Are you tired of piles of receipts and messy expense reports?

It can be a real headache trying to keep track of where your money is going, right?

Nun, das gibt es!

Two popular tools, Synder vs Expensify, aim to simplify expense management.

But which one is the better fit for you?

Let’s take a closer look and help you decide.

Überblick

We looked closely at both Synder and Expensify.

Wir haben ihre Funktionen ausprobiert.

Wir haben gesehen, wie einfach sie zu bedienen waren.

Dies half uns, sie direkt miteinander zu vergleichen.

Jetzt können wir Ihnen zeigen, was jedes einzelne Gerät am besten kann.

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Check it out today!

Preisgestaltung: It has a free trial. The premium plan starts at $52/month.

Hauptmerkmale:

- Multi-Channel Sales Sync

- Automatisierter Abgleich

- Detaillierte Berichterstattung

Schließen Sie sich über 15 Millionen Nutzern an, die Expensify vertrauen, um ihre Finanzen zu vereinfachen. Sparen Sie bis zu 83 % Zeit bei der Erstellung von Spesenabrechnungen.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 5 $ pro Monat.

Hauptmerkmale:

- SmartScan-Belegerfassung

- Firmenkartenabstimmung

- Erweiterte Genehmigungsworkflows.

What is Synder?

Let’s talk about Synder.

It’s a tool that helps your different Geschäft apps talk to each other.

Think of it like a helper that moves your money info where it needs to go.

This can save you a lot of time.

Entdecken Sie auch unsere Favoriten Synder Alternatives…

Unsere Einschätzung

Synder automatisiert Ihre Buchhaltung und synchronisiert Verkaufsdaten nahtlos mit QuickBooks. Xeround vieles mehr. Unternehmen, die Synder nutzen, berichten von einer durchschnittlichen Zeitersparnis von über 10 Stunden pro Woche.

Wichtigste Vorteile

- Automatische Synchronisierung von Verkaufsdaten

- Multi-Channel-Vertriebsverfolgung

- Zahlungsabstimmung

- Integration der Bestandsverwaltung

- Detaillierte Verkaufsberichte

Preisgestaltung

Alle Pläne werden Jährliche Abrechnung.

- Basic: 52 US-Dollar pro Monat.

- Essentiell: 92 US-Dollar pro Monat.

- Pro: 220 US-Dollar pro Monat.

- Prämie: Individuelle Preisgestaltung.

Vorteile

Nachteile

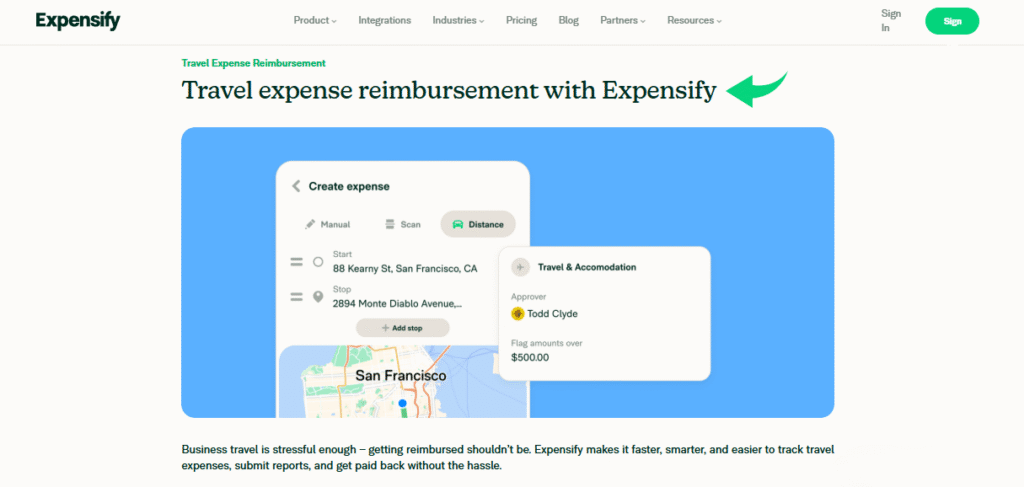

Was ist Expensify?

Okay, reden wir also über Expensify.

Es handelt sich um ein Tool, das Ihnen hilft, den Überblick über Ihre gesamten Geschäftsausgaben zu behalten.

Betrachten Sie es als einen Helfer, der sich merkt, wohin Ihr Geld fließt.

Es kann Informationen von Ihren Belegen und Bankunterlagen abrufen. Ziemlich praktisch!

