Feeling overwhelmed by small business accounting?

Choosing the best software can feel like navigating a maze.

Many entrepreneurs struggle with clunky interfaces, hidden fees, and features they don’t actually need.

But what if there was a solution that simplificado ¿todo?

What if your software de contabilidad was intuitive, affordable, and packed with the tools you actually use?

In this Wave Review, Best Pequeña empresa Accounting Software in 2025, we’ll dive deep into whether Wave is the answer you’ve been searching for.

Let’s explore its features and see if it truly lives up to the hype.

Más de 4 millones de pequeñas empresas confían en Wave para gestionar sus finanzas. Descubra por qué 88% de los usuarios afirman ahorrar una media de 5 horas al mes en teneduría de libros with Wave.

¿Qué es Wave?

Wave is a tool to help pequeña empresa owners manage their money.

It’s like having a digital notebook and calculator all in one place.

You can keep track of the money coming in and the money going out.

Think of it as a way to see how your negocio is doing financially without needing a fancy degree.

It helps you with things like sending bills to customers and keeping your income and expenses organized.

This makes it easier to understand your business’s money and hacer smart choices.

Who Created Wave?

Kirk Simpson y James Lochrie co-founded Wave in 2009 in Canada.

Their goal was simple: make money management easy for small businesses.

They envisioned a user-friendly, affordable tool, unlike the complex options available.

They wanted to empower entrepreneurs to understand their finances without being experts.

Wave has since grown to help millions globally.

Top Benefits of wave

Here are some key reasons why small businesses choose Wave:

- It’s Free for Core Features: One of the biggest draws is that many essential features, like income and expense tracking, invoicing, and basic contabilidad reports, are offered for free. This helps new businesses save money.

- Honeybook 与 Pipedrive 对比 Wave is designed to be simple and intuitive, even for people without an contabilidad background. The straightforward interface makes navigating your finances less complicated.

- Cloud-Based Accessibility: Because it’s online, you can access your wave datos from anywhere with an internet connection. This provides flexibility for business owners on the go.

- Integrated Invoicing: Creating and sending professional invoices to your customers is easy within Wave. You can also track payment statuses, helping you manage your cash flow effectively.

