciones populares: RefreshMe vs Expensify.

Desglosaremos sus características, beneficios y para quién son mejores.

Descripción general

Hemos probado tanto RefreshMe como Expensify.

Los usamos como lo haríamos todos los días.

Esto nos ayudó a ver cómo funcionan.

¡Descubre información financiera más completa! Refresh Me analiza tus gastos y te ayuda a ahorrar de forma más inteligente.

¡Pruébalo ahora!

Precios: Tiene una prueba gratuita. El plan premium cuesta $24.99 al mes.

Características principales:

- Conciliación automatizada

- Flujos de trabajo optimizados

- Interfaz fácil de usar

Únase a más de 15 millones de usuarios que confían en Expensify para simplificar sus finanzas. Ahorre hasta un 83 % en tiempo dedicado a informes de gastos.

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $5 al mes.

Características principales:

- Captura de recibos SmartScan

- Conciliación de tarjetas corporativas

- Flujos de trabajo de aprobación avanzados.

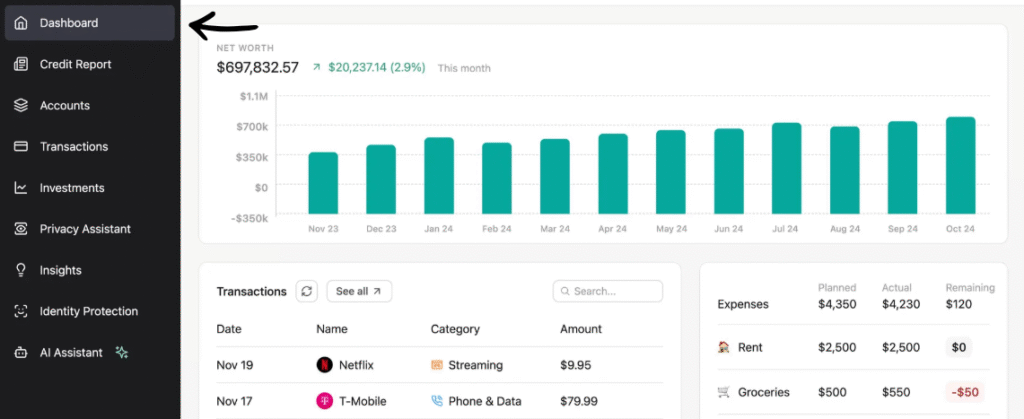

¿Qué es RefreshMe?

RefreshMe es una herramienta que le ayudará a realizar un seguimiento de sus gastos.

Puede ayudarle a mantener sus recibos en un solo lugar. También le ayuda a ver a dónde va su dinero.

Intenta hacer que el seguimiento de gastos sea sencillo para todos.

Además, explora nuestros favoritos Alternativas de Refreshme…

Nuestra opinión

La fortaleza de RefreshMe reside en proporcionar información práctica y en tiempo real. Sin embargo, la falta de precios públicos y la posible falta de funcionalidades contables básicas completas podrían ser un factor a considerar para algunos usuarios.

Beneficios clave

- Paneles financieros en tiempo real

- Detección de anomalías impulsada por IA

- Informes personalizables

- Previsión del flujo de caja

- Evaluación comparativa del rendimiento

Precios

- Individual (3B): $24,99/mes.

- Pareja (3B): $44,99/mes.

Ventajas

Contras

¿Qué es Expensify?

Bien, hablemos de Expensify.

Es una herramienta que te ayuda a realizar un seguimiento de todos tus negocio Gastos. Piensa en ello como un ayudante que recuerda a dónde va tu dinero.

Puede obtener información de tus recibos y datos bancarios. ¡Muy práctico!

Además, explora nuestros favoritos Alternativas a Expensify…

Beneficios clave

- La tecnología SmartScan escanea los detalles del recibo y los extrae con una precisión superior al 95%.

- Los empleados reciben el reembolso rápidamente, a menudo en tan solo un día hábil a través de ACH.

- La tarjeta Expensify puede ahorrarle hasta un 50% en su suscripción con su programa de devolución de efectivo.

- No se ofrece garantía; sus términos establecen que las responsabilidades son limitadas.

Precios

- Recolectar: $5/mes.

- Control: Precios personalizados.

Ventajas

Contras

Comparación de características

Esta comparación detallada resalta las diferencias fundamentales en el propósito entre Refreshme, una herramienta de finanzas personales, y Expensify, una plataforma profesional de gestión de gastos.

1. Servicio principal y público objetivo

- RefrescarmeEsta es una herramienta de finanzas personales diseñada para ayudar a las personas a realizar un seguimiento de sus transacciones y gastos. La clave del servicio es brindar un plan de gestión financiera personalizado, ayudándoles a renovar sus hábitos financieros.

