Bist du ein Kleinunternehmen Loading...

Loading...

Loading...

Loading...

Loading...

Überblick

Loading... machen Loading...

Loading...

Loading...

Nutzen Sie diesen Monat Easy und schließen Sie sich 1.257 Nutzern an, die durchschnittlich 3,5 Stunden gespart und Fehler um 15 % reduziert haben. Starten Sie jetzt Ihre kostenlose Testphase!

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 45 $ pro Monat.

Hauptmerkmale:

- Automatisierter Abgleich

- Optimierte Arbeitsabläufe

- Benutzerfreundliche Oberfläche

QuickBooks wird von über 7 Millionen Unternehmen genutzt und kann Ihnen durchschnittlich 42 Stunden pro Monat einsparen. Buchhaltung.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Abo kostet ab 1,90 $/Monat.

Hauptmerkmale:

- Rechnungsverwaltung

- Ausgabenverfolgung

- Berichterstattung

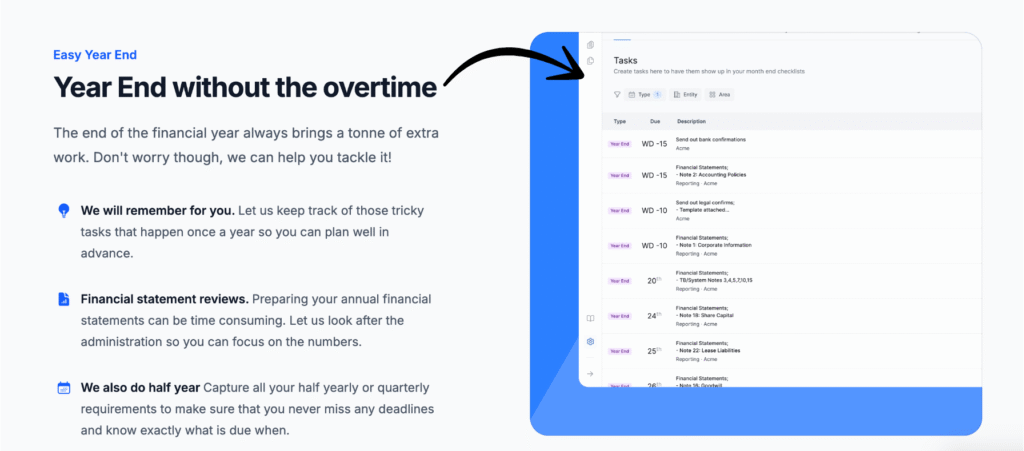

Was ist Easy Month End?

Was genau ist also Easy Month End?

Loading...

Loading...

Entdecken Sie auch unsere Favoriten Einfache Alternativen zum Monatsende…

Unsere Einschätzung

Steigern Sie die Genauigkeit Ihrer Finanzdaten mit Easy Month End. Profitieren Sie von automatisierter Abstimmung und revisionssicheren Berichten. Vereinbaren Sie eine persönliche Demo, um Ihren Monatsabschluss zu optimieren.

Wichtigste Vorteile

- Automatisierte Abgleichsworkflows

- Aufgabenmanagement und -verfolgung

- Varianzanalyse

- Dokumentenverwaltung

- Kollaborationswerkzeuge

Preisgestaltung

- Anlasser24 US-Dollar pro Monat.

- Klein: 45 US-Dollar pro Monat.

- Unternehmen: 89 US-Dollar pro Monat.

- Unternehmen: Individuelle Preisgestaltung.

Vorteile

Nachteile

Was ist QuickBooks?

Loading...

Loading...

Loading... Buchhaltung Lösung.

Entdecken Sie auch unsere Favoriten QuickBooks-Alternativen…

Wichtigste Vorteile

- Automatisierte Transaktionskategorisierung

- Rechnungserstellung und -verfolgung

- Kostenmanagement

- Lohnabrechnungsdienste

- Berichterstellung und Dashboards

Preisgestaltung

- Einfacher Start: 1,90 $/Monat.

- Essentiell: 2,80 $/Monat.

- Plus: 4 US-Dollar pro Monat.

- Fortschrittlich: 7,60 $/Monat.

Vorteile

Nachteile

Funktionsvergleich

Loading...

Loading...

Loading...

- Loading... Loading...

- QuickBooks: Loading...

Loading...

- Loading... Loading... DatenLoading...

- QuickBooks: Loading...

Loading...

- Loading... Loading...

- QuickBooks: Loading...

Loading...

- Loading... Loading...

- QuickBooks: Loading...

Loading...

- Loading... Loading...

- QuickBooks: Loading...

Loading...

- Loading... Loading...

- QuickBooks: Loading... Buchhaltung.

Loading...

- Loading... Loading...

- QuickBooks: Loading...

Loading...

- Loading... Loading...

- QuickBooks: Loading... Berichterstattung.

Loading...

- Loading... Loading...

- QuickBooks: Loading...

Worauf Sie bei der Auswahl von Buchhaltungssoftware achten sollten?

