Are you drowning in receipts and spreadsheets?

Keeping track of your Geschäft money can feel like a huge headache, right?

Zwei beliebte Optionen sind Snyder und Docyt.

But which one is actually better for Du?

Let’s examine these Buchhaltungssoftware options and determine which would make your life easier.

Überblick

We looked closely at both Synder and Docyt.

We tried them out to see what they can do.

This helped us compare them fairly.

Now we can show you how they are alike and different.

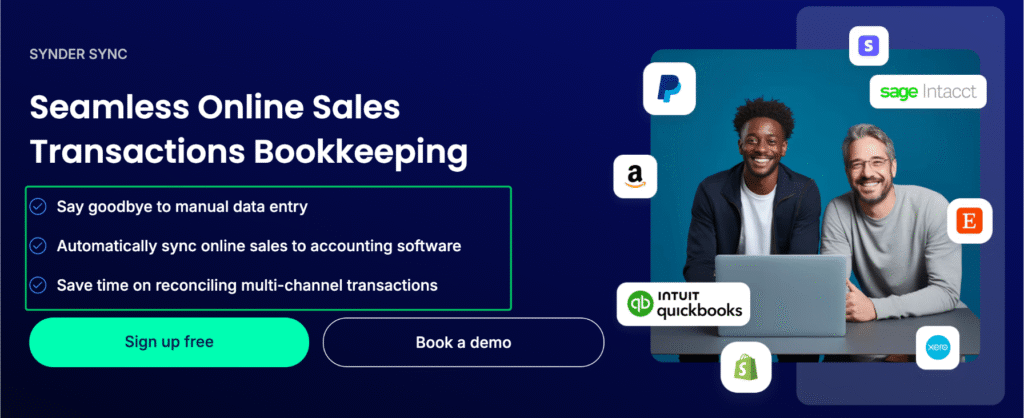

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Check it out today!

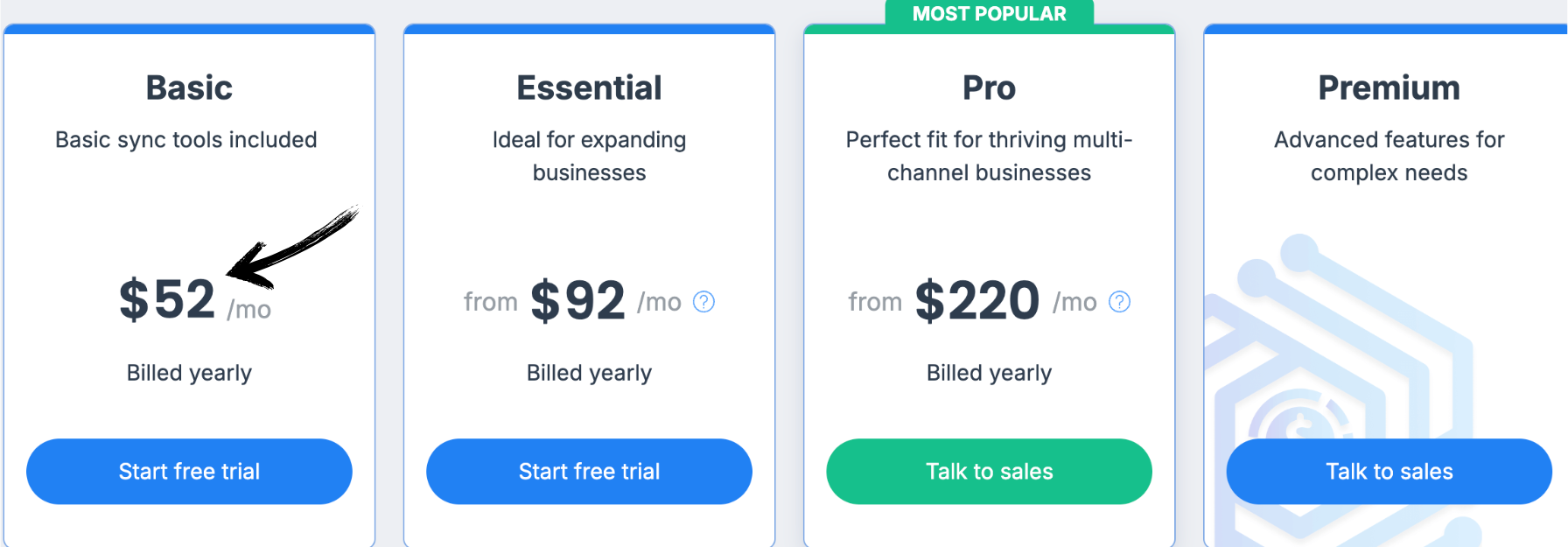

Preisgestaltung: It has a free trial. The premium plan starts at $52/month.

