Haben Sie Schwierigkeiten, Ihre Finanzen zu verwalten?

Insbesondere angesichts der zunehmenden Vermischung von persönlichen und Geschäft Finanzen?

Die Wahl zwischen Anbietern wie Docyt und Quicken kann schwierig sein.

Lass uns tiefer eintauchen und die Stärken von Docyt und Quicken vergleichen, um dir zu helfen machen die beste Wahl.

Überblick

Wir haben sowohl Docyt als auch Quicken gründlich getestet.

Bewertung ihrer Funktionen, Benutzerfreundlichkeit und Gesamtleistung Buchhaltung Fähigkeiten.

Diese praktischen Erfahrungen haben uns zu diesem detaillierten Vergleich geführt, der Ihnen helfen wird, zu erkennen, welche Plattform wirklich herausragt.

Ich habe genug von manuellen Verfahren. BuchhaltungDocyt AI automatisiert die Dateneingabe und den Datenabgleich und spart den Nutzern durchschnittlich 40 Stunden.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 299 $ pro Monat.

Hauptmerkmale:

- Automatisierter Abgleich

- Optimierte Arbeitsabläufe

- Benutzerfreundliche Oberfläche

Sie möchten Ihre Finanzen selbst in die Hand nehmen? Mit Quicken haben Sie Zugriff auf Tausende von Finanzinstituten. Entdecken Sie mehr!

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet 5,59 $/Monat.

Hauptmerkmale:

- Budgetierungstools

- Rechnungsverwaltung

- Investitionsverfolgung

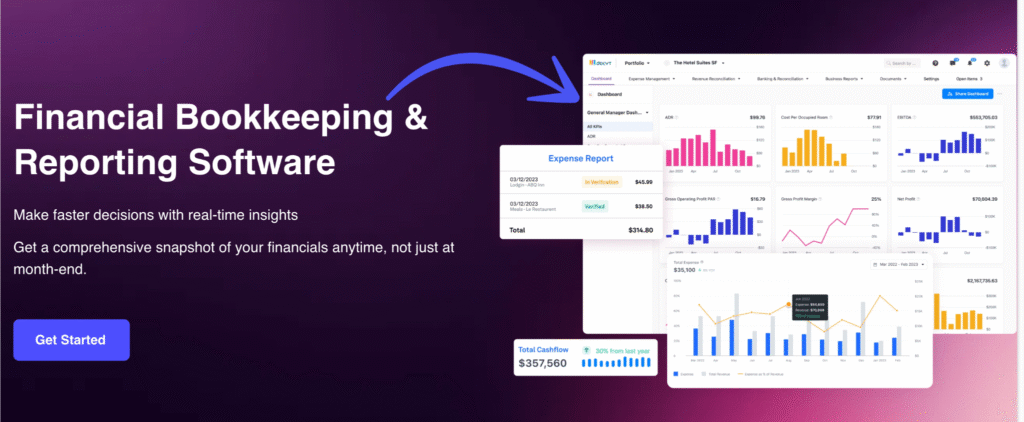

Was ist Docyt?

Was genau ist Docyt? Stellen Sie es sich als Ihren intelligenten Computer vor. Buchhaltung Assistent.

Es nutzt künstliche Intelligenz, um viele der langweiligen Aufgaben zu erledigen.

Es wurde für Unternehmen entwickelt, insbesondere für solche, die eine große Anzahl von Transaktionen nachverfolgen müssen.

Entdecken Sie auch unsere Favoriten Docyt-Alternativen…

Wichtigste Vorteile

- KI-gestützte Automatisierung: Docyt nutzt künstliche Intelligenz. Es extrahiert automatisch Daten aus Finanzdokumenten. Dies umfasst Details von über 100.000 Anbietern.

- Buchhaltung in Echtzeit: Hält Ihre Buchhaltung in Echtzeit auf dem neuesten Stand. So erhalten Sie jederzeit ein genaues Bild Ihrer finanziellen Situation.

- Dokumentenmanagement: Alle Finanzdokumente werden zentral verwaltet. Sie können diese einfach suchen und darauf zugreifen.

- Automatisierte Rechnungszahlung: Automatisiert den Rechnungszahlungsprozess. Rechnungen einfach planen und bezahlen.

- Kostenerstattung: Vereinfacht die Spesenabrechnung von Mitarbeitern. Spesenabrechnungen können schnell eingereicht und genehmigt werden.

