Sind Sie es leid, unordentliche Kassenbons zu sammeln und ständig den Überblick über Ihre Ausgaben zu behalten? Geschäft Ausgaben?

Das kann sich wie richtige Kopfschmerzen anfühlen, nicht wahr?

Die Auswahl der richtigen Software zur Unterstützung kann schwierig sein.

Zwei bekannte Namen, von denen Sie vielleicht schon gehört haben, sind Xero und Expensify.

Beide versprechen machen Die Verwaltung Ihrer Finanzen wird dadurch einfacher, aber welche Option ist tatsächlich besser für Sie?

Überblick

Wir haben sowohl Xero als auch Expensify getestet und dabei ihre Funktionen sowie ihre Vorgehensweise bei alltäglichen Geschäftsaufgaben untersucht.

Diese praktischen Tests ermöglichen es uns, Ihnen einen klaren Vergleich ihrer Stärken und Schwächen zu präsentieren.

Sind Sie bereit, Ihre Finanzen zu vereinfachen?

Schließen Sie sich über 2 Millionen Unternehmen an, die die cloudbasierte Buchhaltungssoftware Xero nutzen. Entdecken Sie jetzt die leistungsstarken Rechnungsstellungsfunktionen!

Preisgestaltung: Es gibt eine kostenlose Testphase. Das kostenpflichtige Abonnement beginnt bei 29 $/Monat.

Hauptmerkmale:

- Bankabstimmung

- Fakturierung

- Berichterstattung

Schließen Sie sich über 15 Millionen Nutzern an, die Expensify vertrauen, um ihre Finanzen zu vereinfachen. Sparen Sie bis zu 83 % Zeit bei der Erstellung von Spesenabrechnungen.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 5 $ pro Monat.

Hauptmerkmale:

- SmartScan-Belegerfassung

- Firmenkartenabstimmung

- Erweiterte Genehmigungsworkflows.

Was ist Xero?

Also, was hat es mit Xero auf sich?

Es ist im Grunde online Buchhaltungssoftware.

Betrachten Sie es als eine Möglichkeit, all Ihre geschäftlichen Finanzangelegenheiten an einem Ort zu verwalten. Ziemlich praktisch.

Entdecken Sie auch unsere Favoriten Xero-Alternativen…

Unsere Einschätzung

Schließen Sie sich über 2 Millionen Unternehmen an Xero verwenden Buchhaltungssoftware. Entdecken Sie jetzt die leistungsstarken Rechnungsstellungsfunktionen!

Wichtigste Vorteile

- Automatisierter Bankabgleich

- Online-Rechnungsstellung und Zahlungen

- Rechnungsverwaltung

- Integration der Gehaltsabrechnung

- Berichterstattung und Analysen

Preisgestaltung

- Anlasser: 29 US-Dollar pro Monat.

- Standard: 46 US-Dollar pro Monat.

- Prämie: 69 US-Dollar pro Monat.

Vorteile

Nachteile

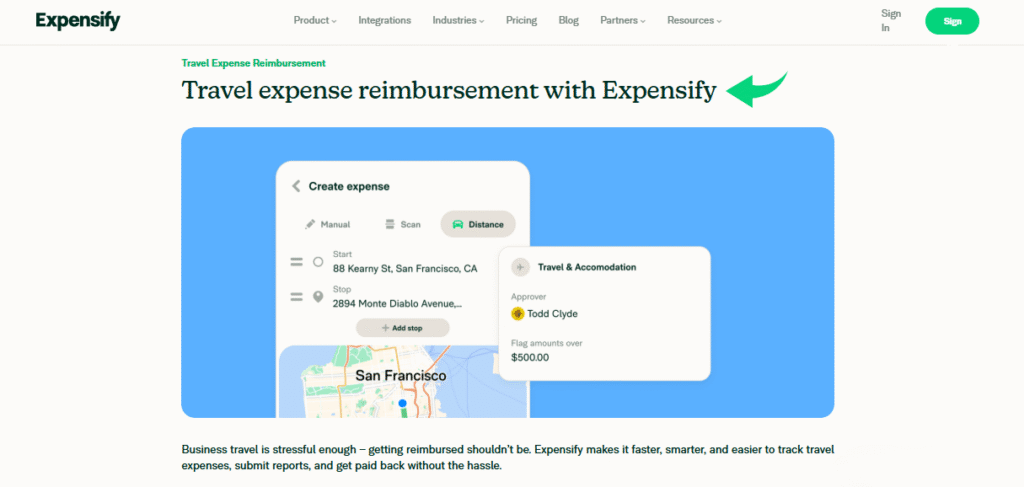

Was ist Expensify?

