Wollen Sie herausfinden, ob Snyder oder FreshBooks besser für Sie geeignet ist? Geschäft?

Die richtige Wahl treffen Buchhaltungssoftware kann sich wie eine große Entscheidung anfühlen.

Sie benötigen eine Software, die einfach zu bedienen ist, aber dennoch leistungsstark genug, um ihre Finanzen zu verwalten.

Welches System gewinnt also?

Werfen wir einen Blick darauf, was Snyder und FreshBooks zu bieten haben und sehen wir, welches Angebot am besten zu Ihnen passt!

Überblick

Wir haben uns sowohl Snyder als auch FreshBooks genauer angesehen.

We tried them out like you would.

This helped us see what each one can do.

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Check it out today!

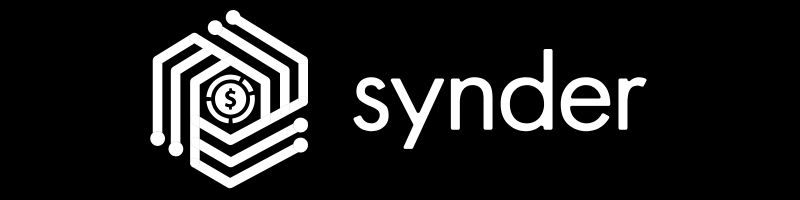

Preisgestaltung: It has a free trial. The premium plan starts at $52/month.

Hauptmerkmale:

- Multi-Channel Sales Sync

- Automatisierter Abgleich

- Detaillierte Berichterstattung

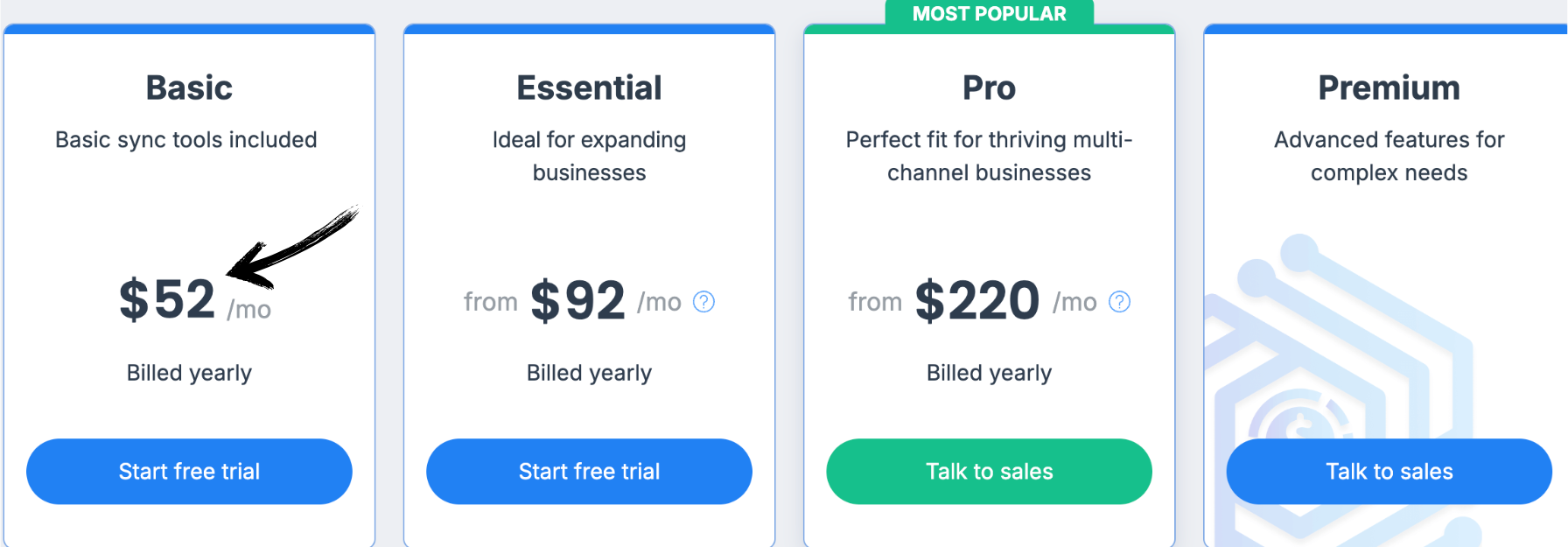

Bereit für einfachere Rechnungsstellung und schnellere Bezahlung? Über 30 Millionen Menschen nutzen bereits FreshBooks. Entdecken Sie es jetzt!

