Month-end close often feels like a giant, messy puzzle, especially with manual Buchhaltung.

Endless spreadsheets, constant re-checking, and the dread of errors can drain your time and energy.

It’s a real headache that can hold your Geschäft back.

Let’s explore Easy Month End vs NetSuite, which option best fits your Buchhaltung Bedürfnisse.

Überblick

We’ve spent considerable time with both traditional month-end processes and NetSuite’s capabilities.

Our comparison stems from hands-on testing and in-depth analysis of how each approach tackles the real-world demands of Buchhaltung.

Nutzen Sie diesen Monat Easy und schließen Sie sich 1.257 Nutzern an, die durchschnittlich 3,5 Stunden gespart und Fehler um 15 % reduziert haben. Starten Sie jetzt Ihre kostenlose Testphase!

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 45 $ pro Monat.

Hauptmerkmale:

- Automatisierter Abgleich

- Optimierte Arbeitsabläufe

- Benutzerfreundliche Oberfläche

Steigern Sie Ihre Produktivität um bis zu 78 %! Erfahren Sie, wie die Automatisierungstools von NetSuite Ihren Arbeitsalltag verändern können. Entdecken Sie mehr!

Preisgestaltung: Es gibt eine kostenlose Testphase. Individuelle Preispläne sind verfügbar.

Hauptmerkmale:

- ERP-Integration

- CRM

- Erweiterte Analytik

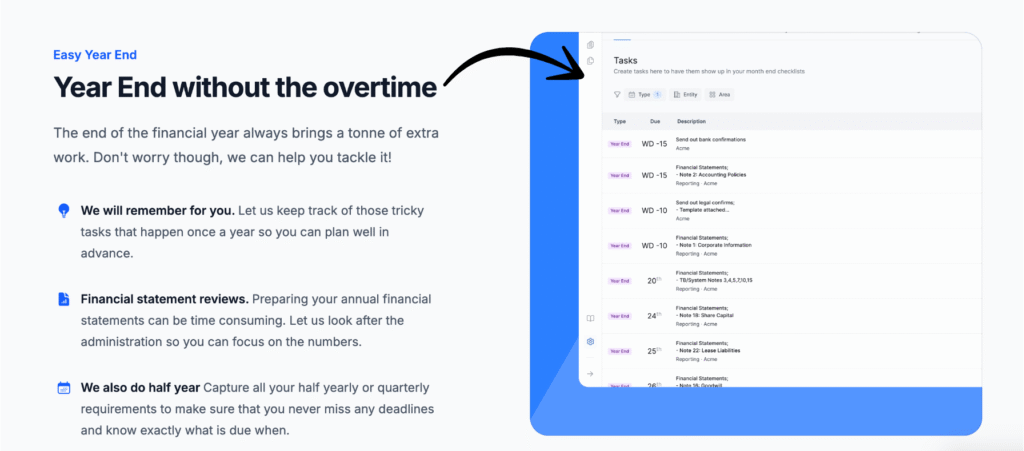

Was ist Easy Month End?

So, you’re looking for an easier way to close your books each month?

Easy Month End is a tool built just for that.

Think of it as your digital checklist and assistant for all those month-end tasks.

Entdecken Sie auch unsere Favoriten Einfache Alternativen zum Monatsende…

Unsere Einschätzung

Steigern Sie die Genauigkeit Ihrer Finanzdaten mit Easy Month End. Profitieren Sie von automatisierter Abstimmung und revisionssicheren Berichten. Vereinbaren Sie eine persönliche Demo, um Ihren Monatsabschluss zu optimieren.

Wichtigste Vorteile

- Automatisierte Abgleichsworkflows

- Aufgabenmanagement und -verfolgung

- Varianzanalyse

- Dokumentenverwaltung

- Kollaborationswerkzeuge

Preisgestaltung

- Anlasser24 US-Dollar pro Monat.

- Klein: 45 US-Dollar pro Monat.

- Unternehmen: 89 US-Dollar pro Monat.

- Unternehmen: Individuelle Preisgestaltung.

Vorteile

Nachteile

Was ist NetSuite?

So, what is NetSuite? It’s a huge software system for businesses.

Think of it as an all-in-one platform. It handles your Buchhaltung, inventory, and even customer relationships.

It’s designed for bigger companies. It aims to connect all your business operations.

Entdecken Sie auch unsere Favoriten NetSuite-Alternativen…

Unsere Einschätzung

Sie benötigen die Leistungsfähigkeit einer Enterprise-Lösung? NetSuite betreut weltweit über 30.000 Kunden mit seiner umfassenden Plattform. Wenn Sie eine vollständige ERP-Integration und fortschrittliche Analysen benötigen, ist NetSuite die richtige Wahl für Ihr Wachstum.

