Sind Sie es leid, sich endlose Anleitungen durchzulesen? Daten Eintragung und unübersichtliche Finanzunterlagen?

Viele Buchhaltung Fachleute sind täglich mit der Bearbeitung von Belegen und Rechnungen konfrontiert.

Was wäre, wenn es einen besseren Weg gäbe?

Hier kommt die moderne KI-gestützte Buchhaltung Lösungen wie Docyt und AutoEntry kommen zum Einsatz.

Lasst uns Docyt und AutoEntry vergleichen und sehen, welches Tool am besten für intelligentere und schnellere Eingaben geeignet ist. Buchhaltung.

Überblick

Wir haben sowohl Docyt als auch AutoEntry auf Herz und Nieren geprüft und ihre Funktionen getestet.

Diese praktischen Erfahrungen haben uns wertvolle Einblicke in ihre Stärken und Schwächen gegeben und uns zu diesem detaillierten Vergleich geführt.

Ich habe genug von manuellen Verfahren. BuchhaltungDocyt AI automatisiert die Dateneingabe und den Datenabgleich und spart den Nutzern durchschnittlich 40 Stunden.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 299 $ pro Monat.

Hauptmerkmale:

- Automatisierter Abgleich

- Optimierte Arbeitsabläufe

- Benutzerfreundliche Oberfläche

Verschwenden Sie nicht länger als 10 Stunden pro Woche mit manueller Dateneingabe. Erfahren Sie, wie Autoentry die Rechnungsbearbeitungszeit um 40 % reduziert hat. Salbei Nutzer.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das kostenpflichtige Abonnement beginnt bei 12 $ pro Monat.

Hauptmerkmale:

- Datenextraktion

- Belegscannen

- Lieferantenautomatisierung

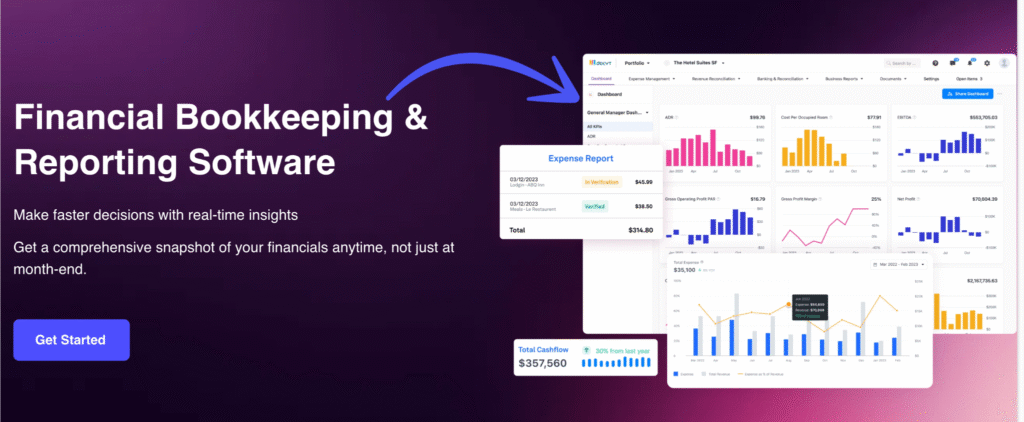

Was ist Docyt?

Was genau ist Docyt? Stellen Sie es sich als Ihre All-in-One-KI-Plattform vor für Buchhaltung.

Es wurde entwickelt, um viele der mühsamen Aufgaben zu automatisieren in Buchhaltung.

Es hilft Unternehmen und Buchhaltungsfirmen dabei, ihre Bücher korrekt und aktuell zu halten.

Entdecken Sie auch unsere Favoriten Docyt-Alternativen…

Wichtigste Vorteile

- KI-gestützte Automatisierung: Docyt nutzt künstliche Intelligenz. Es extrahiert automatisch Daten aus Finanzdokumenten. Dies umfasst Details von über 100.000 Anbietern.

- Buchhaltung in Echtzeit: Hält Ihre Buchhaltung in Echtzeit auf dem neuesten Stand. So erhalten Sie jederzeit ein genaues Bild Ihrer finanziellen Situation.

- Dokumentenmanagement: Alle Finanzdokumente werden zentral verwaltet. Sie können diese einfach suchen und darauf zugreifen.

