¿Eres un? pequeña empresa ¿Es usted propietario o parte de un equipo financiero y tiene dificultades con los cierres de mes?

¿Las hojas de cálculo y las tareas interminables te hacen sentir abrumado y retrasado?

No estás solo

Es fundamental saber cómo va tu negocio, pero también puede ser un verdadero dolor de cabeza.

Analizaremos qué hace la herramienta Easy Month End frente a QuickBooks y lo ayudaremos a decidir.

Descripción general

Para ayudarte hacer La mejor decisión para su negocio.

Hemos examinado exhaustivamente tanto Easy Month End como QuickBooks.

Esta experiencia práctica nos ha proporcionado una imagen clara de sus fortalezas y debilidades, lo que nos ha llevado a esta comparación directa.

Este fin de mes fácil, únete a 1257 usuarios que ahorraron un promedio de 3,5 horas y redujeron los errores en un 15 %. ¡Comienza tu prueba gratuita!

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $45 al mes.

Características principales:

- Conciliación automatizada

- Flujos de trabajo optimizados

- Interfaz fácil de usar

Utilizado por más de 7 millones de empresas, QuickBooks puede ahorrarle un promedio de 42 horas por mes en teneduría de libros.

Precios: Tiene una prueba gratuita. El plan cuesta desde $1.90 al mes.

Características principales:

- Gestión de facturas

- Seguimiento de gastos

- Informes

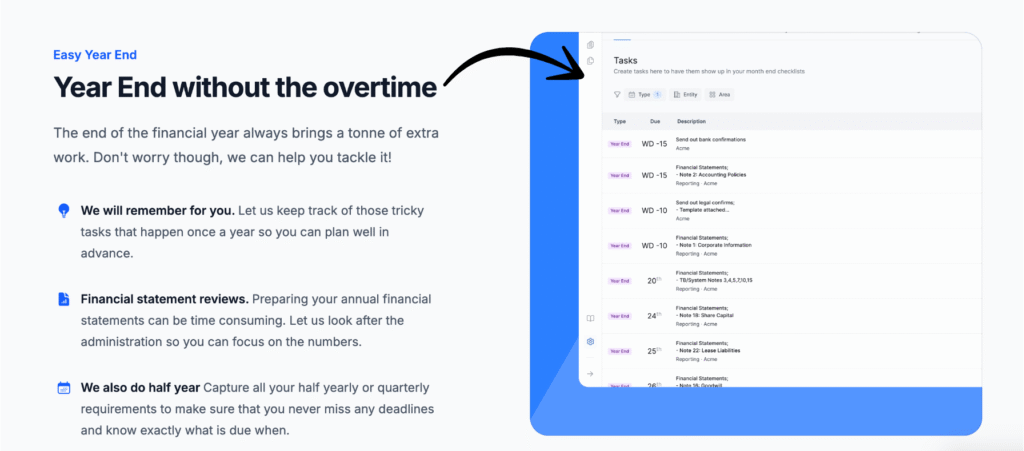

¿Qué es Easy Month End?

Entonces, ¿qué es exactamente Easy Month End?

Piense en ello como su asistente digital para cerrar sus libros.

Está diseñado para hacer que ese proceso a menudo temido sea mucho más sencillo.

Además, explora nuestros favoritos Alternativas fáciles para el fin de mes…

Nuestra opinión

Aumente la precisión financiera con Easy Month End. Aproveche la conciliación automatizada y los informes listos para auditoría. Programe una demostración personalizada para optimizar su proceso de cierre de mes.

Beneficios clave

- Flujos de trabajo de conciliación automatizados

- Gestión y seguimiento de tareas

- Análisis de varianza

- Gestión de documentos

- Herramientas de colaboración

Precios

- Motor de arranque:$24/mes.

- Pequeño: $45/mes.

- Compañía: $89/mes.

- Empresa: Precios personalizados.

Ventajas

Contras

¿Qué es QuickBooks?

Ahora, hablemos de QuickBooks.

Probablemente este es un nombre que ya has escuchado antes.