Wichtigste Vorteile

- Es vereint die Finanzwelt, CRMund ERP in einem einzigen Cloud-System.

- Es unterstützt Unternehmen in über 200 Ländern und 27 Sprachen.

- Über 40.000 Organisationen nutzen diese skalierbare Plattform.

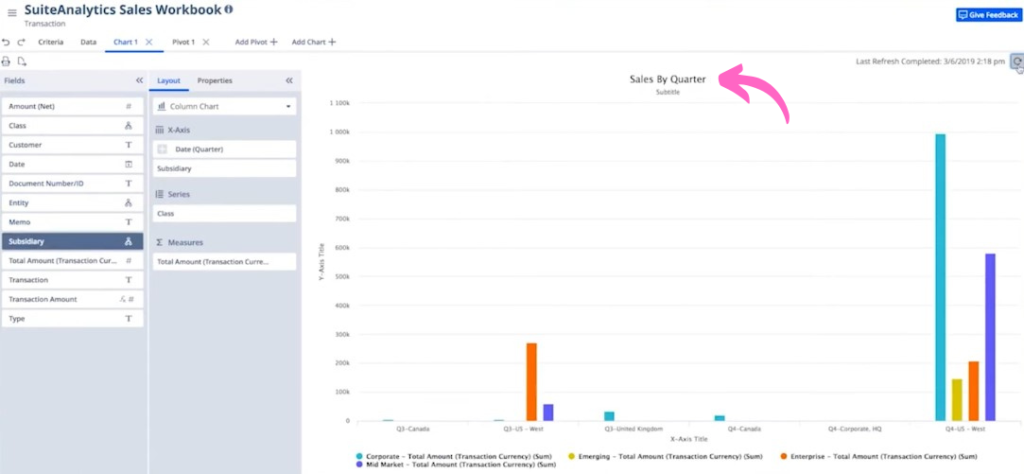

- Sie erhalten integrierte Analysefunktionen für Echtzeit-Einblicke in Ihre Daten.

Preisgestaltung

Sie bieten maßgeschneiderte Preispläne an, die auf Ihre Bedürfnisse zugeschnitten sind. Kontaktieren Sie sie, um Ihr optimales Preisangebot zu erhalten.

Vorteile

Nachteile

Funktionsvergleich

It’s time for a deeper dive.

Your finance team deserves a tool that simplifies their workflow management and makes their lives easier.

Let’s compare how these two platforms handle key financial processes and business solutions in detail.

1. Workflow- und Aufgabenmanagement

- Easy Month End: This cloud-based management software is a dedicated workflow management tool. It provides a single platform to handle all your finance team tasks. You can assign tasks, track progress, and get faster balance sheet reconciliations. It’s a structured approach that makes your first month-end a total breeze.

- NetSuite: As a full enterprise resource planning (ERP) system, NetSuite includes workflow management but on a much broader scale. NetSuite ERP allows you to automate entire business processes, from order management to supply chain. While it helps, its workflow management is just one part of a complex system.

2. Teamzusammenarbeit

- Easy Month End: This is where this management software shines. It’s built for team collaboration. Your team works from a shared single platform where you can leave comments on tasks, get real-time sign-offs, and provide auditors with Prüfung evidence. This eliminates delays and hassle.

- NetSuite: NetSuite offers team collaboration through its fully integrated platform. NetSuite users can access customer data, vendor bills, and expense reports from a single source. Additionally, its cloud-based ERP nature allows multiple business units to work together, but it’s not as purpose-built for the smoother month-end close workflow as Easy Month End.

3. Financial Close and Reporting

- Easy Month End: The ability to handle month-end, quarter-end, and year-end tasks is its core strength. You can automatically track all your reconciliations and collect audit evidence in one place. It helps you reconcile your accounts without manual confirmations, but it relies on an external accounting software for the underlying Buchhaltung.

- NetSuite: NetSuite’s accounting capabilities are designed to enhance audit trails and produce comprehensive financial statements. It centralizes financial processes, providing real-time visibility into your business’s finances. As a full clERP based erp, it offers a fully integrated general ledger, cash management, and accounts receivable to get an accurate financial performance overview.

4. Integration and Connectivity

- Easy Month End: This management software is designed to be a standalone tool for the month-end close process. While you can upload and import data from Excel or other files, it lacks the seamless integration with other software or other systems that a larger ERP system provides.