- Automatisierte Rechnungszahlung: Automatisiert den Rechnungszahlungsprozess. Rechnungen einfach planen und bezahlen.

- Kostenerstattung: Vereinfacht die Spesenabrechnung von Mitarbeitern. Spesenabrechnungen können schnell eingereicht und genehmigt werden.

- Nahtlose Integrationen: Lässt sich in gängige Buchhaltungssoftware integrieren. Dies umfasst QuickBooks und Xero.

- Betrugserkennung: Die KI kann dabei helfen, ungewöhnliche Transaktionen zu erkennen. Dies fügt eine zusätzliche Sicherheitsebene hinzu. SicherheitEs gibt keine spezifische Garantie für die Software, aber es werden kontinuierliche Updates bereitgestellt.

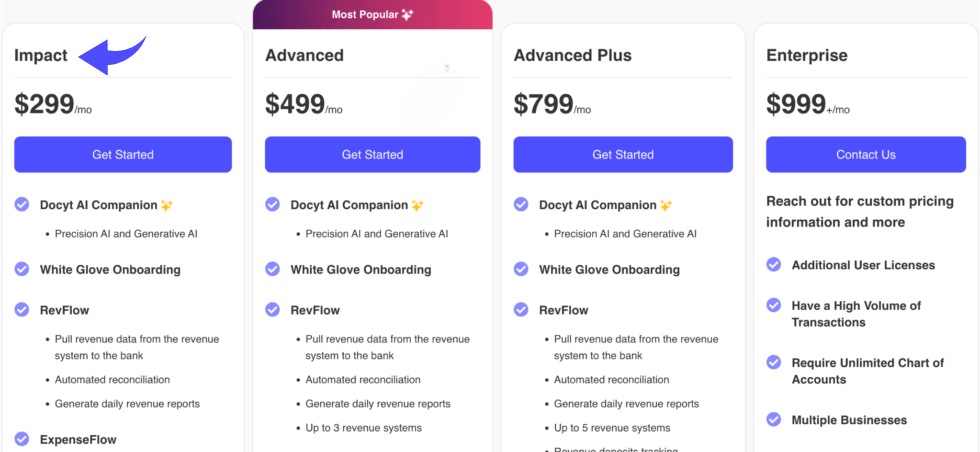

Preisgestaltung

- Auswirkungen: 299 US-Dollar pro Monat.

- Fortschrittlich: 499 US-Dollar/Monat.

- Fortschrittlich Plus: 799 US-Dollar/Monat.

- Unternehmen: 999 US-Dollar/Monat.

