Is your Buchhaltungssoftware a pain?

Many businesses struggle with confusing systems, hidden costs, or too many useless features.

It’s tough to manage finances, taking time away from growing your Unternehmen.

But what if it didn’t have to be? This article shares the 9 best QuickBooks Alternativen.

They’ll cut your financial stress, simplify Buchhaltung, and save you money.

Find the perfect fit for Ihr business!

What are the Best QuickBooks Alternatives?

Choosing new Buchhaltung software can be tricky.

There are so many options out there! We’ve done the hard work for you.

We looked at many choices to find the top ones.

Here is our list of the 9 best QuickBooks alternatives to help you decide.

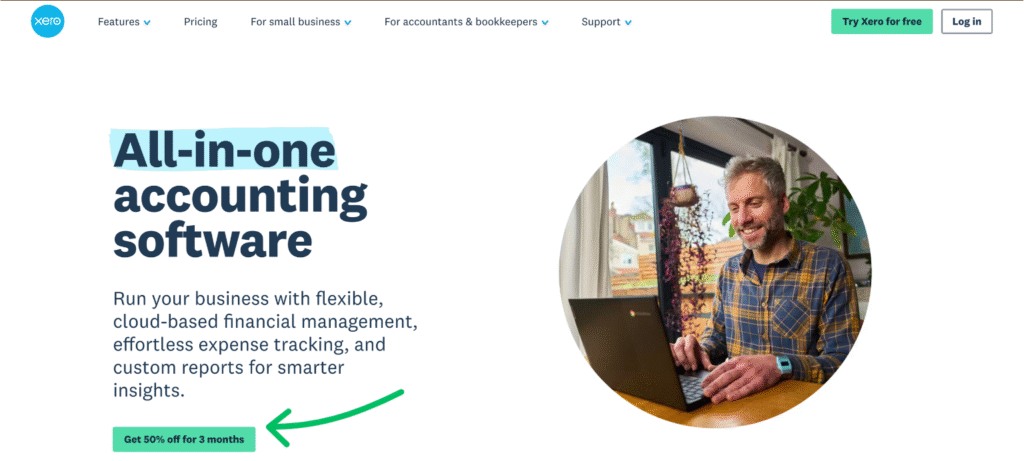

1. Xero (⭐4.8)

Xero is a popular cloud-based Buchhaltung Software.

It’s really user-friendly for kleine Unternehmen. Xero isn’t just for data entry.

It helps you with invoices, bills, and bank reconciliation.

Plus, it works great with Hubdoc for document management.

Erschließen Sie sein Potenzial mit unserem Xero tutorial.

Entdecken Sie auch unser QuickBooks vs Xero Vergleich!