- NetSuite: Oracle Corporation built NetSuite ERP for seamless integration. It can integrate with other modules like customer relationship management (CRM), warehouse management, and supply chain management. This creates a complete business management software that gives you a single platform to access all your data.

5. Ad Hoc and Contracts Management

- Easy Month End: Easy Month End allows you to create ad hoc tasks for one-off projects. You can leave comments on a specific ticket, ensuring your team works efficiently on unexpected finance team tasks. It helps manage any stress and delays from unplanned work.

- NetSuite: NetSuite has features for contracts and project management, which are part of its professional services Automatisierung (PSA) and human capital management (HCM) modules. This goes far beyond simple task management and is designed to handle detailed workforce management and payroll management for large entities.

6. Expense and Payment Management

- Easy Month End: While it helps organize the tasks for expense reports and vendor bills, it doesn’t process the money or pay vendors directly. You can collect audit evidence and track the sign-offs for these tasks, but the actual bank transfer happens in other systems.

- NetSuite: NetSuite has native capabilities to track expenses and process vendor bills. It can manage bank transfers, automate payment options, and provide a full audit trail of every transaction. This level of control is essential for compliance in large businesses.

7. Global Accounting and Multi-Currency

- Easy Month End: Supports multiple currencies within its checklists and reports to handle global operations. It helps organize the month-end close for companies with multiple entities by having a separate checklist for each.

- NetSuite: NetSuite’s global accounting features are a key selling point. The Oracle Corporation built NetSuite to handle multiple currencies and localized tax codes for business units around the world. This is crucial for growing companies operating internationally.

8. Benutzererfahrung und Barrierefreiheit

- Easy Month End: It’s a user-friendly interface designed for accountants. It focuses on clarity and simplicity, ensuring your finance team can access and use it without extensive training. You can import data from Excel easily for a breeze of the first month-end.

- NetSuite: While NetSuite reviews its platform to be user-friendly, its vast number of features can be overwhelming for new users. The system offers access to real-time data through key performance indicators (KPIs) and dashboards, but learning to navigate all your reconciliations can take time.

9. Price and Scalability

- Easy Month End: It has a clear and affordable pricing structure. It’s a great solution for small business owners and medium-sized businesses that need to cancel at any time with no contracts. You can upload and review your reconciliations and answer any comments with ease.

- NetSuite: NetSuite is a significant investment. The cost is high, but it’s built to scale with large businesses. It offers custom integrations and other modules for e commerce, human capital management, professional services automation, and more. Netsuite reviews show it to be a powerful, if expensive, enterprise resource planning system.

Worauf Sie bei der Auswahl von Buchhaltungssoftware achten sollten?

- Ihre Unternehmensgröße: Does the software fit your current business size and future growth? Kleinunternehmen have different needs from large enterprises.

- Spezielle Bedürfnisse: Do you need a focused accounting solution like Easy Month End for just the month-end close process, or a full ERP system like Oracle NetSuite?

- Budget: Can you afford the upfront and ongoing costs? Consider both licensing and implementation.

- Benutzerfreundlichkeit: How quickly can your accounting team and finance team learn and adapt to the workflow?

- Integration: Will it work well with your existing systems, or will it replace them? Think vs. QuickBooks, if that’s your current system.

- Automation Levels: How much automation do you need for transaction processing, journal entries, and revenue recognition?

- Berichterstattung: Does it provide the financial data insights and balance sheet reports you need for decision-making?

Endgültiges Urteil

For most service-based businesses and smaller operations aiming to streamline their month-end.

We pick Easy Month End.

It’s simple, affordable, and perfect for that specific month-end close process headache.

It won’t manage every invoice or all your financial planning, but it gets the job done.

However, if you’re a larger company needing full cloud accounting and management software that handles everything,

NetSuite is the top choice.

We’ve seen how these tools perform, so you can choose what’s best for your accounting team.

Mehr Leichtigkeit zum Monatsende

Hier ein kurzer Vergleich von Easy Month End mit einigen der führenden Alternativen.

- Einfacher Monatsabschluss vs. Puzzle io: Während Puzzle.io für die Buchhaltung von Startups gedacht ist, konzentriert sich Easy Month End speziell auf die Optimierung des Abschlussprozesses.

- Einfacher Monatsabschluss vs. Dex: Dext dient in erster Linie der Erfassung von Dokumenten und Belegen, während Easy Month End ein umfassendes Tool für das Monatsabschlussmanagement ist.

