Elegir lo correcto software de contabilidad feels like a huge task.

¿Qué pasa si tú? hacer the wrong choice?

A bad fit can cause real headaches.

You might waste precious time, miss tracking important expenses, or mess up your books.

That’s where we come in. We’re looking at two popular names: Puzzle IO vs Expensify.

Descripción general

Through rigorous feature-by-feature analysis and hands-on testing of core functionalities like receipt scanning and report generation.

¿Listo para simplificar tus finanzas? Descubre cómo Puzzle IO puede ahorrarte hasta 20 horas al mes. Experimenta la diferencia.

Precios: Plan gratuito disponible. El plan de pago cuesta desde $42.50 al mes.

Características principales:

- Planificación financiera

- Pronóstico

- Análisis en tiempo real

Únase a más de 15 millones de usuarios que confían en Expensify para simplificar sus finanzas. Ahorre hasta un 83 % en tiempo dedicado a informes de gastos.

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $5 al mes.

Características principales:

- Captura de recibos SmartScan

- Conciliación de tarjetas corporativas

- Flujos de trabajo de aprobación avanzados.

¿Qué es Puzzle IO?

Hey, so Puzzle IO, right? It’s an expense management tool.

It seems pretty focused on project costs. Good for keeping tabs on budgets.

Además, explora nuestros favoritos Alternativas a Puzzle IO…

Nuestra opinión

¿Listo para simplificar tus finanzas? Descubre cómo Puzzle io puede ahorrarte hasta 20 horas al mes. ¡Descubre la diferencia hoy mismo!

Beneficios clave

Puzzle IO realmente brilla cuando se trata de ayudarle a comprender hacia dónde se dirige su negocio.

- 92% de Los usuarios informan de una mayor precisión en las previsiones financieras.

- Obtenga información en tiempo real sobre su flujo de caja.

- Cree fácilmente diferentes escenarios financieros para planificar.

- Colabore sin problemas con su equipo en los objetivos financieros.

- Realice un seguimiento de los indicadores clave de rendimiento (KPI) en un solo lugar.

Precios

- Conceptos básicos de contabilidad: $0/mes.

- Perspectivas de contabilidad Plus: $42.50/mes.

- Contabilidad más automatización avanzada: $85/mes.

- Escala de Contabilidad Plus: $255/mes.

Ventajas

Contras

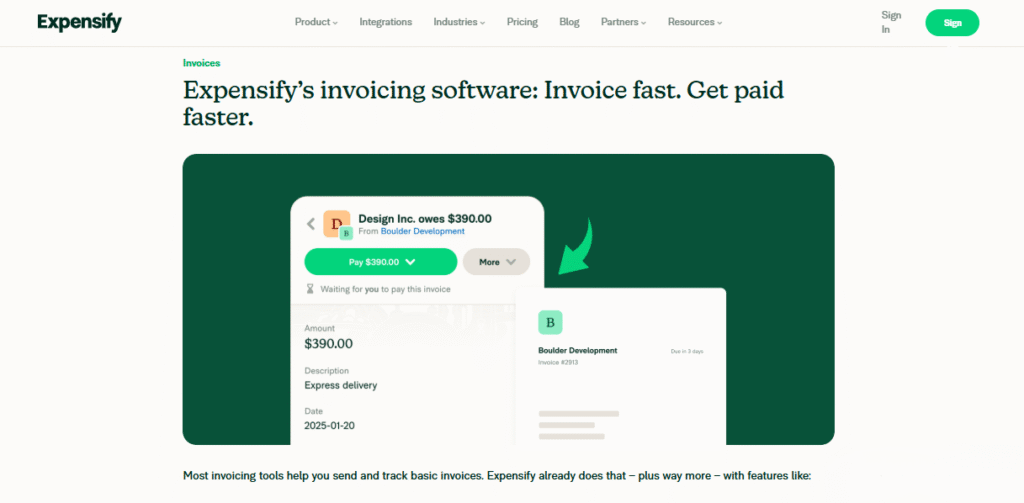

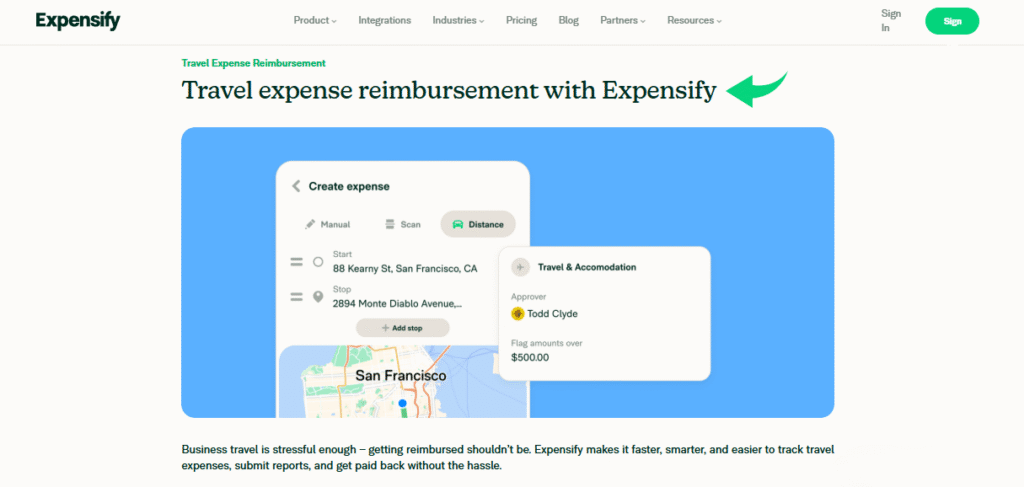

¿Qué es Expensify?

