Ertrinken Sie in Papierkram und sind Sie es leid, stundenlang damit zu verbringen? Buchhaltung?

Du bist nicht allein.

Dort Buchhaltung Automatisierungstools kommen ins Spiel.

Dext und Docyt sind zwei beliebte Optionen, die versprechen, die Art und Weise, wie Sie Ihre Finanzen verwalten, zu revolutionieren.

Aber welches ist das? am besten für Du?

Lasst uns tiefer eintauchen und ihre Funktionen erkunden, um euch zu helfen machen Eine Entscheidung!

Überblick

Wir haben uns sowohl Dext als auch Docyt genauer angesehen.

Wir haben ihre Funktionen ausprobiert.

Dies half uns zu sehen, wie sie bei verschiedenen Aufgaben funktionieren.

Nun können wir sie vergleichen und Ihnen unsere Ergebnisse mitteilen.

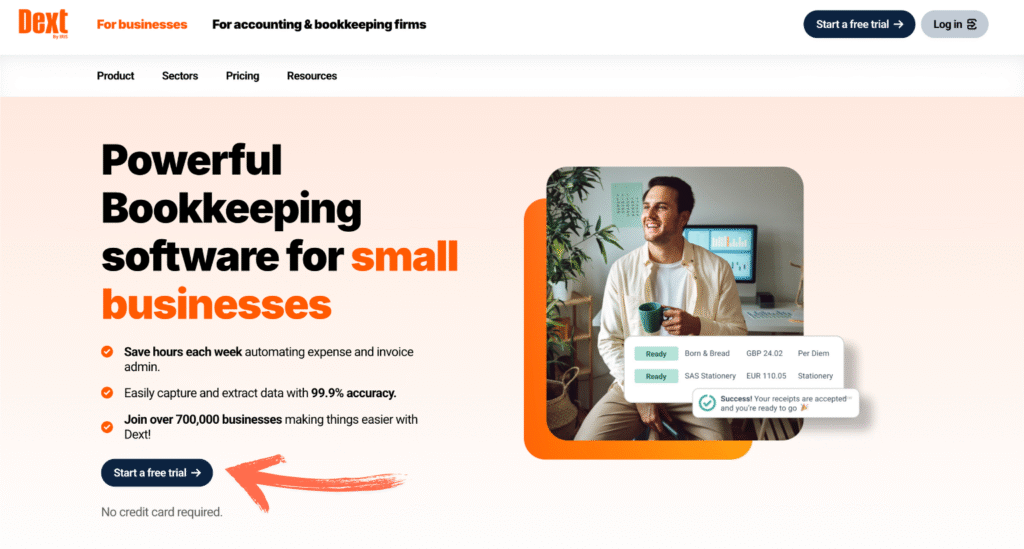

Sind Sie bereit, monatlich mehr als 10 Stunden einzusparen? Erfahren Sie, wie Dext die Dateneingabe automatisiert, Ausgaben verfolgt und Ihre Finanzen optimiert.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 24 $ pro Monat.

Hauptmerkmale:

