Umgang mit Geschäft Die Kosten können einem echt Kopfzerbrechen bereiten, nicht wahr?

Sie erfassen Belege und versuchen, machen Ein gutes Zahlenverständnis und die Hoffnung, dass am Steuertermin alles glatt läuft.

Es handelt sich um ein häufiges Problem für viele Unternehmen, ob groß oder klein.

Was wäre aber, wenn Sie diesen gesamten Prozess vereinfachen und beschleunigen könnten?

Wir sind hier, um Ihnen bei der Entscheidung zwischen Expensify und AutoEntry zu helfen und herauszufinden, welches System am besten zu Ihrem Unternehmen passt.

Überblick

Wir haben Expensify und AutoEntry getestet und dabei ihre Funktionen, Benutzerfreundlichkeit und ihre Fähigkeit, verschiedene Datentypen zu verarbeiten, geprüft. Buchhaltung Aufgaben.

Unser Ziel war es, aus erster Hand zu erfahren, wie diese Tools im Vergleich abschneiden, damit Sie eine kluge Entscheidung für Ihr Unternehmen treffen können.

Schließen Sie sich über 15 Millionen Nutzern an, die Expensify vertrauen, um ihre Finanzen zu vereinfachen. Sparen Sie bis zu 83 % Zeit bei der Erstellung von Spesenabrechnungen.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 5 $ pro Monat.

Hauptmerkmale:

- SmartScan-Belegerfassung

- Firmenkartenabstimmung

- Erweiterte Genehmigungsworkflows.

Verschwenden Sie nicht länger als 10 Stunden pro Woche mit manueller Dateneingabe. Erfahren Sie, wie Autoentry die Rechnungsbearbeitungszeit um 40 % reduziert hat. Salbei Nutzer.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das kostenpflichtige Abonnement beginnt bei 12 $ pro Monat.

Hauptmerkmale:

- Datenextraktion

- Belegscannen

- Lieferantenautomatisierung

Was ist Expensify?

Worum geht es bei Expensify? Es ist ein beliebtes Tool zur Ausgabenverwaltung.

Ziel ist es, die Ausgabenverfolgung so einfach wie möglich zu gestalten.

Sie können Fotos von Belegen machen. Den Rest erledigt das System. Es ist für Unternehmen jeder Größe geeignet.

Entdecken Sie auch unsere Favoriten Alternativen verteuern…

Wichtigste Vorteile

- Die SmartScan-Technologie scannt Belegdetails und extrahiert sie mit einer Genauigkeit von über 95%.

- Die Mitarbeiter erhalten ihre Erstattungen schnell, oft schon innerhalb eines Werktages per ACH-Überweisung.

- Mit der Expensify Card und ihrem Cashback-Programm können Sie bis zu 50 % bei Ihrem Abonnement sparen.

- Es wird keine Garantie übernommen; in den Allgemeinen Geschäftsbedingungen ist die Haftung beschränkt.

Preisgestaltung

- Sammeln: 5 US-Dollar pro Monat.

- Kontrolle: Individuelle Preisgestaltung.

Vorteile

Nachteile

Was ist AutoEntry?

Was ist AutoEntry? Es ist ein Tool zur Automatisierung. Daten Eintrag.

Man kann es sich als intelligenten Scanner für Dokumente vorstellen.

Es erfasst Informationen von Rechnungen und Quittungen.

Entdecken Sie auch unsere Favoriten Alternativen zu AutoEntry…

Unsere Einschätzung

Möchten Sie Ihren Buchhaltungsaufwand reduzieren? AutoEntry verarbeitet jährlich über 28 Millionen Dokumente und bietet eine Genauigkeit von bis zu 99 %. Starten Sie noch heute und gehören Sie zu den über 210.000 Unternehmen weltweit, die ihren Dateneingabeaufwand um bis zu 80 % reduziert haben!

Wichtigste Vorteile

Der größte Vorteil von AutoEntry besteht darin, dass man sich stundenlange, langweilige Arbeit spart.

Die Anwender berichten häufig von einer bis zu 80%igen Zeitersparnis beim manuellen Dateneingabevorgang.