Unsere Meinung

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Wichtigste Vorteile

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

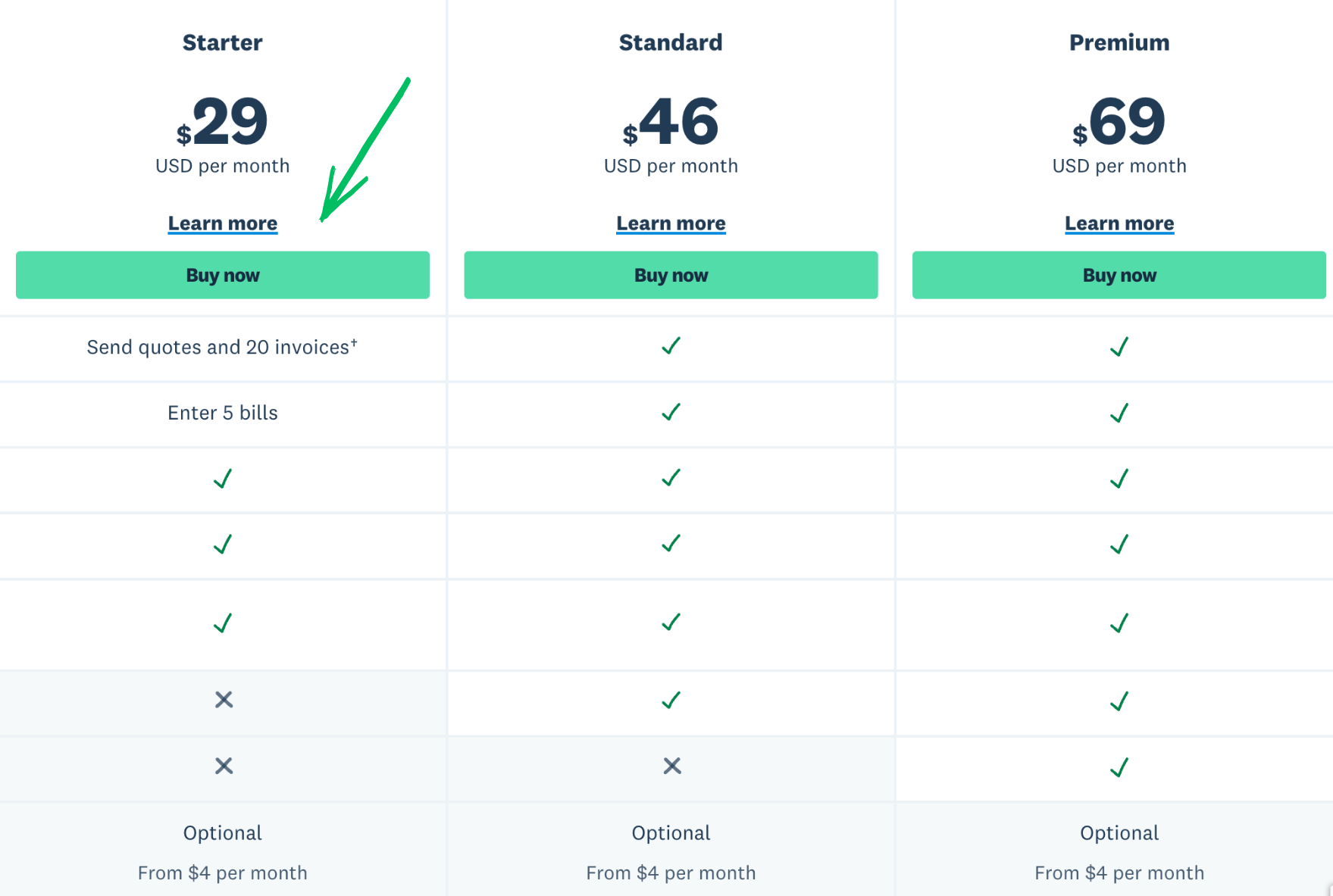

Preisgestaltung

- Starter: $29/Monat.

- Standard: $46/month.

- Prämie: $69/Monat.

Profis

Nachteile

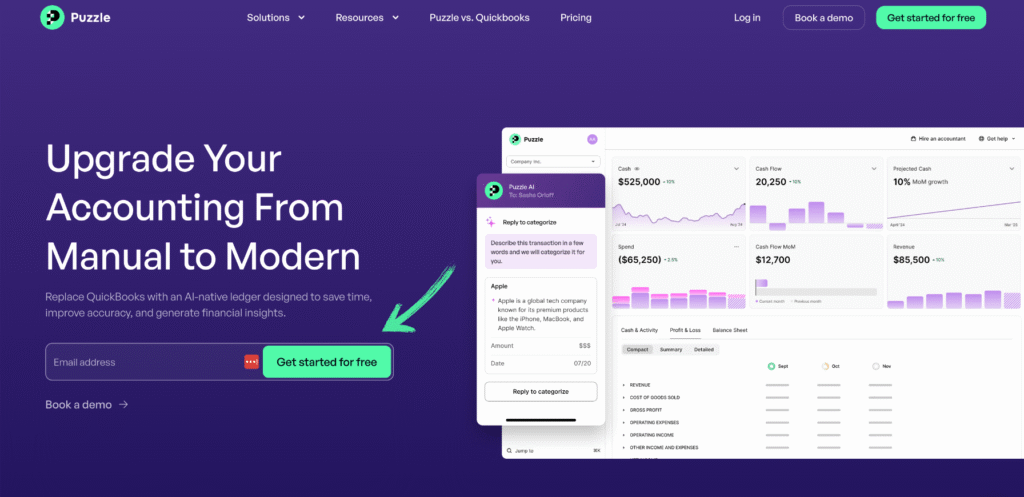

2. Puzzle IO (⭐4.5)

Puzzle IO is a new tool for startups and small businesses.

Sie konzentriert sich auf Automatisierung and clear financial views, cutting down on manual work.

If you want a modern, simple way to manage money, Puzzle IO is worth a look.

Erschließen Sie sein Potenzial mit unserem Puzzle IO tutorial.

Entdecken Sie auch unser QuickBooks vs Puzzle IO-Vergleich!

