¿Tiene dificultades para administrar su dinero?

Especially with the growing mix of personal and negocio ¿finanzas?

Choosing between options like Docyt and Quicken can be tough.

Let’s dive in and compare Docyt vs Quicken strengths to help you hacer La mejor elección.

Descripción general

We’ve thoroughly tested both Docyt and Quicken.

Evaluating their features, ease of use, and overall contabilidad capacidades.

This hands-on experience has led us to this detailed comparison, which will help you see which platform truly excels.

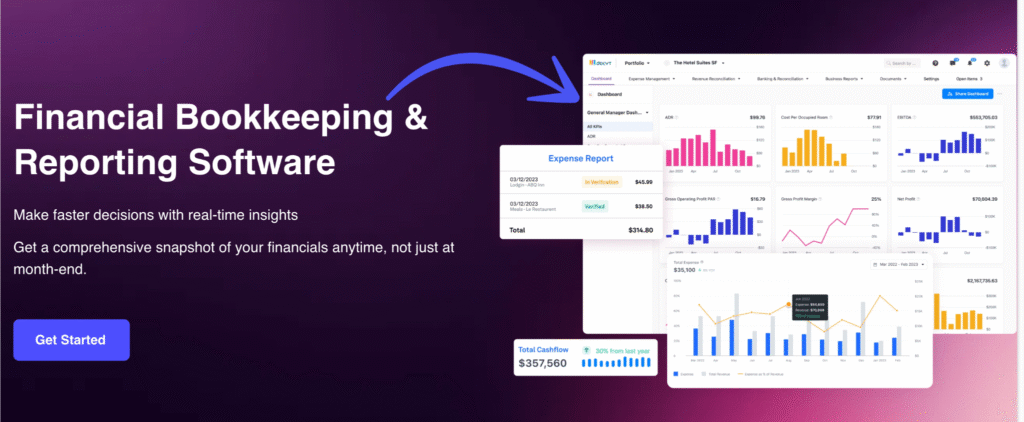

¿Cansado del manual? teneduría de librosDocyt AI automatiza la entrada y conciliación de datos, ahorrando a los usuarios un promedio de 40 horas.

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $299 al mes.

Características principales:

- Conciliación automatizada

- Flujos de trabajo optimizados

- Interfaz fácil de usar

¿Quieres controlar tus finanzas? Con Quicken, puedes conectarte con miles de instituciones financieras. ¡Explora la plataforma para saber más!

Precios: Tiene una prueba gratuita. El plan premium cuesta $5.59 al mes.

Características principales:

- Herramientas de presupuestación

- Gestión de facturas

- Seguimiento de inversiones

¿Qué es Docyt?

So, what exactly is Docyt? Think of it as your smart contabilidad asistente.

It uses artificial intelligence to handle many of the boring tasks.

It’s built for businesses, especially those that need to keep track of a lot of transactions.

Además, explora nuestros favoritos Alternativas a Docyt…

Beneficios clave

- Automatización impulsada por IA: Docyt utiliza inteligencia artificial. Extrae automáticamente datos de documentos financieros. Esto incluye información de más de 100.000 proveedores.

- Contabilidad en tiempo real: Mantiene sus libros contables actualizados en tiempo real. Esto le proporciona una visión financiera precisa en todo momento.

- Gestión de documentos: Centraliza todos tus documentos financieros. Puedes buscarlos y acceder a ellos fácilmente.

- Automatización del pago de facturas: Automatiza el proceso de pago de facturas. Programa y paga facturas fácilmente.

- Reembolso de gastos: Agiliza las reclamaciones de gastos de los empleados. Presenta y aprueba gastos rápidamente.

- Integraciones perfectas: Se integra con los programas de contabilidad más populares. Esto incluye QuickBooks y Xero.

- Detección de fraude: Su IA puede ayudar a detectar transacciones inusuales. Esto añade una capa de seguridad. seguridadNo existe garantía específica para el software, pero se proporcionan actualizaciones continuas.

Precios

- Impacto: $299/mes.

- Avanzado: $499/mes.

- Avanzado Más: $799/mes.

- Empresa: $999/mes.

Ventajas

Contras

¿Qué es Quicken?

So, you’ve heard of Quicken, right?

Quicken has been around for ages, helping people manage their money. Unlike Docyt, it really excels at personal finance.

Many people use it to get a full picture of their financial life, all in one spot.

Además, explora nuestros favoritos Alternativas de Quicken…

Beneficios clave

Quicken es una herramienta poderosa para poner en orden tu vida financiera.

Cuentan con más de 40 años de experiencia y han sido un producto número 1 en ventas.

Sus diversos planes pueden conectarse con más de 14.500 instituciones financieras.

También puede obtener una garantía de devolución de dinero de 30 días para probarlo sin riesgos.

- Se conecta con miles de bancos y tarjetas de crédito.

- Crea presupuestos detallados.