Vorteile

Nachteile

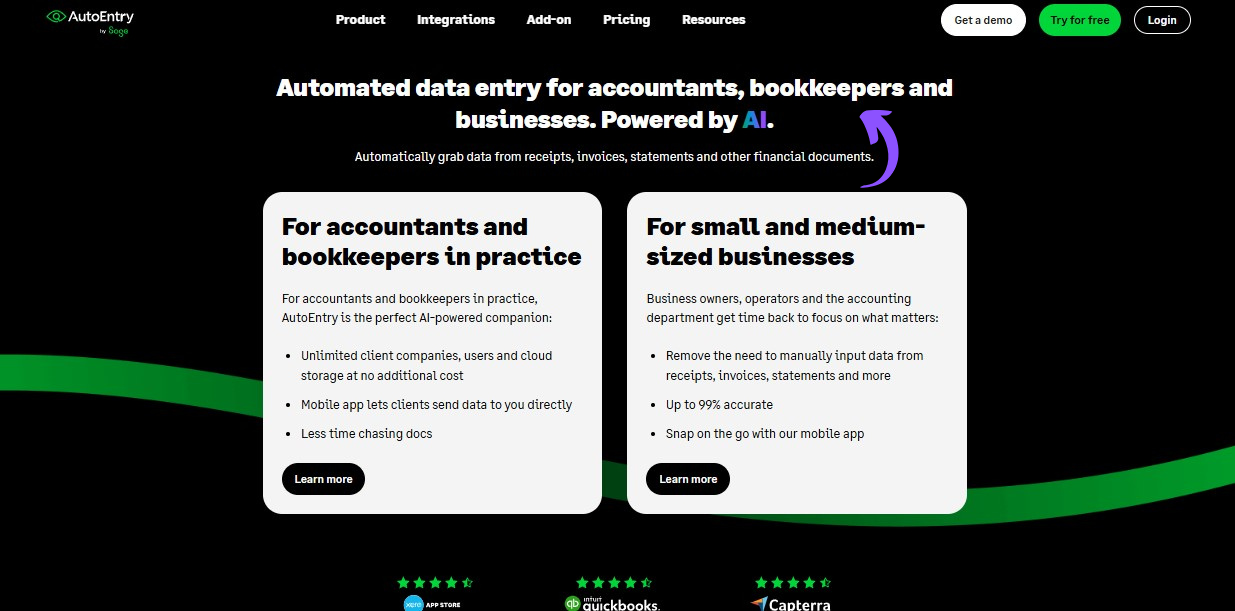

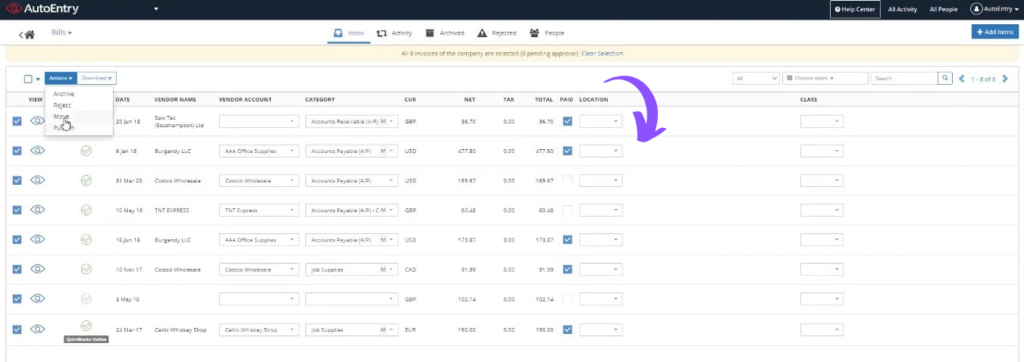

Was ist AutoEntry?

Worum geht es bei AutoEntry? Es ist ein Tool, das die Dateneingabe automatisieren soll.

Es erfasst Daten von Quittungen, Rechnungen und Kontoauszügen.

Anschließend veröffentlicht es sie direkt auf Ihrem Buchhaltungssoftware.

Entdecken Sie auch unsere Favoriten Alternativen zu AutoEntry…

Unsere Einschätzung

Möchten Sie Ihren Buchhaltungsaufwand reduzieren? AutoEntry verarbeitet jährlich über 28 Millionen Dokumente und bietet eine Genauigkeit von bis zu 99 %. Starten Sie noch heute und gehören Sie zu den über 210.000 Unternehmen weltweit, die ihren Dateneingabeaufwand um bis zu 80 % reduziert haben!

Wichtigste Vorteile

Der größte Vorteil von AutoEntry besteht darin, dass man sich stundenlange, langweilige Arbeit spart.

Die Anwender berichten häufig von einer bis zu 80%igen Zeitersparnis beim manuellen Dateneingabevorgang.

Es verspricht eine Genauigkeit von bis zu 99 % bei der Datenextraktion.

AutoEntry bietet keine spezielle Geld-zurück-Garantie, aber die monatlichen Abonnements ermöglichen eine jederzeitige Kündigung.

- Bis zu 99% Genauigkeit der Daten.

- Unbegrenzte Nutzeranzahl bei allen kostenpflichtigen Tarifen.

- Ruft vollständige Positionen aus Rechnungen ab.

- Einfache mobile App zum Fotografieren von Kassenbons.

- Nicht genutzte Guthaben verfallen nach einer Frist von 90 Tagen.

