Pensando en cómo manejar su negocio ¿Dinero? ¡Puede ser un verdadero dolor de cabeza!

A muchos propietarios de empresas les cuesta hacer un seguimiento de cada dólar.

Cuando buscas ayuda, suelen surgir dos grandes nombres: Expensify y QuickBooks.

Pero, ¿cuál es el más adecuado para usted? su ¿negocio?

Esta guía desglosará lo que ofrece Expensify frente a QuickBooks para que pueda elegir el mejor.

Descripción general

Hemos pasado una buena cantidad de tiempo con Expensify y QuickBooks.

Poniéndolos a prueba para ver cómo manejan los negocios del mundo real. contabilidad.

Estas pruebas prácticas nos han proporcionado una imagen clara de sus fortalezas y debilidades, lo que nos ha llevado a esta comparación detallada.

Únase a más de 15 millones de usuarios que confían en Expensify para simplificar sus finanzas. Ahorre hasta un 83 % en tiempo dedicado a informes de gastos.

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $5 al mes.

Características principales:

- Captura de recibos SmartScan

- Conciliación de tarjetas corporativas

- Flujos de trabajo de aprobación avanzados.

Utilizado por más de 7 millones de empresas, QuickBooks puede ahorrarle un promedio de 42 horas por mes en teneduría de libros.

Precios: Tiene una prueba gratuita. El plan cuesta desde $1.90 al mes.

Características principales:

- Gestión de facturas

- Seguimiento de gastos

- Informes

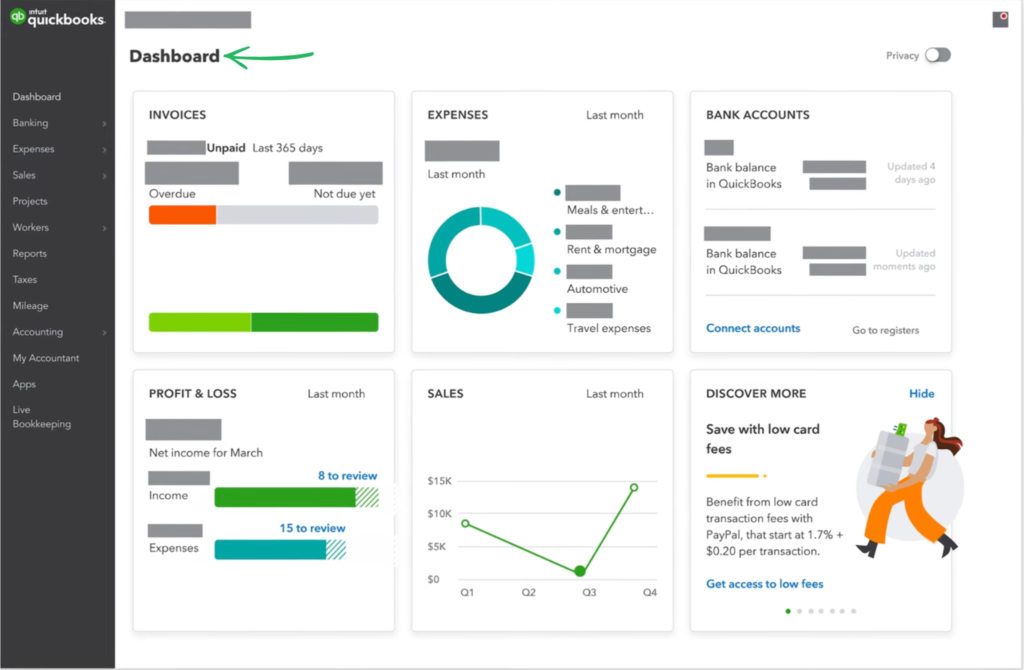

¿Qué es QuickBooks?

QuickBooks es una herramienta muy popular contabilidad herramienta.

Ayuda a las empresas, especialmente a las pequeñas, a realizar un seguimiento de su dinero.

Piense en ello como su organizador financiero.

Además, explora nuestros favoritos Alternativas a QuickBooks…

Beneficios clave

- Categorización automatizada de transacciones

- Creación y seguimiento de facturas

- Gestión de gastos

- Servicios de nómina

- Informes y paneles de control

Precios

- Comienzo sencillo: $1,90/mes.

- Básico: $2.80/mes.

- Más: $4/mes.

- Avanzado: $7.60/mes.

Ventajas

Contras

¿Qué es Expensify?

Expensify tiene como objetivo facilitar el seguimiento de gastos.

Es especialmente bueno para empresas donde la gente gasta dinero a menudo, como por ejemplo viajar o costos del proyecto.

Simplemente toma una fotografía de un recibo y Expensify hace el resto.

