Tratando con contabilidad Al final de cada mes puede ser un verdadero dolor de cabeza.

Estás haciendo malabarismos con números, revisando informes y asegurándote de que todo cuadra.

Es posible que haya oído hablar de herramientas que prometen hacer Esto es más fácil.

Esta publicación analizará en profundidad Easy Month End vs Refreshme, lo que le ayudará a determinar cuál contabilidad Esta herramienta puede salvarte.

Descripción general

Para brindarte una imagen más clara, analizamos en profundidad Easy Month End y Refreshme.

Probamos sus características y observamos lo fáciles que son de usar.

Este enfoque práctico nos ayuda a ofrecerle una comparación justa.

Este fin de mes fácil, únete a 1257 usuarios que ahorraron un promedio de 3,5 horas y redujeron los errores en un 15 %. ¡Comienza tu prueba gratuita!

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $45 al mes.

Características principales:

- Conciliación automatizada

- Flujos de trabajo optimizados

- Interfaz fácil de usar

¡Descubre información financiera más completa! Refresh Me analiza tus gastos y te ayuda a ahorrar de forma más inteligente.

¡Pruébalo ahora!

Precios: Tiene una prueba gratuita. El plan premium cuesta $24.99 al mes.

Características principales:

- Conciliación automatizada

- Flujos de trabajo optimizados

- Interfaz fácil de usar

¿Qué es Easy Month End?

Entonces, ¿qué es exactamente Easy Month End?

Piense en ello como su asistente digital para cerrar sus libros cada mes.

Está diseñado para hacer que esos momentos a menudo estresantes sean mucho más tranquilos.

Además, explora nuestros favoritos Alternativas fáciles para el fin de mes…

Nuestra opinión

Aumente la precisión financiera con Easy Month End. Aproveche la conciliación automatizada y los informes listos para auditoría. Programe una demostración personalizada para optimizar su proceso de cierre de mes.

Beneficios clave

- Flujos de trabajo de conciliación automatizados

- Gestión y seguimiento de tareas

- Análisis de varianza

- Gestión de documentos

- Herramientas de colaboración

Precios

- Motor de arranque:$24/mes.

- Pequeño: $45/mes.

- Compañía: $89/mes.

- Empresa: Precios personalizados.

Ventajas

Contras

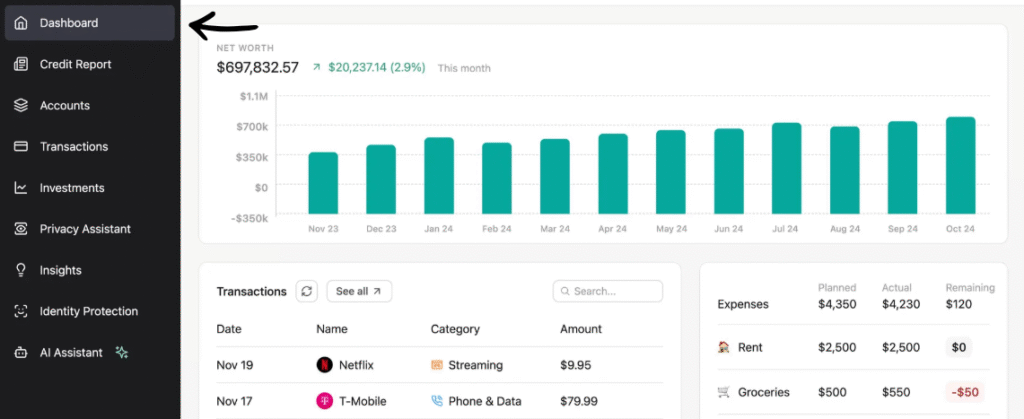

¿Qué es Refreshme?

Entonces, ¿qué pasa con Refreshme?

Esta herramienta realmente se centra en hacer que su contabilidad tareas, especialmente la conciliación, casi sin esfuerzo.

Utiliza tecnología inteligente, incluso algo de IA, para ayudar a hacer coincidir sus números de forma rápida y precisa.

Además, explora nuestros favoritos Alternativas de Refreshme…

Nuestra opinión

La fortaleza de RefreshMe reside en proporcionar información práctica y en tiempo real. Sin embargo, la falta de precios públicos y la posible falta de funcionalidades contables básicas completas podrían ser un factor a considerar para algunos usuarios.

