Die richtige Wahl treffen Buchhaltungssoftware feels like a huge task.

Was wäre, wenn du machen the wrong choice?

A bad fit can cause real headaches.

You might waste precious time, miss tracking important expenses, or mess up your books.

That’s where we come in. We’re looking at two popular names: Puzzle IO vs Expensify.

Überblick

Through rigorous feature-by-feature analysis and hands-on testing of core functionalities like receipt scanning and report generation.

Bereit, Ihre Finanzen zu vereinfachen? Entdecken Sie, wie Puzzle IO Ihnen bis zu 20 Stunden im Monat sparen kann. Erleben Sie den Unterschied.

Preisgestaltung: Kostenloser Tarif verfügbar. Der kostenpflichtige Tarif beginnt bei 42,50 $/Monat.

Hauptmerkmale:

- Finanzplanung

- Prognose

- Echtzeitanalyse

Schließen Sie sich über 15 Millionen Nutzern an, die Expensify vertrauen, um ihre Finanzen zu vereinfachen. Sparen Sie bis zu 83 % Zeit bei der Erstellung von Spesenabrechnungen.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 5 $ pro Monat.

Hauptmerkmale:

- SmartScan-Belegerfassung

- Firmenkartenabstimmung

- Erweiterte Genehmigungsworkflows.

Was ist Puzzle IO?

Hey, so Puzzle IO, right? It’s an expense management tool.

It seems pretty focused on project costs. Good for keeping tabs on budgets.

Entdecken Sie auch unsere Favoriten Puzzle IO-Alternativen…

Unsere Einschätzung

Bereit, Ihre Finanzen zu vereinfachen? Entdecken Sie, wie Puzzle io Ihnen bis zu 20 Stunden im Monat sparen kann. Erleben Sie den Unterschied noch heute!

Wichtigste Vorteile

Puzzle IO glänzt besonders dann, wenn es darum geht, Ihnen zu helfen, zu verstehen, wohin sich Ihr Unternehmen entwickelt.

- 92 % Nutzer berichten von einer höheren Genauigkeit der Finanzprognosen.

- Erhalten Sie Echtzeit-Einblicke in Ihren Cashflow.

- Erstellen Sie unkompliziert verschiedene Finanzszenarien für Ihre Planung.

- Arbeiten Sie nahtlos mit Ihrem Team an Ihren finanziellen Zielen zusammen.

- Wichtige Leistungsindikatoren (KPIs) an einem Ort verfolgen.

Preisgestaltung

- Grundlagen der Buchhaltung: 0 €/Monat.

- Einblicke in Accounting Plus: 42,50 $/Monat.

- Accounting Plus Advanced Automation: 85 US-Dollar pro Monat.

- Accounting Plus-Skala: 255 US-Dollar pro Monat.

Vorteile

Nachteile

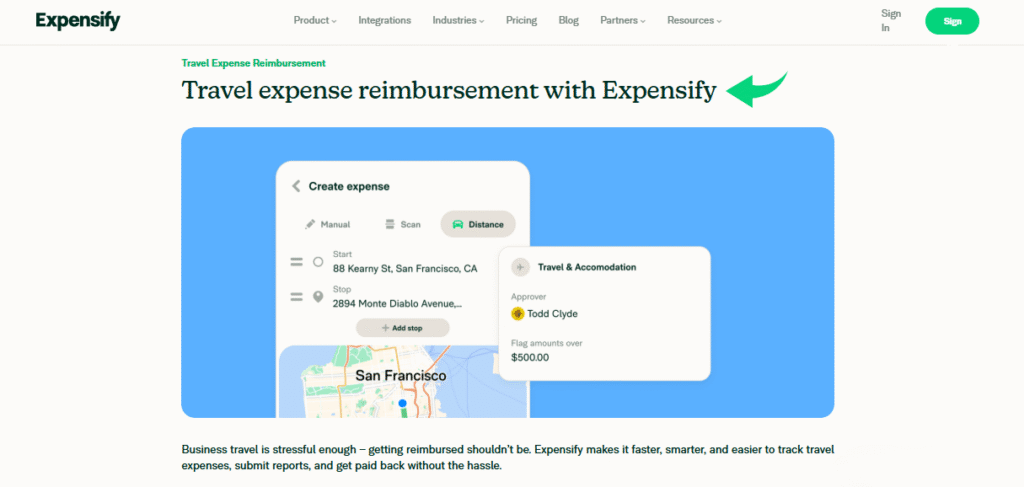

Was ist Expensify?

Okay, so Expensify is another option.

It feels really strong on receipt handling. Their SmartScan seems pretty slick.

Good if you deal with lots of individual expenses.

Entdecken Sie auch unsere Favoriten Alternativen verteuern…

Wichtigste Vorteile

- Die SmartScan-Technologie scannt Belegdetails und extrahiert sie mit einer Genauigkeit von über 95%.

