Are you tired of keeping track of all those receipts?

Imagine if there was an easy way to handle all your expenses without the headache.

Expensify is a popular app that says it can Zencastr et Podcastle sont tous deux conçus pour les podcasteurs. Ils offrent un enregistrement audio de haute qualité, la collaboration à distance avec les invités et des outils de postproduction pour optimiser votre flux de travail. things much simpler.

But is it really the best for you in 2025?

This Expensify review will help you decide if it is the answer to your expense-tracking problems.

Let’s take a closer look!

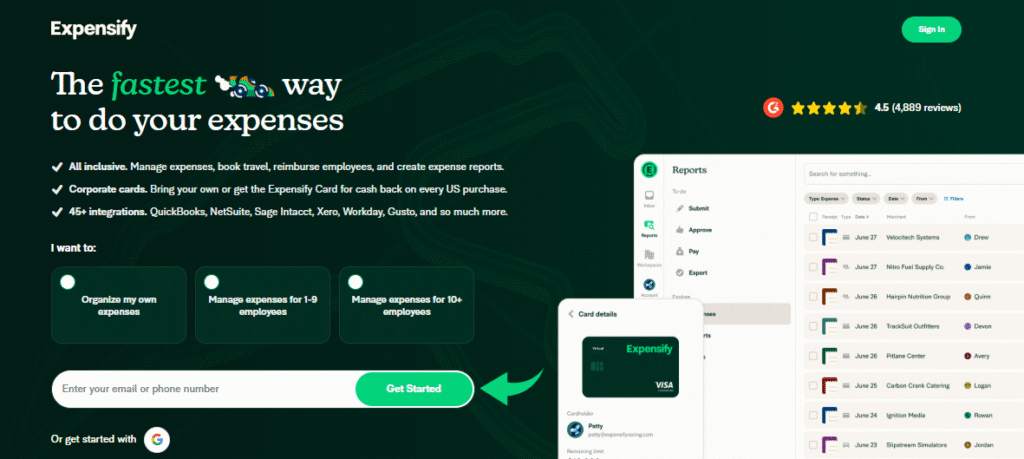

Streamline expenses with Expensify. Join the 10+ million users who’ve automated their expense reports. Join Expensify and get rid of the headache!

What is Expensify?

Expensify is a software that helps you automatically keep track of your money spent.

Think of it as a super helpful tool on your phone!

You can use their mobile app to create an account easily.

One cool feature is how it handles your receipt and expense management process.

You can simply take pictures of your paper receipts, & the app helps keep them organized.

If your company gives you a special card, Expensify can often connect to it.

This helps employee expenses get tracked without much work.

It makes dealing with expenses much easier!

Who Created Expensify?

Expensify was created by David Barrett. He started the company in 2008.

David wanted to make a better way for people to handle expenses.

Before Expensify, he worked at other tech companies.

His vision was to make the receipt and expense management process easy for everyone to use.

He wanted to eliminate the old system of submitting paper receipts and waiting to be reimbursed.

Instead of sending things through email and waiting for approval, he imagined a simpler system for corporate and individual employees.

Now, Expensify works with many other gusto companies to make expense tracking smooth.

Top Benefits of Expensify

Here are some of the best things about using Expensify:

- Easily manage expenses for your team: It’s simple to see who spends what and keep everyone on the same page.

- Faster reimbursement: Employees submit their expenses digitally, so getting paid back is much quicker.

- Use Expensify anywhere: You can add expenses on your phone or computer, making it a handy tool wherever you are.

- Set and enforce your company’s policy: It’s easy to set rules about what can be spent, helping everyone follow the guidelines.

- Approve expenses with one click: Managers can quickly review and approve expenses, saving time for everyone.

- Better spending information: You get clear Daten on where your money is going, helping you understand costs.

- Seamlessly integrate with Buchhaltungssoftware like QuickBooks & Xero: This means you don’t have to enter data manually into different systems; they sync automatically.

- Ideal für reisen expenses: Tracking flights, hotels, and meals becomes much simpler. You can even connect your corporate card to Expensify to automatically record transactions and categorize them for tax purposes.