- Belegscannen

- Spesenabrechnungen

- Bankabstimmung

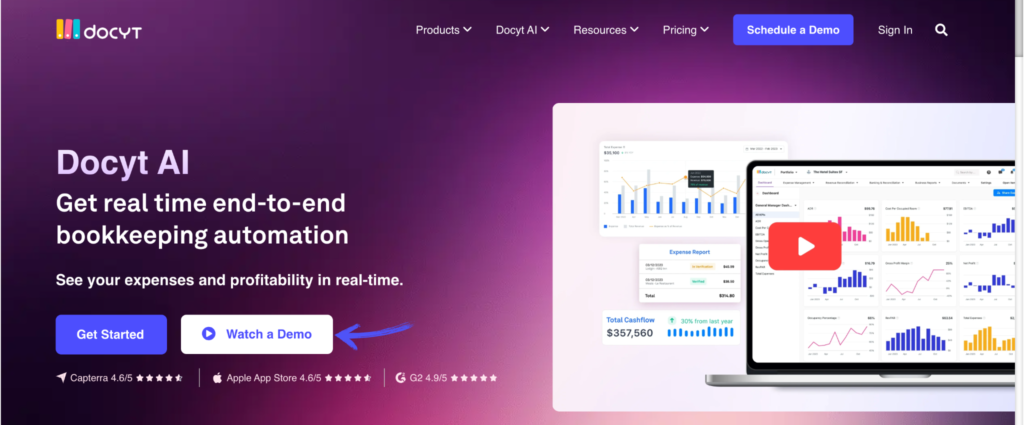

Ich habe genug von manuellen Verfahren. BuchhaltungDocyt AI automatisiert die Dateneingabe und den Datenabgleich und spart den Nutzern durchschnittlich 40 Stunden.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet ab 299 $ pro Monat.

Hauptmerkmale:

- Automatisierter Abgleich

- Optimierte Arbeitsabläufe

- Benutzerfreundliche Oberfläche

Was ist Dext?

Schauen wir uns Dext an. Früher hieß es Receipt Bank.

Es eignet sich hervorragend zum Organisieren von Belegen und Rechnungen.

Sie machen einfach ein Foto oder leiten eine E-Mail weiter. Dext erfasst dann die wichtigen Informationen.

Es hilft dabei, sicherzustellen, dass Ihre Daten ist bereit für Ihren Buchhalter.

Es dreht sich alles darum, Ihre Ausgabenverfolgung kinderleicht zu gestalten.

Entfesseln Sie sein Potenzial mit unserem Dext-Alternativen…

Unsere Einschätzung

Sind Sie bereit, monatlich mehr als 10 Stunden einzusparen? Erfahren Sie, wie die automatisierte Dateneingabe, Ausgabenverfolgung und Berichtsfunktion von Dext Ihre Finanzen optimieren können.

Wichtigste Vorteile

Dext glänzt besonders dann, wenn es darum geht, das Ausgabenmanagement zum Kinderspiel zu machen.

- 90 % der Nutzer berichten von einer deutlichen Verringerung des Papierchaos.

- Es zeichnet sich durch eine Genauigkeitsrate von über 98 % aus. bei der Datenextraktion aus Dokumenten.

- Das Erstellen von Spesenabrechnungen wird unglaublich schnell und einfach.

- Lässt sich reibungslos in gängige Buchhaltungsplattformen wie QuickBooks und Xero integrieren.

- Hilft dabei, den Überblick über wichtige Finanzdokumente zu behalten.

Preisgestaltung

- Jahresabonnement: $24

Vorteile

Nachteile

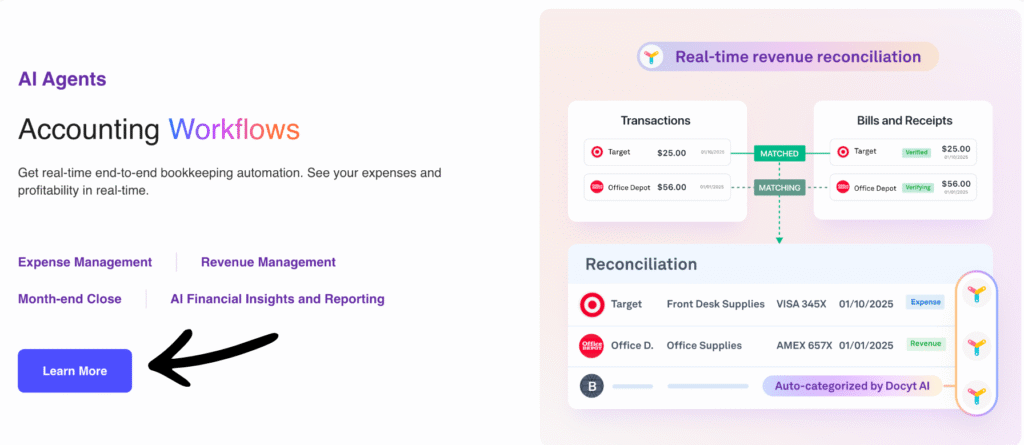

Was ist Docyt?