Es verspricht eine Genauigkeit von bis zu 99 % bei der Datenextraktion.

AutoEntry bietet keine spezielle Geld-zurück-Garantie, aber die monatlichen Abonnements ermöglichen eine jederzeitige Kündigung.

- Bis zu 99% Genauigkeit der Daten.

- Unbegrenzte Nutzeranzahl bei allen kostenpflichtigen Tarifen.

- Ruft vollständige Positionen aus Rechnungen ab.

- Einfache mobile App zum Fotografieren von Kassenbons.

- Nicht genutzte Guthaben verfallen nach einer Frist von 90 Tagen.

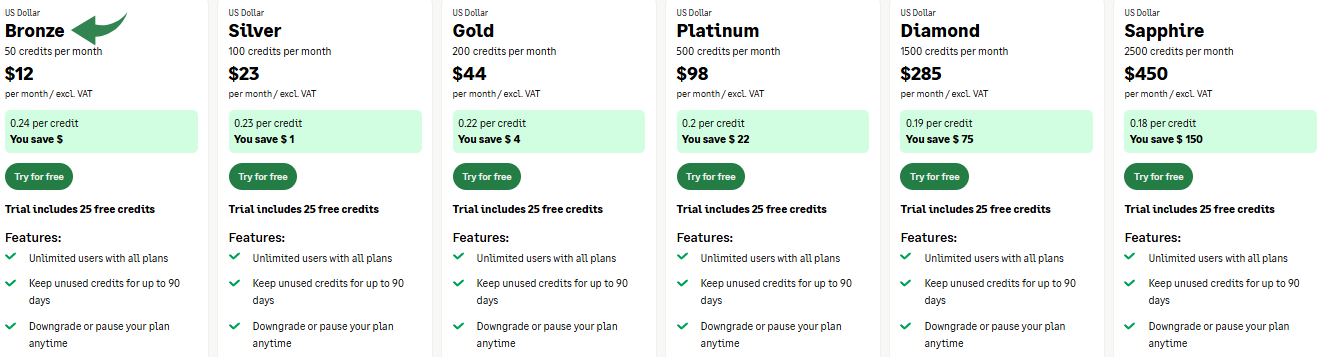

Preisgestaltung

- Bronze12 US-Dollar pro Monat.

- Silber23 US-Dollar pro Monat.

- Gold44 US-Dollar pro Monat.

- Platin: 98 $/Monat.

- Diamant285 US-Dollar pro Monat.

- Saphir: 450 $/Monat.

Vorteile

Nachteile

Funktionsvergleich

Sich in der Welt der Dokumente zurechtfinden Automatisierung erfordert die Auswahl zwischen Plattformen, die für spezifische Aufgaben entwickelt wurden.

Dieser Vergleich stellt Expensify – den Spezialisten für Spesenabrechnung – AutoEntry – die Datenerfassungssoftware – gegenüber, um deren unterschiedliche Funktionen detailliert darzustellen und Ihnen bei der Lösung Ihrer wichtigsten Probleme zu helfen. Buchhaltung Herausforderungen.

1. Kernzweck und Fokus

- Kosten erhöhen Vereinfacht den gesamten Spesenabrechnungsprozess. Das benutzerfreundliche Tool unterstützt Mitarbeiter beim Einreichen von Spesenabrechnungen und der schnellen Erstattung ihrer Kosten. Der Fokus liegt auf der Spesenabrechnung in Echtzeit und den Genehmigungsprozessen für Arbeitgeber.