Avec Text To Video, vous pouvez saisir ce que vous souhaitez voir se produire dans la vidéo.

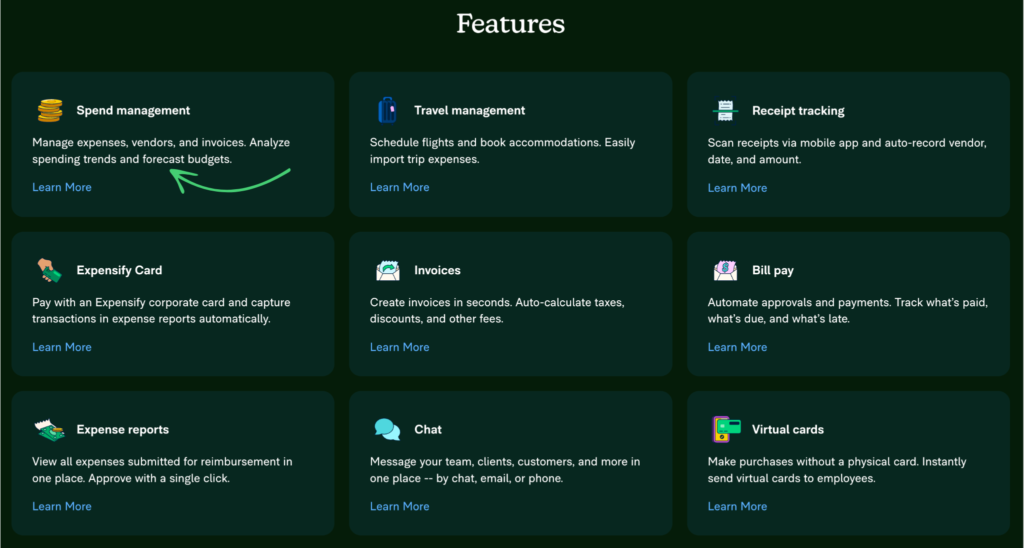

Expensify has some really cool things it can do to make dealing with money much easier.

It has special tools that help you keep track of where your money goes, make reports, and even plan trips!

Let’s look at some of the best things Expensify can do for you.

1. Expense Management Process

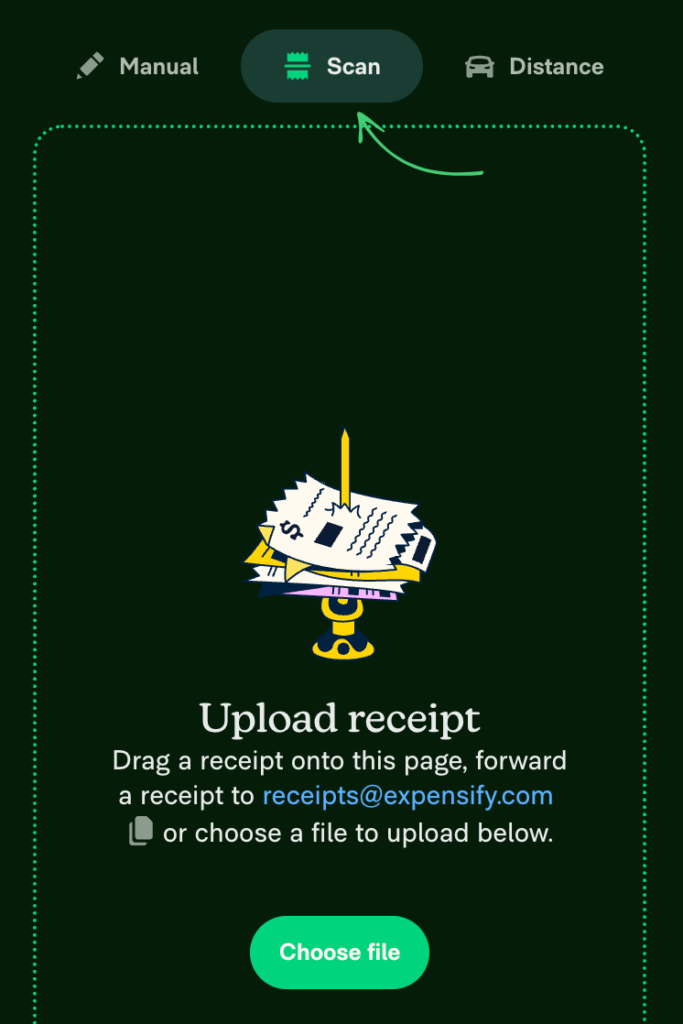

Keeping track of receipts used to be a pain.