Docyt ist ein Tool, das Unternehmen bei ihren Finanzen unterstützt.

Es nutzt intelligente Technologie, um Rechnungen und Belege für Sie zu lesen.

Das bedeutet deutlich weniger Tipparbeit.

Es bietet Ihnen außerdem einen klaren und stets aktuellen Überblick über Ihre Geschäftsfinanzen.

Entfesseln Sie sein Potenzial mit unserem Docyt-Alternativen…

Wichtigste Vorteile

- KI-gestützte Automatisierung: Docyt nutzt künstliche Intelligenz. Es extrahiert automatisch Daten aus Finanzdokumenten. Dies umfasst Details von über 100.000 Anbietern.

- Buchhaltung in Echtzeit: Hält Ihre Buchhaltung in Echtzeit auf dem neuesten Stand. So erhalten Sie jederzeit ein genaues Bild Ihrer finanziellen Situation.

- Dokumentenmanagement: Alle Finanzdokumente werden zentral verwaltet. Sie können diese einfach suchen und darauf zugreifen.

- Automatisierte Rechnungszahlung: Automatisiert den Rechnungszahlungsprozess. Rechnungen einfach planen und bezahlen.

- Kostenerstattung: Vereinfacht die Spesenabrechnung von Mitarbeitern. Spesenabrechnungen können schnell eingereicht und genehmigt werden.

- Nahtlose Integrationen: Lässt sich in gängige Buchhaltungssoftware integrieren. Dies umfasst QuickBooks und Xero.

- Betrugserkennung: Die KI kann dabei helfen, ungewöhnliche Transaktionen zu erkennen. Dies fügt eine zusätzliche Sicherheitsebene hinzu. SicherheitEs gibt keine spezifische Garantie für die Software, aber es werden kontinuierliche Updates bereitgestellt.

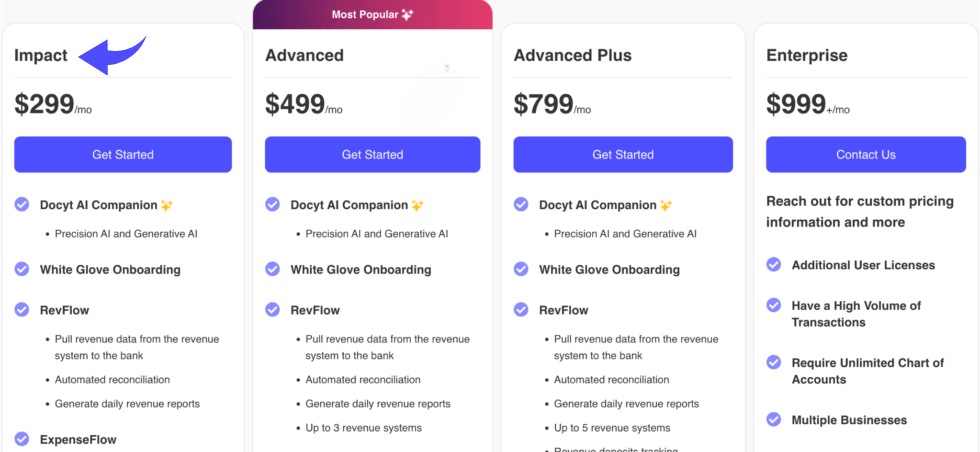

Preisgestaltung

- Auswirkungen: 299 US-Dollar pro Monat.

- Fortschrittlich: 499 US-Dollar/Monat.

- Fortschrittlich Plus: 799 US-Dollar/Monat.

- Unternehmen: 999 US-Dollar/Monat.

Vorteile

Nachteile

Funktionsvergleich

Schauen wir uns an, wie Dext und Docyt im Vergleich abschneiden.

Wir werden zehn wichtige Merkmale vergleichen, die sie bieten.