- Nahtlose Integrationen: Lässt sich in gängige Buchhaltungssoftware integrieren. Dies umfasst QuickBooks und Xero.

- Betrugserkennung: Die KI kann dabei helfen, ungewöhnliche Transaktionen zu erkennen. Dies fügt eine zusätzliche Sicherheitsebene hinzu. SicherheitEs gibt keine spezifische Garantie für die Software, aber es werden kontinuierliche Updates bereitgestellt.

Preisgestaltung

- Auswirkungen: 299 US-Dollar pro Monat.

- Fortschrittlich: 499 US-Dollar/Monat.

- Fortschrittlich Plus: 799 US-Dollar/Monat.

- Unternehmen: 999 US-Dollar/Monat.

Vorteile

Nachteile

Was ist Quicken?

Sie haben also schon von Quicken gehört, richtig?

Quicken gibt es schon seit Ewigkeiten und es hilft Menschen bei der Verwaltung ihrer Finanzen. Im Gegensatz zu Docyt ist es besonders gut im Bereich der privaten Finanzen.

Viele Menschen nutzen es, um sich einen umfassenden Überblick über ihre finanzielle Situation zu verschaffen – alles an einem Ort.

Entdecken Sie auch unsere Favoriten Quicken-Alternativen…

Wichtigste Vorteile

Quicken ist ein leistungsstarkes Werkzeug, um Ihre Finanzen in Ordnung zu bringen.

Sie verfügen über mehr als 40 Jahre Erfahrung und sind ein absolutes Bestsellerprodukt.

Ihre verschiedenen Tarife ermöglichen die Anbindung an über 14.500 Finanzinstitute.

Sie erhalten außerdem eine 30-Tage-Geld-zurück-Garantie, um es risikofrei auszuprobieren.

- Verbindet sich mit Tausenden von Banken und Kreditkarten.

- Erstellt detaillierte Budgets.

- Erfasst Investitionen und Nettovermögen.

- Bietet Instrumente zur Ruhestandsplanung.

Preisgestaltung

- Quicken Simplifi: 2,99 $/Monat.

Vorteile

Nachteile

Funktionsvergleich

Let’s dive deeper into the core functionalities.

Dieser Abschnitt vergleicht, wie Docyt und Quicken mit wichtigen Vorgängen umgehen. Buchhaltung Prozesse und Finanzvorgänge, um Ihnen dabei zu helfen, eine Plattform zu finden, die Ihren spezifischen Bedürfnissen entspricht.

1. KI-gestützte Buchhaltung und Automatisierung

- Docyt: DocytDie KI-gestützte Plattform von ‘s ist ein Wendepunkt für die Eliminierung manueller Prozesse Daten Eintrag. Es nutzt KI-gestützte Buchhaltung und KI. Automatisierung Software zur Bewältigung mühsamer Aufgaben und zur Automatisierung von Backoffice-Tätigkeiten, wodurch Ihr Team entlastet wird. Docyt Er lernt die Feinheiten Ihres Geschäfts kennen.

- Beschleunigen: Beschleunigen ist ein benutzerfreundliches Tool. Es hilft bei der Automatisierung. Buchhaltung Aufgaben werden durch das Herunterladen von Transaktionen von Bankkonten erledigt. Allerdings ist das Verfahren stärker auf menschliche Eingaben angewiesen und weist Mängel auf. Docyt‘s tiefgreifende, geschäftsorientierte KI-gestützte Buchhaltungsprozesse.

2. Finanzberichterstattung in Echtzeit

- Docyt: Docyt Es bietet Finanzberichte in Echtzeit und sofortige Transparenz der Finanzlage. Der Fokus liegt auf der Bereitstellung von Echtzeit-Einblicken in wichtige Leistungsindikatoren. Dies ist unerlässlich für strategische Entscheidungen und die kontinuierliche Finanzkontrolle.

- Beschleunigen: Beschleunigen bietet Echtzeitberichte über Ihren Cashflow und Ihre Ausgaben, was hervorragend für Software zur persönlichen Finanzplanung geeignet ist. Berichterstattung ist weniger auf komplexe Geschäftsanalysen zugeschnitten, im Gegensatz Docyt‘s Spezialwerkzeuge.