With Expensify, you can just snap a picture of your receipt with your phone.

The app can read the important details, like the amount and where you spent the money.

This means you don’t have to write everything down manually.

It’s a simple way to see all your transactions in one place.

This feature helps you manage the spending & makes sure you don’t lose any important information.

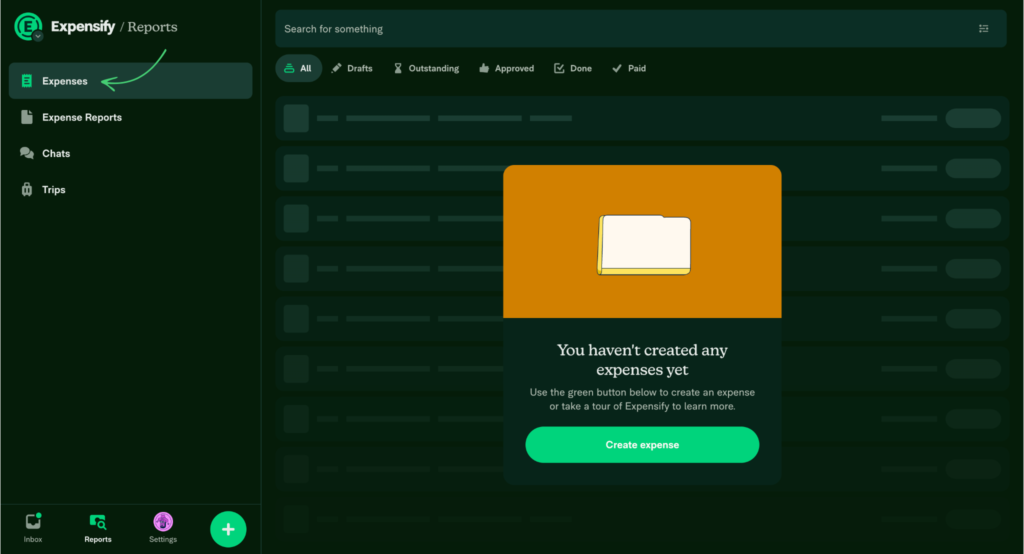

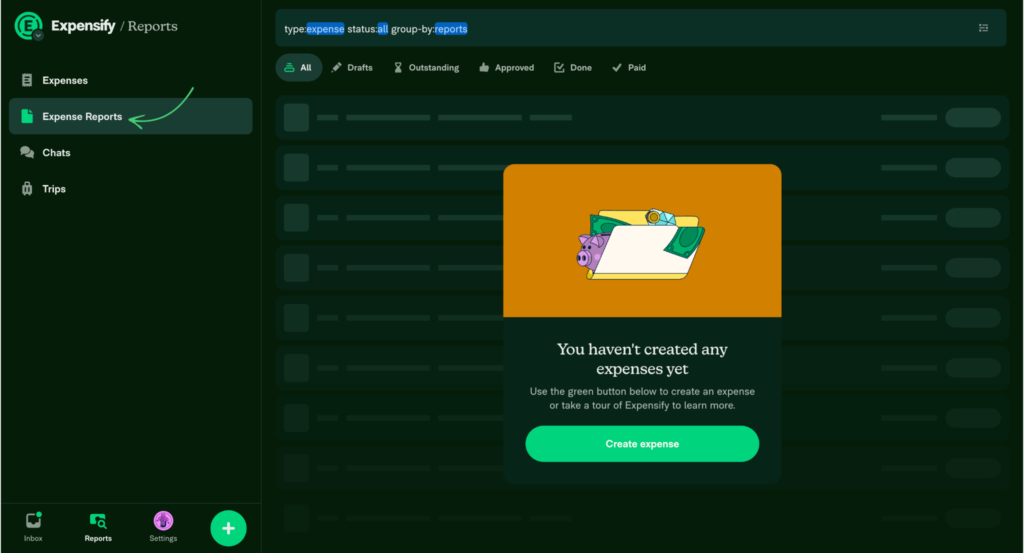

2. Expense Reports

You usually have to make a report when you need to tell your company how much money you spent.