- Ihre Unternehmensgröße: Kleinunternehmen Loading...

- Spezielle Bedürfnisse: Loading... Buchhaltung Loading...

- Integration: Loading...

- Benutzererfahrung: Loading...

- Berichterstattung: Loading...

- Skalierbarkeit: Loading...

- Unterstützung: Loading...

- Loading... Loading...

- Loading... Loading...

- Loading... Loading...

- Daten Sicherheit: Loading...

Endgültiges Urteil

Loading...

Nach eingehender Prüfung beider Lösungen ist QuickBooks unsere Empfehlung für die meisten Unternehmen.

Loading...

Loading...

Loading...

Loading...

Loading...

Mehr Leichtigkeit zum Monatsende

Hier ein kurzer Vergleich von Easy Month End mit einigen der führenden Alternativen.

- Einfacher Monatsabschluss vs. Puzzle io: Während Puzzle.io für die Buchhaltung von Startups gedacht ist, konzentriert sich Easy Month End speziell auf die Optimierung des Abschlussprozesses.

- Einfacher Monatsabschluss vs. Dex: Dext dient in erster Linie der Erfassung von Dokumenten und Belegen, während Easy Month End ein umfassendes Tool für das Monatsabschlussmanagement ist.

- Einfacher Monatsabschluss vs. Xero: Xero ist eine vollständige Buchhaltungsplattform für kleine Unternehmen, während Easy Month End eine spezielle Lösung für den Abschlussprozess bietet.

- Einfacher Monatsabschluss vs. Synder: Synder ist auf die Integration von E-Commerce-Daten spezialisiert, im Gegensatz zu Easy Month End, das ein Workflow-Tool für den gesamten Finanzabschluss ist.

- Einfacher Monatsabschluss vs. Docyt: Docyt nutzt KI für Buchhaltung und Dateneingabe, während Easy Month End die Schritte und Aufgaben des Finanzabschlusses automatisiert.

- Einfacher Monatsabschluss vs. RefreshMe: RefreshMe ist eine Finanzcoaching-Plattform, die sich von Easy Month End'#8217's Fokus auf Monatsabschlüsse unterscheidet.

- Einfacher Monatsabschluss vs. Sage: Sage ist eine umfassende Unternehmensmanagement-Suite, während Easy Month End eine spezialisiertere Lösung für eine wichtige Buchhaltungsfunktion bietet.

- Easy Month End vs Zoho Books: Zoho Books ist eine All-in-One-Buchhaltungssoftware, Easy Month End hingegen ist ein speziell für den Monatsabschluss entwickeltes Tool.

- Einfacher Monatsabschluss vs. Welle: Wave bietet kostenlose Buchhaltungsdienstleistungen für kleine Unternehmen an, während Easy Month End eine fortschrittlichere Lösung für die Monatsabschlussverwaltung bietet.

- Einfacher Monatsabschluss vs. Quicken: Quicken ist ein Tool für die private Finanzplanung, daher ist Easy Month End die bessere Wahl für Unternehmen, die einen Monatsabschluss durchführen müssen.

- Einfacher Monatsabschluss vs. Hubdoc: Hubdoc automatisiert die Dokumentenerfassung, Easy Month End hingegen ist für die Verwaltung des gesamten Monatsabschluss-Workflows und der Teamaufgaben konzipiert.

- Einfacher Monatsabschluss vs. Ausgaben: Expensify ist eine Spesenmanagement-Software und hat eine andere Funktion als Easy Month End, dessen Hauptaugenmerk auf dem Finanzabschluss liegt.

- Einfacher Monatsabschluss vs. QuickBooks: QuickBooks ist eine umfassende Buchhaltungslösung, während Easy Month End ein spezifischeres Tool für die Durchführung des Monatsabschlusses selbst ist.

- Einfacher Monatsabschluss vs. automatische Eingabe: AutoEntry ist ein Datenerfassungstool, Easy Month End hingegen ist eine komplette Plattform für das Aufgaben- und Workflow-Management beim Monatsabschluss.

- Einfacher Monatsabschluss vs. FreshBooks: FreshBooks richtet sich an Freiberufler und kleine Unternehmen, während Easy Month End eine spezielle Lösung für den Monatsabschluss bietet.

- Einfacher Monatsabschluss vs. NetSuite: NetSuite ist ein vollwertiges ERP-System mit einem breiteren Funktionsumfang als Easy Month End, das sich speziell auf den Finanzabschluss konzentriert.

Mehr zu QuickBooks

- QuickBooks vs Puzzle IODiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- QuickBooks vs. DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- QuickBooks vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- QuickBooks vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- QuickBooks vs. Easy MonatsabschlussDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- QuickBooks vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- QuickBooks vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- QuickBooks vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- QuickBooks vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- QuickBooks vs. QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- QuickBooks vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- QuickBooks vs. ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- QuickBooks vs. AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- QuickBooks vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- QuickBooks vs. NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Loading...

Loading...

Kann ich Easy Month End mit QuickBooks verwenden?

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading... Buchhaltungssoftware Loading...