Preisgestaltung: Es gibt eine kostenlose Testphase. Das kostenpflichtige Abonnement beginnt bei 2,10 $/Monat.

Hauptmerkmale:

- Zeiterfassung

- Fakturierung

- Buchhaltung

What is Synder?

Let’s talk about Synder.

It’s a tool that helps your different business apps talk to each other.

Think of it like a helper that moves your money info where it needs to go.

This can save you a lot of time.

Entdecken Sie auch unsere Favoriten Synder Alternatives…

Unsere Einschätzung

Synder automatisiert Ihre Buchhaltung und synchronisiert Verkaufsdaten nahtlos mit QuickBooks. Xeround vieles mehr. Unternehmen, die Synder nutzen, berichten von einer durchschnittlichen Zeitersparnis von über 10 Stunden pro Woche.

Wichtigste Vorteile

- Automatische Synchronisierung von Verkaufsdaten

- Multi-Channel-Vertriebsverfolgung

- Zahlungsabstimmung

- Integration der Bestandsverwaltung

- Detaillierte Verkaufsberichte

Preisgestaltung

Alle Pläne werden Jährliche Abrechnung.

- Basic: 52 US-Dollar pro Monat.

- Essentiell: 92 US-Dollar pro Monat.

- Pro: 220 US-Dollar pro Monat.

- Prämie: Individuelle Preisgestaltung.

Vorteile

Nachteile

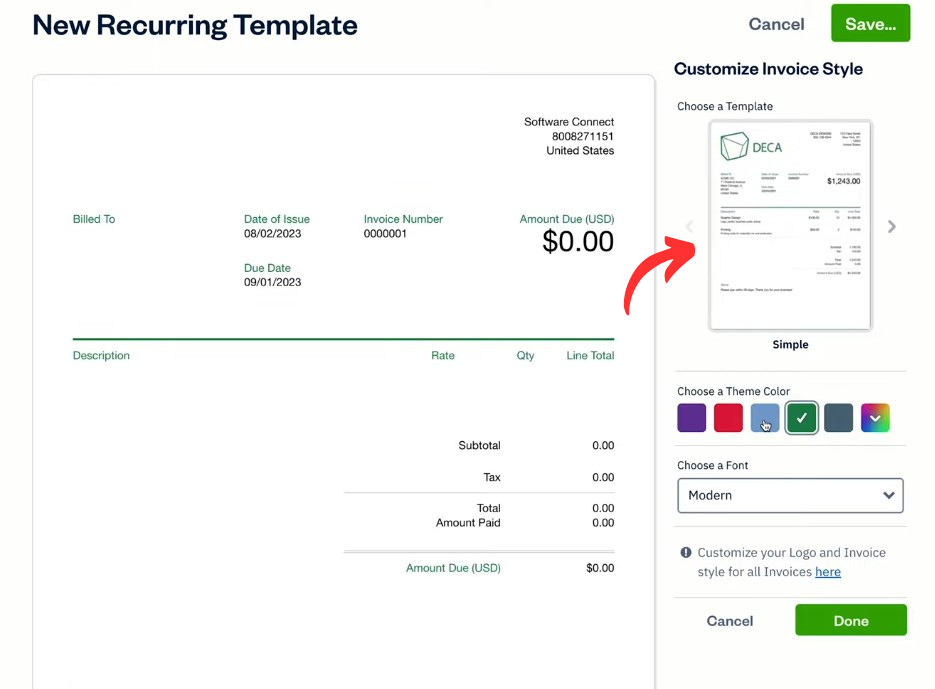

Was ist FreshBooks?