Expensify makes this process much faster.

Once you’ve tracked your expenses, you can easily create reports.

The software puts everything together for you so you don’t have to.

Managers can then approve these reports quickly.

This saves everyone time and makes the approval process smooth.

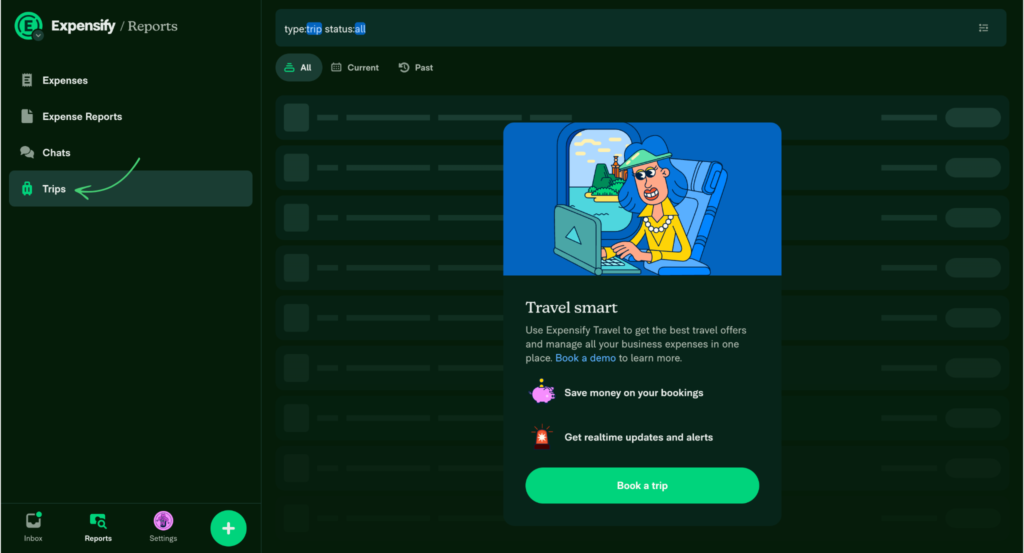

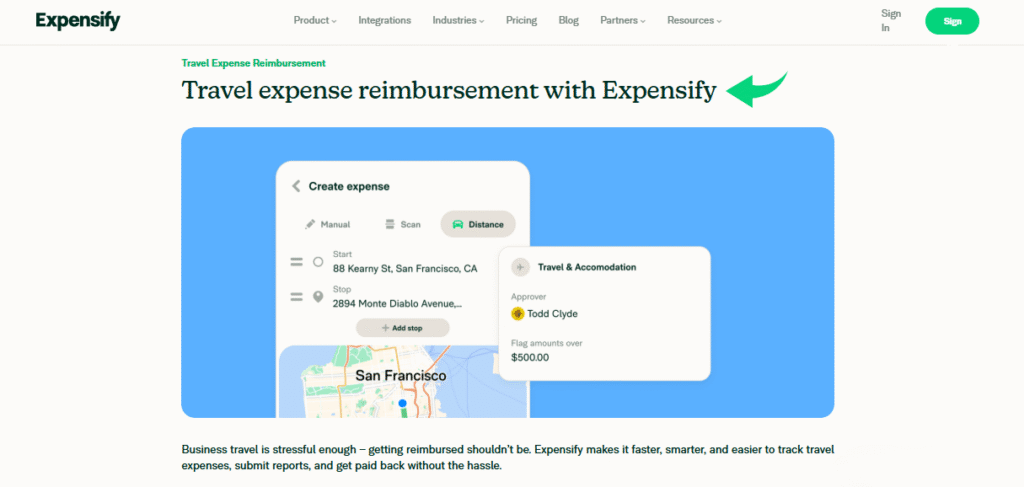

3. Trip Offers

If you reisen for work, Expensify can even help you find good deals.

