Haben Sie es satt, endlose Belege und Tabellenkalkulationen zu durchforsten?

Möchten Sie Ihre Buchhaltung Prozess und wertvolle Zeit sparen?

Besonders Buchhaltung Unternehmen, die ihren Arbeitsablauf optimieren möchten.

Dieser Leitfaden hilft Ihnen, die wichtigsten Funktionen von Docyt und Expensify zu verstehen, damit Sie machen eine fundierte Entscheidung für Ihr Unternehmen.

Überblick

Wir haben sowohl Docyt als auch Expensify auf Herz und Nieren geprüft und ihre Kernfunktionen sowie ihre Alltagstauglichkeit getestet. Buchhaltung applications.

Dieser direkte Vergleich zeigt Ihnen, wie die einzelnen Plattformen im Vergleich abschneiden und hilft Ihnen bei der Entscheidung, welche besser zu Ihrem Unternehmen passt.

Ich habe genug von manuellen Verfahren. BuchhaltungDocyt AI automatisiert die Dateneingabe und den Datenabgleich und spart den Nutzern durchschnittlich 40 Stunden.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 299 $ pro Monat.

Hauptmerkmale:

- Automatisierter Abgleich

- Optimierte Arbeitsabläufe

- Benutzerfreundliche Oberfläche

Schließen Sie sich über 15 Millionen Nutzern an, die Expensify vertrauen, um ihre Finanzen zu vereinfachen. Sparen Sie bis zu 83 % Zeit bei der Erstellung von Spesenabrechnungen.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 5 $ pro Monat.

Hauptmerkmale:

- SmartScan-Belegerfassung

- Firmenkartenabstimmung

- Erweiterte Genehmigungsworkflows.

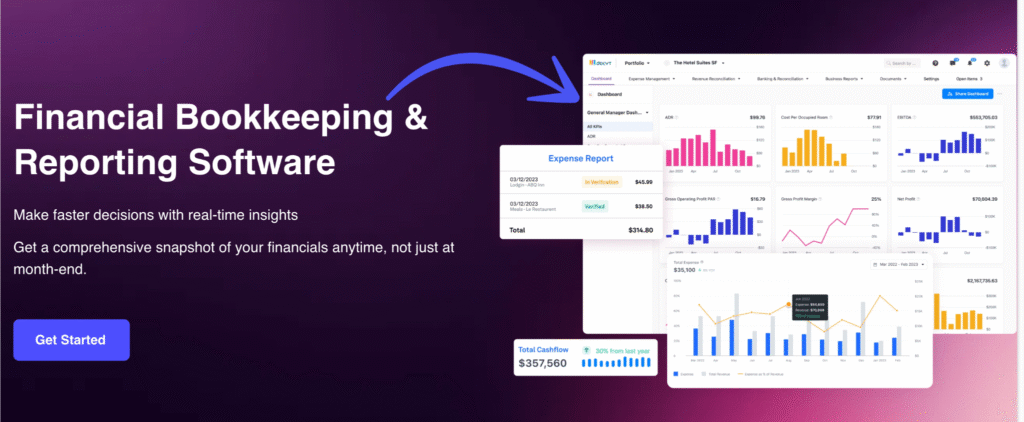

Was ist Docyt?

Docyt ist wie ein superintelligenter Assistent für Ihr Leben Buchhaltung.

Es nutzt spezielle KI, um einen Großteil der komplexen Aufgaben zu übernehmen.

Betrachten Sie es als ein Tool, das sich mit Ihrem Bankkonto und Ihren Kreditkarten verbindet und Ihre Transaktionen automatisch sortiert.

Entdecken Sie auch unsere Favoriten Docyt-Alternativen…

Wichtigste Vorteile

- KI-gestützte Automatisierung: Docyt nutzt künstliche Intelligenz. Es extrahiert automatisch Daten aus Finanzdokumenten. Dies umfasst Details von über 100.000 Anbietern.

- Buchhaltung in Echtzeit: Hält Ihre Buchhaltung in Echtzeit auf dem neuesten Stand. So erhalten Sie jederzeit ein genaues Bild Ihrer finanziellen Situation.

- Dokumentenmanagement: Alle Finanzdokumente werden zentral verwaltet. Sie können diese einfach suchen und darauf zugreifen.

- Automatisierte Rechnungszahlung: Automatisiert den Rechnungszahlungsprozess. Rechnungen einfach planen und bezahlen.

- Kostenerstattung: Vereinfacht die Spesenabrechnung von Mitarbeitern. Spesenabrechnungen können schnell eingereicht und genehmigt werden.

