Are you feeling lost in the world of business finances?

Keeping track of money coming in & going out can be a real headache.

You’re looking for a simpler way to manage it all.

That’s why we’re diving into a head-to-head comparison of two popular options: Xero vs Docyt.

Let’s find out together!

لمحة عامة

We’ve taken a close look at both Xero and Docyt.

Putting them through their paces with typical الأعمال التجارية الصغيرة tasks.

Our hands-on testing focused on ease of use and core accounting features.

Automation capabilities and how well they integrate with other business tools.

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features!

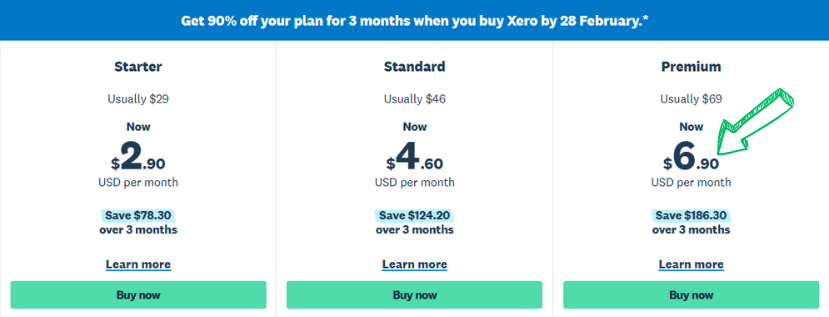

التسعير: It has a free trial. paid plan starts at $2.90/month.

الميزات الرئيسية:

- Invoicing

- Bank Reconciliation

- Reporting

Tired of manual bookkeeping? Docyt AI automates data entry and reconciliation.

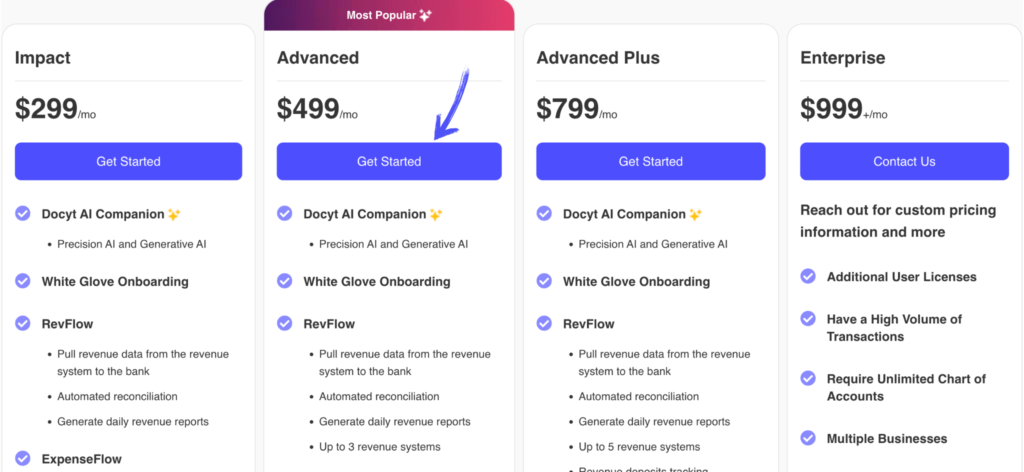

التسعير: It has a free trial. The premium plan starts at $299/month.

الميزات الرئيسية:

- Document Automation

- Expense Management

- Bill Pay

What is Xero?

So, Xero, huh? It’s popular. Lots of small businesses use it.

Think of it as your online hub for all things money.