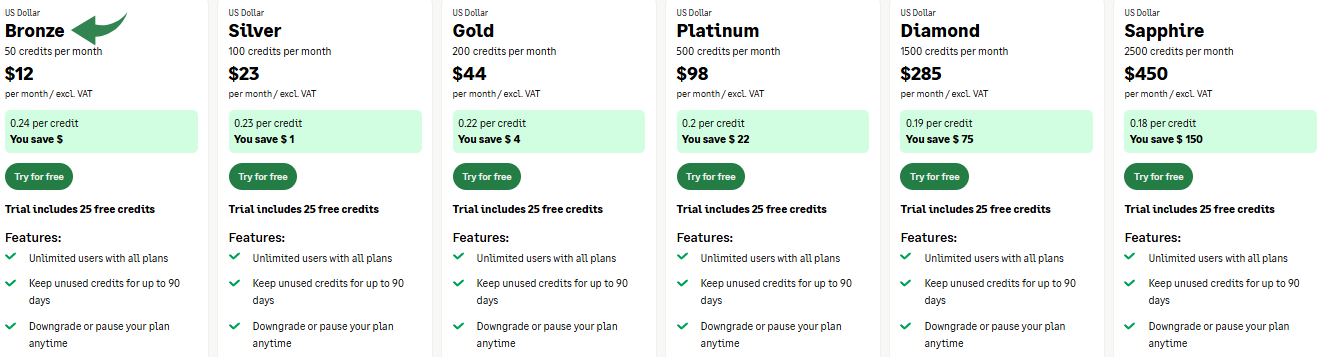

Preisgestaltung

- Bronze12 US-Dollar pro Monat.

- Silber23 US-Dollar pro Monat.

- Gold44 US-Dollar pro Monat.

- Platin: 98 $/Monat.

- Diamant285 US-Dollar pro Monat.

- Saphir: 450 $/Monat.

Vorteile

Nachteile

Funktionsvergleich

Es ist an der Zeit, die Werkzeuge einmal genauer miteinander zu vergleichen.

Beide versprechen machen Sie erleichtern Ihnen das Leben, aber sie gehen Ihre Finanzgeschäfte auf ganz unterschiedliche Weise an.

Mal sehen, wie sich ihre Kernfunktionen im Vergleich schlagen.

1. Vollständige Buchhaltungs-KI

- DocytHier zeigt Docyt AI seine Stärken. Es fungiert als KI-Buchhalter und übernimmt den gesamten Buchhaltungszyklus. Buchhaltung Aufgaben. Es wurde entwickelt, um alles abzudecken, von der Ausgabenverwaltung bis zum Jahresabschluss, und automatisiert Backoffice-Aufgaben.

- Automatischer EinstiegAutoEntry ist ein Spezialtool. Es konzentriert sich auf den ersten Schritt: die Eliminierung der manuellen Dateneingabe aus Dokumenten. Anschließend überträgt es diese Daten an Ihr bestehendes Buchhaltungssystem, beispielsweise QuickBooks Online, für die weiteren Buchhaltungsprozesse.

2. Finanzkontrolle in Echtzeit

- DocytDie Plattform bietet sofortige Transparenz über Ihre Finanzlage und Echtzeit-Einblicke. Dies ist entscheidend für strategische Entscheidungen. Sie behalten die volle Kontrolle über Ihre Finanzen, da Ihre Buchhaltung kontinuierlich aktualisiert wird.

- Automatischer EinstiegAutoEntry zielt auf Geschwindigkeit und Genauigkeit bei der Dateneingabe ab. Es hilft, indem es die manuelle Dateneingabe eliminiert und so die Datenqualität verbessert. Die letztendliche, konstante Finanzkontrolle und Berichterstattung Verlassen Sie sich auf Ihre angeschlossene Buchhaltungssoftware.

3. Führung mehrerer Unternehmen

- DocytFür Unternehmen mit mehreren Geschäftsbereichen oder Standorten ist dies ein echter Wendepunkt. Docyt kann konsolidierte Übersichtsberichte für Ihre Einheiten erstellen und wichtige Leistungsindikatoren mühelos über alle Standorte hinweg verfolgen.

- Automatischer EinstiegAutoEntry ermöglicht die Nutzung einer unbegrenzten Anzahl von Benutzern und Kundenunternehmen. Es unterstützt die Dokumentenerfassung für mehrere Unternehmen, erstellt jedoch keine konsolidierten Übersichtsberichte oder komplexe Berichte für mehrere Unternehmen.

4. Kosten- und Umsatzabstimmung

- DocytDocyt bietet automatisierte Bankabstimmung und spezialisierte Umsatzabstimmung. Der Fokus liegt auf der Erkennung von Fehlern in der Umsatzbuchhaltung und der Minimierung von Diskrepanzen zwischen Ihren Bankkonten und Ihrem Hauptbuch.