- Nahtlose Integrationen: Lässt sich in gängige Buchhaltungssoftware integrieren. Dies umfasst QuickBooks und Xero.

- Betrugserkennung: Die KI kann dabei helfen, ungewöhnliche Transaktionen zu erkennen. Dies fügt eine zusätzliche Sicherheitsebene hinzu. SicherheitEs gibt keine spezifische Garantie für die Software, aber es werden kontinuierliche Updates bereitgestellt.

Preisgestaltung

- Auswirkungen: 299 US-Dollar pro Monat.

- Fortschrittlich: 499 US-Dollar/Monat.

- Fortschrittlich Plus: 799 US-Dollar/Monat.

- Unternehmen: 999 US-Dollar/Monat.

Vorteile

Nachteile

Was ist Expensify?

Expensify ist dafür bekannt, Spesenabrechnungen kinderleicht zu erstellen.

Das ist wie Magie für Ihre Kassenbons! Sie machen einfach ein Foto von Ihrem Kassenbon mit Ihrem Handy.

Anschließend liest Expensify die Informationen und füllt Ihren Spesenbericht für Sie aus.

Entdecken Sie auch unsere Favoriten Alternativen verteuern…

Wichtigste Vorteile

- Die SmartScan-Technologie scannt Belegdetails und extrahiert sie mit einer Genauigkeit von über 95%.

- Die Mitarbeiter erhalten ihre Erstattungen schnell, oft schon innerhalb eines Werktages per ACH-Überweisung.

- Mit der Expensify Card und ihrem Cashback-Programm können Sie bis zu 50 % bei Ihrem Abonnement sparen.

- Es wird keine Garantie übernommen; in den Allgemeinen Geschäftsbedingungen ist die Haftung beschränkt.

Preisgestaltung

- Sammeln: 5 US-Dollar pro Monat.

- Kontrolle: Individuelle Preisgestaltung.

Vorteile

Nachteile

Funktionsvergleich

Sowohl Docyt als auch Expensify haben sich zum Ziel gesetzt, Ihr Finanzleben zu vereinfachen.

Sie konzentrieren sich jedoch auf unterschiedliche Aspekte der Finanzgeschäfte.

Dieser Vergleich wird Ihnen helfen zu erkennen, welche Buchhaltung Automatisierung Dieses Tool ist der entscheidende Faktor für Ihre spezifischen Bedürfnisse.

1. Kernphilosophie der Automatisierung

- DocytDocyt AI ist eine umfassende KI-Automatisierungssoftware. Sie automatisiert nahezu alle Buchhaltungsprozesse, einschließlich Backoffice- und Buchhaltungsaufgaben. Docyt lernt Ihre Arbeitsabläufe kennen. Geschäft Komplexität und zeitaufwändige Bearbeitung von Aufgaben im gesamten Finanzbuch, nicht nur bei den Ausgaben.

- Kosten erhöhenExpensify vereinfacht die Spesenabrechnung enorm. Die Automatisierung konzentriert sich auf die Bearbeitung von Belegfotos, beispielsweise die sofortige Verarbeitung. Expensify ist spezialisiert auf die schnelle Abwicklung der Spesenabrechnung für Mitarbeiter.

2. Finanzielle Transparenz und Berichterstattung

- DocytSie erhalten sofortigen Einblick in Ihre finanzielle Lage durch Echtzeitberichte. Die KI-gestützte Plattform von Docyt bietet Ihnen Echtzeit-Einblicke in Ihre wichtigsten Leistungsindikatoren und Ihren Cashflow und gewährleistet so eine kontinuierliche Finanzkontrolle für strategische Entscheidungen.

- Kosten erhöhenExpensify bietet Echtzeit-Einblicke in die Mitarbeiterausgaben und unterstützt so Manager bei der Spesenabrechnung. Berichterstattung Erfasst in erster Linie Kategorien, Projekte und Schlagwörter, um Arbeitgebern zu helfen, zu erkennen, wohin Zahlungen fließen.

3. Multi-Entity- und Skalierbarkeit

- DocytDie KI-gestützte Plattform von Docyt kann mühelos konsolidierte Rollup-Berichte für alle Ihre Geschäftsstandorte erstellen. Es liefert sowohl konsolidierte Rollup-Berichte als auch individuelle Finanzberichte für eine detailliertere Abteilungsrechnungslegung und ist daher ideal für kleine Unternehmen mit großen Wachstumsplänen.