Okay, und was ist mit Expensify?

Dieses Tool ist speziell für Ausgaben konzipiert. Man kann damit ganz einfach Fotos von Belegen machen und Spesenabrechnungen erstellen.

Es geht darum, Ihnen Zeit und Ärger mit diesen lästigen Kosten zu ersparen.

Entdecken Sie auch unsere Favoriten Alternativen verteuern…

Wichtigste Vorteile

- Die SmartScan-Technologie scannt Belegdetails und extrahiert sie mit einer Genauigkeit von über 95%.

- Die Mitarbeiter erhalten ihre Erstattungen schnell, oft schon innerhalb eines Werktages per ACH-Überweisung.

- Mit der Expensify Card und ihrem Cashback-Programm können Sie bis zu 50 % bei Ihrem Abonnement sparen.

- Es wird keine Garantie übernommen; in den Allgemeinen Geschäftsbedingungen ist die Haftung beschränkt.

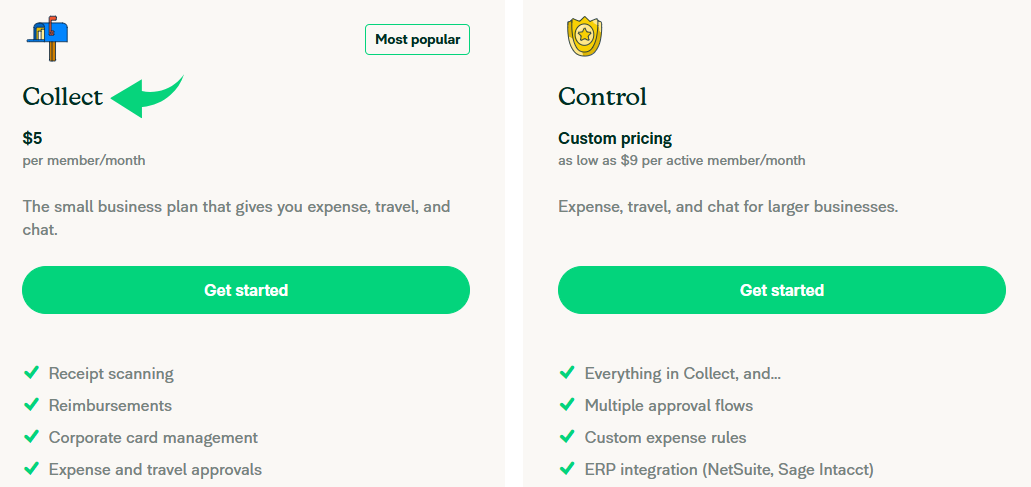

Preisgestaltung

- Sammeln: 5 US-Dollar pro Monat.

- Kontrolle: Individuelle Preisgestaltung.

Vorteile

Nachteile

Funktionsvergleich

Lasst uns genauer betrachten, wie diese beiden Produkte im Vergleich abschneiden.

Wir werden uns die wichtigsten Merkmale ansehen, um Ihnen bei der Entscheidung zu helfen, welches Produkt am besten zu Ihrem Unternehmen passt.

Insbesondere wenn Sie ein Kleinunternehmer sind, der nach dem Besten sucht Buchhaltung Software.

1. Kernbuchhaltung vs. Kostenmanagement

- XeroDies ist ein vollständiges Enterprise-Resource-Planning-System (ERP). Es heißt Xero. Buchhaltung Software, eine echte Cloud-basierte Buchhaltungssoftware, die alle Finanzaufgaben und Ihre gesamte Finanzlage abdeckt.

- Kosten erhöhenSeine Hauptfunktion besteht im Ausgabenmanagement. Es hilft Ihnen, Ausgaben schnell zu verwalten, bietet aber keine vollständigen Buchhaltungsfunktionen.

2. Rechnungsstellung und Zahlungen

- XeroMit Xero können Sie in höheren Tarifstufen unbegrenzt Rechnungen erstellen. Es bietet eine vollständige Debitorenbuchhaltung für offene Rechnungen und verarbeitet Bestellungen sowie weitere Zahlungsfunktionen.

