Tratando con negocio Los gastos pueden ser un verdadero dolor de cabeza, ¿verdad?

Estás rastreando recibos, intentando hacer sentido de los números y esperar que todo salga bien para la época de impuestos.

Es un problema común para muchas empresas, grandes o pequeñas.

¿Pero qué pasaría si pudiese hacer todo este proceso más sencillo y rápido?

Estamos aquí para ayudarle a determinar cuál es la opción más adecuada para su negocio (Expensify vs AutoEntry).

Descripción general

Hemos probado Expensify y AutoEntry, evaluando sus características, facilidad de uso y qué tan bien manejan diferentes contabilidad tareas.

Nuestro objetivo era ver de primera mano cómo se combinan estas herramientas para que usted pueda tomar una decisión inteligente para su negocio.

Únase a más de 15 millones de usuarios que confían en Expensify para simplificar sus finanzas. Ahorre hasta un 83 % en tiempo dedicado a informes de gastos.

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $5 al mes.

Características principales:

- Captura de recibos SmartScan

- Conciliación de tarjetas corporativas

- Flujos de trabajo de aprobación avanzados.

Deje de perder más de 10 horas semanales ingresando datos manualmente. Vea cómo Autoentry redujo el tiempo de procesamiento de facturas en un 40 %. Sabio usuarios.

Precios: Tiene una prueba gratuita. El plan de pago cuesta desde $12 al mes.

Características principales:

- Extracción de datos

- Escaneo de recibos

- Automatización de proveedores

¿Qué es Expensify?

¿En qué consiste Expensify? Es una herramienta popular para gestionar gastos.

Su objetivo es hacer que el seguimiento de tus gastos sea muy fácil.

Puedes tomar fotos de recibos. Se encarga de todo desde ahí. Está diseñado para empresas de todos los tamaños.

Además, explora nuestros favoritos Alternativas a Expensify…

Beneficios clave

- La tecnología SmartScan escanea los detalles del recibo y los extrae con una precisión superior al 95%.

- Los empleados reciben el reembolso rápidamente, a menudo en tan solo un día hábil a través de ACH.

- La tarjeta Expensify puede ahorrarle hasta un 50% en su suscripción con su programa de devolución de efectivo.

- No se ofrece garantía; sus términos establecen que las responsabilidades son limitadas.

Precios

- Recolectar: $5/mes.

- Control: Precios personalizados.

Ventajas

Contras

¿Qué es AutoEntry?

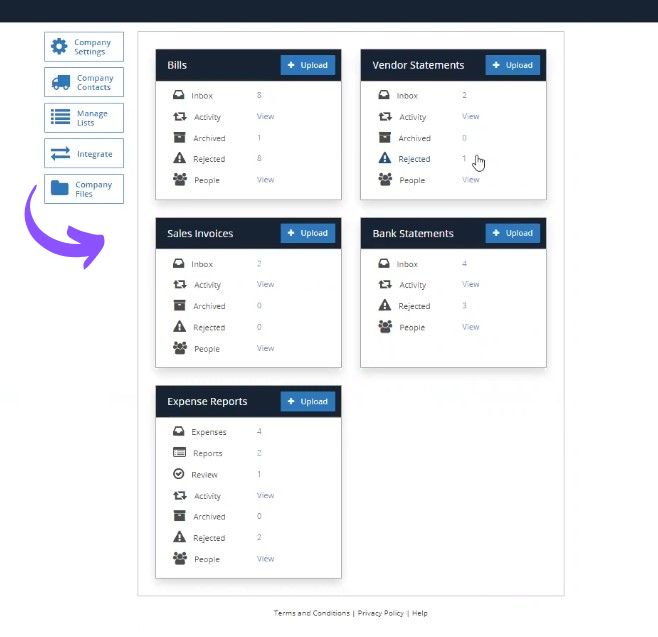

Entonces, ¿qué es AutoEntry? Es una herramienta diseñada para automatizar datos entrada.

Piense en ello como un escáner inteligente para documentos.

Captura información de facturas y recibos.

