Are you tired of spending too much time on bookkeeping?

It can be a real headache.

Imagine if a smart helper could take over many of those tasks.

That’s where AI Buchhaltung software comes in!

These tools use smart technology to machen. managing your money easier.

We’ve looked at many options and found the 9 best AI Buchhaltung software for 2025.

Keep reading to find the perfect AI helper for your books!

What is the Best AI Accounting Software?

Picking the right AI Buchhaltung software can feel like a big decision.

Many tools promise to simplify things, but how do you know which one is truly the best fit for you?

We’ve done the hard work and checked out many options.

Here are our top picks for the best AI Buchhaltung software to help you automate your books and save time.

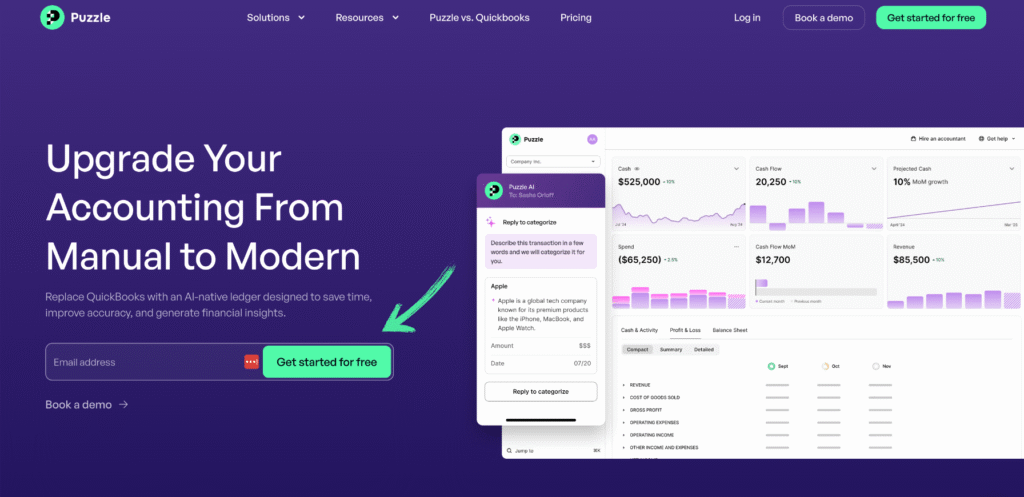

1. Puzzle IO (⭐️4.8)

So, Puzzle IO, what’s the deal?

Well, it’s AI Buchhaltung software that wants to make your financial planning smarter.

It’s all about giving you a clear picture of your Unternehmen finances.

Erschließen Sie sein Potenzial mit unserem Puzzle IO tutorial.

Unsere Meinung

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Wichtigste Vorteile

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

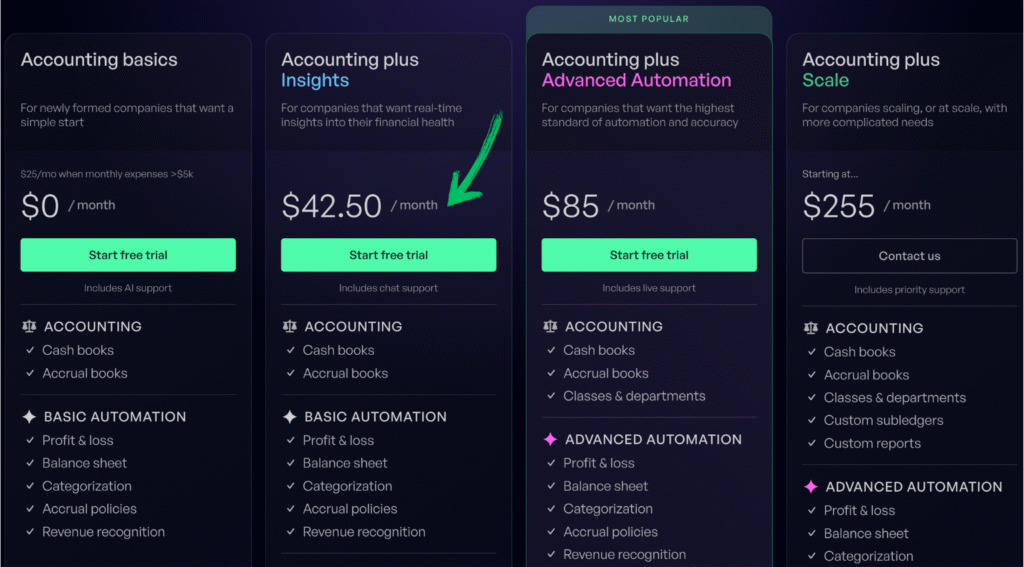

Preisgestaltung

- Accounting basics: $0/Monat.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Profis