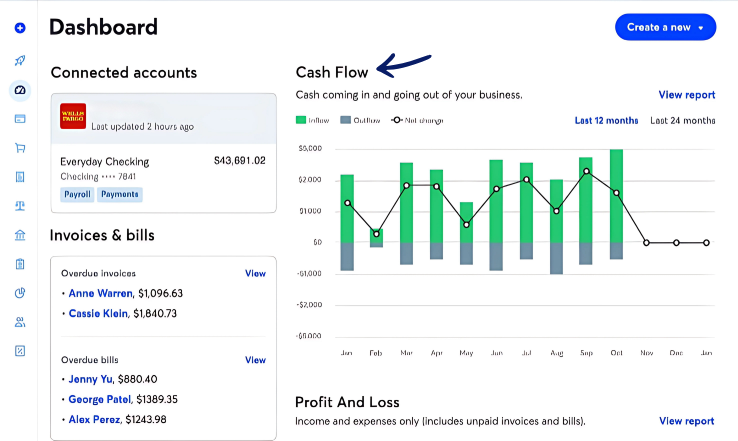

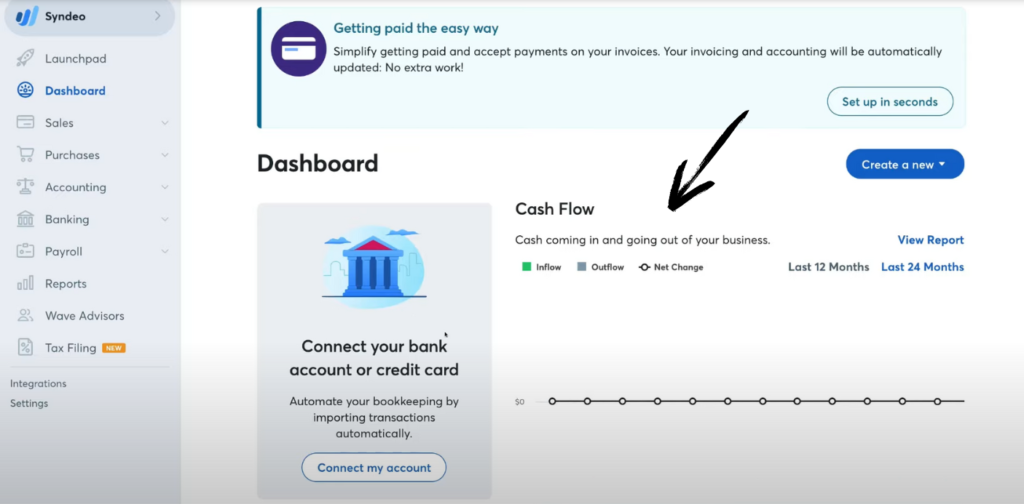

- Bank Connections: You can also connect your bank accounts and credit cards to Wave, which automatically pulls in your transactions. This saves time on manual data entry and helps keep your records accurate.

- Scalable Options: While the core features are free, Wave also offers paid add-ons like payroll and payment processing as your business grows and your needs become more complex.

- Good for Service-Based Businesses: Muchos trabajadores autónomos and service providers find Wave particularly well-suited for their needs, especially with its invoicing and expense-tracking capabilities.

Mejores características

Wave is a popular contabilidad software designed for small businesses and freelancers.

It’s known for its user-friendly tools that help you manage your money and get ready for tax time without a lot of stress.

Wave brings together features like invoicing, payments, and teneduría de libros into one place, making it easier to handle your finances.

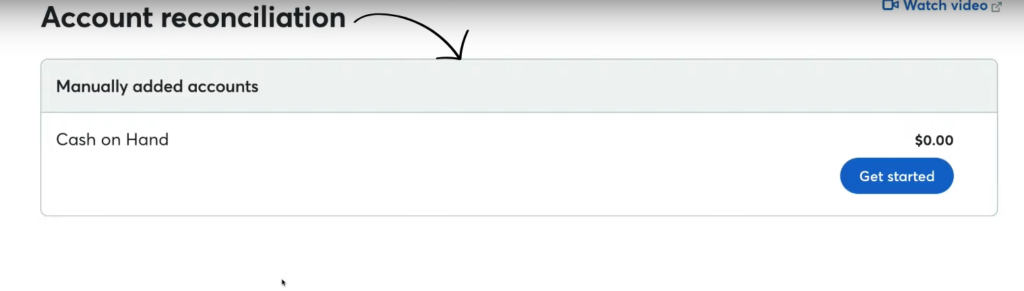

1. Account Reconciliation

This feature helps you make sure the money in your bank account matches what you have recorded in Wave.

It’s like checking your homework to make sure you didn’t miss anything. Wave can connect to your bank, which makes this process fast and easy.

It helps you catch mistakes and keep your books accurate.

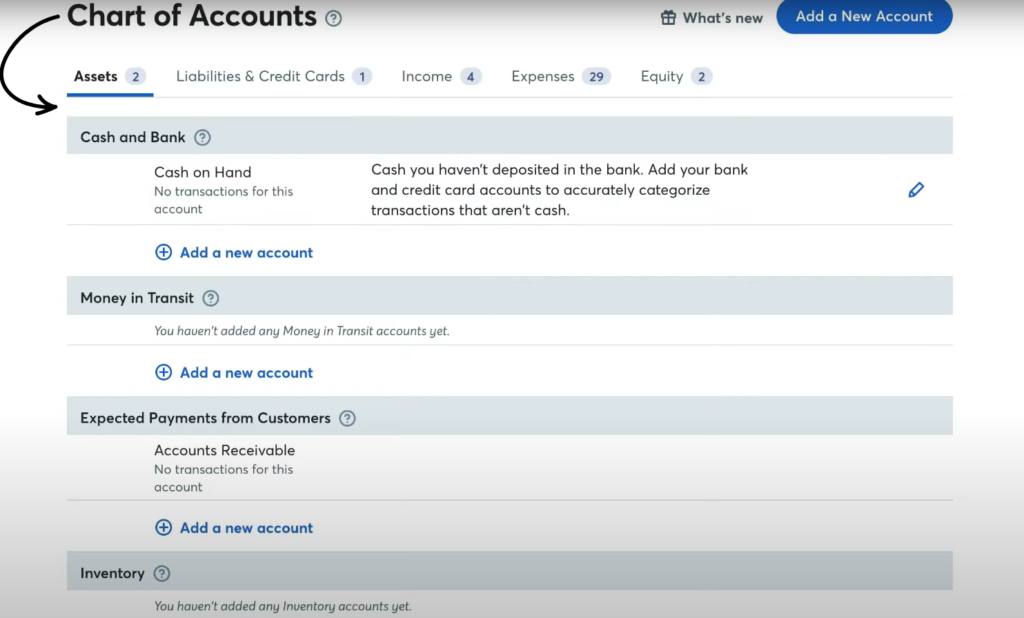

2. Charts of Accounts

Think of the charts of accounts as a list of all your business money categories.