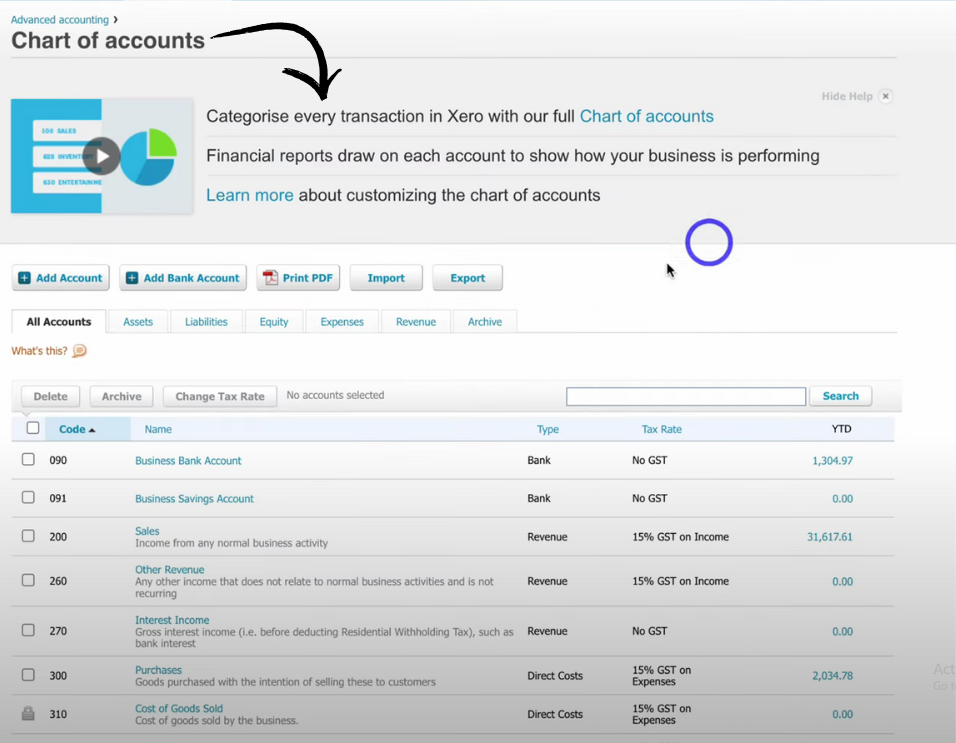

It helps you keep track of sales and bills. You can also connect your bank accounts.

This makes seeing where your money goes easier.

Also, explore our favorite Xero alternatives…

Join 2 million+ businesses using Xero برامج المحاسبة. Explore its powerful invoicing features now!

المزايا الرئيسية

- Automatically imports daily bank transactions.

- Send professional invoices and get paid faster.

- Run over 50 types of financial reports.

- Connect with over 1000 other business apps.

التسعير

- مبتدئ: $2.90

- قياسي: $4.60

- قسط: $6.90

الإيجابيات

السلبيات

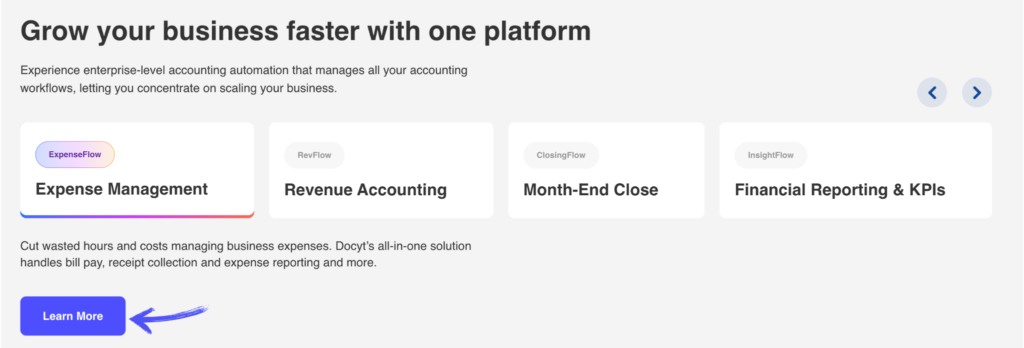

What is Docyt?

Now, let’s talk about Docyt. This one’s a bit different.

It really focuses on automation. Think less manual data entry.

It uses AI to handle documents. This can save you a ton of time.

It’s designed to streamline your financial workflows.

Also, explore our favorite Docyt alternatives…

Tired of manual bookkeeping? Docyt AI automates data entry and reconciliation, saving users an average of 40 hours per month.

المزايا الرئيسية

Docyt has some really cool things it can do:

- It can automatically pull data from 10+ different places, like your bank and credit cards.

- It uses smart technology to understand your documents with 99% accuracy.

- You can see all your important financial info in 1 easy-to-use spot.

- It helps you work with your team and share info easily with unlimited users on some plans.

التسعير

Docyt has different ways you can pay, depending on what you need:

- Impact: $299/شهرياً

- متقدم: $499/month

- Advanced Plus: $799/month

- المؤسسة: $999/month

الإيجابيات

السلبيات

مقارنة الميزات

Let’s dive into a detailed review of Xero and Docyt.

We’ll compare their key features side-by-side. This will help you see how they stack up.

We’ll look at things like budgeting, accounts payable, and expense tracking.

1. Budgeting and Forecasting

- Xero: Offers basic budgeting tools. You can set budgets for different accounts. It also provides some cash flow forecasting.

- Docyt: Focuses less on traditional budgeting. It provides real-time insights for better financial decisions.

2. Accounts Payable

- زيرو Manages accounts payable well. It allows you to enter bills and schedule payments. It also handles vendor management.

- دوكيت Streamlines accounts payable with automation. It automatically extracts data from invoices, saving time and reducing errors.

3. Expense Tracking

- Xero: Offers good expense tracking. You can record expenses and reimburse employees. It also integrates with credit card feeds.

- Docyt: Excels at expense tracking with AI. It automatically categorizes expenses from receipts and other documents.

4. Document Management

- Xero: Stores documents. You can attach files to transactions. This keeps everything organized.

- Docyt: Automates document handling. It captures, categorizes, and stores documents. This eliminates manual data entry.

5. عمليات الدمج

- Xero: Integrates with many apps. This includes payroll, إدارة علاقات العملاء, and inventory management software.

- Docyt: Integrates with accounting platforms. It works with QuickBooks Online and Xero. It also connects with POS systems.

6. User Interface and Experience

- Xero: Has a user-friendly interface. It’s easy to navigate, as shown in many screenshots. The rating for ease of use is high.

- Docyt: Offers a modern interface. It’s designed for efficiency. The rating for automation is very good.

