Got that tricky month-end close giving you a headache?

Or maybe you’re swamped with receipts and invoices, dreaming of a magic wand to handle Daten entry?

Loading...

Many businesses, big and small, struggle with these Buchhaltung Aufgaben.

Let’s dive in and see Easy Month End vs AutoEntry, which can make your Buchhaltung Einfacher.

Überblick

We’ve put both Easy Month End and AutoEntry through their paces.

Testing their features and how they handle real-world Buchhaltung Herausforderungen.

This hands-on experience has given us a clear picture for this direct comparison.

Nutzen Sie diesen Monat Easy und schließen Sie sich 1.257 Nutzern an, die durchschnittlich 3,5 Stunden gespart und Fehler um 15 % reduziert haben. Starten Sie jetzt Ihre kostenlose Testphase!

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 45 $ pro Monat.

Hauptmerkmale:

- Automatisierter Abgleich

- Optimierte Arbeitsabläufe

- Benutzerfreundliche Oberfläche

Verschwenden Sie nicht länger als 10 Stunden pro Woche mit manueller Dateneingabe. Erfahren Sie, wie Autoentry die Rechnungsbearbeitungszeit um 40 % reduziert hat. Salbei Nutzer.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das kostenpflichtige Abonnement beginnt bei 12 $ pro Monat.

Hauptmerkmale:

- Datenextraktion

- Belegscannen

- Lieferantenautomatisierung

Was ist Easy Month End?

Let’s talk about Easy Month End. What is it, exactly?

It’s a tool designed to make your month-end Buchhaltung viel reibungsloser.

Think of it as your assistant for closing the books.

Entdecken Sie auch unsere Favoriten Einfache Alternativen zum Monatsende…

Unsere Einschätzung

Steigern Sie die Genauigkeit Ihrer Finanzdaten mit Easy Month End. Profitieren Sie von automatisierter Abstimmung und revisionssicheren Berichten. Vereinbaren Sie eine persönliche Demo, um Ihren Monatsabschluss zu optimieren.

Wichtigste Vorteile

- Automatisierte Abgleichsworkflows

- Aufgabenmanagement und -verfolgung

- Varianzanalyse

- Dokumentenverwaltung

- Kollaborationswerkzeuge

Preisgestaltung

- Anlasser24 US-Dollar pro Monat.

- Klein: 45 US-Dollar pro Monat.

- Unternehmen: 89 US-Dollar pro Monat.

- Unternehmen: Individuelle Preisgestaltung.

Vorteile

Nachteile

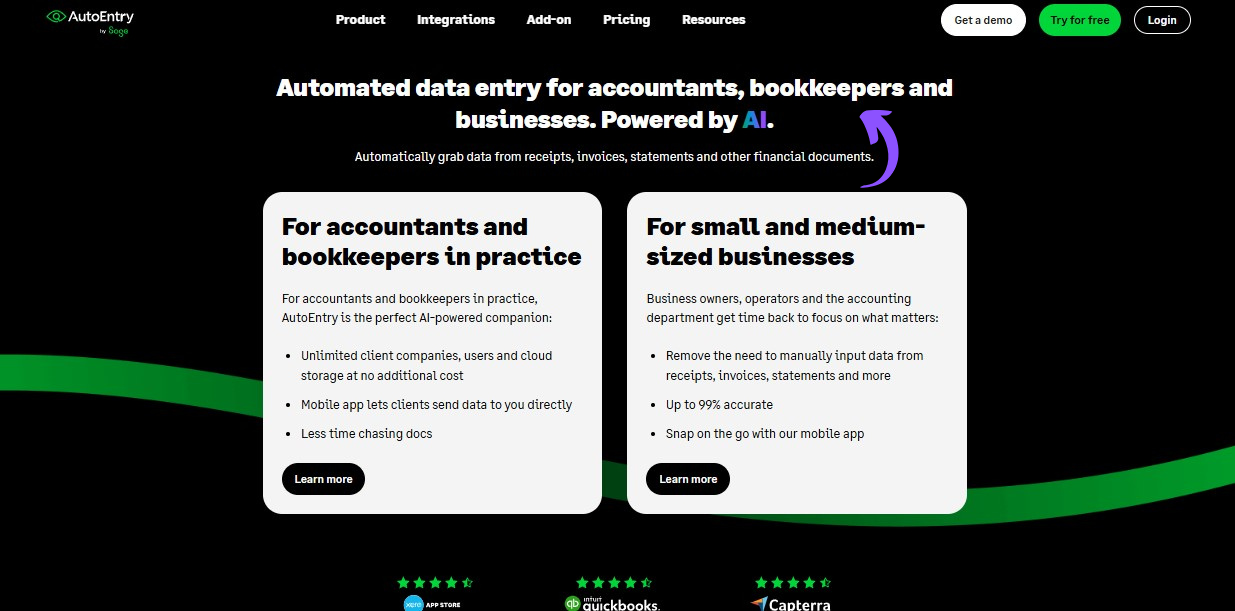

Was ist AutoEntry?