- Kosten erhöhenDie Rechnungsstellung ist einfach gehalten und auf die Abrechnung bestimmter Ausgaben mit dem Kunden ausgerichtet, nicht auf die umfassende Verkaufsrechnungsstellung.

3. Bankintegration und -abstimmung

- XeroEs bietet automatische Bankfeeds und zeichnet sich durch die Abstimmung von Banktransaktionen mit Echtzeitdaten aus. Daten. Dadurch bleiben Ihre Finanzunterlagen korrekt.

- Kosten erhöhen: Verbindet sich mit Bankkonten, um Transaktionen abzurufen. Der Schwerpunkt liegt auf dem Abgleich dieser Transaktionen mit Belegen, insbesondere bei der Expensify-Karte.

4. Berichterstattung und Analyse

- XeroXero's Berichterstattung Die Funktionen sind überzeugend. Sie erhalten Berichte zum Cashflow-Management und einen klaren Überblick über Ihre Geschäftsentwicklung. Das Xero-Dashboard bietet Ihnen eine Finanzübersicht.

- Kosten erhöhenDie Berichte konzentrieren sich eng auf Ausgabentrends und Zusammenfassungen und unterstützen so den Kostenmanagementprozess.

5. Projektverfolgung und -management

- XeroMit Xero können Sie Projektzeiten und -kosten erfassen und Kunden die erbrachten Leistungen in Rechnung stellen. Dies trägt zum Geschäftswachstum bei.

- Kosten erhöhenAusgaben können zwar projektbezogen mithilfe von Tags erfasst werden, es fehlen jedoch spezielle Projektmanagement-Tools.

6. Mobile App

- XeroDie mobile App funktioniert auf iOS und Android. Geräte. Viele Finanzaufgaben wie Rechnungsstellung und Kontenabstimmung können Sie unterwegs erledigen.

- Kosten erhöhenDie mobile App eignet sich hervorragend für die Spesenabrechnung. Belege lassen sich in Sekundenschnelle fotografieren und einreichen.

7. Benutzerfreundlichkeit und Schnittstelle

- XeroXero vereinfacht die Buchhaltung durch seine benutzerfreundliche Oberfläche – ein Pluspunkt für Kleinunternehmen Eigentümer.

- Kosten erhöhenEs verfügt über eine sehr einfache Benutzeroberfläche, wodurch der Ausgabenverwaltungsprozess für den Endbenutzer schnell und unkompliziert ist.

8. Erweiterte Funktionen und Skalierbarkeit

- XeroDas Basispaket bietet erweiterte Funktionen wie Bestandsverwaltung und Unterstützung mehrerer Währungen. Es eignet sich gut für etablierte Unternehmen und ist ideal für expandierende Unternehmen.

- Kosten erhöhenBietet Funktionen für große Organisationen, konzentriert sich aber eher auf den Kostenmanagementprozess, als eine vollständige Enterprise-Resource-Planning-Lösung anzubieten.

9. Preisgestaltung und Wert

- XeroXero verwendet strukturierte Preispläne wie den Frühbuchertarif. Er bietet einen umfassenden Mehrwert für alle Ihre Finanzdaten.

- Kosten erhöhenDie Preisgestaltung ist nutzerbasiert und somit auch für unabhängige Auftragnehmer oder eine kleine Anzahl von Arbeitgebern erschwinglich, die eine zuverlässige Spesenabrechnung benötigen.

Worauf Sie bei der Auswahl von Buchhaltungssoftware achten sollten?

Die Wahl der richtigen Software beeinflusst die finanzielle Gesundheit Ihres Unternehmens. Hier einige wichtige Punkte, die Sie beachten sollten:

- Automatisierung: Reduziert die Software die manuelle Dateneingabe? Xero zeichnet sich durch die Automatisierung des Bankkontoabgleichs und der Rechnungserfassung aus.

- Genehmigungsablauf: Achten Sie bei Spesenabrechnungen auf einen flexiblen Genehmigungsprozess. Expensify erleichtert Mitarbeitern die Einreichung von Berichten und ermöglicht Managern die schnelle Prüfung und Genehmigung von Anträgen.

- Ökosystem: Xero Buchhaltungssoftware ERP bietet eine komplette Lösung, aber überprüfen Sie die Verbindung zu anderen von Ihnen verwendeten Tools.

