Graut es Ihnen vor dem Monatsabschluss?

Für viele kleine UnternehmenEs ist eine riesige Belastung.

Sie sind es wahrscheinlich leid, ständig mit Tabellenkalkulationen zu jonglieren und zu versuchen, machen Überblick über Ihre Finanzen.

Zwei beliebte Buchhaltungssoftware Optionen: Einfacher Monatsabschluss und Wellenfunktion.

In diesem Artikel vergleichen wir die Funktionen von Easy Month End und Wave, um Ihnen bei der Entscheidung zu helfen, welches System besser für Sie geeignet ist. Buchhaltung Bedürfnisse.

Überblick

Um Ihnen ein möglichst klares Bild zu vermitteln, haben wir sowohl Easy Month End als auch Wave gründlich getestet.

Wir tauchen tief in ihre Funktionen, die Benutzererfahrung und den Gesamtwert ein.

Dieser praxisorientierte Ansatz ermöglichte es uns zu vergleichen, wie die einzelnen Plattformen mit gängigen Problemen umgehen. Buchhaltung Aufgaben direkt.

Nutzen Sie diesen Monat Easy und schließen Sie sich 1.257 Nutzern an, die durchschnittlich 3,5 Stunden gespart und Fehler um 15 % reduziert haben. Starten Sie jetzt Ihre kostenlose Testphase!

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 45 $ pro Monat.

Hauptmerkmale:

- Automatisierter Abgleich

- Optimierte Arbeitsabläufe

- Benutzerfreundliche Oberfläche

Über 4 Millionen kleine Unternehmen Vertrauen Sie Wave die Verwaltung Ihrer Finanzen an. Entdecken Sie die Angebote von Wave und finden Sie das passende für sich.

Preisgestaltung: Kostenloser Tarif verfügbar. Der kostenpflichtige Tarif beginnt bei 19 $/Monat.

Hauptmerkmale:

- Fakturierung

- Bankwesen

- Lohnabrechnungs-Add-on.

Was ist Easy Month End?

Worum geht es also bei Easy Month End?

Es handelt sich um ein Tool, das speziell für den monatlichen Buchabschluss entwickelt wurde.

Betrachten Sie es als Ihren Assistenten für die Aufgaben zum Monatsende.

Entdecken Sie auch unsere Favoriten Einfache Alternativen zum Monatsende…

Unsere Einschätzung

Steigern Sie die Genauigkeit Ihrer Finanzdaten mit Easy Month End. Profitieren Sie von automatisierter Abstimmung und revisionssicheren Berichten. Vereinbaren Sie eine persönliche Demo, um Ihren Monatsabschluss zu optimieren.

Wichtigste Vorteile

- Automatisierte Abgleichsworkflows

- Aufgabenmanagement und -verfolgung

- Varianzanalyse

- Dokumentenverwaltung

- Kollaborationswerkzeuge

Preisgestaltung

- Anlasser24 US-Dollar pro Monat.

- Klein: 45 US-Dollar pro Monat.

- Unternehmen: 89 US-Dollar pro Monat.

- Unternehmen: Individuelle Preisgestaltung.

Vorteile

Nachteile

Was ist eine Welle?

Was ist Wave also? Es ist ein voll ausgestattetes Buchhaltung Software.

Wave wird oft dafür gelobt, dass es kostenlos ist. Wave unterstützt kleine Unternehmen bei der Rechnungsstellung und Spesenabrechnung.

Sie können auch Ihre Lohn- und Gehaltsabrechnung verwalten.

Entdecken Sie auch unsere Favoriten Wellenalternativen…

Unsere Einschätzung

Geben Sie sich nicht mit weniger zufrieden! Schließen Sie sich den über 2 Millionen Kleinunternehmen an, die auf die leistungsstarken, kostenlosen Buchhaltungsfunktionen von Wave setzen, um ihre Finanzen noch heute zu optimieren.

Wichtigste Vorteile

Zu den Stärken von Wave gehören:

- Ein 100% kostenloser Basis-Buchhaltungsplan.

- Wir betreuen über 2 Millionen Kleinunternehmen.

- Einfache Rechnungserstellung und Zahlungsabwicklung.

- Keine langfristigen Verträge oder Garantien.

Preisgestaltung

- Starterplan: 0 € pro Monat.

- Pro-Plan: 19 Dollar pro Monat.

Vorteile

Nachteile

Funktionsvergleich

Lasst uns genauer betrachten, wie sich diese beiden Plattformen vergleichen lassen.