This feature can show you offers for flights and hotels.

It’s like having a little travel helper built right into your expense app.

This can help your company save money and make planning trips less stressful for employees.

4. Expensify Card

Expensify also offers its own special card, called the Expensify Card.

If your company uses these cards, it can make tracking expenses even easier.

When an employee uses the Expensify Card for work expenses, the transactions automatically show up in the app.

You don’t even need to take a picture of a receipt in many cases!

It helps keep all corporate card spending organized and makes the receipt and expense management process super smooth.

You can even set spending limits and rules for the card, which helps your company control costs and follow your policy.

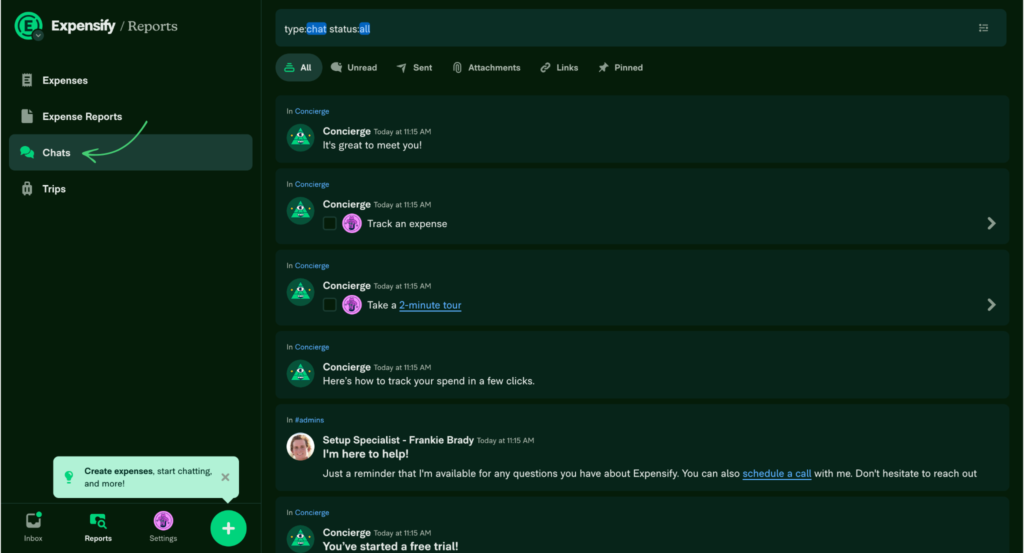

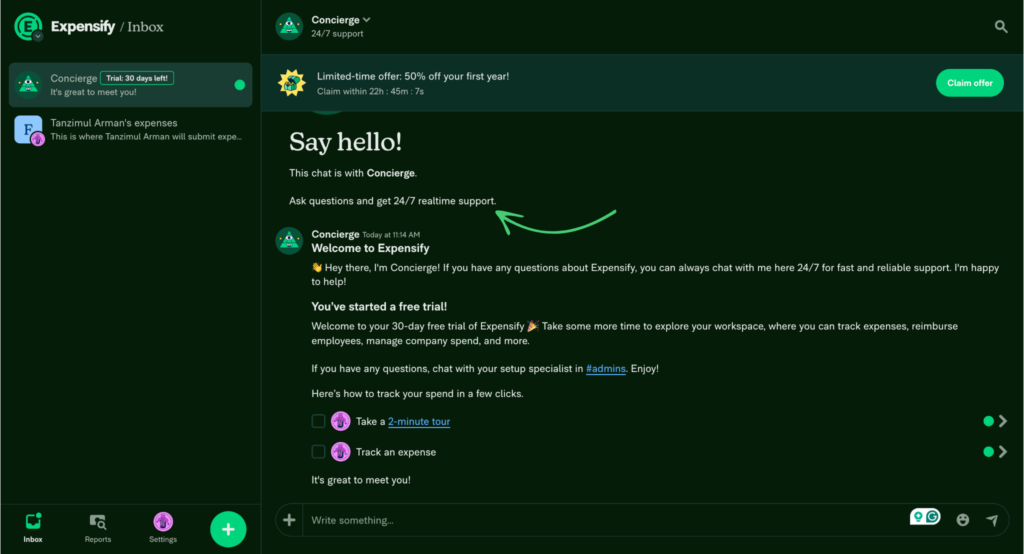

5. Easy Chats

Sometimes, you need to talk to people about an expense.