Hauptmerkmale:

- Multi-Channel Sales Sync

- Automatisierter Abgleich

- Detaillierte Berichterstattung

Ich habe genug von manuellen Verfahren. BuchhaltungDocyt AI automatisiert die Dateneingabe und den Datenabgleich und spart den Nutzern durchschnittlich 40 Stunden.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 299 $ pro Monat.

Hauptmerkmale:

- Automatisierter Abgleich

- Optimierte Arbeitsabläufe

- Benutzerfreundliche Oberfläche

What is Synder?

Let’s talk about Synder.

It’s a tool that helps your different business apps talk to each other.

Think of it like a helper that moves your money info where it needs to go.

This can save you a lot of time.

Entdecken Sie auch unsere Favoriten Synder Alternatives…

Unsere Einschätzung

Synder automatisiert Ihre Buchhaltung und synchronisiert Verkaufsdaten nahtlos mit QuickBooks. Xeround vieles mehr. Unternehmen, die Synder nutzen, berichten von einer durchschnittlichen Zeitersparnis von über 10 Stunden pro Woche.

Wichtigste Vorteile

- Automatische Synchronisierung von Verkaufsdaten

- Multi-Channel-Vertriebsverfolgung

- Zahlungsabstimmung

- Integration der Bestandsverwaltung

- Detaillierte Verkaufsberichte

Preisgestaltung

Alle Pläne werden Jährliche Abrechnung.

- Basic: 52 US-Dollar pro Monat.

- Essentiell: 92 US-Dollar pro Monat.

- Pro: 220 US-Dollar pro Monat.

- Prämie: Individuelle Preisgestaltung.

Vorteile

Nachteile

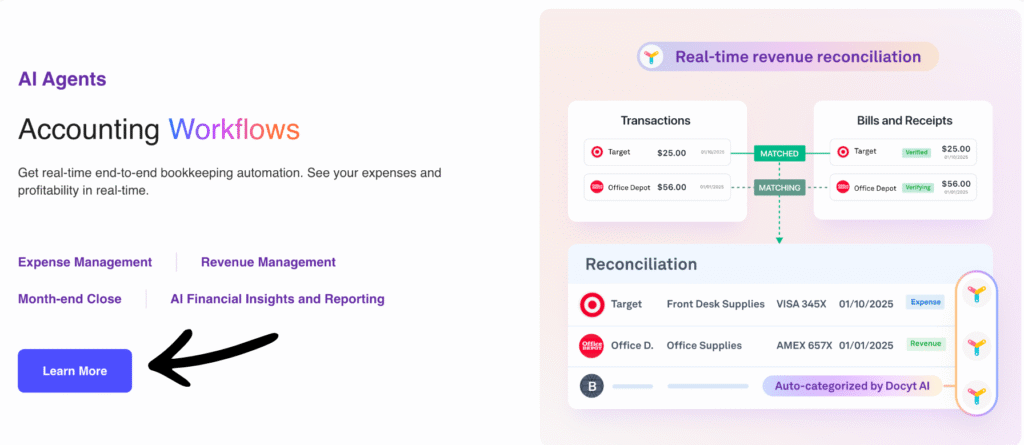

Was ist Docyt?

Let’s talk about Docyt.

It’s a tool that helps businesses keep track of their money stuff.

It can grab info from your bank and your bills.

This means less typing for you!

Entdecken Sie auch unsere Favoriten Docyt Alternatives…

Wichtigste Vorteile

- KI-gestützte Automatisierung: Docyt nutzt künstliche Intelligenz. Es extrahiert automatisch Daten aus Finanzdokumenten. Dies umfasst Details von über 100.000 Anbietern.

- Buchhaltung in Echtzeit: Hält Ihre Buchhaltung in Echtzeit auf dem neuesten Stand. So erhalten Sie jederzeit ein genaues Bild Ihrer finanziellen Situation.

- Dokumentenmanagement: Alle Finanzdokumente werden zentral verwaltet. Sie können diese einfach suchen und darauf zugreifen.

- Automatisierte Rechnungszahlung: Automatisiert den Rechnungszahlungsprozess. Rechnungen einfach planen und bezahlen.

- Kostenerstattung: Vereinfacht die Spesenabrechnung von Mitarbeitern. Spesenabrechnungen können schnell eingereicht und genehmigt werden.