- Die Mitarbeiter erhalten ihre Erstattungen schnell, oft schon innerhalb eines Werktages per ACH-Überweisung.

- Mit der Expensify Card und ihrem Cashback-Programm können Sie bis zu 50 % bei Ihrem Abonnement sparen.

- Es wird keine Garantie übernommen; in den Allgemeinen Geschäftsbedingungen ist die Haftung beschränkt.

Preisgestaltung

- Sammeln: 5 US-Dollar pro Monat.

- Kontrolle: Individuelle Preisgestaltung.

Vorteile

Nachteile

Funktionsvergleich

Navigation Kleinunternehmen finances can be challenging.

This comparison highlights key features of Puzzle IO and Expensify.

Examining how each platform addresses Buchhaltung, expense reports, and automation to help you simplify financial management.

1. Core Audience & Focus

- Puzzle IO is a game-changer built for early-stage startups and co-founder teams, focusing on up-to-date financial statements and key metrics right out of the box.

- Kosten erhöhen focuses on an efficient expense management process for employees and contractors, making it easy for them to file and for employers to reimburse.

2. Automated Bookkeeping

- Puzzle IO is designed for autonomous bookkeeping, using AI to automate tedious tasks and provide an accurate picture of the current state of the company quickly.

- Kosten erhöhen Automatisierung is concentrated on receipts and expense report creation, aiming to simplify the process for the user and their manager’s approval.

3. Startup Financial Health Metrics

- Puzzle IO provides startup founders with instant access to key metrics like cash runway, burn rate, and MRR, offering clear insights into their financial health.

- Kosten erhöhen focuses on spending, helping companies control spending and reconcile the Expensify Card, but does not natively provide comprehensive startup metrics.

4. Complex Accrual Accounting

- Puzzle IO includes built-in accrual automation to handle complex items like revenue recognition and prepaid expenses automatically, which is vital for providing a true and accurate picture of revenue.

- Kosten erhöhen does not focus on the underlying accrual Buchhaltung logic for things like fixed assets and deferred revenue; its strength is expense capture.

5. Expense Reporting Experience

- Puzzle IO erlaubt for transaction categorization and expense tracking, but does not specialize in complex, multi-level expense management processes and reimbursement workflows.

- Kosten erhöhen makes it easy for the team to log mileage, snap a photo of a receipt in a few seconds, and get reimbursed quickly, which is a game-changer for employees.

6. AI-Powered Functionality

- Puzzle IO uses AI for smart transaction categorization, continuous accuracy checks, and streamlining the setup for non-accountants.

- Kosten erhöhen uses its SmartScan technology for receipt Daten extraction and AI-powered automation to match transactions, making the process less time-consuming.

7. Focus on Financial Statements

- Puzzle IO’s primary goal is to generate real-time, audit-ready financial statements, helping startup founders stay up to date and prepare for investors or tax time.

- Kosten erhöhen is a pre-accounting tool that passes expense data to other tools like QuickBooks or Xero for final statement generation by a finance expert.

8. Corporate Card Management

- Puzzle IO integrates with various cards, focusing on getting data into the books quickly.

- Kosten erhöhen offers the Expensify Card, which links seamlessly to its system, automates reconciliation, and allows employers to set smart spending limits.

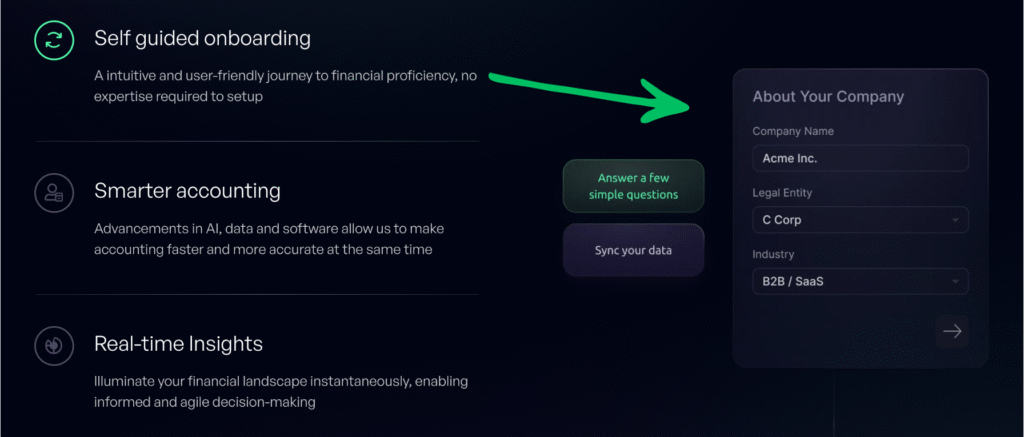

9. Ease of Setup

- Puzzle IO Angebots an easy setup and a modern interface, minimizing errors and making it simple for the co founder who may be a non Buchhalter.

- Kosten erhöhen also offers a quick and easy setup for the expense management process, which helps employees and contractors submit expenses and reports in less time.