Expensify has a chat feature that lets you talk to your team right in the app.

If a manager has a comment utiliser Copper CRM about a transaction, you can quickly answer it.

This makes it easier to sort things out and keeps everyone on the same page.

It’s a simple way to communicate without having to send lots of emails.

6. Receipt Scanning

Expensify has a great feature for scanning receipts. You simply take a picture of your receipt with your phone.

The app’s technology, called SmartScan, reads the receipt.

It saves you from having to type in all the information yourself.

This makes it quick and easy to add new expenses.

You can throw away the paper receipt after you scan it.

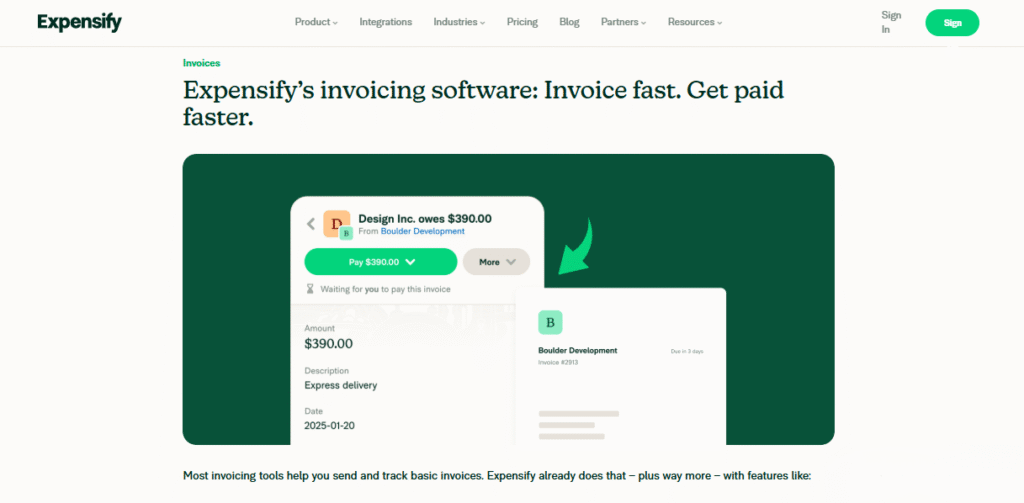

7. Bill Pay and Invoicing

Expensify can do more than just handle expenses.

This means you can get paid faster and manage your company’s money all in one place.

It helps you keep track of what you owe and what you are owed.

This helps you stay on top of your Geschäft finances.

8. Global Reimbursements

If you have people who work in other countries, Expensify can help.

It can reimburse employees and contractors all over the world.

It will even pay them in their local currency.

This makes it simple to pay people, no matter where they are.

It works with many different banks and currencies.

9. Integration with Other Software

Expensify can connect with many other programs you already use.

It works with Buchhaltung software like QuickBooks and Xero. This lets all your financial information flow from one place to another.

You do not have to enter the same information over and over again.

This saves you a lot of time and effort.