Dies wird Ihnen helfen, das für Ihre Bedürfnisse am besten geeignete Werkzeug zu finden. Buchhaltung und Buchhaltungsabläufe.

1. Datenerfassung und -extraktion

- Dext: Es nutzt OCR-Technologie (optische Zeichenerkennung), um Daten aus Belegen, Rechnungen und anderen Dokumenten zu extrahieren. Ziel von Dext Prepare ist die hochpräzise Erfassung von Belegen, wodurch die manuelle Dateneingabe für Quelldokumente entfällt.

- Docyt: Docyt's KI-gestützt Die Plattform kombiniert OCR mit fortschrittlichem maschinellem Lernen zur Datenextraktion. Sie ist darauf ausgelegt, Finanzdokumente wie ein Mensch zu lesen und zu verstehen, wodurch manuelle Eingabefehler minimiert und komplexere Datenextraktionen bewältigt werden.

2. Vollständige Workflow-Automatisierung

- Dext: Der Schwerpunkt liegt auf der Datenerfassungs- und -aufbereitungsphase. Es hilft, die ersten Schritte der Datenerfassung zu automatisieren. Buchhaltung Workflow- und Dokumentenmanagement.

- Docyt: Es ist vollständig KI Automatisierung Eine Software, die Aufgaben wie den automatisierten Bankabgleich, die Rechnungszahlung und sogar komplexe Umsatzabstimmungen automatisiert. Sie zielt darauf ab, viele mühsame Aufgaben zu übernehmen und so die manuelle Dateneingabe im gesamten Prozess zu eliminieren.

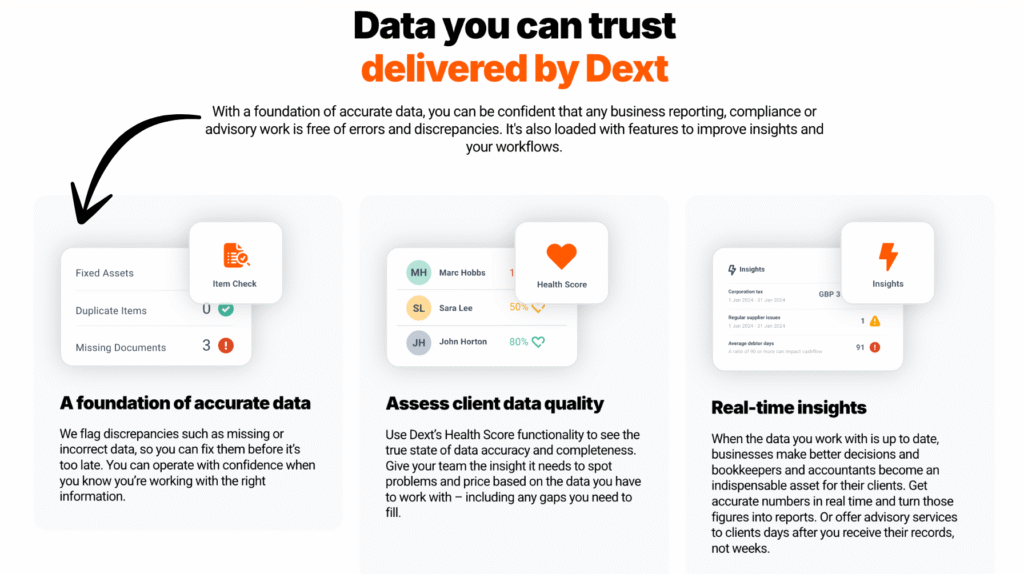

3. Finanzielle Einblicke in Echtzeit

- Dext: Bietet eine übersichtliche Historie der Ausgaben und Einkäufe und liefert Ihnen somit aktuelle Daten für eine bessere Entscheidungsfindung.

- Docyt: Bietet hervorragende Echtzeit-Einblicke und sofortige Transparenz Ihrer Finanzlage. Berichte und Dashboards visualisieren Ihren Cashflow und wichtige Leistungsindikatoren. sofort, um eine ständige finanzielle Kontrolle zu gewährleisten.