Hier finden Sie eine detaillierte Aufschlüsselung der einzelnen Funktionen, die Ihnen hilft, deren Stärken und Schwächen im Detail zu verstehen.

1. Monatsabschluss vs. allgemeine Buchhaltung

- Easy Month End ist ein hochspezialisiertes Tool für den Monatsabschluss. Es bietet Ihrem Finanzteam eine strukturierte Checkliste und ein Workflow-Management-System zur Erfassung der gesammelten Daten. Prüfung Beweise liefern und einen reibungsloseren Monatsabschluss gewährleisten. Es ist keine vollständige Buchhaltung Lösung.

- Wave ist ein umfassendes Kleinunternehmen Buchhaltungssoftware. Sie ist so konzipiert, dass sie alle Aspekte Ihrer Buchhaltung abdeckt. BuchhaltungVon täglichen Transaktionen bis hin zur Finanzberichterstattung. Es soll eine Komplettlösung für Ihre Buchhaltungs- und Lohnabrechnungsbedürfnisse sein.

2. Preisgestaltung und Wert

- Easy Month End ist ab 24 $ pro Monat erhältlich. Es handelt sich um ein professionelles Tool für eine spezielle Aufgabe. Sie bezahlen dafür, dass es den Monatsabschluss deutlich vereinfacht.

- Wave bietet einen leistungsstarken, kostenlosen Starter-Tarif mit allen wichtigen Basisfunktionen. Der Pro-Tarif kostet 16 US-Dollar pro Monat und bietet zusätzliche Funktionen wie den automatischen Import von Banktransaktionen sowie eine unbegrenzte Nutzeranzahl. Dieser Mehrwert ist ein wichtiger Bestandteil vieler Wave-Buchhaltungsbewertungen.

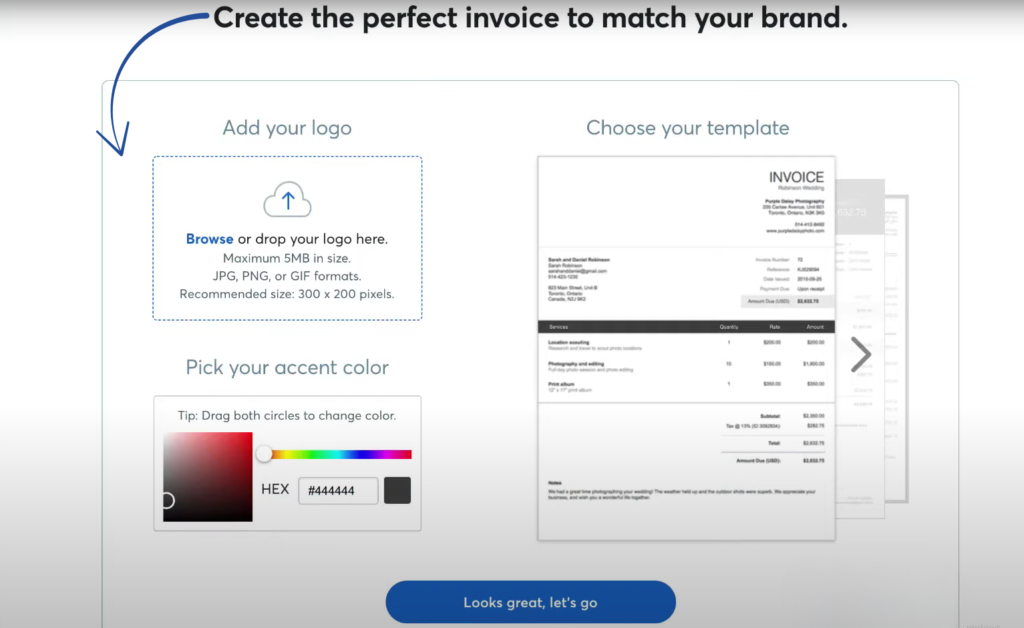

3. Rechnungsstellung und Abrechnung

- Easy Month End verfügt über keine Rechnungsstellungs- oder Abrechnungsfunktionen. Es handelt sich nicht um eine Rechnungssoftware.

- Wave ist führend in diesem Bereich. Sie können Rechnungen erstellen und versenden, wiederkehrende Zahlungen einrichten und sogar automatische Zahlungserinnerungen nutzen. Außerdem können Sie Online-Zahlungen per Kreditkarte und Banküberweisung akzeptieren.