Nachteile

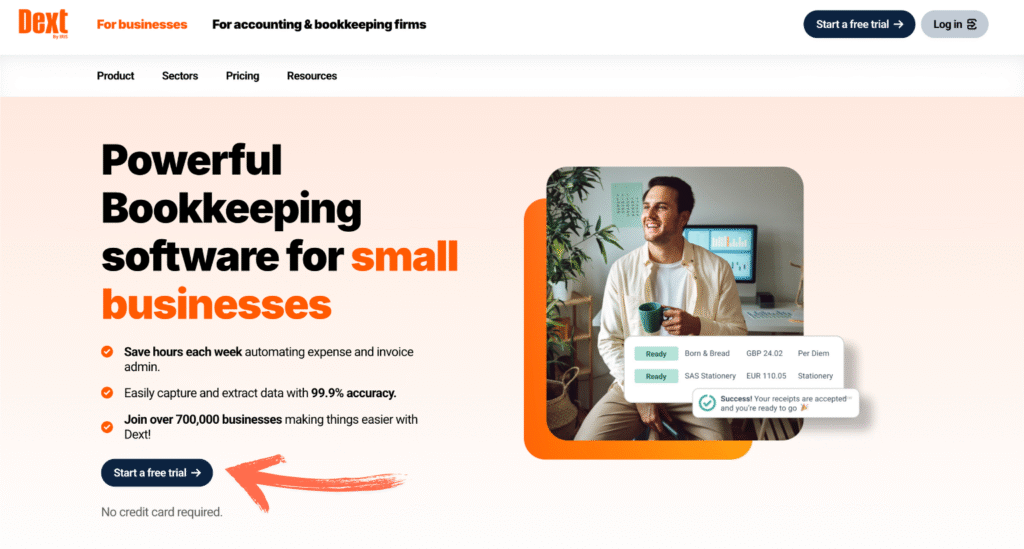

2. Dext (⭐️4.5)

Okay, let’s talk about Dext. Think of it as your super-efficient Daten entry helper.

It uses AI to grab information from your receipts and invoices.

This means way less manual typing for you!

Erschließen Sie sein Potenzial mit unserem Dext tutorial…

Unsere Meinung

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Wichtigste Vorteile

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

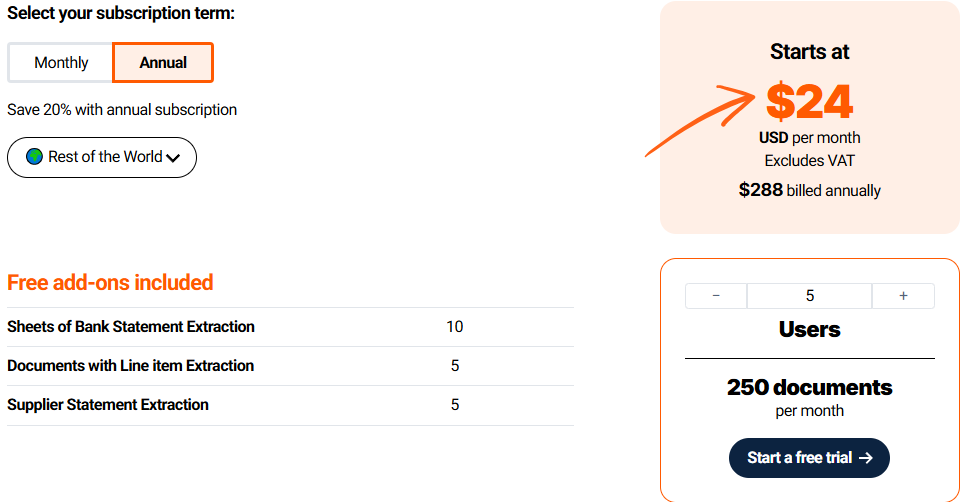

Preisgestaltung

- Annually Subscription: $24

Profis

Nachteile

3. Xero (⭐️4.0)

Alright, let’s chat about Xero. It’s a well-known cloud-based Buchhaltung Software.