4. Unterstützung für mehrere Entitäten

- Dext: Kann mehrere Dext-Kundenkonten oder Geschäftsstandorte verwalten, was ideal ist für Buchhaltung Firmen.

- Docyt: Speziell für Unternehmen mit mehreren Standorten entwickelt. Es kann problemlos konsolidierte Rollup-Berichte erstellen und individuelle Finanzberichte für verschiedene Standorte mühelos verwalten.

5. Funktionen der mobilen App

- Dext: Die Dext-Mobil-App ist für ihre benutzerfreundlichen Scanfunktionen bekannt. Sie ermöglicht es Nutzern, Belege und Spesenabrechnungen schnell und unkompliziert von unterwegs einzureichen.

- Docyt: Die mobile App konzentriert sich auf die Bereitstellung von Echtzeitberichten und die Möglichkeit, Transaktionen zu prüfen und zu genehmigen, wodurch Sie die Finanzverwaltung immer im Blick haben.

6. Integration und Konnektivität

- Dext: Bietet direkte Integrationen mit Plattformen wie QuickBooks Online und Xero, wodurch eine tiefe Integration für die einfache Veröffentlichung von Finanzdaten ermöglicht wird.

- Docyt: Lässt sich auch mit QuickBooks Online und anderen Systemen integrieren. BuchhaltungssoftwareDie Vernetzung ist jedoch oft umfassender und greift auf Bankkonten und verschiedene Geschäftssysteme zurück, um einen ganzheitlichen Überblick zu erhalten.

7. Ausgaben- und Umsatzdaten

- Dext: Hervorragend geeignet für die Verwaltung von Spesenabrechnungen und die Nachverfolgung von Ausgaben. Es erfasst Dokumente zu Kosten- und Umsatzdaten.

- Docyt: Bearbeitet Spesenabrechnungen, bietet aber auch Tools für die Umsatzabstimmung und die Verwaltung von Verkaufsdaten auf Abteilungs- oder Unternehmensebene.

8. Umgang mit Sicherheit und Zuverlässigkeit

- Dext: Bietet hohe Sicherheit und Systemzuverlässigkeit für die Speicherung von Belegen und anderen Finanzdokumenten.

- Docyt: Der Fokus liegt auf einem sicheren Datenfluss und es handelt sich um eine zuverlässige Sicherheitslösung. Sollten Sie auf ein kleineres Problem stoßen, wie beispielsweise eine Fehlermeldung wie „cloudflare ray id found“ oder „cloudflare ray id“, handelt es sich in der Regel um eine Standardmeldung des zugrunde liegenden Sicherheitsdienstes und nicht um eine Sicherheitslücke.

9. Kostenlose Testversion und Preisgestaltung

- Dext: Dext kann man oft mit einer kostenlosen Testphase ausprobieren. Es bietet wettbewerbsfähige Preispläne für beides. Kleinunternehmen Eigentümer und größere Wirtschaftsprüfungsgesellschaften.

- Docyt: Bietet heute auch eine kostenlose Testversion an, der Startpreis ist jedoch oft höher, da eine leistungsfähigere KI enthalten ist. Buchhaltung und vollständige Automatisierungsfunktionen.

10. Fokus auf KI statt Datenaufbereitung

- Dext: Der Schwerpunkt liegt primär auf dem Einsatz von KI zur präzisen Datenextraktion und -aufbereitung, wodurch der Aufwand im Frontend effektiv reduziert wird. Buchhaltung Prozesse.

- Docyt: Nutzt seine Docyt AI-Plattform als KI-Buchhalter, um verschiedene Aktionen wie Kategorisierung und Abstimmung durchzuführen, zeitaufwändige Aufgaben zu bewältigen und Backoffice-Tätigkeiten zu automatisieren.

Worauf Sie bei der Auswahl einer Buchhaltungssoftware achten sollten?