Beneficios clave

- Paneles financieros en tiempo real

- Detección de anomalías impulsada por IA

- Informes personalizables

- Previsión del flujo de caja

- Evaluación comparativa del rendimiento

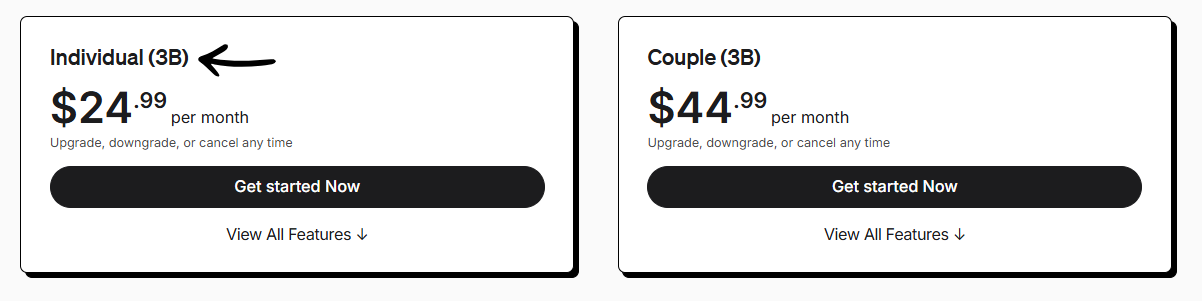

Precios

- Individual (3B): $24,99/mes.

- Pareja (3B): $44,99/mes.

Ventajas

Contras

Comparación de características

Analicemos las características principales de cada plataforma para ver cómo se comparan.

Esta comparación le ayudará a decidir qué herramienta le brinda a su equipo de finanzas la eficiencia que merece.

1. Gestión del flujo de trabajo

- Fin de mes fácil: Esta plataforma ofrece una gestión robusta del flujo de trabajo para gestionar las tareas de fin de mes, trimestre y año. Está diseñada para el trabajo de un equipo financiero, ayudándoles a mantenerse al tanto de todas sus tareas pendientes y plazos de proyectos.

- Refrescarme: Esta herramienta se centra más en las finanzas personales y la gestión de tareas. Ayuda a las personas a realizar un seguimiento de sus facturas y objetivos financieros, sin complicaciones. negocio flujos de trabajo.

2. Reconciliación

- Fin de mes fácil: Está diseñado para la conciliación de balances y ayuda a conciliar todas sus conciliaciones. Su objetivo es agilizar las conciliaciones de balances al vincularse directamente con sus... datos.

- Refrescarme: Si bien puede conciliar cuentas personales, su función no es para balances corporativos complejos. Es para banca personal y tarjetas de crédito.

3. Colaboración en equipo

- Fin de mes fácil: Esta herramienta es una plataforma única para el equipo de finanzas. Permite asignar tareas, dejar comentarios y realizar un seguimiento del progreso en un solo lugar para mejorar la colaboración y evitar retrasos en la comunicación.

- Refrescarme: Esta es una herramienta de usuario único para finanzas personales.9 No tiene funciones de colaboración en equipo ni la posibilidad de que varias personas accedan a una cuenta compartida.

4. Automatización y sincronización de datos

- Fin de mes fácil: Esta plataforma ayuda a eliminar automáticamente la molestia de las listas de verificación manuales. También se sincroniza con las principales... contabilidad Software para hacer que el proceso de cierre de mes sea muy sencillo.

- Refrescarme: Le ayuda a organizar automáticamente sus gastos personales.11 También envía recordatorios para que nunca olvides pagar una factura, haciéndote la vida más fácil.

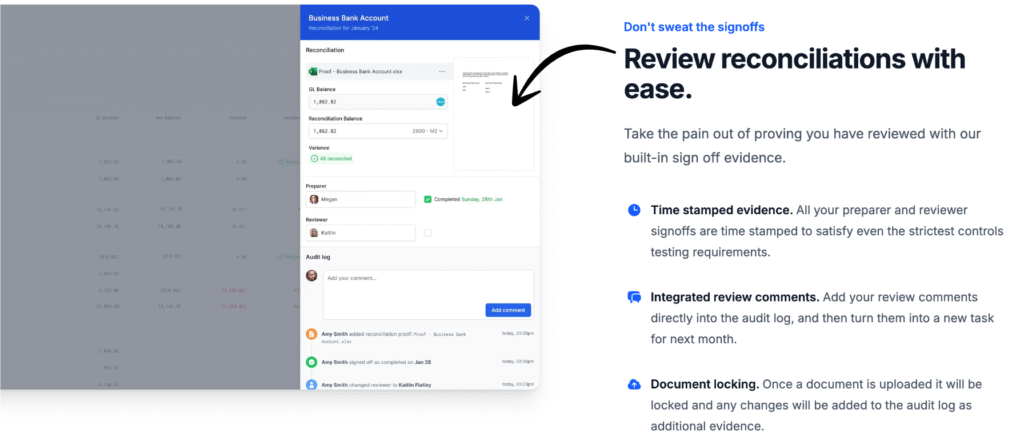

5. Auditoría y Cumplimiento

- Fin de mes fácil: Le ayuda a recopilar evidencia de auditoría y proporciona un registro completo de cada paso. Puede otorgar acceso de solo lectura a los auditores para que puedan revisar todo por sí mismos. Esto promueve el cumplimiento normativo.