A diferencia de Easy Month End, QuickBooks es una herramienta completa contabilidad solución.

Además, explora nuestros favoritos Alternativas a QuickBooks…

Beneficios clave

- Categorización automatizada de transacciones

- Creación y seguimiento de facturas

- Gestión de gastos

- Servicios de nómina

- Informes y paneles de control

Precios

- Comienzo sencillo: $1,90/mes.

- Básico: $2.80/mes.

- Más: $4/mes.

- Avanzado: $7.60/mes.

Ventajas

Contras

Comparación de características

Entremos en detalles. Hemos probado ambas plataformas para ver cómo gestionan las tareas clave.

Esta comparación le mostrará qué software está realmente diseñado para sus necesidades financieras específicas.

1. Propósito principal y gestión del flujo de trabajo

- Fin de mes fácil: Esta herramienta es especializada. Es una plataforma única para gestionar las tareas de fin de mes y puntuales del equipo financiero. Su objetivo es crear un sistema de gestión del flujo de trabajo que te facilite la vida.

- QuickBooks: Intuit QuickBooks es una suite de contabilidad completa. QuickBooks te ayuda a gestionar tu dinero, crear facturas y pagarlas. Es una herramienta integral para todas las finanzas de tu empresa, no solo para una parte del proceso.

2. Conciliación e integridad de los datos

- Fin de mes fácil: Esta es una gran ventaja. Permite conciliar los balances con mayor rapidez al vincularlos con su contabilidad. datosAyuda a conciliar su cuenta bancaria con menos confirmaciones manuales, reduciendo el estrés de los errores.

- QuickBooks: QuickBooks le permite conciliar sus cuentas bancarias fácilmente. Importa las transacciones de su cuenta bancaria para garantizar la precisión de sus registros. También puede conciliar extractos de tarjetas de crédito.

3. Colaboración en equipo y gestión de tareas

- Fin de mes fácil: La plataforma está diseñada para la colaboración en equipo. Puedes asignar tareas del equipo de finanzas a diferentes empleados y hacer seguimiento de su progreso. Esta función te ayuda a gestionar a tu equipo y a aumentar la eficiencia.

- QuickBooks: La versión en línea de QuickBooks ofrece acceso en línea para múltiples usuarios. Puede invitar a su contador o empleados a acceder a los datos empresariales. Esto facilita una colaboración fluida en equipo.

4. Pagos y nóminas

- Fin de mes fácil: Esta herramienta se centra en la revisión y cierre de tareas, por lo que no ofrece servicios de pagos ni nóminas.

- QuickBooks: QuickBooks es una solución eficaz para pagos y nóminas. Con QuickBooks Payroll, puede pagar a empleados y proveedores. También gestiona pagos a contratistas y servicios de depósito directo.

5. Gestión y auditoría de documentos

- Fin de mes fácil: Es una plataforma única para recopilar evidencia de auditoría. Puede cargar documentos y obtener la aprobación. Esto le ayuda a garantizar que sus registros estén listos para los auditores, reduciendo las complicaciones y los retrasos.

- QuickBooks: Puede adjuntar documentos a las transacciones. Esto es útil para recopilar evidencia de auditoría. Le ayuda a mantener registros precisos para la preparación y el cumplimiento de impuestos.

6. Tipo de plataforma y accesibilidad

- Fin de mes fácil: Es una versión en línea a la que puedes acceder desde cualquier lugar. Está diseñada para facilitar el proceso de cierre a tu equipo financiero.

- QuickBooks: Intuit ofrece QuickBooks en su versión de escritorio y en línea. La versión de escritorio se instala en su computadora, mientras que la versión en línea le brinda acceso en línea y permite un servicio completo. teneduría de libros.

7. Comercio electrónico y gestión fiscal

- Fin de mes fácil: Esta herramienta no está diseñada para la gestión de impuestos sobre las ventas, sino para la conciliación de balances y las tareas del equipo financiero.