- Echtzeit Berichterstattung: Achten Sie auf Software, die Finanzberichte in Echtzeit und Einblicke in die Rentabilität liefert. Dies ist entscheidend für strategische Entscheidungen.

- Automatisierungsgrad: Prüfen Sie, ob thDas Tool geht über das Sammeln von Belegen hinaus und übernimmt auch komplexe Buchhaltungsaufgaben wie die Bezahlung von Rechnungen und den Monatsabschluss.

- KI-Lernen: Passt sich das System, wie beispielsweise das von Docyt erlernte, an die individuellen Besonderheiten Ihres Unternehmens an? Das erleichtert die Arbeit ungemein und ist ein echter Wendepunkt.

- Fehlerreduzierung: Das Tool soll dabei helfen, Fehler in der Umsatzbuchhaltung zu vermeiden und Probleme wie fehlerhafte Daten aufzuzeigen.

- Integrationsfreundlichkeit: Stellen Sie sicher, dass die Software mit Ihren bestehenden Systemen kompatibel ist und sichere Bankdaten- und E-Mail-Übermittlungsfunktionen nutzt.

- Dokumentenerfassung: Der Dienst sollte mehrere Möglichkeiten zur Einreichung von Dokumenten bieten, ähnlich wie bei Dext oder den Funktionen, die Dext auf verschiedene Weise anbietet.

- Systemzuverlässigkeit: Achten Sie auf Benutzerfreundlichkeit und Systemzuverlässigkeit, um sicherzustellen, dass Ihre Finanztransaktionen vor potenziellen Problemen wie Online-Angriffen geschützt sind.

- Ausgabenmanagement: Es soll Ihnen Zeit sparen, indem es automatisch Rechnungen abruft und Lieferantenregeln mit korrekten Steuerdaten anwendet.

- Spezielle Bedürfnisse: Überlegen Sie, ob Sie eine detaillierte Abteilungsbuchhaltung oder Nachverfolgung für bestimmte Branchen oder Kundenbestellungen benötigen.

- Datensicherheit: Wählen Sie vorrangig einen Anbieter, der Ihre Daten schützt, insbesondere vor potenziellen Bedrohungen, die durch Begriffe wie SQL-Befehl gekennzeichnet sind (dies betrifft jedoch eher das Entwicklungsteam des Website-Betreibers).

Endgültiges Urteil

Wir haben die Funktionen geprüft und uns angeschaut, was diese Tools so großartig macht.

Beide helfen Ihnen, Zeit zu sparen und den manuellen Dateneingabeaufwand zu reduzieren.

Dext ist eine gute Wahl, wenn Ihr Hauptaugenmerk auf der schnellen Erfassung von Belegen und der Erstellung von Dokumenten in nur wenigen Minuten liegt.

Für moderne Unternehmen ist Docyt jedoch unsere Wahl.

Es bietet eine vollständige KI-gestützte Buchhaltung, die den gesamten Buchhaltungsprozess automatisiert.

Für viele Menschen ist das ein Wendepunkt.

Docyt nimmt Ihnen einen Großteil der Arbeit ab, von komplexen Abstimmungen bis hin zu Echtzeit-Einblicken in Ihre Rentabilität.

Wir haben den durchschnittlichen Aufwand eines Experten betrieben, um diese Systeme wirklich zu vergleichen, damit Sie darauf vertrauen können, dass diese Wahl Ihr Finanzleben einfacher macht.

Mehr von Dext

Wir haben uns auch angesehen, wie Dext im Vergleich zu anderen Tools für Ausgabenmanagement und Buchhaltung abschneidet:

- Dext vs Xero: Xero bietet eine umfassende Buchhaltungslösung mit integrierten Funktionen für das Ausgabenmanagement.

- Dext vs Puzzle IO: Puzzle IO zeichnet sich durch KI-gestützte Finanzanalysen und Prognosen aus..

- Dext vs Synder: Synder konzentriert sich auf die Synchronisierung von E-Commerce-Verkaufsdaten und Zahlungsabwicklung.