It’s not just AI, but it cleverly uses AI tools to make things smoother, like automatic bank reconciliation.

It’s a solid all-around option.

Erschließen Sie sein Potenzial mit unserem Xero tutorial…

Unsere Meinung

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Wichtigste Vorteile

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Preisgestaltung

- Starter: $29/Monat.

- Standard: $46/month.

- Prämie: $69/Monat.

Profis

Nachteile

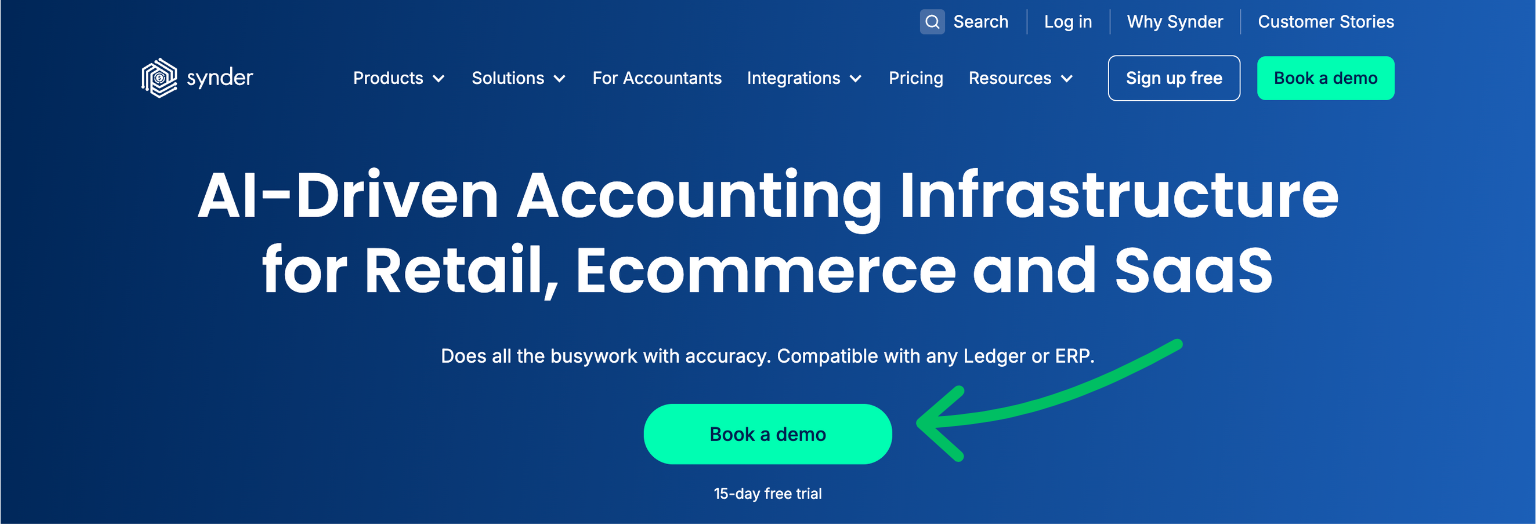

4. Synder (⭐️3.8)

Next up is Synder. This tool focuses on making e-commerce accounting a breeze.

It uses AI to sync Verkauf data and payments from various platforms directly into your accounting software.

If you sell online, this could be a lifesaver.