- QuickBooks: QuickBooks facilita el cálculo automático del impuesto sobre las ventas al momento de los pagos. Además, proporciona informes para simplificar la preparación de impuestos. Esto facilita la gestión financiera de su negocio.

8. Personalización y eficiencia

- Fin de mes fácil: Esta herramienta ha ampliado su capacidad para gestionar las tareas de fin de mes. Puedes personalizar listas de verificación y flujos de trabajo, lo que ayuda a que tu equipo trabaje con mayor eficiencia.

- QuickBooks: QuickBooks Online Advanced cuenta con potentes funciones de personalización. Puede personalizar los informes para adaptarlos a las necesidades de su empresa. Esto mejora la eficiencia y ayuda a mantener la precisión. reportando.

9. Precios y suscripciones

- Fin de mes fácil: Puedes pagar los servicios mensualmente. Puedes cancelar en cualquier momento, así que no hay contratos a largo plazo. Pruébalo al final de tu primer mes para ver si te conviene.

- QuickBooks: La licencia de los productos QuickBooks es una suscripción mensual. Puede cancelarla en cualquier momento. Es importante leer las reseñas de QuickBooks para asegurarse de elegir el plan adecuado para su empresa.

¿Qué tener en cuenta al elegir un software de contabilidad?

- Tamaño de su negocio: Pequeñas empresas Necesitan menos funciones complejas. Los más grandes se benefician de opciones robustas.

- Necesidades específicas: ¿Necesitas completo? contabilidad ¿O solo ayuda de fin de mes? Identifica tus principales problemas.

- Integración: ¿Funcionará con tus herramientas actuales? Comprueba que las conexiones sean perfectas.

- Experiencia de usuario: ¿Es fácil de aprender y usar a diario? Su interfaz intuitiva ahorra tiempo.

- Informe: ¿Te proporciona la información financiera que necesitas? Busca informes personalizables.

- Escalabilidad: ¿Podría el software crecer con tu negocio? No quieres cambiar de plataforma con frecuencia.

- Apoyo: ¿Qué tipo de ayuda hay disponible? Un buen soporte es vital para la resolución de problemas.

- Costo vs. Valor: ¿La tarifa justifica las características? Compara los costos mensuales con los beneficios.

- Acceso de Contador: ¿Puede un contador trabajar fácilmente con el sistema? Esto simplifica el cierre del año.

- Ajuste industrial: ¿Se adapta a requisitos específicos de la industria? Algunos programas son más adecuados para ciertos nichos.

- Datos Seguridad: ¿Qué tan bien están protegidos sus datos financieros? Esto es innegociable.

Veredicto final

Entonces, ¿cuál deberías elegir?

Después de analizar ambos detenidamente, QuickBooks es nuestra elección para la mayoría de las empresas.

Ofrece una solución contable completa.

Podrás gestionar todo, desde las ventas diarias hasta informes detallados.

Si bien Easy Month End es ideal simplemente para cerrar libros.

QuickBooks ofrece más funciones y flexibilidad para la empresa promedio.

Le ayuda a realizar un seguimiento de todos sus asuntos monetarios en un solo lugar.

Más de Fin de Mes Fácil

A continuación se muestra una breve comparación de Easy Month End con algunas de las principales alternativas.

- Fin de mes fácil vs Puzzle io: Mientras que Puzzle.io está destinado a la contabilidad de empresas emergentes, Easy Month End se centra específicamente en agilizar el proceso de cierre.

- Fin de mes fácil vs. Dext: Dext está destinado principalmente a la captura de documentos y recibos, mientras que Easy Month End es una herramienta integral de gestión de cierre de mes.

- Fin de mes fácil vs. Xero: Xero es una plataforma de contabilidad completa para pequeñas empresas, mientras que Easy Month End proporciona una solución dedicada al proceso de cierre.

- Fin de mes fácil vs. Synder: Synder se especializa en la integración de datos de comercio electrónico, a diferencia de Easy Month End, que es una herramienta de flujo de trabajo para todo el cierre financiero.

- Fin de mes fácil vs. Docyt: Docyt utiliza IA para la contabilidad y la entrada de datos, mientras que Easy Month End automatiza los pasos y tareas del cierre financiero.