- Automatischer EinstiegDer Hauptvorteil von AutoEntry liegt hier in der Bereitstellung sauberer Daten für Ihren Bankabgleich. Es extrahiert Daten aus Kontoauszügen und Eingangsrechnungen, der eigentliche automatisierte Bankabgleich erfolgt jedoch durch Ihr Hauptbuchhaltungssystem.

5. Datenlernen & Personalisierung

- DocytDocyt lernt Ihre spezifischen Bedürfnisse und die Feinheiten Ihres Unternehmens kennen. Seine KI Automatisierung Die Software passt sich Ihren Kategorisierungsgewohnheiten an. Dadurch wird Ihr gesamtes Finanzmanagement im Laufe der Zeit deutlich intelligenter.

- Automatischer EinstiegAutoEntry lernt außerdem durch benutzerdefinierte Regeln für Kategorisierung und Lieferantennamen. Sobald eine Regel festgelegt ist, kann sie Aufgaben wie die automatische Veröffentlichung automatisieren und Ihnen so die Arbeit erleichtern und Zeit für wiederkehrende Schritte sparen.

6. Berichterstattung und Analyse

- DocytDocyt bietet Echtzeitberichte und Dashboards, die Einblicke in den Cashflow und die Abteilungsbuchhaltung in Echtzeit ermöglichen. Sie können einzelne Finanzberichte einsehen oder die konsolidierten Daten betrachten.

- Automatischer EinstiegAutoEntry bietet keine dedizierte Berichtsfunktion. Es stellt sicher, dass Sie in QuickBooks Online oder Ihrem anderen Buchhaltungssystem über genaue und aktuelle Daten verfügen. Anschließend verwenden Sie diese Software, um Ihre Echtzeitberichte zu erstellen.

7. Fokus auf den Buchhaltungsprozess

- DocytDie KI-gestützte Plattform von Docyt konzentriert sich auf die Optimierung des gesamten Buchhaltungsprozesses. Sie übernimmt zeitaufwändige Aufgaben, die über die reine Datenerfassung hinausgehen, wie beispielsweise Monatsabschlüsse und die Rechnungszahlung.

- Automatischer EinstiegAutoEntry konzentriert sich auf die Dateneingabe im Rahmen von Buchhaltungsprozessen. Es zeichnet sich durch die schnelle und präzise Automatisierung der Erfassung von Finanzdokumenten und anderen Unterlagen aus.

8. Backoffice-Management

- DocytEs wurde für die Automatisierung von Backoffice-Funktionen entwickelt. Dies umfasst das gesamte Spektrum des Finanzmanagements und der Abteilungsbuchhaltung und bietet Ihnen eine leistungsstarke, integrierte Suite.

- Automatischer EinstiegAutoEntry ist eine großartige Unterstützung für den Backoffice-Bereich. Es übernimmt eine wichtige, zeitaufwändige Aufgabe, die Dateneingabe, und gibt Ihrem Team so die Möglichkeit, sich auf andere Buchhaltungsaufgaben zu konzentrieren.

9. Benutzeroberfläche und Benutzererfahrung

- DocytDocyt ist für seine vergleichsweise benutzerfreundliche Oberfläche bekannt, insbesondere angesichts seines großen Funktionsumfangs. Es bewältigt die Komplexität des fortschrittlichen KI-gestützten Finanzmanagements.

- Automatischer EinstiegAutoEntry ist unkompliziert und einfach zu bedienen, insbesondere die mobile App zum Hochladen von Dokumenten. Der klare Fokus auf die Datenerfassung macht die Benutzeroberfläche intuitiv und benutzerfreundlich.

Worauf Sie bei der Auswahl von Buchhaltungssoftware achten sollten?

- Sicherheit und SchutzSchützt die Sicherheitslösung vor Online-Angriffen? Prüfen Sie, ob die Plattform einen Sicherheitsdienst zum Schutz Ihrer Daten nutzt und ob sie Möglichkeiten zur Behebung von Problemen bietet, wie z. B. einer Sperrung aufgrund von Aktionen, die diese Sperrung auslösen könnten (z. B. das Absenden eines SQL-Befehls oder fehlerhafter Daten).

- Genauigkeit der DatenerfassungAchten Sie auf die Qualität der optischen Zeichenerkennung. Werden Positionen aus anderen Finanzdokumenten präzise und mühelos extrahiert? Lesen Sie Erfahrungsberichte zu Autoentry-Systemen, um die Leistung im praktischen Einsatz einzuschätzen.