- Nahtlose Integrationen: Lässt sich in gängige Buchhaltungssoftware integrieren. Dies umfasst QuickBooks und Xero.

- Betrugserkennung: Die KI kann dabei helfen, ungewöhnliche Transaktionen zu erkennen. Dies fügt eine zusätzliche Sicherheitsebene hinzu. SicherheitEs gibt keine spezifische Garantie für die Software, aber es werden kontinuierliche Updates bereitgestellt.

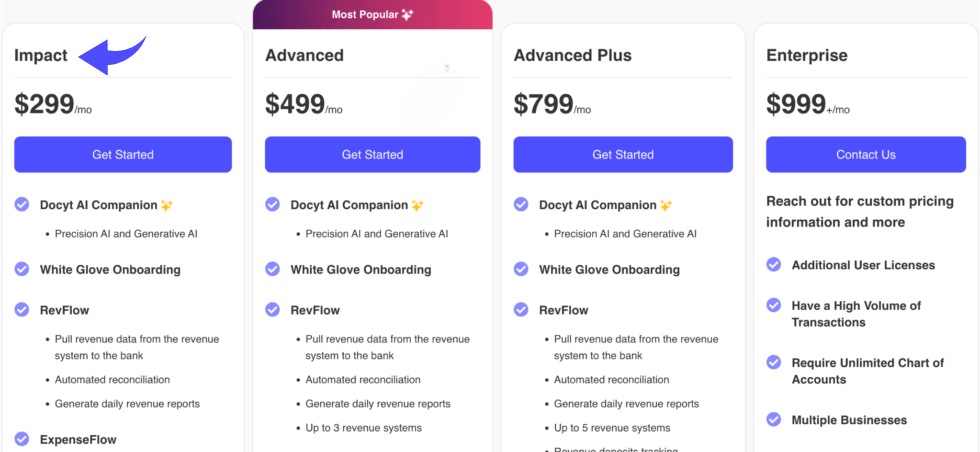

Preisgestaltung

- Auswirkungen: 299 US-Dollar pro Monat.

- Fortschrittlich: 499 US-Dollar/Monat.

- Fortschrittlich Plus: 799 US-Dollar/Monat.

- Unternehmen: 999 US-Dollar/Monat.

Vorteile

Nachteile

Funktionsvergleich

We will look at what each one does best.

This will help you decide which is a better fit for your business.

1. Sales Channels

- Synder is great for businesses that sell a lot online. It easily connects to all your sales channels, like Shopify, Stripe, and Etsy.

- Docyt also connects to many sales platforms to manage your multi-channel sales business.

2. Automated Accounting

- Synder offers automated Buchhaltung. It pulls your transactions in the background to help keep your books balanced with one click.

- Docyt is also a game-changer for automating back-office and Buchhaltung Aufgaben mithilfe seiner intelligenten Plattform erledigen.

3. AI Bookkeeping

- Docyt stands out with its AI Buchhaltung. It uses AI Automatisierung software to handle time-consuming tasks. Docyt learns your business intricacies to machen things easier.

- Synder focuses more on linking your sales and payment Daten to your main accounting system.

4. Real-Time Insights

- Synder gives you real-time insights so you know the instant financial status visibility of your money.

- Docyt also gives real-time financial reports. This helps you make smart strategic decisions.

5. Expense Management

- Both tools can help with expenses. Synder tracks your fees and taxes.

- Docyt is excellent for expense management. Its receipt capture feature makes it simple to handle expenses. This helps with automated bank reconciliation.

6. Month-End Close

- Closing the books at the end of the month is a big job. Docyt helps your finance teams with their month end close. It can even generate consolidated roll up and individual financial statements.

- This helps in ensuring constant financial control and cutting down on tedious tasks.

7. Historical Transactions

- When you setup Synder, you can bring in historical transactions. This is helpful for moving your old data to your new software.

8. Key Integrations

- Synder is compatible with many tools. It works with QuickBooks Online, QuickBooks, and Salbei Intacct.

- Docyt also works well with QuickBooks Online and helps with bill pay and revenue reconciliation.

9. Multi-Currency

- If you sell in different places, you need to handle multiple currencies. Synder is made to handle different currencies easily. It takes care of the details so you do not have to worry.

Worauf sollte man bei der Auswahl einer Buchhaltungssoftware achten?

Here are the key things to look for when you are choosing a tool like Synder or Docyt:

- Look for strong accounting automation. The software should automate tasks like managing invoices and payouts to save you time.

- Check if it helps with eliminating manual data entry. This reduces the chance of making mistakes and revenue accounting errors.