Unlock its potential with our Synder tutorial…

Unsere Meinung

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Wichtigste Vorteile

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

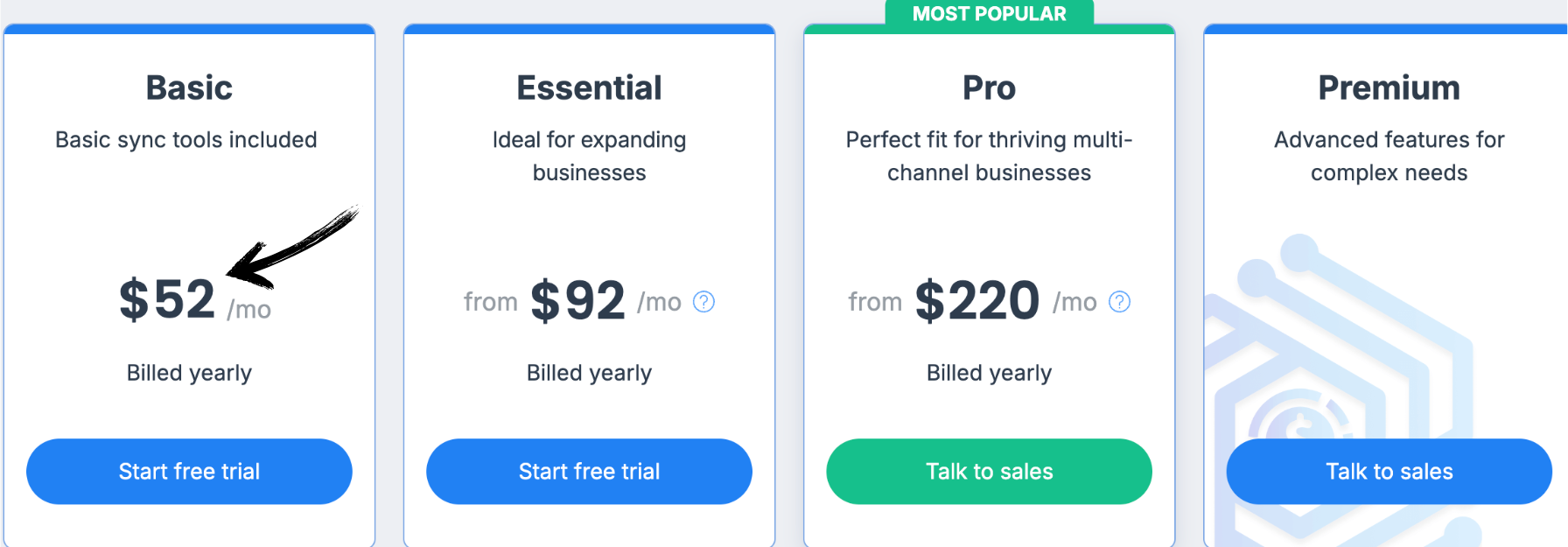

Preisgestaltung

Alle Pläne werden Jährlich abgerechnet.

- Grundlegend: $52/month.

- Wesentlich: $92/month.

- Pro: $220/month.

- Prämie: Individuelle Preisgestaltung.