Además, explora nuestros favoritos Alternativas de entrada automática…

Nuestra opinión

¿Listo para reducir tu tiempo de contabilidad? AutoEntry procesa más de 28 millones de documentos al año y ofrece una precisión de hasta el 99 %. ¡Empieza hoy y únete a las más de 210 000 empresas de todo el mundo que han reducido sus horas de entrada de datos hasta en un 80 %!

Beneficios clave

La mayor ventaja de AutoEntry es ahorrar horas de trabajo aburrido.

Los usuarios a menudo ven hasta un 80% menos de tiempo dedicado a la entrada manual de datos.

Promete hasta un 99% de precisión en la extracción de datos.

AutoEntry no ofrece una garantía de devolución de dinero específica, pero sus planes mensuales le permiten cancelar en cualquier momento.

- Hasta un 99% de precisión en los datos.

- Usuarios ilimitados en todos los planes pagos.

- Extrae artículos de línea completos de las facturas.

- Aplicación móvil sencilla para tomar fotografías de recibos.

- 90 días para que los créditos no utilizados se transfieran.

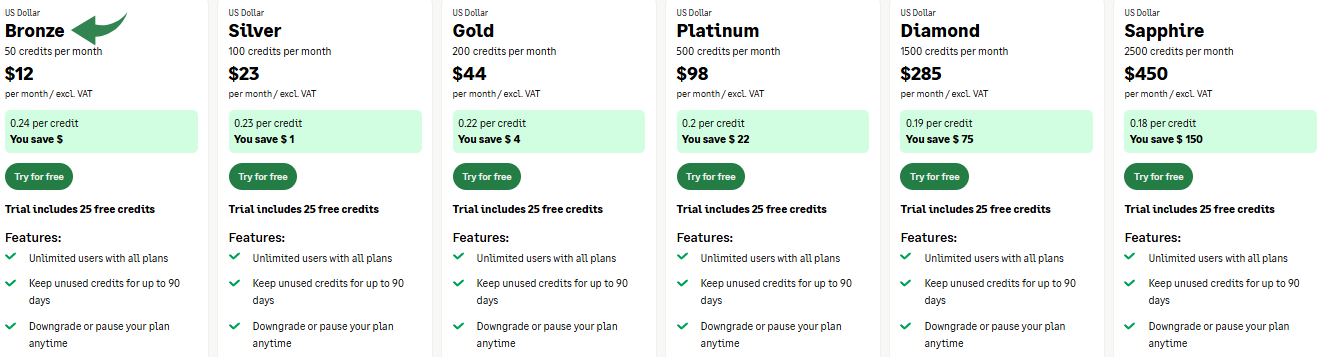

Precios

- Bronce:$12/mes.

- Plata:$23/mes.

- Oro:$44/mes.

- Platino:$98/mes.

- Diamante:$285/mes.

- Zafiro:$450/mes.

Ventajas

Contras

Comparación de características

Navegando por el mundo del documento automatización requiere elegir entre plataformas diseñadas para tareas específicas.

Esta comparación contrasta Expensify, el especialista en informes de gastos, con AutoEntry, el motor de captura de datos, para detallar sus diferentes funcionalidades y ayudarlo a resolver sus problemas más críticos. contabilidad desafíos.

1. Propósito central y enfoque

- Expensificar Simplifica todo el proceso de gestión de gastos. Es una herramienta centrada en el usuario, diseñada para ayudar a los empleados a enviar informes de gastos y obtener reembolsos rápidamente. Se centra en la gestión de gastos en tiempo real y los flujos de trabajo de aprobación para empleadores.

- Entrada automática Es una solución de seguridad de automatización diseñada para extraer automáticamente datos de documentos administrativos y financieros. Su propósito no es... contabilidad pero eliminando el esfuerzo y el tiempo invertido en la entrada manual de datos, proporcionando a un número ilimitado de usuarios una integración perfecta.

2. Captura de recibos y extracción de datos

- Expensificar Excelente para capturar datos. Toma una foto de un recibo con la app del móvil, y Expensify prepara los datos para su registro en segundos. Esto es crucial para que los empleados, tanto en la web como en el móvil, puedan controlar sus gastos al instante.