Entdecken Sie auch unsere Favoriten Alternativen verteuern…

Wichtigste Vorteile

- Die SmartScan-Technologie scannt Belegdetails und extrahiert sie mit einer Genauigkeit von über 95%.

- Die Mitarbeiter erhalten ihre Erstattungen schnell, oft schon innerhalb eines Werktages per ACH-Überweisung.

- Mit der Expensify Card und ihrem Cashback-Programm können Sie bis zu 50 % bei Ihrem Abonnement sparen.

- Es wird keine Garantie übernommen; in den Allgemeinen Geschäftsbedingungen ist die Haftung beschränkt.

Preisgestaltung

- Sammeln: 5 US-Dollar pro Monat.

- Kontrolle: Individuelle Preisgestaltung.

Vorteile

Nachteile

Funktionsvergleich

Let’s dive into the details of what each tool offers.

We will look at nine key features to help you see how they are different and which one might work best for you.

1. Sales Channels & Transaction Syncing

Synder is built for ecommerce businesses.

It can connect to all your sales channels like Shopify, Etsy, eBay, Stripe, Square, and PayPal.

This allows it to bring in a high volume of sales Daten, including historical transactions.

It can sync mode to keep everything up to date, which helps keep your books balanced in real time.

2. Expense Management

Expensify is a powerful tool for the expense management process.

You can take a photo of a receipt with the app. It will then capture the details in a few seconds.

This makes it easy for employees to submit their costs and manage expenses.

It also has the Expensify card to machen things even faster.

3. Financial Automation & Bookkeeping

Synder’s main goal is automated Buchhaltung.

It helps finance teams with Buchhaltung. It can automatically record sales and expenses from your sales channels.

Expensify is more about automating the expense management process.

It uses AI to simplify submitting and getting approval for reports.

4. Multi-Currency & Payouts

For businesses that sell in different countries, multi-currency support is important.

Synder handles this well. It also helps you track payouts from your different platforms and match them with your bank account.

Expensify also has multi-currency features to handle international spending.

5. Integrationen

Both platforms are compatible with many other programs.

Expensify can integrate with popular accounting systems like QuickBooks Online, NetSuite, and Xero.

Synder is also compatible with these and more, including Salbei Intacct.

6. Benutzererfahrung

Synder is designed to run in the background.

You just do a quick setup, and then it handles things on its own.

Expensify is very easy to use for the user on a phone, web, or desktop.

You can capture a receipt with a quick photo and it is immediately ready.

7. Team Management & Approval

Expensify is perfect for finance teams who need to streamline their approval process.

A manager can review a report in a few seconds and approve it.

You can log mileage and track different projects.

You can also give access to contractors.

8. Real-Time Data & Insights

With Synder, you get real time data. It gives you insights into your sales.

You can see all the details from your sales channels.

Expensify also gives you real-time data for your expenses.

This lets a manager respond to requests right away.

9. Issue Resolution

Sometimes things can go wrong.

Synder can help you resolve issues with fees, taxes, refunds, and discounts.

This helps keep your balance sheets accurate.

Expensify can also help you resolve issues when an expense is blocked or has details that need to be fixed.

Worauf sollte man bei der Auswahl einer Buchhaltungssoftware achten?

When you’re ready to switch from a manual system, it can be a lot of stress to pick the right tool.

The truth is, the best choice depends on what your organization needs.

Here are some key things to focus on to avoid mistakes and find the best connection.

- Look at the Expensify reviews and other product feedback to see what real employers and Buchhalter think.

- Check if it can handle multi-channel sales. You want a tool that can reimburse employees and manage all your sales channels, from your website to Clover.

- A good tool helps keep your books balanced and supports reconciliation to prevent financial mistakes.

- For your team, the tool should be easy to use and not a stress. It should allow employees to capture a photo and file it in a flexible way.

- Make sure it handles subscriptions, shipping, taxes, and refunds automatically. This will help you achieve proper revenue recognition and gaap compliance.

- The tool should make it simple for a small number of users to submit expenses and get them approved with one click.

- Check if the tool allows you to add tags and categories to transactions. This helps with organization and getting expected insights.

- The best tools are compatible with what you already use. It should export data easily to your Buchhaltung System.

- See how it handles different types of expenses, like inventory or mileage. It should be flexible enough for your unique business needs.

- A connection to all your sales channels like Clover is key for an ecommerce business. It helps keep your inventory and sales records straight.

- Look for a tool that makes it easy for employees to get reimbursed for completing their expense reports. They should be able to file reports and have them stored on a single page.

- A tool should also let you set up triggers or rules. This means a report can be highlighted or approved based on certain details.