Profis

Nachteile

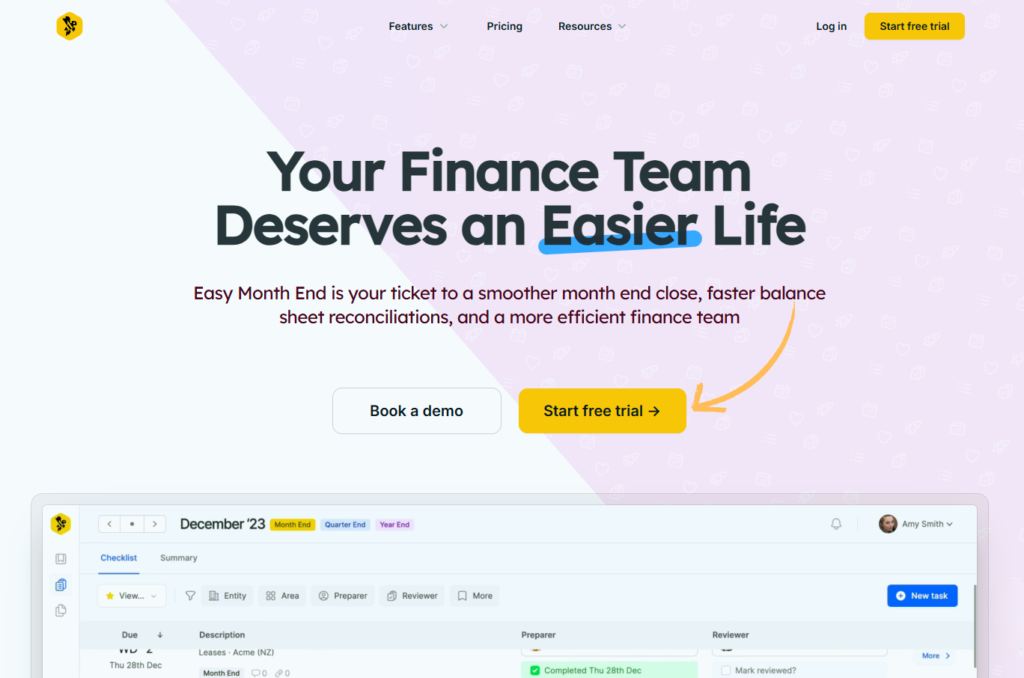

5. Easy Month End (⭐️3.7)

Easy Month End is designed to simplify and automate the often-stressful month-end closing process.

It uses AI to help you review, reconcile, and finalize your financial records more efficiently.

Say bye to late nights spent crunching numbers!

Erschließen Sie sein Potenzial mit unserem Easy Month End tutorial…

Unsere Meinung

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Wichtigste Vorteile

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

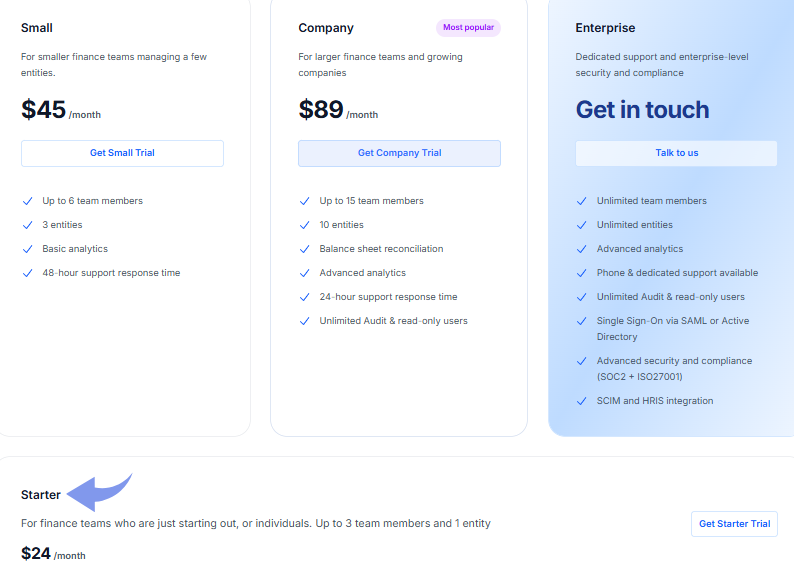

Preisgestaltung

- Starter: $24/month.

- Klein: $45/month.

- Company: $89/month.

- Unternehmen: Individuelle Preisgestaltung.

Profis

Nachteile

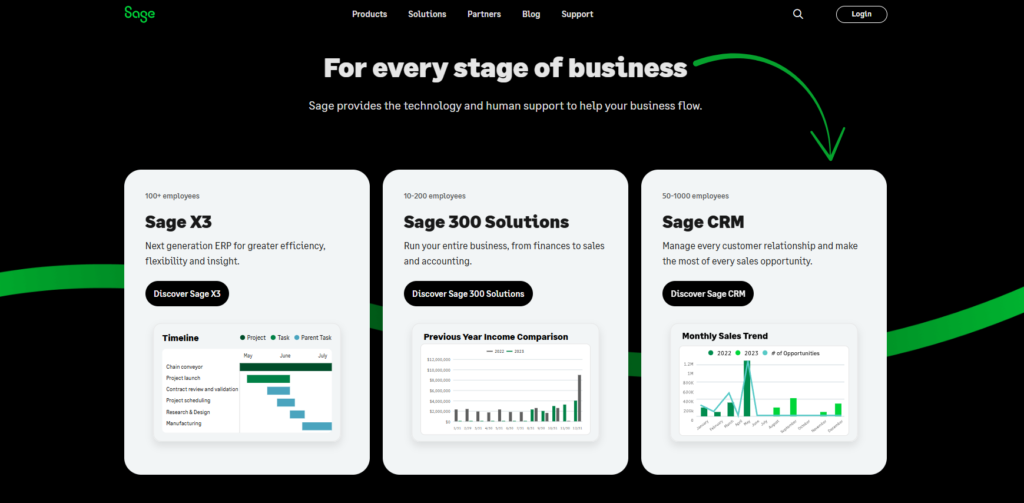

6. Sage (⭐️3.6)

So, Sage is a big name in the accounting world. They have been around for a while.