Okay, so Expensify is another option.

It feels really strong on receipt handling. Their SmartScan seems pretty slick.

Good if you deal with lots of individual expenses.

Además, explora nuestros favoritos Alternativas a Expensify…

Beneficios clave

- La tecnología SmartScan escanea los detalles del recibo y los extrae con una precisión superior al 95%.

- Los empleados reciben el reembolso rápidamente, a menudo en tan solo un día hábil a través de ACH.

- La tarjeta Expensify puede ahorrarle hasta un 50% en su suscripción con su programa de devolución de efectivo.

- No se ofrece garantía; sus términos establecen que las responsabilidades son limitadas.

Precios

- Recolectar: $5/mes.

- Control: Precios personalizados.

Ventajas

Contras

Comparación de características

Navigating pequeña empresa finances can be challenging.

This comparison highlights key features of Puzzle IO and Expensify.

Examining how each platform addresses teneduría de libros, expense reports, and automation to help you simplify financial management.

1. Core Audience & Focus

- Rompecabezas IO is a game-changer built for early-stage startups and co-founder teams, focusing on up-to-date financial statements and key metrics right out of the box.

- Expensificar focuses on an efficient expense management process for employees and contractors, making it easy for them to file and for employers to reimburse.

2. Automated Bookkeeping

- Rompecabezas IO is designed for autónomo bookkeeping, using AI to automate tedious tasks and provide an accurate picture of the current state of the company quickly.

- Expensificar automatización is concentrated on receipts and expense report creation, aiming to simplify the process for the user and their manager’s approval.

3. Startup Financial Health Metrics

- Rompecabezas IO provides startup founders with instant access to key metrics like cash pista, burn rate, and MRR, offering clear insights into their financial health.

- Expensificar focuses on spending, helping companies control spending and reconcile the Expensify Card, but does not natively provide comprehensive startup metrics.

4. Complex Accrual Accounting

- Rompecabezas IO includes built-in accrual automation to handle complex items like revenue recognition and prepaid expenses automatically, which is vital for providing a true and accurate picture of revenue.

- Expensificar does not focus on the underlying accrual contabilidad logic for things like fixed assets and deferred revenue; its strength is expense capture.

5. Expense Reporting Experience

- Rompecabezas IO permite for transaction categorization and expense tracking, but does not specialize in complex, multi-level expense management processes and reimbursement workflows.

- Expensificar makes it easy for the team to log mileage, snap a photo of a receipt in a few seconds, and get reimbursed quickly, which is a game-changer for employees.

6. AI-Powered Functionality

- Rompecabezas IO uses AI for smart transaction categorization, continuous accuracy checks, and streamlining the setup for non-accountants.

- Expensificar uses its SmartScan technology for receipt datos extraction and AI-powered automation to match transactions, making the process less time-consuming.

7. Focus on Financial Statements

- Rompecabezas IO’s primary goal is to generate real-time, audit-ready financial statements, helping startup founders stay up to date and prepare for investors or tax time.

- Expensificar is a pre-accounting tool that passes expense data to other tools like QuickBooks or Xero for final statement generation by a finance expert.

8. Corporate Card Management

- Rompecabezas IO integrates with various cards, focusing on getting data into the books quickly.

- Expensificar offers the Expensify Card, which links seamlessly to its system, automates reconciliation, and allows employers to set smart spending limits.

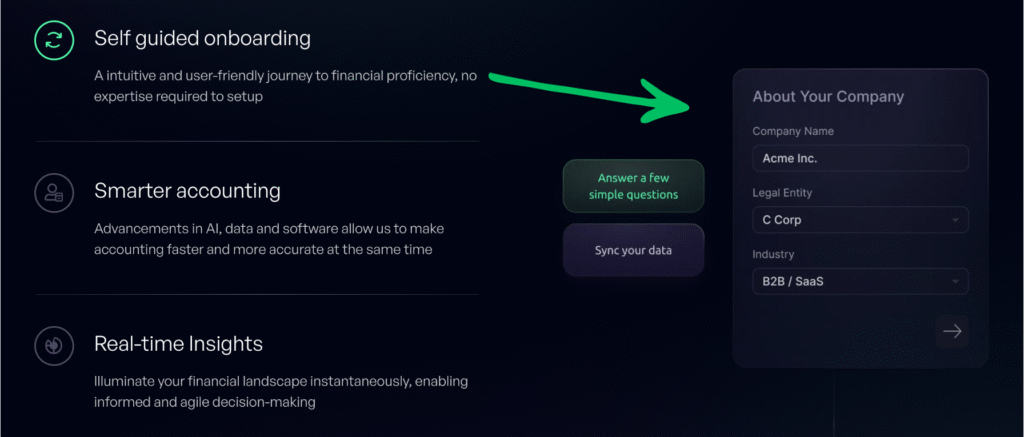

9. Ease of Setup

- Rompecabezas IO ofertas an easy setup and a modern interface, minimizing errors and making it simple for the co founder who may be a non contadores.