3. Mehrere Unternehmen und Konsolidierung

- DocytDocyt eignet sich hervorragend für die mühelose Verwaltung mehrerer Unternehmen und Standorte. Es erstellt konsolidierte Übersichtsberichte mit aggregierten Daten oder individuellen Finanzberichten. So behalten Sie die Finanzen Ihres gesamten Portfolios stets im Blick.

- Beschleunigen: Der Beschleunigen Die Business-Version kann zwar mehrere Unternehmen mithilfe von Tags verfolgen, bietet aber keine umfassenden, automatisierten Funktionen für einen konsolidierten Übersichtsbericht. Ihr Fokus liegt eher auf der Verwaltung einzelner Konten in einer einzigen Datei.

4. Erfassung von Ausgaben und Belegen

- DocytDie Plattform übernimmt das Spesenmanagement durch automatisierte Belegerfassung. Dieses System reduziert Fehler in der Umsatzbuchhaltung und ist der Schlüssel zur Automatisierung von Backoffice-Prozessen, was die Arbeit von Buchhaltern erheblich erleichtert.

- Beschleunigen: Beschleunigen bietet zwar eine Belegerfassungsfunktion, diese ist jedoch weniger integriert und automatisiert als DocytEs bietet eine zuverlässige Rechnungsverfolgung und Ausgabenkategorisierung, vor allem für Software zur persönlichen Finanzplanung.

5. Rechnungszahlung und Cashflow

- Docyt: DocytDie integrierte Funktion zur Rechnungszahlung ist Teil der automatisierten Buchhaltungsprozesse. Sie verwaltet Zahlungen, reduziert den Zeitaufwand für diese zeitaufwändigen Aufgaben und bietet Ihnen eine bessere Transparenz Ihres Cashflows.

- Beschleunigen: Beschleunigen Es bietet leistungsstarke Funktionen zur Rechnungszahlung und -verfolgung. Sie erhalten einen umfassenden Überblick über Ihre Finanzen und können Ihren Cashflow besser planen, indem Sie anstehende Zahlungen von Ihren Bankkonten verwalten.

6. Investitionsverfolgung

- Docyt: Docyt Es ist für die Buchhaltung und die Automatisierung von Buchhaltungsprozessen konzipiert. Es ist nicht für die Verwaltung von Anlagekonten oder die umfassende private Finanzplanung geeignet. Seine Stärke liegt in der Verwaltung von Geschäftsstandorten.

- Beschleunigen: Beschleunigen ist ein führender Anbieter im Bereich der Nachverfolgung von Anlagekonten. Beschleunigen Premierminister und Beschleunigen Die Deluxe-Versionen bieten umfangreiche Tools für die Portfolioüberwachung und die Ruhestandsplanung, was ein Kernmerkmal von Beschleunigen brand.

7. Abteilungsrechnungswesen

- Docyt: Docyt Unterstützt die detaillierte Abteilungsrechnung. Dies hilft Ihnen, wichtige Leistungsindikatoren und die Rentabilität in verschiedenen Bereichen Ihres Unternehmens zu verfolgen und bietet Managern Echtzeit-Einblicke.

- Beschleunigen: BeschleunigenDie Funktionen sind allgemeiner gehalten und konzentrieren sich auf die persönlichen Einnahmen und Ausgaben von Unternehmen. Es ist nicht für die komplexen Anforderungen der mehrstufigen Abteilungsbuchhaltung größerer Unternehmen ausgelegt.

8. Bankabstimmung

- Docyt: DocytDas System umfasst einen automatisierten Bank- und Umsatzabgleich. Dies beschleunigt die Buchhaltungsprozesse erheblich und gewährleistet eine ständige Finanzkontrolle durch das schnelle Erkennen von Unstimmigkeiten.

- Beschleunigen: Beschleunigen bietet leistungsstarke Tools für den Bankabgleich. Es synchronisiert Bankkonten zuverlässig, um Ihnen beim Abgleich Ihrer Aufzeichnungen zu helfen – eine Funktion, die Beschleunigen Diese Software wird seit Jahrzehnten angeboten.

9. Technologie und Sicherheit

- Docyt: DocytDie KI-gestützte Plattform nutzt modernste KI für Sicherheit und Automatisierung. Es handelt sich um eine Cloud-basierte Anwendung, die speziell für moderne Buchhaltungsteams entwickelt wurde.