Their software uses AI to help with things like invoicing and bank reconciliation.

They offer different products for all kinds of businesses.

Erschließen Sie sein Potenzial mit unserem Sage tutorial…

Unsere Meinung

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Wichtigste Vorteile

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

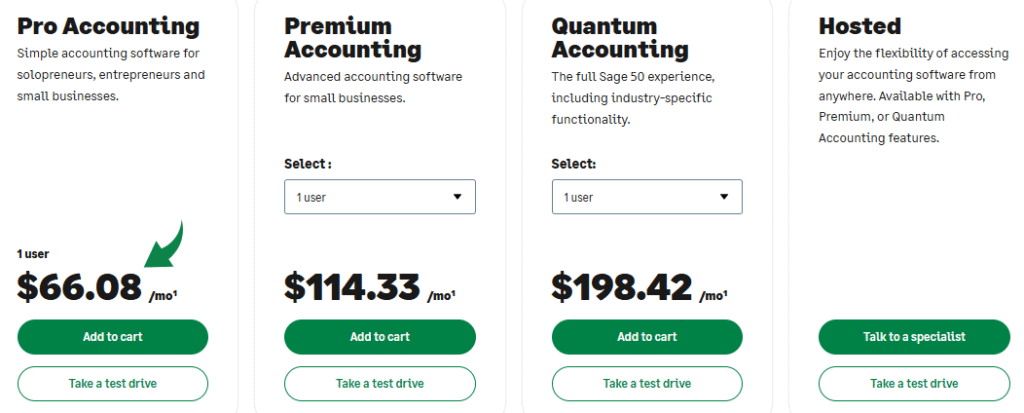

Preisgestaltung

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Profis

Nachteile

7. RefreshMe (⭐️3.5)

RefreshMe focuses on providing real-time financial insights and analysis using AI.

It aims to give business owners a clear and up-to-date view of their financial health, helping them make informed decisions quickly.

Erschließen Sie sein Potenzial mit unserem RefreshMe tutorial…

Unsere Meinung

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Wichtigste Vorteile

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

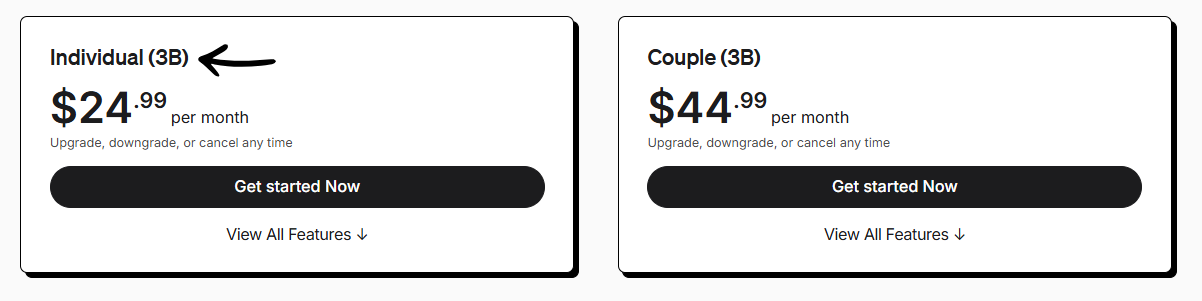

Preisgestaltung

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Profis

Nachteile

8. QuickBooks (⭐️3.4)

QuickBooks is another big name in accounting software.

Like Xero, it’s not purely AI-driven, but it incorporates AI features to automate tasks like categorizing transactions and predicting cash flow.

It’s a popular choice for many kleine Unternehmen.