4. Ausgabenmanagement und Belege

- Easy Month End verfügt nicht über ein dediziertes Ausgabenmanagementsystem. Es wurde entwickelt, um den Monatsabschluss abzugleichen. Daten die Sie während des Schließvorgangs aus anderen Quellen hochladen.

- Wave bietet eine hervorragende Ausgabenverfolgung mit Belegscanning und der Möglichkeit, Bankkonten zu verknüpfen, um Transaktionen automatisch zu importieren. Der Pro-Tarif bietet zusätzlich die digitale Belegerfassung und automatische Zusammenführung für noch mehr Effizienz.

5. Teamzusammenarbeit und Arbeitsabläufe

- Easy Month End wurde für die Zusammenarbeit im Team entwickelt. Es ermöglicht Ihnen, Aufgaben zuzuweisen, den Fortschritt zu verfolgen und Freigaben von Teammitgliedern einzuholen. Sie können Kommentare zu Aufgaben hinterlassen, und Prüfer können den Fortschritt überprüfen, wodurch aussagekräftige Prüfungsnachweise erstellt werden.

- Wave bietet mit dem Pro-Plan grundlegende Kollaborationsfunktionen, die die Nutzung durch mehrere Benutzer ermöglichen. Allerdings fehlen ihm die strukturierten Workflow-Management- und Überprüfungsfunktionen von Easy Month End.

6. Berichtswesen und Dashboard

- Das Dashboard von Easy Month End konzentriert sich auf den Fortschritt Ihres Monatsabschlusses. Es bietet einen klaren Überblick darüber, was bereits erledigt ist und was noch aussteht, sodass nichts übersehen wird.

- Wave bietet ein traditionelles Finanz-Dashboard mit einer Übersicht Ihrer Geldmanagement-Funktionen. Sie können verschiedene Berichte erstellen, aber die Anpassungsmöglichkeiten sind weniger umfangreich als bei teurerer Software wie beispielsweise [Name der Software/des Programms einfügen]. QuickBooks.

7. Kernfunktionalität

- Easy Month End bietet zwar einen begrenzten Funktionsumfang, dafür aber umfassende Lösungen. Es handelt sich um ein speziell entwickeltes Tool, das den Monatsabschluss für Finanzteams optimiert.

- Wave bietet eine breite Palette grundlegender Buchhaltungsfunktionen. Zwar fehlen Funktionen zur Bestandsverwaltung und zur Erfassung von Arbeitsstunden, dennoch ist es eine leistungsstarke und kostengünstige Lösung für alltägliche Aufgaben in kleinen Unternehmen. Geschäft Eigentümer.

8. Use Case and Target Audience

- Easy Month End ist für professionelle Finanzteams gedacht, die ihre Monats-, Quartals- oder Jahresabschlüsse effizienter gestalten möchten. Es ist ein hervorragendes Tool, um manuelle Checklisten in Excel oder Outlook zu ersetzen.

- Wave wurde für Freiberufler, Unternehmer und Kleinstunternehmer entwickelt, die ein einfaches, aber dennoch leistungsstarkes Tool zur Finanzverwaltung benötigen. Es ist ideal für alle, die kein System mit vollem Funktionsumfang kaufen möchten.

9. Sicherheit

- Easy Month End gewährleistet die Einhaltung der Vorschriften durch eine detaillierte Dokumentation aller Prüfschritte. Jeder Vorgang wird erfasst, sodass Sie die Verantwortlichkeit sicherstellen und beruhigt sein können, wenn der Ersteller und die Prüfer die Monatsabschlüsse unterzeichnen.

- Wave nutzt Multi-Faktor-Authentifizierung und sichere Bankverbindungen, um Ihr Geld zu schützen. Es bietet Sicherheit auf Bankniveau. Sicherheit um die Sicherheit Ihrer Daten zu gewährleisten.

Worauf Sie bei der Auswahl von Buchhaltungssoftware achten sollten?

- Ihre geschäftlichen BedürfnisseSind Sie ein freiberuflicher Mitarbeiter, der bezahlt werden muss, oder leiten Sie ein großes Finanzteam? Dies hilft bei der Entscheidung, ob Sie eine kostenlose Plattform oder einen kostenpflichtigen Pro-Tarif benötigen.

- HauptmerkmaleBenötigen Sie Rechnungsstellungsfunktionen wie unbegrenzte Rechnungsstellung und automatische Zahlungserinnerungen oder Verwaltungsfunktionen wie Workflow und Teamzusammenarbeit?

