¿Tiene dificultades para mantener sus finanzas organizadas?

Muchas personas se sienten abrumadas por recibos, extractos bancarios y la interminable tarea de datos entrada.

Aquí es donde entra en juego el software financiero, que promete: hacer las cosas más fáciles.

Pero con tantas opciones, ¿cómo elegir la correcta?

Vamos a sumergirnos en una comparación clave: Quicken vs AutoEntry.

Descripción general

Analizamos tanto Quicken como AutoEntry muy de cerca.

We used them ourselves to see how they work.

Esto nos ayudó a comprender sus fortalezas y debilidades en las tareas financieras cotidianas.

¿Quieres controlar tus finanzas? Con Quicken, puedes conectarte con miles de instituciones financieras. ¡Explora la plataforma para saber más!

Precios: Tiene una prueba gratuita. El plan premium cuesta $5.59 al mes.

Características principales:

- Herramientas de presupuestación

- Gestión de facturas

- Seguimiento de inversiones

Deje de perder más de 10 horas semanales ingresando datos manualmente. Vea cómo Autoentry redujo el tiempo de procesamiento de facturas en un 40 %. Sabio usuarios.

Precios: Tiene una prueba gratuita. El plan de pago cuesta desde $12 al mes.

Características principales:

- Extracción de datos

- Escaneo de recibos

- Automatización de proveedores

¿Qué es Quicken?

Entonces, ¿te estás preguntando acerca de Quicken?

Es como una herramienta que te ayuda a ver todo tu dinero en un solo lugar.

Piense en ello como su organizador de dinero digital.

Puede ayudarle a realizar un seguimiento de sus cuentas bancarias, facturas e incluso inversiones.

Bastante útil, ¿verdad?

Además, explora nuestros favoritos Alternativas de Quicken…

Beneficios clave

Quicken es una herramienta poderosa para poner en orden tu vida financiera.

Cuentan con más de 40 años de experiencia y han sido un producto número 1 en ventas.

Sus diversos planes pueden conectarse con más de 14.500 instituciones financieras.

También puede obtener una garantía de devolución de dinero de 30 días para probarlo sin riesgos.

- Se conecta con miles de bancos y tarjetas de crédito.

- Crea presupuestos detallados.

- Realiza un seguimiento de las inversiones y el patrimonio neto.

- Ofrece herramientas de planificación de la jubilación.

Precios

- Quicken Simplifi: $2,99/mes.

Ventajas

Contras

¿Qué es AutoEntry?

Bien, hablemos de AutoEntry.

Es una herramienta que te ayuda a ingresar tu documentación en tu computadora sin tener que escribir todo tú mismo.

Piense en ello como un ayudante inteligente para sus facturas y recibos.

Los lee y coloca la información donde debe ir.

Además, explora nuestros favoritos Alternativas de entrada automática…

Nuestra opinión

¿Listo para reducir tu tiempo de contabilidad? AutoEntry procesa más de 28 millones de documentos al año y ofrece una precisión de hasta el 99 %. ¡Empieza hoy y únete a las más de 210 000 empresas de todo el mundo que han reducido sus horas de entrada de datos hasta en un 80 %!

Beneficios clave

La mayor ventaja de AutoEntry es ahorrar horas de trabajo aburrido.

Los usuarios a menudo ven hasta un 80% menos de tiempo dedicado a la entrada manual de datos.

Promete hasta un 99% de precisión en la extracción de datos.

AutoEntry no ofrece una garantía de devolución de dinero específica, pero sus planes mensuales le permiten cancelar en cualquier momento.

- Hasta un 99% de precisión en los datos.

- Usuarios ilimitados en todos los planes pagos.

- Extrae artículos de línea completos de las facturas.

- Aplicación móvil sencilla para tomar fotografías de recibos.

- 90 días para que los créditos no utilizados se transfieran.