Unsere Meinung

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Wichtigste Vorteile

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

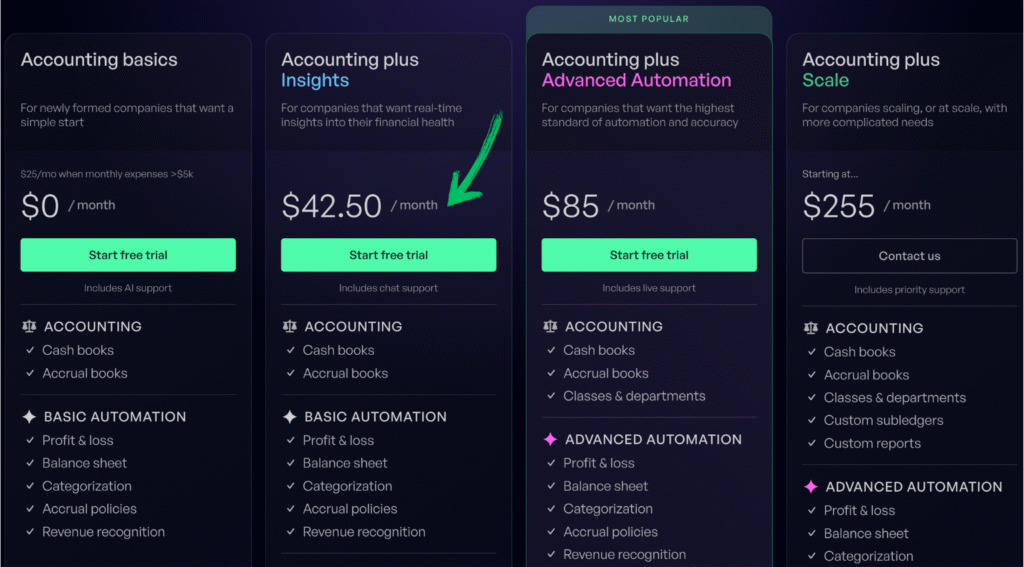

Preisgestaltung

- Accounting basics: $0/Monat.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Profis

Nachteile

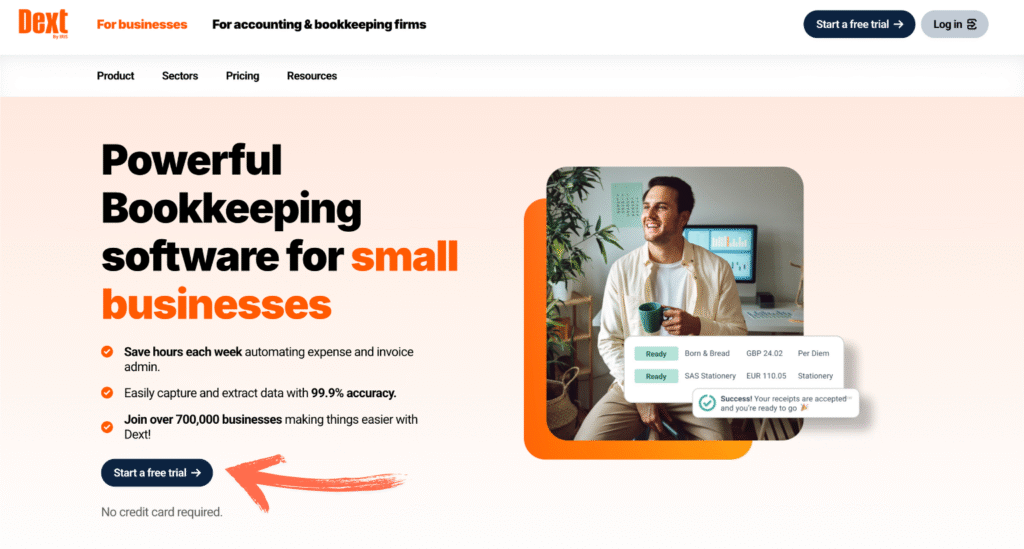

3. Dext (⭐4.0)

Dext (formerly Receipt Bank) helps automate document collection.

It’s like a digital assistant for receipts and invoices.

It links with many accounting software programs to machen. bookkeeping easier, though it’s not a full accounting system.

Erschließen Sie sein Potenzial mit unserem Dext tutorial.

Entdecken Sie auch unser QuickBooks vs Dext Vergleich!