- Einfacher Monatsabschluss vs. Xero: Xero ist eine vollständige Buchhaltungsplattform für kleine Unternehmen, während Easy Month End eine spezielle Lösung für den Abschlussprozess bietet.

- Einfacher Monatsabschluss vs. Synder: Synder ist auf die Integration von E-Commerce-Daten spezialisiert, im Gegensatz zu Easy Month End, das ein Workflow-Tool für den gesamten Finanzabschluss ist.

- Einfacher Monatsabschluss vs. Docyt: Docyt nutzt KI für Buchhaltung und Dateneingabe, während Easy Month End die Schritte und Aufgaben des Finanzabschlusses automatisiert.

- Einfacher Monatsabschluss vs. RefreshMe: RefreshMe ist eine Finanzcoaching-Plattform, die sich von Easy Month End'#8217's Fokus auf Monatsabschlüsse unterscheidet.

- Einfacher Monatsabschluss vs. Sage: Sage ist eine umfassende Unternehmensmanagement-Suite, während Easy Month End eine spezialisiertere Lösung für eine wichtige Buchhaltungsfunktion bietet.

- Easy Month End vs Zoho Books: Zoho Books ist eine All-in-One-Buchhaltungssoftware, Easy Month End hingegen ist ein speziell für den Monatsabschluss entwickeltes Tool.

- Einfacher Monatsabschluss vs. Welle: Wave bietet kostenlose Buchhaltungsdienstleistungen für kleine Unternehmen an, während Easy Month End eine fortschrittlichere Lösung für die Monatsabschlussverwaltung bietet.

- Einfacher Monatsabschluss vs. Quicken: Quicken ist ein Tool für die private Finanzplanung, daher ist Easy Month End die bessere Wahl für Unternehmen, die einen Monatsabschluss durchführen müssen.

- Einfacher Monatsabschluss vs. Hubdoc: Hubdoc automatisiert die Dokumentenerfassung, Easy Month End hingegen ist für die Verwaltung des gesamten Monatsabschluss-Workflows und der Teamaufgaben konzipiert.

- Einfacher Monatsabschluss vs. Ausgaben: Expensify ist eine Spesenmanagement-Software und hat eine andere Funktion als Easy Month End, dessen Hauptaugenmerk auf dem Finanzabschluss liegt.

- Einfacher Monatsabschluss vs. QuickBooks: QuickBooks ist eine umfassende Buchhaltungslösung, während Easy Month End ein spezifischeres Tool für die Durchführung des Monatsabschlusses selbst ist.

- Einfacher Monatsabschluss vs. automatische Eingabe: AutoEntry ist ein Datenerfassungstool, Easy Month End hingegen ist eine komplette Plattform für das Aufgaben- und Workflow-Management beim Monatsabschluss.

- Einfacher Monatsabschluss vs. FreshBooks: FreshBooks richtet sich an Freiberufler und kleine Unternehmen, während Easy Month End eine spezielle Lösung für den Monatsabschluss bietet.

- Einfacher Monatsabschluss vs. NetSuite: NetSuite ist ein vollwertiges ERP-System mit einem breiteren Funktionsumfang als Easy Month End, das sich speziell auf den Finanzabschluss konzentriert.

Mehr von NetSuite

- NetSuite vs PuzzleDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- NetSuite vs. DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- NetSuite vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- NetSuite vs. SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- NetSuite vs. Easy Month EndDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- NetSuite vs. DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- NetSuite vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- NetSuite vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- NetSuite vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- NetSuite vs. QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- NetSuite vs. HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- NetSuite vs ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- NetSuite vs. QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- NetSuite vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

Häufig gestellte Fragen

Is Easy Month End a full accounting software like NetSuite?

No, Easy Month End is a specialized tool for managing the month-end close process. NetSuite is a comprehensive ERP system that handles all aspects of financial management and business processes.

Can small businesses use NetSuite?

While NetSuite is powerful, its complexity and cost often machen it less suitable for most small businesses. Easy Month End is typically a more practical accounting solution for their specific business needs.

How does automation differ between the two?

Easy Month End automates task tracking and reminders for your accounting team. NetSuite offers deeper automation across financial data entry, journal entries, and extensive workflow integration.

Does Easy Month End handle invoice processing?

No, Easy Month End does not process individual invoice or transaction data. It focuses on organizing the close checklist tasks required to finalize accounts, not the underlying bookkeeping.

Which is better for financial planning?

NetSuite offers robust modules for financial planning and budget management as part of its ERP system. Easy Month End does not directly support financial planning; it’s solely for the month-end close process.