- Beschleunigen: Der Beschleunigen Die Software hat eine lange Geschichte und bietet Optionen sowohl für Desktop-Computer (Windows als auch für andere Betriebssysteme). mac) und mobile App-Funktionalität. Es gewährleistet hohe Sicherheitsstandards zum Schutz Ihrer Finanzdaten.

Worauf Sie bei der Auswahl von Buchhaltungssoftware achten sollten?

- HauptmerkmaleBesitzt es genau die Schlüsselfunktionen, die Sie für Ihre Unternehmensfinanzen benötigen?

- ZielgruppeIst es für Privatpersonen (Quicken Home) oder für Wirtschaftsprüfungsgesellschaften konzipiert?

- KI-AutomatisierungWie gut automatisiert es Aufgaben und bewältigt zeitaufwändige Aufgaben wie die Rechnungsverwaltung?

- Mehrere EntitätenKann es Konten verfolgen und zusammenführen, wenn Sie Mietobjekte oder mehrere Unternehmen besitzen?

- BenutzeroberflächeIst die Benutzeroberfläche für Ihr Team (durchschnittlicher Benutzer) intuitiv?

- AbonnementkostenSind die wiederkehrenden Kosten den Nutzen wert, den man erhält, insbesondere mit Blick auf die Zukunft?

- Berichtswesen: Stellt die Software von Anfang an grundlegende Salden- und Verkaufsberichte bereit?

- KI-BuchhalterIst darin ein KI-gestützter Buchhalter enthalten, der den Monatsabschluss beschleunigt und den Monatsabschluss vollständig durchführt?

- IntegrationenFunktioniert es gut mit QuickBooks Online und anderen Alternativen?

- UnterstützungGibt es guten Support, falls Probleme auftreten?

Endgültiges Urteil

Nach genauer Prüfung hängt unsere Wahl von Ihrem Ziel ab.

Für anspruchsvolle Funktionen und Automatisierung im Bereich der Geschäftsbuchhaltung ist Docyt die beste Wahl.

Es bietet umfassende Cloud-Buchhaltung und reduziert den manuellen Aufwand.

Wir nutzen Tests und verifizierte Nutzerbewertungen, um Ihnen authentische Softwarevergleiche zu bieten.

Zum Beispiel, ob QuickBooks ein weit verbreitetes Tool ist oder im Vergleich zu anderen Tools.

Für private Zwecke oder einen kleinen Nebenverdienst ist Quicken besser geeignet.

Es ist preiswert und ideal für die Budgetplanung. Was brauchen Sie also am meisten?

Mehr von Docyt

Bei der Suche nach der richtigen Buchhaltungssoftware ist es hilfreich, die verschiedenen Plattformen miteinander zu vergleichen.

Hier folgt ein kurzer Vergleich von Docyt mit vielen seiner Alternativen.

- Docyt vs Puzzle IO: Während beide bei Finanzangelegenheiten helfen, konzentriert sich Docyt auf KI-gestützte Buchhaltung für Unternehmen, während Puzzle IO die Rechnungsstellung und Spesenabrechnung für Freiberufler vereinfacht.

- Docyt vs. Dext: Docyt bietet eine komplette KI-gestützte Buchhaltungsplattform an, während Dext sich auf die automatisierte Datenerfassung aus Dokumenten spezialisiert hat.

- Docyt vs. Xero: Docyt ist für seine umfassende KI-Automatisierung bekannt. Xero bietet ein umfassendes und benutzerfreundliches Buchhaltungssystem für allgemeine Geschäftsanforderungen.

- Docyt gegen Synder: Docyt ist ein KI-gestütztes Buchhaltungstool zur Automatisierung von Backoffice-Prozessen. Synder konzentriert sich auf die Synchronisierung von E-Commerce-Verkaufsdaten mit Ihrer Buchhaltungssoftware.

- Docyt vs. Easy Monatsende: Docyt ist eine umfassende KI-gestützte Buchhaltungslösung. Easy Month End ist ein Spezialtool, das speziell für die Optimierung und Vereinfachung des Monatsabschlusses entwickelt wurde.

- Docyt vs RefreshMe: Docyt ist ein Buchhaltungsprogramm für Unternehmen, während RefreshMe eine App für persönliche Finanzen und Budgetplanung ist.

- Docyt vs Sage: Docyt verfolgt einen modernen, KI-gestützten Ansatz. Sage ist ein traditionsreiches Unternehmen, das eine breite Palette an klassischen und cloudbasierten Buchhaltungslösungen anbietet.