Unsere Meinung

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Wichtigste Vorteile

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Preisgestaltung

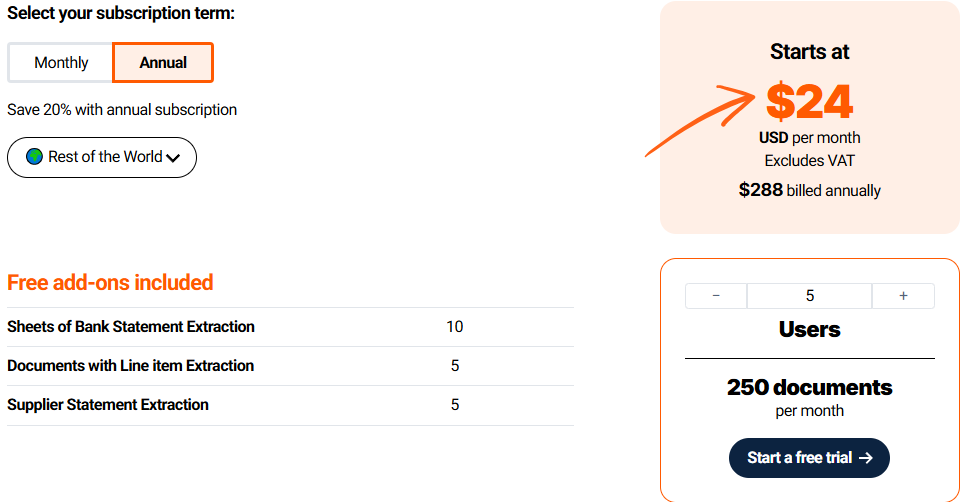

- Annually Subscription: $24

Profis

Nachteile

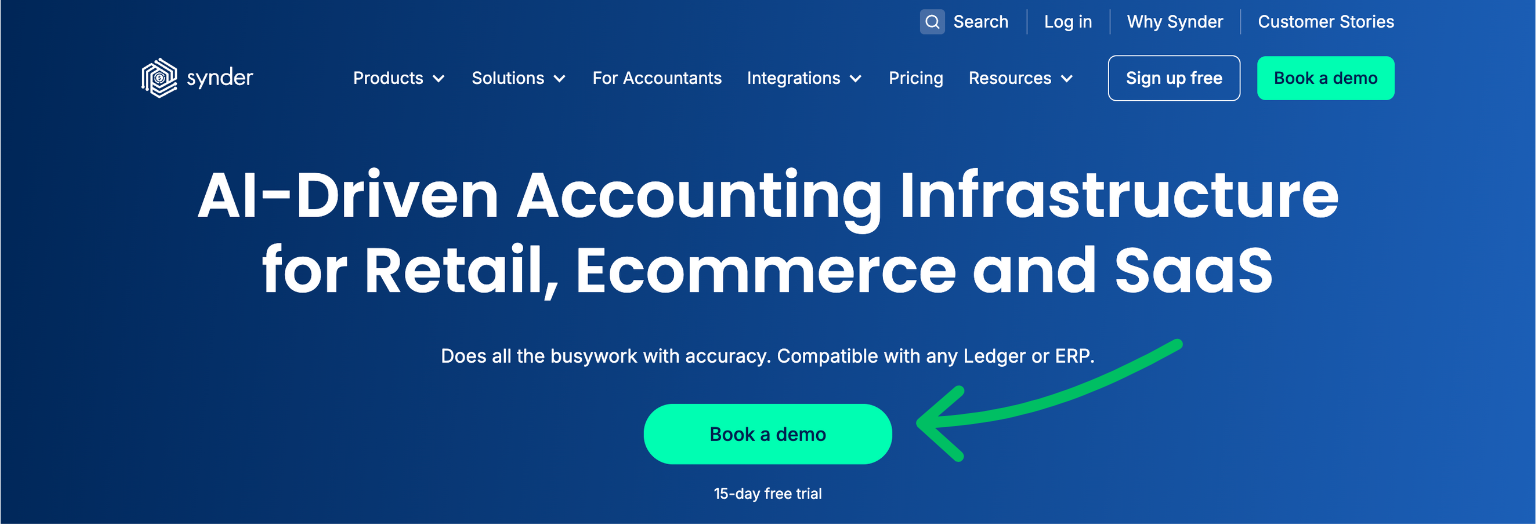

4. Synder (⭐3.8)

Synder helps e-commerce businesses by linking online sales to Buchhaltung Software.

If you sell on Shopify, Amazon, or Stripe, Synder brings all that data together.

It aims to cut errors and show all your online sales in one place.

Unlock its potential with our Synder tutorial.

Entdecken Sie auch unser QuickBooks vs Synder Vergleich!