Wave makes this list easy to read and understand.

It helps you see where your money is going and where it is coming from.

This is a key part of keeping good financial records.

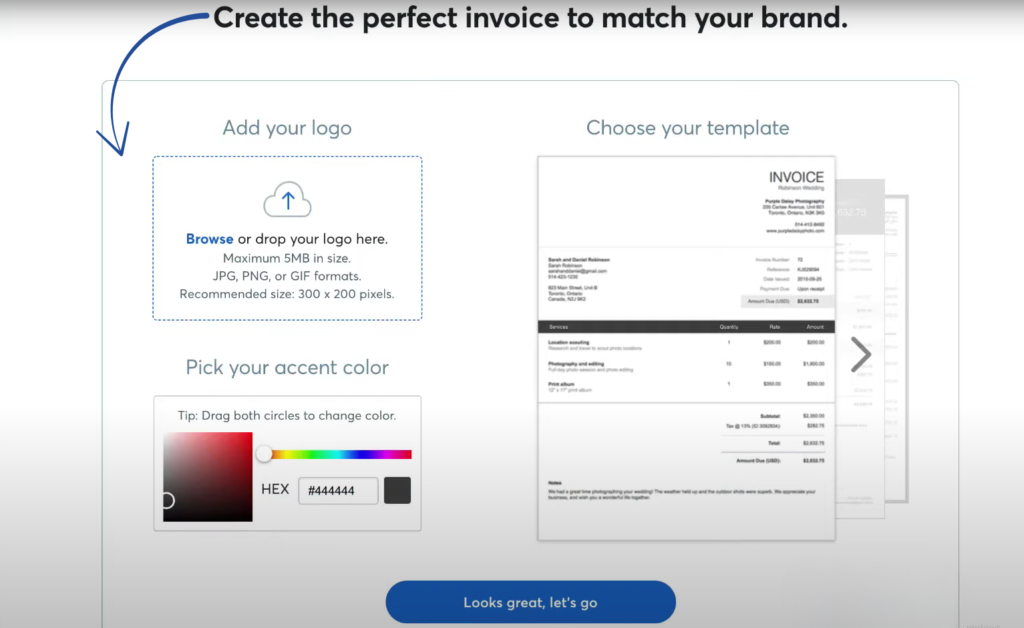

3. Invoices

Wave lets you create & send professional-looking invoices to your clients.

You can make them match your business by adding your logo and colors.

You can send them out quickly and even set up reminders to send to clients who are late on their payments.

This helps you get paid faster.

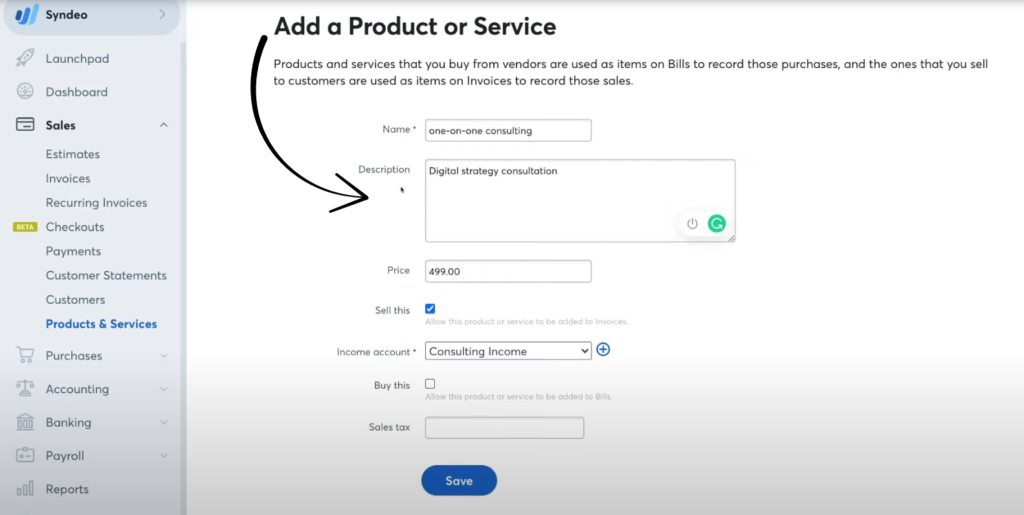

4. Products & Services

This feature lets you build a list of all the things you sell.

