处理 会计 每个月底都可能让人头疼。

你得处理各种数字,核对报告,确保所有数据都正确无误。

你可能听说过一些号称可以……的工具 制作 这样更容易些。

本文将深入探讨 Easy Month End 和 Refreshme 的区别,帮助您决定选择哪一款。 会计 这款工具可以帮到你。

概述

为了让您更清楚地了解情况,我们深入研究了 Easy Month End 和 Refreshme 这两款产品。

我们测试了它们的功能,考察了它们的易用性。

这种亲力亲为的方式有助于我们为您带来公平的比较。

这个轻松的月底,加入1257位用户的行列,他们平均节省了3.5小时,并将错误率降低了15%。立即开始免费试用!

定价: 它提供免费试用。高级套餐起价为每月 45 美元。

主要特点:

- 自动对账

- 简化工作流程

- 用户友好界面

解锁更深层次的财务洞察!Refresh Me 分析您的支出,帮助您更明智地储蓄。

现在就试试吧!

定价: 它提供免费试用。高级套餐每月24.99美元。

主要特点:

- 自动对账

- 简化工作流程

- 用户友好界面

什么是简易月末结算?

那么,什么是“轻松月末”呢?

你可以把它想象成你的数字助理,帮你每月完成账目结算。

它旨在让这段通常充满压力的时期变得更加顺利。

此外,还可以探索我们最喜欢的 轻松的月末替代方案…

我们的观点

使用 Easy Month End 提升财务准确性。利用自动化对账和符合审计要求的报告功能。预约个性化演示,简化您的月末流程。

主要优势

- 自动化对账工作流程

- 任务管理和跟踪

- 方差分析

- 文档管理

- 协作工具

定价

- 起动机:每月 24 美元。

- 小的: 每月45美元。

- 公司: 每月89美元。

- 企业: 定制定价。

优点

缺点

Refreshme是什么?

那么,Refreshme怎么样?

这个工具真正专注于让你 会计 各项任务,尤其是和解工作,几乎毫不费力。

它运用智能技术,甚至包括一些人工智能技术,来帮助快速准确地匹配你的数字。

此外,还可以探索我们最喜欢的 Refreshme 的替代方案…

我们的观点

RefreshMe 的优势在于提供实时、可操作的洞察。然而,缺乏公开定价以及核心会计功能可能不够全面,可能是部分用户需要考虑的问题。

主要优势

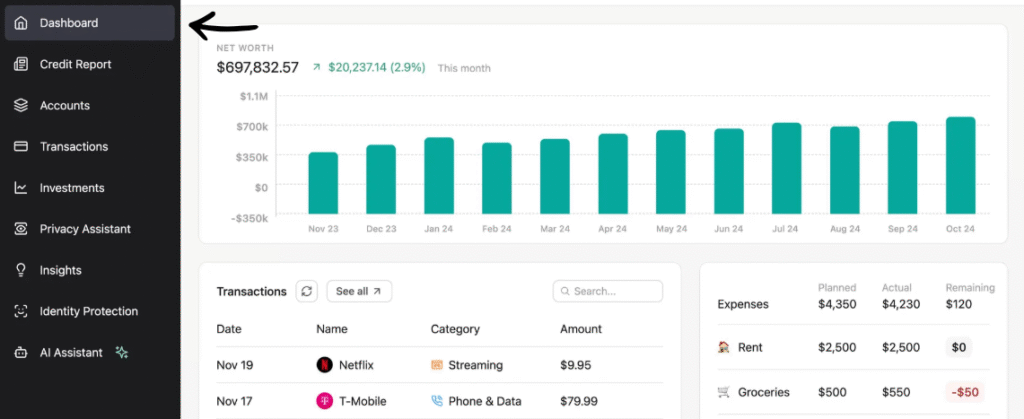

- 实时财务仪表盘

- 人工智能驱动的异常检测

- 可自定义报告

- 现金流预测

- 性能基准测试

定价

- 个人(3B): 每月 24.99 美元。

- 情侣(3B): 每月 44.99 美元。

优点

缺点

功能对比

让我们深入了解每个平台的核心功能,看看它们之间的优劣。

通过对比,您可以决定哪款工具能够为您的财务团队带来应有的效率。

1. 工作流程管理

- 轻松结束月末: 该平台提供强大的工作流程管理功能,可处理月末、季度末和年末任务。它专为财务团队的工作方式而设计,帮助他们掌控所有待办事项和项目进度。

- RefreshMe: 这款工具更侧重于个人理财和任务管理。它可以帮助个人追踪个人账单和财务目标,功能并不复杂。 商业 工作流程。

2. 和解

- 轻松结束月末: 它专为资产负债表调节而设计,可帮助您完成所有调节。它旨在通过直接链接到您的系统来加快资产负债表调节速度。 数据.