- Realiza un seguimiento de las inversiones y el patrimonio neto.

- Ofrece herramientas de planificación de la jubilación.

Precios

- Quicken Simplifi: $2,99/mes.

Ventajas

Contras

Comparación de características

Profundicemos en las funcionalidades principales.

This section compares how Docyt and Quicken handle crucial contabilidad processes and financial operations, helping you match a platform to your specific needs.

1. Contabilidad y automatización con IA

- Docyt: Docyt‘s AI-powered platform is a game-changer for eliminating manual datos entrada. It uses AI bookkeeping and AI automatización software to handle tedious tasks and automate back-office duties, freeing up your team. Docyt learns your business intricacies.

- Acelerar: Acelerar is a user-friendly tool. It helps automate teneduría de libros duties by downloading transactions from bank accounts. However, it relies more on human input and lacks Docyt‘s deep, business-focused AI-powered accounting processes.

2. Informes financieros en tiempo real

- Docyt: Docyt provides real-time financial reports and instant financial status visibility. It is focused on offering real-time insights into key performance indicators. This is vital for strategic decision-making and ensuring constant financial control.

- Acelerar: Acelerar offers real-time reports on your cash flow and spending, which is excellent for personal finance software. The reportando is less tailored for complex business analysis, unlike Docyt‘s specialized tools.

3. Multi-Entity and Consolidation

- Docyt: Docyt excels at managing multiple businesses and business locations effortlessly. It can generate consolidated roll up reports, providing an aggregate view or individual financial statements. This makes constant financial control across your portfolio simple.

- Acelerar: El Acelerar business version can track multiple businesses using tags, but it lacks the robust, automated features for a consolidated roll up report. Its focus is more on managing separate accounts within a single file.

4. Expense and Receipt Capture

- Docyt: The platform handles expense management using automated receipt capture. This system reduces revenue accounting errors and is key to automating back office operations, making life easier for accountants.

- Acelerar: Acelerar offers receipt capture functionality, but it is less integrated and automated than Docyt‘s. It provides solid bill tracking and expense categorization, primarily for personal finance software.

5. Bill Pay and Cash Flow

- Docyt: Docyt‘s integrated bill pay feature is part of the automated accounting processes. It manages payments, reducing the time spent on these time-consuming tasks and giving you better cash flow visibility.

- Acelerar: Acelerar offers robust bill pay and bill tracking features. It gives you an overall financial picture and helps with planning your cash flow by managing upcoming payments from your bank accounts.

6. Investment Tracking

- Docyt: Docyt is designed for bookkeeping and automating accounting processes. It is not built to track investment accounts or deep personal financial planning. Its strength is in business locations management.

- Acelerar: Acelerar is a leader in tracking investment accounts. The Acelerar Premier and Acelerar Deluxe versions offer extensive tools for portfolio monitoring and retirement planning, which is a core feature of the Acelerar marca.

7. Departmental Accounting

- Docyt: Docyt supports detailed departmental accounting. This helps you track key performance indicators and profitability across different parts of your business, offering real time insights for managers.

- Acelerar: Acelerar‘s features are more generalized, focusing on business personal income and expenses. It is not designed for the complex needs of multi-layered departmental accounting found in larger businesses.

8. Bank Reconciliation

- Docyt: Docyt‘s system includes automated bank reconciliation and revenue reconciliation. This significantly speeds up accounting processes and ensures constant financial control by quickly spotting discrepancies.

- Acelerar: Acelerar provides strong bank reconciliation tools. It reliably syncs bank accounts to help you reconcile your records, a feature the Acelerar software has offered for decades.

9. Technology and Security

- Docyt: Docyt‘s ai powered platform uses cutting-edge AI for security and automation. It is a cloud-based app designed for the modern team of accountants.

- Acelerar: El Acelerar software has a long history and offers options for both desktop (windows and impermeable) and mobile app functionality. It maintains strong security to protect your financial picture.

¿Qué tener en cuenta al elegir un software de contabilidad?

- Características principales: Does it have the exact key features you need for your business finances?

- Target User: Is it built for individuals (Quicken Home) or accounting firms?

- Automatización de IA: How well does it automate tasks and handle time-consuming tasks like managing invoices?

- Multi-Entity: Can it track and consolidate accounts if you have rental properties or multiple businesses?

- Interfaz de usuario: Is the user interface intuitive for your team (average user)?

- Subscription Cost: Is the recurring cost worth the value you get, especially looking at the future?

- Reporting: Does the software provide essential balances and sales reports from the beginning?

- AI Bookkeeper: Does it include an AI bookkeeper to speed up the month-end close and complete the month-end?

- Integraciones: Does it work well with QuickBooks Online and other alternatives?

- Apoyo: Is there good support if you run into problems?

Veredicto final

After looking closely, our pick depends on your goal.

For serious business accounting features and automation, Docyt wins.

It provides comprehensive cloud accounting and cuts manual work.