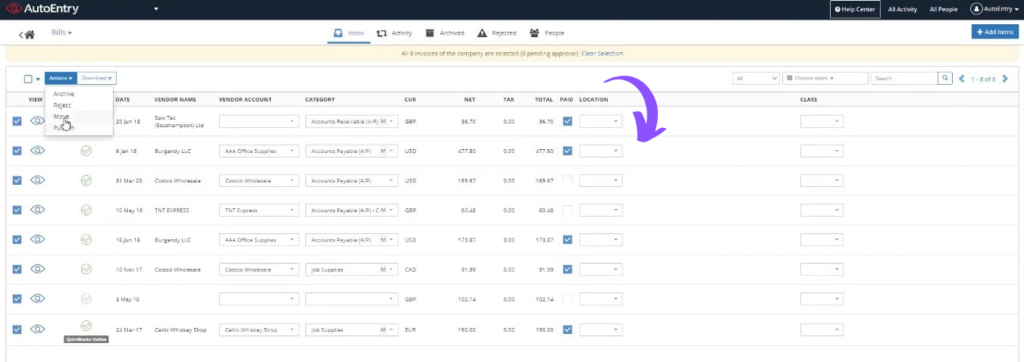

Now, let’s look at AutoEntry. What is it all about?

Simply put, it’s a smart tool that helps you with data entry.

Imagine taking a picture of a receipt, and all the numbers automatically appear in your Buchhaltungssoftware.

Entdecken Sie auch unsere Favoriten Alternativen zu AutoEntry…

Unsere Einschätzung

Möchten Sie Ihren Buchhaltungsaufwand reduzieren? AutoEntry verarbeitet jährlich über 28 Millionen Dokumente und bietet eine Genauigkeit von bis zu 99 %. Starten Sie noch heute und gehören Sie zu den über 210.000 Unternehmen weltweit, die ihren Dateneingabeaufwand um bis zu 80 % reduziert haben!

Wichtigste Vorteile

Der größte Vorteil von AutoEntry besteht darin, dass man sich stundenlange, langweilige Arbeit spart.

Die Anwender berichten häufig von einer bis zu 80%igen Zeitersparnis beim manuellen Dateneingabevorgang.

Es verspricht eine Genauigkeit von bis zu 99 % bei der Datenextraktion.

AutoEntry bietet keine spezielle Geld-zurück-Garantie, aber die monatlichen Abonnements ermöglichen eine jederzeitige Kündigung.

- Bis zu 99% Genauigkeit der Daten.

- Unbegrenzte Nutzeranzahl bei allen kostenpflichtigen Tarifen.

- Ruft vollständige Positionen aus Rechnungen ab.

- Einfache mobile App zum Fotografieren von Kassenbons.

- Nicht genutzte Guthaben verfallen nach einer Frist von 90 Tagen.