- 刷新我: 虽然它可以核对个人账户,但它并不适用于复杂的公司资产负债表。它主要用于个人银行和信用卡交易。

3. 团队协作

- 轻松结束月末: 这款工具是财务团队真正的一体化平台。您可以在这里分配任务、发表评论并跟踪进度,从而提高团队协作效率,避免沟通延误。

- RefreshMe: 这是一个单用户个人理财工具。9 它不具备团队协作功能,也不支持多人共享账户。

4. 自动化和数据同步

- 轻松结束月末: 这个平台可以自动帮你摆脱手动检查清单的繁琐工作,还能与主流系统同步。 会计 让月末结算流程变得轻松便捷的软件。

- RefreshMe: 它可以帮助您自动管理个人支出。11 它还会发送提醒,让您永远不会忘记支付账单,让生活更轻松。

5. 审计与合规

- 轻松结束月末: 它能帮助您收集审计证据,并为每个步骤提供完整的审计日志。您可以授予审计人员只读权限,以便他们自行查看所有内容。这有助于提高合规性。

- 刷新我: 此工具并非为正式的商业审计而设计,仅供个人使用,且不生成审计证据。

6. 临时任务和灵活性

- 轻松结束月末: 该平台已扩展其功能,可管理临时任务和其他非月度事项。它可以处理财务团队的各种任务。

- 刷新我: 它专注于处理日常个人财务事务,并非旨在追踪各种独特的商业任务。

7. 核心目的

- 轻松结束月末: 这是一张专门用于简化月末结算流程的通行证。它的设计目的是帮助财务团队以更少的错误完成工作。

- 刷新我: 它的核心目的是个人预算和财务健康。它旨在帮助用户掌控自己的资金,并不包含企业改变运营方式的内容。

8. 审核和签字

- 轻松结束月末: 一项关键功能是能够管理编制人和审核团队的签字确认。这是月末结算流程中至关重要的一环,有助于确保每个人都尽职尽责。

- 刷新我: 它没有审核或签字的概念。这是一个供单个用户管理个人财务的工具。

9. 价格和可扩展性

- 轻松结束月末: 您可以选择不同的套餐来管理少量实体,或者扩展到无限用户。无需签订合同,您可以随时取消。

- 刷新我: 其定价模式基于个人使用,提供个人、情侣和家庭套餐。它并非为拥有多个实体的企业而设计,无法扩展规模。

选择会计软件时应该注意哪些方面?

- 要确定 Refreshme 是否完全符合您的需求,请考虑其数据处理方式是否足以满足您的需求。

- 它的团队管理功能是否有助于打造更高效的财务团队?

- 分析其如何处理银行转账和其他人工确认事宜非常重要。

- 该应用程序是否具有用户友好的界面,让您轻松度过第一个月的月底?

- 确保数据上传和导入过程简单快捷,并且能够从 Excel 输入数据。

- 对于您的客户而言,它提供的服务是否符合他们的业务需求?

- 查看软件的使用年限以及是否持续更新。

- 问问自己,这样做是否能减轻团队的压力,因为你的财务团队值得拥有这样的机会。

- 客服人员能否以一种宛如艺术形式的方式来回答问题?

- 了解软件将如何帮助企业改进至关重要。

- 此外,还要寻找一款能够与你一同成长的工具,而不是那种千篇一律的解决方案。

- 避免使用过去曾出现过失败案例且没有明确改进方向的软件。

- 在决定长期使用该软件之前,尽量先体验一下完整演示版。

- 它能处理复杂案例吗?如果它遇到你发现的新的财务状况,该怎么办?

- 如果你的企业旗下有多个实体,它会刷新所有实体的数据吗?

- 确保它是您使用场景的完美解决方案,并且易于上手。

- 为了确保良好的用户体验,请记得定期清除浏览器缓存和 Cookie。

最终判决

仔细比较两者之后,我们的最终结论是:对于大多数企业来说,简易的月末结算方式是更好的选择。

Refreshme 对个人理财很有帮助。

Easy Month End 直接解决企业财务结算方面的难题。

它可以帮助你的会计师按时收到每个月的所有款项。

它清晰的结构便于月末流程和审计追踪,使其具有优势。

我们已经深入研究了这些工具,因此您可以放心地选择它们。

更多轻松的月末

以下是 Easy Month End 与一些主要替代方案的简要比较。

- 轻松月末 vs Puzzle io: Puzzle.io 主要面向初创公司会计,而 Easy Month End 则专注于简化结账流程。

- 轻松月末 vs Dext: Dext 主要用于文档和收据采集,而 Easy Month End 是一款综合性的月末结算管理工具。

- Easy Month End 与 Xero 的对比: Xero 是一个面向小型企业的完整会计平台,而 Easy Month End 则为结算流程提供了一个专门的解决方案。