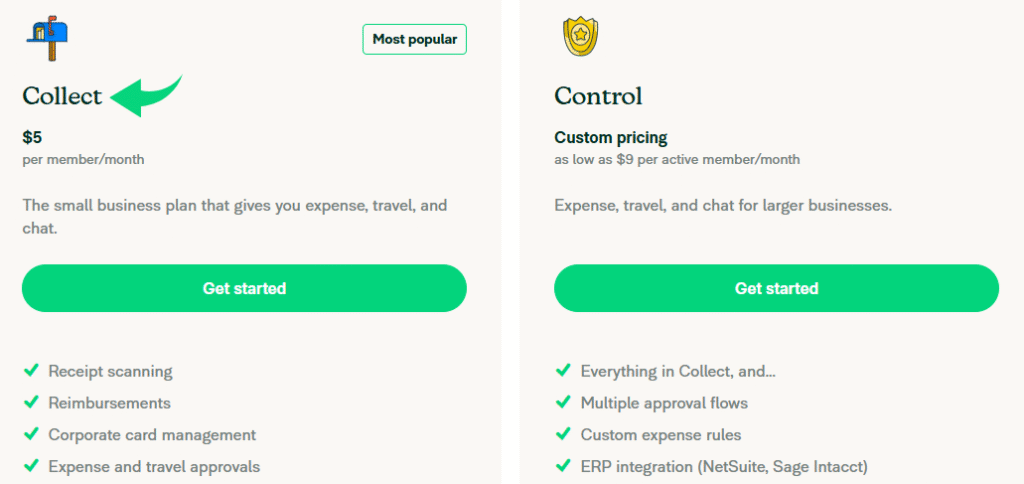

Preise

| Il s'agit d'une plateforme d'IA connue pour ses productions artistiques époustouflantes, qui fonctionne via un bot Discord et utilise un modèle d'abonnement pour l'accès. | Preis |

| Collect | $5/member/month |

| Control | Starts at $9/member/month |

Il s’agit d’un modèle d’image IA open source qui peut être personnalisé et exécuté sur votre propre matériel ou accessible via divers services.

Knowing the good and bad helps you decide.

Here’s a look at what Expensify offers and where it might fall short.

Pros

Nachteile

Alternatives of Expensify

While Expensify has many great features, other software options can also help with receipt and expense management processes.

Here are a few Expensify Alternatives to consider:

- Puzzle IO: Diese Software konzentriert sich auf KI-gestützte Finanzplanung.

- Rechts: Dieses Tool eignet sich hervorragend zum Erfassen von Dokumenten und Extrahieren von Daten.

- Xero: Dies ist eine beliebte Online-Buchhaltungssoftware für kleine Unternehmen.

- Sünder: Es ist auf die Synchronisierung von E-Commerce- und Zahlungsdaten mit Buchhaltungssoftware spezialisiert.

- Einfacher Monatsabschluss: Diese Software wurde entwickelt, um Ihre Finanzaufgaben am Monatsende zu rationalisieren.

- Docyt: Es nutzt künstliche Intelligenz für die Buchhaltung und automatisiert die Finanzabläufe.

- Salbei: Dies ist ein umfassendes Softwarepaket für Unternehmen und Buchhaltung.

- Zoho Bücher: Das Online-Buchhaltungstool ist dafür bekannt, dass es erschwinglich und für kleine Unternehmen geeignet ist.

- Welle: This option provides free accounting software for small businesses.

- Hubdoc: Es ist auf die Erfassung und Organisation von Finanzdokumenten für die Buchhaltung spezialisiert.

- QuickBooks: Eine sehr bekannte Buchhaltungssoftware, die Unternehmen bei allen Aufgaben von der Rechnungsstellung bis zur Gehaltsabrechnung unterstützt.

- AutoEntry: Dieses Tool automatisiert die Dateneingabe durch Scannen und Analysieren von Dokumenten wie Rechnungen und Quittungen.

- FreshBooks: Diese Software wurde speziell für Freiberufler und kleine Unternehmen entwickelt, wobei der Schwerpunkt auf der Rechnungsstellung und Zeiterfassung liegt.

- NetSuite: Eine leistungsstarke und vollständige Cloud-basierte Business Management Suite für größere Unternehmen.

Expensify Compared

- Expensify vs Puzzle: Diese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Das Gegenstück ist für die persönlichen Finanzen gedacht.

- Expensify vs Dext: Dies ist ein Business-Tool zum Erfassen von Quittungen und Rechnungen. Das andere Tool erfasst persönliche Ausgaben.

- Expensify vs Xero: Dies ist eine beliebte Online-Buchhaltungssoftware für kleine Unternehmen. Die Konkurrenzsoftware ist für den privaten Gebrauch gedacht.

- Expensify vs Synder: Dieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf persönliche Finanzen.

- Expensify vs Easy Month End: Dies ist ein Business-Tool zur Rationalisierung von Aufgaben am Monatsende. Sein Konkurrent dient der Verwaltung persönlicher Finanzen.