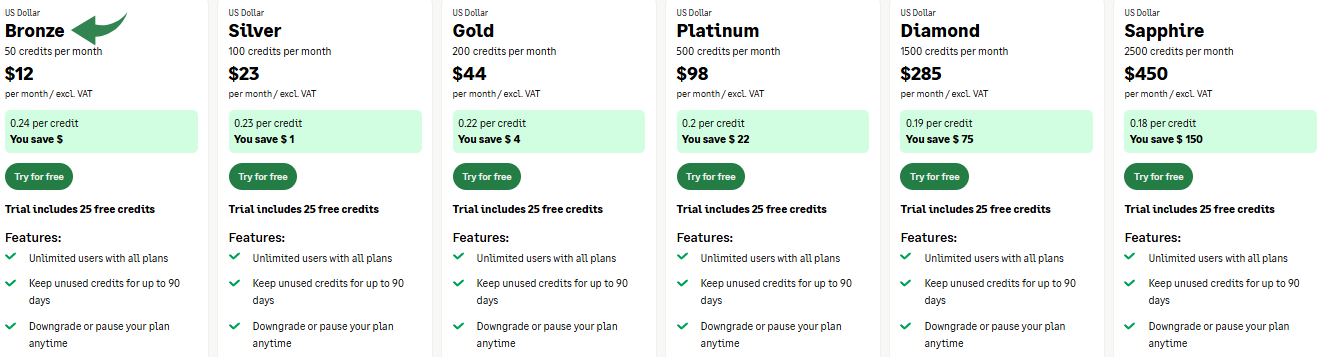

Preisgestaltung

- Bronze12 US-Dollar pro Monat.

- Silber23 US-Dollar pro Monat.

- Gold44 US-Dollar pro Monat.

- Platin: 98 $/Monat.

- Diamant285 US-Dollar pro Monat.

- Saphir: 450 $/Monat.

Vorteile

Nachteile

Funktionsvergleich

Now that we’ve examined each product individually, let’s compare them side-by-side.

This feature comparison will help you see where each tool truly stands out.

Loading...

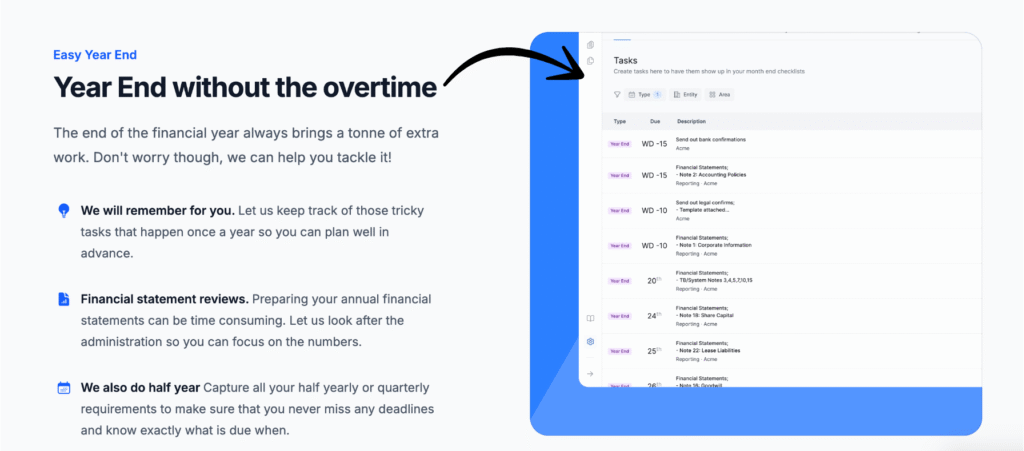

- Unkomplizierter Monatsabschluss: This tool is a complete workflow management system. It helps you handle month-end, quarter-end, and year-end tasks. It brings clarity to the entire month-end process for your finance team. You can easily leave comments and assign tasks.

- Automatischer Einstieg: This is not a workflow management tool. Its primary function is to simplify collecting financial documents. It gets data in, but it doesn’t manage the overall month-end process.

2. Bilanzabstimmung

- Unkomplizierter Monatsabschluss: This tool makes balance sheet reconciliation easy. It helps you match transactions and provides a full audit trail. You get a clear view of all your reconciliations in one place.

- Automatischer Einstieg: Its main purpose is data extraction. It gets the information from documents so you can do your reconciliations, but it doesn’t provide the reconciliation tools itself.

3. Audit Evidence and Compliance

- Unkomplizierter Monatsabschluss: This platform is built to help you collect audit evidence. It tracks every action and provides a clear audit trail. You can even invite auditors to the platform to help you prove compliance.

- Automatischer Einstieg: This tool helps you have digital copies of your financial documents for an audit. However, it doesn’t provide the tracking and sign-offs that a dedicated audit tool offers.

4. Teamzusammenarbeit

- Unkomplizierter Monatsabschluss: This tool is designed for team collaboration. You can assign tasks, leave comments, and track progress in real-time. This makes sure the entire finance team is on the same page and works more efficiently.

- Automatischer Einstieg: This tool is mainly for individual use, though multiple users can have access. Its collaboration features are limited to sharing documents and data, not managing shared workflow tasks.

5. Document Data Extraction

- Unkomplizierter Monatsabschluss: This tool does not have a direct data extraction feature. You need to manually upload or enter your documents.