Además, explora nuestros favoritos Alternativas a Expensify…

Beneficios clave

- La tecnología SmartScan escanea los detalles del recibo y los extrae con una precisión superior al 95%.

- Los empleados reciben el reembolso rápidamente, a menudo en tan solo un día hábil a través de ACH.

- La tarjeta Expensify puede ahorrarle hasta un 50% en su suscripción con su programa de devolución de efectivo.

- No se ofrece garantía; sus términos establecen que las responsabilidades son limitadas.

Precios

- Recolectar: $5/mes.

- Control: Precios personalizados.

Ventajas

Contras

Comparación de características

Elegir la plataforma financiera adecuada es crucial para los autónomos y las empresas medianas.

Esta comparación utiliza reseñas de Expensify y QuickBooks para resaltar las diferencias entre los gastos dedicados automatización de Expensify y el sistema de contabilidad a gran escala de Intuit QuickBooks.

1. Funcionalidad básica y enfoque

- Expensificar Es una herramienta especializada que ayuda a las empresas a gestionar sus gastos y simplificar el proceso de reembolso. Se centra en la generación de informes de gastos y la agilización de los procesos de aprobación para empleados y contratistas.

- QuickBooks ofrece una completa contabilidad Sistema para gestionar las finanzas empresariales. Sus funciones principales incluyen el plan de cuentas, la conciliación, la gestión de ventas y proveedores, el pago de impuestos y la generación de informes financieros.

2. Captura y automatización de gastos

- Expensificar Hace que la captura de gastos sea un proceso rapidísimo. El usuario puede elegir y tomar una foto de un recibo con la aplicación Expensify en su bolsillo, y... datos Se extrae en unos segundos y está listo para enviarse para su aprobación.

- QuickBooks Ahorra tiempo al importar automáticamente las transacciones bancarias y vincular los datos de las tarjetas de crédito. Incluye funciones de escaneo de recibos y herramientas para registrar fácilmente el kilometraje y el dinero para la preparación de impuestos.

3. Informe de gastos y reembolso

- Expensificar Gestiona el proceso integral de informes de gastos. Los empleadores pueden establecer políticas y aprobar solicitudes de inmediato. La plataforma es excelente para gestionar rápidamente los reembolsos mediante depósito directo a la cuenta bancaria del usuario.

- QuickBooks maneja los gastos reportando sino que lo integra con el sistema de cuentas por pagar. Requiere una configuración cuidadosa para garantizar que los gastos se codifiquen correctamente antes de que puedan pagarse como facturas o vincularse a QuickBooks Payroll para los beneficios de los empleados.

4. Precios y plataforma

- Expensificar Tiene una estructura de precios flexible, que suele basarse en el número de usuarios o equipos por mes. Ofrece la Tarjeta Expensify para ahorrar en comisiones y automatizar los pagos. La interfaz es accesible en la web y en dispositivos móviles.

- QuickBooks"Los precios son escalonados y generalmente más altos, lo que refleja la complejidad del servicio completo. teneduría de librosOfrece una versión en línea basada en la nube (fácil acceso en línea) y QuickBooks Desktop (datos de escritorio almacenados localmente en su computadora).

5. Herramientas financieras especializadas

- Expensificar Está diseñado para gestionar gastos de proyectos y corporativos. Incluye funciones para codificar transacciones mediante etiquetas y categorías para necesidades organizativas complejas. El usuario puede exportar datos rápidamente a QuickBooks.

- QuickBooks Ofrece un seguimiento exhaustivo de datos empresariales, gestión de órdenes de compra, cálculo de impuestos sobre las ventas y seguimiento del tiempo de los empleados con QuickBooks Time. Proporciona informes financieros completos, como balances generales, cruciales para la gestión estratégica.

6. Seguridad y cumplimiento

- Expensificar Los productos utilizan una seguridad robusta y controles de políticas en tiempo real para proteger los fondos de la empresa. En ocasiones, el usuario queda bloqueado si una acción realizada podría activar este bloqueo o se prevé que sea maliciosa, lo que le obliga a responder para resolver el problema.

- Intuir QuickBooks Cuenta con la confianza de décadas de uso para proteger las finanzas empresariales confidenciales. Está diseñado para garantizar la precisión en la preparación de impuestos y el cumplimiento de la normativa legal, proporcionando al contador informes fiables.

7. Interfaz de usuario y facilidad de uso

- Expensify La interfaz de usuario es clara, rápida y está diseñada para una interacción mínima. Esto hace que completar los informes de gastos sea sencillo e intuitivo, incluso para un número reducido de usuarios o un nuevo miembro del equipo.