Okay, reden wir also über FreshBooks.

Betrachten Sie es als Helfer für Ihre Finanzangelegenheiten.

Es ist für Leute gemacht, die laufen kleine Unternehmen und freiberufliche Tätigkeiten ausüben.

Es hilft Ihnen, Rechnungen zu versenden, den Überblick über Ihre Einnahmen zu behalten und zu sehen, wohin Ihr Geld fließt.

Es ist, als hätte man eine einfache Möglichkeit, die Finanzen seines Unternehmens zu verwalten.

Entdecken Sie auch unsere Favoriten FreshBooks-Alternativen…

Unsere Einschätzung

Sie haben genug von komplizierter Buchhaltung? Über 30 Millionen Unternehmen vertrauen FreshBooks, um professionelle Rechnungen zu erstellen. Vereinfachen Sie Ihre Buchhaltung. Buchhaltungssoftware Heute!

Wichtigste Vorteile

- Professionelle Rechnungserstellung

- Automatische Zahlungserinnerungen

- Zeiterfassung

- Projektmanagement-Tools

- Ausgabenverfolgung

Preisgestaltung

- Lite: 2,10 $/Monat.

- Plus: 3,80 $/Monat.

- Prämie: 6,50 $/Monat.

- Wählen: Individuelle Preisgestaltung.

Vorteile

Nachteile

Funktionsvergleich

Hallo! Kommen wir nun zu den Details der Funktionen, die machen Diese beiden Plattformen stechen hervor.

Wir haben die Funktionen von Snyder und FreshBooks genau unter die Lupe genommen, um Ihnen einen möglichst präzisen Vergleich zu ermöglichen.

1. E-Commerce-Integration und Vertriebskanäle

Synder ist für den E-Commerce konzipiert.

Es kann Verbindungen zu all Ihren Vertriebskanälen wie Shopify, Stripe, eBay, Square und mehr herstellen.

Das ist äußerst hilfreich, wenn Sie ein hohes Transaktionsvolumen haben und alle Ihre Daten synchronisieren müssen. Buchhaltung System im Einzelsynchronisationsmodus.

FreshBooks konzentriert sich zwar stärker auf dienstleistungsorientierte Unternehmen, kann aber auch Zahlungen entgegennehmen und sich mit einigen Zahlungsdienstleistern verbinden.

2. Historische Transaktionen

Müssen Sie alte Daten importieren? Synder eignet sich hervorragend zum Synchronisieren historischer Transaktionen aus der Vergangenheit.

Das bedeutet, dass Sie alle Ihre Vertriebskanäle mit einem Klick in Ihre Buchhaltung einbinden können.

FreshBooks ermöglicht zwar auch den Import von Vergangenheitsdaten, ist aber nicht so stark auf große Datenmengen aus verschiedenen Vertriebskanälen ausgerichtet wie Snyder.

3. Automatisierte Buchhaltung

Tatsächlich kann die manuelle Dateneingabe sehr stressig sein.

Synder bietet eine vollautomatisierte Buchhaltung, die Ihnen hilft, Ihre Bücher im Gleichgewicht zu halten, ohne dass Sie viel Arbeit selbst erledigen müssen.

Es kann sogar Dinge wie Rückerstattungen, Rabatte, Versand und Gebühren im Hintergrund abwickeln.

FreshBooks hat großartige Automatisierung für Rechnungsstellung und Spesenabrechnung, aber Synder geht mit Multi-Channel-Vertrieb noch einen Schritt weiter.

4. Umsatzrealisierung und Einhaltung der Rechnungslegungsgrundsätze

Für größere Unternehmen oder solche mit Abonnements ist die Umsatzrealisierung von zentraler Bedeutung.

Synder verfügt über ein spezielles Tool, das dabei hilft.

Es hilft auch bei der Einhaltung der GAAP-Richtlinien, was für Finanzteams von großem Vorteil ist. Buchhalter.

