Haben Sie Schwierigkeiten, Ihre Finanzen zu ordnen?

Viele Kleinunternehmen owners and individuals face a common

Finden Buchhaltungssoftware that makes the month-end close easy and accurate.

You need a solution that simplifies your financial life without headaches.

In this article, we’ll dive into Easy Month End vs Quicken to help you figure out which is better for your Buchhaltung Bedürfnisse.

Überblick

We’ve thoroughly tested both Easy Month End and Quicken.

Putting their features, ease of use, and overall effectiveness for Buchhaltung to the test.

This hands-on experience has allowed us to gather the key insights needed to provide a direct comparison.

Nutzen Sie diesen Monat Easy und schließen Sie sich 1.257 Nutzern an, die durchschnittlich 3,5 Stunden gespart und Fehler um 15 % reduziert haben. Starten Sie jetzt Ihre kostenlose Testphase!

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 45 $ pro Monat.

Hauptmerkmale:

- Automatisierter Abgleich

- Optimierte Arbeitsabläufe

- Benutzerfreundliche Oberfläche

Sie möchten Ihre Finanzen selbst in die Hand nehmen? Mit Quicken haben Sie Zugriff auf Tausende von Finanzinstituten. Entdecken Sie mehr!

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet 5,59 $/Monat.

Hauptmerkmale:

- Budgetierungstools

- Rechnungsverwaltung

- Investitionsverfolgung

Was ist Easy Month End?

Sprechen wir über Easy Month End. Was ist das?

It’s a tool designed to make your month-end Buchhaltung process smoother.

Think of it as your personal guide to closing your books.

Entdecken Sie auch unsere Favoriten Einfache Alternativen zum Monatsende…

Unsere Einschätzung

Steigern Sie die Genauigkeit Ihrer Finanzdaten mit Easy Month End. Profitieren Sie von automatisierter Abstimmung und revisionssicheren Berichten. Vereinbaren Sie eine persönliche Demo, um Ihren Monatsabschluss zu optimieren.

Wichtigste Vorteile

- Automatisierte Abgleichsworkflows

- Aufgabenmanagement und -verfolgung

- Varianzanalyse

- Dokumentenverwaltung

- Kollaborationswerkzeuge

Preisgestaltung

- Anlasser24 US-Dollar pro Monat.

- Klein: 45 US-Dollar pro Monat.

- Unternehmen: 89 US-Dollar pro Monat.

- Unternehmen: Individuelle Preisgestaltung.

Vorteile

Nachteile

Was ist Quicken?

Now, let’s talk about Quicken. What is Quicken?

It’s a well-known software for managing your money.

It’s been around for a long time.

Entdecken Sie auch unsere Favoriten Quicken-Alternativen…

Wichtigste Vorteile

Quicken ist ein leistungsstarkes Werkzeug, um Ihre Finanzen in Ordnung zu bringen.

Sie verfügen über mehr als 40 Jahre Erfahrung und sind ein absolutes Bestsellerprodukt.

Ihre verschiedenen Tarife ermöglichen die Anbindung an über 14.500 Finanzinstitute.

Sie erhalten außerdem eine 30-Tage-Geld-zurück-Garantie, um es risikofrei auszuprobieren.

- Verbindet sich mit Tausenden von Banken und Kreditkarten.

- Erstellt detaillierte Budgets.

- Erfasst Investitionen und Nettovermögen.

- Bietet Instrumente zur Ruhestandsplanung.

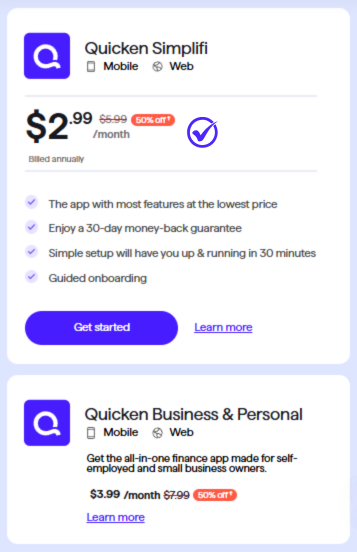

Preisgestaltung

- Quicken Simplifi: 2,99 $/Monat.

Vorteile

Nachteile

Funktionsvergleich

Let’s dive into the core differences between these two financial tools.

We will evaluate their functionality to help you machen an informed decision for your financial needs.

Loading...

- Unkomplizierter Monatsabschluss: Built for workflow management, it helps you handle month-end, quarter-end, and year-end tasks with checklists. This helps the finance team deserve a solution to make their lives easier.

- Beschleunigen: Has some tracking for bills and invoices, but lacks a dedicated team-based workflow.

Loading...