- Fin de mes fácil vs. RefreshMe: RefreshMe es una plataforma de asesoramiento financiero, que se diferencia del enfoque de Easy Month End en la gestión cercana.

- Fin de mes fácil vs. Sage: Sage es una suite de gestión empresarial a gran escala, mientras que Easy Month End ofrece una solución más especializada para una función contable crítica.

- Fin de mes fácil vs. Zoho Books: Zoho Books es un software de contabilidad todo en uno, mientras que Easy Month End es una herramienta diseñada específicamente para el proceso de fin de mes.

- Fin de mes fácil vs. ola: Wave ofrece servicios de contabilidad gratuitos para pequeñas empresas, mientras que Easy Month End ofrece una solución más avanzada para la gestión cercana.

- Fin de mes fácil vs. Quicken: Quicken es una herramienta de finanzas personales, lo que hace que Easy Month End sea una mejor opción para las empresas que necesitan administrar el cierre de mes.

- Fin de mes fácil vs. Hubdoc: Hubdoc automatiza la recopilación de documentos, pero Easy Month End está diseñado para administrar todo el flujo de trabajo de cierre y las tareas del equipo.

- Fin de mes fácil vs. Expensify: Expensify es un software de gestión de gastos, que es una función diferente del enfoque principal de Easy Month End en el cierre financiero.

- Fin de mes fácil vs. QuickBooks: QuickBooks es una solución de contabilidad integral, mientras que Easy Month End es una herramienta más específica para gestionar el cierre de mes en sí.

- Fin de mes fácil vs. entrada automática: AutoEntry es una herramienta de captura de datos, mientras que Easy Month End es una plataforma completa para la gestión de tareas y flujo de trabajo durante el cierre.

- Fin de mes fácil vs. FreshBooks: FreshBooks está dirigido a autónomos y pequeñas empresas, mientras que Easy Month End ofrece una solución específica para el cierre de mes.

- Fin de mes fácil vs NetSuite: NetSuite es un sistema ERP completo, con un alcance más amplio que el enfoque especializado de Easy Month End en el cierre financiero.

Más de QuickBooks

- QuickBooks frente a Puzzle IOEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- QuickBooks frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- QuickBooks frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- QuickBooks frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- QuickBooks vs. Easy Month EndEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- QuickBooks frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- QuickBooks frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- QuickBooks frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- QuickBooks frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- QuickBooks frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- QuickBooks frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- QuickBooks frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- QuickBooks vs. Entrada automáticaEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- QuickBooks frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- QuickBooks frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Es Easy Month End un reemplazo para QuickBooks?

No, Easy Month End no reemplaza completamente la contabilidad. Se especializa en la gestión del proceso de cierre. QuickBooks gestiona todas sus tareas contables diarias, como la facturación y el seguimiento de gastos.

¿Puedo utilizar Easy Month End con QuickBooks?

Sí, Easy Month End está diseñado para integrarse con QuickBooks. Puedes vincular tus datos financieros, simplificando así el proceso de conciliación y cierre de mes en ambas plataformas.

¿Qué software es mejor para las pequeñas empresas?

Gracias a sus completas funciones, QuickBooks suele ser la mejor opción para pequeñas empresas en cuanto a contabilidad general. Si su principal dificultad es el cierre de mes, Easy Month End podría ser una herramienta útil para complementar su configuración actual.

¿QuickBooks simplifica el cierre de mes?

QuickBooks ofrece herramientas para facilitar los procesos de cierre de mes, como la conciliación y la generación de informes. Sin embargo, es una herramienta contable amplia, no enfocada específicamente en el cierre paso a paso como Easy Month End.

¿Cuál es la principal diferencia en su propósito?

La principal diferencia radica en el enfoque. Easy Month End es una herramienta especializada para tareas de cierre de período, mientras que QuickBooks es una herramienta integral y completa. software de contabilidad que cubre todos los aspectos de la gestión financiera.