Struggling to keep your Geschäft finances neat and tidy?

Viele Kleinunternehmen owners face the headache of managing receipts, invoices, and bank statements.

Imagine a world where your financial documents organize themselves.

This is where tools like Wave vs Hubdoc step in.

Let’s dive in and find out, so you can machen Eine kluge Entscheidung – und kehren Sie zu dem zurück, was Sie am besten können.

Überblick

We put Wave and Hubdoc through real-world tests.

We tried them with different businesses. This helped us see how each one works.

Now, we can share what we found to help you compare them easily.

Über 4 Millionen kleine Unternehmen Vertrauen Sie Wave die Verwaltung Ihrer Finanzen an. Entdecken Sie die Angebote von Wave und finden Sie das passende für sich.

Preisgestaltung: Kostenloser Tarif verfügbar. Der kostenpflichtige Tarif beginnt bei 19 $/Monat.

Hauptmerkmale:

- Fakturierung

- Bankwesen

- Lohnabrechnungs-Add-on.

Save time with Hubdoc! Users typically save 4 hours a week on data entry. Plus, Hubdoc auto-organizes 99% of docs.

Preisgestaltung: It has a free trial. The premium plan starts at $12/month.

Hauptmerkmale:

- Automated Document Fetching

- Datenextraktion

- Direct Buchhaltung Integration

Was ist eine Welle?

Okay, reden wir über Wave.

Betrachten Sie es als einen hilfsbereiten Freund für Ihre Geschäftsfinanzen.

Es ermöglicht Ihnen beispielsweise das Versenden von Rechnungen und die Nachverfolgung von Einnahmen und Ausgaben.

Es kann Ihnen helfen, sich einen umfassenden Überblick über Ihre Unternehmensfinanzen zu verschaffen.

Entdecken Sie auch unsere Favoriten Wellenalternativen…

Unsere Einschätzung

Geben Sie sich nicht mit weniger zufrieden! Schließen Sie sich den über 2 Millionen Kleinunternehmen an, die auf die leistungsstarken, kostenlosen Buchhaltungsfunktionen von Wave setzen, um ihre Finanzen noch heute zu optimieren.

Wichtigste Vorteile

Zu den Stärken von Wave gehören:

- Ein 100% kostenloser Basis-Buchhaltungsplan.

- Wir betreuen über 2 Millionen Kleinunternehmen.

- Einfache Rechnungserstellung und Zahlungsabwicklung.

- Keine langfristigen Verträge oder Garantien.

Preisgestaltung

- Starterplan: 0 € pro Monat.

- Pro-Plan: 19 Dollar pro Monat.

Vorteile

Nachteile

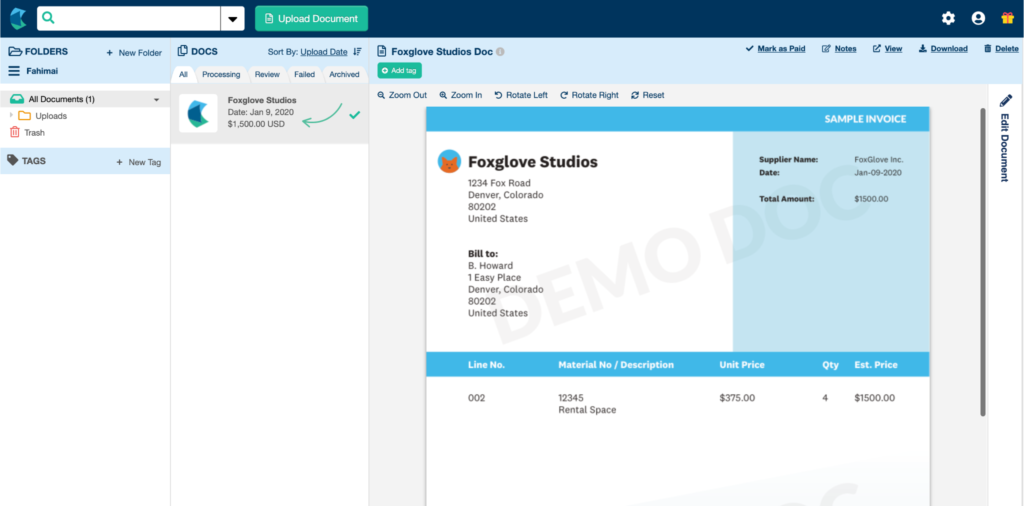

What is Hubdoc?

Okay, let’s talk about Hubdoc.

Betrachten Sie es als hilfreichen Assistenten für Ihre Unterlagen.