Unsere Meinung

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Wichtigste Vorteile

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

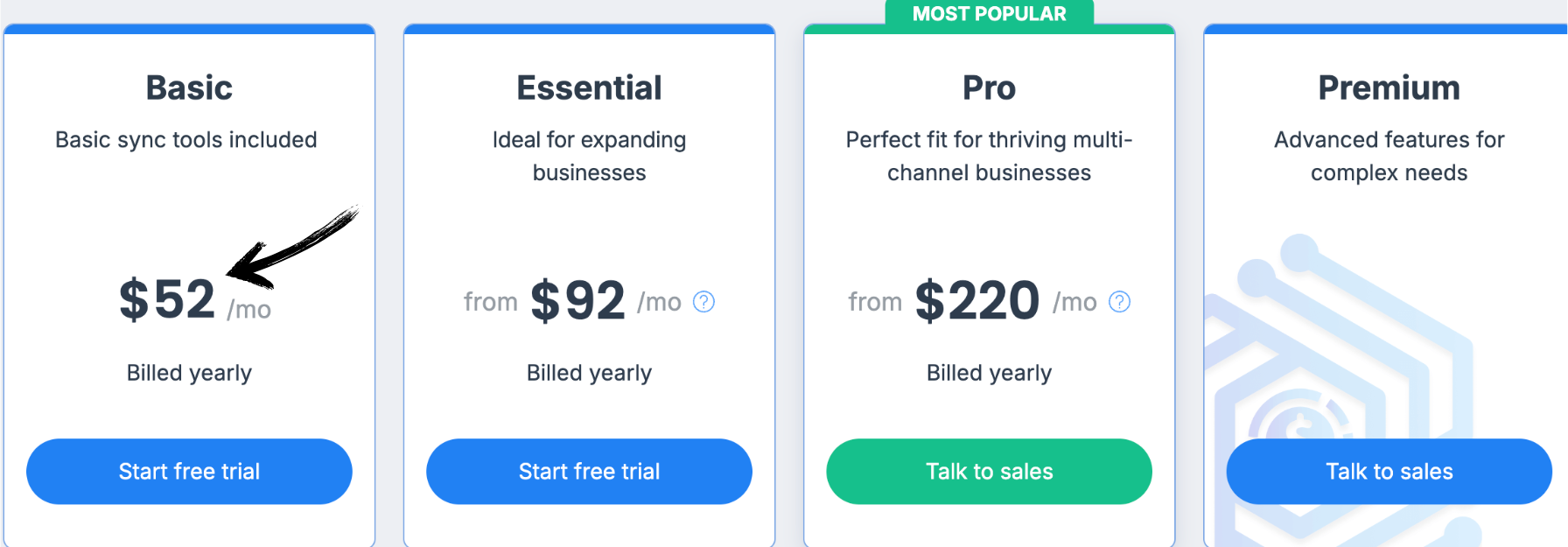

Preisgestaltung

Alle Pläne werden Jährlich abgerechnet.

- Grundlegend: $52/month.

- Wesentlich: $92/month.

- Pro: $220/month.

- Prämie: Individuelle Preisgestaltung.

Profis

Nachteile

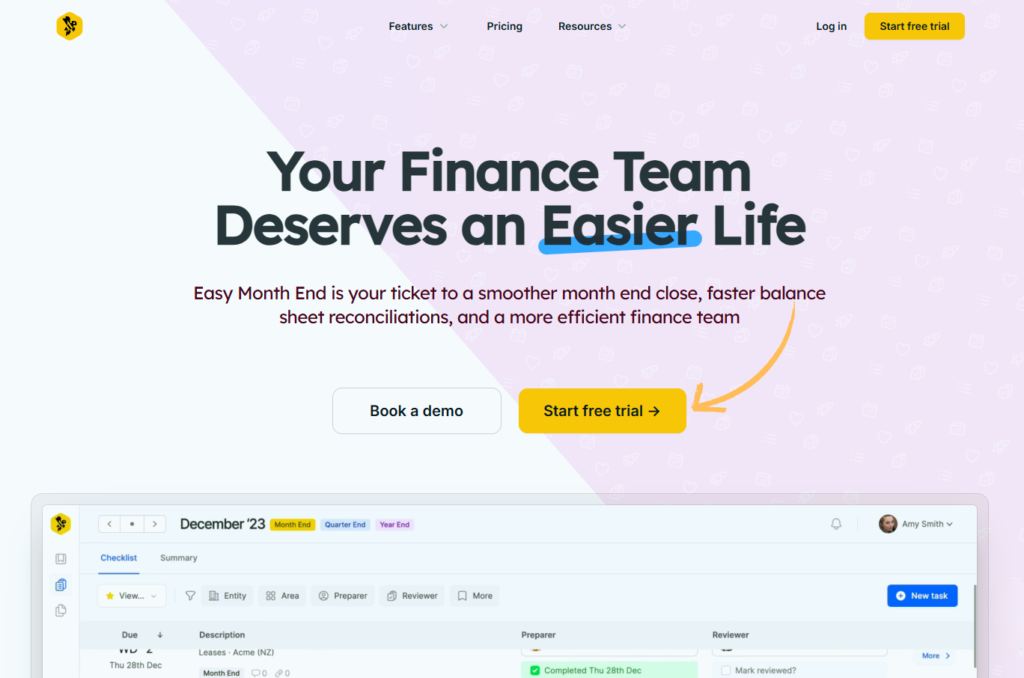

5. Easy Month End (⭐3.6)

Easy Month End is a tool designed to make your monthly financial close much simpler.

It’s built for finance teams. It helps you track tasks and manage reconciliations.

Think of it as your checklist, task manager, and reconciliation assistant all in one place.

It helps you manage your financial tasks and get things done on time, every time.

Erschließen Sie sein Potenzial mit unserem Easy Month End tutorial.

Entdecken Sie auch unser QuickBooks vs Easy Month End Vergleich!

Unsere Meinung

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Wichtigste Vorteile

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

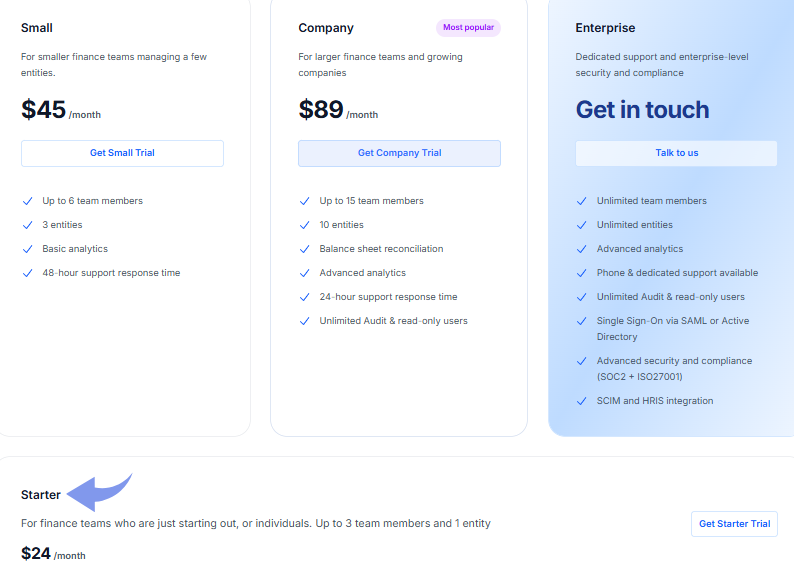

Preisgestaltung

- Starter: $24/month.