- Unterstützung & Lernen: Steht Ihnen ein reaktionsschneller Support (per Telefon oder Chat) und übersichtliche Online-Ressourcen (Xero Central) zur Verfügung, die Ihnen bei der Lösung von Problemen helfen?

- Datenkontrolle: Achten Sie bei einem möglichen Wechsel auf eine einfache Datenmigration. Sie sollten Ihre Kundendaten und Finanzdaten problemlos exportieren können.

- Kernaufgaben: Kann das Unternehmen die Lagerbestände (Lagerdaten) effektiv verwalten und die Umsatzsteuerberechnungen für mehrere Standorte durchführen?

- Budgetierung & Wachstum: Die Kosten für Xero sind ein Faktor, aber das richtige Tool hilft Unternehmen dabei, ihre Finanzen für wachsende Unternehmen zu verwalten.

- Anpassung: Können Sie individuell anpassbare Berichte erstellen und Zahlungen nach Ihren Bedürfnissen planen?

- Kostenerstattung: Wie schnell kann das Unternehmen den Mitarbeitern die Kosten erstatten? Expensify-Bewertungen heben diese Geschwindigkeit hervor.

- Probefahrt: Testen Sie Xero oder Expensify immer mit einer kostenlosen Testversion, um sicherzustellen, dass die Benutzeroberfläche und die Funktionen Ihren Bedürfnissen entsprechen.

Endgültiges Urteil

Nach Prüfung der Funktionen hängt unsere Wahl von Ihren Hauptbedürfnissen ab.

Wenn Sie einen umfassenden Buchhaltungsservice benötigen, empfehlen wir Xero, da es eine Komplettlösung für Ihre Buchhaltungssoftware bietet.

Es übernimmt die Online-Rechnungsstellung und die Kreditorenbuchhaltung, sodass Sie Rechnungen erfassen und Ihre wichtigsten Geschäftsfinanzen verwalten können.

Beispielsweise sind im Basistarif bis zu fünf Rechnungen möglich.

Wenn Ihr Hauptziel jedoch die Vereinfachung von Spesenabrechnungen ist, ist Expensify das richtige Werkzeug.

Es hilft Ihrem Team, Belege schnell und einfach per Smartphone oder Desktop-Ansicht zu kodieren und einzureichen.

Unabhängig von Ihrer Wahl bieten beide Systeme eine gute Sicherheit für Ihre Finanzdaten.

Wir haben die detaillierte Analyse für Sie übernommen, damit Sie ohne langes Vorgehen eine fundierte Entscheidung treffen können.

Mehr von Xero

Die Wahl der richtigen Buchhaltungssoftware erfordert die Prüfung einer Reihe von Optionen.

Hier ein kurzer Vergleich von Xero mit anderen gängigen Produkten.

- Xero vs. QuickBooks: QuickBooks ist ein wichtiger Konkurrent. Beide bieten zwar ähnliche Kernfunktionen, Xero wird jedoch häufig für seine übersichtliche Benutzeroberfläche und die unbegrenzte Benutzeranzahl gelobt. QuickBooks kann komplexer sein, bietet aber sehr leistungsstarke Berichtsfunktionen.

- Xero vs FreshBooks: FreshBooks ist besonders bei Freiberuflern und Dienstleistungsunternehmen beliebt. Es eignet sich hervorragend für Rechnungsstellung und Zeiterfassung. Xero bietet eine umfassendere Buchhaltungslösung.

- Xero vs. Sage: Sowohl Sage als auch Xero bieten Lösungen für kleine Unternehmen an. Sage bietet jedoch auch umfassendere ERP-Systeme (Enterprise Resource Planning) für größere Unternehmen.

- Xero vs Zoho Books: Zoho Books ist Teil einer umfangreichen Suite von Business-Anwendungen. Es bietet oft erweiterte Funktionen für die Lagerverwaltung und ist sehr kostengünstig. Xero hingegen ist eine führende Option, die sich durch Einfachheit und Benutzerfreundlichkeit auszeichnet.

- Xero vs Wave: Wave ist für seinen kostenlosen Tarif bekannt. Er eignet sich hervorragend für Kleinstunternehmen oder Freiberufler mit begrenztem Budget. Xero bietet einen größeren Funktionsumfang und ist besser für Unternehmenswachstum geeignet.