- Die Software sollte Ihre Bedürfnisse erfüllen, egal ob Sie mehrere Unternehmen besitzen oder verschiedene Geschäftsstandorte verwalten.

- The tool should offer real-time reports and offer real-time insights. This is important for strategic decision-making and tracking key performance indicators.

- Make sure it is compatible with all your platforms like PayPal, Stripe, Square, Shopify, Ebay, and your current accounting processes.

- If you need it, the software must handle multiple currencies and help with revenue recognition and GAAP compliance.

- Look for features that help with financial management and managing your bank accounts.

- Docyt’s AI-powered platform and its AI bookkeeper features are great if you want to use the latest AI to streamline your financial operations.

- It should help you easily see your profitability and manage inventory, shipping, and discounts.

- It should generate accurate balance sheets and work well with accounting firms that help kleine Unternehmen.

Endgültiges Urteil

We took a close look at both tools.

While Synder is a solid choice for high-volume ecommerce sellers.

We have to pick Docyt as the overall winner for most small businesses. Why?

Docyt offers features that truly help with eliminating manual data entry.

Its smart platform handles complex tasks like departmental accounting and managing many business locations effortlessly.

This reduces your stress. If you are looking to truly switch from a lot of boring work to accounting automation, Docyt is the better choice.

We’ve done the deep review on these tools, so you can be glad to trust our pick for your specific needs.

More of Synder

- Synder vs Puzzle io: Puzzle.io is an AI-powered accounting tool built for startups, with a focus on metrics like burn rate and runway. Synder is more focused on syncing multi-channel sales data for a broader range of businesses.

- Synder vs Dext: Dext is an automation tool that excels at capturing and managing data from bills and receipts. Synder, on the other hand, specializes in automating the flow of sales transactions.

- Synder vs Xero: Xero is a full-featured cloud accounting platform. Snyder works with Xero to automate data entry from sales channels, whereas Xero handles all-in-one accounting tasks like invoicing and reporting.

- Synder vs Easy Month End: Easy Month End is a tool designed to help businesses organize and streamline their month-end closing process. Synder is more about automating daily transaction data flow.

- Synder vs Docyt: Docyt uses AI for a wide range of bookkeeping, including bill pay and expense management. Synder is more focused on automatically syncing sales and payment data from multiple channels.

- Synder vs RefreshMe: RefreshMe is a personal finance and task management application. This is not a direct competitor, as Synder is a business accounting automation tool.

- Synder vs Sage: Sage is a long-standing, comprehensive accounting system with advanced features like inventory management. Synder is a specialized tool that automates data entry into accounting systems like Sage.

- Synder vs Zoho Books: Zoho Books is a complete accounting solution. Snyder ergänzt Zoho Books durch die Automatisierung des Imports von Verkaufsdaten von verschiedenen E-Commerce-Plattformen.

- Synder vs Wave: Wave is a free, user-friendly accounting software, often used by freelancers and very small businesses. Synder is a paid automation tool designed for businesses with high-volume, multi-channel sales.

- Synder vs Quicken: Quicken is primarily personal finance management software, though it has some small business features. Synder is built specifically for business accounting automation.

- Synder vs Hubdoc: Hubdoc is a document management and data capture tool, similar to Dext. It focuses on digitizing bills and receipts. Synder focuses on syncing online sales and payment data.

- Synder vs Expensify: Expensify is a tool for managing expense reports and receipts. Synder is for automating sales transaction data.

- Synder vs QuickBooks: QuickBooks ist eine umfassende Buchhaltungssoftware. Snyder integrates with QuickBooks to automate the process of bringing in detailed sales data, making it a valuable add-on rather than a direct alternative.

- Synder vs AutoEntry: AutoEntry is a data entry automation tool that captures information from invoices, bills, and receipts. Synder focuses on automating sales and payment data from ecommerce platforms.

- Synder vs FreshBooks: FreshBooks is an accounting software designed for freelancers and small service-based businesses, with a focus on invoicing. Synder is for businesses with a high volume of sales from multiple online channels.

- Synder vs NetSuite: NetSuite is a comprehensive Enterprise Resource Planning (ERP) system. Synder is a specialized tool that syncs ecommerce data into broader platforms like NetSuite.

Mehr von Docyt

Bei der Suche nach der richtigen Buchhaltungssoftware ist es hilfreich, die verschiedenen Plattformen miteinander zu vergleichen.

Hier folgt ein kurzer Vergleich von Docyt mit vielen seiner Alternativen.