Es ruft Ihre Rechnungen und Kontoauszüge von verschiedenen Online-Quellen ab.

Dann bleiben sie alle übersichtlich an einem Ort geordnet.

Ziemlich cool, oder?

Entdecken Sie auch unsere Favoriten Hubdoc alternatives…

Wichtigste Vorteile

Hubdoc’s main strength is its focus on document automation.

- 99% accuracy: Hubdoc uses OCR to ensure data is captured correctly.

- Revisionssichere Speicherung: It stores documents securely, so you never lose a file again.

- Saves 10 hours monthly: Users report significant time savings by eliminating manual entry.

- Automated supplier fetching.

- Mobile photo capture.

- Seamless Xero integration.

Preisgestaltung

- Hubdoc price: 12 Dollar pro Monat.

Vorteile

Nachteile

Funktionsvergleich

Selecting the best Buchhaltung software is a matter of understanding each platform’s core specialty.

This Wave review and Hubdoc review will evaluate a free accounting software against a powerful document automation tool, guiding Kleinunternehmen owners to the right solution for their business operations.

1. Kernzweck und Plattform

- Welle Financial is a full small business Buchhaltungssoftware solution. Its free platform includes the general ledger, Buchhaltung records, and core accounting features. Wave makes managing personal finance simple and is built for the small business owner.

- Hubdoc is a document and Daten capture service, not an accounting platform. Its key features automate tasks by collecting financial documents and converting them into usable bank transactions. It works as a third party app to help accountant access data for other online accounting systems.

2. Preise und Abonnement

- Welle offers a complete free version (free starter plan), including unlimited invoices and multiple companies management. Wave’s two plans structure offers a paid pro plan for advanced features with optional additional costs for add-ons, making it a very cost-effective choice.

- Hubdoc is often available as free Buchhaltung software when bundled with other popular business apps (like Xero), but it is a paid product on its own. The billing period is typically monthly, and its value is measured by the Zeiterfassung and save time it provides the bookkeeper.

3. Expense and Data Automation

- Welle helps track expenses by allowing you to connect to bank accounts to auto import bank transactions. Digital receipt capture is available, and the auto merge feature helps reconcile bank transactions with less manual effort.

- Hubdoc is a specialist in document automation. It can automatically file records and bank statements and extract data from them, significantly reducing the time tracking spent on manual data entry for expenses. The mobile app is excellent for receipt scanning receipts on the go.

4. Rechnungsstellung und Zahlungen

- Welle Financial’s invoicing software allows you to create and send recurring invoices. You can accept multiple online payments via credit card payments (credit card transaction) and bank payments, with integrated payment processing that includes Apple Pay.

- Hubdoc has no native invoicing features. Its payments functionality is limited to capturing vendor bills and invoices sent to you (accounts payable), which it then pushes to other systems like QuickBooks Online for the accountant to pay bills.

5. Lohn- und Gehaltsabrechnung und Zeiterfassung

- Welle Payroll is an integrated accounting and payroll add-on that enables payroll processing and direct deposit for both active employee and independent contractor paid. Wave does not, however, offer dedicated billable hours or track mileage functionality.

- Hubdoc does not have run payroll or payroll processing capabilities. It is focused on financial documents and does not track employee time or manage sales tax calculations.

6. User Access and Collaboration

- Welle supports unlimited users for free, making it an ideal free platform for collaboration with your accountant or bookkeeper. It also allows you to track expenses for multiple companies from a single account.

- Hubdoc allows you to grant accountant access to clients’ records. This collaborative feature ensures that the accountant or bookkeeper always has the latest files via the internet connection, allowing them to spend less time requesting documents.

7. Financial Analysis and Reporting

- Welle offers essential financial reports and tools to view cash flow and profit from your income and expenses. This allows the small business owner to keep a full picture of their personal finance and business finances.

- Hubdoc does not generate financial reports or offer budgeting tools. It merely collects the raw source records and data so that the connected online accounting system can generate reports and provide real time data.

8. Mobile Funktionalität und Zugriff

- Both platforms offer a strong mobile app. Wave's mobile app allows you to create invoices and manage payments on the go. Hubdoc’s app is purely focused on receipt scanning and document upload to the cloud.

- Hubdoc's cloud-native nature ensures you have access to your documents from anywhere in the world with an internet connection. Wave is also cloud-based, so you can run your business from any mobile device.

9. Automation of Cash Flow and Payments

- Welle products help with cash flow by providing automated payment reminders and recurring billing. Wave integrates its own services seamlessly to simplify the entire process of getting paid and pay bills.