- Expensify vs Docyt: Dieses nutzt KI für die Unternehmensbuchhaltung und Automatisierung. Das andere nutzt KI als persönlichen Finanzassistenten.

- Expensify vs Sage: Dies ist eine umfassende Suite für die Unternehmensbuchhaltung. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für die persönliche Finanzplanung.

- Expensify vs Zoho Books: Dies ist ein Online-Buchhaltungstool für kleine Unternehmen. Das Konkurrenztool ist für den persönlichen Gebrauch gedacht.

- Expensify vs Wave: Dies ist eine kostenlose Buchhaltungssoftware für kleine Unternehmen. Das Gegenstück ist für Privatpersonen konzipiert.

- Expensify vs Hubdoc: Dieses Programm ist auf die Erfassung von Dokumenten für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzverwaltung.

- Expensify vs QuickBooks: Dies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative ist für die persönlichen Finanzen konzipiert.

- Expensify vs AutoEntry: Dies dient der Automatisierung der Dateneingabe für die Unternehmensbuchhaltung. Die Alternative ist ein persönliches Finanztool.

- Expensify vs FreshBooks: Dies ist eine Buchhaltungssoftware für Freiberufler und kleine Unternehmen. Seine Alternative ist für persönliche Finanzen.

- Expensify vs NetSuite: Dies ist eine leistungsstarke Business Management Suite für große Unternehmen. Der Konkurrent ist eine einfache persönliche Finanz-App.

Personal Experience with Expensify

Our team needed a better web access to handle expense reports.

The old way was slow and difficult. We chose to use Expensify to trigger things.

The product helped us manage expenses much more easily.

We were able to get rid of paper receipts and speed up our entire process.

Now, we can handle everything quickly and with a lot more accuracy.

- The ability to take a photo of a receipt and have the details automatically read was a big help. The photo of the receipt could be scanned in a few seconds. This meant no more manual data entry. All the information was immediately captured and made ready to file.

- We gave each employee a flexible way to submit expenses. They could use the desktop or the mobile app in their pocket. This made it easy to log expenses as they happened. The expense information was then stored securely in the app.

- The system had great Sicherheit. Our financial data was safe. The connection to our Buchhaltung software was also secure. We knew our company’s information was protected.

- We were able to respond to expense requests in real time. This helped us resolve any issues right away. It saved our managers from being blocked by a long list of approvals.

- The tool let us add custom tags and categories for different projects. This made it easy for our organization to track spending. It helped our employers keep an eye on what was being spent.

- The app’s built-in mileage tracker was a key feature. It would log our business trips automatically. This was much better than writing down the miles by hand.

- We were able to export our data with just a small number of clicks. This was expected and made it easy to create reports. The vereinfacht process gave us better support from our accounting team.

- We could use a special code for each project or client. This gave us more control. It made our expense tracking even more detailed for our customers.

Abschließende Gedanken

If keeping track of money is hard for you or your work, Expensify could help.

It’s like a helper for your receipts and spending. Taking pictures of receipts is easy.

Getting paid back happens faster.

It can even work with other computer programs you might use.

Some choices cost more money. But if you want to save time and trouble,

Expensify is worth a look.

Want to make expenses easier?

Go to Expensify’s website and see how it works for you!

Häufig Gestellte Fragen

How does Expensify help with receipts?

Expensify lets you take pictures of your receipts with your phone. The app then reads the important information and keeps it organized for you, so you don’t have to keep track of paper.

Can Expensify connect to my accounting software?

Yes, Expensify can connect and sync with popular accounting software like QuickBooks and Xero. This means your expense data can automatically go into your accounting system.

Is Expensify good for big companies?

Expensify offers plans designed for small teams and larger corporate companies. Its features help manage large numbers of employees submitting expenses and enforce company policy.

How much does Expensify cost to use?

Expensify has different pricing plans, including a free option for individuals with limited use. Paid plans for businesses vary in cost depending on the features and the number of users you need.

Can I use Expensify for personal expenses, too?

Yes, you can use Expensify for personal expense tracking. The free plan is often suitable for individuals who want a simple way to keep track of their spending and receipts.