- Automatischer Einstieg: Its key strength is data extraction. Its optical character recognition (OCR) technology automatically extracts data from receipts, purchase invoices, bank statements, and other financial documents. This saves an incredible amount of time spent on manual data entry.

6. Expense Reports

- Unkomplizierter Monatsabschluss: This tool is not an expense Berichterstattung tool. It helps you manage the month-end close process, but it doesn’t compile expense data.

- Automatischer Einstieg: This tool simplifies expense reporting. It can capture and categorize expenses from documents and organize them.

7. Bank Reconciliations

- Unkomplizierter Monatsabschluss: This tool can directly perform balance sheet reconciliations and connect with your bank accounts to ensure your books are balanced.

- Automatischer Einstieg: This tool captures bank account data and helps get it ready for reconciliation. It provides the transaction details you need.

8. Handling Ad-Hoc Tasks

- Unkomplizierter Monatsabschluss: This tool has expanded its features to handle ad hoc tasks beyond the month-end close process. This makes it a single platform for a variety of finance team tasks.

- Automatischer Einstieg: This tool’s focus is too narrow to help with ad hoc tasks. It is built for one thing: getting data from financial documents into your Buchhaltung Software.

9. Preismodell

- Unkomplizierter Monatsabschluss: This tool uses a traditional subscription model based on users and entities. You have a set monthly fee that gives you access to all features.

- Automatischer Einstieg: This tool offers a flexible subscription. It uses a credit-based model where you pay for what you use. There are no long-term contracts, and you can cancel anytime.

Worauf Sie bei der Auswahl von Buchhaltungssoftware achten sollten?

When you’re trying to find a tool that can give your finance team an easier life, here’s a checklist to machen sure you get the right fit.

- Look for a tool that can make your month-end process a breeze, resulting in a smoother month-end close with fewer errors and delays. This way, you can stay calm, and your finance team deserves that.

- The software should help your team be more efficient and offer features for team management and team collaboration. The whole team works better with the ability to see tasks and leave comments in one place.

- Make sure the platform can handle faster balance sheet reconciliations and has a clear audit trail for your preparer to use. You should be able to review and reconcile everything easily.

- Check the pricing model, such as autoentry pricing, which is often a flexible pricing per month rather than a fixed subscription. Some also offer unlimited users, which saves a lot of money.

- The solution should handle all your paperwork effortlessly. Look for the ability to import data from bank transfers and other sources, and to auto-publish documents.

- Consider a tool that helps with ad hoc needs, so you can answer any questions that come up and feel less stress.

- Security is key. The software should protect itself from online attacks and use a security service and a strong security solution to prevent being blocked. If you’re unable to access a page, you might see a cloudflare ray id found or a Cloudflare Ray ID.

- The software should be able to handle actions that could trigger this block, including submitting a certain word or phrase or a sql command, or malformed data. If your action you just performed triggered the security solution, you should be able to email the site owner to resolve it.

- Check if it has a good mobile phone app. Your clients will also appreciate the effort of a good system.

Endgültiges Urteil

So, which one do we pick? It depends on your biggest need.

If month-end closing gives you headaches, and you need clear workflows.

Easy Month End is your champion. It truly streamlines that process.

But if you’re buried in receipts, AutoEntry is the clear winner.

Es ist Automatisierung for document capture is a game-changer, making data entry much simpler.

We’ve tested these tools ourselves to give you honest advice.

The best tool solves your specific problems.

Mehr Leichtigkeit zum Monatsende

Hier ein kurzer Vergleich von Easy Month End mit einigen der führenden Alternativen.

- Einfacher Monatsabschluss vs. Puzzle io: Während Puzzle.io für die Buchhaltung von Startups gedacht ist, konzentriert sich Easy Month End speziell auf die Optimierung des Abschlussprozesses.

- Einfacher Monatsabschluss vs. Dex: Dext dient in erster Linie der Erfassung von Dokumenten und Belegen, während Easy Month End ein umfassendes Tool für das Monatsabschlussmanagement ist.

- Einfacher Monatsabschluss vs. Xero: Xero ist eine vollständige Buchhaltungsplattform für kleine Unternehmen, während Easy Month End eine spezielle Lösung für den Abschlussprozess bietet.

- Einfacher Monatsabschluss vs. Synder: Synder ist auf die Integration von E-Commerce-Daten spezialisiert, im Gegensatz zu Easy Month End, das ein Workflow-Tool für den gesamten Finanzabschluss ist.