- 轻松月末 vs 辛德尔: Synder 专注于整合电子商务数据,这与 Easy Month End 不同,后者是一个用于整个财务结算的工作流程工具。

- 轻松月末 vs Docyt: Docyt 使用人工智能进行记账和数据录入,而 Easy Month End 则自动执行财务结算的步骤和任务。

- 轻松月末 vs RefreshMe: RefreshMe 是一个财务辅导平台,这与 Easy Month End 专注于月末结算管理有所不同。

- Easy Month End 与 Sage: Sage 是一款大型企业管理套件,而 Easy Month End 则为关键的会计功能提供更专业的解决方案。

- 轻松月末对比 Zoho Books: Zoho Books 是一款一体化会计软件,而 Easy Month End 是一款专为月末结算流程而设计的工具。

- 轻松的月末 vs 浪潮: Wave 为小型企业提供免费的会计服务,而 Easy Month End 则为月末管理提供更高级的解决方案。

- 轻松月末结算对比 Quicken: Quicken 是一款个人理财工具,因此 Easy Month End 对于需要管理月末结算的企业来说是更好的选择。

- 轻松月末结算对比 Hubdoc: Hubdoc 可以自动收集文档,但 Easy Month End 旨在管理完整的结算工作流程和团队任务。

- 轻松月末结算对比Expensify: Expensify 是一款费用管理软件,这与 Easy Month End 的核心功能——财务结算——有所不同。

- Easy Month End 与 QuickBooks 对比: QuickBooks 是一款综合性的会计解决方案,而 Easy Month End 则是一款更专门用于管理月末结算的工具。

- 简易月末结算与自动录入: AutoEntry 是一款数据采集工具,而 Easy Month End 是一个完整的平台,用于在月末结算期间进行任务和工作流程管理。

- Easy Month End 与 FreshBooks 的对比: FreshBooks 适用于自由职业者和小企业,而 Easy Month End 则提供专门的月末结算解决方案。

- 轻松月末结算对比 NetSuite: NetSuite 是一个功能齐全的 ERP 系统,其范围比 Easy Month End 专注于财务结算的范围更广。

更多 Refreshme

- Refresh me vs Puzzle IO: 这款软件专注于为初创企业提供人工智能驱动的财务规划。它的姊妹软件则面向个人理财领域。

- 刷新我 vs Dext: 这是一个用于记录收据和发票的商业工具。另一个工具用于追踪个人支出。

- Refresh me 对比 Xero: 这是一款面向小型企业的热门在线会计软件。它的竞争对手是面向个人用户的。

- Refresh me vs Synder: 这款工具可以将电子商务数据与会计软件同步。它的替代版本则专注于个人理财。

- 刷新我 vs 轻松月末: 这是一个用于简化月末工作的商业工具。它的竞争对手是用于管理个人财务的工具。

- 刷新我 vs Docyt: 前者利用人工智能进行企业记账和自动化,后者则利用人工智能作为个人理财助手。

- 刷新我 vs Sage: 这是一个功能全面的企业会计软件。它的竞争对手是一款更易于使用的个人理财工具。

- Refresh me vs Zoho Books: 这是一个面向小型企业的在线会计工具。它的竞争对手是面向个人用户的。

- 刷新我 vs 波浪: 这款软件为小型企业提供免费的会计软件。它的姊妹软件则面向个人用户。

- Refresh me 与 Quicken: 两者都是个人理财工具,但这款工具提供更深入的投资追踪功能,另一款则更简单易用。

- Refresh me vs Hubdoc: 这款软件专门用于簿记的文档采集。它的竞争对手是一款个人理财工具。

- Refresh me vs Expensify: 这是一个企业费用管理工具。另一个工具则用于个人费用跟踪和预算。

- Refresh me vs QuickBooks: 这是知名的企业会计软件。它的替代版本则是为个人理财而设计的。

- 刷新我 vs 自动输入: 这款产品旨在实现企业会计数据录入的自动化。它的替代产品是一款个人理财工具。

- Refresh me vs FreshBooks: 这是面向自由职业者和小企业的会计软件。它的另一个版本则用于个人理财。

- Refresh me vs NetSuite: 这是一个功能强大的企业管理套件,适用于大型企业。它的竞争对手是一款简单的个人理财应用。

常见问题解答

Easy Month End 和 Refreshme 的主要区别是什么?

Easy Month End 专注于简化企业的财务结算流程。而 Refreshme 则更侧重于个人财务管理和单笔交易的自动对账。

Easy Month End 能帮我报税吗?

是的,通过整理您的财务数据并提供清晰的审计跟踪,Easy Month End 可帮助您确保记录准确无误,并准备好进行税务准备,从而使您的会计师的工作更加顺利。

Refreshme 是否能与其他会计软件(例如 Dext)集成?

虽然 Refreshme 提供数据同步功能,但它的主要关注点是个人理财。它可能没有与特定企业进行广泛的集成。 会计 像 Dext 这样的工具,是专业企业解决方案所能提供的。

我应该多久更新一次这些工具中的财务信息?

为了确保准确性,最好定期更新您的财务信息,理想情况下每天或每周更新一次。频繁更新可以确保您的报告保持最新状态,并帮助您避免月底的紧急处理。