Endgültiges Urteil

So, which one should you pick: Synder or Expensify?

It’s easy to use for snapping receipts and managing reimbursements.

However, if you run a Kleinunternehmen and need help with things like invoices, getting paid.

And keeping your books in order with your Buchhaltung software, Synder might be the better fit.

Its ability to integrate and automate many financial tasks can save you a lot of time.

We think Synder offers a bit more for businesses that want to automate more of their money management.

We’ve looked closely at both, so we hope this helps you choose what works best for you!

More of Synder

- Synder vs Puzzle io: Puzzle.io is an AI-powered accounting tool built for startups, with a focus on metrics like burn rate and runway. Synder is more focused on syncing multi-channel sales data for a broader range of businesses.

- Synder vs Dext: Dext is an automation tool that excels at capturing and managing data from bills and receipts. Synder, on the other hand, specializes in automating the flow of sales transactions.

- Synder vs Xero: Xero is a full-featured cloud accounting platform. Snyder works with Xero to automate data entry from sales channels, whereas Xero handles all-in-one accounting tasks like invoicing and reporting.

- Synder vs Easy Month End: Easy Month End is a tool designed to help businesses organize and streamline their month-end closing process. Synder is more about automating daily transaction data flow.

- Synder vs Docyt: Docyt uses AI for a wide range of bookkeeping, including bill pay and expense management. Synder is more focused on automatically syncing sales and payment data from multiple channels.

- Synder vs RefreshMe: RefreshMe is a personal finance and task management application. This is not a direct competitor, as Synder is a business accounting automation tool.

- Synder vs Sage: Sage is a long-standing, comprehensive accounting system with advanced features like inventory management. Synder is a specialized tool that automates data entry into accounting systems like Sage.

- Synder vs Zoho Books: Zoho Books is a complete accounting solution. Snyder ergänzt Zoho Books durch die Automatisierung des Imports von Verkaufsdaten von verschiedenen E-Commerce-Plattformen.

- Synder vs Wave: Wave is a free, user-friendly accounting software, often used by freelancers and very small businesses. Synder is a paid automation tool designed for businesses with high-volume, multi-channel sales.

- Synder vs Quicken: Quicken is primarily personal finance management software, though it has some small business features. Synder is built specifically for business accounting automation.

- Synder vs Hubdoc: Hubdoc is a document management and data capture tool, similar to Dext. It focuses on digitizing bills and receipts. Synder focuses on syncing online sales and payment data.

- Synder vs Expensify: Expensify is a tool for managing expense reports and receipts. Synder is for automating sales transaction data.

- Synder vs QuickBooks: QuickBooks ist eine umfassende Buchhaltungssoftware. Snyder integrates with QuickBooks to automate the process of bringing in detailed sales data, making it a valuable add-on rather than a direct alternative.

- Synder vs AutoEntry: AutoEntry is a data entry automation tool that captures information from invoices, bills, and receipts. Synder focuses on automating sales and payment data from ecommerce platforms.

- Synder vs FreshBooks: FreshBooks is an accounting software designed for freelancers and small service-based businesses, with a focus on invoicing. Synder is for businesses with a high volume of sales from multiple online channels.

- Synder vs NetSuite: NetSuite is a comprehensive Enterprise Resource Planning (ERP) system. Synder is a specialized tool that syncs ecommerce data into broader platforms like NetSuite.

Mehr Ausgaben

- Kosten vs. RätselDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- Expensify vs DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- Expensify vs XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- Expensify vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Ausgaben vs. Einfaches MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- Expensify vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- Expensify vs SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- Expensify vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Kostensteigerung vs. WelleDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- Expensify vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- Expensify vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- Expensify vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- Expensify vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- Expensify vs NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

What is the main difference between Synder and Expensify?

Expensify is mostly for tracking expenses and receipts. Synder does that too, but it also helps with invoices, payments, and connects to your Buchhaltungssoftware to automate things.

Is Synder better for small businesses?

Synder can be very helpful for a Kleinunternehmen. It helps with getting paid and keeping your financial records organized by integrateing with tools like Zoho and FreshBooks.

Can Expensify integrate with my accounting software?

Yes, Expensify can integrate with many accounting software options. This helps you keep your expense information in one place.

Does Synder help with getting paid faster?

Yes, Synder helps you create and send invoices. It can also remind customers to pay, which can help you get paid faster.

Which tool is easier to use for a startup?

Both tools try to be easy to use. Expensify is simple for tracking expenses. Synder might take a little more time to set up all its automation features, but it can save time später for a startup.