- Docyt vs Zoho Books: Docyt konzentriert sich auf KI-gestützte Buchhaltungsautomatisierung. Zoho Books ist eine Komplettlösung, die einen umfassenden Funktionsumfang zu einem wettbewerbsfähigen Preis bietet.

- Docyt vs Wave: Docyt bietet leistungsstarke KI-Automatisierung für wachsende Unternehmen. Wave ist eine kostenlose Buchhaltungsplattform, die sich besonders für Freiberufler und Kleinstunternehmen eignet.

- Docyt vs Quicken: Docyt ist für die betriebliche Buchhaltung konzipiert. Quicken ist in erster Linie ein Tool für die private Finanzverwaltung und Budgetplanung.

- Docyt vs Hubdoc: Docyt ist ein komplettes KI-gestütztes Buchhaltungssystem. Hubdoc ist ein Datenerfassungstool, das Finanzdokumente automatisch sammelt und verarbeitet.

- Docyt vs Expensify: Docyt übernimmt alle Buchhaltungsaufgaben. Expensify ist spezialisiert auf die Verwaltung und das Reporting von Mitarbeiterausgaben.

- Docyt vs QuickBooks: Docyt ist eine KI-Automatisierungsplattform, die QuickBooks erweitert. QuickBooks ist eine umfassende Buchhaltungssoftware für Unternehmen jeder Größe.

- Docyt vs AutoEntry: Docyt ist eine KI-gestützte Buchhaltungslösung mit umfassendem Service. AutoEntry konzentriert sich speziell auf die Extraktion und Automatisierung von Dokumentendaten.

- Docyt vs FreshBooks: Docyt nutzt fortschrittliche KI zur Automatisierung. FreshBooks ist eine benutzerfreundliche Lösung, die aufgrund ihrer Funktionen zur Rechnungsstellung und Zeiterfassung bei Freiberuflern beliebt ist.

- Docyt vs. NetSuite: Docyt ist ein Tool zur Automatisierung der Buchhaltung. NetSuite ist ein umfassendes Enterprise-Resource-Planning-System (ERP) für große Unternehmen.

Mehr von Quicken

- Quicken vs PuzzleDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- Quicken vs. DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- Quicken vs. XeroDas ist online beliebt. Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Quicken vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Quicken vs. Easy MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- Quicken vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- Quicken vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- Quicken vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Quicken vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- Quicken vs. HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- Quicken vs ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- Quicken vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- Quicken vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- Quicken vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- Quicken vs. NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Ist Quicken für kleine Unternehmen geeignet?

Quicken, insbesondere die Version Home & Business, kann für sehr viele Anwendungen genutzt werden. kleine Unternehmen oder Freiberufler. Für komplexere Geschäftsvorgänge ist jedoch in der Regel eine spezielle Buchhaltungssoftware besser geeignet.

Worin besteht der Hauptunterschied zwischen Docyt und Quicken?

Docyt konzentriert sich auf KI-gestützte Buchhaltungsautomatisierung für Unternehmen und übernimmt Aufgaben wie die Transaktionskategorisierung. Quicken ist primär für die private Finanzverwaltung gedacht, einschließlich Budgetierung und Investitionsverfolgung.

Lässt sich Docyt mit anderer Buchhaltungssoftware integrieren?

Ja, Docyt lässt sich in viele bestehende Buchhaltungssysteme integrieren. Dadurch können Arbeitsabläufe optimiert werden, selbst wenn Sie Software wie QuickBooks oder andere gängige Plattformen verwenden.

Ist Docyt mit NetSuite vergleichbar?

NetSuite NetSuite ist ein umfassendes Cloud-ERP-System, das deutlich umfangreicher ist als Docyt. Während Docyt auf die Automatisierung der Buchhaltung spezialisiert ist, bietet NetSuite ein umfassendes Cloud-ERP-System, das viele Geschäftsfunktionen jenseits der Buchhaltung abdeckt.

Wie funktioniert die KI von Docyt?

Die KI von Docyt lernt Ihr Unternehmen während der Nutzung kennen. Sie automatisiert die Datenextraktion aus Dokumenten und kategorisiert Transaktionen, wodurch der manuelle Aufwand reduziert und die Genauigkeit im Laufe der Zeit verbessert wird.