- Klein: $45/month.

- Company: $89/month.

- Unternehmen: Individuelle Preisgestaltung.

Profis

Nachteile

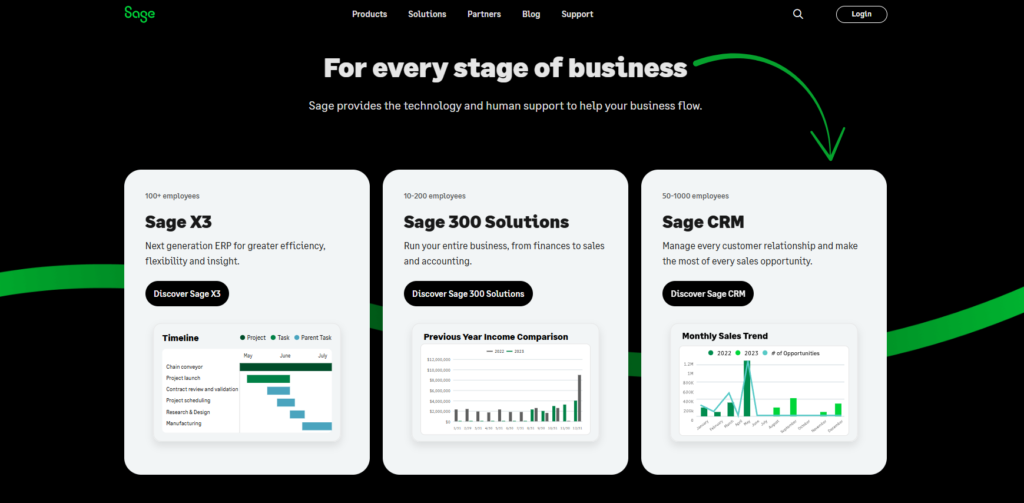

6. Sage (⭐️3.4)

So, Sage is a big name in the Buchhaltung world. They have been around for a while.

Their software uses AI to help with things like invoicing and bank reconciliation.

From small startups to large enterprises. It helps manage finances, payroll, and operations.

It’s a well-established name in Buchhaltung.

Erschließen Sie sein Potenzial mit unserem Sage tutorial.

Entdecken Sie auch unser Quickbooks vs Sage Vergleich!

Unsere Meinung

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Wichtigste Vorteile

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

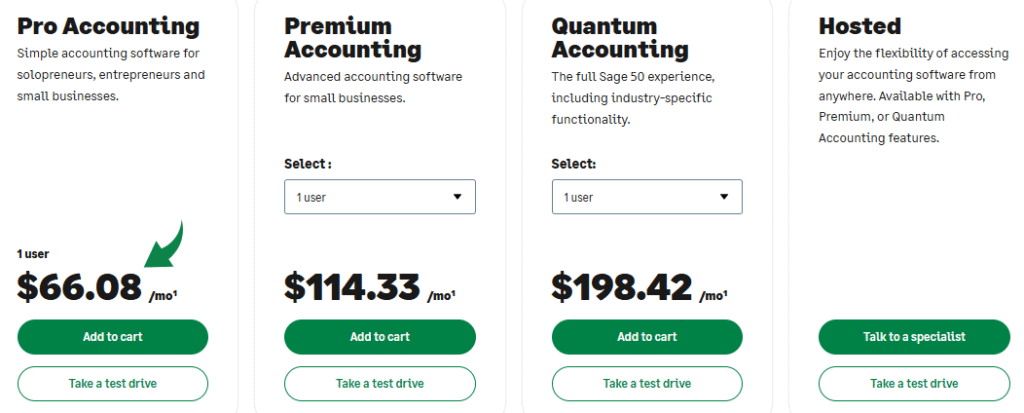

Preisgestaltung

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Profis

Nachteile

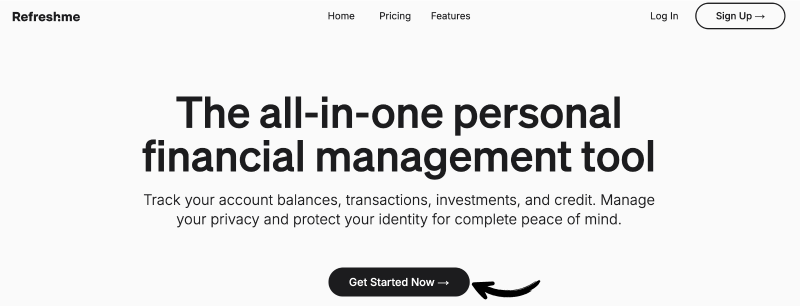

7. RefreshMe (⭐️3.2)

RefreshMe focuses on providing real-time financial insights and analysis using AI.