- Einfacher Monatsabschluss vs. Docyt: Docyt nutzt KI für Buchhaltung und Dateneingabe, während Easy Month End die Schritte und Aufgaben des Finanzabschlusses automatisiert.

- Einfacher Monatsabschluss vs. RefreshMe: RefreshMe ist eine Finanzcoaching-Plattform, die sich von Easy Month End'#8217's Fokus auf Monatsabschlüsse unterscheidet.

- Einfacher Monatsabschluss vs. Sage: Sage ist eine umfassende Unternehmensmanagement-Suite, während Easy Month End eine spezialisiertere Lösung für eine wichtige Buchhaltungsfunktion bietet.

- Easy Month End vs Zoho Books: Zoho Books ist eine All-in-One-Buchhaltungssoftware, Easy Month End hingegen ist ein speziell für den Monatsabschluss entwickeltes Tool.

- Einfacher Monatsabschluss vs. Welle: Wave bietet kostenlose Buchhaltungsdienstleistungen für kleine Unternehmen an, während Easy Month End eine fortschrittlichere Lösung für die Monatsabschlussverwaltung bietet.

- Einfacher Monatsabschluss vs. Quicken: Quicken ist ein Tool für die private Finanzplanung, daher ist Easy Month End die bessere Wahl für Unternehmen, die einen Monatsabschluss durchführen müssen.

- Einfacher Monatsabschluss vs. Hubdoc: Hubdoc automatisiert die Dokumentenerfassung, Easy Month End hingegen ist für die Verwaltung des gesamten Monatsabschluss-Workflows und der Teamaufgaben konzipiert.

- Einfacher Monatsabschluss vs. Ausgaben: Expensify ist eine Spesenmanagement-Software und hat eine andere Funktion als Easy Month End, dessen Hauptaugenmerk auf dem Finanzabschluss liegt.

- Einfacher Monatsabschluss vs. QuickBooks: QuickBooks ist eine umfassende Buchhaltungslösung, während Easy Month End ein spezifischeres Tool für die Durchführung des Monatsabschlusses selbst ist.

- Einfacher Monatsabschluss vs. automatische Eingabe: AutoEntry ist ein Datenerfassungstool, Easy Month End hingegen ist eine komplette Plattform für das Aufgaben- und Workflow-Management beim Monatsabschluss.

- Einfacher Monatsabschluss vs. FreshBooks: FreshBooks richtet sich an Freiberufler und kleine Unternehmen, während Easy Month End eine spezielle Lösung für den Monatsabschluss bietet.

- Einfacher Monatsabschluss vs. NetSuite: NetSuite ist ein vollwertiges ERP-System mit einem breiteren Funktionsumfang als Easy Month End, das sich speziell auf den Finanzabschluss konzentriert.

Mehr zu AutoEntry

- Automatischer Einstieg vs. PuzzleDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- AutoEntry vs DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- AutoEntry vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- AutoEntry vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Automatischer Monatsabschluss vs. Einfaches MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- AutoEntry vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- AutoEntry vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- AutoEntry vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- AutoEntry vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- AutoEntry vs. QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- AutoEntry vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- AutoEntry vs ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- AutoEntry vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- AutoEntry vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- AutoEntry vs NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Does AutoEntry help with personal budgeting?

NEIN, using AutoEntry mainly focuses on business expense automation, not personal budgeting or personal finance software for individuals to track spending or personal financial data.

Is Easy Month End a comprehensive cloud accounting for businesses?

Easy Month End is a tool that streamlines the closing process but isn’t a full accounting system. It complements existing software, rather than offering comprehensive cloud accounting for businesses.

Can these tools help with financial planning for investment?

Neither Easy Month End nor AutoEntry directly offers features for financial planning or investment management. They focus on data entry and month-end tasks for operational accounting.

Do these solutions work for e-commerce businesses?

Yes, both can be useful for e-commerce. AutoEntry helps with high volumes of transaction data, while Easy Month End aids in organizing the financial close for online sales.

How do these compare to solutions like Docyt uses AI, or Puzzle IO offers unique features?

Tools like Docyt use AI, and Puzzle IO offers unique features, often leveraging AI for broader automated bookkeeping or specific industry needs. Easy Month End and AutoEntry specialize in their respective areas: month-end close and data entry.