This could be a product you ship or a service you provide, like mowing a lawn.

By having this list, you can add items to your invoices with just a click.

This makes creating invoices much quicker and easier than typing everything out each time.

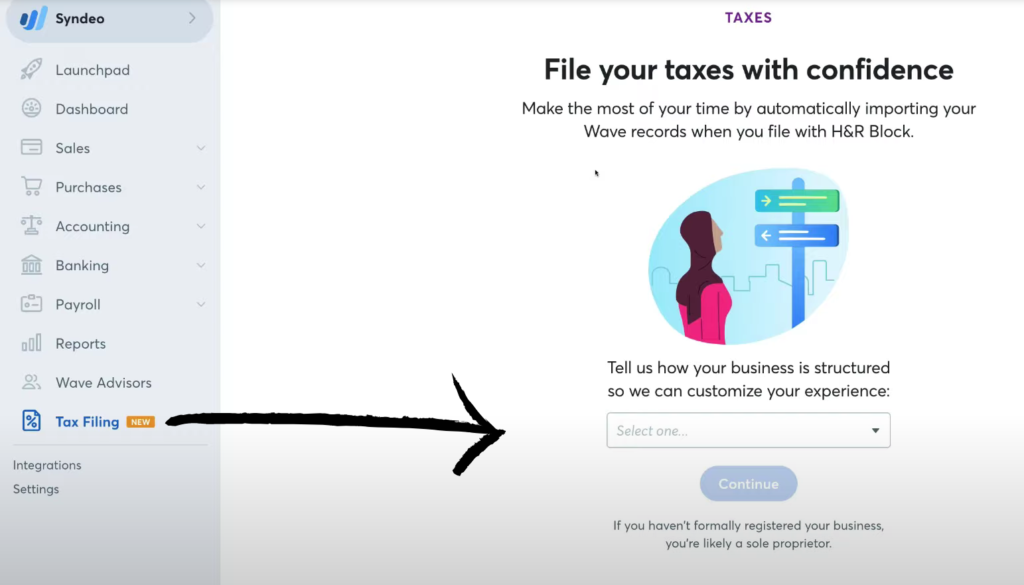

5. Tax Filing

Wave helps make tax season less of a headache.

The software organizes your income and expenses throughout the year.

It can also create important reports like a Profit and Loss statement, which your accountant needs to file your taxes.

With its payroll feature, Wave can even help with automatic tax payments and filings in some areas.

6. Expense Tracking

Wave makes it simple to keep track of every dollar you spend for your business.

You can connect all of your bank account & credit cards, and the program will automatically bring in your transactions.

This saves you from having to enter everything by hand.

You can even take pictures of your receipts with the mobile app to keep a digital record.

7. Financial Reporting

With Wave, you can easily create important reports that show you how your business is doing.

These reports can show you how much money you made, how much you spent, and your overall financial health.

They give you a clear picture of your business, so you can make smart decisions.

8. Mobile App

Wave has a mobile app that lets you handle your business finances on the go.

You can create invoices, track expenses, and see your financial reports from anywhere.

This is great for people who are always busy and don’t have time to sit at a desk.

9. Multi-Currency Support

If your business works with clients from other countries, this feature is very useful.

Wave can handle different types of money from all over the world.

This means you can create invoices and track payments in other currencies without any hassle.

It’s great for freelancers and businesses that have a global reach.

Precios

Here’s a simple look at Wave Accounting’s pricing:

| Nombre del plan | Precio | Características principales |

| Starter Plan | $0 | Create Unlimited estimates, invoices, bills and bookeeping records. |

| Pro plan | $19/mes | Auto import bank transactions, Auto merge and categories bank. |

Pros y contras

Understanding both the good & bad sides helps you decide if Wave fits your business needs.

Let’s explore its key advantages and potential drawbacks.

Ventajas

Contras

Alternatives of Wave

If Wave doesn’t quite meet your needs, here are a few Wave alternatives to consider:

- Rompecabezas IO: This software focuses on AI-powered financial planning.

- Bien: This tool is great for capturing documents and extracting data.