FreshBooks eignet sich auch hervorragend für BuchhaltungDer Fokus liegt jedoch nicht so sehr auf diesen spezifischen fortgeschrittenen Funktionen.

5. Berichterstattung und Erkenntnisse

Sie müssen wissen, wie es Ihrem Unternehmen geht. Synder liefert Ihnen Berichte und Einblicke zu Themen wie Auszahlungen, Gebühren und Steuern.

Es hilft Ihnen, die Details Ihres Unternehmens von einem Ort aus zu sehen.

FreshBooks bietet außerdem aussagekräftige Buchhaltungsberichte und ein gutes FreshBooks-Dashboard, mit dem Sie Ausgaben verfolgen und Projekte verwalten können.

6. Preispläne

Beide bieten unterschiedliche Preismodelle an, die Ihren Bedürfnissen entsprechen.

FreshBooks bietet vier Abonnements an: Lite, Plus, Premium und Select.

Der Lite-Tarif eignet sich hervorragend für Selbstständige und Freiberufler. Gegen eine geringe monatliche Gebühr können Sie Rechnungen an Ihre Kunden senden.

Der FreshBooks Plus-Tarif bietet mehr Funktionen und ermöglicht die Abrechnung mit bis zu 50 Kunden.

Die Preisgestaltung von Synder hängt stärker von der Anzahl Ihrer Transaktionen ab, wodurch sie sich auch für Unternehmen mit hohem Transaktionsvolumen eignet.

7. Projekt- und Zeitmanagement

Wenn Sie nach Stunden abrechnen, ist dies wichtig.

FreshBooks verfügt über hervorragende Projektmanagement-Funktionen, mit denen Sie die Zeit erfassen und Projekte verwalten können.

Es hilft Ihnen, die abrechnungsfähige Zeit zu verwalten und die Rentabilität von Projekten zu verfolgen.

Synder konzentriert sich stärker auf die Synchronisierung von Verkaufsdaten und verfügt nicht über solche Projektmanagement-Tools.

8. Mobile App

Sind Sie viel unterwegs? Die FreshBooks-Mobil-App funktioniert hervorragend auf beiden Plattformen. iOS und Android-Geräte.

Es ermöglicht Ihnen, Rechnungen zu versenden, Ausgaben zu verfolgen und Ihr Geschäft auch ohne Internetverbindung im Blick zu behalten.

Synder bietet auch eine App für mobile Geräte an, seine Stärken liegen aber hauptsächlich in der Desktop- und Webversion.

9. Kundensupport

Wenn man Probleme hat, wünscht man sich ein hilfsbereites Team.

In Rezensionen zu FreshBooks wird häufig erwähnt, dass der Kundenservice sehr gut ist.

Gerne stellen sie Ihnen ein hilfsbereites Team zur Verfügung, das Sie bei der Einrichtung unterstützt und eventuelle Fehler während des automatisierten Prozesses behebt.

Worauf sollte man bei der Auswahl einer Buchhaltungssoftware achten?

- E-Commerce und IntegrationenWenn Sie eine E-Commerce-Website oder Kassensysteme wie Clover, Stripe, Square, Etsy oder PayPal verwenden, stellen Sie sicher, dass die Software kompatibel ist und ein hohes Transaktionsvolumen bewältigen kann. Suchen Sie nach einer Lösung, die mit all Ihren Vertriebskanälen verbunden ist.

- AutomatisierungAchten Sie auf automatisierte Buchhaltungsfunktionen, die Ihnen Zeit sparen, von der Synchronisierung mit Ihrer Bank bei nicht abgeglichenen Transaktionen bis hin zur Bearbeitung wiederkehrender Rechnungen.

- PreispläneVergleichen Sie die Preispläne und deren Leistungen. Eine kostenlose Version oder ein Lite-Tarif eignen sich gut für den Einstieg. Prüfen Sie, ob eine Pauschalgebühr oder eine monatliche Gebühr anfällt und welche Funktionen im Premium- oder Select-Tarif enthalten sind.