- Entrada automática Utiliza tecnología de reconocimiento óptico de caracteres para cargar facturas de compra, extractos bancarios y otros documentos financieros. Captura partidas y todos los detalles de las transacciones, y está diseñado para gestionar grandes volúmenes de papeleo con rapidez.

3. Flujo de trabajo y proceso de aprobación

- Expensificar Cuenta con un sólido flujo de trabajo de aprobación donde el gerente o el equipo de finanzas pueden revisar las solicitudes y aprobarlas. El sistema ayuda a los empleadores a reembolsar a empleados y contratistas mediante depósito directo y a responder a los informes en tiempo real.

- Entradas automáticas El flujo de trabajo se centra en la exportación automatizada de datos. Es principalmente una plataforma de pruebas donde los datos se extraen, codifican y marcan automáticamente para su publicación automática directamente en software de contabilidad, simplificando enormemente el proceso de ingreso de datos.

4. Modelo de precios y uso

- Expensificar El precio mensual es flexible y suele basarse en el número de usuarios activos o el volumen de informes enviados. La Tarjeta Expensify ofrece gestión automatizada de gastos y flujos de trabajo de reembolso para empleados.

- Entrada automática El precio se basa en el uso y se vende mediante un sistema de crédito. La plataforma permite un número ilimitado de usuarios y ofrece precios flexibles para que los clientes paguen solo por el volumen de documentos y extractos bancarios que necesitan procesar al mes.

5. Integración y flujo de datos

- Expensificar Se integra fuertemente con software de contabilidad como QuickBooksEsta conexión permite a los clientes exportar informes de gastos, registros de kilometraje y otros detalles y transacciones a su sistema financiero para la presentación de impuestos.

- Entradas automáticas Su punto fuerte es su perfecta integración con muchas soluciones de software de contabilidad (como Xero o QuickBooks). Está diseñado específicamente para transferir de manera eficiente datos de facturas de compra y gastos a otro sistema.

6. Seguridad y amenazas en línea

- Expensificar Nos tomamos la seguridad muy en serio, protegiendo los datos de los usuarios y las políticas corporativas. En algunos casos, puede ocurrir una activación de seguridad. Expensify responderá para resolver estas solicitudes de seguridad por teléfono o chat.

- Entrada automática Se protege de ataques en línea mediante un servicio de seguridad como Cloudflare. En ocasiones, varias acciones que podrían desencadenar un bloqueo, como enviar una palabra o frase, un comando SQL, datos malformados o un archivo que contenga una palabra específica, pueden provocar el bloqueo de la acción realizada y requerir que el propietario del sitio le permita acceder a la página mediante un correo electrónico con su dirección IP y el ID de Ray de Cloudflare encontrado.

7. Características especializadas

- Expensificar es robusto para viajar y gestión de proyectos. Permite registrar el kilometraje automáticamente y los usuarios pueden asignar gastos a proyectos o categorías específicos para una organización compleja. Ofrece herramientas dedicadas para gestionar rápidamente los informes de gastos.

- Entradas automáticas Su especialización reside en la captura precisa de datos. Puede procesar partidas completas de una factura y codificar automáticamente las transacciones según las entradas anteriores, lo que proporciona una integración perfecta con la contabilidad.

8. Interfaz de usuario y acceso

- Expensify La interfaz es clara e intuitiva, diseñada para un uso rápido en dispositivos móviles. Ofrece acceso en tiempo real a informes de gastos y solicitudes pendientes, tanto desde la web como desde la app móvil.

- Entradas automáticas La interfaz web se centra en el flujo de documentos y la edición de los detalles extraídos. Si bien es fácil cargar documentos, su acceso principal se centra en la revisión del archivo por parte del gerente o contador antes de publicarlo en el sistema contable.

9. Gestión y control

- Expensificar Ofrece a los empleadores control sobre sus gastos, permitiéndoles crear y aplicar políticas de inmediato. Pueden establecer límites al uso de tarjetas de crédito y aprobar gastos antes de su reembolso, lo que ayuda a los equipos financieros a ahorrar tiempo y dinero.