- Expensificar also offers a quick and easy setup for the expense management process, which helps employees and contractors submit expenses and reports in less time.

¿Qué tener en cuenta al elegir un software de contabilidad?

- Look beyond basic Expensify reviews to see how the software handles the complete general ledger and organization.

- The software needs a reliable connection to your bank accounts to avoid manual data entry and reduce errors.

- Ensure the platform gives you a clear cash runway and not just a summary of past data—don’t wait for insights.

- The ability to manage expenses must be flexible, supporting phone, desktop, and web access.

- Check the speed of completing reports and the ease of exporting data to your clients or accountant.

- It should allow users to create and submit requests immediately, and managers to approve them quickly.

- The system must reliably respond to inputs and not be blocked by simple issues.

- All financial details should be securely stored in a digital pocket for easy review.

- The software should offer automated code assignment and customizable categories and tags.

- Your final thoughts should confirm that the system can scale with your future organization, moving you away from spreadsheets.

- A key insight is whether the platform is structured for a small number of users or a growing organization.

- An efficient system should trigger notifications when action is expected, simplifying the single-view page workflow.

- Consider why others chose Puzzle or a similar full-stack tool over a pure expense manager.

Veredicto final

Picking between Puzzle IO and Expensify depends on your main needs.

Expensify is tops for expense reports and receipts.

But Puzzle IO does more for overall money tracking, invoices, and connecting with payroll (even like QuickBooks).

Both are cloud-based.

If you want a wider view of your negocio, money, and something that can grow.

Puzzle IO wins. We checked them out carefully.

So our advice should help you choose the right software to save time.

Neither doesn’t really offer free contabilidad for most businesses.

Más de Puzzle IO

Hemos comparado Puzzle IO con otras herramientas de contabilidad. Aquí tienes un vistazo rápido a sus características más destacadas:

- Puzzle IO frente a Xero: Xero ofrece amplias funciones de contabilidad con sólidas integraciones

- Rompecabezas IO contra Dext: Puzzle IO destaca por sus perspectivas y previsiones financieras basadas en IA.

- Puzzle IO contra Synder: Synder se destaca en la sincronización de datos de ventas y pagos.

- Puzzle IO vs. Easy Month End: Easy Month End simplifica el proceso de cierre financiero.

- Puzzle IO frente a Docyt: Docyt utiliza IA para automatizar tareas de contabilidad.

- Puzzle IO frente a RefreshMe: RefreshMe se centra en el seguimiento en tiempo real del rendimiento financiero.

- Puzzle IO contra Sage: Sage ofrece soluciones contables sólidas para empresas de distintos tamaños.

- Puzzle IO frente a Zoho Books: Zoho Books ofrece contabilidad asequible con CRM integración.

- Puzzle IO contra Wave: Wave ofrece software de contabilidad gratuito para pequeñas empresas.

- Puzzle IO frente a Quicken: Quicken es conocido por la gestión de finanzas personales y de pequeñas empresas.

- Rompecabezas IO contra Hubdoc: Hubdoc se especializa en recopilar documentos y extraer datos..

- Puzzle IO frente a Expensify: Expensify ofrece informes y gestión de gastos integrales.

- Puzzle IO frente a QuickBooks: QuickBooks es una opción popular para la contabilidad de pequeñas empresas.

- Puzzle IO vs. Entrada automática: AutoEntry automatiza la entrada de datos de facturas y recibos.

- Puzzle IO frente a FreshBooks: FreshBooks está diseñado para la facturación empresarial basada en servicios.

- Puzzle IO frente a NetSuite: NetSuite ofrece una suite integral para la planificación de recursos empresariales.

Más de Expensify

- Expensify vs PuzzleEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Expensify frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Expensify frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Expensify vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Expensify frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Expensify frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Expensify frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Expensify frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Expensify frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Expensify vs. AutoEntryEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Expensify frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Expensify frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

What key features should software for small businesses include?

Essential features are invoicing, expense tracking, bank reconciliation, and reportando to manage business finances effectively.

Can accounting software help with automation?

Yes, many platforms offer automation for tasks like data entry, bank feeds, and payment reminders, saving time.

Is there free accounting software suitable for small businesses?

Some free options exist with basic features, but they may lack advanced capabilities or scalability for growing businesses.

How can AI-powered features benefit small business accounting?

AI can automate categorization, detect anomalies, and provide insights, improving accuracy and efficiency in financial management.

Which type of accounting software is best for my small business?

The best software depends on your specific business needs, size, and complexity. Consider features, integrations, and scalability.