- Berichterstattung und EinblickeAchten Sie darauf, dass die Software übersichtliche Berichte und Einblicke in Ihre Bilanzen, Rechnungsstellung und andere Finanzdaten liefert, um Ihnen die Steuererklärung zu erleichtern. Suchen Sie nach einem Tool, das Ihnen ein umfassendes Bild Ihrer Geschäftspartner und Kunden vermittelt.

- Advanced FeaturesBenötigen Sie mehr als nur grundlegende Rechnungsstellungsfunktionen, sollten Sie nach erweiterten Zahlungsoptionen wie ACH-Überweisungen und einem virtuellen Terminal Ausschau halten. Möglicherweise benötigen Sie auch eine Bestandsverwaltung, doppelte Buchführung oder die Möglichkeit, Projekte zu verwalten und die Arbeitszeit für abrechnungsfähige Kunden zu erfassen.

- Flexibilität: Der best accounting software should be flexible. It should be able to handle multi-currency transactions and connect with other accounting software like Xero or NetSuite.

- BenutzerfreundlichkeitZiel ist es, Stress zu reduzieren, nicht ihn zu erhöhen. Eine gute Buchhaltungssoftware sollte sich einfach einrichten lassen und eine benutzerfreundliche Oberfläche bieten, die für Sie und Ihre Teammitglieder leicht zu bedienen ist.

- Unterstützung: Achten Sie auf einen zuverlässigen Kundensupport, der Ihnen bei Problemen weiterhilft. Lesen Sie Rezensionen zu FreshBooks oder anderer Software, um die Erfahrungen anderer Nutzer kennenzulernen.

- Sonstige BedürfnisseÜberlegen Sie, ob Sie professionelle Kostenvoranschläge erstellen, Mahngebühren bearbeiten oder Kundenhonorare verwalten müssen. Manche Tools sind ausschließlich für Projekte konzipiert, wählen Sie daher das Tool, das am besten zu Ihrem Unternehmen passt.

Endgültiges Urteil

Also, welches sollten Sie wählen: Snyder oder FreshBooks?

Für viele Kleinunternehmen Für Inhaber und Einzelunternehmer ist FreshBooks die beste Wahl.

Es ist einfach einfacher zu handhaben für Dinge wie Rechnungsstellung und Ausgabenverfolgung.

Und falls Sie eine Lohnbuchhaltung benötigen, ist diese oft schon integriert.

Dank seiner starken Integration und der Möglichkeit zur Dateneingabe in Echtzeit trägt es zur Optimierung Ihres Arbeitsablaufs bei.

Wir haben beides ausgiebig getestet und hoffen daher, dass Ihnen dies bei der Entscheidung hilft, was für Ihr Business-Management am besten geeignet ist.

More of Synder

- Synder vs Puzzle io: Puzzle.io is an AI-powered accounting tool built for startups, with a focus on metrics like burn rate and runway. Synder is more focused on syncing multi-channel sales data for a broader range of businesses.

- Synder vs Dext: Dext is an automation tool that excels at capturing and managing data from bills and receipts. Synder, on the other hand, specializes in automating the flow of sales transactions.

- Synder vs Xero: Xero is a full-featured cloud accounting platform. Snyder works with Xero to automate data entry from sales channels, whereas Xero handles all-in-one accounting tasks like invoicing and reporting.

- Synder vs Easy Month End: Easy Month End is a tool designed to help businesses organize and streamline their month-end closing process. Synder is more about automating daily transaction data flow.

- Synder vs Docyt: Docyt uses AI for a wide range of bookkeeping, including bill pay and expense management. Synder is more focused on automatically syncing sales and payment data from multiple channels.

- Synder vs RefreshMe: RefreshMe is a personal finance and task management application. This is not a direct competitor, as Synder is a business accounting automation tool.

- Synder vs Sage: Sage is a long-standing, comprehensive accounting system with advanced features like inventory management. Synder is a specialized tool that automates data entry into accounting systems like Sage.