Erschließen Sie sein Potenzial mit unserem QuickBooks tutorial…

Wichtigste Vorteile

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

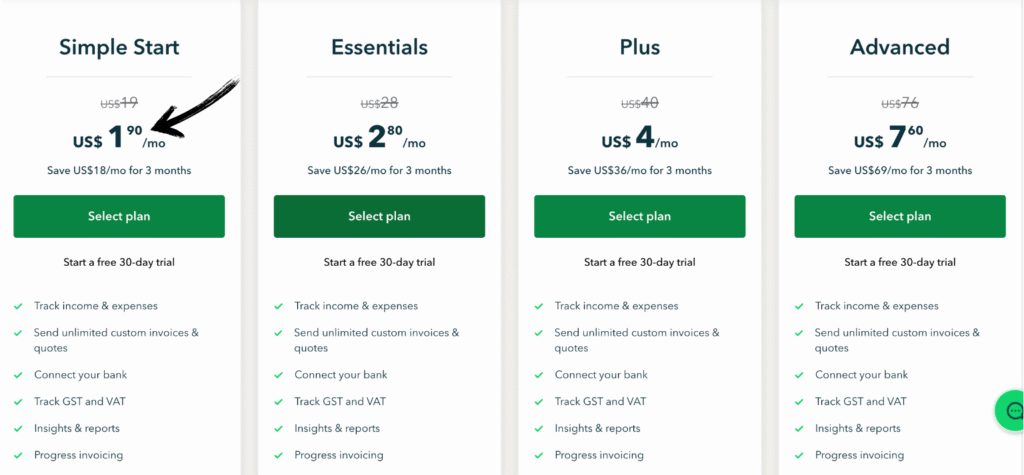

Preisgestaltung

- Simple Start: $1.90/month.

- Wesentlich: $2.80/month.

- Plus: $4/month.

- Fortgeschrittene: $7.60/month.

Profis

Nachteile

9. FreshBooks (⭐️3.2)

FreshBooks is designed with Freiberufler and service-based businesses in mind.

It focuses on simplifying invoicing, Zeiterfassung, and project management, and incorporates some AI to help with these tasks.

Erschließen Sie sein Potenzial mit unserem FreshBooks tutorial…

Unsere Meinung

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your Buchhaltungssoftware today!

Wichtigste Vorteile

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

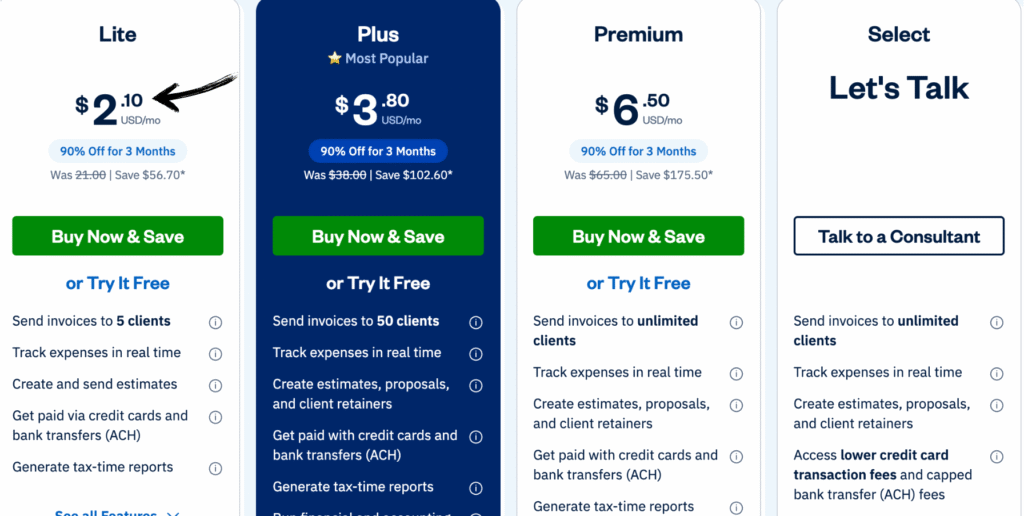

Preisgestaltung

- Leicht: $2.10/month.

- Plus: $3.80/month.

- Prämie: $6.50/month.

- Wählen Sie aus: Individuelle Preisgestaltung.

Profis

Nachteile

What to look for when buying an AI Accounting Software?