- Docyt vs Puzzle IO: Während beide bei Finanzangelegenheiten helfen, konzentriert sich Docyt auf KI-gestützte Buchhaltung für Unternehmen, während Puzzle IO die Rechnungsstellung und Spesenabrechnung für Freiberufler vereinfacht.

- Docyt vs. Dext: Docyt bietet eine komplette KI-gestützte Buchhaltungsplattform an, während Dext sich auf die automatisierte Datenerfassung aus Dokumenten spezialisiert hat.

- Docyt vs. Xero: Docyt ist für seine umfassende KI-Automatisierung bekannt. Xero bietet ein umfassendes und benutzerfreundliches Buchhaltungssystem für allgemeine Geschäftsanforderungen.

- Docyt gegen Synder: Docyt ist ein KI-gestütztes Buchhaltungstool zur Automatisierung von Backoffice-Prozessen. Synder konzentriert sich auf die Synchronisierung von E-Commerce-Verkaufsdaten mit Ihrer Buchhaltungssoftware.

- Docyt vs. Easy Monatsende: Docyt ist eine umfassende KI-gestützte Buchhaltungslösung. Easy Month End ist ein Spezialtool, das speziell für die Optimierung und Vereinfachung des Monatsabschlusses entwickelt wurde.

- Docyt vs RefreshMe: Docyt ist ein Buchhaltungsprogramm für Unternehmen, während RefreshMe eine App für persönliche Finanzen und Budgetplanung ist.

- Docyt vs Sage: Docyt verfolgt einen modernen, KI-gestützten Ansatz. Sage ist ein traditionsreiches Unternehmen, das eine breite Palette an klassischen und cloudbasierten Buchhaltungslösungen anbietet.

- Docyt vs Zoho Books: Docyt konzentriert sich auf KI-gestützte Buchhaltungsautomatisierung. Zoho Books ist eine Komplettlösung, die einen umfassenden Funktionsumfang zu einem wettbewerbsfähigen Preis bietet.

- Docyt vs Wave: Docyt bietet leistungsstarke KI-Automatisierung für wachsende Unternehmen. Wave ist eine kostenlose Buchhaltungsplattform, die sich besonders für Freiberufler und Kleinstunternehmen eignet.

- Docyt vs Quicken: Docyt ist für die betriebliche Buchhaltung konzipiert. Quicken ist in erster Linie ein Tool für die private Finanzverwaltung und Budgetplanung.

- Docyt vs Hubdoc: Docyt ist ein komplettes KI-gestütztes Buchhaltungssystem. Hubdoc ist ein Datenerfassungstool, das Finanzdokumente automatisch sammelt und verarbeitet.

- Docyt vs Expensify: Docyt übernimmt alle Buchhaltungsaufgaben. Expensify ist spezialisiert auf die Verwaltung und das Reporting von Mitarbeiterausgaben.

- Docyt vs QuickBooks: Docyt ist eine KI-Automatisierungsplattform, die QuickBooks erweitert. QuickBooks ist eine umfassende Buchhaltungssoftware für Unternehmen jeder Größe.

- Docyt vs AutoEntry: Docyt ist eine KI-gestützte Buchhaltungslösung mit umfassendem Service. AutoEntry konzentriert sich speziell auf die Extraktion und Automatisierung von Dokumentendaten.

- Docyt vs FreshBooks: Docyt nutzt fortschrittliche KI zur Automatisierung. FreshBooks ist eine benutzerfreundliche Lösung, die aufgrund ihrer Funktionen zur Rechnungsstellung und Zeiterfassung bei Freiberuflern beliebt ist.

- Docyt vs. NetSuite: Docyt ist ein Tool zur Automatisierung der Buchhaltung. NetSuite ist ein umfassendes Enterprise-Resource-Planning-System (ERP) für große Unternehmen.

Häufig gestellte Fragen

Is Synder better for sales businesses?

Synder is really good if you sell things online a lot. It easily connects to many sales platforms and payment systems to keep track of your income.

Does Docyt help with organizing bills?

Yes, Docyt has special features that help you manage and organize your bills and receipts. It can even use AI to understand what your documents are.

Can my accountant use Synder or Docyt?

Yes, both Synder and Docyt allow Buchhalter to access your financial data. This makes it easier for them to help you with your business finances.

Which software is easier for beginners?

Both are designed to be user-friendly. However, Docyt’s AI features for organizing documents might be a little different for some new users at first.

Do Synder and Docyt help with seeing my cash flow?

Yes, both give you reports that show the money coming in and going out of your business. This helps you understand your financial health.