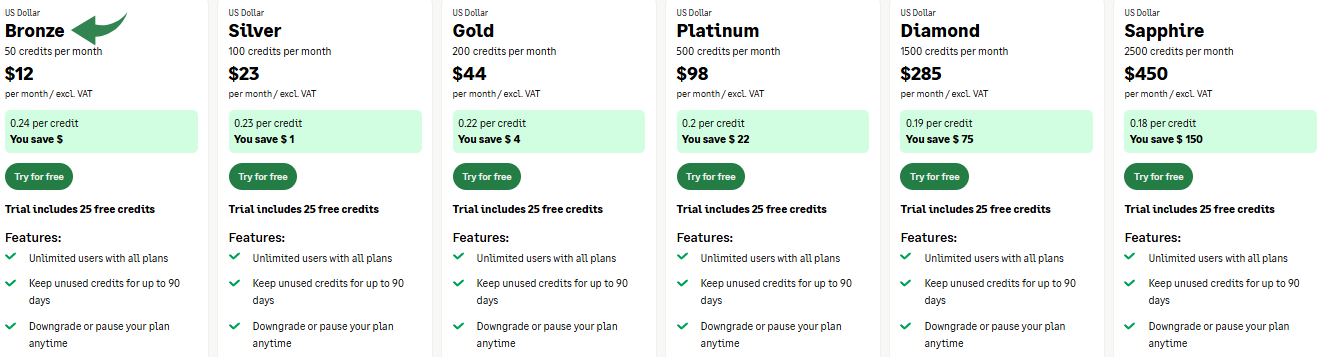

Precios

- Bronce:$12/mes.

- Plata:$23/mes.

- Oro:$44/mes.

- Platino:$98/mes.

- Diamante:$285/mes.

- Zafiro:$450/mes.

Ventajas

Contras

Comparación de características

Elegir entre contabilidad Las versiones de software pueden ser un desafío.

Esta comparación de Quicken vs AutoEntry le ayudará a evaluar qué funcionalidad y características clave de la plataforma se alinean con las necesidades personales de su negocio.

Revisaremos cada uno para ver cuál proporciona el mejor valor y control para su gestión financiera.

1. Propósito principal y funcionalidad

- Acelerar Software ha sido una marca confiable de software de finanzas personales durante décadas. Su propósito es ayudar a los usuarios a gestionar su panorama financiero completo, desde la elaboración de presupuestos hasta la supervisión de cuentas de inversión y la planificación de la jubilación.

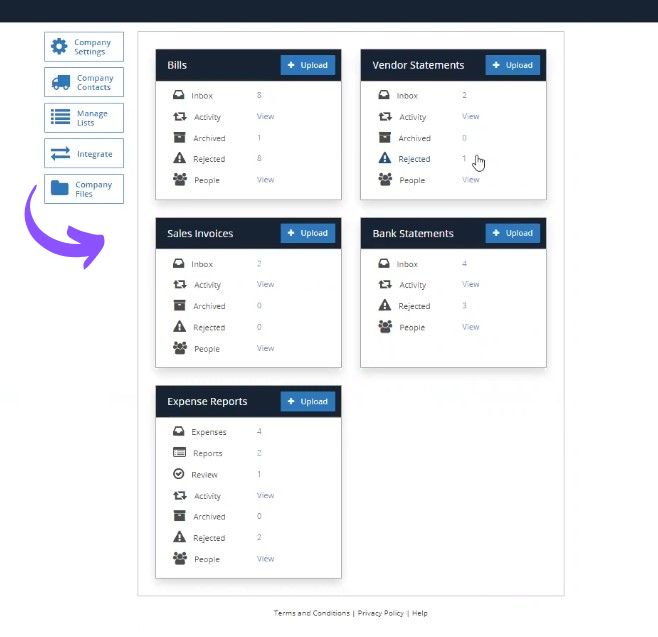

- Entrada automática es una alternativa moderna que se especializa en la captura de datos y no es una plataforma de contabilidad completa.

2. Captura de datos y automatización

- AutoEntry utiliza reconocimiento óptico de caracteres para extraer datos de documentos financieros, como facturas de compra o recibos. Puede capturar documentos mediante una aplicación móvil o correo electrónico.

- Las revisiones del software por parte de los clientes muestran que ahorra mucho tiempo dedicado a cualquier tipo de ingreso manual de datos, pero el costo depende del uso de créditos.

3. Longevidad y propiedad

- Acelerar Lleva décadas en el mercado. La marca fue adquirida por Aquiline Capital Partners, un detalle que vale la pena destacar, ya que influirá en el desarrollo futuro del software.