- Refrescarme: Esta herramienta no está diseñada para auditorías empresariales formales. Es para uso personal y no genera evidencia de auditoría.

6. Tareas ad hoc y flexibilidad

- Fin de mes fácil: Esta plataforma ha ampliado sus capacidades para gestionar tareas puntuales y otros elementos no mensuales. Puede gestionar todo tipo de tareas del equipo financiero.

- Refrescarme: Se centra en tareas recurrentes de finanzas personales. No está diseñado para gestionar una amplia gama de tareas empresariales específicas.

7. Propósito principal

- Fin de mes fácil: Es un ticket especializado para un cierre de mes más fluido. Está diseñado para ayudar al equipo financiero a completar su trabajo con menos errores.

- Refrescarme: Su propósito principal es la elaboración de presupuestos personales y la salud financiera. Se trata de tomar el control del propio dinero y no tiene el contenido necesario para que una empresa modifique sus operaciones.

8. Revisión y aprobación

- Fin de mes fácil: Una característica clave es la capacidad de gestionar las aprobaciones tanto del preparador como del equipo de revisión. Es una parte vital del proceso de cierre de mes que ayuda a que todos rindan cuentas.

- Refrescarme: No existe el concepto de revisión ni aprobación. Es una herramienta para que un solo usuario gestione sus finanzas personales.

9. Precio y escalabilidad

- Fin de mes fácil: Puedes elegir entre diferentes planes para gestionar varias entidades o ampliar tu plan a un número ilimitado de usuarios. No hay contratos y puedes cancelarlo en cualquier momento.

- Refrescarme: Su modelo de precios se basa en el uso personal, con planes para individuos, parejas y familias. No está diseñado para empresas con múltiples entidades.

¿Qué tener en cuenta al elegir un software de contabilidad?

- Para que Refreshme sea la solución perfecta, considere si su tratamiento de datos es suficiente para sus necesidades.

- ¿Sus funciones de gestión de equipos ayudan a crear un equipo de finanzas más eficiente?

- Es importante analizar cómo se maneja una transferencia bancaria y otras confirmaciones manuales.

- ¿La aplicación tiene una interfaz fácil de usar que hace que tu primer fin de mes sea más fácil?

- Asegúrese de que el proceso de carga e importación de sus datos sea simple y rápido, y que tenga la capacidad de ingresar datos desde Excel.

- Para sus clientes, ¿los servicios que ofrece se ajustan a las necesidades de su negocio?

- Observe la antigüedad del software y si se ha actualizado periódicamente.

- Pregúntese si esto le ahorrará estrés a su equipo, porque su equipo de finanzas lo merece.

- ¿Puede el soporte responder una pregunta de una manera que parezca una forma de arte?

- Es vital tener una perspectiva de cómo el software ayudará a su negocio a mejorar.

- Además, busque una herramienta que pueda crecer con usted y que no sea una solución única para todos.

- Evite utilizar un software que haya fallado en el pasado y que no tenga un camino claro para mejorar.

- Vea si puede acceder a una demostración completa antes de comprometerse con el software por más tiempo.

- ¿Puede gestionar casos complejos? ¿Qué ocurre si se encuentra con una nueva situación financiera?

- Si tiene una empresa con múltiples entidades, ¿se actualizarán los datos de todas ellas?

- Asegúrese de que sea la solución perfecta para su caso de uso y que tenga una rampa de acceso fácil.

- No olvides borrar tus cookies de vez en cuando para garantizar una experiencia de usuario limpia.

Veredicto final

Después de analizar ambos en profundidad, nuestro veredicto final es que That Easy Month End es la mejor opción para la mayoría de las empresas.

Si bien Refreshme es excelente para las finanzas personales.

Easy Month End aborda directamente los dolores de cabeza del cierre financiero de la empresa.

Ayuda a su contador a tener todo a tiempo cada ciclo mensual.

Su estructura clara para el sencillo proceso de fin de mes y los registros de auditoría le dan la ventaja.

Hemos profundizado en estas herramientas para que puedas seleccionarlas con confianza.

Más de Fin de Mes Fácil

A continuación se muestra una breve comparación de Easy Month End con algunas de las principales alternativas.

- Fin de mes fácil vs Puzzle io: Mientras que Puzzle.io está destinado a la contabilidad de empresas emergentes, Easy Month End se centra específicamente en agilizar el proceso de cierre.

- Fin de mes fácil vs. Dext: Dext está destinado principalmente a la captura de documentos y recibos, mientras que Easy Month End es una herramienta integral de gestión de cierre de mes.