- PreisgestaltungBenötigen Sie eine kostenlose Version oder sind Sie bereit für ein Abonnement mit zusätzlichen Kosten? Überlegen Sie, ob die kostenlose Plattform für Ihre Bedürfnisse ausreicht.

- Allgemeine FunktionalitätBenötigen Sie eine robuste Hauptbuchhaltung und Bilanzabstimmungen, oder müssen Sie lediglich den Cashflow verfolgen und Rechnungen versenden?

- Berichterstattung und ErkenntnisseKann die Software die benötigten Berichte, wie Bilanzen und Finanzberichte, erstellen, um Ihnen Sicherheit und ein einfacheres Leben zu ermöglichen?

- IntegrationenFunktioniert die Software mit anderen Tools, die Sie verwenden? Wave integriert sich mit Zahlungsabwicklern, aber wie sieht es mit anderen Tools aus, mit denen Ihr Team arbeitet, wie z. B. der Lohn- und Gehaltsabrechnung?

- Unterstützung und RessourcenGibt es ein Hilfecenter oder Tutorials, die Ihnen helfen, die Software zu verstehen und Ihre Fragen bei Verzögerungen oder Fehlern zu beantworten?

- SkalierbarkeitKann die Software mehrere Unternehmen oder eine wachsende Anzahl von Benutzern verwalten, wenn Ihr Unternehmen wächst?

- AnwendungsfallHandelt es sich um private Finanzen, einen einzelnen Freiberufler oder ein größeres Unternehmen mit einem Team? Davon hängt ab, ob eine einfache oder eine komplexere Lösung für die Monatsabschlussarbeiten benötigt wird.

Endgültiges Urteil

Nach eingehender Prüfung beider Plattformen ist unsere Wahl für ein professionelles Finanzteam Easy Month End.

Wave ist eine hervorragende kostenlose Plattform für unabhängige Auftragnehmer, die bezahlt werden müssen, und gleichzeitig eine gute mobile App für die Rechnungsstellung unterwegs.

Es ist nicht für anspruchsvolle Aufgaben im Finanzteam konzipiert.

Easy Month End wurde genau für diesen Zweck entwickelt.

Es ermöglicht dem Finanzteam, manuelle Bestätigungen durchzuführen und Bilanzabstimmungen schneller vorzunehmen, und bietet dabei ein beruhigendes Gefühl.

Dieses Tool bietet eine zentrale Plattform für all Ihre Abstimmungen und erleichtert den oft stressigen ersten Monatsabschluss.

Wenn Ihr Unternehmen ein professionelles Werkzeug zur Verwaltung Ihres Finanzteams benötigt.

Für die grundlegende Buchhaltung empfehlen wir Wave, Easy Month End ist jedoch die überlegene Lösung, um Ihr Finanzteam effizienter zu gestalten.

Mehr Leichtigkeit zum Monatsende

Hier ein kurzer Vergleich von Easy Month End mit einigen der führenden Alternativen.

- Einfacher Monatsabschluss vs. Puzzle io: Während Puzzle.io für die Buchhaltung von Startups gedacht ist, konzentriert sich Easy Month End speziell auf die Optimierung des Abschlussprozesses.

- Einfacher Monatsabschluss vs. Dex: Dext dient in erster Linie der Erfassung von Dokumenten und Belegen, während Easy Month End ein umfassendes Tool für das Monatsabschlussmanagement ist.

- Einfacher Monatsabschluss vs. Xero: Xero ist eine vollständige Buchhaltungsplattform für kleine Unternehmen, während Easy Month End eine spezielle Lösung für den Abschlussprozess bietet.

- Einfacher Monatsabschluss vs. Synder: Synder ist auf die Integration von E-Commerce-Daten spezialisiert, im Gegensatz zu Easy Month End, das ein Workflow-Tool für den gesamten Finanzabschluss ist.

- Einfacher Monatsabschluss vs. Docyt: Docyt nutzt KI für Buchhaltung und Dateneingabe, während Easy Month End die Schritte und Aufgaben des Finanzabschlusses automatisiert.

- Einfacher Monatsabschluss vs. RefreshMe: RefreshMe ist eine Finanzcoaching-Plattform, die sich von Easy Month End'#8217's Fokus auf Monatsabschlüsse unterscheidet.

- Einfacher Monatsabschluss vs. Sage: Sage ist eine umfassende Unternehmensmanagement-Suite, während Easy Month End eine spezialisiertere Lösung für eine wichtige Buchhaltungsfunktion bietet.