- Hubdoc helps automate the front end of cash flow management by collecting and organizing bank statements and vendor bills. This saves time for the bookkeeping tasks and the back-end process of tax time. The wave accounting review is why many recommend wave as a strong online accounting platform.

Worauf sollte man bei einer Buchhaltungssoftware achten?

To find the right financial solution, you must evaluate an accounting platform on five key dimensions that determine its value and fit.

- Skalierbarkeit: Can the software grow with any of your business?Scalability is crucial, especially when deciding between self hosted and cloud-based solutions. A strong subscription level should support unlimited bookkeeping records and allow you to easily add multiple users. Unlike on premise systems that require purchasing new hardware, cloud platforms allow you to pay for your needs through a tiered structure (such as a free plan to a paid plan), often with a discounted rate for commitment, ensuring your financial system adapts over time.

- Unterstützung: What kind of help is available if you have questions?Support quality is paramount for giving peace of mind and simplifying tax filing. Ensure the vendor has a reliable help center and can address issues related to bank transfers and accounts receivable quickly. Look for clear support channels that promise resolution within a few business days.

- Benutzerfreundlichkeit: Is it something you and your team can learn quickly? The simplicity of the user interface affects how quickly multiple users can become proficient. The software should make it easy to track expenses and manage money management features. It should also efficiently handle core operations, like automatically importing transactions automatically from your bank, to reduce manual effort.

- Spezielle Bedürfnisse: Does it handle the unique things your business does? The system must directly support your core workflows. If you manage sales, it should integrate purchase orders and facilitate accounts receivable. If you have global customers, it should support multiple tax jurisdictions. Features like accept online payments are crucial for modern customers. For advanced users, particularly those integrating with add-ons (like Xero users frequently do), checking API compatibility is essential.

- Sicherheit: How safe is your financial data with this software?Security is non-negotiable for bank transfers and managing customers’ payment data. The vendor must protect your information with advanced security measures, such as multi factor authentication. You should be able to segment Berichterstattung for a specific date range for security audits and be confident that your tax filing data is secure.

Endgültiges Urteil

Which one wins: Wave or Hubdoc?

If you need a full, free Buchhaltung system, choose Wave.

It offers invoicing and basic expense tracking. It’s great for small businesses.

But if you struggle with receipts and bank statements, pick Hubdoc.

It’s very smart. It grabs details automatically. We tested both tools. We saw them work in real businesses.

Choose Wave for all your Buchhaltung.

Pick Hubdoc for document help. Your business will be happier.

Mehr von Wave

- Wave vs Puzzle IODiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- Wave vs. DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- Wave vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- Wave vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Wellen vs. Einfaches MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- Wave vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- Wave vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- Wave vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Wave vs. QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- Wave vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- Welle vs. AusgabenDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- Wave vs. QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- Wave vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- Wave vs. FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- Wave vs. NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

More of Hubdoc

- Hubdoc vs PuzzleDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- Hubdoc vs DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- Hubdoc vs XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- Hubdoc vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Hubdoc vs Easy Month EndDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- Hubdoc vs Docyt: This uses AI for business bookkeeping and Automatisierung. The other uses AI as a personal finance assistant.

- Hubdoc vs SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- Hubdoc vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Hubdoc vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- Hubdoc vs ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- Hubdoc vs. QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- Hubdoc vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- Hubdoc vs. FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- Hubdoc vs. NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Is Wave really free for users?

Yes, Wave offers its core accounting, invoicing, and receipt tracking features for free. They make money from paid services like payroll and credit card processing. This makes Wave a great option for Freiberufler and small businesses on a budget.

How does Wave vs Hubdoc compare for document collection?

Hubdoc specializes in automated document collection and data extraction. It’s superior for gathering receipts, bills, and bank statements automatically. Wave also allows receipt uploads, but Hubdoc’s smart capture is more robust for high-volume document management.

Can Hubdoc integrate with accounting software other than Xero?

While Hubdoc is owned by Xero and integrates seamlessly, it also offers connections to other platforms. You can export data to other accounting software, but its deepest functionality and automation are typically realized when paired with Xero.

Is Hubdoc better for bank reconciliation?

Hubdoc helps a lot with bank reconciliation by automatically fetching bank statements and extracting transaction data. This pre-populates information, making the reconciliation process smoother and faster in your accounting software like Xero or FreshBooks, or even Zoho Books.

How do you make money from these comparisons?

Our aim is to offer objective reviews. We may earn a referral fee when you visit a vendor or provider through our links. This does not impact our research or methodology, ensuring our reviews are authentic and unbiased to help you choose the best tool.