- Fin de mes fácil vs. Xero: Xero es una plataforma de contabilidad completa para pequeñas empresas, mientras que Easy Month End proporciona una solución dedicada al proceso de cierre.

- Fin de mes fácil vs. Synder: Synder se especializa en la integración de datos de comercio electrónico, a diferencia de Easy Month End, que es una herramienta de flujo de trabajo para todo el cierre financiero.

- Fin de mes fácil vs. Docyt: Docyt utiliza IA para la contabilidad y la entrada de datos, mientras que Easy Month End automatiza los pasos y tareas del cierre financiero.

- Fin de mes fácil vs. RefreshMe: RefreshMe es una plataforma de asesoramiento financiero, que se diferencia del enfoque de Easy Month End en la gestión cercana.

- Fin de mes fácil vs. Sage: Sage es una suite de gestión empresarial a gran escala, mientras que Easy Month End ofrece una solución más especializada para una función contable crítica.

- Fin de mes fácil vs. Zoho Books: Zoho Books es un software de contabilidad todo en uno, mientras que Easy Month End es una herramienta diseñada específicamente para el proceso de fin de mes.

- Fin de mes fácil vs. ola: Wave ofrece servicios de contabilidad gratuitos para pequeñas empresas, mientras que Easy Month End ofrece una solución más avanzada para la gestión cercana.

- Fin de mes fácil vs. Quicken: Quicken es una herramienta de finanzas personales, lo que hace que Easy Month End sea una mejor opción para las empresas que necesitan administrar el cierre de mes.

- Fin de mes fácil vs. Hubdoc: Hubdoc automatiza la recopilación de documentos, pero Easy Month End está diseñado para administrar todo el flujo de trabajo de cierre y las tareas del equipo.

- Fin de mes fácil vs. Expensify: Expensify es un software de gestión de gastos, que es una función diferente del enfoque principal de Easy Month End en el cierre financiero.

- Fin de mes fácil vs. QuickBooks: QuickBooks es una solución de contabilidad integral, mientras que Easy Month End es una herramienta más específica para gestionar el cierre de mes en sí.

- Fin de mes fácil vs. entrada automática: AutoEntry es una herramienta de captura de datos, mientras que Easy Month End es una plataforma completa para la gestión de tareas y flujo de trabajo durante el cierre.

- Fin de mes fácil vs. FreshBooks: FreshBooks está dirigido a autónomos y pequeñas empresas, mientras que Easy Month End ofrece una solución específica para el cierre de mes.

- Fin de mes fácil vs NetSuite: NetSuite es un sistema ERP completo, con un alcance más amplio que el enfoque especializado de Easy Month End en el cierre financiero.

Más de Refreshme

- Refréscame vs Puzzle IO: Este software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Refrescarme vs Dext: Esta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Refrescarme vs Xero: Este es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Refrescarme vs Synder: Esta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Refrescarme vs Fin de mes fácil: Esta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Refrescarme vs Docyt: Este utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Refrescarme vs Sage: Esta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Refrescarme vs Zoho Books: Esta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Refrescarme vs Wave: Este software de contabilidad es gratuito para pequeñas empresas. Su versión está diseñada para particulares.

- Refrescarme vs Quicken: Ambas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- Refrescarme vs Hubdoc: Se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Refrescarme vs. Expensify: Esta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Refrescarme vs QuickBooks: Este es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Actualizarme vs Entrada automática: Está diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Refrescarme vs FreshBooks: Este es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Refrescarme vs NetSuite: Esta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Cuál es la principal diferencia entre Easy Month End vs Refreshme?

Easy Month End se centra en optimizar las tareas de cierre financiero de su empresa. Sin embargo, Refreshme está más orientado a la gestión de finanzas personales y la conciliación automatizada de transacciones individuales.

¿Puede Easy Month End ayudarme con mis impuestos?

Sí, al organizar sus datos financieros y proporcionar registros de auditoría claros, Easy Month End ayuda a garantizar que sus registros sean precisos y estén listos para la preparación de impuestos, lo que hace que el proceso sea más sencillo para su contador.

¿Refreshme se integra con otro software de contabilidad como Dext?

Si bien Refreshme ofrece sincronización de datos, se centra principalmente en las finanzas personales. Es posible que no tenga integraciones tan completas con aplicaciones específicas para empresas. contabilidad herramientas como Dext que ofrecería una solución empresarial dedicada.

¿Con qué frecuencia debo actualizar mi información financiera en estas herramientas?

Para una precisión óptima, es recomendable actualizar su información financiera regularmente, idealmente a diario o semanalmente. Esta actualización frecuente garantiza que sus informes estén al día y le ayuda a evitar las prisas de fin de mes.