- QuickBooks Tiene una curva de aprendizaje inicial más pronunciada debido a la amplitud de sus servicios y la complejidad de su plan de cuentas. Sin embargo, una vez dominado, QuickBooks ayuda a los usuarios a mantener una organización clara y agilizar flujos de trabajo complejos.

8. Multiusuario y gestión

- Expensificar Permite que varios usuarios envíen y aprueben informes, creando un sistema controlado y responsable para que los empleadores gestionen sus gastos. Expensify ayuda a ahorrar tiempo al reducir las llamadas telefónicas para resolver los informes.

- QuickBooks Ofrece licencias de usuario escalables y acceso basado en roles para que varios usuarios y el contable puedan trabajar simultáneamente con los datos de la empresa. Esto es fundamental para las medianas empresas que necesitan controles internos.

9. Banca y pagos empresariales

- QuickBooks Ofrece QuickBooks Checking para banca empresarial y proporciona servicios integrales de pago, incluyendo depósito directo para empleados y contratistas. Ayuda a los proveedores a recibir sus pagos de forma rápida y precisa.Comparación segura

- El Expensificar Card es una tarjeta de crédito que se integra inmediatamente con la aplicación, automatizando el proceso de conciliación de gastos para pagos corporativos.

¿Qué buscar en un software de contabilidad?

A continuación se presentan algunos aspectos clave a tener en cuenta al momento de tomar su decisión:

- Facilidad de uso: ¿Es fácil de aprender y navegar?

- Escalabilidad: ¿Puede crecer con su negocio?

- Integración: ¿Se conecta con otras herramientas que utilizas?

- Informe: ¿Ofrece la información financiera que necesita?

- Acceso móvil: ¿Puedes administrar tus finanzas mientras estás en movimiento?

- Atención al cliente: ¿Hay ayuda disponible si te quedas atascado?

- Seguridad: ¿Cómo protege sus datos financieros?

- Estructura de precios: ¿Es transparente y económico para sus necesidades?

- Características específicas: ¿Tiene características únicas importantes para su industria?

- Automatización: ¿Cuánto se puede automatizar para ahorrar tiempo y reducir errores?

Veredicto final

Después de analizar ambos detenidamente, nuestra elección entre QuickBooks y Expensify realmente depende de su necesidad principal.

Si necesita contabilidad completa, como facturación y nóminas.

QuickBooks es un sistema de contabilidad integral y, a menudo, la mejor opción.

Simplifica todo el proceso de gestión de gastos.

Hemos utilizado ambos ampliamente, así que confíe en nuestros conocimientos para ayudarle a elegir la herramienta adecuada por su dinero.

QuickBooks puede ser más sólido, pero Expensify se destaca en su área específica.

Más de QuickBooks

- QuickBooks frente a Puzzle IOEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- QuickBooks frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- QuickBooks frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- QuickBooks frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- QuickBooks vs. Easy Month EndEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- QuickBooks frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- QuickBooks frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- QuickBooks frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- QuickBooks frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- QuickBooks frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- QuickBooks frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- QuickBooks frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- QuickBooks vs. Entrada automáticaEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- QuickBooks frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- QuickBooks frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Más de Expensify

- Expensify vs PuzzleEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Expensify frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Expensify frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Expensify vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Expensify frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Expensify frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Expensify frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Expensify frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Expensify frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Expensify vs. AutoEntryEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Expensify frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Expensify frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Puedo usar Expensify y QuickBooks juntos?

Sí, Expensify y QuickBooks ofrecen una integración perfecta. Esto permite que los datos de gastos se integren directamente en su sistema de contabilidad, lo que le ayuda a ahorrar tiempo y a reducir errores en su gestión financiera.

¿Qué es mejor para una pequeña empresa: Expensify o QuickBooks?

Depende de las necesidades de su negocio. Expensify destaca como una solución dedicada a la gestión de gastos, que permite el seguimiento de gastos y reembolsos. QuickBooks es un software de contabilidad integral que abarca tareas financieras más amplias.

¿Expensify realiza un seguimiento de los gastos facturables y no facturables?

Sí, Expensify te permite categorizar gastos facturables y no facturables. Esta función te ayuda a asignar costos con precisión a clientes o proyectos.

¿Qué funciones de seguimiento de gastos también ofrece QuickBooks?

QuickBooks también ofrece potentes funciones de seguimiento de gastos, como captura de recibos, categorización y la posibilidad de vincular transacciones con tarjetas de crédito. Está integrado con sus herramientas de gestión financiera más amplias.

¿Cuándo debería utilizar QuickBooks Online en lugar de Expensify?

Utilice QuickBooks En línea para todas sus necesidades de contabilidad, facturación y nómina. Si su prioridad es optimizar la gestión de gastos y los reembolsos a empleados, Expensify es la solución ideal.