- Synder vs Zoho Books: Zoho Books is a complete accounting solution. Snyder ergänzt Zoho Books durch die Automatisierung des Imports von Verkaufsdaten von verschiedenen E-Commerce-Plattformen.

- Synder vs Wave: Wave is a free, user-friendly accounting software, often used by freelancers and very small businesses. Synder is a paid automation tool designed for businesses with high-volume, multi-channel sales.

- Synder vs Quicken: Quicken is primarily personal finance management software, though it has some small business features. Synder is built specifically for business accounting automation.

- Synder vs Hubdoc: Hubdoc is a document management and data capture tool, similar to Dext. It focuses on digitizing bills and receipts. Synder focuses on syncing online sales and payment data.

- Synder vs Expensify: Expensify is a tool for managing expense reports and receipts. Synder is for automating sales transaction data.

- Synder vs QuickBooks: QuickBooks ist eine umfassende Buchhaltungssoftware. Snyder integrates with QuickBooks to automate the process of bringing in detailed sales data, making it a valuable add-on rather than a direct alternative.

- Synder vs AutoEntry: AutoEntry is a data entry automation tool that captures information from invoices, bills, and receipts. Synder focuses on automating sales and payment data from ecommerce platforms.

- Synder vs FreshBooks: FreshBooks is an accounting software designed for freelancers and small service-based businesses, with a focus on invoicing. Synder is for businesses with a high volume of sales from multiple online channels.

- Synder vs NetSuite: NetSuite is a comprehensive Enterprise Resource Planning (ERP) system. Synder is a specialized tool that syncs ecommerce data into broader platforms like NetSuite.

Mehr von FreshBooks

- FreshBooks vs Puzzle IODiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- FreshBooks vs. DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- FreshBooks vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- FreshBooks vs. SnyderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- FreshBooks vs. Easy MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- FreshBooks vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- FreshBooks vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- FreshBooks vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- FreshBooks vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- FreshBooks vs QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- FreshBooks vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- FreshBooks vs ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- FreshBooks vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- FreshBooks vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- FreshBooks vs. NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Ist Snyder besser als FreshBooks?

Das hängt von Ihren Bedürfnissen ab. FreshBooks eignet sich hervorragend für Rechnungsstellung und Ausgabenverfolgung, insbesondere für dienstleistungsorientierte Unternehmen. Snyder zeichnet sich durch die Automatisierung der Buchhaltung und die Integration mit zahlreichen Plattformen für E-Commerce und andere Unternehmen mit hohem Bedarf an soliden Finanzverbindungen aus.

Lässt sich Synder in QuickBooks integrieren?

Ja, Synder bietet eine nahtlose Integration mit QuickBooks Online und QuickBooks Desktop. Dies ermöglicht die automatische Datensynchronisierung und macht die Buchhaltung für Unternehmen effizienter. using QuickBooks.

Bietet FreshBooks Lohnabrechnung an?

Ja, FreshBooks bietet in einigen seiner Tarife Lohnabrechnungsfunktionen über Gusto an. Dadurch ist Folgendes möglich: Kleinunternehmen Inhaber können die Zahlungen ihrer Teams direkt innerhalb der FreshBooks-Plattform verwalten.

Welches ist einfacher zu bedienen, Snyder oder FreshBooks?

FreshBooks gilt allgemein als benutzerfreundlicher, insbesondere für Einzelunternehmer und kleine Unternehmen mit einfachen Anforderungen an Rechnungsstellung und Ausgabenverfolgung. Snyder hingegen, mit seinen umfassenderen Automatisierungsfunktionen, erfordert unter Umständen etwas mehr Einarbeitungszeit.

Kann Synder bei der Bankabstimmung helfen?

Ja, Synder wurde speziell entwickelt, um den Bankabstimmungsprozess zu automatisieren und zu vereinfachen, indem Transaktionen zwischen Ihren Bankkonten und Ihrer Buchhaltungssoftware automatisch abgeglichen werden. Dies spart Zeit und reduziert Fehler.