- Xero vs. Quicken: Quicken ist hauptsächlich für die private Finanzverwaltung gedacht. Zwar bietet es einige Funktionen für Unternehmen, ist aber keine vollwertige Buchhaltungslösung. Xero hingegen wurde speziell für die komplexen Anforderungen der betrieblichen Buchhaltung entwickelt.

- Xero vs HubdocEs handelt sich hierbei nicht um direkte Konkurrenten. Sowohl Dext als auch Hubdoc sind Tools, die die Dokumentenerfassung und Dateneingabe automatisieren. Sie sind direkt in Xero integriert, um die Buchhaltung schneller und genauer zu gestalten.

- Xero vs Synder: Synder ist eine Plattform, die Vertriebskanäle und Zahlungsanbieter mit Buchhaltungssoftware verbindet. Sie hilft dabei, die Dateneingabe von Plattformen wie Shopify und Stripe direkt in Xero zu automatisieren.

- Xero vs ExpensifyExpensify konzentriert sich speziell auf das Spesenmanagement. Xero bietet zwar auch Spesenfunktionen, Expensify bietet jedoch fortschrittlichere Tools für die Verwaltung von Mitarbeiterausgaben und -erstattungen.

- Xero vs. Netsuite: NetSuite ist ein umfassendes ERP-System für große Unternehmen. Es bietet eine komplette Palette an Tools für das Unternehmensmanagement. Xero ist kein ERP-System, aber eine hervorragende Buchhaltungslösung für kleine Unternehmen.

- Xero vs Puzzle IO: Puzzle IO ist eine Finanzplattform für Startups, die sich auf Finanzberichte in Echtzeit und automatisierte Dateneingabe konzentriert.

- Xero vs. Easy Monatsabschluss: Diese Software ist ein Spezialwerkzeug zur Automatisierung des Monatsabschlusses und unterstützt die Abstimmung und die Nachverfolgung von Konten. Sie ist für die Zusammenarbeit mit Xero konzipiert, nicht als Ersatz.

- Xero vs Docyt: Docyt nutzt KI, um Backoffice- und Buchhaltungsaufgaben zu automatisieren. Es bietet die Möglichkeit, alle Ihre Finanzdokumente und -daten an einem Ort einzusehen.

- Xero vs RefreshMe: RefreshMe ist eine einfachere Buchhaltungssoftware mit Basisfunktionen, die häufig für private Finanzen oder sehr kleine Unternehmen verwendet wird.

- Xero vs AutoEntry: Ähnlich wie Dext und Hubdoc ist AutoEntry ein Tool, das die Datenextraktion aus Belegen und Rechnungen automatisiert und für die Integration und Erweiterung von Buchhaltungssoftware wie Xero entwickelt wurde.

Mehr Ausgaben

- Kosten vs. RätselDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- Expensify vs DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- Expensify vs XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- Expensify vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Ausgaben vs. Einfaches MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- Expensify vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- Expensify vs SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- Expensify vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Kostensteigerung vs. WelleDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- Expensify vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- Expensify vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- Expensify vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- Expensify vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- Expensify vs NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Ist Xero für die allgemeine Buchhaltung besser als Expensify?

Ja, Xero bietet umfassende Buchhaltungsfunktionen wie Rechnungsstellung, Bankabstimmung und Finanzberichterstattung und ist damit eine vollständigere Lösung.

Kann Expensify Buchhaltungssoftware wie Xero ersetzen?

Nein, Expensify konzentriert sich auf das Ausgabenmanagement. Es lässt sich zwar in Xero integrieren, bietet aber keine vollständigen Buchhaltungsfunktionen.

Welches Programm ist einfacher zur Ausgabenverfolgung zu bedienen: Xero oder Expensify?

Expensify gilt aufgrund seiner benutzerfreundlichen Funktionen zum Scannen von Belegen und zur Berichterstellung allgemein als einfacher für das Spesenmanagement.

Funktionieren Xero und Expensify gut zusammen?

Ja, Expensify und Xero verfügen über starke Integrationsmöglichkeiten, die eine nahtlose Übertragung der Ausgabendaten in Ihr Buchhaltungssystem ermöglichen.

Welche Plattform eignet sich besser für kleine Unternehmen mit begrenztem Budget?

Der Einstiegsplan von Expensify ist in der Regel günstiger, Xero bietet jedoch umfassendere Funktionen, die für wachsende Kleinunternehmen von Vorteil sein können.