- Dext vs Easy Monatsende: Easy Month End vereinfacht die monatlichen Finanzabschlussverfahren.

- Dext vs Docyt: Docyt nutzt KI zur Automatisierung von Buchhaltungs- und Dokumentenverwaltungsaufgaben.

- Dext vs RefreshMe: RefreshMe bietet Echtzeit-Einblicke in die finanzielle Leistungsfähigkeit von Unternehmen.

- Dext vs Sage: Sage bietet eine Reihe von Buchhaltungslösungen mit Funktionen zur Ausgabenverfolgung an.

- Dext vs Zoho Books: Zoho Books bietet integrierte Buchhaltung mit Funktionen zur Ausgabenverwaltung.

- Dext vs Wave: Wave bietet kostenlose Buchhaltungssoftware mit grundlegenden Funktionen zur Ausgabenverfolgung.

- Dext vs Quicken: Quicken ist beliebt für die private Finanzverwaltung und die grundlegende Erfassung von Geschäftsausgaben.

- Dext vs Hubdoc: Hubdoc ist spezialisiert auf die automatisierte Dokumentenerfassung und Datenextraktion.

- Dext vs Expensify: Expensify bietet robuste Lösungen für Spesenabrechnung und -verwaltung.

- Dext vs QuickBooks: QuickBooks ist eine weit verbreitete Buchhaltungssoftware mit Funktionen zur Ausgabenverwaltung.

- Dext vs AutoEntry: AutoEntry automatisiert die Dateneingabe von Rechnungen, Quittungen und Kontoauszügen.

- Dext vs FreshBooks: FreshBooks ist für dienstleistungsorientierte Unternehmen mit Rechnungsstellung und Ausgabenverfolgung konzipiert.

- Dext vs NetSuite: NetSuite bietet ein umfassendes ERP-System mit Funktionen zur Kostenverwaltung.

Mehr von Docyt

Bei der Suche nach der richtigen Buchhaltungssoftware ist es hilfreich, die verschiedenen Plattformen miteinander zu vergleichen.

Hier folgt ein kurzer Vergleich von Docyt mit vielen seiner Alternativen.

- Docyt vs Puzzle IO: Während beide bei Finanzangelegenheiten helfen, konzentriert sich Docyt auf KI-gestützte Buchhaltung für Unternehmen, während Puzzle IO die Rechnungsstellung und Spesenabrechnung für Freiberufler vereinfacht.

- Docyt vs. Dext: Docyt bietet eine komplette KI-gestützte Buchhaltungsplattform an, während Dext sich auf die automatisierte Datenerfassung aus Dokumenten spezialisiert hat.

- Docyt vs. Xero: Docyt ist für seine umfassende KI-Automatisierung bekannt. Xero bietet ein umfassendes und benutzerfreundliches Buchhaltungssystem für allgemeine Geschäftsanforderungen.

- Docyt gegen Synder: Docyt ist ein KI-gestütztes Buchhaltungstool zur Automatisierung von Backoffice-Prozessen. Synder konzentriert sich auf die Synchronisierung von E-Commerce-Verkaufsdaten mit Ihrer Buchhaltungssoftware.

- Docyt vs. Easy Monatsende: Docyt ist eine umfassende KI-gestützte Buchhaltungslösung. Easy Month End ist ein Spezialtool, das speziell für die Optimierung und Vereinfachung des Monatsabschlusses entwickelt wurde.

- Docyt vs RefreshMe: Docyt ist ein Buchhaltungsprogramm für Unternehmen, während RefreshMe eine App für persönliche Finanzen und Budgetplanung ist.

- Docyt vs Sage: Docyt verfolgt einen modernen, KI-gestützten Ansatz. Sage ist ein traditionsreiches Unternehmen, das eine breite Palette an klassischen und cloudbasierten Buchhaltungslösungen anbietet.