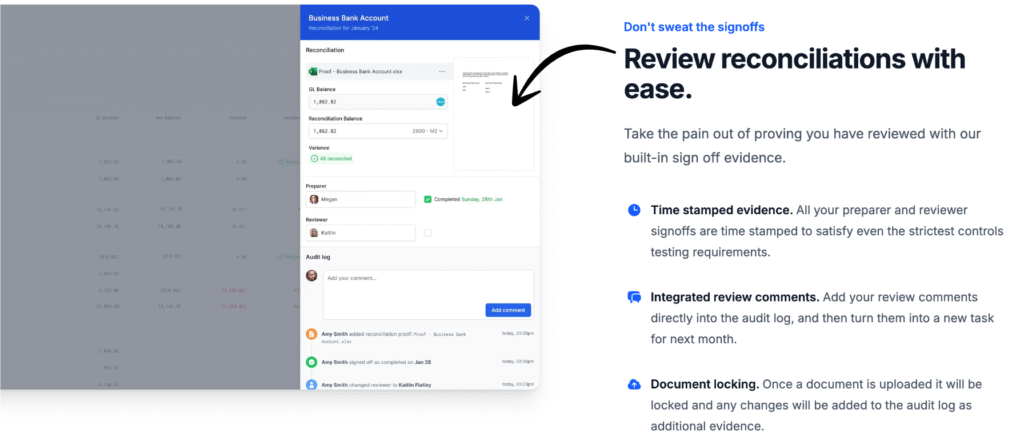

- Unkomplizierter Monatsabschluss: Designed for all your reconciliations. It helps you manage balance sheet reconciliation with no manual confirmations needed. This is key for a more efficient finance team.

- Beschleunigen: Its ability to reconcile is a separate process; it focuses on comparing bank statements and other balances.

3. Reporting and Analysis

- Unkomplizierter Monatsabschluss: Provides reports specific to the close process, allowing you to collect Prüfung evidence. It’s a tool for getting a smoother month-end close.

- Beschleunigen: Offers a broader analysis of your finances. You can evaluate your spending and get detailed reports on your investments and retirement savings.

4. Audience and Purpose

- Unkomplizierter Monatsabschluss: A professional tool for a finance team to manage their tasks. It is not for personal use.

- Beschleunigen: A well-known Quicken brand for decades, it is primarily a personal finance solution. It also has a QuickBooks business version for self-employed individuals.

Loading...

- Unkomplizierter Monatsabschluss: A ticket to a more efficient process. It helps streamline and reduce the hassle of manual work. You can get sign-offs on tasks.

- Beschleunigen: Offers automated downloads for transactions, but its core functionality is less about team-based workflow management.

6. Platform and Accessibility

- Unkomplizierter Monatsabschluss: A web-based single platform, so you can access it from anywhere.

- Beschleunigen: Traditionally a desktop os application but now has a web and mobile app companion. The Quicken Deluxe and Quicken Premier versions offer different levels of access.

7. Tax and Financial Planning

- Unkomplizierter Monatsabschluss: Does not offer personal financial planning or tax-specific tools.

- Beschleunigen: A leader in personal financial planning. It has features to manage retirement and future financial goals. The QuickBooks software can generate tax-related reports.

8. Business and Personal Focus

- Unkomplizierter Monatsabschluss: This is a business tool for a dedicated team.

- Beschleunigen: The Quicken business personal plan is for a Kleinunternehmen owner who wants to pay bills and get a full financial picture. This is something Quicken Home and Quicken Deluxe can do.

9. Benutzererfahrung

- Unkomplizierter Monatsabschluss: Its interface is designed for Buchhaltung workflows, allowing you to leave comments and have an auditable log.

- Beschleunigen: Has a familiar user interface with a long history on the market. It gives users control over their finances from the beginning.

Worauf Sie bei der Auswahl von Buchhaltungssoftware achten sollten?

Choosing the right tool is key. Here are some factors to consider, so you can ensure you pick the right one.

- Ihre Bedürfnisse: Think about if you need a personal finance software for a quicken review of your life or a tool for business finances. Look at the key features you need, such as managing rental properties, bill tracking, or handling investment accounts.

- Teamzusammenarbeit: A tool should make your finance team tasks easier. Look for solutions with strong team collaboration that help the team works together. This can mean getting faster balance sheet reconciliations and a way to manage tasks and have them marked as completed.

- Effizienz und Automatisierung: The software should make your life easier life. You should be able to upload or import Daten with no delays. This helps you manage sales and income smoothly from the first month end.

- Compliance & Audits: Your software should help you answer to auditors. It should have features that make it easy to maintain compliance and avoid errors. This reduces stress for your whole team.

- Loading...: Consider the software’s ability to create a bank transfer or manage ad hoc tasks. A good quicken software can handle different entities and provide monitoring for your purchase decisions.

- Company and Support: Evaluate the alternatives and their overall value. Look at a company’s financial backing, like how aquiline capital partners acquired Quicken. This can give you an outlook on its future. You should be able to cancel a subscription easily if needed.

- Loading...: The process of setting up should be a breeze. The preparer should have an easy time with data entry. Look at the ability to handle contracts and other documents, and if the software can be expanded with add-ons. You can additionally use a combination of software and excel to manage everything.

Endgültiges Urteil

So, which one wins: Easy Month End or Quicken?

It really depends on your needs. For dedicated business accounting, close.

Quicken is a strong choice.

However, for most individuals managing their overall finances, we recommend you use Easy Month End.