- Entrada automática Las revisiones muestran que es un producto más nuevo y más especializado y una buena opción para evaluar si su objetivo principal es reducir el tiempo dedicado a la entrada de datos.

4. Finanzas empresariales y personales

- Acelerar Business es una aplicación de escritorio para Windows o Impermeable que permite a los usuarios crear facturas y administrar sus finanzas personales y empresariales en un solo lugar.

- Entradas automáticas El enfoque está en la racionalización teneduría de libros para empresas mediante la publicación automática de datos en plataformas como QuickBooks.

5. Seguridad y acceso a los datos

- Una solución de seguridad es crucial para proteger sus documentos financieros. Ambas plataformas se toman muy en serio la seguridad de los datos. Por ejemplo, a veces un servicio de seguridad para protegerse contra ataques en línea bloqueará una acción que acaba de realizar.

- Esto podría activar una alerta con un ID de rayo de Cloudflare encontrado, lo que indica un bloqueo que incluye el envío de una determinada palabra o frase, un comando SQL o datos mal formados, y es posible que no pueda acceder a la página.

6. Gestión de las finanzas

- Acelerar Ofrece una plataforma integral para gestionar todos los aspectos de sus finanzas, desde el control de sus inversiones hasta el seguimiento de sus gastos. Es un líder consolidado en el mercado y ofrece diversas alternativas para diferentes casos de uso.

- Entradas automáticas La gestión es específicamente para extraer y publicar datos, no para un análisis financiero completo.

7. Integraciones

- El Acelerar La marca es una plataforma independiente, pero puede conectarse con miles de instituciones financieras.

- Entradas automáticas El valor proviene de su perfecta integración con otras plataformas de contabilidad como QuickBooks, eliminando la necesidad de iniciar sesión en varias aplicaciones diferentes para procesar sus facturas de compra y otros documentos financieros.

8. Accesibilidad y Plataforma

- Acelerar Es principalmente una descarga de escritorio para Windows o Mac, con una aplicación móvil para monitoreo.

- Entrada automática Es un servicio en la nube, por lo que puedes acceder a tus datos desde cualquier teléfono móvil o computadora. Al iniciar un negocio, a menudo se requiere acceso móvil para controlar gastos y ventas.

9. Precios y planes

- El Acelerar La marca ofrece diferentes versiones, como Quicken Deluxe, Quicken Premier y Quicken Business, con precios basados en la suscripción.

- El Entrada automática El modelo de precios es un plan flexible basado en un sistema de créditos para usuarios ilimitados. Esto te permite comprar solo lo que necesitas y te da control sobre tus gastos.

¿Qué buscar en un software de contabilidad?

Aquí hay algunas cosas adicionales que debes tener en cuenta:

- Escalabilidad¿Puede la herramienta específica crecer con su negocio? Al principio, es posible que solo necesite un seguimiento básico de facturas, pero a medida que las finanzas de su negocio crezcan, sus necesidades cambiarán. Busque planes con diferentes niveles y considere el costo mensual. Por ejemplo, Quicken tiene diferentes versiones, desde Quicken Home hasta planes con más funciones que pueden gestionar alquiler Propiedades y flujos de ingresos complejos. Debe evaluar la estructura de precios para garantizar que el software pueda escalar sin requerir un esfuerzo excesivo ni un cambio completo del sistema.

- Apoyo¿Qué tipo de ayuda está disponible si tiene preguntas? Una buena atención al cliente es invaluable. El software debe contar con recursos accesibles para ayudarle a resolver problemas. Esto incluye una base de conocimientos o la posibilidad de contactar por correo electrónico al propietario del sitio o al equipo de soporte. Consulte una reseña reciente de Quicken para ver qué opinan los usuarios sobre su experiencia con el soporte. Saber que un equipo está disponible para ayudarle es crucial para el buen funcionamiento de su negocio.

- Facilidad de uso¿Es algo que usted y su equipo pueden aprender rápidamente? La interfaz de usuario es clave para la adopción. Una interfaz optimizada e intuitiva reduce la curva de aprendizaje para usted y su equipo. Quiere centrarse en las finanzas de su empresa, no en comprender un software complejo. Busque un diseño claro que facilite el registro de transacciones y la búsqueda rápida de partidas específicas.