- Docyt vs Zoho Books: Docyt konzentriert sich auf KI-gestützte Buchhaltungsautomatisierung. Zoho Books ist eine Komplettlösung, die einen umfassenden Funktionsumfang zu einem wettbewerbsfähigen Preis bietet.

- Docyt vs Wave: Docyt bietet leistungsstarke KI-Automatisierung für wachsende Unternehmen. Wave ist eine kostenlose Buchhaltungsplattform, die sich besonders für Freiberufler und Kleinstunternehmen eignet.

- Docyt vs Quicken: Docyt ist für die betriebliche Buchhaltung konzipiert. Quicken ist in erster Linie ein Tool für die private Finanzverwaltung und Budgetplanung.

- Docyt vs Hubdoc: Docyt ist ein komplettes KI-gestütztes Buchhaltungssystem. Hubdoc ist ein Datenerfassungstool, das Finanzdokumente automatisch sammelt und verarbeitet.

- Docyt vs Expensify: Docyt übernimmt alle Buchhaltungsaufgaben. Expensify ist spezialisiert auf die Verwaltung und das Reporting von Mitarbeiterausgaben.

- Docyt vs QuickBooks: Docyt ist eine KI-Automatisierungsplattform, die QuickBooks erweitert. QuickBooks ist eine umfassende Buchhaltungssoftware für Unternehmen jeder Größe.

- Docyt vs AutoEntry: Docyt ist eine KI-gestützte Buchhaltungslösung mit umfassendem Service. AutoEntry konzentriert sich speziell auf die Extraktion und Automatisierung von Dokumentendaten.

- Docyt vs FreshBooks: Docyt nutzt fortschrittliche KI zur Automatisierung. FreshBooks ist eine benutzerfreundliche Lösung, die aufgrund ihrer Funktionen zur Rechnungsstellung und Zeiterfassung bei Freiberuflern beliebt ist.

- Docyt vs. NetSuite: Docyt ist ein Tool zur Automatisierung der Buchhaltung. NetSuite ist ein umfassendes Enterprise-Resource-Planning-System (ERP) für große Unternehmen.

Häufig gestellte Fragen

Worin besteht der Hauptunterschied zwischen Dext und Docyt?

Dext eignet sich hervorragend für die Spesenabrechnung und Belegverwaltung. Docyt bietet eine umfassendere Automatisierung der Buchhaltung, einschließlich der Bearbeitung von Rechnungen und Belegen sowie der Bereitstellung von Finanzübersichten in Echtzeit. Docyt zielt darauf ab, den gesamten Arbeitsablauf weiter zu vereinfachen.

Mit welcher Buchhaltungssoftware sind Dext und Docyt kompatibel?

Sowohl Dext als auch Docyt lassen sich häufig in gängige Buchhaltungssoftware wie QuickBooks und Xero integrieren. Docyt bietet oft ein breiteres Spektrum an Integrationen mit anderen Unternehmensmanagement-Tools.

Ist Dext oder Docyt besser für kleine Unternehmen?

Dext kann ein guter Ausgangspunkt für sehr kleine Unternehmen sein, die sich auf Ausgabenmanagement konzentrieren. Wenn jedoch ein Kleinunternehmen Wer eine umfassendere Automatisierung seiner Buchhaltung zur Prozessoptimierung wünscht, für den könnte Docyt eine bessere langfristige Investition sein.

Kann mein Steuerberater Dext oder Docyt verwenden?

Ja, beide Tools können verwendet werden von Buchhalter und Wirtschaftsprüfungsgesellschaften. Docyt verfügt über spezielle Funktionen, die Buchhaltern helfen, mehrere Mandanten effizient zu verwalten.

Welches Tool eignet sich besser zur Automatisierung der Dateneingabe?

Beide Tools automatisieren die Dateneingabe, aber Docyt verarbeitet tendenziell eine größere Bandbreite an Dokumenten, die über reine Belege hinausgehen, und nutzt KI zur Informationsgewinnung, was den Prozess im Vergleich zu Dexts Hauptfokus auf Spesenabrechnungen weiter vereinfachen kann.