- Kosten erhöhenExpensify ist skalierbar und eignet sich sowohl für wenige Nutzer als auch für große Unternehmen. Obwohl es mehrere Projekte und Kategorien unterstützt, liegt der Fokus auf individuellen Spesenabrechnungen und nicht auf komplexen, unternehmensübergreifenden Buchhaltungsprozessen.

4. Abstimmung und Genauigkeit

- DocytDiese KI-Automatisierungssoftware eignet sich hervorragend für die Umsatzabstimmung und den automatisierten Bankabgleich. Sie überprüft kontinuierlich Ihre Bankkonten und andere Konten. Daten Quellen, wodurch Fehler in der Umsatzbuchhaltung reduziert und die manuelle Dateneingabe für diese mühsamen Aufgaben überflüssig wird.

- Kosten erhöhenDie Automatisierung von Expensify reduziert den manuellen Dateneingabeaufwand für Belege drastisch. Die automatisierten Erstattungs- und Firmenkartenfunktionen vereinfachen den Bankabstimmungsprozess, jedoch deckt Expensify keine vollständige Umsatzabstimmung ab.

5. Ausgabenverfolgung und -erfassung

- DocytMitarbeiter reichen Belege mithilfe der Fotofunktion der mobilen App ein. Die KI-Plattform von docyt übernimmt anschließend zeitaufwändige Aufgaben, indem sie den Beleg automatisch der entsprechenden Transaktion und den gespeicherten Daten zuordnet.

- Kosten erhöhenExpensify vereinfacht das Erfassen von Belegen und die Kilometererfassung. Ein Foto genügt, und die Daten werden in Sekundenschnelle verarbeitet. Sie können Ausgaben erfassen und sie direkt von Ihrem Smartphone oder Webbrowser aus bestimmten Kategorien und Tags zuordnen.

6. Buchhaltungsabläufe und Monatsabschluss

- DocytDocyt AI bietet vollständige KI-gestützte Buchhaltung und automatisiert Buchhaltungs- und Arbeitsabläufe. Es unterstützt Sie dabei. Buchhalter den Monatsabschlussprozess drastisch beschleunigen und Echtzeit-Einblicke liefern, wodurch die durchschnittlich lange Wartezeit auf die endgültigen Zahlen entfällt.

- Kosten erhöhenExpensify optimiert den Spesenabrechnungsprozess innerhalb der umfassenderen Buchhaltungsprozesse. Es unterstützt Arbeitgeber bei der Genehmigung und Überprüfung von Spesenabrechnungen vor Monatsende und ermöglicht so eine schnellere Spesenabwicklung.

7. Integrationen und Datenfluss

- DocytDocyt AI lässt sich nahtlos in Buchhaltungsplattformen wie QuickBooks Online integrieren und ermöglicht so eine kontinuierliche Datensynchronisierung in Echtzeit. Dies ist von entscheidender Bedeutung, um eine ständige Finanzkontrolle zu gewährleisten und Ihre Buchhaltungsprozesse auf dem neuesten Stand zu halten.

- Kosten erhöhenExpensify bietet eine einfache Verbindung für den Export von Spesenabrechnungen in QuickBooks Online und andere Plattformen. Dadurch wird sichergestellt, dass Zahlungen und Spesenabrechnungen umgehend zur Erstattung und Nachverfolgung übertragen werden.

8. Benutzererfahrung und Support

- DocytDie umfassenden und detaillierten Testberichte von Expensify zeigen, dass Docyt exzellenten Support bietet. Docyt AI ist als vollwertiger KI-Buchhalter konzipiert, der Ihnen das Leben erleichtert, indem er diese lästigen Aufgaben wie ein Mensch erledigt.

- Kosten erhöhenExpensify wird in Rezensionen durchweg für seine Benutzerfreundlichkeit gelobt. Es ist ein flexibles Tool für Mitarbeiter. Bei Problemen kann die Plattform Ihre Anfrage per Web oder Desktop beantworten und das Problem lösen – ganz im Sinne der erwarteten Servicequalität.

9. Technische Sicherheit und Befehle

- DocytDie Plattform nutzt einen robusten Sicherheitsdienst, um alle Finanzinformationen zu schützen und sicherzustellen, dass die Daten nicht durch bösartige SQL-Befehlseinschleusung oder andere Bedrohungen kompromittiert werden.

- Kosten erhöhenBei einem Serverproblem wird möglicherweise die Cloudflare Ray ID in einer Fehlermeldung angezeigt. Hierbei handelt es sich um eine technische Kennung, die dem Unternehmen und dem Website-Betreiber hilft, Zugriffsprobleme zu lösen und bestätigt, dass eine ausgefeilte Sicherheitslösung vorhanden ist, wenn eine Anfrage blockiert wird.