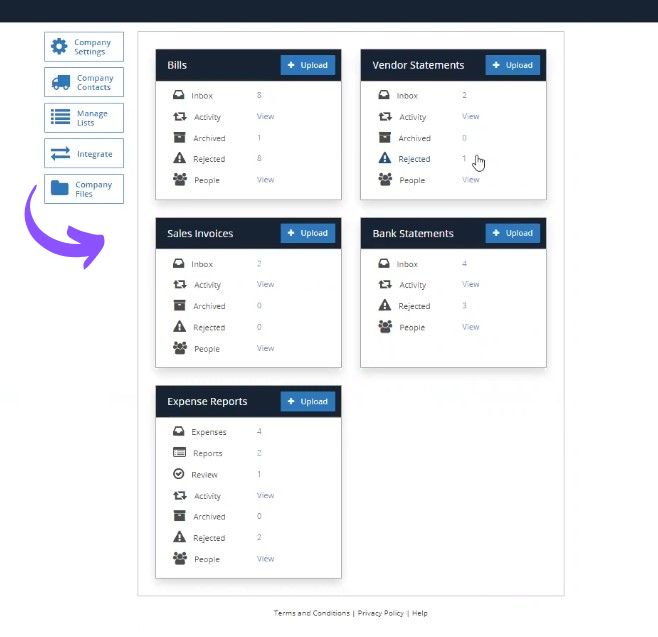

- Automatischer Einstieg ist eine automatisierte Sicherheitslösung, die entwickelt wurde, um Daten automatisch aus Papierdokumenten und Finanzunterlagen zu extrahieren. Ihr Zweck ist nicht Buchhaltung Durch die Eliminierung des Aufwands und der Zeit für die manuelle Dateneingabe wird eine nahtlose Integration für eine unbegrenzte Anzahl von Benutzern ermöglicht.

2. Belegerfassung und Datenextraktion

- Kosten erhöhen Exzellent in der Erfassung. Sie fotografieren einen Beleg mit der Smartphone-App, und Expensify stellt die Daten innerhalb weniger Sekunden zur Erfassung bereit. Dies ist für Mitarbeiter im Web oder mobil unerlässlich, um Ausgaben sofort zu verfolgen.

- Automatischer Einstieg Es nutzt optische Zeichenerkennungstechnologie (OCR), um Einkaufsrechnungen, Kontoauszüge und andere Finanzdokumente hochzuladen. Es erfasst Einzelposten und alle Transaktionsdetails und ist für die schnelle Verarbeitung großer Dokumentenmengen ausgelegt.

3. Arbeitsablauf und Genehmigungsprozess

- Kosten erhöhen Das System verfügt über einen robusten Genehmigungsworkflow, in dem Manager oder das Finanzteam Anträge prüfen und genehmigen können. Es unterstützt Arbeitgeber bei der Auszahlung von Honoraren an Mitarbeiter und Auftragnehmer per Direktüberweisung und ermöglicht die Echtzeit-Beantwortung von Berichten.

- AutoEntry's Der Workflow konzentriert sich auf den automatisierten Datenexport. Es handelt sich primär um eine Staging-Plattform, auf der Daten automatisch extrahiert, codiert und für die automatische Veröffentlichung direkt in [Zielplattform/System/etc.] gekennzeichnet werden. Buchhaltungssoftwarewodurch der Dateneingabeprozess erheblich vereinfacht wird.

4. Preis- und Nutzungsmodell

- Kosten erhöhen Die monatlichen Preise sind flexibel und richten sich häufig nach der Anzahl der aktiven Nutzer oder dem Volumen der eingereichten Berichte. Die Expensify Card bietet Mitarbeitern automatisierte Spesenverwaltung und Abrechnungsprozesse.

- Automatischer Einstieg Die Preisgestaltung erfolgt nutzungsbasiert über ein Guthabensystem. Die Plattform ermöglicht eine unbegrenzte Nutzerzahl und bietet flexible Preisgestaltung, sodass Kunden nur für das monatlich zu verarbeitende Dokumenten- und Kontoauszugsvolumen bezahlen.

5. Integration und Datenfluss

- Kosten erhöhen Lässt sich nahtlos in Buchhaltungssoftware integrieren wie QuickBooksDiese Verbindung ermöglicht es Kunden, Spesenabrechnungen, Kilometerprotokolle und andere Details und Transaktionen zur Steuererklärung in ihr Finanzsystem zu exportieren.