Worauf Sie bei der Auswahl von Buchhaltungssoftware achten sollten?

- Look beyond basic Expensify reviews to see how the software handles the complete general ledger and organization.

- The software needs a reliable connection to your bank accounts to avoid manual data entry and reduce errors.

- Ensure the platform gives you a clear cash runway and not just a summary of past data—don’t wait for insights.

- The ability to manage expenses must be flexible, supporting phone, desktop, and web access.

- Check the speed of completing reports and the ease of exporting data to your clients or accountant.

- It should allow users to create and submit requests immediately, and managers to approve them quickly.

- The system must reliably respond to inputs and not be blocked by simple issues.

- All financial details should be securely stored in a digital pocket for easy review.

- The software should offer automated code assignment and customizable categories and tags.

- Your final thoughts should confirm that the system can scale with your future organization, moving you away from spreadsheets.

- A key insight is whether the platform is structured for a small number of users or a growing organization.

- An efficient system should trigger notifications when action is expected, simplifying the single-view page workflow.

- Consider why others chose Puzzle or a similar full-stack tool over a pure expense manager.

Endgültiges Urteil

Picking between Puzzle IO and Expensify depends on your main needs.

Expensify is tops for expense reports and receipts.

But Puzzle IO does more for overall money tracking, invoices, and connecting with payroll (even like QuickBooks).

Both are cloud-based.

If you want a wider view of your Geschäft, money, and something that can grow.

Puzzle IO wins. We checked them out carefully.

So our advice should help you choose the right software to save time.

Neither doesn’t really offer free Buchhaltung for most businesses.

Mehr von Puzzle IO

Wir haben Puzzle IO mit anderen Buchhaltungstools verglichen. Hier ein kurzer Überblick über die herausragenden Funktionen:

- Puzzle IO vs Xero: Xero bietet umfassende Buchhaltungsfunktionen mit starken Integrationen.

- Puzzle IO vs Dext: Puzzle IO zeichnet sich durch KI-gestützte Finanzanalysen und Prognosen aus..

- Puzzle IO vs Synder: Synder zeichnet sich durch die Synchronisierung von Verkaufs- und Zahlungsdaten aus.

- Puzzle IO vs. Einfaches Monatsende: Easy Month End vereinfacht den Finanzabschluss.

- Puzzle IO vs Docyt: Docyt nutzt KI zur Automatisierung von Buchhaltungsaufgaben.

- Puzzle IO vs RefreshMe: RefreshMe konzentriert sich auf die Echtzeitüberwachung der finanziellen Leistungsfähigkeit.

- Puzzle IO vs Sage: Sage bietet robuste Buchhaltungslösungen für Unternehmen unterschiedlicher Größe.

- Puzzle IO vs Zoho Books: Zoho Books bietet erschwingliche Buchhaltung mit CRM Integration.

- Puzzle IO vs Wave: Wave bietet kostenlose Buchhaltungssoftware für Kleinunternehmen an.

- Puzzle IO vs Quicken: Quicken ist bekannt für Finanzmanagement für Privatpersonen und kleine Unternehmen.

- Puzzle IO vs Hubdoc: Hubdoc ist auf das Sammeln von Dokumenten und das Extrahieren von Daten spezialisiert..

- Puzzle IO vs Expensify: Expensify bietet umfassende Spesenabrechnung und -verwaltung.

- Puzzle IO vs QuickBooks: QuickBooks ist eine beliebte Wahl für die Buchhaltung kleiner Unternehmen.

- Puzzle IO vs AutoEntry: AutoEntry automatisiert die Dateneingabe von Rechnungen und Belegen.

- Puzzle IO vs FreshBooks: FreshBooks ist speziell auf die Rechnungsstellung von Dienstleistungsunternehmen zugeschnitten.

- Puzzle IO vs NetSuite: NetSuite bietet eine umfassende Suite für Enterprise Resource Planning (ERP).

Mehr Ausgaben

- Kosten vs. RätselDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- Expensify vs DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- Expensify vs XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- Expensify vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Ausgaben vs. Einfaches MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- Expensify vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- Expensify vs SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- Expensify vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Kostensteigerung vs. WelleDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- Expensify vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- Expensify vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- Expensify vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- Expensify vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- Expensify vs NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

What key features should software for small businesses include?

Essential features are invoicing, expense tracking, bank reconciliation, and Berichterstattung to manage business finances effectively.

Can accounting software help with automation?

Yes, many platforms offer automation for tasks like data entry, bank feeds, and payment reminders, saving time.

Is there free accounting software suitable for small businesses?

Some free options exist with basic features, but they may lack advanced capabilities or scalability for growing businesses.

How can AI-powered features benefit small business accounting?

AI can automate categorization, detect anomalies, and provide insights, improving accuracy and efficiency in financial management.

Which type of accounting software is best for my small business?

The best software depends on your specific business needs, size, and complexity. Consider features, integrations, and scalability.