- Entrada automática Ayuda a ahorrar tiempo y esfuerzo al equipo de finanzas al automatizar la entrada de datos para facturas y extractos de compra. El proceso está diseñado para agilizar las tareas contables y clasificar las transacciones en las categorías correctas con una revisión mínima.

¿Qué buscar en un software de contabilidad?

Elegir lo correcto contabilidad El software implica mucho más que simplemente comparar características. Considere estas ideas clave:

- La integración es clave: ¿Se sincroniza con su software de contabilidad existente, como QuickBooks, Xero o? FreshBooks? Las conexiones perfectas ahorran tiempo.

- Capacidades de automatización: Busque una automatización sólida. ¿Cuánta entrada manual de datos financieros puede eliminar?

- Interfaz de usuario: ¿Es fácil usar el sistema a diario? Una interfaz torpe puede ralentizarlo.

- Escalabilidad: ¿Puede el software crecer con tu negocio? No querrás cambiar de plataforma cada pocos años.

- Apoyo: ¿Qué tipo de atención al cliente hay disponible? La ayuda oportuna es crucial cuando surgen problemas.

- Seguridad: ¿Cómo protege sus datos financieros confidenciales? La seguridad de los datos es primordial.

- Informes: ¿Ofrece los informes que necesitas? Unos buenos informes aportan información valiosa.

Veredicto final

Entonces, ¿cuál es la mejor opción? Para la mayoría de las empresas que necesitan una gestión completa de gastos, elegimos Expensify.

Ofrece seguimiento completo de gastos y aprobaciones.

Su aplicación móvil es ideal para escanear recibos rápidamente.

Pero si su necesidad principal es simplemente la entrada automatizada de datos para facturas y recibos, especialmente para contabilidad empresas con altos volúmenes.

AutoEntry es potente. Realmente destaca al incorporar datos financieros a su sistema. contabilidad software.

Hemos probado ambos exhaustivamente para que puedas confiar en nuestros conocimientos.

Más de Expensify

- Expensify vs PuzzleEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Expensify frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Expensify frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Expensify vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Expensify frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Expensify frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Expensify frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Expensify frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Expensify frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Expensify vs. AutoEntryEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Expensify frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Expensify frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Más de AutoEntry

- Entrada automática vs. RompecabezasEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Entrada automática frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Entrada automática frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Entrada automática frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Entrada automática vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Entrada automática frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Entrada automática vs. SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Entrada automática frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Entrada automática vs. WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Entrada automática frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- Entrada automática frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Entrada automática vs. ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Entrada automática frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Entrada automática frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Entrada automática frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Es Expensify bueno para las pequeñas empresas?

Sí, Expensify en general es muy bueno para pequeñas empresasSu función SmartScan y los informes de gastos automatizados simplifican el seguimiento financiero, ahorrando tiempo a los equipos más pequeños.

¿Funciona AutoEntry con QuickBooks?

Sí, AutoEntry se integra perfectamente con QuickBooks, tanto en la versión de escritorio como en línea. Esto permite la transferencia automatizada de datos de facturas y recibos directamente a su software de contabilidad QuickBooks.

¿Puedo utilizar tanto Expensify como AutoEntry?

Aunque algunas funciones se solapan, generalmente no es necesario ni rentable usar ambas simultáneamente para las tareas principales. Elija la que mejor se adapte a sus necesidades principales de contabilidad y gestión de gastos.

¿Qué tan preciso es el OCR en estas herramientas?

Tanto Expensify como AutoEntry ofrecen una alta precisión de OCR. SmartScan de Expensify suele tener una precisión de alrededor del 95 % para recibos, mientras que AutoEntry suele alcanzar el 98 % para diversos tipos de documentos.

¿Qué es mejor para simplemente digitalizar recibos?

Supongamos que su único objetivo es digitalizar y extraer datos de recibos y facturas. En ese caso, AutoEntry podría tener una ligera ventaja gracias a su enfoque especializado en la extracción automatizada de datos y su alta precisión.