- AutoEntry's Eine Stärke ist die nahtlose Integration mit vielen Buchhaltungssoftwarelösungen (wie z. B. Xero oder QuickBooks). Es wurde speziell für die effiziente Übertragung von Einkaufsrechnungs- und Ausgabendaten in ein anderes System entwickelt.

6. Sicherheit und Online-Bedrohungen

- Kosten erhöhen Expensify nimmt Sicherheit ernst und schützt Nutzerdaten sowie Unternehmensrichtlinien. In manchen Fällen kann es dennoch zu einem Sicherheitsvorfall kommen. Expensify reagiert umgehend und bearbeitet diese Anfragen per Telefon oder Chat.

- Automatischer Einstieg Die Website schützt sich vor Online-Angriffen mithilfe eines Sicherheitsdienstes wie Cloudflare. Gelegentlich können bestimmte Aktionen, die eine Sperrung auslösen könnten – beispielsweise die Eingabe eines bestimmten Wortes oder einer bestimmten Phrase, eines SQL-Befehls oder fehlerhafter Daten oder einer Datei, die ein bestimmtes Wort enthält – dazu führen, dass Ihre Aktion blockiert wird. In diesem Fall muss der Website-Betreiber Ihnen den Zugriff auf die Seite per E-Mail mit Ihrer IP-Adresse und der gefundenen Cloudflare Ray-ID freigeben.

7. Besondere Merkmale

- Kosten erhöhen ist robust für reisen und Projektmanagement. Es kann Kilometer automatisch erfassen, und Benutzer können Ausgaben bestimmten Projekten oder Kategorien zuordnen, um komplexe Strukturen zu organisieren. Es bietet spezielle Tools zur schnellen Verwaltung von Spesenabrechnungen.

- AutoEntry's Die Spezialisierung liegt in der präzisen Datenerfassung. Das System kann vollständige Rechnungspositionen verarbeiten und Transaktionen automatisch anhand vorheriger Einträge kodieren und so eine nahtlose Integration in die Buchhaltung gewährleisten.

8. Benutzeroberfläche und Zugriff

- Expensify's Die Benutzeroberfläche ist übersichtlich und intuitiv und für die schnelle mobile Nutzung optimiert. Sie ermöglicht den Echtzeitzugriff auf Spesenabrechnungen und offene Anträge sowohl über das Web als auch über die mobile App.

- AutoEntry's Die Weboberfläche konzentriert sich auf den Dokumentenfluss und die Bearbeitung extrahierter Details. Dokumente lassen sich zwar einfach hochladen, der Hauptzugriff ist jedoch auf die Überprüfung der Datei durch den Manager oder Buchhalter vor der Buchung im Buchhaltungssystem ausgerichtet.

9. Management und Kontrolle

- Kosten erhöhen Es ermöglicht Arbeitgebern, die Ausgaben zu kontrollieren, indem sie Richtlinien sofort erstellen und durchsetzen können. Sie können Limits für die Kreditkartennutzung festlegen und Ausgaben vor der Erstattung genehmigen, wodurch Finanzabteilungen Zeit und Geld sparen.

- Automatischer Einstieg Das System spart dem Finanzteam Zeit und Aufwand, indem es die Dateneingabe für Eingangsrechnungen und Kontoauszüge automatisiert. Der Prozess ist darauf ausgelegt, Buchhaltungsaufgaben zu optimieren und Transaktionen mit minimalem Prüfaufwand den richtigen Kategorien zuzuordnen.

Worauf sollte man bei einer Buchhaltungssoftware achten?

Die richtige Wahl treffen Buchhaltung Softwareentwicklung umfasst mehr als nur den Vergleich von Funktionen. Beachten Sie folgende wichtige Erkenntnisse:

- Integration ist der Schlüssel: Lässt es sich mit Ihrer bestehenden Buchhaltungssoftware wie QuickBooks, Xero oder FreshBooksNahtlose Verbindungen sparen Zeit.

- Automatisierungsfunktionen: Achten Sie auf eine starke Automatisierung. Wie viel manuelle Dateneingabe kann dadurch bei Finanzdaten entfallen?