We use testing and verified user reviews to bring you authentic software comparisons.

Such as whether QuickBooks is a widely used tool, or compared to other tools.

For personal money or a small side hustle, Quicken is better.

It’s affordable and great for budgeting. So, what do you need most?

Más de Docyt

A la hora de buscar el software de contabilidad adecuado, es útil ver cómo se comparan las diferentes plataformas.

A continuación se muestra una breve comparación de Docyt frente a muchas de sus alternativas.

- Docyt frente a Puzzle IO: Si bien ambos ayudan con las finanzas, Docyt se centra en la contabilidad impulsada por IA para empresas, mientras que Puzzle IO simplifica la facturación y los gastos para los autónomos.

- Docyt frente a Dext: Docyt ofrece una plataforma completa de contabilidad con inteligencia artificial, mientras que Dext se especializa en la captura automatizada de datos de documentos.

- Docyt frente a Xero: Docyt es conocido por su profunda automatización con IA. Xero ofrece un sistema de contabilidad completo y fácil de usar para las necesidades empresariales generales.

- Docyt frente a Synder: Docyt es una herramienta de contabilidad con IA para la automatización de back-office. Synder se centra en sincronizar los datos de ventas de comercio electrónico con su software de contabilidad.

- Docyt vs Easy Month End: Docyt es una solución integral de contabilidad con IA. Easy Month End es una herramienta especializada diseñada específicamente para optimizar y simplificar el proceso de cierre de mes.

- Docyt frente a RefreshMe: Docyt es una herramienta de contabilidad empresarial, mientras que RefreshMe es una aplicación de finanzas y presupuestos personales.

- Docyt frente a Sage: Docyt utiliza un enfoque moderno basado en la IA. Sage es una empresa con una larga trayectoria que ofrece una amplia gama de soluciones de contabilidad tradicionales y en la nube.

- Docyt frente a Zoho Books: Docyt se centra en la automatización contable mediante IA. Zoho Books es una solución integral que ofrece un conjunto completo de funciones a un precio competitivo.

- Docyt frente a Wave: Docyt ofrece potente automatización con IA para empresas en crecimiento. Wave es una plataforma de contabilidad gratuita ideal para autónomos y microempresas.

- Docyt frente a Quicken: Docyt está diseñado para la contabilidad empresarial. Quicken es principalmente una herramienta para la gestión de finanzas personales y la elaboración de presupuestos.

- Docyt frente a Hubdoc: Docyt es un sistema completo de contabilidad con IA. Hubdoc es una herramienta de captura de datos que recopila y procesa automáticamente documentos financieros.

- Docyt frente a Expensify: Docyt gestiona una amplia gama de tareas contables. Expensify es especialista en la gestión y elaboración de informes sobre gastos de empleados.

- Docyt frente a QuickBooks: Docyt es una plataforma de automatización con IA que optimiza QuickBooks. QuickBooks es un software de contabilidad integral para empresas de todos los tamaños.

- Docyt vs. AutoEntry: Docyt es una solución integral de contabilidad con inteligencia artificial. AutoEntry se centra específicamente en la extracción y automatización de datos documentales.

- Docyt frente a FreshBooks: Docyt utiliza IA avanzada para la automatización. FreshBooks es una solución intuitiva y popular entre los freelancers por sus funciones de facturación y control de tiempo.

- Docyt frente a NetSuite: Docyt es una herramienta de automatización contable. NetSuite es un sistema completo de planificación de recursos empresariales (ERP) para grandes corporaciones.

Más de Quicken

- Quicken vs. PuzzleEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Quicken frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Quicken frente a Xero:Esto es popular en línea. software de contabilidad Para pequeñas empresas. Su competidor es para uso personal.

- Quicken frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Quicken vs. Easy Month EndEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Quicken frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Quicken frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Quicken frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Quicken frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Quicken frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Quicken frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Quicken frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Quicken frente a AutoEntryEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Quicken frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Quicken frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

Is Quicken good for small businesses?

Quicken, especially its Home & Business version, can work for very pequeñas empresas or freelancers. However, dedicated business accounting software is usually better for more complex operations.

What is the main difference between Docyt and Quicken?

Docyt focuses on AI-driven accounting automation for businesses, handling tasks like transaction categorization. Quicken is primarily for personal finance management, including budgeting and investment tracking.

Does Docyt integrate with other accounting software?

Yes, Docyt integrates with many existing accounting systems. This allows it to streamline workflows even if you’re using software like QuickBooks or other popular platforms.

Is Docyt similar to NetSuite?

NetSuite is a comprehensive cloud ERP system, much broader than Docyt. While Docyt specializes in accounting automation, NetSuite offers a comprehensive cloud ERP covering many business functions beyond just accounting.

How does Docyt’s AI work?

Docyt’s AI learns your business as you use it. It automates data extraction from documents and categorizes transactions, reducing manual effort and improving accuracy over time.