Worauf Sie bei der Auswahl von Buchhaltungssoftware achten sollten?

- Integration with existing tools: Lässt es sich mit Ihrem aktuellen Kassensystem verbinden? CRModer ERP-Systeme?

- Skalierbarkeit für Wachstum: Kann es mit zunehmender Anzahl von Nutzern oder Geschäftsstandorten mitwachsen?

- Automatisierungsgrad: Wie viel manuelle Dateneingabe wird dadurch tatsächlich eingespart?

- Berichtsfunktionen: Bietet es die spezifischen Einblicke und Finanzberichte, die Sie benötigen?

- Benutzerfreundlichkeit: Ist die Benutzeroberfläche für Ihr Team intuitiv und reduziert sie so die Schulungszeit?

- Kundendienst: Welche Hilfe steht Ihnen zur Verfügung, wenn Sie Probleme haben?

- Security features: Wie schützt es Ihre sensiblen Finanzdaten?

- Cost vs. Value: Bietet die Buchhaltungslösung angesichts ihrer Funktionen und der potenziellen Zeitersparnis ein gutes Preis-Leistungs-Verhältnis?

- Mobile access: Können Sie Ihre Finanzen auch unterwegs verwalten?

Endgültiges Urteil

Nach genauer Betrachtung von Docyt und Expensify.

Wir halten Expensify für die insgesamt bessere Wahl für die meisten Unternehmen.

Und hier ist der Grund: Es ist unglaublich einfach zu bedienen, insbesondere für die Verwaltung von täglichen Ausgaben und Belegen.

Die SmartScan-Funktion ist eine echte Zeitersparnis und vereinfacht eine Aufgabe, die vielen Menschen unangenehm ist.

Docyt bietet zwar eine leistungsstarke KI für tiefergehende Analysen, Buchhaltung.

Wir sind überzeugt, dass das benutzerfreundliche Design und der starke Fokus auf schnelle Kostenerstattungen es zu einem Gewinner für die Optimierung Ihrer Finanzprozesse machen.

Mehr von Docyt

Bei der Suche nach der richtigen Buchhaltungssoftware ist es hilfreich, die verschiedenen Plattformen miteinander zu vergleichen.

Hier folgt ein kurzer Vergleich von Docyt mit vielen seiner Alternativen.

- Docyt vs Puzzle IO: Während beide bei Finanzangelegenheiten helfen, konzentriert sich Docyt auf KI-gestützte Buchhaltung für Unternehmen, während Puzzle IO die Rechnungsstellung und Spesenabrechnung für Freiberufler vereinfacht.

- Docyt vs. Dext: Docyt bietet eine komplette KI-gestützte Buchhaltungsplattform an, während Dext sich auf die automatisierte Datenerfassung aus Dokumenten spezialisiert hat.

- Docyt vs. Xero: Docyt ist für seine umfassende KI-Automatisierung bekannt. Xero bietet ein umfassendes und benutzerfreundliches Buchhaltungssystem für allgemeine Geschäftsanforderungen.

- Docyt gegen Synder: Docyt ist ein KI-gestütztes Buchhaltungstool zur Automatisierung von Backoffice-Prozessen. Synder konzentriert sich auf die Synchronisierung von E-Commerce-Verkaufsdaten mit Ihrer Buchhaltungssoftware.

- Docyt vs. Easy Monatsende: Docyt ist eine umfassende KI-gestützte Buchhaltungslösung. Easy Month End ist ein Spezialtool, das speziell für die Optimierung und Vereinfachung des Monatsabschlusses entwickelt wurde.

- Docyt vs RefreshMe: Docyt ist ein Buchhaltungsprogramm für Unternehmen, während RefreshMe eine App für persönliche Finanzen und Budgetplanung ist.

- Docyt vs Sage: Docyt verfolgt einen modernen, KI-gestützten Ansatz. Sage ist ein traditionsreiches Unternehmen, das eine breite Palette an klassischen und cloudbasierten Buchhaltungslösungen anbietet.

- Docyt vs Zoho Books: Docyt konzentriert sich auf KI-gestützte Buchhaltungsautomatisierung. Zoho Books ist eine Komplettlösung, die einen umfassenden Funktionsumfang zu einem wettbewerbsfähigen Preis bietet.

- Docyt vs Wave: Docyt bietet leistungsstarke KI-Automatisierung für wachsende Unternehmen. Wave ist eine kostenlose Buchhaltungsplattform, die sich besonders für Freiberufler und Kleinstunternehmen eignet.