7. Automation

- Xero: Automates some tasks. Bank reconciliation is a key example. It helps to ensure accuracy.

- Docyt: Automates many tasks. It automatically processes documents. This significantly reduces manual work.

What Should You Consider in Accounting Software?

- Here’s a quick rundown of other important factors:

- قابلية التوسع: Could the software grow with your business needs?

- دعم العملاء: Is help readily available when you need it?

- الأمن: How secure is your financial data with the software?

- الوصول عبر الهاتف المحمول: Can you manage your finances on the go?

- Specific Industry Needs: Does the software cater to your industry’s unique requirements?

- التعاون: Can multiple team members access and use the software effectively?

- Reporting Capabilities: Does it offer the specific reports you need to analyze your business performance?

الحكم النهائي

We checked out Xero and Docyt.

For most small businesses, Xero wins.

It’s great for all your main accounting needs, like bills and invoices.

It also connects with many other helpful apps.

Docyt is awesome for saving time on paperwork with its automatic document sorting.

But if you need a full accounting system to handle your client’s finances.

Xero is likely the better choice. We did the homework, so you can pick what works best for you!

More of Xero

- Xero vs Puzzle IO: Puzzle IO offers advanced analytics and forecasting for deeper insights.

- Xero vs Dext: Dext excels in receipt scanning and automated data extraction for expenses.

- Xero vs Synder: Synder specializes in e-commerce accounting and multi-channel sales reconciliation.

- Xero vs. Easy Month End: Easy Month End focuses on streamlining the financial close process efficiently.

- Xero vs RefreshMe: RefreshMe provides real-time cash flow forecasting and scenario planning.

- Xero vs Sage: Sage offers a broad range of accounting solutions, particularly for larger businesses.

- Xero vs Zoho Books: Zoho Books provides integrated CRM and project management features.

- Xero vs Wave: Wave offers free accounting software with paid payroll and payment options.

- Xero vs Quicken: Quicken is known for personal finance but also has small business options.

- Xero vs Hubdoc: Hubdoc focuses on automatically fetching and organizing financial documents.

- Xero vs Expensify: Expensify offers robust expense reporting and management features for teams.

- Xero vs QuickBooks: QuickBooks is a popular choice with various plans for different business sizes.

- Xero vs AutoEntry: AutoEntry automates the data entry of invoices, receipts, and bank statements.

- Xero vs FreshBooks: FreshBooks is designed for service-based businesses with strong invoicing features.

- Xero vs NetSuite: NetSuite offers a comprehensive ERP system with advanced accounting capabilities.

More of Docyt

- Docyt vs Puzzle IO: Puzzle IO focuses on advanced financial analysis and business intelligence.

- Docyt vs Dext: Dext specializes in automating data entry from receipts and invoices.

- Docyt vs Synder: Synder automates accounting for e-commerce businesses and sales channels.

- Docyt vs Easy Month End: Easy Month End streamlines and automates the month-end closing process.

- Docyt vs RefreshMe: RefreshMe centers on real-time cash flow management and predictive analysis.

- Docyt vs Sage: Sage provides enterprise-level accounting and financial management solutions.

- Docyt vs Zoho Books: Zoho Books offers integrated accounting, CRM, and project management capabilities.

- Docyt vs Wave: Wave provides free accounting software with optional payroll and payment services.

- Docyt vs Quicken: Quicken offers personal finance tools alongside some small business accounting features.

- Docyt vs Hubdoc: Hubdoc automates document collection and organization for accounting workflows.

- Docyt vs Expensify: Expensify provides automated expense reporting and السفر management for businesses.

- Docyt vs QuickBooks: QuickBooks offers accounting solutions for small to medium-sized businesses with various plans.

- Docyt vs AutoEntry: AutoEntry automates data capture from invoices, receipts, and bank statements.

- Docyt vs FreshBooks: FreshBooks focuses on invoicing and accounting for service-based businesses.

- Docyt vs NetSuite: NetSuite offers comprehensive ERP with robust accounting and financial management.

الأسئلة الشائعة

هل Xero مناسب لإدارة فواتير العملاء؟

نعم، تقدم Xero ميزات قوية للفواتير. يمكنك إنشاء وإرسال فواتير احترافية إلى عملائك بسهولة.

هل يتكامل Docyt مع برنامج المحاسبة الحالي الخاص بي؟

يتكامل Docyt مع المنصات الشائعة مثل Xero و QuickBooks Online. تحقق من التوافق مع نظامك الحالي.

ما البرنامج الأفضل لتتبع النفقات باستخدام بطاقات الائتمان؟

يتعامل كل من Xero و Docyt مع معاملات بطاقات الائتمان. يقدم Docyt أتمتة أكثر تقدمًا لمعالجة الإيصالات.

هل يمكنني إدارة الميزانيات بفعالية باستخدام Xero؟

يوفر Xero أدوات لإنشاء الميزانيات ومراقبتها للحسابات المختلفة داخل شركتك.

هل Docyt حل محاسبي كامل مثل Xero؟

Docyt focuses heavily on automation and document management. Xero offers a more comprehensive suite of accounting features for your client’s needs.