It works on both Windows and Quicken Mac, with great Berichterstattung.

While Easy Month End is great for a specific task.

Mehr Leichtigkeit zum Monatsende

Hier ein kurzer Vergleich von Easy Month End mit einigen der führenden Alternativen.

- Einfacher Monatsabschluss vs. Puzzle io: Während Puzzle.io für die Buchhaltung von Startups gedacht ist, konzentriert sich Easy Month End speziell auf die Optimierung des Abschlussprozesses.

- Einfacher Monatsabschluss vs. Dex: Dext dient in erster Linie der Erfassung von Dokumenten und Belegen, während Easy Month End ein umfassendes Tool für das Monatsabschlussmanagement ist.

- Einfacher Monatsabschluss vs. Xero: Xero ist eine vollständige Buchhaltungsplattform für kleine Unternehmen, während Easy Month End eine spezielle Lösung für den Abschlussprozess bietet.

- Einfacher Monatsabschluss vs. Synder: Synder ist auf die Integration von E-Commerce-Daten spezialisiert, im Gegensatz zu Easy Month End, das ein Workflow-Tool für den gesamten Finanzabschluss ist.

- Einfacher Monatsabschluss vs. Docyt: Docyt nutzt KI für Buchhaltung und Dateneingabe, während Easy Month End die Schritte und Aufgaben des Finanzabschlusses automatisiert.

- Einfacher Monatsabschluss vs. RefreshMe: RefreshMe ist eine Finanzcoaching-Plattform, die sich von Easy Month End'#8217's Fokus auf Monatsabschlüsse unterscheidet.

- Einfacher Monatsabschluss vs. Sage: Sage ist eine umfassende Unternehmensmanagement-Suite, während Easy Month End eine spezialisiertere Lösung für eine wichtige Buchhaltungsfunktion bietet.

- Easy Month End vs Zoho Books: Zoho Books ist eine All-in-One-Buchhaltungssoftware, Easy Month End hingegen ist ein speziell für den Monatsabschluss entwickeltes Tool.

- Einfacher Monatsabschluss vs. Welle: Wave bietet kostenlose Buchhaltungsdienstleistungen für kleine Unternehmen an, während Easy Month End eine fortschrittlichere Lösung für die Monatsabschlussverwaltung bietet.

- Einfacher Monatsabschluss vs. Quicken: Quicken ist ein Tool für die private Finanzplanung, daher ist Easy Month End die bessere Wahl für Unternehmen, die einen Monatsabschluss durchführen müssen.

- Einfacher Monatsabschluss vs. Hubdoc: Hubdoc automatisiert die Dokumentenerfassung, Easy Month End hingegen ist für die Verwaltung des gesamten Monatsabschluss-Workflows und der Teamaufgaben konzipiert.

- Einfacher Monatsabschluss vs. Ausgaben: Expensify ist eine Spesenmanagement-Software und hat eine andere Funktion als Easy Month End, dessen Hauptaugenmerk auf dem Finanzabschluss liegt.

- Einfacher Monatsabschluss vs. QuickBooks: QuickBooks ist eine umfassende Buchhaltungslösung, während Easy Month End ein spezifischeres Tool für die Durchführung des Monatsabschlusses selbst ist.

- Einfacher Monatsabschluss vs. automatische Eingabe: AutoEntry ist ein Datenerfassungstool, Easy Month End hingegen ist eine komplette Plattform für das Aufgaben- und Workflow-Management beim Monatsabschluss.

- Einfacher Monatsabschluss vs. FreshBooks: FreshBooks richtet sich an Freiberufler und kleine Unternehmen, während Easy Month End eine spezielle Lösung für den Monatsabschluss bietet.

- Einfacher Monatsabschluss vs. NetSuite: NetSuite ist ein vollwertiges ERP-System mit einem breiteren Funktionsumfang als Easy Month End, das sich speziell auf den Finanzabschluss konzentriert.

Mehr von Quicken

- Quicken vs PuzzleDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- Quicken vs. DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- Quicken vs. XeroDas ist online beliebt. Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Quicken vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Quicken vs. Easy MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- Quicken vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- Quicken vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- Quicken vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Quicken vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- Quicken vs. HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- Quicken vs ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- Quicken vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- Quicken vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- Quicken vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- Quicken vs. NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Is Easy Month End good for personal budgeting?

No, Easy Month End is designed specifically for business accounting and month-end closing processes. It does not offer features for personal budgeting or managing individual finances.

Can I track my receipts with Quicken?

Yes, Quicken allows you to track and categorize receipts, making it easier to manage expenses for both personal finances and Kleinunternehmen accounting, especially for tax purposes.

Does Quicken offer a free trial?

Quicken often offers new users a free trial, allowing them to test its features before committing to a subscription. Check its official website for current offers.

Is Quicken available for Mac users?

Yes, Quicken has a dedicated version for Quicken Mac users, offering similar features to its Windows counterpart for comprehensive financial management on Apple devices.

Which software is more highly customizable?

Quicken is generally more highly customizable for personal finance tracking, budgeting categories, and reports. Easy Month End offers customization primarily around its month-end checklist workflows.