Here’s what matters most in the accounting industry:

- Financial Processes: Can the software automate your core financial processes and handle the entire accounting processes? Look for tools that manage accounts payable, expense reports, and other parts of your internal accounting processes.

- AI Technology: How does the ai technology actually work? Does it use natural language processing to understand documents or machine learning algorithms to find patterns? The best accounting ai should go beyond basic Automatisierung.

- Data & Analysis: The software should be able to analyze financial data for you. It should provide deep data analysis and give you actionable insights from your financial statements. It should also excel at data management.

- Productivity & Accuracy: A key benefit is saving time on repetitive tasks. Look for software that reduces human error and boosts productivity.

- Business Impact: Consider how the ai in accounting will affect your business. Can it help with tax compliance? Does it provide real-time insights for your financial operations?

- The Human Factor: It’s important to know the software’s relationship with accounting professionals. Will ai replace accountants or simply help them? Look for a tool that works with and supports your team.

How Can AI Accounting Software Help You?

Think about all the time you spend on things like sorting receipts and typing in numbers.

AI accounting software can do a lot of that stuff for you, automatically!

This means you have more time to focus on running your business.

These smart tools can also help you see how your business is doing with clear reports.

Some can even guess how much money you’ll have in the future!

It’s like having a super-smart helper for your business finances, making things easier and helping you make better choices.

Einkaufsführer

Bei unserer Suche nach dem besten Produkt haben wir diese Faktoren berücksichtigt:

- Eigenschaften: We looked at key ai powered tools like expense management software and accounts payable automation. We also examined how each ai tool provides real time insights, helps with cash flow forecasting, and uses predictive analytics to gauge a business’s financial health. We also checked for features like fraud detection, risk management, and the ability to generate accurate financial reports.

- Automatisierung: We focused on how each ai software can automate repetitive tasks, such as manual data entry and repetitive accounting tasks. We also assessed how these ai systems simplify routine tasks for financial professionals and the finance departments. This is the core of accounting automation.

- Data Analysis: We investigated how each solution uses artificial intelligence ai and machine learning algorithms to analyze data and find trends by analyzing historical data. We checked if they could identify patterns and provide valuable insights for business leaders and help with business growth.

- Business Impact: We considered how the software helps businesses manage their day-to-day business processes and improves a company’s financial performance. We also considered how these ai tools affect the accounting team and if they help with client communication. We also looked at how each tool’s business models address future trends.

- Benutzerfreundlichkeit: We considered how simple each accounting system was to use and if it could help with bookkeeping tasks. We also factored in the likelihood of human error and the quality of data management. Finally, we considered the claim that ai replace accountants.

- Unterstützung oder Erstattung: We looked at whether they offered a community, support, or refund policy.

Einpacken

We’ve explored some great ai accounting tools that can change how your business operates.

These aren’t just simple accounting tools; they use robotic process automation to handle boring, repetitive tasks so you don’t have to.

This frees up finance and accounting professionals to focus on more strategic work.

By using relevant data, these tools provide powerful insights for better financial Berichterstattung.

We’ve given you a breakdown of some of the best options on the market.

Trust our research to help you find the right fit, so you can stop doing manual work and start making smarter decisions.

Häufig gestellte Fragen

What exactly is AI accounting software?

It’s software that uses artificial intelligence to automate and simplify accounting tasks. These can include data entry, reconciliation, accounting firms, and report generation, saving you time and effort.

Is AI accounting software safe for my financial data?

Reputable AI accounting software uses strong Sicherheit measures to protect your data. Look for features like encryption and secure servers. Always research a provider’s security practices before trusting them with your financials.

Will AI accounting software replace human accountants?

It’s unlikely. AI excels at automation and data processing, but human accountants offer critical thinking, strategic advice, and nuanced interpretation that AI can’t fully replicate. They often work together.

How much does AI accounting software typically cost?

Pricing varies widely depending on the software’s features and the size of your business. Some offer monthly subscriptions starting from a few dollars, while more advanced solutions can cost hundreds per month.

What kind of businesses benefit most from AI accounting software?

Many types of businesses can benefit, from small startups to larger enterprises. However, those with a high volume of transactions, a need for efficient reporting, or a desire to reduce manual errors often see the biggest advantages.