- Xero: This is a popular online accounting software for small businesses.

- Pecador: It specializes in syncing e-commerce and payment data with accounting software.

- Fin de mes fácil: This software is designed to streamline your month-end financial tasks.

- Docyt: It uses artificial intelligence for bookkeeping and automates financial workflows.

- Sabio: This is a comprehensive business and accounting software suite.

- Libros de Zoho: An online accounting tool, it is known for being affordable and great for small businesses.

- Quicken: A popular personal finance management tool that helps organize budgets.

- Hubdoc: It specializes in capturing and organizing financial documents for bookkeeping.

- Expensificar: This app is focused on expense management, making it easy to track and submit receipts.

- QuickBooks: A very well-known accounting software that helps businesses with everything from invoicing to payroll.

- AutoEntry: This tool automates data entry by scanning and analyzing documents like invoices and receipts.

- FreshBooks: This software is built specifically for freelancers & small businesses, with a focus on invoicing & time tracking.

- NetSuite: A powerful and complete cloud-based business management suite for larger companies.

Wave Compared

- Olas vs Puzzle IOEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Wave vs DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Wave vs XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave vs SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Fin de mes Wave vs EasyEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Wave vs DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Wave vs SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Wave vs Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave vs QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- Wave frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Wave vs ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Wave vs QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Onda vs. Entrada automáticaEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Wave vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Wave vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Personal Experience with Wave

Our team found Wave to be a great pequeña empresa accounting software.

We are pequeña empresa owners and loved that it had a free version.

The free contabilidad and free platform gave us a good start.

We could manage multiple companies and have multiple users on the account. The free starter plan helped us a lot.

It gave us all the basic contabilidad features we needed.

With the free version, we could send unlimited invoices and manage teneduría de libros records.

We could even accept online payments and get paid faster. The software made it easy for us to track our money.

It gave us payment reminders for our clients. We used the digital receipt capture feature to track our expenses.

Más tarde, we decided to get the paid pro plan.

We used payroll processing to pay our team.

- Small Business Accounting Software: Wave is a great tool for managing our business money.

- Free Accounting Software: It offers a lot of features at no cost.

- Versión gratuita: The basic plan is free and is very helpful.

- Unlimited Invoices: We could send as many invoices as we needed.

- Recurring Invoices: We set up bills to be sent automatically.

- Accept Online Payments: Clients could pay us easily with credit cards, Apple Pay, or bank payments.

- Payroll Processing: We could pay our employees and contractors.

- Direct Deposit: We paid our team instantáneamente.

- Digital Receipt Capture: We took pictures of receipts to track spending.

- Multiple Users: Our whole team could use the software together.

- Money Management Features: The software helped us track all our income and expenses.

- Billable Hours: We could track the time we spent on projects.

We could pay an active employee or an independent contractor paid with direct deposit. This gave our team giving peace of mind.

We also got a discounted rate for online payments. The two plans made it easy to choose what we needed.

We used the recurring billing feature for some clients.

Reflexiones finales

Based on this wave accounting review, we recommend wave.

This invoicing software is great for small business owners.

It has many free tools. It can track your spending with receipt scanning. Wave integrates with your bank.

This brings in transactions automatically. The paid plans offer more.

You can use wave payroll and send automated payment reminders.

You can also accept credit card payments.

With features like multi factor authentication and unlimited users, it’s a secure platform. Its help center is there to help you.

Wave is a great choice for your business finances.

Preguntas frecuentes

¿Es Wave para las finanzas personales o para los negocios?

Wave está diseñado para propietarios de pequeñas empresas. Sus herramientas ayudan con la contabilidad empresarial y las nóminas, no con las finanzas personales.

¿Cuál es el nivel de suscripción?

Wave ofrece un plan gratuito con funciones básicas. Los planes de pago ofrecen más funciones, como el pago de nóminas y un mejor soporte para las transacciones con tarjeta de crédito.

¿Cuánto tarda en procesarse un pago?

Los pagos pueden tardar entre uno y siete días laborables en procesarse. Los pagos con tarjeta de crédito suelen ser más rápidos que los pagos bancarios.

¿Puedo crear informes para un intervalo de fechas concreto?

Yes, you can filter your reports to show a specific date range. This helps you analyze your business finances over any period you choose.

Does Wave have a general ledger?

Yes, Wave has a general ledger. It automatically tracks all your financial activity, making it easy to create accurate bookkeeping records.