It aims to give business owners a clear and up-to-date view of their financial health, helping them make informed decisions quickly.

This tool can save you from a lot of headaches and make sure your Daten is accurate.

It’s a handy addition to your accounting routine.

Erschließen Sie sein Potenzial mit unserem Refreshme tutorial.

Entdecken Sie auch unser Quickbooks vs Refreshme Vergleich!

Unsere Meinung

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Wichtigste Vorteile

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

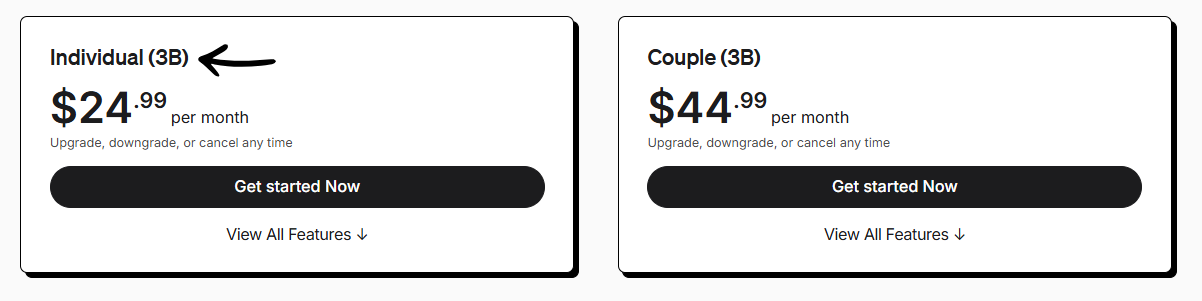

Preisgestaltung

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Profis

Nachteile

8. Docyt (⭐3.0)

Docyt is an AI-powered platform for finance and accounting.

It helps businesses automate their Buchhaltung.

Think of it as a smart assistant for your money tasks.

If you want to use AI for your finances and reduce manual work, Docyt is a strong contender.

Erschließen Sie sein Potenzial mit unserem Docyt tutorial.

Entdecken Sie auch unser Synder vs Docyt Vergleich!

Wichtigste Vorteile

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of Sicherheit. There’s no specific warranty for the software, but continuous updates are provided.

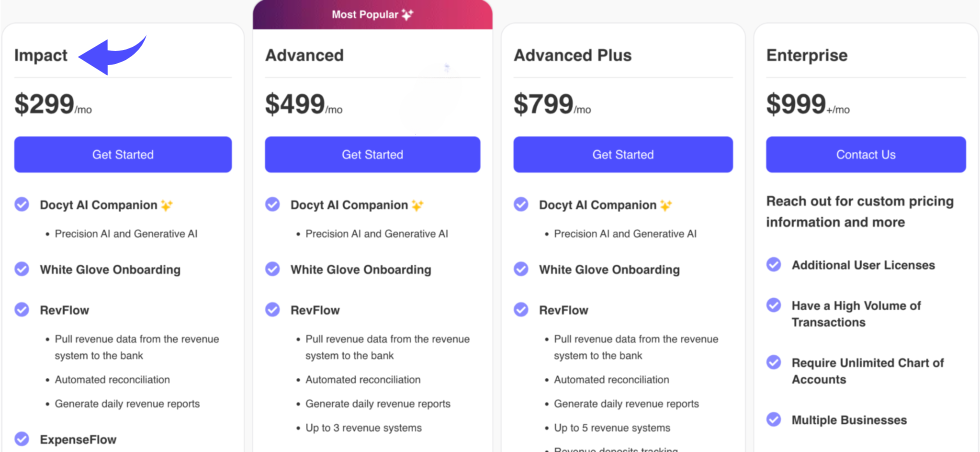

Preisgestaltung

- Auswirkungen: $299/month.

- Fortgeschrittene: $499/month.

- Fortgeschrittene Plus: $799/month.

- Unternehmen: $999/month.

Profis

Nachteile

9. FreshBooks (⭐2.8)

FreshBooks is ideal for Freiberufler and service businesses.

It makes invoicing super simple.

If you send many bills and track projects, FreshBooks will save you time.

Erschließen Sie sein Potenzial mit unserem FreshBooks tutorial.

Entdecken Sie auch unser QuickBooks vs FreshBooks Vergleich!

Unsere Meinung

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your Buchhaltungssoftware today!