- Benutzeroberfläche: Ist das System im Alltag einfach zu bedienen? Eine umständliche Benutzeroberfläche kann die Arbeitsabläufe verlangsamen.

- Skalierbarkeit: Kann die Software mit Ihrem Unternehmen mitwachsen? Sie möchten ja nicht alle paar Jahre die Plattform wechseln.

- Unterstützung: Welche Art von Kundensupport wird angeboten? Schnelle Hilfe ist bei Problemen entscheidend.

- Sicherheit: Wie werden Ihre sensiblen Finanzdaten geschützt? Datensicherheit hat oberste Priorität.

- Berichterstattung: Bietet es die benötigten Berichte? Gute Berichte liefern wertvolle Erkenntnisse.

Endgültiges Urteil

Welches System gewinnt also? Für die meisten Unternehmen, die ein umfassendes Ausgabenmanagement benötigen, wählen wir Expensify.

Es bietet eine vollständige Ausgabenverfolgung und Genehmigungsfunktion.

Die mobile App eignet sich hervorragend zum schnellen Scannen von Belegen.

Wenn Ihr Hauptbedarf jedoch lediglich in der automatisierten Dateneingabe für Rechnungen und Belege besteht, insbesondere für Buchhaltung Firmen mit hohem Volumen.

AutoEntry ist leistungsstark. Es eignet sich hervorragend, um Finanzdaten in Ihr System zu übertragen. Buchhaltung Software.

Wir haben beides gründlich getestet, damit Sie unseren Erkenntnissen vertrauen können.

Mehr Ausgaben

- Kosten vs. RätselDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- Expensify vs DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- Expensify vs XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- Expensify vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Ausgaben vs. Einfaches MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- Expensify vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- Expensify vs SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- Expensify vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Kostensteigerung vs. WelleDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- Expensify vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- Expensify vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- Expensify vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- Expensify vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- Expensify vs NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Mehr zu AutoEntry

- Automatischer Einstieg vs. PuzzleDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- AutoEntry vs DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- AutoEntry vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- AutoEntry vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Automatischer Monatsabschluss vs. Einfaches MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- AutoEntry vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- AutoEntry vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- AutoEntry vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- AutoEntry vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- AutoEntry vs. QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- AutoEntry vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- AutoEntry vs ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- AutoEntry vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- AutoEntry vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- AutoEntry vs NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Ist Expensify für kleine Unternehmen geeignet?

Ja, Expensify ist im Allgemeinen sehr gut für kleine UnternehmenDie SmartScan-Funktion und die automatisierte Spesenabrechnung vereinfachen die Finanzverfolgung und sparen kleineren Teams Zeit.

Funktioniert AutoEntry mit QuickBooks?

Ja, AutoEntry lässt sich nahtlos in QuickBooks integrieren, sowohl in die Desktop- als auch in die Online-Version. Dadurch werden Rechnungen und Belege automatisch direkt in Ihre QuickBooks-Buchhaltungssoftware übertragen.

Kann ich sowohl Expensify als auch AutoEntry verwenden?

Obwohl sie einige Überschneidungen aufweisen, ist es in der Regel weder notwendig noch kosteneffektiv, beide gleichzeitig für Kernaufgaben zu verwenden. Wählen Sie dasjenige, das Ihren primären Anforderungen an Buchhaltung und Kostenmanagement am besten entspricht.

Wie genau ist die OCR-Erkennung dieser Geräte?

Sowohl Expensify als auch AutoEntry zeichnen sich durch eine hohe OCR-Genauigkeit aus. Expensifys SmartScan erreicht typischerweise eine Genauigkeit von rund 95 % bei Belegen, während AutoEntry bei verschiedenen Dokumentarten oft 98 % erzielt.

Welches Programm eignet sich besser zum reinen Digitalisieren von Belegen?

Angenommen, Ihr einziger Schwerpunkt liegt auf der Digitalisierung und Datenextraktion von Belegen und Rechnungen. In diesem Fall könnte AutoEntry aufgrund seiner Spezialisierung auf automatisierte Datenextraktion und hohe Genauigkeit einen leichten Vorteil bieten.