- IntegrationGewährleisten Sie eine nahtlose Integration mit Ihrem aktuellen System. BuchhaltungssoftwareKann man das Hochladen einfach mit einem Mobiltelefon durchführen?

- Pricing StrukturBasieren die Preise für die automatische Anmeldung auf einer monatlichen Gebühr oder auf einem flexiblen Preismodell mit Guthaben? Prüfen Sie, ob eine unbegrenzte Nutzerzahl angeboten wird.

- FehlerbehebungWie geht die Plattform mit unerwarteten Fehlern um? Was sollten Sie tun, wenn eine Ihrer Aktionen vom Sicherheitsdienst als fehlerhaft markiert wird und Sie nicht mehr auf eine Seite zugreifen können? Sie sollten den Website-Betreiber per E-Mail kontaktieren können, um die Sperre aufzuheben, insbesondere wenn die Meldung „Cloudflare Ray ID gefunden“ erscheint.

- Erweiterte FunktionenKann es mit besonderen Situationen umgehen, wie z. B. mit einem bestimmten Wort oder einer bestimmten Phrase, die eine Sperrung auslösen könnte? Gibt es klare Anweisungen, wenn das System eine Sicherheitswarnung ausgelöst hat?

Endgültiges Urteil

Für die vollständige Automatisierung des Rechnungswesens und die Gewährleistung einer ständigen Finanzkontrolle ist Docyt unsere Wahl.

Es geht über die einfache Datenerfassung hinaus und bietet mühelos Finanzberichte in Echtzeit für alle Ihre Geschäftsstandorte.

Wir haben uns für Docyt entschieden, weil es die Komplexität der Finanzen Ihres Unternehmens bewältigt und die Rentabilität in Echtzeit verfolgt.

Wir haben diese Tools in verschiedenen Branchen getestet, um Ihnen eine genaue durchschnittliche Leistungsbewertung zu liefern.

Wenn das System eine Aktion blockieren würde, z. B. wenn es ausgeführt würde, würde die Sicherheitslösung ausgelöst, nachdem ein Benutzer versucht hat, einen SQL-Befehl zu formulieren oder ein bestimmtes Wort einzugeben.

Der umfassendere Funktionsumfang von Docyt ist darauf ausgelegt, alle Ihre Transaktionen sicher und zuverlässig abzuwickeln.

Dieser ganzheitliche Ansatz macht es zur überlegenen Wahl für das gesamte Finanzmanagement.

Mehr von Docyt

Bei der Suche nach der richtigen Buchhaltungssoftware ist es hilfreich, die verschiedenen Plattformen miteinander zu vergleichen.

Hier folgt ein kurzer Vergleich von Docyt mit vielen seiner Alternativen.

- Docyt vs Puzzle IO: Während beide bei Finanzangelegenheiten helfen, konzentriert sich Docyt auf KI-gestützte Buchhaltung für Unternehmen, während Puzzle IO die Rechnungsstellung und Spesenabrechnung für Freiberufler vereinfacht.

- Docyt vs. Dext: Docyt bietet eine komplette KI-gestützte Buchhaltungsplattform an, während Dext sich auf die automatisierte Datenerfassung aus Dokumenten spezialisiert hat.

- Docyt vs. Xero: Docyt ist für seine umfassende KI-Automatisierung bekannt. Xero bietet ein umfassendes und benutzerfreundliches Buchhaltungssystem für allgemeine Geschäftsanforderungen.

- Docyt gegen Synder: Docyt ist ein KI-gestütztes Buchhaltungstool zur Automatisierung von Backoffice-Prozessen. Synder konzentriert sich auf die Synchronisierung von E-Commerce-Verkaufsdaten mit Ihrer Buchhaltungssoftware.

- Docyt vs. Easy Monatsende: Docyt ist eine umfassende KI-gestützte Buchhaltungslösung. Easy Month End ist ein Spezialtool, das speziell für die Optimierung und Vereinfachung des Monatsabschlusses entwickelt wurde.

- Docyt vs RefreshMe: Docyt ist ein Buchhaltungsprogramm für Unternehmen, während RefreshMe eine App für persönliche Finanzen und Budgetplanung ist.

- Docyt vs Sage: Docyt verfolgt einen modernen, KI-gestützten Ansatz. Sage ist ein traditionsreiches Unternehmen, das eine breite Palette an klassischen und cloudbasierten Buchhaltungslösungen anbietet.