- Easy Month End vs Zoho Books: Zoho Books ist eine All-in-One-Buchhaltungssoftware, Easy Month End hingegen ist ein speziell für den Monatsabschluss entwickeltes Tool.

- Einfacher Monatsabschluss vs. Welle: Wave bietet kostenlose Buchhaltungsdienstleistungen für kleine Unternehmen an, während Easy Month End eine fortschrittlichere Lösung für die Monatsabschlussverwaltung bietet.

- Einfacher Monatsabschluss vs. Quicken: Quicken ist ein Tool für die private Finanzplanung, daher ist Easy Month End die bessere Wahl für Unternehmen, die einen Monatsabschluss durchführen müssen.

- Einfacher Monatsabschluss vs. Hubdoc: Hubdoc automatisiert die Dokumentenerfassung, Easy Month End hingegen ist für die Verwaltung des gesamten Monatsabschluss-Workflows und der Teamaufgaben konzipiert.

- Einfacher Monatsabschluss vs. Ausgaben: Expensify ist eine Spesenmanagement-Software und hat eine andere Funktion als Easy Month End, dessen Hauptaugenmerk auf dem Finanzabschluss liegt.

- Einfacher Monatsabschluss vs. QuickBooks: QuickBooks ist eine umfassende Buchhaltungslösung, während Easy Month End ein spezifischeres Tool für die Durchführung des Monatsabschlusses selbst ist.

- Einfacher Monatsabschluss vs. automatische Eingabe: AutoEntry ist ein Datenerfassungstool, Easy Month End hingegen ist eine komplette Plattform für das Aufgaben- und Workflow-Management beim Monatsabschluss.

- Einfacher Monatsabschluss vs. FreshBooks: FreshBooks richtet sich an Freiberufler und kleine Unternehmen, während Easy Month End eine spezielle Lösung für den Monatsabschluss bietet.

- Einfacher Monatsabschluss vs. NetSuite: NetSuite ist ein vollwertiges ERP-System mit einem breiteren Funktionsumfang als Easy Month End, das sich speziell auf den Finanzabschluss konzentriert.

Mehr von Wave

- Wave vs Puzzle IODiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- Wave vs. DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- Wave vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- Wave vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Wellen vs. Einfaches MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- Wave vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- Wave vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- Wave vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Wave vs. QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- Wave vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- Welle vs. AusgabenDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- Wave vs. QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- Wave vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- Wave vs. FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- Wave vs. NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Ist Wave für die Buchhaltung wirklich kostenlos?

Ja, Wave Accounting bietet einen kostenlosen Tarif mit grundlegenden Buchhaltungsfunktionen wie Rechnungsstellung, Spesenabrechnung und Berichtswesen. Premium-Dienste wie Lohnabrechnung oder Zahlungsabwicklung sind kostenpflichtig.

Welche Lösung ist besser für ein wachsendes Unternehmen, Easy Month End oder Wave?

Wave eignet sich im Allgemeinen besser für wachsende Unternehmen, die umfassende Buchhaltungsfunktionen benötigen. Easy Month End ist auf Monatsabschlüsse spezialisiert, während Wave eine breitere Buchhaltungslösung zur Verwaltung verschiedener Geschäftsanforderungen bietet.

Kann ich mit Wave den Lagerbestand verfolgen?

Wave bietet keine umfassenden Funktionen zur Bestandsverfolgung. Wenn die Bestandsverwaltung für Ihr Unternehmen von zentraler Bedeutung ist, sollten Sie andere Buchhaltungssoftwarelösungen oder Integrationen von Drittanbietern in Betracht ziehen.

Bietet Easy Month End Anpassungsoptionen?

Easy Month End bietet anpassbare Checklisten und Vorlagen für Ihren individuellen Monatsabschluss. Im Gegensatz zu Wave bietet es jedoch keine so umfassenden Anpassungsmöglichkeiten für allgemeine Buchhaltungsfunktionen.

Wie schneidet Wave im Vergleich zu anderer kostenloser Buchhaltungssoftware ab?

Wave hebt sich unter den kostenlosen Buchhaltungsprogrammen durch seine umfassenden Basisfunktionen und die benutzerfreundliche Oberfläche hervor. Obwohl es auch andere Programme gibt, bietet Wave ein starkes Set an Tools, die dabei helfen. Kleinunternehmen Die Eigentümer verwalten ihre Finanzen effektiv.