- Necesidades específicas¿Gestiona las funciones específicas de su negocio? Asegúrese de que el software sea compatible con sus transacciones específicas, como los pagos a proveedores o el seguimiento de los ingresos de las propiedades en alquiler. Esto incluye la facilidad con la que gestiona diferentes tipos de ingresos y gastos. Elegir la herramienta adecuada entre las alternativas disponibles en el mercado le ahorrará tiempo y frustraciones a largo plazo.

- Seguridad¿Qué tan seguros están sus datos financieros con este software? La seguridad de los datos es primordial. Todo software debe protegerse de las amenazas en línea, a menudo utilizando un servicio de seguridad para proteger las cuentas de usuario. Tenga en cuenta que, a veces, una acción perfectamente legítima que acaba de realizar podría activar este bloqueo del sistema de seguridad, especialmente al ingresar información financiera específica. Si está bloqueado, verá un mensaje indicando que se ha activado la solución de seguridad, que a menudo proporciona su dirección IP. Por eso, debe tener una forma de contactar rápidamente al propietario del sitio para informarle y resolver el problema. El software también debe detallar las diversas acciones que podrían activar un bloqueo de seguridad, incluido el envío de datos inusuales, para evitar que se le bloquee innecesariamente.

Veredicto final

Entonces, ¿cuál es mejor: Quicken o AutoEntry?

Realmente depende de lo que necesites.

Si desea que un solo programa gestione todo su dinero personal, Quicken es su mejor opción.

Elabora presupuestos y da seguimiento a las inversiones. Ofrece un panorama financiero completo.

Sin embargo, si su necesidad principal es simplemente introducir información de los recibos en otros contabilidad software, AutoEntry es el especialista.

Es ideal para ese trabajo específico. Hemos usado ambos. Sabemos que ayudan a diferentes personas.

¡Elige el que resuelva tu mayor problema de dinero!

Más de Quicken

- Quicken vs. PuzzleEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Quicken frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Quicken frente a Xero:Esto es popular en línea. software de contabilidad Para pequeñas empresas. Su competidor es para uso personal.

- Quicken frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Quicken vs. Easy Month EndEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Quicken frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Quicken frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Quicken frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Quicken frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Quicken frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Quicken frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Quicken frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Quicken frente a AutoEntryEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Quicken frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Quicken frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Más de AutoEntry

- Entrada automática vs. RompecabezasEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Entrada automática frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Entrada automática frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Entrada automática frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Entrada automática vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Entrada automática frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Entrada automática vs. SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Entrada automática frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Entrada automática vs. WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Entrada automática frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- Entrada automática frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Entrada automática vs. ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Entrada automática frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Entrada automática frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Entrada automática frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Cuál es la principal diferencia entre Quicken y AutoEntry?

Quicken es un gestor completo de finanzas personales para presupuestos e inversiones. AutoEntry se centra en la extracción de datos de documentos como recibos. Ayuda a agilizar la introducción de información en otros programas de contabilidad.

¿Puede AutoEntry reemplazar programas como Hubdoc o Dext?

Sí, AutoEntry es un competidor directo de servicios como Hubdoc y Dext. Todas estas herramientas tienen como objetivo automatizar el proceso de convertir documentos físicos en datos digitales para la contabilidad. Todas ayudan con automatización.

¿Es Quicken bueno para la categorización de gastos de pequeñas empresas?

Quicken puede ayudar con la categorización básica para pequeña empresa Gastos. Sin embargo, para fines contables e impositivos empresariales más avanzados, un software de contabilidad especializado podría ser más adecuado, a menudo compatible con herramientas como AutoEntry.

¿Cómo ayuda AutoEntry a mi flujo de trabajo contable?

AutoEntry mejora tu flujo de trabajo al reducir la entrada manual de datos. Subes documentos y AutoEntry extrae la información clave. Estos datos se sincronizan directamente con tu software de contabilidad, ahorrando tiempo y reduciendo errores.

¿AutoEntry ofrece potentes funciones de automatización?

Sí, AutoEntry está diseñado para la automatización. Utiliza tecnología inteligente para leer y procesar facturas y recibos rápidamente. Esto permite una extracción de datos eficiente y ayuda a automatizar la transferencia de información financiera.