- Docyt vs Zoho Books: Docyt konzentriert sich auf KI-gestützte Buchhaltungsautomatisierung. Zoho Books ist eine Komplettlösung, die einen umfassenden Funktionsumfang zu einem wettbewerbsfähigen Preis bietet.

- Docyt vs Wave: Docyt bietet leistungsstarke KI-Automatisierung für wachsende Unternehmen. Wave ist eine kostenlose Buchhaltungsplattform, die sich besonders für Freiberufler und Kleinstunternehmen eignet.

- Docyt vs Quicken: Docyt ist für die betriebliche Buchhaltung konzipiert. Quicken ist in erster Linie ein Tool für die private Finanzverwaltung und Budgetplanung.

- Docyt vs Hubdoc: Docyt ist ein komplettes KI-gestütztes Buchhaltungssystem. Hubdoc ist ein Datenerfassungstool, das Finanzdokumente automatisch sammelt und verarbeitet.

- Docyt vs Expensify: Docyt übernimmt alle Buchhaltungsaufgaben. Expensify ist spezialisiert auf die Verwaltung und das Reporting von Mitarbeiterausgaben.

- Docyt vs QuickBooks: Docyt ist eine KI-Automatisierungsplattform, die QuickBooks erweitert. QuickBooks ist eine umfassende Buchhaltungssoftware für Unternehmen jeder Größe.

- Docyt vs AutoEntry: Docyt ist eine KI-gestützte Buchhaltungslösung mit umfassendem Service. AutoEntry konzentriert sich speziell auf die Extraktion und Automatisierung von Dokumentendaten.

- Docyt vs FreshBooks: Docyt nutzt fortschrittliche KI zur Automatisierung. FreshBooks ist eine benutzerfreundliche Lösung, die aufgrund ihrer Funktionen zur Rechnungsstellung und Zeiterfassung bei Freiberuflern beliebt ist.

- Docyt vs. NetSuite: Docyt ist ein Tool zur Automatisierung der Buchhaltung. NetSuite ist ein umfassendes Enterprise-Resource-Planning-System (ERP) für große Unternehmen.

Mehr zu AutoEntry

- Automatischer Einstieg vs. PuzzleDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- AutoEntry vs DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- AutoEntry vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- AutoEntry vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Automatischer Monatsabschluss vs. Einfaches MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- AutoEntry vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- AutoEntry vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- AutoEntry vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- AutoEntry vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- AutoEntry vs. QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- AutoEntry vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- AutoEntry vs ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- AutoEntry vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- AutoEntry vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- AutoEntry vs NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Ist Docyt für die vollständige Buchhaltung besser als AutoEntry?

Docyt ist für die durchgängige KI-gestützte Buchhaltung konzipiert und kann mehr Aufgaben bewältigen. AutoEntry konzentriert sich hauptsächlich auf die Dateneingabe. Daher ist Docyt für die vollständige Buchhaltung besser geeignet.

Kann AutoEntry alle meine Buchhaltungsanforderungen erfüllen?

Nein, AutoEntry zeichnet sich durch seine Fähigkeit aus, Daten aus Dokumenten zu extrahieren. Es lässt sich in Buchhaltungssoftware wie QuickBooks integrieren. Xero um Ihre Buchhaltungsbedürfnisse zu erfüllen.

Ist die KI-Automatisierung für meine Finanzdaten zuverlässig?

Ja, die KI-Automatisierung in Docyt und AutoEntry ist äußerst zuverlässig. Sie reduziert menschliche Fehler und beschleunigt die Verarbeitung, was zu genaueren Finanzdaten führt.

Welches Tool eignet sich besser für kleine Unternehmen?

Beide Lösungen können kleinen Unternehmen helfen. AutoEntry eignet sich hervorragend für die Dateneingabe, Docyt hingegen bietet eine umfassendere Lösung zur Automatisierung der Buchhaltung und ist somit ideal für breitere Anforderungen.

Benötige ich mit diesen Tools überhaupt noch einen Buchhalter?

Diese Tools automatisieren zwar viele Aufgaben, doch das Fachwissen eines Buchhalters bleibt wertvoll. Er kann komplexe Daten interpretieren, strategische Beratung bieten und die Einhaltung gesetzlicher Bestimmungen sicherstellen.