- Docyt vs Quicken: Docyt ist für die betriebliche Buchhaltung konzipiert. Quicken ist in erster Linie ein Tool für die private Finanzverwaltung und Budgetplanung.

- Docyt vs Hubdoc: Docyt ist ein komplettes KI-gestütztes Buchhaltungssystem. Hubdoc ist ein Datenerfassungstool, das Finanzdokumente automatisch sammelt und verarbeitet.

- Docyt vs Expensify: Docyt übernimmt alle Buchhaltungsaufgaben. Expensify ist spezialisiert auf die Verwaltung und das Reporting von Mitarbeiterausgaben.

- Docyt vs QuickBooks: Docyt ist eine KI-Automatisierungsplattform, die QuickBooks erweitert. QuickBooks ist eine umfassende Buchhaltungssoftware für Unternehmen jeder Größe.

- Docyt vs AutoEntry: Docyt ist eine KI-gestützte Buchhaltungslösung mit umfassendem Service. AutoEntry konzentriert sich speziell auf die Extraktion und Automatisierung von Dokumentendaten.

- Docyt vs FreshBooks: Docyt nutzt fortschrittliche KI zur Automatisierung. FreshBooks ist eine benutzerfreundliche Lösung, die aufgrund ihrer Funktionen zur Rechnungsstellung und Zeiterfassung bei Freiberuflern beliebt ist.

- Docyt vs. NetSuite: Docyt ist ein Tool zur Automatisierung der Buchhaltung. NetSuite ist ein umfassendes Enterprise-Resource-Planning-System (ERP) für große Unternehmen.

Mehr Ausgaben

- Kosten vs. RätselDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- Expensify vs DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- Expensify vs XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- Expensify vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Ausgaben vs. Einfaches MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- Expensify vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- Expensify vs SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- Expensify vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Kostensteigerung vs. WelleDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- Expensify vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- Expensify vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- Expensify vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- Expensify vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- Expensify vs NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Ist Docyt besser für große Wirtschaftsprüfungsgesellschaften geeignet?

Docyt bietet leistungsstarke KI-Automatisierung für umfassende Buchhaltungsprozesse und eignet sich daher ideal für Unternehmen mit mehreren Standorten und komplexen Finanzdaten. Die Fähigkeit, aggregierte Finanzberichte zu erstellen und detaillierte Finanzanalysen in Echtzeit bereitzustellen, kann für größere Unternehmen, die ihre Backoffice- und Buchhaltungsprozesse optimieren möchten, ein entscheidender Vorteil sein.

Kann Expensify die Rechnungsstellung und Zahlungsabwicklung übernehmen?

Ja, Expensify bietet Buchhaltungsfunktionen zum Erstellen und Versenden von Rechnungen. Es ermöglicht außerdem die Verwaltung von Rechnungszahlungen und trägt so zur Optimierung Ihrer Kreditoren- und Debitorenbuchhaltung bei. Obwohl es hauptsächlich für Spesenabrechnungen bekannt ist, deckt sein Funktionsumfang auch diese grundlegenden Bedürfnisse des Finanzmanagements ab.

Welche Software ist für neue Benutzer leichter zu erlernen?

Expensify zeichnet sich im Allgemeinen durch eine geringere Einarbeitungszeit aus, da es sich auf die Spesenabrechnung konzentriert und eine intuitive mobile App bietet. Docyt hingegen, mit seiner umfassenderen KI-Automatisierung für komplette Buchhaltungsprozesse sowie Backoffice- und Finanzbuchhaltungsaufgaben, erfordert möglicherweise etwas mehr Aufwand bei der Einrichtung und Einarbeitung.

Sind Docyt und Expensify beide mit QuickBooks kompatibel?

Ja, sowohl Docyt als auch Expensify bieten umfassende Integrationen mit gängigen Buchhaltungsprogrammen wie QuickBooks. Dadurch wird ein reibungsloser Datenaustausch zwischen Ihrer Ausgabenmanagement-Plattform und Ihrem primären Buchhaltungssystem gewährleistet, was die manuelle Dateneingabe reduziert und die Abstimmung verbessert.

Wie verbessern diese Instrumente die finanzielle Transparenz?

Beide Tools verbessern die Transparenz Ihrer finanziellen Situation deutlich. Docyt liefert Echtzeit-Einblicke in Rentabilität und Geschäftsentwicklung, während Expensify übersichtliche Berichte zu Ihren Ausgabengewohnheiten erstellt. Sie helfen Ihnen, sofort zu verstehen, wofür Sie Ihr Geld ausgeben, und unterstützen Sie so bei besseren Entscheidungen.