- ExpensificarEs una plataforma dedicada a la gestión de gastos para empresas y sus empleados. Su objetivo es agilizar el seguimiento de los gastos empresariales, desde su registro hasta su reembolso, lo que la convierte en un sistema vital para gerentes y... pequeña empresa propietarios.

2. Captura y registro de gastos

- RefrescarmePermite recopilar automáticamente información de tus cuentas bancarias y tarjetas de crédito. Es una herramienta sencilla para gestionar transacciones personales, con la posibilidad de crear categorías personalizadas para mantenerte organizado.

- ExpensificarExpensify destaca por su tecnología SmartScan: la captura de gastos. Puedes tomar una foto de un recibo y el sistema extraerá automáticamente los detalles, eliminando así la necesidad de realizar el pago manualmente. datos Entrada. También puedes registrar el kilometraje de los proyectos directamente desde la aplicación.

3. Aprobación y reembolso

- RefrescarmeCarece de funciones para la aprobación formal de gastos o el reembolso, ya que no es una herramienta orientada a empresas. Su propósito es ayudarle a realizar un seguimiento de sus transacciones personales.

- ExpensificarEstá diseñado para esto. Ofrece un sólido flujo de trabajo de aprobación donde un gerente puede revisar y aprobar informes de gastos en tiempo real y con gran detalle. El sistema está diseñado para reembolsar a empleados y contratistas rápidamente mediante pagos automatizados.

4. Informes de gastos

- RefrescarmeProporciona informes detallados sobre tus hábitos de gasto para ayudarte a actualizar tu presupuesto y enfoque financiero. El contenido está diseñado para darte una idea de adónde va tu dinero.

- ExpensificarLe ayuda a presentar informes de gastos al vincular automáticamente los recibos con las transacciones. Expensify facilita el envío a todos los empleados y la revisión de un gerente, lo que ayuda a la empresa a cumplir con las normativas.

5. Automatización e IA

- Refrescarme:Utiliza IA para brindar un tratamiento personalizado a tus finanzas y ofrece consejos para mejorar tus gastos. automatización Está diseñado para la gestión del dinero personal.

- ExpensificarSus funciones de automatización son muy avanzadas. El sistema utiliza IA para categorizar automáticamente los gastos, detectar infracciones de políticas y vincular las transacciones con los recibos, lo que ayuda enormemente a los gerentes a ahorrar tiempo y esfuerzo.

6. Interfaz de usuario y usabilidad

- RefrescarmeLa interfaz de usuario es sencilla y muy intuitiva, lo que facilita el acceso y la revisión de las finanzas de cualquier persona. Esta simplicidad es una parte clave de su atractivo.

- ExpensificarExpensify facilita la gestión de gastos con una interfaz clara. Está diseñado para simplificar un sistema complejo y agilizar y facilitar la elaboración de informes de gastos.

7. Integraciones y ecosistema

- RefrescarmeEs un sistema independiente que se conecta a su cuenta bancaria y tarjetas de crédito. No se integra con software de contabilidad empresarial como... QuickBooks.

- Expensificar:Se integra perfectamente con los principales contabilidad Las plataformas, como QuickBooks, suelen destacar su robusta conexión para facilitar la conciliación. Esto permite a las empresas exportar datos directamente a su sistema contable.

8. Seguridad y privacidad

- RefrescarmePrioriza la seguridad y la privacidad. La plataforma utiliza un protocolo de seguridad avanzado para proteger tu información y ofrece funciones como monitoreo de la dark web y protección contra el robo de identidad.

- ExpensificarTambién cuenta con sólidos protocolos de seguridad. Su sistema está diseñado para proteger los datos empresariales y un gerente puede establecer permisos para acceder a los informes de gastos.

9. Costo y opciones de pago

- RefrescameOfrece varios planes asequibles para personas, parejas y familias. Los precios son transparentes y están diseñados para que puedas administrar tus finanzas de forma económica.

- ExpensificarOfrece un modelo de precios flexible con planes para un número reducido de usuarios y organizaciones más grandes. La tarjeta Expensify ofrece beneficios y descuentos adicionales, y la plataforma facilita los pagos y reembolsos.

¿Qué buscar en un software de contabilidad?

- Escalabilidad¿Puede el sistema cambiar con sus clientes? Las tarifas de licencia de QuickBooks Desktop podrían obligarle a cancelar antes de que los datos de su negocio se expandan. Si un proceso de órdenes de compra falla, el sistema debe actualizarse para resolver el problema de inmediato.