Wichtigste Vorteile

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

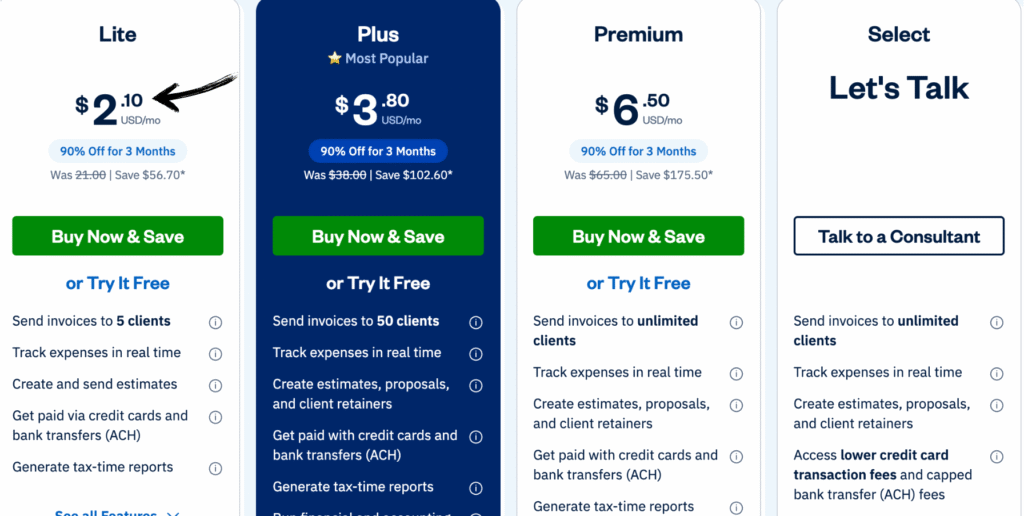

Preisgestaltung

- Leicht: $2.10/month.

- Plus: $3.80/month.

- Prämie: $6.50/month.

- Wählen Sie aus: Individuelle Preisgestaltung.

Profis

Nachteile

Einkaufsführer

When doing our research to find the best tool for accounting, we determined using these factors to find a great alternative to QuickBooks for kleines Unternehmen owners and small business customers:

- Preisgestaltung: How much did each product cost? We looked at free accounting software options, free plans, and different pricing plans to help small businesses save money. We also considered whether the software was a cloud-based solution or a traditional desktop software, as this can affect cost.

- Merkmale: What were the best accounting features of each product? We looked for a full featured accounting software that goes beyond basic accounting tools. This included advanced features like unlimited invoices, time tracking, recurring invoices, payment reminders, paid plan and the ability to manage invoices and accept payments. We also sought out software that had dedicated invoicing software and invoicing features. We looked for more advanced features such as double entry Buchhaltung, inventory tracking, project management, and project tracking. For a comprehensive accounting solution, we also considered features like payroll online, the ability to run payroll, and the creation of professional invoices and create purchase orders. We also looked for helpful features such as a user friendly interface, a client portal or customer portal, and the ability to manage bank accounts, credit card transaction, and bank transfers, with helpful app integrations. This also included the ability to accept payments through a payment gateway, and accounting automation. We also considered if it had similar features to popular choices like Zoho CRM and Sage Accounting.

- Negativ: What was missing from each product? We identified any missing features that would prevent the software from being a great alternative. For example, some tools may be lacking in-depth reporting, or the ability to manage multiple companies. We also noted if a product lacked more advanced features or enterprise resource planning (ERP) capabilities. We also looked at the user experience, noting if the software was less intuitive and user friendly compared to others. We also noted if a product did not support online payments, ACH payments, or other important payment gateway options. We also considered if the software required a constant internet connection. We also looked at features for sales channels and contact data.

- Support & refund: Do they offer a community, support, & refund policy? We assessed the quality of customer support, whether they offered tax prep help, and if they could help with tax prep. We also evaluated if they offered helpful features like late payment reminders, and the ability to track expenses and Zeiterfassung. We looked at how well each accounting solution fit into a business’s existing tech stack and if it met the business needs.

Einpacken

Picking the best accounting software is a big deal for kleines Unternehmen Eigentümer.

We’ve shown you a bunch of other QuickBooks alternatives, not just QuickBooks Online or QuickBooks Desktop.

It’s important to find an intuitive accounting software that has all the features you need.

This includes good invoicing features, bill payment, payment processing, and solid reporting features.

We know what we’re talking about because we’ve done the hard work of researching and comparing these accounting apps.

We’ve looked at what works and what doesn’t, so you don’t have to.

You can trust our guide to help you find the right fit for your business.

Häufig gestellte Fragen

What are the best QuickBooks Alternatives?

The best alternatives include Zoho Bücher, Zoho CRM, Xero, and FreshBooks. They offer strong features for invoicing, balance sheet, expense tracking, and reporting, and cater to different business sizes and needs.

Why should I consider a QuickBooks Alternative?

You might need a different option due to cost, specific features, ease of use, or if your business has unique needs not met by QuickBooks. Many alternatives offer specialized tools.

Are there free QuickBooks alternatives?

Ja, Welle Accounting is a popular free option for basic accounting, invoicing, and receipt scanning. It’s great for freelancers and very small businesses on a tight budget.

How do I choose the right alternative for my business?

Consider your business size, industry, budget, required features (like invoicing, payroll, inventory), ease of use, and integration with other tools. A free trial can help you decide.

Can I easily switch from QuickBooks to another software?

Many alternatives offer tools or guides to help you import your existing financial data from QuickBooks. It often involves exporting data to a CSV or Excel file and then importing it into the new software.