- Apoyo¿Qué tipo de ayuda hay disponible si tiene preguntas? Las reseñas pueden ofrecer información sobre si su equipo de soporte puede resolver errores complejos de conciliación. Necesita un representante en vivo que responda a sus solicitudes cuando una transacción está bloqueada por un código de seguridad.

- Facilidad de uso¿Es algo que usted y su equipo pueden aprender rápidamente? Expensify facilita ingresar una foto y registrar el kilometraje desde su bolsillo, pero la versión de escritorio de QuickBooks puede ser más difícil de dominar para un gerente nuevo.

- Necesidades específicas¿Gestiona las actividades únicas de su negocio? ¿El trato a los clientes varía según su edad? ¿El software gestiona los gastos de un número reducido de usuarios y permite el seguimiento de proveedores y clientes mediante etiquetas?

- Seguridad¿Qué tan seguros están tus datos financieros con este software? La seguridad se actualiza constantemente. La tarjeta Expensify ofrece seguridad en tiempo real, pero siempre debes revisar los datos almacenados. La diferencia es evidente: las interfaces sencillas tienen menos probabilidades de fallar que las complejas y ayudan a los empleadores a aprobar solicitudes para gestionar gastos.

Al recibir las últimas reseñas de Expensify, los servicios deben ser perfectos y analizar el comportamiento del usuario durante períodos más largos, teniendo en cuenta cómo las cookies a veces fallaron en casos más antiguos.

La configuración debería tardar unos segundos en la página prevista, lo que permitirá a los empleadores activar una incorporación rápida, ya que los usuarios desean tener acceso a un producto perfecto de inmediato.

Veredicto final

Entonces, ¿cuál gana: RefreshMe o Expensify?

Después de analizar todo, nuestra elección depende de lo que necesites.

Si usted es una empresa que busca gestionar gastos de empleados, facturas e informes financieros complejos.

Expensify es probablemente su mejor opción.

Está diseñado para equipos más grandes y necesidades comerciales detalladas. Es más simple y excelente para el seguimiento del dinero personal.

Probamos ambos y entendemos sus puntos fuertes.

Elige el que mejor se adapte a tu vida o negocio.

Más de Refreshme

- Refréscame vs Puzzle IO: Este software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Refrescarme vs Dext: Esta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Refrescarme vs Xero: Este es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Refrescarme vs Synder: Esta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Refrescarme vs Fin de mes fácil: Esta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Refrescarme vs Docyt: Este utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Refrescarme vs Sage: Esta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Refrescarme vs Zoho Books: Esta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Refrescarme vs Wave: Este software de contabilidad es gratuito para pequeñas empresas. Su versión está diseñada para particulares.

- Refrescarme vs Quicken: Ambas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- Refrescarme vs Hubdoc: Se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Refrescarme vs. Expensify: Esta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Refrescarme vs QuickBooks: Este es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Actualizarme vs Entrada automática: Está diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Refrescarme vs FreshBooks: Este es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Refrescarme vs NetSuite: Esta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Más de Expensify

- Expensify vs PuzzleEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Expensify frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Expensify frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Expensify vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Expensify frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Expensify frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Expensify frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Expensify frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Expensify frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Expensify vs. AutoEntryEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Expensify frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Expensify frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Es RefreshMe bueno para las pequeñas empresas?

RefreshMe es ideal para uso personal y presupuestos. Ayuda a las personas a controlar sus gastos y planificar sus finanzas fácilmente. pequeñas empresasExpensify podría ser una mejor opción debido a sus funciones para gastos de equipo y facturación.

¿Expensify también puede rastrear gastos personales?

Sí, Expensify permite el seguimiento de gastos personales. Sin embargo, su diseño principal y sus funciones más destacadas están orientadas a los informes de gastos empresariales y la gestión de equipos. Podría ser más complejo de lo necesario para uso personal.

¿Qué herramienta es más barata entre RefreshMe vs Expensify?

Los precios pueden variar. Generalmente, RefreshMe ofrece planes más sencillos, a menudo con un plan gratuito para uso básico. Expensify suele tener precios más complejos según las características y el número de usuarios, orientados a empresas.

¿Ambas aplicaciones se conectan a mi banco?

Sí, tanto RefreshMe como Expensify pueden conectarse a tus cuentas bancarias. Esto les permite recopilar automáticamente tus datos de gastos, lo que facilita y agiliza el seguimiento de tus gastos.

¿Puedo usar estas aplicaciones en mi teléfono?

¡Por supuesto! Tanto RefreshMe como Expensify tienen aplicaciones móviles. Puedes usarlas en tu smartphone o tablet. Esto significa que puedes administrar tu dinero y tus gastos dondequiera que estés.